1. Global Satellite Communication Terminal Market Outlook

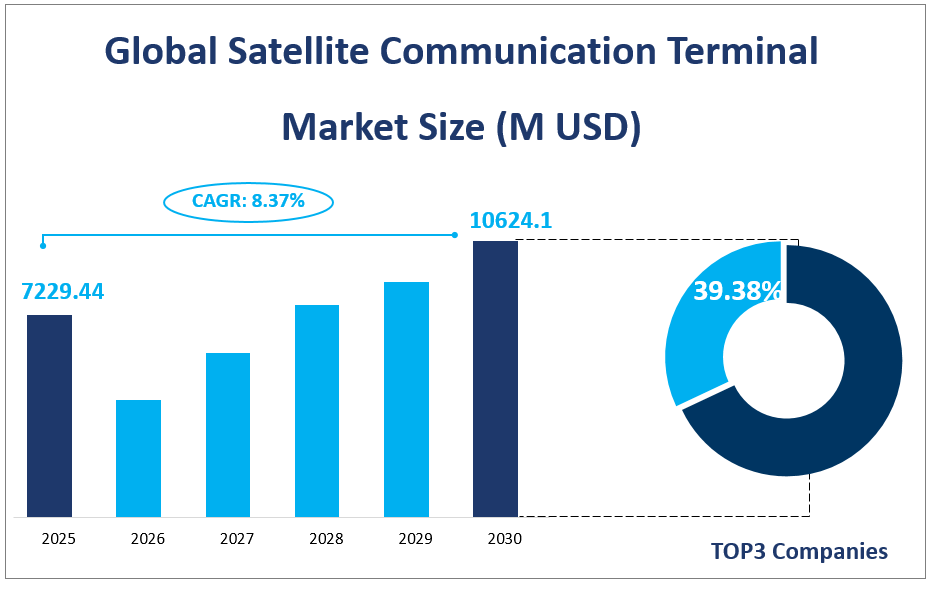

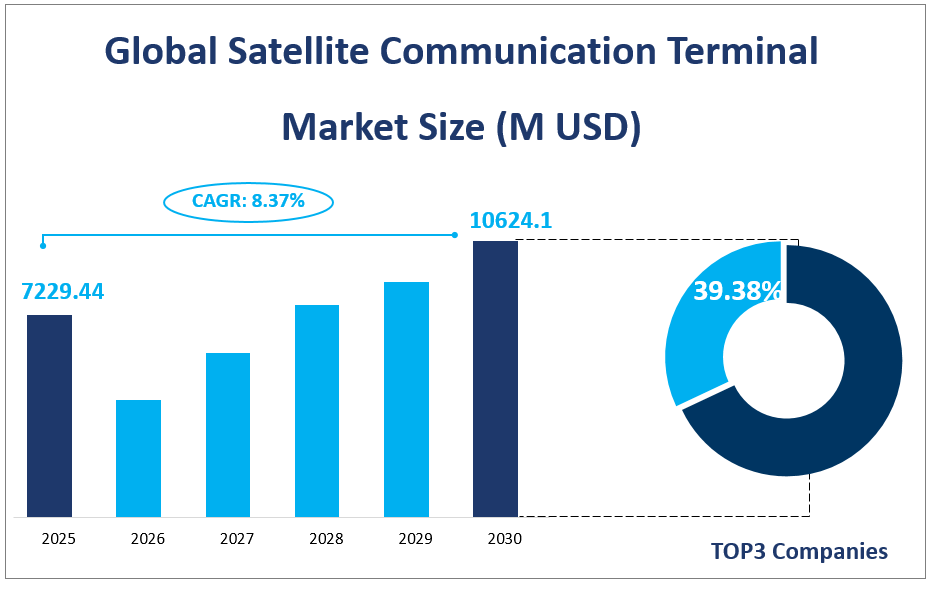

The global satellite communication terminal market is projected to experience significant growth in the coming years, with a substantial increase in market size expected by 2025. The global satellite communication terminal market size is anticipated to reach a value of $7229.44 million in 2025, showcasing a CAGR of 8.37% from 2025 to 2030. This growth is attributed to the increasing demand for reliable communication infrastructure in remote and hard-to-reach areas, advancements in satellite technology, and the expansion of broadband services across the globe.

