1. Global Operational Amplifier Market Summary and Insights

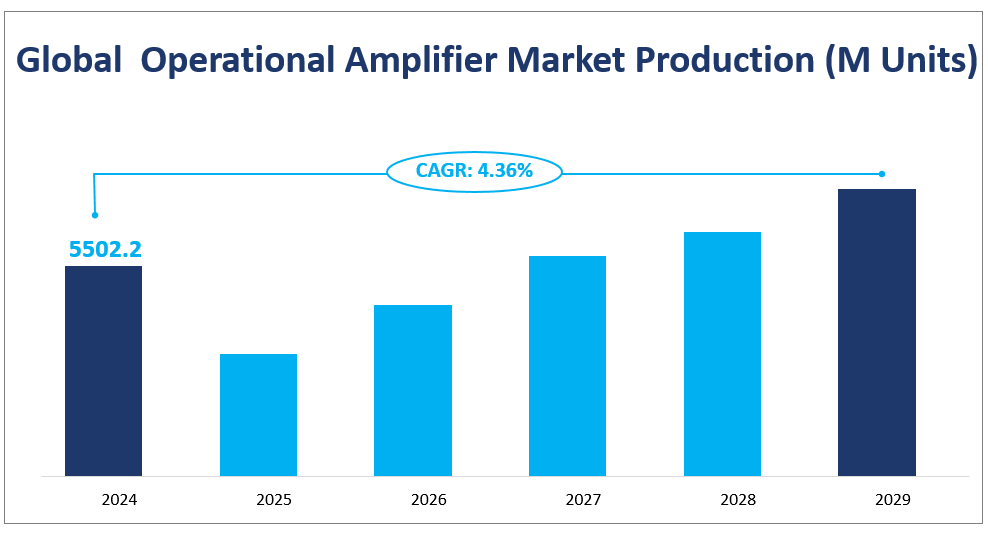

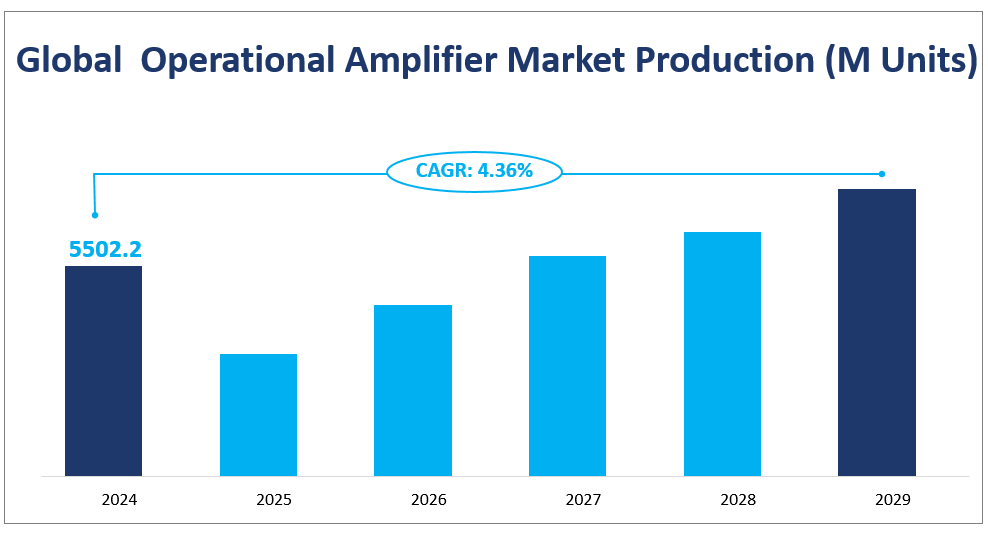

The global operational amplifier market is projected to reach a market value of approximately 5502.2 M Units in 2024 with a CAGR of 4.36% from 2024 to 2029. The operational amplifier, commonly referred to as an op-amp, is a versatile electronic component used in a variety of applications, including signal conditioning, filtering, and mathematical operations such as addition, subtraction, integration, and differentiation.

