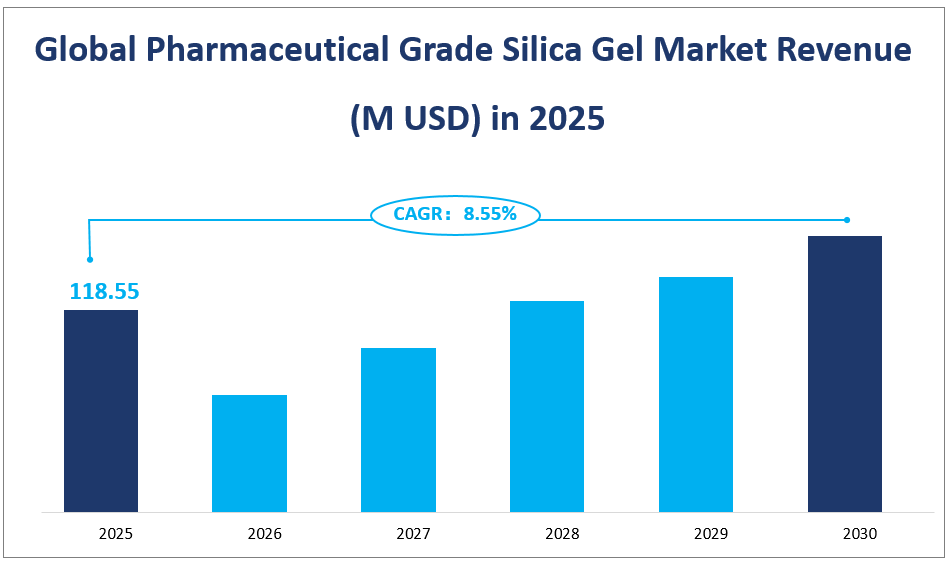

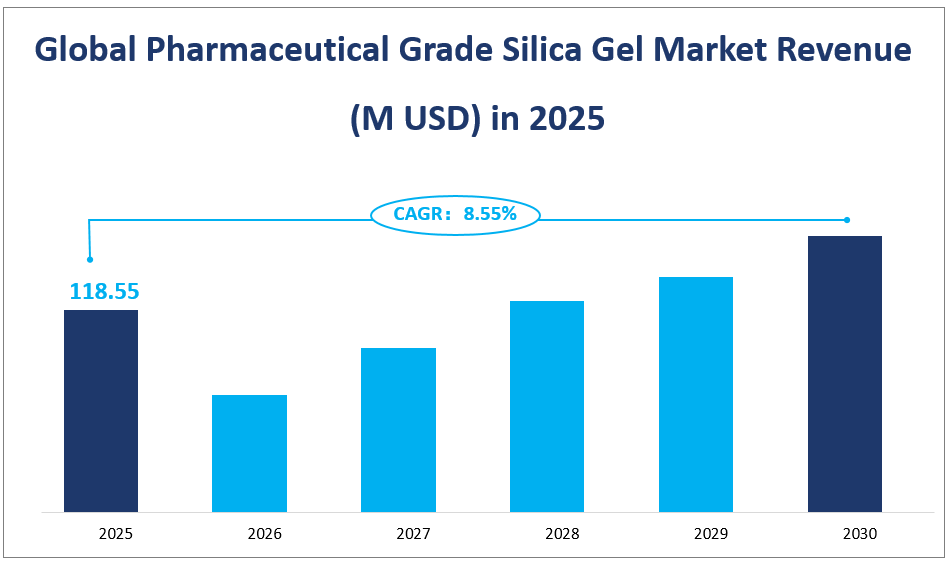

1. Global Pharmaceutical Grade Silica Gel Market Forecast

The global Pharmaceutical Grade Silica Gel market is projected to experience significant growth in the coming years. By 2025, the market revenue is expected to reach approximately $118.55 million with a CAGR of 8.55% from 2025 to 2030.