The satellite communication terminal, often referred to as a satellite earth station, is a critical component of satellite communication systems. It enables the transmission and reception of signals from satellites orbiting the Earth, facilitating long-distance communication even in areas where traditional terrestrial infrastructure is lacking or inadequate. This technology plays a vital role in various sectors, including military, government, maritime, aeronautical, and civilian applications, providing voice, data, and video transmission capabilities.

The satellite communication terminal market is segmented by type, with C Band terminals projected to have a significant share. The C Band, ranging from 4.0 to 8.0 gigahertz (GHz) in the microwave spectrum, is known for its ability to penetrate atmospheric conditions such as rain and snow, making it suitable for fixed satellite services and weather radar systems. The C Band is expected to contribute significantly to the satellite communication terminal market expansion due to its reliability and broad application in commercial telecommunications.

Global Satellite Communication Terminal Market Size (M USD)

2. Driving Factors of Satellite Communication Terminal Market

Technological Advancements: The continuous development and refinement of satellite technology are key drivers of the market. Innovations in areas such as signal processing, antenna design, and miniaturization are making satellite communication terminals more efficient and cost-effective.

Global Connectivity Demand: There is a growing need for global connectivity, particularly in sectors like telecommunications, maritime, aviation, and in remote land locations where terrestrial infrastructure is limited. Satellite communication terminals are essential for providing reliable communications in these areas.

Government and Military Applications: The strategic importance of satellite communication in national security and defense has led to increased investment in satellite technology by governments worldwide, thereby driving market growth.

Commercial Telecommunications: The expansion of broadband services and the need for high-speed internet in remote areas are contributing to the demand for satellite communication terminals, especially with the advent of high-throughput satellites.

3. Limiting Factors of Satellite Communication Terminal Market

Spectrum Scarcity: The limited availability of suitable spectrum for satellite communications poses a challenge. Spectrum congestion and the need to avoid interference with other communication systems can hinder market growth.

High Costs: The high costs associated with the development, launch, and maintenance of satellites, as well as the construction of ground infrastructure, make satellite communication a costly affair. These expenses can limit the adoption of satellite communication terminals, especially in price-sensitive markets.

Terrestrial Competition: The development of terrestrial communication technologies, such as fiber optics and 5G networks, can provide strong alternatives to satellite communications in areas with well-developed infrastructure, affecting the satellite market’s growth.

Technical Challenges: Issues related to transmission delay, signal stability, and bandwidth limitations of satellite communications can impact the user experience and the reliability of satellite services, particularly in applications requiring high real-time performance.

In conclusion, while the global satellite communication terminal market is set to experience significant growth, it must navigate challenges such as spectrum scarcity and high operational costs to realize its full potential. Despite these limitations, the satellite communication terminal market prospects remain promising, driven by technological advancements and the increasing demand for global connectivity.

4. Satellite Communication Terminal Market Segment

The global satellite communication terminal market is diversified, with various product types catering to different frequency bands and applications.

Product Types

L Band (1 to 2 GHz): The L band is utilized for various applications, including mobile satellite services and some military communications. It is known for its resistance to signal attenuation in fog and light rain. This segment is projected to generate a $141.20 million market size in 2025.

C Band (4.0 to 8.0 GHz): The C band is a workhorse in satellite communications, used for fixed satellite services and weather radar systems. It is known for its ability to penetrate atmospheric conditions. This segment is projected to generate a $2520.41 million market size in 2025.

X Band (8.0–12.0 GHz): The X band offers higher frequency, providing better resolution for radar systems, and is often used in military radar and satellite communication applications. This segment is projected to generate a $736.13 million market size in 2025.

S-Band (2 to 4 GHz): The S-band is used for a variety of purposes, including satellite communication and radar systems. It is known for its balance between range and data rate. This segment is projected to generate a $364.63 million market size in 2025.

Ku Band (12 to 18 GHz): The Ku band is used for satellite communication, particularly in regions with high population density, offering higher data transfer rates than the C band. This segment is projected to generate a $2156.38 million market size in 2025.

Ka-Band (26.5–40 GHz): The Ka-band provides even higher data transfer rates than the Ku band and is used for broadband satellite communication and Earth observation. This segment is projected to generate a $1310.69 million market size in 2025.

