1 Global Sampling Valve Market Size and Definition

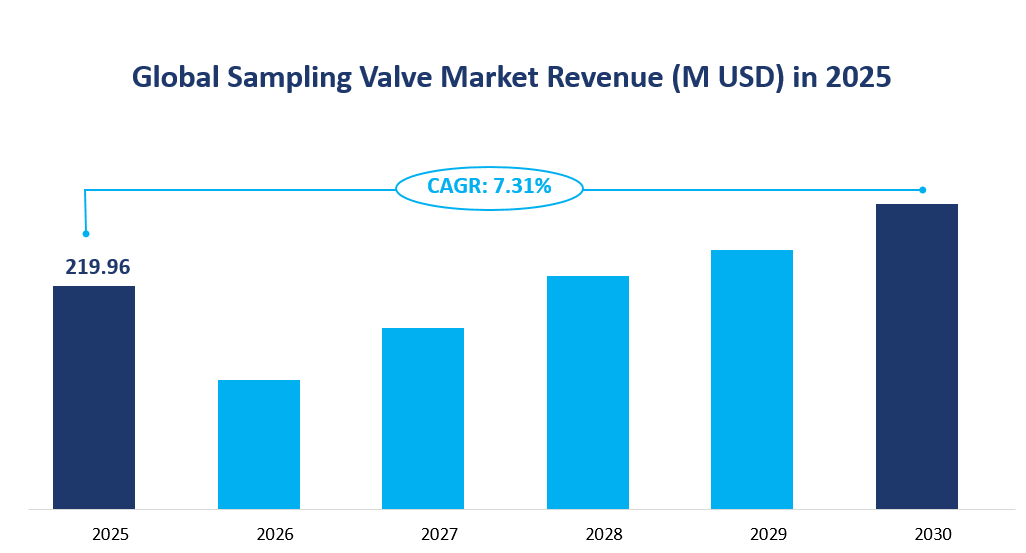

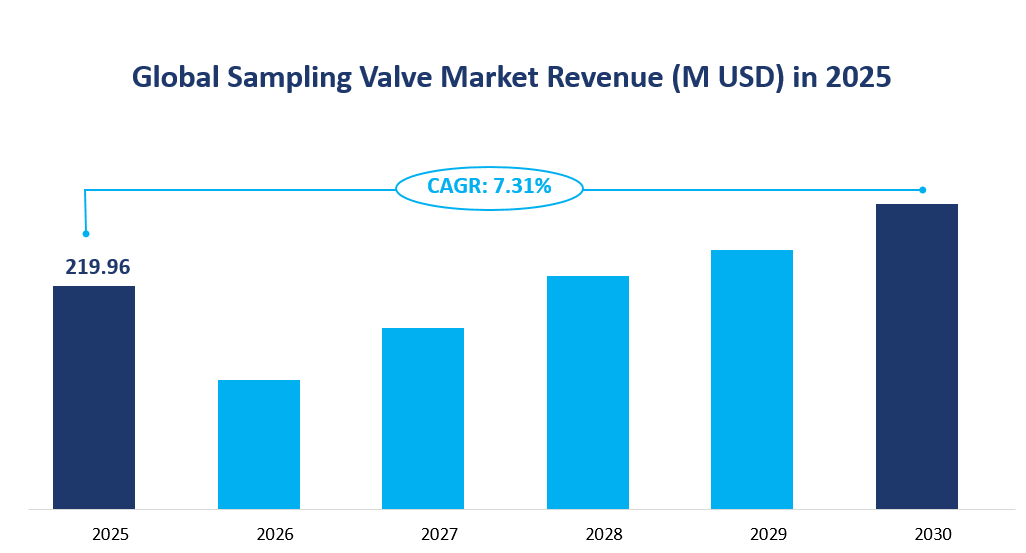

The global sampling valve market is projected to witness significant growth in the coming years, driven by increasing demand from various downstream industries. In 2025, the global sampling valve market is estimated to reach a total value of $219.96 million. This growth is supported by a Compound Annual Growth Rate (CAGR) of 7.31% from 2025 to 2030, indicating a steady expansion of the market over the forecast period.