Pharmaceutical Grade Silica Gel is a highly active adsorbent material, composed of an amorphous and porous form of silicon dioxide. It is characterized by its non-toxicity, non-corrosiveness, and ability to absorb moisture effectively. This material is crucial in the pharmaceutical industry for maintaining the integrity and efficacy of drugs and supplements. It is used as a desiccant to prevent moisture contamination, as a drug carrier to enhance the stability of active pharmaceutical ingredients, and as an adsorbent to remove impurities. The versatility and safety of Pharmaceutical Grade Silica Gel make it an indispensable component in the manufacturing and packaging processes of pharmaceutical products.

Global Pharmaceutical Grade Silica Gel Market Revenue (M USD) in 2025

2. Driving Factors of the Pharmaceutical Grade Silica Gel Market

Increasing Demand from the Pharmaceutical Industry: The pharmaceutical sector is a major consumer of silica gel due to its ability to protect medicines from moisture, thereby preserving their efficacy and shelf life. As the global demand for pharmaceutical products continues to rise, driven by an aging population and increasing health awareness, the need for silica gel as a stabilizing and protective agent also grows.

Economic Development in Key Regions: Regions such as Asia-Pacific, particularly China and Japan, are experiencing significant economic growth. This economic expansion translates into increased downstream demand for pharmaceutical products, which in turn drives the market for pharmaceutical-grade silica Gel. The development of infrastructure and the growth of the middle class in these regions further contribute to the market’s expansion.

Advancements in E-commerce: The rise of e-commerce has revolutionized the way products are sold and distributed. Online platforms reduce operational costs and provide easier access to a broader customer base. This trend has been particularly beneficial for the silica gel industry, as it allows manufacturers to reach global markets more efficiently, thereby boosting demand.

3. Limiting Factors of Pharmaceutical Grade Silica Gel Market Growth

Fluctuations in Raw Material Prices: The primary raw material for silica gel, sodium silicate, is subject to price volatility. Significant increases in the cost of raw materials can impact the profitability of silica gel manufacturers, potentially leading to higher product prices and reduced market demand.

Intense Industry Competition: The Pharmaceutical Grade Silica Gel market is highly competitive, with numerous players vying for market share. This competition can lead to aggressive pricing strategies, reduced profit margins, and increased pressure on companies to innovate and differentiate their products. Companies without a competitive edge may struggle to survive in this environment.

Regulatory and Compliance Challenges: The pharmaceutical industry is heavily regulated, and silica gel products must meet stringent quality and safety standards. Compliance with these regulations can be costly and time-consuming, posing a barrier to entry for new players and a continuous challenge for existing ones.

Economic Uncertainty: Global economic conditions, including recessions, trade disputes, and fluctuations in currency exchange rates, can impact the demand for pharmaceutical products and, by extension, silica gel. Economic instability can lead to reduced consumer spending on healthcare, affecting the overall market dynamics.

4. Pharmaceutical Grade Silica Gel Market Segment

Solid Silica Gel

Solid silica gel is the dominant product type in the market, with a significant market share and substantial revenue contributions. By 2025, the market revenue for solid silica gel is expected to reach approximately $108.63 million. Solid silica gel is highly valued for its versatility and effectiveness in various applications, including as a desiccant, drug carrier, and adsorbent. Its ability to absorb moisture and maintain the stability of pharmaceutical products makes it an essential component in the industry.

Liquid Silica Gel

Liquid silica gel, while a smaller segment compared to its solid counterpart, is gaining traction due to its unique properties and specific applications. The market revenue for liquid silica gel in 2025 is projected to be around $9.92 million. Liquid silica gel is often used in applications requiring a more fluid medium, such as in certain drug formulations and specialized coatings. Its growth is driven by the increasing demand for innovative pharmaceutical solutions that require liquid-based silica gel products.

