1. Global Siding Market Overview and Future Projections

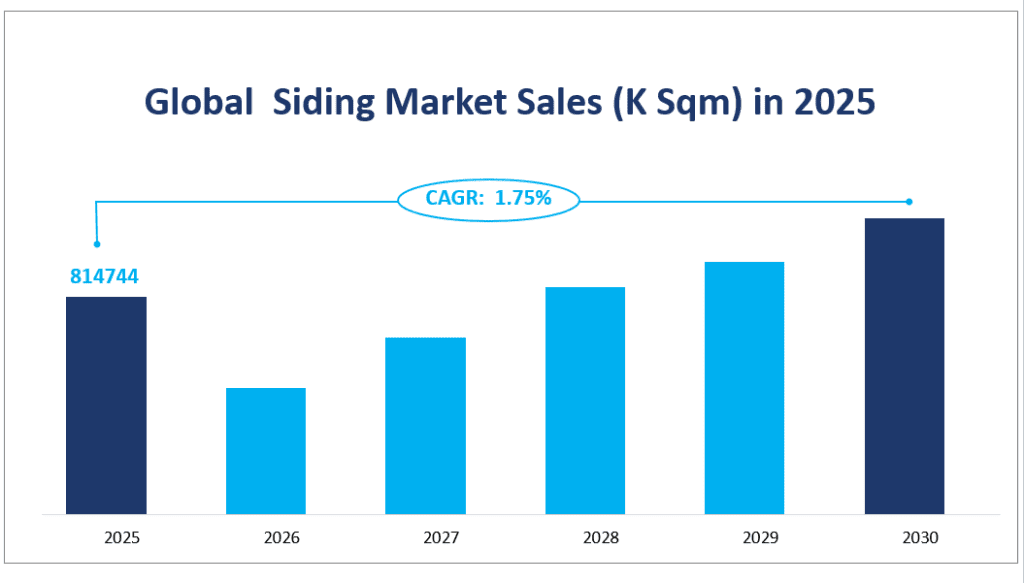

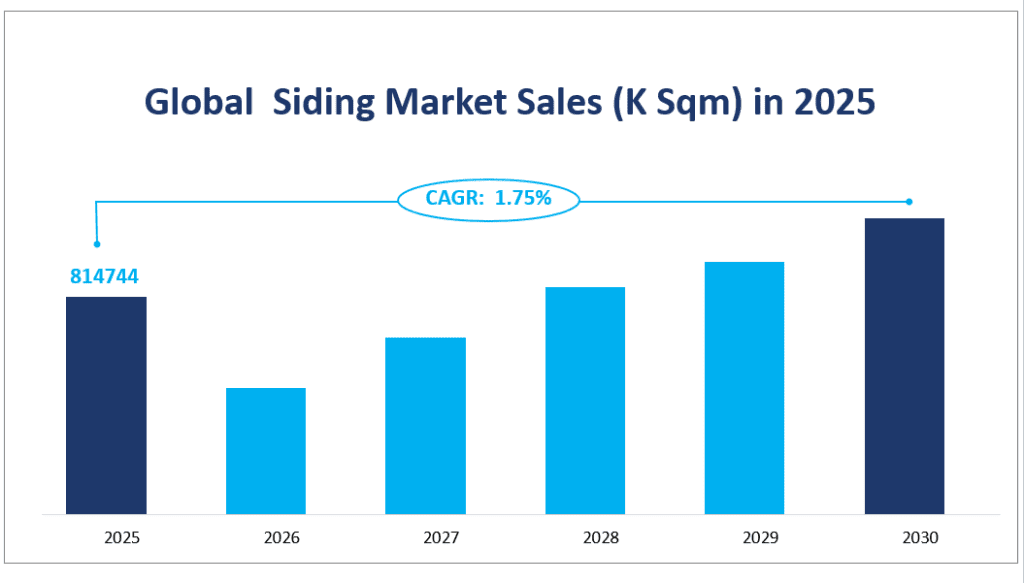

The global siding market, which pertains to the protective materials attached to the exterior of buildings, has shown a consistent growth trajectory in recent years. In 2025, the market sales are projected to reach 814744 K Sqm with a CAGR of 1.75% from 2025 to 2030, indicating a steady expansion in the industry. Siding, crucial for withstanding environmental elements and enhancing building aesthetics, is a diverse market segment with products ranging from wood to composite materials. The market’s growth can be attributed to the increasing demand for durable, low-maintenance, and aesthetically pleasing exterior building solutions. As the world’s population grows and urbanization accelerates, the need for siding that offers protection and enhances the visual appeal of buildings is expected to rise, driving market growth.