The C Band holds the largest market share due to its widespread use in commercial telecommunications and weather radar systems. Its ability to penetrate atmospheric conditions makes it a preferred choice for fixed satellite services.

On the other hand, the Ka-Band exhibits the fastest growth rate, attributed to its higher data transfer capabilities, which are increasingly in demand for broadband satellite communication and high-throughput satellite systems. The Ka Band’s growth is also driven by its applications in Earth observation and remote sensing, which are critical for environmental monitoring and defense.

In summary, while the C Band dominates the market with its extensive applications, the Ka-Band leads in growth, reflecting a market shift towards higher frequency bands that offer greater data transfer rates and capacity. This trend is expected to continue as the demand for high-speed broadband and advanced communication services grows globally.

Applications Analysis

The global satellite communication terminal market serves various applications, each with distinct requirements and market dynamics.

Maritime Military/Government: This sector includes satellite communication terminals used for military operations, national security, and government communications, emphasizing secure and reliable connectivity. This segment is projected to generate a $4362.05 million market size in 2025.

Civil: The civil sector encompasses commercial and non-military uses, such as broadcasting, telecommunications, and internet services for civilian populations. This segment is projected to generate a $2867.39 million market size in 2025.

The Maritime Military/Government application holds the largest market share, driven by the critical need for secure and reliable communication in defense and national security operations. The demand for advanced communication systems in military theaters and for intelligence gathering is a key factor contributing to this sector’s dominance.

However, the Civil application exhibits the fastest growth rate, primarily due to the increasing demand for broadband internet services, especially in remote areas where terrestrial infrastructure is lacking. The expansion of satellite-based internet services globally is a significant driver for this growth, as it promises to bridge the digital divide by providing internet access to underserved regions. As technology advances and the demand for reliable global communication increases, these trends are expected to shape the future of the satellite communication terminal market.