Solid silica gel holds the largest market share, accounting for the majority of the total market revenue. This dominance is attributed to its widespread use across various pharmaceutical applications, where its high adsorption capacity and stability are critical. In contrast, liquid silica gel, while growing, remains a niche product type, catering to specific needs within the industry.

Market Revenue and Growth of Applications in 2025

Desiccant

Desiccants are the largest application segment, with a significant market share and substantial revenue contributions. By 2025, the market revenue for desiccants is expected to reach approximately $71.43 million. Desiccants are crucial in maintaining the dryness and stability of pharmaceutical products, preventing moisture contamination, and ensuring product efficacy.

Drug Carrier

Drug carriers represent a growing application segment, with a market revenue projected to reach $13.49 million by 2025. Drug carriers are essential in the formulation of pharmaceutical products, providing a medium for active ingredients and ensuring their stability and delivery. The growth in this segment is driven by the increasing complexity of drug formulations and the need for more effective delivery systems.

Adsorbent

Adsorbents are another significant application, with market revenue expected to reach $18.69 million by 2025. Adsorbents are used to remove impurities and maintain the purity of pharmaceutical products. Their effectiveness in various purification processes makes them an essential component in the industry.

Glidant

Glidants, while a smaller segment, are gaining importance due to their role in improving the flow properties of powders and granules in pharmaceutical manufacturing. The market revenue for glidants in 2025 is projected to be around $8.26 million. Their growth is driven by the increasing demand for efficient manufacturing processes and improved product quality.

Desiccants hold the largest market share, accounting for the majority of the total market revenue. This dominance is attributed to their critical role in maintaining the stability and efficacy of pharmaceutical products. In contrast, other applications, while growing, remain niche segments, catering to specific needs within the industry.

While desiccants have a larger market share, the fastest-growing application segment is drug carriers. This faster growth rate for drug carriers suggests that their applications are expanding, and they are becoming more integral to the pharmaceutical industry’s evolving needs.