Siding, in the construction industry, refers to the exterior cladding of a building, designed to protect the structure from various environmental factors such as sunlight, rain, snow, heat, and cold. It forms the first line of defense for a building’s envelope, ensuring a stable and comfortable indoor environment. Siding can be made from a variety of materials, including wood, plastic, metal, composite, and stone, each offering distinct benefits and aesthetic qualities. The choice of siding material can significantly impact a building’s energy efficiency, durability, and overall appearance.

Global Siding Market Sales (K Sqm) in 2025

2. Driving Factors of Siding Market Growth

The siding market is influenced by several driving factors that contribute to its growth. One of the primary factors is the global trend towards urbanization and the consequent increase in construction activities. As cities expand, there is a surge in the demand for residential, commercial, and industrial buildings, each requiring siding for protection and aesthetic purposes. Additionally, the growth in infrastructure development in developing countries is another key driver, as it creates a substantial market for siding products.

Technological advancements have led to the introduction of new materials and innovative siding products that are more durable, require less maintenance, and offer better insulation properties. Insulated siding, for example, has emerged as a new type of siding that not only enhances the energy efficiency of buildings but also provides a design life of over 50 years. Such innovations are expected to boost market growth by improving consumer satisfaction and expanding product offerings.

Furthermore, the market is also driven by the increasing awareness of sustainable building practices. Consumers and builders are leaning towards materials that are environmentally friendly and have a lower carbon footprint. This trend is prompting manufacturers to develop siding products that align with sustainable development goals, thereby opening new growth opportunities.

3. Limiting Factors of Siding Market Growth

Despite the positive growth indicators, the siding market faces certain challenges that could limit its expansion. One of the primary constraints is the variability in the performance and limitations of different siding materials. For instance, wood siding, while aesthetically pleasing, requires regular maintenance and is susceptible to damage from pests and weathering. Vinyl siding, on the other hand, faces environmental concerns due to its non-biodegradable nature and the release of toxic gases when burned.

Another limiting factor is the increasing consumer demand for sustainability in manufacturing materials. As sustainability becomes a core concern for businesses and consumers alike, manufacturers face the challenge of adapting their production methods to use recyclable materials and develop products that meet these environmental standards. This shift towards sustainable practices can be a complex and costly process, potentially hindering market growth.

In conclusion, the global siding market is poised for steady growth, driven by urbanization, technological advancements, and a focus on sustainability. However, the industry must also navigate the challenges posed by material limitations and the increasing importance of sustainable manufacturing practices. As the market evolves, stakeholders must innovate and adapt to these challenges to maintain growth and competitiveness in the global construction industry.

4. Global Siding Market Segment Analysis

Product Types and Sales Performance in 2025

Wood Siding: Known for its natural beauty and traditional appeal, wood siding is expected to have sales of 130977 K Sqm in 2025. Despite its popularity, wood siding requires regular maintenance and is susceptible to environmental damage.

Plastic Siding: Celebrated for its affordability and low maintenance, plastic siding is projected to reach 231523 K Sqm in sales, making it a dominant player in the market.

Metal Siding: Prized for its durability and modern aesthetic, metal siding is forecasted to achieve 103704 K Sqm in sales, reflecting its growing popularity in commercial and industrial sectors.

Composite Siding: A favorite for its versatility and resistance to weathering, composite siding is expected to see sales of 102404 K Sqm, indicating a steady growth trend.

Stone Siding: For its prestige and natural look, stone siding is anticipated to have sales of 106800 K Sqm, though it holds a smaller market share due to its higher cost and weight.

In terms of market share, Plastic Siding is expected to hold the largest share in 2025, driven by its cost-effectiveness and wide acceptance in the residential construction sector. It offers a balance of affordability and durability, which resonates with a broad range of consumers.