Sampling valves are essential devices used to obtain medium samples from pipelines or equipment. They play a crucial role in industries where frequent chemical analysis of samples is required, such as oil & gas, pharmaceuticals, papermaking, food & beverages, and chemicals. These valves allow for the safe and accurate extraction of fluid samples, ensuring quality control and compliance with industry standards.

Figure Global Sampling Valve Market Revenue and CAGR 2025-2030

2 Drivers and Limitations of Sampling Valve Market Growth

The growth of the global sampling valve market is primarily driven by the increasing demand from downstream industries. As the global economy continues to develop and the population grows, the need for efficient and reliable sampling solutions becomes more pronounced. Key drivers include:

Broad Application Scope: Sampling valves are indispensable in various industries, including oil & gas, pharmaceuticals, papermaking, food & beverages, and chemicals. The continuous growth in these sectors drives the demand for sampling valves.

Technological Advancements: Innovations in valve technology, such as the development of smart sampling valves, enhance operational efficiency and accuracy. These advancements are expected to further boost market growth.

E-commerce Expansion: The rise of e-commerce platforms has simplified the procurement process for end-users, reducing transaction costs and improving accessibility to a wider range of products.

Constraints:

Fierce Competition: The sampling valve industry is highly competitive, with numerous manufacturers and suppliers vying for market share. This competition can lead to price wars, affecting profit margins.

Raw Material Price Fluctuations: The primary raw material for sampling valves is stainless steel, whose prices are subject to fluctuations due to geopolitical issues, trade wars, and supply chain disruptions. These fluctuations can impact production costs and profitability.

Environmental Concerns: The manufacturing process of sampling valves generates waste and pollution, necessitating environmental compliance measures that can increase production costs.

3 Sampling Valve Market Technological Innovations and Mergers & Acquisitions Analysis

The sampling valve market is experiencing significant technological advancements and corporate dynamics. Key trends include:

Smart Manufacturing: The integration of Internet of Things (IoT) technology and data analytics is transforming the production process. Smart sampling valves equipped with sensors and connectivity features enable real-time monitoring and automation, enhancing operational efficiency and reducing human error.

Digital Transformation: Many companies are undergoing digital transformation, leveraging big data, cloud computing, and artificial intelligence to optimize their operations. This shift is expected to improve product quality and customer satisfaction.

Corporate Mergers and Acquisitions: Strategic mergers and acquisitions are common in the industry, as companies seek to expand their market presence and product portfolios. For example, Emerson Electric’s recent proposal to acquire National Instruments highlights the trend of companies consolidating to enhance their competitive edge.

4 Global Sampling Valve Market Analysis by Type

The global sampling valve market is anticipated to experience significant growth in the coming years, with a diverse range of valve types contributing to this expansion. By 2025, the market is projected to reach substantial revenues, driven by the increasing demand from various industrial sectors.

Double Opening Valves

These valves are characterized by their safety and stability in sampling processes. They are composed of two connected ball valves, allowing for efficient medium flow into a sampling vessel. The forecasted revenue for Double Opening Valves in 2025 is 95.45 M USD, reflecting a market share of 43.39%. This type is particularly popular in industries such as oil & gas and chemicals, where reliable sampling is crucial.

Flange Clip Valves

Flange Clip Valves operate on the principle of sealing through the vertebral body at the top of the valve stem and the taper hole of the valve seat. They are estimated to generate a revenue of 81.01 M USD in 2025, capturing a market share of 36.83%. These valves are commonly used in pharmaceutical and papermaking industries due to their precise control and hygiene maintenance capabilities.

Sampling Valves with an Insulated Jacket

Designed for applications requiring temperature control, these valves prevent crystallization and ensure sample integrity. They are expected to reach a revenue of 43.51 M USD in 2025, holding a market share of 19.78%. Their importance is highlighted in industries like food & beverages and chemicals, where maintaining the quality of samples is vital.