Market Revenue and Share by Segment

| Revenue (M USD) in 2025 | Market Share in 2025 | ||

| By Type | Solid | 108.63 | 91.64% |

| Liquid | 9.92 | 8.36% | |

| By Application | Desiccant | 71.43 | 60.26% |

| Drug Carrier | 13.49 | 11.38% | |

| Adsorbent | 18.69 | 15.77% | |

| Glidant | 8.26 | 6.97% |

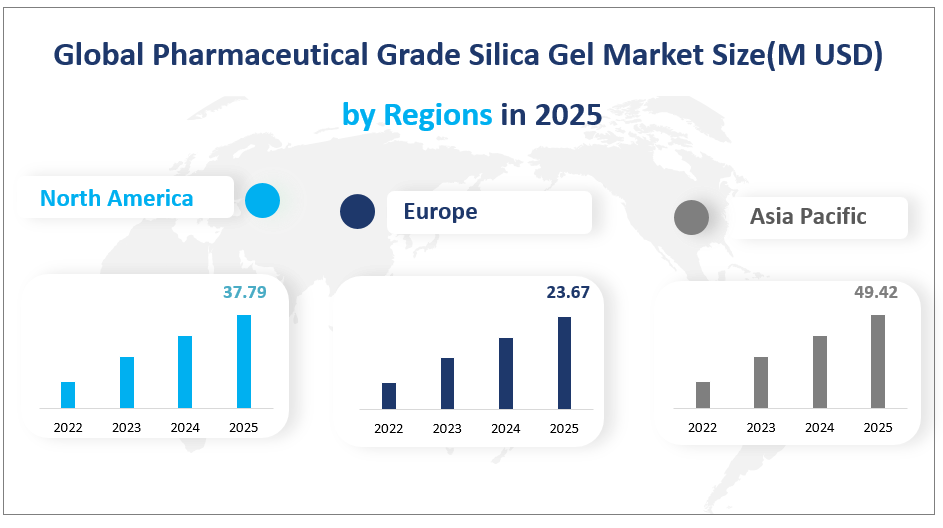

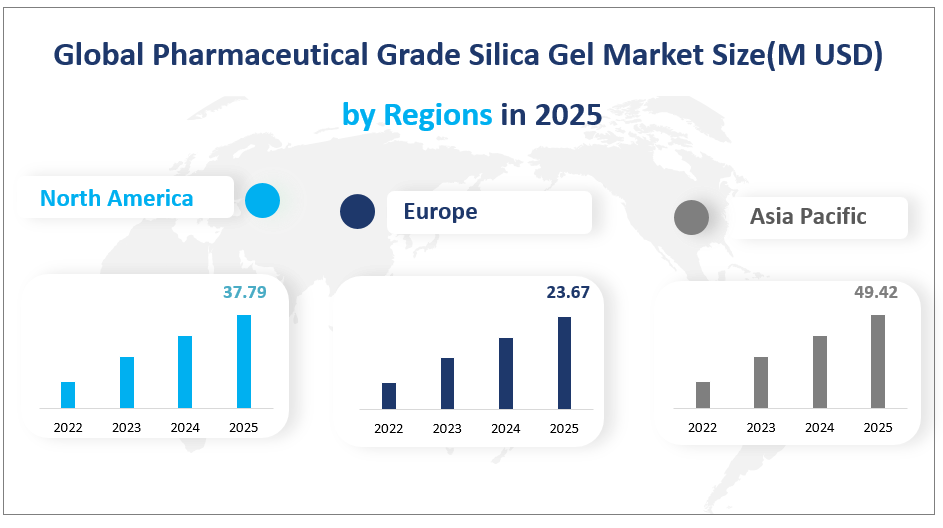

5. Regional Pharmaceutical Grade Silica Gel Market

North America is a significant player in the global Pharmaceutical Grade Silica Gel market, with substantial contributions from the United States and Canada. By 2025, the market revenue in North America is projected to reach approximately $37.79 million. The region’s robust economy, advanced healthcare infrastructure, and strong pharmaceutical industry drive the demand for silica gel products. The growth is further supported by the presence of major manufacturers and a focus on innovation and quality.

Europe, with its diverse economies and strong pharmaceutical sector, is another key region in the market. The market revenue in Europe is expected to reach $23.67 million by 2025. European countries, particularly Germany, the United Kingdom, France, Italy, and Spain, contribute significantly to the market. The region’s emphasis on quality and regulatory compliance ensures that silica gel products meet high standards, making them a preferred choice for pharmaceutical companies.

The Asia-Pacific region is emerging as a dominant force in the global Pharmaceutical Grade Silica Gel market. By 2025, the market revenue in this region is projected to reach $49.42 million. The region’s rapid economic development, increasing healthcare expenditure, and growing pharmaceutical industry are key factors contributing to the demand for silica gel products. China, in particular, is a major consumer and producer of silica gel, with significant investments in research and development.

The Middle East and Africa region is another area of interest, with significant potential for growth. By 2025, the market revenue in this region is projected to reach $3.13 million.

Global Pharmaceutical Grade Silica Gel Market Size(M USD) by Regions in 2025

6. Top 3 Companies in the Pharmaceutical Grade Silica Gel Market

Company Introduction and Business Overview

Honglin Silica Gel, established in 2013, is a high-tech enterprise specializing in the research, development, and production of silica gel series products. The company is headquartered in China and has a global business distribution. Honglin Silica Gel is known for its modern machinery, integrated production lines, and advanced air granulation technology. The company’s products are widely used in various applications, including packaging moisture-proof desiccants, pet padding, and catalyst carriers.

Products Offered

Honglin Silica Gel offers a range of products, including Type A silica gel, which is used for moisture absorption and as a catalyst carrier. The company’s products are known for their high bulk density and performance in low humidity conditions, making them suitable for air purification and chemical separation.

