1. Global Probiotics Strain Market Outlook

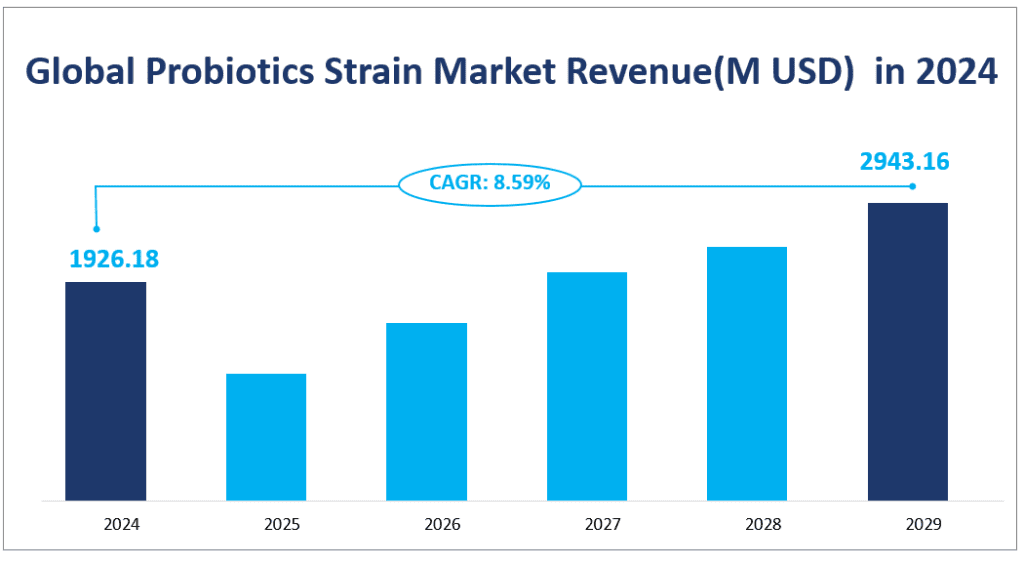

The global probiotics strain market revenue is anticipated to reach $1926.18 million in 2024, with a CAGR of 8.59% from 2024 to 2029. Probiotics strains, defined as live microorganisms that confer health benefits when administered in adequate amounts, are gaining traction for their potential to support digestive health, immune function, and overall well-being. These beneficial bacteria and yeasts are increasingly being integrated into food and beverage products, dietary supplements, and pharmaceutical applications, reflecting a growing consumer demand for health-promoting products.

Global Probiotics Strain Market Revenue(M USD) in 2024

2. Probiotics Strain Market Growth Drivers

The market for probiotic strains is driven by several key factors. Firstly, the increasing global population and the continuous growth in downstream demand are contributing to the expansion of the market. Economic development in regions like Asia Pacific, particularly in countries such as China, Japan, and India, has led to a significant increase in disposable incomes, which in turn boosts the demand for probiotic-based products. Additionally, the rising awareness of health and wellness, along with the growing trend of preventive healthcare, is fostering a preference for natural and probiotic-rich foods and supplements among consumers.

Technological advancements in the field of probiotics have also played a crucial role in market growth. Innovations in strain development and delivery systems have improved the efficacy and accessibility of probiotics, making them more appealing to consumers. Furthermore, the food and beverage industry’s expansion, especially in the Asia Pacific region, is creating new opportunities for the incorporation of probiotic strains into a variety of products, thereby driving market growth.

3. Probiotics Strain Market Limiting Factors

Despite the positive growth trajectory, the probiotics strain market faces certain challenges that could limit its expansion. One of the primary constraints is the need to meet international quality standards and regulations for probiotic products. Organizations such as the FAO/WHO Expert Consultation on Evaluation of Health and Nutritional Properties of Probiotics have established guidelines that can lead to the substantiation of health claims related to probiotic agents, which can be a complex and costly process for manufacturers.