Table Global Sampling Valve Market Size and Share by Type in 2025

|

Type |

Market Size (M USD) |

Market Share (%) |

|---|---|---|

|

Double Opening Valves |

95.45 |

43.39 |

|

Flange Clip Valves |

81.01 |

36.83 |

|

Sampling Valve with an Insulated Jacket |

43.51 |

19.78 |

5 Global Sampling Valve Market Analysis by Application

The global sampling valve market is set to witness considerable growth in the coming years, with different applications driving demand across various industries. The year 2025 is projected to be a significant milestone, with consumption expected to reach new heights.

Oil & Gas

The oil and gas sector is anticipated to consume 15.00 K Units of sampling valves in 2025, reflecting a market share of 3.01%. This sector’s demand is driven by the need for reliable and efficient sampling solutions in exploration and production processes.

Pharmaceutical

The pharmaceutical industry is projected to be a major consumer of sampling valves, with a forecasted consumption of 101.10 K Units, accounting for 20.31% of the market. The growth in this sector is attributed to the increasing demand for high-quality pharmaceuticals and the need for stringent quality control measures.

Papermaking

In the papermaking industry, the consumption of sampling valves is expected to reach 45.38 K Units, representing a market share of 9.11%. This application is crucial for monitoring the quality of paper products throughout the manufacturing process.

Food & Beverages

The food and beverages sector is expected to consume a significant number of sampling valves, with a projected consumption of 122.77 K Units, making up 24.66% of the market. This sector requires precise sampling to ensure product safety and quality.

Chemicals

The chemicals industry is forecasted to be the largest consumer of sampling valves, with a consumption of 136.86 K Units, capturing a market share of 27.49%. The need for accurate sampling in chemical processes to ensure product quality and safety drives this demand.