In 2022, Honglin Silica Gel reported sales revenue of 15.19 million USD. The company’s strong market position and continuous innovation have contributed to its growth and success in the industry.

Company Introduction and Business Overview

Fuji Silysia Chemical, established in 1965, is a leading chemical company specializing in the production of high-quality micronized synthetic silica gel. The company is headquartered in Japan and has a global business distribution. Fuji Silysia Chemical is known for its expertise in producing silica gel for various industries, including pharmaceuticals, cosmetics, and food.

Products Offered

Fuji Silysia Chemical offers a range of products, including SYLYSIA FCP, a high-purity and porous amorphous silica gel used in pharmaceutical and nutraceutical applications. The company’s products are known for their chemical inertness, odorlessness, and tastelessness, making them suitable for use in tablet coatings and as anti-blocking agents.

In 2022, Fuji Silysia Chemical reported sales revenue of 11.87 million USD. The company’s focus on quality and innovation has helped it maintain a strong market position in the industry.

Company Introduction and Business Overview

WR Grace & Co., established in 1854, is an American chemical business known for its specialty chemicals and materials. The company is headquartered in the United States and has a global business distribution. WR Grace & Co. operates in two divisions: Grace Catalysts Technologies and Grace Materials and Chemicals. The company is renowned for its expertise in producing catalysts and silica-based materials for various industries.

Products Offered

WR Grace & Co. offers a range of products, including SYLOID® AL-1FP/63FP silicas, which control moisture transfer and protect pharmaceutical products. The company’s products are also used as glidants and suspension aids in pharmaceutical formulations, ensuring product stability and efficacy.

In 2022, WR Grace & Co. reported sales revenue of 9.04 million USD. The company’s long-standing reputation and continuous innovation have helped it maintain a strong market position in the industry.

Major Players

| Company Name | Headquarters | Business Distribution |

| Honglin Silica Gel | China | Worldwide |

| Fuji Silysia Chemical | Japan | Worldwide |

| WR Grace & Co. | USA | Worldwide |

| Clariant International Ltd | Switzerland | Worldwide |

| Multisorb Technologies, Inc. | USA | Worldwide |

| Makall | China | Worldwide |

| Dongying Yiming New Materials | China | Worldwide |

| Desiccare Inc. | USA | Worldwide |

| Chengyu Chemical | China | Worldwide |

| Sorbead India | India | Worldwide |

| Interra Global Corp. | USA | Worldwide |

1 Market Overview

1.1 Product Definition and Market Characteristics

1.2 Global Pharmaceutical Grade Silica Gel Market Size

1.3 Market Segmentation

1.4 Global Macroeconomic Analysis

1.5 SWOT Analysis

2 Market Dynamics

2.1 Market Drivers

2.2 Market Constraints and Challenges

2.3 Emerging Market Trends

2.4 Impact of COVID-19

2.4.1 Short-term Impact

2.4.2 Long-term Impact

3 Associated Industry Assessment

3.1 Supply Chain Analysis

3.2 Industry Active Participants

3.2.1 Suppliers of Raw Materials

3.2.2 Key Distributors/Retailers

3.3 Alternative Product Analysis

3.4 The Impact of Covid-19 From the Perspective of Industry Chain

4 Market Competitive Landscape

4.1 Industry Leading Players

4.2 Industry News

4.2.1 Key Product Launch News

4.2.2 M&A and Expansion Plans

5 Analysis of Leading Companies

5.1 Honglin Silica Gel

5.1.1 Honglin Silica Gel Company Profile

5.1.2 Honglin Silica Gel Business Overview

5.1.3 Honglin Silica Gel Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.1.4 Honglin Silica Gel Pharmaceutical Grade Silica Gel Products Introduction

5.2 Fuji Silysia Chemical

5.2.1 Fuji Silysia Chemical Company Profile

5.2.2 Fuji Silysia Chemical Business Overview

5.2.3 Fuji Silysia Chemical Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.2.4 Fuji Silysia Chemical Pharmaceutical Grade Silica Gel Products Introduction