Another limiting factor is the complexity involved in integrating probiotic strains into functional foods. The success of such products depends on consumer demand, technological capabilities, and legislative regulatory frameworks. Consumers’ lack of knowledge about the health effects of specific ingredients can hinder the acceptance of functional foods enriched with probiotics. Moreover, the risk of contamination during the cultivation and production process poses a significant challenge, as probiotic products are highly dependent on the cultivation by living organisms, making them vulnerable to microbial contamination.

In conclusion, while the global probiotics strain market is poised for significant growth, it must navigate through a complex regulatory environment and technological challenges to fully realize its potential. Despite these hurdles, the market’s prospects remain promising, driven by a growing consumer base that values health and wellness, and a food industry that is increasingly incorporating probiotics into its product offerings.

4. Analysis of Probiotics Strain Market Segment

Product Types of Probiotics Strain

The global probiotics strain market is diversified, with various product types playing significant roles in human and animal health. The product types are primarily classified based on the strains of bacteria they contain, which are known for their health benefits.

Lactobacillus acidophilus

Lactobacillus acidophilus is a strain of bacteria that is naturally found in the human gut and is known for its ability to promote healthy gut flora and support immune health. In 2024, this product type is projected to generate a substantial market revenue of $458.25 million, reflecting its widespread use in dietary supplements and food products. Its market share is significant due to its established reputation and consumer recognition.

Lactobacillus rhamnosus GG

Lactobacillus rhamnosus GG, commonly referred to as LGG, is a specific strain of bacteria that has been extensively studied for its health benefits, particularly in enhancing gut health and potentially reducing symptoms of irritable bowel syndrome. The market revenue for LGG is expected to be $302.27 million in 2024, with a steady growth rate due to its strong scientific backing and increasing consumer demand for natural health solutions.

Bifidobacterium bifidum

Bifidobacterium bifidum is a strain of bacteria that is one of the most common probiotic bacteria found in the human gut. It is known for its role in improving gut health and boosting the immune system. In 2024, Bifidobacterium bifidum is anticipated to have a substantial market value of $873.37 million, driven by its use in a variety of food and beverage products, as well as dietary supplements.

Among these product types, Bifidobacterium bifidum is expected to have the biggest market share in 2024, driven by its widespread use in various applications and the growing consumer awareness of its benefits.

Applications of the Probiotics Strain Market

The food and beverages segment is the largest within the probiotics strain market. It includes products like yogurt, fermented milk, and other drinks that contain probiotics. In 2024, this segment is expected to dominate the market with a market revenue of $1451.24 million, reflecting the increasing consumer preference for health-enhancing foods and the growing trend of functional foods.

Probiotics are also used in animal feed to improve gut health and overall well-being in livestock. The market revenue for animal feed is projected to be $52.76 million in 2024, with a steady growth rate due to the increasing demand for natural and sustainable animal husbandry practices.

Dietary supplements containing probiotics are gaining popularity for their potential to support digestive health and immunity. In 2024, this application is expected to have a considerable market revenue of $305.61 million, with a growing rate as more consumers seek proactive health solutions.

This category includes other niche applications of probiotic strains, which may include industrial uses or specialized health products. The market revenue for “Others” is also expected to grow in 2024, albeit at a slower pace compared to the other segments.

The Food and Beverages application is anticipated to hold the biggest market share in 2024, driven by widespread consumer acceptance and the integration of probiotics into a variety of popular food products. On the other hand, the Dietary Supplements application is expected to exhibit the fastest-growing rate, fueled by the rising health consciousness and the quest for natural remedies to support gut health and immunity.