Table Global Sampling Valve Consumption and Market Share by Application in 2025

|

Application |

Consumption (K Units) |

Market Share (%) |

|---|---|---|

|

Oil & Gas |

15.00 |

3.01 |

|

Pharmaceutical |

101.10 |

20.31 |

|

Papermaking |

45.38 |

9.11 |

|

Food & Beverages |

122.77 |

24.66 |

|

Chemicals |

136.86 |

27.49 |

6 Global Sampling Valve Market Analysis by Region

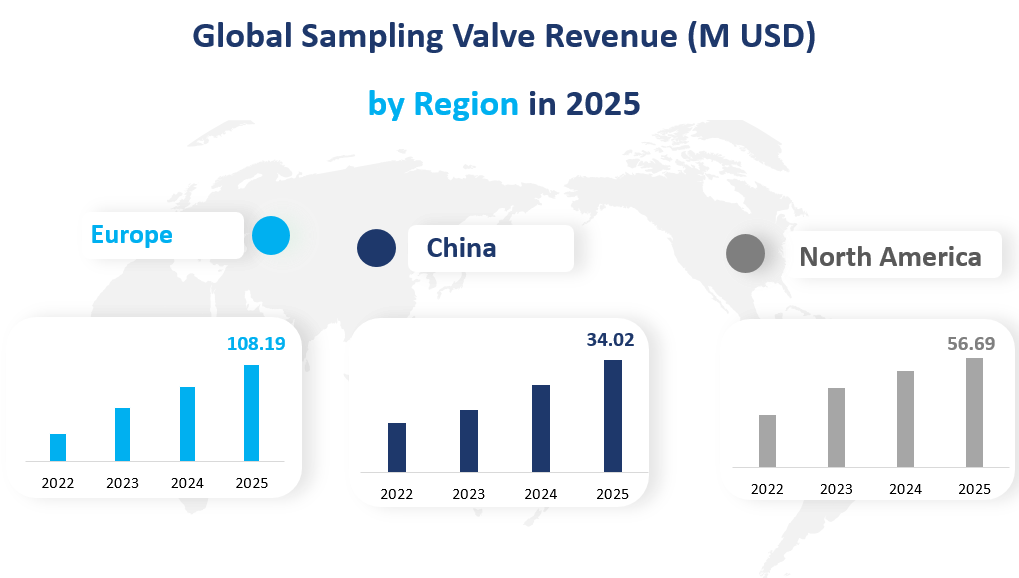

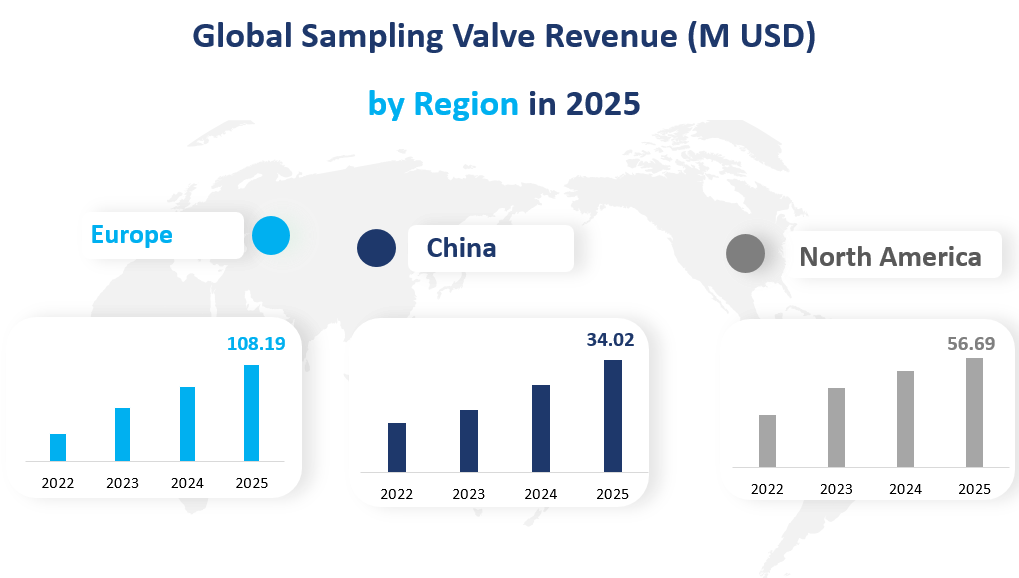

North America

In 2025, the North American market is forecasted to generate a revenue of $56.69 million, reflecting a growth rate of 9.40%. This region has shown a consistent upward trend with a slight dip in growth rate over the years. The steady growth can be attributed to the region’s robust industrial base and ongoing investments in infrastructure development, particularly in the oil & gas and chemicals sectors.

Europe

Europe is anticipated to be the largest regional market by value in 2025, with a projected revenue of $108.19 million. The growth rate for this year is 9.73%, indicating a strong market performance. Europe’s significant position in the global market can be credited to its advanced manufacturing capabilities and stringent regulatory environments that demand high-quality sampling valves. The pharmaceutical and food & beverages sectors are particularly prominent drivers of demand in this region.

China

The Chinese market is expected to exhibit the fastest growth rate among the three regions in 2025, with a projected revenue of $34.02 million and a growth rate of 11.52%. This rapid growth is driven by China’s expanding industrial sectors, increased focus on environmental protection, and the rising need for efficient process control in industries such as chemicals and papermaking.

Figure Global Sampling Valve Revenue (M USD) by Region in 2025

7 Global Sampling Valve Market: Top 3 Companies Analysis

7.1 GEA Group

Company Introduction and Business Overview

GEA Group is a global leader in engineering and manufacturing of advanced process technology, components, and equipment. Established in Germany in 1881, GEA has expanded its operations worldwide, serving various industries including food, beverage, pharmaceutical, and energy sectors. The company is known for its comprehensive solutions that enhance efficiency, sustainability, and safety in industrial processes.

Products Offered

GEA offers a diverse range of sampling valves designed for different applications. Their product portfolio includes the SAMPLING SYSTEM VESTA®, a modular aseptic sampling system that allows for flexible and automated sampling at various process line locations. These systems are designed to be compact and adaptable to different customer process requirements, ensuring high-quality and reliable sampling.

Sales Revenue in 2022

In 2022, GEA Group reported sales revenues of approximately $18.52 million in the sampling valve segment. This revenue reflects GEA’s strong market position and its ability to deliver innovative solutions that meet the evolving needs of its customers across different industries.