5.3 WR Grace & Co.

5.3.1 WR Grace & Co. Company Profile

5.3.2 WR Grace & Co. Business Overview

5.3.3 WR Grace & Co. Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.3.4 WR Grace & Co. Pharmaceutical Grade Silica Gel Products Introduction

5.4 Clariant International Ltd

5.4.1 Clariant International Ltd Company Profile

5.4.2 Clariant International Ltd Business Overview

5.4.3 Clariant International Ltd Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.4.4 Clariant International Ltd Pharmaceutical Grade Silica Gel Products Introduction

5.5 Multisorb Technologies, Inc.

5.5.1 Multisorb Technologies, Inc. Company Profile

5.5.2 Multisorb Technologies, Inc. Business Overview

5.5.3 Multisorb Technologies, Inc. Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.5.4 Multisorb Technologies, Inc. Pharmaceutical Grade Silica Gel Products Introduction

5.6 Makall

5.6.1 Makall Company Profile

5.6.2 Makall Business Overview

5.6.3 Makall Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.6.4 Makall Pharmaceutical Grade Silica Gel Products Introduction

5.7 Dongying Yiming New Materials

5.7.1 Dongying Yiming New Materials Company Profile

5.7.2 Dongying Yiming New Materials Business Overview

5.7.3 Dongying Yiming New Materials Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.7.4 Dongying Yiming New Materials Pharmaceutical Grade Silica Gel Products Introduction

5.8 Desiccare Inc.

5.8.1 Desiccare Inc. Company Profile

5.8.2 Desiccare Inc. Business Overview

5.8.3 Desiccare Inc. Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.8.4 Desiccare Inc. Pharmaceutical Grade Silica Gel Products Introduction

5.9 Chengyu Chemical

5.9.1 Chengyu Chemical Company Profile

5.9.2 Chengyu Chemical Business Overview

5.9.3 Chengyu Chemical Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.9.4 Chengyu Chemical Pharmaceutical Grade Silica Gel Products Introduction

5.10 Sorbead India

5.10.1 Sorbead India Company Profile

5.10.2 Sorbead India Business Overview

5.10.3 Sorbead India Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.10.4 Sorbead India Pharmaceutical Grade Silica Gel Products Introduction

5.11 Interra Global Corp.

5.11.1 Interra Global Corp. Company Profile

5.11.2 Interra Global Corp. Business Overview

5.11.3 Interra Global Corp. Pharmaceutical Grade Silica Gel Sales, Revenue, Average Selling Price and Gross Margin (2017-2022)