Market Revenue and Share by Segment

| Market Revenue in 2024 | Market Share in 2024 | ||

| By Type | Lactobacillus acidophilus | 458.25 M USD | 23.79% |

| Lactobacillus rhamnosus GG | 302.27 M USD | 15.69% | |

| Bifidobacterium bifidum | 873.37 M USD | 45.34% | |

| Others | 292.28 M USD | 15.17% | |

| By Application | Food and Beverages | 1451.24 M USD | 75.34% |

| Animal Feed | 52.76 M USD | 2.74% | |

| Dietary Supplement | 305.61 M USD | 15.87% | |

| Others | 116.57 M USD | 6.05% |

5. Regional Probiotics Strain Industry Analysis

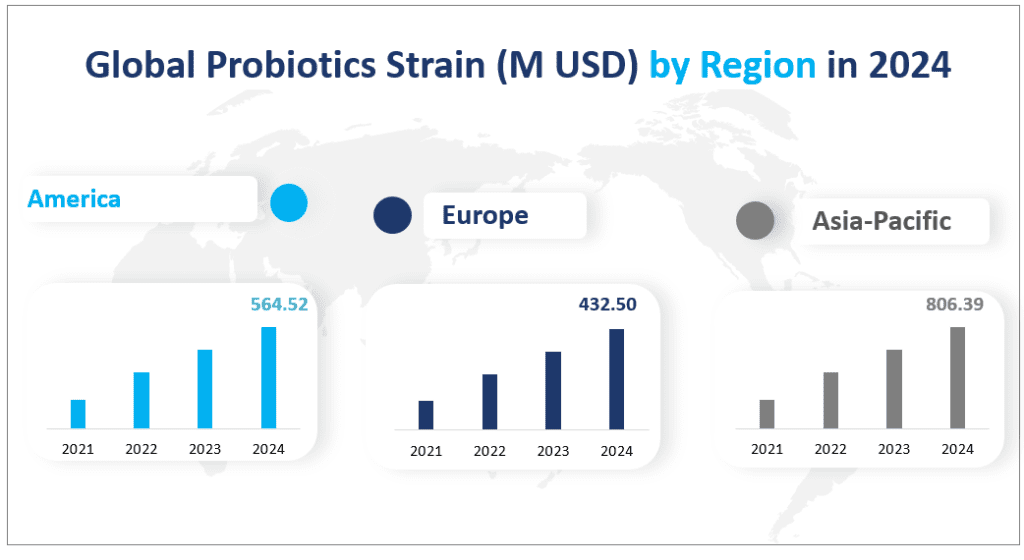

Americas

The Americas have long been a significant player in the probiotics strain market. By 2024, the region is expected to reach a revenue of $564.52 million, driven by the United States’ robust health supplement industry and the growing demand for probiotic-enriched food and beverages. The region’s mature market and high health consciousness among consumers contribute to its leading position.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region in the probiotics strain market by 2024 with a market revenue of $806.39 million. This growth is fueled by countries like China and India, where the burgeoning middle class and increasing health awareness are driving the demand for probiotic products. The region’s market share has been on the rise, surpassing that of the Americas in 2021, and this trend is expected to continue.

Europe

Europe, with its well-established market for health products, is expected to hold a considerable share of the probiotics strain market with a revenue of $432.50 million in 2024. The region’s revenue is bolstered by the presence of key players in the probiotics industry and a strong inclination towards natural health solutions among consumers.

The Asia Pacific region is projected to be the fastest-growing region, driven by economic growth and increasing health consciousness in countries like China and India.

Global Probiotics Strain (M USD) by Region in 2024

6. Analysis of the Top Five Companies in the Probiotics Strain Market

Established in 1897 and headquartered in the USA, DuPont is a global leader in biotechnology and the manufacture of chemicals and pharmaceuticals. The company offers a range of probiotic products under the HOWARU® brand, targeting various health needs. With a strong market presence and a history of over a century in probiotics, DuPont is expected to generate substantial revenue in 2024, driven by its high-performance, stable, and functional probiotic strains.

Founded in 1874 and based in Denmark, Chr. Hansen is renowned for its probiotic strains, with products like Lactobacillus rhamnosus, and LGG®. The company’s focus on scientific research and clinical trials has solidified its position in the market. Chr. Hansen’s commitment to advancing probiotic science is expected to result in significant revenue in 2024.