Applications and Sales Performance in 2025

Infrastructure: This application is expected to have sales of 102275 K Sqm, reflecting the continuous development of public works and urban infrastructure projects.

Residential Building: The largest application sector, Residential Building, is anticipated to reach 332265 K Sqm in sales, driven by the global demand for housing and the pursuit of aesthetically pleasing and durable home exteriors.

Commercial Building: With sales projected at 205870 K Sqm, Commercial Building applications are also significant, as businesses seek to enhance their properties’ curb appeal and efficiency.

Industrial Building: This sector is expected to have sales of 142455 K Sqm, as industrial facilities require robust and low-maintenance siding solutions.

The Residential Building application holds the largest share, attributable to the continuous growth in the housing market and the demand for visually appealing and durable exteriors in residential constructions. The fastest-growing application is expected to be the Industrial Building sector, due to the rapid industrialization and the need for robust, low-maintenance exterior solutions in industrial settings.

The siding market’s applications reflect the dynamic nature of the construction industry, with each sector contributing to the market’s growth. Residential Building dominates the market with the largest share, while Industrial Building exhibits the fastest growth, indicating a shift towards more robust and specialized siding solutions. As the market continues to expand, these trends are expected to influence the development and innovation of siding applications worldwide.

Market Sales by Segment

| Market Sales (K Sqm) in 2025 | ||

| By Type | Wood Siding | 130977 |

| Plastic Siding | 231523 | |

| Metal Siding | 103704 | |

| Composite Siding | 102404 | |

| Stone Siding | 106800 | |

| By Application | Infrastructure | 102275 |

| Residential Building | 332265 | |

| Commercial Building | 205870 | |

| Industrial Building | 142455 |

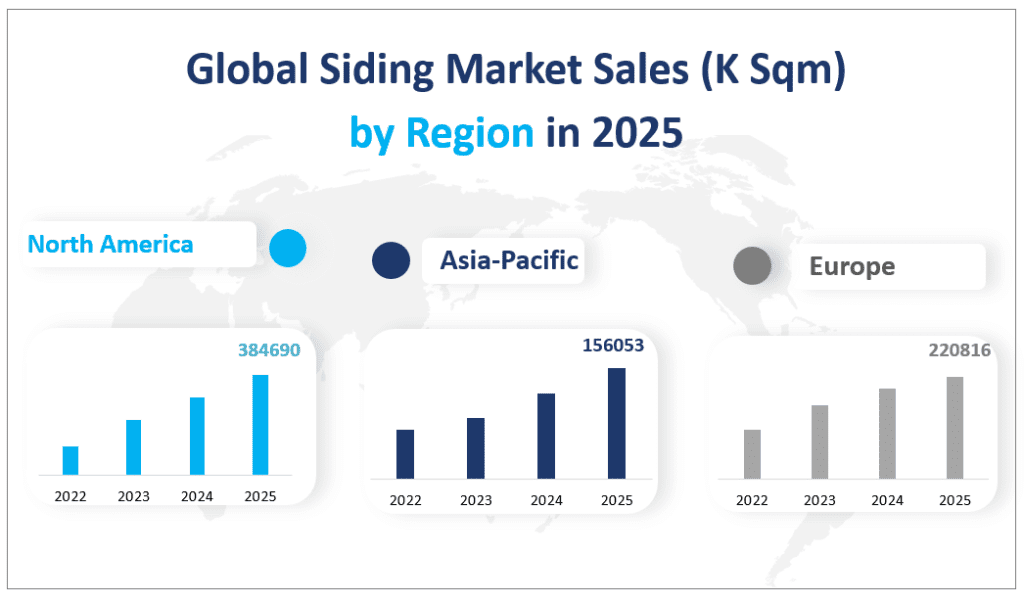

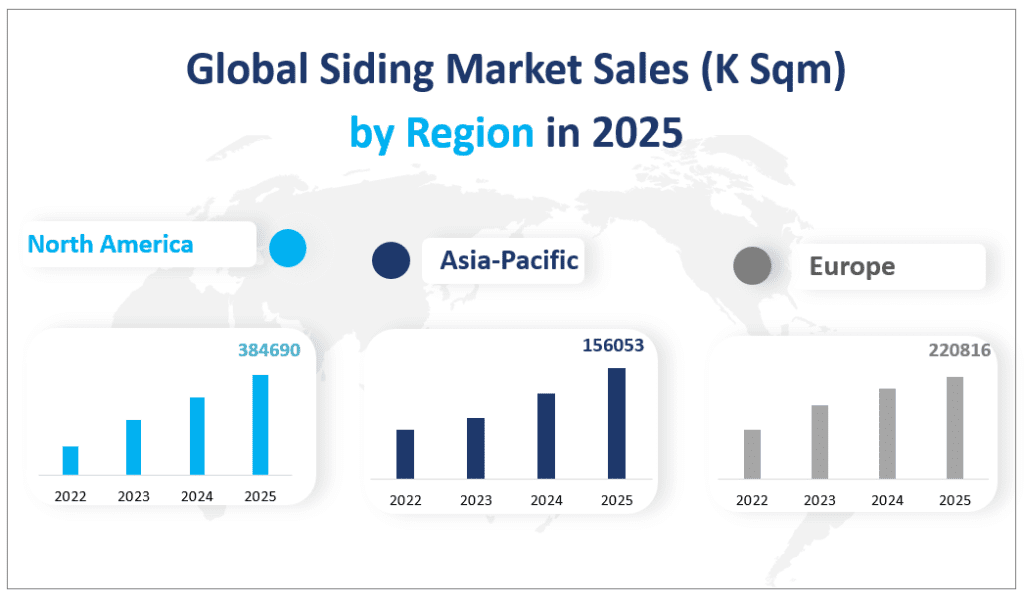

5. Global Siding Market Sales by Region

North America: With a projected sales of 384690 K Sqm in 2025, North America continues to be the largest regional market for siding. This region has a strong demand for siding products due to its well-established construction industry and the ongoing need for residential and commercial building construction.