5.11.4 Interra Global Corp. Pharmaceutical Grade Silica Gel Products Introduction

6 Market Analysis and Forecast, By Product Types

6.1 Global Pharmaceutical Grade Silica Gel Sales, Revenue and Market Share by Types (2017-2022)

6.1.1 Global Pharmaceutical Grade Silica Gel Sales and Market Share by Types (2017-2022)

6.1.2 Global Pharmaceutical Grade Silica Gel Revenue and Market Share by Types (2017-2022)

6.1.3 Global Pharmaceutical Grade Silica Gel Price by Types (2017-2022)

6.2 Global Pharmaceutical Grade Silica Gel Market Forecast by Types (2022-2027)

6.2.1 Global Pharmaceutical Grade Silica Gel Market Forecast Sales and Market Share by Types (2022-2027)

6.2.2 Global Pharmaceutical Grade Silica Gel Market Forecast Revenue and Market Share by Types (2022-2027)

6.3 Global Pharmaceutical Grade Silica Gel Sales, Price and Growth Rate by Types (2017-2022)

6.3.1 Global Pharmaceutical Grade Silica Gel Sales, Price and Growth Rate of Solid (2017-2022)

6.3.2 Global Pharmaceutical Grade Silica Gel Sales, Price and Growth Rate of Liquid (2017-2022)

6.4 Global Pharmaceutical Grade Silica Gel Market Revenue and Sales Forecast, by Types (2022-2027)

6.4.1 Solid Market Revenue and Sales Forecast (2022-2027)

6.4.2 Liquid Market Revenue and Sales Forecast (2022-2027)

7 Market Analysis and Forecast, By Applications

7.1 Global Pharmaceutical Grade Silica Gel Sales, Revenue and Market Share by Applications (2017-2022)

7.1.1 Global Pharmaceutical Grade Silica Gel Sales and Market Share by Applications (2017-2022)

7.1.2 Global Pharmaceutical Grade Silica Gel Revenue and Market Share by Applications (2017-2022)

7.2 Global Pharmaceutical Grade Silica Gel Market Forecast by Applications (2022-2027)

7.2.1 Global Pharmaceutical Grade Silica Gel Market Forecast Sales and Market Share by Applications (2022-2027)

7.2.2 Global Pharmaceutical Grade Silica Gel Market Forecast Revenue and Market Share by Applications (2022-2027)

7.3 Global Revenue, Sales and Growth Rate by Applications (2017-2022)

7.3.1 Global Pharmaceutical Grade Silica Gel Revenue, Sales and Growth Rate of Desiccant (2017-2022)

7.3.2 Global Pharmaceutical Grade Silica Gel Revenue, Sales and Growth Rate of Drug Carrier (2017-2022)

7.3.3 Global Pharmaceutical Grade Silica Gel Revenue, Sales and Growth Rate of Adsorbent (2017-2022)

7.3.4 Global Pharmaceutical Grade Silica Gel Revenue, Sales and Growth Rate of Glidant (2017-2022)

7.3.5 Global Pharmaceutical Grade Silica Gel Revenue, Sales and Growth Rate of Others (2017-2022)

7.4 Global Pharmaceutical Grade Silica Gel Market Revenue and Sales Forecast, by Applications (2022-2027)

7.4.1 Desiccant Market Revenue and Sales Forecast (2022-2027)

7.4.2 Drug Carrier Market Revenue and Sales Forecast (2022-2027)

7.4.3 Adsorbent Market Revenue and Sales Forecast (2022-2027)

7.4.4 Glidant Market Revenue and Sales Forecast (2022-2027)

7.4.5 Others Market Revenue and Sales Forecast (2022-2027)

8 Market Analysis and Forecast, By Regions

8.1 Global Pharmaceutical Grade Silica Gel Sales by Regions (2017-2022)

8.2 Global Pharmaceutical Grade Silica Gel Market Revenue by Regions (2017-2022)

8.3 Global Pharmaceutical Grade Silica Gel Market Forecast by Regions (2022-2027)

9 North America Pharmaceutical Grade Silica Gel Market Analysis

9.1 Market Overview and Prospect Analysis

9.2 North America Pharmaceutical Grade Silica Gel Market Sales and Growth Rate (2017-2022)

9.3 North America Pharmaceutical Grade Silica Gel Market Revenue and Growth Rate (2017-2022)

9.4 North America Pharmaceutical Grade Silica Gel Market Forecast

9.5 The Influence of COVID-19 on North America Market