Market Revenue by Segment

| Market Revenue (M USD) in 2025 | ||

| By Type | L Band | 141.20 |

| C Band | 2520.41 | |

| X Band | 736.13 | |

| S-Band | 364.63 | |

| Ku Band | 2156.38 | |

| Ka-Band | 1310.69 | |

| By Application | Maritime Military/Government | 4362.05 |

| Civil | 2867.39 |

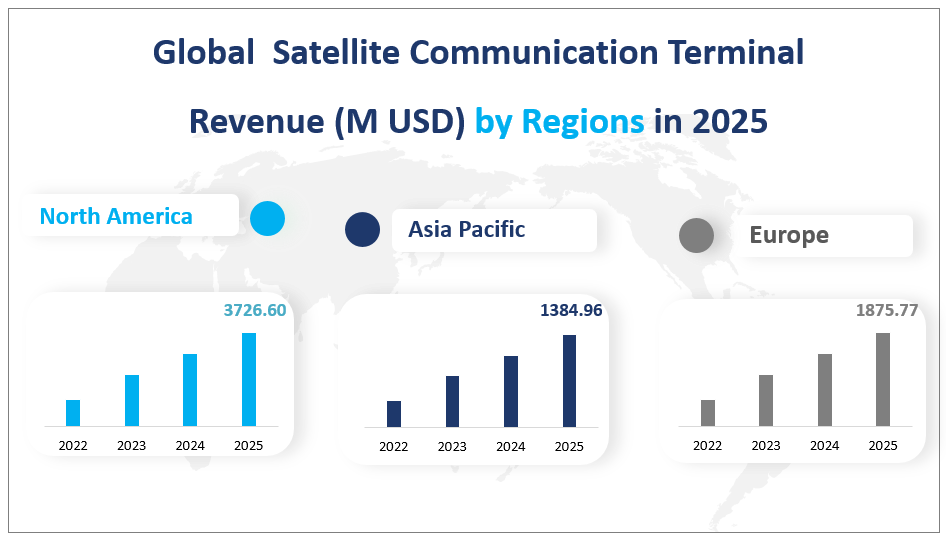

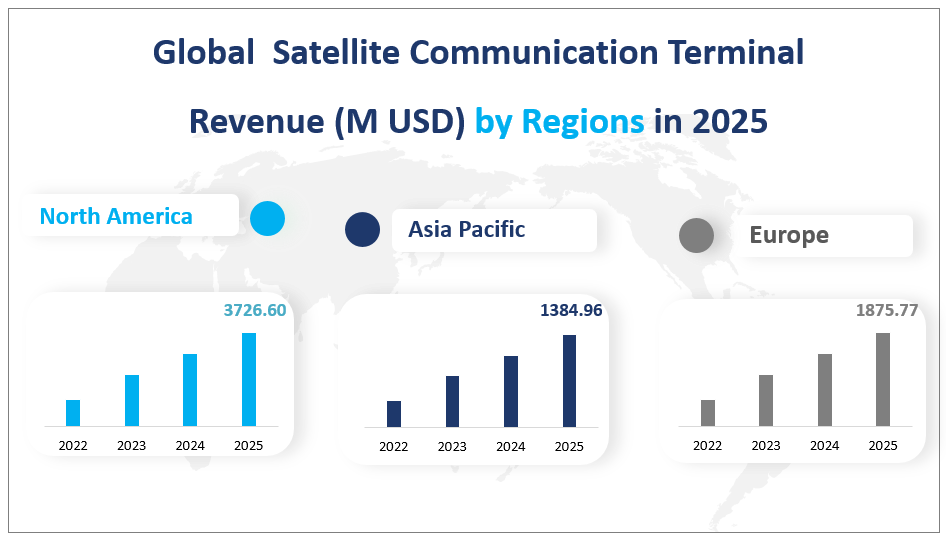

5. Regional Satellite Communication Terminal Market

The global satellite communication terminal market is a diverse and dynamic landscape, with different regions exhibiting unique growth patterns and revenue contributions.

North America: The region’s dominance of the global satellite communication terminal market is underpinned by the United States’ significant investments in satellite technology for both civilian and military use. The country’s advanced space programs and the presence of major satellite manufacturers give it a competitive edge. North America is expected to generate a $3,726.60 million market size in 2025.

Europe: Europe holds a substantial market share, with Germany, France, and the UK leading the way. The region’s strong focus on space technology and satellite applications, along with collaborative efforts among European countries, contributes to its market share. Europe is projected to reach a $1,875.77 million market size in 2025.

Asia Pacific: The region’s growth is driven by China’s aggressive space program and the increasing demand for satellite communication in India and Australia. The region’s vast geography and the need for improved connectivity in remote areas are also driving factors. Asia Pacific is anticipated to contribute a $1,384.96 million market size in 2025.

North America will emerge as the biggest satellite communication terminal market by revenue in 2025, driven by the region’s strong investment in satellite technology, advanced telecommunications infrastructure, and the presence of key satellite communication terminal market manufacturers. The region’s significant defense spending and the adoption of satellite communication for military and government applications also contribute to its market leadership.

Asia Pacific is identified as the fastest-growing satellite communication terminal region. This growth is attributed to the rapid expansion of satellite-based services in the region, particularly in China, Japan, and India. The increasing demand for broadband connectivity in remote areas, the growth of the maritime industry, and the region’s burgeoning aerospace sector are key factors driving the satellite communication terminal market expansion.

In conclusion, the global satellite communication terminal market is characterized by diverse regional dynamics, with North America leading in revenue and Asia Pacific showing the most promising growth. As the market continues to evolve, regional-specific factors will play a crucial role in shaping the global landscape of the satellite communication terminal market.

Global Satellite Communication Terminal Revenue (M USD) by Regions in 2025

6. Analysis of the Top Five Companies in the Global Satellite Communication Terminal Market

The global satellite communication terminal market is competitive, with several companies playing significant roles. L3Harris, SpaceX, and Raytheon Technologies are the top 3 companies in the global satellite communication terminal market with a share of 39.38% in 2024

Introduction and Business Overview: L3Harris Technologies is a leading provider of advanced defense and commercial technologies across air, land, sea, space, and cyber domains. The company offers a wide range of products and services, including integrated mission systems, space and airborne systems, and communication systems.

Products: L3Harris specializes in large fixed SATCOM terminals, providing connectivity to the Global Information Grid (GIG) and supporting high-priority military communications.

Introduction and Business Overview: SpaceX is renowned for designing, manufacturing, and launching advanced rockets and spacecraft. The company is also known for its Starlink satellite constellation, providing global internet coverage.

Products: SpaceX offers satellite communication terminals that support Starlink’s broadband services, enabling high-speed internet in remote locations.