Established in 1915 and headquartered in Canada, Lallemand offers a unique range of probiotic strains under brands like Rosell® and LAFTI®. The company’s focus on women’s health and functional foods has been a key differentiator. Lallemand’s revenue in 2024 is projected to be substantial, driven by its innovative probiotic solutions.

Probi, founded in 1991 and headquartered in Sweden, is known for its comprehensive portfolio of probiotic products, such as Probi Digestis®. The company’s focus on clinical proof and strain efficacy positions it well in the market. Probi’s revenue in 2024 is expected to benefit from its strong brand presence and product diversity.

Founded in 1953 and based in France, Biocodex is known for its probiotic yeast strain, Saccharomyces boulardii CNCM I-745®. The company’s expertise in gut microbiota has made it an international player in the probiotics realm. Biocodex’s revenue in 2024 is anticipated to grow due to its established product line and continuous research in microbiota health.

Major Players

| Company Name | Headquarters | Sales Region |

| DuPont (Danisco) | Wilmington, DE, USA | Worldwide |

| Chr. Hansen | Hørsholm, Denmark | Worldwide |

| Lallemand | Montreal, Quebec, Canada | Worldwide |

| Probi | Lund, Sweden | Worldwide |

| Biocodex | Gentilly, France | Worldwide |

| Kerry | Naas, County Kildare, Ireland | Worldwide |

| Protexin | Somerset, UK | Worldwide |

| Lesaffre | Marcambal, France | Worldwide |

| Novozymes | Bagsværd, Denmark | Worldwide |

| Unique Biotech | Hyderabad, India | Worldwide |

| Synbiotech | Kaohsiung City, Taiwan | Worldwide |

| Probiotical S.p.A. | Novara, Italy | Worldwide |

| Cerbios-Pharma | Barbengo – Lugano, Switzerland | Worldwide |

| Aumgene Bioscience | Surat, India | Asia, Europe, and America |

1 Scope of the Report

1.1 Market Introduction

1.2 Years Considered

1.3 Research Objectives

1.4 Market Research Methodology

1.5 Research Process and Data Source

1.5.1 Secondary Data

1.5.2 Primary Data

1.5.3 Market Size Estimation

1.5.4 Legal Disclaimer

1.6 Economic Indicators

1.7 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Probiotics Strain Market Size 2016-2026