9.6 North America Pharmaceutical Grade Silica Gel Market Analysis by Country

9.6.1 U.S. Pharmaceutical Grade Silica Gel Sales and Growth Rate

9.6.2 Canada Pharmaceutical Grade Silica Gel Sales and Growth Rate

9.6.3 Mexico Pharmaceutical Grade Silica Gel Sales and Growth Rate

10 Europe Pharmaceutical Grade Silica Gel Market Analysis

10.1 Market Overview and Prospect Analysis

10.2 Europe Pharmaceutical Grade Silica Gel Market Sales and Growth Rate (2017-2022)

10.3 Europe Pharmaceutical Grade Silica Gel Market Revenue and Growth Rate (2017-2022)

10.4 Europe Pharmaceutical Grade Silica Gel Market Forecast

10.5 The Influence of COVID-19 on Europe Market

10.6 Europe Pharmaceutical Grade Silica Gel Market Analysis by Country

10.6.1 Germany Pharmaceutical Grade Silica Gel Sales and Growth Rate

10.6.2 United Kingdom Pharmaceutical Grade Silica Gel Sales and Growth Rate

10.6.3 France Pharmaceutical Grade Silica Gel Sales and Growth Rate

10.6.4 Italy Pharmaceutical Grade Silica Gel Sales and Growth Rate

10.6.5 Spain Pharmaceutical Grade Silica Gel Sales and Growth Rate

10.6.6 Russia Pharmaceutical Grade Silica Gel Sales and Growth Rate

11 Asia-Pacific Pharmaceutical Grade Silica Gel Market Analysis

11.1 Market Overview and Prospect Analysis

11.2 Asia-Pacific Pharmaceutical Grade Silica Gel Market Sales and Growth Rate (2017-2022)

11.3 Asia-Pacific Pharmaceutical Grade Silica Gel Market Revenue and Growth Rate (2017-2022)

11.4 Asia-Pacific Pharmaceutical Grade Silica Gel Market Forecast

11.5 The Influence of COVID-19 on Asia Pacific Market

11.6 Asia-Pacific Pharmaceutical Grade Silica Gel Market Analysis by Country

11.6.1 China Pharmaceutical Grade Silica Gel Sales and Growth Rate

11.6.2 Japan Pharmaceutical Grade Silica Gel Sales and Growth Rate

11.6.3 South Korea Pharmaceutical Grade Silica Gel Sales and Growth Rate

11.6.4 Australia Pharmaceutical Grade Silica Gel Sales and Growth Rate

11.6.5 India Pharmaceutical Grade Silica Gel Sales and Growth Rate

12 South America Pharmaceutical Grade Silica Gel Market Analysis

12.1 Market Overview and Prospect Analysis

12.2 South America Pharmaceutical Grade Silica Gel Market Sales and Growth Rate (2017-2022)

12.3 South America Pharmaceutical Grade Silica Gel Market Revenue and Growth Rate (2017-2022)

12.4 South America Pharmaceutical Grade Silica Gel Market Forecast

12.5 The Influence of COVID-19 on South America Market

12.6 South America Pharmaceutical Grade Silica Gel Market Analysis by Country

12.6.1 Brazil Pharmaceutical Grade Silica Gel Sales and Growth Rate

12.6.2 Argentina Pharmaceutical Grade Silica Gel Sales and Growth Rate

12.6.3 Colombia Pharmaceutical Grade Silica Gel Sales and Growth Rate

13 Middle East and Africa Pharmaceutical Grade Silica Gel Market Analysis

13.1 Market Overview and Prospect Analysis

13.2 Middle East and Africa Pharmaceutical Grade Silica Gel Market Sales and Growth Rate (2017-2022)

13.3 Middle East and Africa Pharmaceutical Grade Silica Gel Market Revenue and Growth Rate (2017-2022)

13.4 Middle East and Africa Pharmaceutical Grade Silica Gel Market Forecast

13.5 The Influence of COVID-19 on Middle East and Africa Market

13.6 Middle East and Africa Pharmaceutical Grade Silica Gel Market Analysis by Country

13.6.1 UAE Pharmaceutical Grade Silica Gel Sales and Growth Rate

13.6.2 Egypt Pharmaceutical Grade Silica Gel Sales and Growth Rate

13.6.3 South Africa Pharmaceutical Grade Silica Gel Sales and Growth Rate

14 Conclusions and Recommendations

15 Appendix

15.1 Methodology

15.2 Research Data Source

15.2.1 Secondary Data

15.2.2 Primary Data

15.2.3 Market Size Estimation

15.2.4 Legal Disclaimer