7.2 Alfa Laval

Company Introduction and Business Overview

Alfa Laval, headquartered in Sweden, is a multinational company specializing in heat transfer, separation, and fluid handling. Founded in 1883, Alfa Laval has a long history of innovation and quality, providing products and solutions that are crucial in various sectors such as energy, food and water, marine, and climate solutions.

Products Offered

Alfa Laval’s sampling valve offerings include the SB Membrane Sampling Valve, designed for taking bulk or aseptic samples under sterile conditions. This valve is particularly useful in breweries and other hygienic processes like food and dairy. It ensures minimal contamination risk, high accuracy, repeatability, and reliability.

Sales Revenue in 2022

For the year ended in 2022, Alfa Laval reported sales revenues of about $15.47 million from its sampling valve segment. This revenue showcases Alfa Laval’s strong product portfolio and its effectiveness in meeting the demands of the market.

7.3 NEUMO-Ehrenberg-Group

Company Introduction and Business Overview

NEUMO-Ehrenberg-Group, headquartered in Germany, is a leading manufacturer and distributor of stainless steel products and metal cutting tools in Europe. Established in 1947, the group has grown to employ over 1,900 people worldwide, offering a wide range of products that serve various industries.

Products Offered

The group offers aseptic BioCheck Sampling Valves, designed for sterile sampling in critical environments. These valves are essential for ensuring the integrity and safety of samples in processes involving food, beverages, and pharmaceuticals.

Sales Revenue in 2022

NEUMO-Ehrenberg-Group reported sales revenues of around $11.96 million from its sampling valve segment in 2022. This revenue highlights the company’s competitive edge in providing high-quality sampling solutions to its customers.