2.1.2 Probiotics Strain Market Size CAGR by Region 2020 VS 2021 VS 2026

2.2 Probiotics Strain Segment by Type

2.2.1 Lactobacillus acidophilus

2.2.2 Lactobacillus rhamnosus GG

2.2.3 Bifidobacterium bifidum

2.3 Probiotics Strain Market Size by Type

2.3.1 Probiotics Strain Market Size CAGR by Type

2.3.2 Global Probiotics Strain Market Size Market Share by Type (2016-2021)

2.4 Probiotics Strain Segment by Application

2.4.1 Food and Beverages

2.4.2 Animal Feed

2.4.3 Dietary Supplement

2.5 Probiotics Strain Market Size by Application

2.5.1 Probiotics Strain Market Size CAGR by Application

2.5.2 Global Probiotics Strain Market Size Market Share by Application (2016-2021)

3 Global Probiotics Strain Market Size by Player

3.1 Global Probiotics Strain Revenue Market Share by Players

3.1.1 Global Probiotics Strain Revenue by Players (2016-2021)

3.1.2 Global Probiotics Strain Revenue Market Share by Players (2016-2021)

3.2 Global Probiotics Strain Key Players Head office and Sales Region

3.3 Market Concentration Rate Analysis

3.3.1 Competition Landscape Analysis

3.4 Mergers & Acquisitions, Expansion

4 Probiotics Strain by Regions

4.1 Probiotics Strain Market Size by Regions

4.2 Americas Probiotics Strain Revenue Growth

4.3 APAC Probiotics Strain Revenue Growth

4.4 Europe Probiotics Strain Revenue Growth

4.5 Middle East & Africa Probiotics Strain Revenue Growth

5 Americas

5.1 Americas Probiotics Strain Revenue by Countries

5.2 Americas Probiotics Strain Revenue by Types

5.3 Americas Probiotics Strain Revenue by Applications

5.4 United States

5.5 Canada

5.6 Mexico

6 APAC

6.1 APAC Probiotics Strain Revenue by Countries

6.2 APAC Probiotics Strain Revenue by Types

6.3 APAC Probiotics Strain Revenue by Applications

6.4 China

6.5 Japan

6.6 Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

7 Europe

7.1 Europe Probiotics Strain Revenue by Countries

7.2 Europe Probiotics Strain Revenue by Types

7.3 Europe Probiotics Strain Revenue by Applications

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

7.9 Spain

8 Middle East & Africa

8.1 Middle East & Africa Probiotics Strain Revenue by Countries

8.2 Middle East & Africa Probiotics Strain Revenue by Types

8.3 Middle East & Africa Probiotics Strain Revenue by Applications

8.4 Egypt

8.5 South Africa

8.6 Israel

8.7 Turkey

8.8 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.1.1 Growing Demand from Key Regions