Introduction and Business Overview: Raytheon Technologies is a major aerospace and defense company, offering systems and services for commercial, military, and government customers worldwide.

Products: Raytheon specializes in protected satellite communications, including Anti-Jam Tactical Satellite Communications (PATS).

Introduction and Business Overview: Viasat is an innovator in satellite communication products and services, offering fixed and mobile broadband services, secure networking systems, and tactical data link systems.

Products: Viasat’s product lineup includes the GAT-5510 terminal, a next-generation Ka-band terminal for airborne operations.

Introduction and Business Overview: Thales Group is a global leader in smart technologies for the aerospace, defense, and security markets, providing electronic systems, software, and services.

Products: Thales offers a range of satellite communication terminals, including the Tampa TM-850 MP and TM-FA130 Manpack and Fly-Away Terminals.

These top companies are instrumental in shaping the satellite communication terminal market with their cutting-edge technologies and global reach. Their continued innovation and strategic expansion efforts are expected to drive the market’s growth in the coming years.

Major Players

| Company Name | Headquarters | Area Served |

| L3Harris | USA | Worldwide |

| SpaceX | USA | Worldwide |

| Raytheon Technologies | USA | Worldwide |

| Viasat | USA | Worldwide |

| Thales Group | France | Worldwide |

| General Dynamics Mission Systems | USA | Mainly in North America, Europe, Asia |

| Eutelsat OneWeb | UK | Mainly in North America, Europe, Asia |

| Cobham Satcom | Denmark | Mainly in Europe, Asia, and North America |

| Ball Aerospace | USA | Mainly in Europe, Asia, and North America |

| Honeywell | USA | Mainly in North America, Europe, Asia |

| DataPath | USA | Mainly in Europe, Asia, and North America |

| Hytera Communications Corporation Limited | China | Mainly in Europe, Asia, and North America |

| Beijing StarNeto Technology Co., Ltd. | China | Mainly in Asia |

| Chengdu MandS Electronics Technology Co., Ltd. | China | Mainly in Asia |

| Kingsignal Technology Co., Ltd. | China | Mainly in Asia |

| Satpro M&C Tech Co.,Ltd. | China | Mainly in Europe, Asia, the Middle East |

| Jiangsu LeZone Technology Corp., Ltd | China | Mainly in Asia |

| Hwa Create Corporation Ltd. | China | Mainly in Asia |

| KEYIDEA | China | Mainly in Asia |

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Satellite Communication Terminal Market Size Growth Rate by Type: 2019 VS 2024 VS 2030

1.2.2 Market Analysis by Type

1.3 Market Analysis by Application

1.3.1 Global Satellite Communication Terminal Market Size Growth Rate by Application: 2019 VS 2024 VS 2030

1.3.2 Maritime Military/Government

1.3.3 Civil

1.4 Study Objectives

2 Market Perspective

2.1 Global Satellite Communication Terminal Market Size (2019-2030)

2.2 Global Satellite Communication Terminal Market Size across Key Geographies Worldwide: 2019 VS 2023 VS 2030

2.3 Global Satellite Communication Terminal Market Size by Region (2019-2024)

2.4 Global Satellite Communication Terminal Market Size Forecast by Region (2025-2030)

3 Satellite Communication Terminal Competitive by Company

3.1 Global Satellite Communication Terminal Revenue by Players

3.1.1 Global Satellite Communication Terminal Revenue by Players (2019-2024)

3.1.2 Global Satellite Communication Terminal Market Share by Players (2019-2024)

3.2 Global Satellite Communication Terminal Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Global Satellite Communication Terminal Market Concentration Ratio