1 Sampling Valve Market Overview

1.1 Product Overview and Scope of Sampling Valve

1.2 Sampling Valve Segment by Type

1.2.1 Global Sampling Valve Market Size Growth Rate Analysis by Type 2022 VS 2030

1.2.2 Double Opening Valves

1.2.3 Flange Clip Valves

1.2.4 Sampling Valve with an Insulated Jacket

1.3 Sampling Valve Segment by Applications

1.3.1 Sampling Valve Consumption Comparison by Application: 2020 VS 2022 VS 2030

1.3.2 Sampling Valve Applications

1.4 Global Market Growth Prospects

1.4.1 Global Sampling Valve Revenue Estimates and Forecasts (2020-2030)

1.4.2 Global Sampling Valve Production Estimates and Forecasts (2020-2030)

1.5 Global Sampling Valve Market by Region

1.5.1 Global Sampling Valve Market Size Estimates and Forecasts by Region: 2020 VS 2022 VS 2030

1.5.2 North America Sampling Valve Estimates and Forecasts (2020-2030)

1.5.3 Europe Sampling Valve Estimates and Forecasts (2020-2030)

1.5.4 China Sampling Valve Estimates and Forecasts (2020-2030)

1.5.5 Japan Sampling Valve Estimates and Forecasts (2020-2030)

2 Market Competition by Manufacturers

2.1 Global Sampling Valve Production Market Share by Manufacturer

2.2 Global Sampling Valve Revenue Market Share by Manufacturer (2020-2022)

2.3 Sampling Valve Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

2.4 Global Sampling Valve Average Price by Manufacturers (2020-2022)

2.5 Manufacturers Sampling Valve Headquarters, Founded Time and Area Served

2.6 Sampling Valve Market Competitive Situation and Trends

2.6.1 Sampling Valve Market Concentration Rate

2.6.2 Global Top 5 and Top 10 Players Market Share by Revenue

3 Production by Region

3.1 Global Production of Sampling Valve by Regions (2020-2022)

3.2 Global Sampling Valve Revenue and Market Share by Regions

3.3 Global Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

3.4 North America Sampling Valve Production

3.4.1 North America Sampling Valve Production Growth Rate (2020-2022)

3.4.2 North America Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

3.5 Europe Sampling Valve Production

3.5.1 Europe Sampling Valve Production Growth Rate (2020-2022)

3.5.2 Europe Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

3.6 China Sampling Valve Production

3.6.1 China Sampling Valve Production Growth Rate (2020-2022)

3.6.2 China Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

3.7 Japan Sampling Valve Production

3.7.1 Japan Sampling Valve Production Growth Rate (2020-2022)

3.7.2 Japan Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

4 Global Sampling Valve Consumption by Region

4.1 Global Sampling Valve Consumption by Regions

4.1.1 Global Sampling Valve Consumption by Region

4.1.2 Global Sampling Valve Consumption Market Share by Region

4.2 North America

4.2.1 North America Sampling Valve Consumption by Country

4.2.2 U.S.

4.2.3 Canada

4.3 Europe

4.3.1 Europe Sampling Valve Consumption by Country

4.3.2 Germany

4.3.3 France

4.3.4 U.K.

4.3.5 Italy

4.3.6 Russia

4.4 Asia Pacific

4.4.1 Asia Pacific Sampling Valve Consumption by Region

4.4.2 China

4.4.3 Japan

4.4.4 South Korea

4.4.5 China Taiwan

4.4.6 Southeast Asia

4.4.7 India

4.4.8 Australia

4.5 Latin America

4.5.1 Latin America Sampling Valve Consumption by Country

4.5.2 Mexico

4.5.3 Brazil

5 Production, Revenue, Price Trend by Type

5.1 Global Sampling Valve Production and Market Share by Type (2020-2022)

5.2 Global Sampling Valve Revenue Market Share by Type (2020-2022)

5.3 Global Sampling Valve Price by Type (2020-2022)

6 Consumption by Application

6.1 Global Sampling Valve Consumption Market Share by Applications (2020-2022)

6.2 Global Sampling Valve Consumption Growth Rate by Application (2020-2022)

7 Key Companies Profiled

7.1 GEA Group

7.1.1 GEA Group Sampling Valve Corporation Information

7.1.2 Sampling Valve Product Portfolio

7.1.3 GEA Group Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.1.4 GEA Group Main Business and Markets Served

7.2 Alfa Laval

7.2.1 Alfa Laval Sampling Valve Corporation Information

7.2.2 Sampling Valve Product Portfolio

7.2.3 Alfa Laval Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.2.4 Alfa Laval Main Business and Markets Served

7.3 NEUMO-Ehrenberg-Group

7.3.1 NEUMO-Ehrenberg-Group Sampling Valve Corporation Information

7.3.2 Sampling Valve Product Portfolio

7.3.3 NEUMO-Ehrenberg-Group Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.3.4 NEUMO-Ehrenberg-Group Main Business and Markets Served

7.4 Pfeiffer

7.4.1 Pfeiffer Sampling Valve Corporation Information

7.4.2 Sampling Valve Product Portfolio

7.4.3 Pfeiffer Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.4.4 Pfeiffer Main Business and Markets Served

7.5 BIAR Sampling Systems

7.5.1 BIAR Sampling Systems Sampling Valve Corporation Information

7.5.2 Sampling Valve Product Portfolio

7.5.3 BIAR Sampling Systems Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.5.4 Main Business and Markets Served

7.6 KEOFITT A/S

7.6.1 KEOFITT A/S Sampling Valve Corporation Information

7.6.2 Sampling Valve Product Portfolio

7.6.3 KEOFITT A/S Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.6.4 KEOFITT A/S Main Business and Markets Served

7.7 Emerson Electric

7.7.1 Emerson Electric Sampling Valve Corporation Information

7.7.2 Sampling Valve Product Portfolio

7.7.3 Emerson Electric Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.7.4 Emerson Electric Main Business and Markets Served

7.7.5 Emerson Electric Recent Developments/Updates

7.8 Orbinox

7.8.1 Orbinox Sampling Valve Corporation Information

7.8.2 Sampling Valve Product Portfolio

7.8.3 Orbinox Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.8.4 Orbinox Main Business and Markets Served

7.9 RITAG

7.9.1 RITAG Sampling Valve Corporation Information

7.9.2 Sampling Valve Product Portfolio

7.9.3 RITAG Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.9.4 RITAG Main Business and Markets Served

7.10 Strahman Valves

7.10.1 Strahman Valves Sampling Valve Corporation Information

7.10.2 Sampling Valve Product Portfolio

7.10.3 Strahman Valves Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.10.4 Strahman Valves Main Business and Markets Served