9.1.2 Growing Demand from Key Applications and Potential Industries

9.2 Market Challenges and Impact

9.3 Market Trends

10 Global Probiotics Strain Probiotics Strain Forecast

10.1 Global Probiotics Strain Forecast by Regions (2021-2026)

10.1.1 Global Probiotics Strain Forecast by Regions (2021-2026)

10.1.2 Americas Probiotics Strain Forecast

10.1.3 APAC Probiotics Strain Forecast

10.1.4 Europe Probiotics Strain Forecast

10.1.5 Middle East & Africa Probiotics Strain Forecast

10.2 Americas Probiotics Strain Forecast by Countries

10.2.1 United States Probiotics Strain Forecast

10.2.2 Canada Probiotics Strain Forecast

10.2.3 Mexico Probiotics Strain Forecast

10.3 APAC Probiotics Strain Forecast by Countries

10.3.1 China Probiotics Strain Forecast

10.3.2 Japan Probiotics Strain Forecast

10.3.3 Korea Probiotics Strain Forecast

10.3.4 Southeast Asia Probiotics Strain Forecast

10.3.5 India Probiotics Strain Forecast

10.3.6 Australia Probiotics Strain Forecast

10.4 Europe Probiotics Strain Forecast by Countries

10.4.1 Germany Probiotics Strain Forecast

10.4.2 France Probiotics Strain Forecast

10.4.3 UK Probiotics Strain Forecast

10.4.4 Italy Probiotics Strain Forecast

10.4.5 Russia Probiotics Strain Forecast

10.4.6 Spain Probiotics Strain Forecast

10.5 Middle East & Africa Probiotics Strain Forecast by Countries

10.5.1 Egypt Probiotics Strain Forecast

10.5.2 South Africa Probiotics Strain Forecast

10.5.3 Israel Probiotics Strain Forecast

10.5.4 Turkey Probiotics Strain Forecast

10.5.5 GCC Countries Probiotics Strain Forecast

10.6 Global Probiotics Strain Probiotics Strain Forecast by Type

10.7 Global Probiotics Strain Probiotics Strain Forecast by Application

11 Key Players Analysis

11.1 Dupont

11.1.1 Company Profiles

11.1.2 Probiotics Strain Product Offered

11.1.3 Dupont Revenue, Gross Margin and Market Share 2016-2021

11.1.4 Dupont Main Business Overview

11.1.5 Dupont Latest Developments

11.2 Chr. Hansen

11.2.1 Company Profiles

11.2.2 Probiotics Strain Product Offered

11.2.3 Chr. Hansen Revenue, Gross Margin and Market Share 2016-2021

11.2.4 Chr. Hansen Main Business Overview

11.2.5 Chr. Hansen Latest Developments

11.3 Lallemand

11.3.1 Company Profiles

11.3.2 Probiotics Strain Product Offered

11.3.3 Lallemand Revenue, Gross Margin and Market Share 2016-2021

11.3.4 Lallemand Main Business Overview

11.3.5 Lallemand Latest Developments

11.4 Probi

11.4.1 Company Profiles

11.4.2 Probiotics Strain Product Offered

11.4.3 Probi Revenue, Gross Margin and Market Share 2016-2021

11.4.4 Probi Main Business Overview

11.4.5 Probi Latest Developments

11.5 Biocodex

11.5.1 Company Profiles

11.5.2 Probiotics Strain Product Offered

11.5.3 Biocodex Revenue, Gross Margin and Market Share 2016-2021

11.5.4 Biocodex Main Business Overview

11.5.5 Biocodex Latest Developments

11.6 Kerry

11.6.1 Company Profiles

11.6.2 Probiotics Strain Product Offered

11.6.3 Kerry Revenue, Gross Margin and Market Share 2016-2021

11.6.4 Kerry Main Business Overview

11.6.5 Kerry Latest Developments

11.7 Protexin

11.7.1 Company Profiles

11.7.2 Probiotics Strain Product Offered

11.7.3 Protexin Revenue, Gross Margin and Market Share 2016-2021

11.7.4 Protexin Main Business Overview

11.7.5 Protexin Latest Developments

11.8 Lesaffre

11.8.1 Company Profiles

11.8.2 Probiotics Strain Product Offered

11.8.3 Lesaffre Revenue, Gross Margin and Market Share 2016-2021

11.8.4 Lesaffre Main Business Overview

11.8.5 Lesaffre Latest Developments

11.9 Novozymes

11.9.1 Company Profiles

11.9.2 Probiotics Strain Product Offered

11.9.3 Novozymes Revenue, Gross Margin and Market Share 2016-2021

11.9.4 Novozymes Main Business Overview

11.9.5 Novozymes Latest Developments

11.10 Unique Biotech

11.10.1 Company Profiles

11.10.2 Probiotics Strain Product Offered

11.10.3 Unique Biotech Revenue, Gross Margin and Market Share 2016-2021

11.10.4 Unique Biotech Main Business Overview

11.11 Synbiotech

11.11.1 Company Profiles

11.11.2 Probiotics Strain Product Offered

11.11.3 Synbiotech Revenue, Gross Margin and Market Share 2016-2021

11.11.4 Synbiotech Main Business Overview

11.11.5 Synbiotech Latest Developments

11.12 Probiotical S.p.A.

11.12.1 Company Profiles

11.12.2 Probiotics Strain Product Offered

11.12.3 Probiotical S.p.A. Revenue, Gross Margin and Market Share 2016-2021

11.12.4 Probiotical S.p.A. Main Business Overview

11.12.5 Probiotical S.p.A. Latest Developments

11.13 Cerbios-Pharma

11.13.1 Company Profiles

11.13.2 Probiotics Strain Product Offered

11.13.3 Cerbios-Pharma Revenue, Gross Margin and Market Share 2016-2021

11.13.4 Cerbios-Pharma Main Business Overview

11.13.5 Cerbios-Pharma Latest Developments

11.14 Aumgene Bioscience

11.14.1 Company Profiles

11.14.2 Probiotics Strain Product Offered

11.14.3 Aumgene Bioscience Revenue, Gross Margin and Market Share 2016-2021

11.14.4 Aumgene Bioscience Main Business Overview

12 Research Findings and Conclusion

13 Appendix

13.1 Methodology

13.2 Research Data Source

13.2.1 Secondary Data

13.2.2 Primary Data

13.2.3 Market Size Estimation

13.2.4 Legal Disclaimer