3.3.1 Global Satellite Communication Terminal Market Concentration Ratio (CR5)

3.3.2 Global Top 10 and Top 5 Companies by Satellite Communication Terminal Revenue in 2023

3.4 Global Satellite Communication Terminal Key Players Head office

3.5 Global Satellite Communication Terminal Key Players Area Served

3.6 Mergers & Acquisitions, Expansion Plans

4 Global Satellite Communication Terminal Breakdown Data by Type

4.1 Global Satellite Communication Terminal Historical Revenue by Type

4.2 Global Satellite Communication Terminal Forecasted Revenue by Type (2025-2030)

5 Global Satellite Communication Terminal Breakdown Data by Application

5.1 Global Satellite Communication Terminal Historical Revenue by Application (2019-2024)

5.2 Global Satellite Communication Terminal Forecasted Revenue by Application (2025-2030)

6 North America

6.1 North America Satellite Communication Terminal Revenue by Type (2019-2030)

6.2 North America Satellite Communication Terminal Revenue by Application (2019-2030)

6.3 North America Satellite Communication Terminal Revenue by Country (2019-2030)

6.3.2 Canada

7 Europe

7.1 Europe Satellite Communication Terminal Revenue by Type (2019-2030)

7.2 Europe Satellite Communication Terminal Revenue by Application (2019-2030)

7.3 Europe Satellite Communication Terminal Revenue by Country (2019-2030)

7.3.2 France

7.3.3 U.K.

7.3.4 Italy

7.3.5 Russia

7.3.6 Spain

8 Asia Pacific

8.1 Asia Pacific Satellite Communication Terminal Revenue by Type (2019-2030)

8.2 Asia Pacific Satellite Communication Terminal Revenue by Application (2019-2030)

8.3 Asia Pacific Satellite Communication Terminal Revenue by Country (2019-2030)

8.3.2 Japan

8.3.3 South Korea

8.3.4 India

8.3.5 Australia

8.3.6 Southeast Asia

9 Latin America

9.1 Latin America Satellite Communication Terminal Revenue by Type (2019-2030)

9.2 Latin America Satellite Communication Terminal Revenue by Application (2019-2030)

9.3 Latin America Satellite Communication Terminal Revenue by Country (2019-2030)

9.3.2 Brazil

9.3.3 Argentina

10 Middle East and Africa

10.1 Middle East and Africa Satellite Communication Terminal Revenue by Type (2019-2030)

10.2 Middle East and Africa Satellite Communication Terminal Revenue by Application (2019-2030)

10.3 Middle East and Africa Satellite Communication Terminal Revenue by Country (2019-2030)

10.3.2 Saudi Arabia

10.3.3 U.A.E

11 Company Profiles

11.1 L3Harris

11.1.1 L3Harris Corporation Information

11.1.2 L3Harris Business Overview

11.1.3 Satellite Communication Terminal Products and Services

11.1.4 L3Harris Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.1.5 L3Harris Recent Development

11.2 SpaceX

11.2.1 SpaceX Corporation Information

11.2.2 SpaceX Business Overview

11.2.3 Satellite Communication Terminal Products and Services

11.2.4 SpaceX Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.2.5 SpaceX Recent Development

11.3 Raytheon Technologies

11.3.1 Raytheon Technologies Corporation Information

11.3.2 Raytheon Technologies Business Overview

11.3.3 Satellite Communication Terminal Products and Services

11.3.4 Raytheon Technologies Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.3.5 Raytheon Technologies Recent Development