Europe: Europe is expected to generate sales of 220816 K Sqm in 2025. The region has a mature market with a focus on sustainable and energy-efficient building materials, which is driving the demand for innovative siding solutions.

Asia-Pacific: The Asia-Pacific region is projected to have sales of 156053 K SqmK Sqm in 2025. This region is experiencing rapid urbanization and economic growth, leading to an increased demand for construction materials, including siding.

The biggest regional market by sales in 2025 is North America, with a substantial share of the global siding market revenue. This can be attributed to the region’s large construction industry and the ongoing demand for high-quality building materials.

The fastest-growing region is expected to be the Asia-Pacific, with a CAGR that outpaces other regions. The growth in this region is driven by rapid economic development, urbanization, and the increasing demand for energy-efficient and sustainable building materials in countries like China, India, and Australia.

Global Siding Market Sales (K Sqm) by Region in 2025

6. Analysis of the Top Five Companies in the Global Siding Market

Company Introduction: James Hardie Industries is a leading producer and marketer of high-performance fiber cement and fiber gypsum building solutions. Established in 1888, the company has a global presence with plant locations in Europe and the Philippines.

Business Overview: James Hardie Industries specializes in innovative siding solutions that cater to both residential and commercial markets worldwide.

Products Offered: The company offers a range of siding products, including HardieShingle® Siding, known for its distinct look and low maintenance requirements.

Company Introduction: Saint-Gobain, established in 1665, is an international company engaged in the design, manufacturing, and distribution of building materials.

Business Overview: The company produces a wide range of insulation systems, water supply systems, solar solutions, and building materials for global distribution.

Products Offered: Saint-Gobain offers products like Single 7″ Straight Edge Perfection Shingles, known for their aesthetic appeal and durability.

Company Introduction: Georgia-Pacific Corporation, established in 1927, is a leading manufacturer and marketer of tissue, pulp, paper, packaging, building products, and related chemicals.

Business Overview: The company operates across North America and South America, employing over 30,000 people at approximately 300 locations.

Products Offered: Georgia-Pacific Corporation offers Plytanium Plywood Siding, known for its quality and performance in various building applications.