7.11 KIESELMANN

7.11.1 KIESELMANN Sampling Valve Corporation Information

7.11.2 Sampling Valve Product Portfolio

7.11.3 KIESELMANN Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.11.4 KIESELMANN Main Business and Markets Served

7.12 Swissfluid AG

7.12.1 Swissfluid AG Sampling Valve Corporation Information

7.12.2 Sampling Valve Product Portfolio

7.12.3 Swissfluid AG Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.12.4 Swissfluid AG Main Business and Markets Served

7.13 SchuF

7.13.1 SchuF Sampling Valve Corporation Information

7.13.2 Sampling Valve Product Portfolio

7.13.3 SchuF Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.13.4 SchuF Main Business and Markets Served

7.14 Genebre Group

7.14.1 Genebre Group Sampling Valve Corporation Information

7.14.2 Sampling Valve Product Portfolio

7.14.3 Genebre Group Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.14.4 Genebre Group Main Business and Markets Served

7.15 BOM INDUSTRIAL VALVES

7.15.1 BOM INDUSTRIAL VALVES Sampling Valve Corporation Information

7.15.2 Sampling Valve Product Portfolio

7.15.3 BOM INDUSTRIAL VALVES Sampling Valve Production, Revenue, Price and Gross Margin (2020-2022)

7.15.4 BOM INDUSTRIAL VALVES Main Business and Markets Served

8 Sampling Valve Manufacturing Cost Analysis

8.1 Sampling Valve Key Raw Materials Analysis

8.1.1 Key Raw Materials

8.1.2 Key Raw Materials Price Trend

8.1.3 Key Suppliers of Raw Materials

8.2 Proportion of Manufacturing Cost Structure

8.2.1 Raw Materials

8.2.2 Labor Cost

8.2.3 Manufacturing Expenses

8.3 Manufacturing Process Analysis of Sampling Valve

8.4 Sampling Valve Industrial Chain Analysis

9 Marketing Channel, Distributors and Customers

9.1 Marketing Channel

9.1.1 Direct Channel

9.1.2 Indirect Channel

9.2 Sampling Valve Distributors List

9.3 Sampling Valve Customers

10 Market Dynamics

10.1 Sampling Valve Industry Trends

10.2 Sampling Valve Growth Drivers

10.3 Sampling Valve Market Challenges

10.4 Sampling Valve Market Restraints

10.5 Influence Factors

11 Production and Supply Forecast

11.1 Global Forecasted Production of Sampling Valve by Region (2025-2030)

11.2 North America Sampling Valve Production, Revenue Forecast (2025-2030)

11.3 Europe Sampling Valve Production, Revenue Forecast (2025-2030)

11.4 China Sampling Valve Production, Revenue Forecast (2025-2030)

11.5 Japan Sampling Valve Production, Revenue Forecast (2025-2030)

12 Consumption and Demand Forecast

12.1 Global Forecasted Demand of Sampling Valve

12.2 North America Consumption of Sampling Valve by Country

12.3 Europe Consumption of Sampling Valve by Country

12.4 Asia Pacific Sampling Valve Consumption of Sampling Valve by Country

12.5 Latin America Sampling Valve Consumption of Sampling Valve by Country

13 Forecast by Type and by Application (2025-2030)

13.1 Global Production, Revenue and Price Forecast by Type (2025-2030)

13.1.1 Global Forecasted Production of Sampling Valve by Type (2025-2030)

13.1.2 Global Forecasted Revenue of Sampling Valve by Type (2025-2030)

13.1.3 Global Forecasted Price of Sampling Valve by Type (2025-2030)

13.2 Global Forecasted Consumption of Sampling Valve by Application (2025-2030)

14 Research Findings and Conclusion

15 Appendix

15.1 Methodology

15.2 Research Data Source

15.2.1 Secondary Data

15.2.2 Primary Data

15.2.3 Market Size Estimation

15.2.4 Legal Disclaimer