11.4 Viasat

11.4.1 Viasat Corporation Information

11.4.2 Viasat Business Overview

11.4.3 Satellite Communication Terminal Products and Services

11.4.4 Viasat Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.4.5 Viasat Recent Development

11.5 Thales Group

11.5.1 Thales Group Corporation Information

11.5.2 Thales Group Business Overview

11.5.3 Satellite Communication Terminal Products and Services

11.5.4 Thales Group Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.5.5 Thales Group Recent Development

11.6 General Dynamics Mission Systems

11.6.1 General Dynamics Mission Systems Corporation Information

11.6.2 General Dynamics Mission Systems Business Overview

11.6.3 Satellite Communication Terminal Products and Services

11.6.4 General Dynamics Mission Systems Satellite Communication Terminal Revenue and Gross Margin (2019- 2024)

11.6.5 General Dynamics Mission Systems Recent Development

11.7 Eutelsat OneWeb

11.7.1 Eutelsat OneWeb Corporation Information

11.7.2 Eutelsat OneWeb Business Overview

11.7.3 Satellite Communication Terminal Products and Services

11.7.4 Eutelsat OneWeb Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.7.5 Eutelsat OneWeb Recent Development

11.8 Cobham Satcom

11.8.1 Cobham Satcom Corporation Information

11.8.2 Cobham Satcom Business Overview

11.8.3 Satellite Communication Terminal Products and Services

11.8.4 Cobham Satcom Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.8.5 Cobham Satcom Recent Development

11.9 Ball Aerospace

11.9.1 Ball Aerospace Corporation Information

11.9.2 Ball Aerospace Business Overview

11.9.3 Satellite Communication Terminal Products and Services

11.9.4 Ball Aerospace Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.9.5 Ball Aerospace Recent Development

11.10 Honeywell

11.10.1 Honeywell Corporation Information

11.10.2 Honeywell Business Overview

11.10.3 Satellite Communication Terminal Products and Services

11.10.4 Honeywell Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.10.5 Honeywell Recent Development

11.11 DataPath

11.11.1 DataPath Corporation Information

11.11.2 DataPath Business Overview

11.11.3 Satellite Communication Terminal Products and Services

11.11.4 DataPath Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.11.5 DataPath Recent Development

11.12 Hytera Communications Corporation Limited

11.12.1 Hytera Communications Corporation Limited Corporation Information

11.12.2 Hytera Communications Corporation Limited Business Overview

11.12.3 Satellite Communication Terminal Products and Services

11.12.4 Hytera Communications Corporation Limited Satellite Communication Terminal Revenue and Gross Margin (2019- 2024)

11.12.5 Hytera Communications Corporation Limited Recent Development

11.13 Beijing StarNeto Technology Co., Ltd.

11.13.1 Beijing StarNeto Technology Co., Ltd. Corporation Information

11.13.2 Beijing StarNeto Technology Co., Ltd. Business Overview

11.13.3 Satellite Communication Terminal Products and Services

11.13.4 Beijing StarNeto Technology Co., Ltd. Satellite Communication Terminal Revenue and Gross Margin (2019- 2024)

11.14 Chengdu MandS Electronics Technology Co.,Ltd.

11.14.1 Chengdu MandS Electronics Technology Co.,Ltd. Corporation Information

11.14.2 Chengdu MandS Electronics Technology Co.,Ltd. Business Overview

11.14.3 Satellite Communication Terminal Products and Services

11.14.4 Chengdu MandS Electronics Technology Co.,Ltd. Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.15 Kingsignal Technology Co., Ltd.

11.15.1 Kingsignal Technology Co., Ltd. Corporation Information

11.15.2 Kingsignal Technology Co., Ltd. Business Overview

11.15.3 Satellite Communication Terminal Products and Services

11.15.4 Kingsignal Technology Co., Ltd. Satellite Communication Terminal Revenue and Gross Margin (2019- 2024)

11.15.5 Kingsignal Technology Co., Ltd. Recent Development

11.16 Satpro M&C Tech Co.,Ltd.

11.16.1 Satpro M&C Tech Co.,Ltd. Corporation Information

11.16.2 Satpro M&C Tech Co.,Ltd. Business Overview

11.16.3 Satellite Communication Terminal Products and Services

11.16.4 Satpro M&C Tech Co.,Ltd. Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.17 Jiangsu LeZone Technology Corp., Ltd

11.17.1 Jiangsu LeZone Technology Corp., Ltd Corporation Information

11.17.2 Jiangsu LeZone Technology Corp., Ltd Business Overview

11.17.3 Satellite Communication Terminal Products and Services

11.17.4 Jiangsu LeZone Technology Corp., Ltd Satellite Communication Terminal Revenue and Gross Margin (2019- 2024)

11.18 Hwa Create Corporation Ltd.

11.18.1 Hwa Create Corporation Ltd. Corporation Information

11.18.2 Hwa Create Corporation Ltd. Business Overview

11.18.3 Satellite Communication Terminal Products and Services

11.18.4 Hwa Create Corporation Ltd. Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

11.19 KEYIDEA

11.19.1 KEYIDEA Corporation Information

11.19.2 KEYIDEA Business Overview

11.19.3 Satellite Communication Terminal Products and Services

11.19.4 KEYIDEA Satellite Communication Terminal Revenue and Gross Margin (2019-2024)

12 Satellite Communication Terminal Market Dynamics

12.1 Satellite Communication Terminal Market Trends

12.2 Satellite Communication Terminal Market Drivers

12.3 Satellite Communication Terminal Market Challenges

12.4 Satellite Communication Terminal Market Restraints

13 Appendix

13.1 Methodology

13.2.1 Secondary Data