Company Introduction: Cornerstone Building Brands, formed from the merger of Ply Gem Building Products and NCI Building Systems, is the largest manufacturer of exterior building products in North America.

Business Overview: The company focuses on providing a wide range of exterior building products, including siding solutions.

Products Offered: Cornerstone Building Brands offers the Structure® Home Insulation System™ Siding, which combines vinyl siding technologies with high-performance foam insulation.

Company Introduction: Louisiana Pacific Corporation, established in 1973, manufactures building materials and engineered wood products used by homebuilders and light commercial builders.

Business Overview: The company’s products include oriented strand board sheathing, flooring, siding and trim, i-joists, and laminated veneer lumber.

Products Offered: Louisiana Pacific Corporation offers LP® SmartSide® LAP SIDING, known for its durability and versatility in color options.

Major Players

| Company Name | Plant Locations | Market Distribution |

| James Hardie Industries | Europe, Philippines | Worldwide |

| Saint-Gobain | North America | Worldwide |

| Georgia-Pacific Corporation | United States | North America, Europe, Asia |

| Cornerstone Building Brands | United States | North America |

| Louisiana Pacific Corporation | United States | North America, South America, Europe |

| Etex Group | Germany, Belgium | Worldwide |

| Associated Materials, LLC | United States | United States |

| Westlake Chemical Corporation | United States, China | North America, Europe, Asia |

| Kingspan Group | Worldwide | Worldwide |

| Boral | United States | Australia, North America |

| Asahi Tostem Exterior Building Materials | Japan | Japan |

| Norandex | United States | North America, Europe |

| Ruukki Construction | Finland, Poland, Lithuania, Sweden, Estonia, Ukraine | North Europe |

| Shanghai Seventrust Industry | China | Worldwide |

| Tata BlueScope Steel | India | India |

| Nichiha | United States, Japan, China | Worldwide |

| MBCI | United States | United States |

| Metalcraft Roofing | New Zealand | New Zealand |

| Weathertex | Australia | Worldwide |

| Revelstone | South Africa | Africa, United States, United Kingdom, Cyprus |

| Palagio Engineering | Italy | Worldwide |

| National Cladding | United Kingdom | United Kingdom |

| Everite Building Products | South Africa | Africa |

1 Siding Market Overview

1.1 Product Overview and Scope of Siding

1.2 Siding Segment by Type

1.2.1 Global Siding Sales Growth Rate Comparison by Type (2015-2025)

1.2.2 Wood Siding

1.2.3 Plastic Siding

1.2.4 Metal Siding

1.2.5 Composite Siding

1.2.6 Stone Siding

1.3 Market Analysis by Applications

1.3.1 Siding Consumption Comparison by Application (2015-2025)

1.3.2 Infrastructure

1.3.3 Residential Building

1.3.4 Commercial Building

1.3.5 Industrial Building

1.4 Global Siding Market by Region

1.4.1 Global Siding Revenue 2015-2026

1.4.2 Global Siding Sales 2015-2026

1.4.3 Siding Market Size by Region: 2020 Versus 2026

2 Global Siding Market Competition by Manufacturers

2.1 Global Siding Sales Market Share by Manufacturers (2015-2020)

2.2 Global Siding Revenue Share by Manufacturers (2015-2020)

2.3 Global Siding Average Price by Manufacturers (2015-2020)

2.4 Siding Market Competitive Situation and Trends

2.4.1 Siding Market Concentration Rate

2.4.2 Global Top 5 and Top 10 Players Market Share by Revenue

2.4.3 Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

2.4.4 Mergers & Acquisitions, Expansion

3 Siding Retrospective Market Scenario by Region

3.1 Global Siding Retrospective Market Scenario in Sales by Region: 2015-2020

3.2 Global Siding Retrospective Market Scenario in Revenue by Region: 2015-2020

3.3 North America Siding Market Facts & Figures by Country

3.3.1 North America Siding Sales Growth Rate (2015-2020)

3.3.2 North America Siding Revenue Growth Rate (2015-2020)

3.3.3 U.S.

3.3.4 Canada

3.4 Europe Siding Market Facts & Figures by Country

3.4.1 Europe Siding Sales Growth Rate (2015-2020)

3.4.2 Europe Siding Revenue Growth Rate (2015-2020)

3.4.3 Germany

3.4.4 France

3.4.5 U.K.

3.4.6 Italy

3.4.7 Russia

3.5 Asia Pacific Siding Market Facts & Figures by Country

3.5.1 Asia Pacific Siding Sales Growth Rate (2015-2020)

3.5.2 Asia Pacific Siding Revenue Growth Rate (2015-2020)

3.5.3 China

3.5.4 Japan

3.5.5 South Korea

3.5.6 India

3.5.7 Australia

3.5.8 Taiwan

3.5.9 Indonesia

3.5.10 Thailand

3.5.11 Malaysia

3.5.12 Philippines

3.5.13 Vietnam

3.6 Latin America Siding Market Facts & Figures by Country

3.6.1 Latin America Siding Sales Growth Rate (2015-2020)

3.6.2 Latin America Siding Revenue Growth Rate (2015-2020)

3.6.3 Mexico

3.6.4 Brazil

3.6.5 Argentina

3.7 Middle East and Africa Siding Market Facts & Figures by Country

3.7.1 Middle East and Africa Siding Sales Growth Rate (2015-2020)

3.7.2 Middle East and Africa Siding Revenue Growth Rate (2015-2020)

3.7.3 Turkey

3.7.4 Saudi Arabia

3.7.5 U.A.E

4 Global Siding Historic Market Analysis by Type

4.1 Global Siding Sales and Market Share by Type (2015-2020)

4.2 Global Siding Revenue Market Share by Type (2015-2020)

4.3 Global Siding Price by Type (2015-2020)

4.4 Global Siding Market Share by Price Tier (2015-2020): Low-End, Mid-Range and High-End

5 Global Siding Historic Market Analysis by Application

5.1 Global Siding Consumption Market Share by Applications (2015-2020)

5.2 Global Siding Consumption Growth Rate by Application

5.3 Global Siding Price by Application (2015-2020)

6 Manufacturers Profiles

6.1 James Hardie Industries

6.1.1 Business Overview

6.1.2 James Hardie Industries Products Offered

6.1.3 James Hardie Industries Siding Sales, Revenue and Gross Margin

6.2 Saint-Gobain

6.2.1 Business Overview

6.2.2 Saint-Gobain Products Offered

6.2.3 Saint-Gobain Siding Sales, Revenue and Gross Margin

6.3 Georgia-Pacific Corporation

6.3.1 Business Overview

6.3.2 Georgia-Pacific Corporation Products Offered

6.3.3 Georgia-Pacific Corporation Siding Sales, Revenue and Gross Margin

6.4 Cornerstone Building Brands

6.4.1 Business Overview

6.4.2 Cornerstone Building Brands Products Offered

6.4.3 Cornerstone Building Brands Siding Sales, Revenue and Gross Margin

6.5 Louisiana Pacific Corporation

6.5.1 Business Overview

6.5.2 Louisiana Pacific Corporation Products Offered

6.5.3 Louisiana Pacific Corporation Siding Sales, Revenue and Gross Margin

6.6 Etex Group

6.6.1 Business Overview

6.6.2 Etex Group Products Offered

6.6.3 Etex Group Siding Sales, Revenue and Gross Margin

6.7 Associated Materials, LLC

6.7.1 Business Overview

6.7.2 Associated Materials, LLC Products Offered

6.7.3 Associated Materials, LLC Siding Sales, Revenue and Gross Margin

6.8 Westlake Chemical Corporation

6.8.1 Business Overview

6.8.2 Westlake Chemical Corporation Products Offered

6.8.3 Westlake Chemical Corporation Siding Sales, Revenue and Gross Margin

6.9 Kingspan Group

6.9.1 Business Overview

6.9.2 Kingspan Group Products Offered

6.9.3 Kingspan Group Siding Sales, Revenue and Gross Margin

6.10 Boral

6.10.1 Business Overview

6.10.2 Boral Products Offered

6.10.3 Boral Siding Sales, Revenue and Gross Margin

6.11 Asahi Tostem Exterior Building Materials

6.11.1 Business Overview

6.11.2 Asahi Tostem Exterior Building Materials Products Offered

6.11.3 Asahi Tostem Exterior Building Materials Siding Sales, Revenue and Gross Margin

6.12 Norandex

6.12.1 Business Overview

6.12.2 Norandex Products Offered

6.12.3 Norandex Siding Sales, Revenue and Gross Margin

6.13 Ruukki Construction

6.13.1 Business Overview

6.13.2 Ruukki Construction Products Offered

6.13.3 Ruukki Construction Siding Sales, Revenue and Gross Margin

6.14 Shanghai Seventrust Industry

6.14.1 Business Overview

6.14.2 Shanghai Seventrust Industry Products Offered

6.14.3 Shanghai Seventrust Industry Siding Sales, Revenue and Gross Margin

6.15 Tata BlueScope Steel

6.15.1 Business Overview

6.15.2 Tata BlueScope Steel Products Offered

6.15.3 Tata BlueScope Steel Siding Sales, Revenue and Gross Margin

6.16 Nichiha

6.16.1 Business Overview

6.16.2 Nichiha Products Offered

6.16.3 Nichiha Siding Sales, Revenue and Gross Margin

6.17 MBCI

6.17.1 Business Overview

6.17.2 MBCI Products Offered

6.17.3 MBCI Siding Sales, Revenue and Gross Margin

6.18 Metalcraft Roofing

6.18.1 Business Overview

6.18.2 Metalcraft Roofing Products Offered

6.18.3 Metalcraft Roofing Siding Sales, Revenue and Gross Margin

6.19 Weathertex

6.19.1 Business Overview

6.19.2 Weathertex Products Offered

6.19.3 Weathertex Siding Sales, Revenue and Gross Margin

6.20 Revelstone

6.20.1 Business Overview

6.20.2 Revelstone Products Offered

6.20.3 Revelstone Siding Sales, Revenue and Gross Margin

6.21 Palagio Engineering

6.21.1 Business Overview

6.21.2 Palagio Engineering Products Offered

6.21.3 Palagio Engineering Siding Sales, Revenue and Gross Margin

6.22 National Cladding

6.22.1 Business Overview

6.22.2 National Cladding Products Offered

6.22.3 National Cladding Siding Sales, Revenue and Gross Margin

6.23 Everite Building Products

6.23.1 Business Overview

6.23.2 Everite Building Products Products Offered

6.23.3 Everite Building Products Siding Sales, Revenue and Gross Margin

7 Siding Manufacturing Cost Analysis

7.1 Siding Key Raw Materials Analysis

7.2 Proportion of Manufacturing Cost Structure

7.2.1 Raw Materials

7.2.2 Labor Cost

7.2.3 Manufacturing Expenses

7.3 Manufacturing Process Analysis of Siding

7.4 Siding Industrial Chain Analysis

8 Marketing Channel, Distributors and Customers

8.1 Marketing Channel

8.2 Siding Distributors List

8.3 Siding Customers

9 Market Dynamics

9.1 Market Trends

9.2 Opportunities and Drivers

9.3 Challenges

9.4 Porter’s Five Forces Analysis

10 Global Market Forecast

10.1 Global Siding Market Estimates and Projections by Type

10.1.1 Global Forecasted Sales of Siding by Type (2020-2026)

10.1.2 Global Forecasted Revenue of Siding by Type (2020-2026)

10.2 Siding Market Estimates and Projections by Application

10.2.1 Global Forecasted Sales of Siding by Application (2020-2026)

10.2.2 Global Forecasted Revenue of Siding by Application (2020-2026)

10.3 Siding Market Estimates and Projections by Region

10.3.1 Global Forecasted Sales of Siding by Region (2020-2026)

10.3.2 Global Forecasted Revenue of Siding by Region (2020-2026)

10.4 North America Siding Estimates and Projections (2020-2026)

10.5 Europe Siding Estimates and Projections (2020-2026)

10.6 Asia Pacific Siding Estimates and Projections (2020-2026)

10.7 Latin America Siding Estimates and Projections (2020-2026)

10.8 Middle East and Africa Siding Estimates and Projections (2020-2026)

11 Research Findings and Conclusion

12 Appendix

12.1 Methodology

12.2 Research Data Source