Operational amplifiers are characterized by their high gain, differential input, and single-ended output. They are integral to analog electronics and are employed in numerous devices, from simple amplifiers to complex signal-processing systems. The op-amp’s ability to amplify weak signals makes it essential in applications ranging from consumer electronics to industrial automation and medical devices.

The operational amplifier’s design typically includes multiple terminals, allowing for various configurations depending on the application. These configurations can include inverting, non-inverting, and differential amplifiers, among others. The op-amp’s operational characteristics, such as bandwidth, input impedance, and output impedance, are critical parameters that influence its performance in specific applications.

The market for operational amplifiers is driven by the increasing demand for electronic devices across various sectors, including automotive, industrial, medical, and consumer electronics. As technology advances, the need for more sophisticated and efficient amplifiers has risen, leading to innovations in op-amp design and functionality. Furthermore, the shift towards automation and smart technologies in industries is expected to bolster the demand for operational amplifiers, as they play a crucial role in sensor applications and data acquisition systems.

Global Operational Amplifier Market Production (M Units)

2. Operational Amplifier Market Driving Factors

The growth of the operational amplifier market is influenced by several driving factors. One of the primary drivers is the increasing demand for consumer electronics. As the global population becomes more tech-savvy, the consumption of electronic devices such as smartphones, tablets, and smart home appliances continues to rise. Operational amplifiers are essential components in these devices, facilitating signal processing and amplification, which enhances the overall performance of electronic systems.

Another significant driving factor is the advancement of technology. The development of more sophisticated operational amplifiers with enhanced features, such as lower power consumption, higher integration levels, and improved performance metrics, is attracting manufacturers and consumers alike. The emergence of Industry 4.0 and the Internet of Things (IoT) is also propelling the demand for operational amplifiers, as these technologies rely heavily on efficient signal processing and data acquisition systems.

The growing automotive sector is another critical driver. With the increasing integration of electronic components in vehicles, including advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies, operational amplifiers are becoming indispensable in automotive applications. Their role in sensor signal conditioning and control systems is vital for the development of safer and more efficient vehicles.

3. Operational Amplifier Market Limiting Factors

However, the operational amplifier market also faces several limiting factors. One of the primary challenges is the intense competition among manufacturers. The operational amplifier market is characterized by a large number of players, leading to price wars and reduced profit margins. Companies must continuously invest in research and development to differentiate their products and maintain market share, which can strain financial resources.

Additionally, the high cost of raw materials and manufacturing processes can hinder market growth. Fluctuations in the prices of essential components, such as silicon wafers, can impact production costs and, subsequently, the pricing of operational amplifiers. Manufacturers must navigate these challenges while striving to deliver high-quality products at competitive prices.

Lastly, the complexity of analog circuit design poses a barrier to entry for new players in the market. Designing effective operational amplifier circuits requires a deep understanding of analog principles, which may limit the number of companies capable of producing innovative solutions. This complexity can also lead to design challenges, resulting in increased development time and costs.

In conclusion, while the operational amplifier market is poised for growth driven by technological advancements and rising demand across various sectors, it must also contend with competitive pressures, cost challenges, and the intricacies of analog design.

4. Operational Amplifier Market Segment

Among different product types, the General Purpose segment is anticipated to contribute the largest market share in 2024.

The operational amplifier market is segmented into several product types, each with distinct characteristics and applications. The major types include General Purpose, Precision, High Speed, Low Noise, and Low Power operational amplifiers.

General Purpose: These amplifiers are adaptable and versatile for use in a wide range of electronic circuits. In 2024, the market production is forecasted to be 2790.0 M units, holding the largest market share with a 48.53% share of the total production.

Precision: Designed for applications requiring high accuracy, including sensor signal conditioning. The 2024 market production is expected to be 611.1 M units, with a 10.63% market share.

High Speed: Used in high-performance data acquisition systems and other applications demanding quick signal processing. The production in 2024 is forecasted at 603.0 M units, capturing a 10.49% market share.

Low Noise: Enables better signal fidelity in demanding conditions, with market production expected to be 393.3 M units in 2024, holding a 6.84% market share.

Low Power: Designed for applications where power consumption is a concern, with a market production of 310.3 M units in 2024 and a 5.40% market share.

Among these, the general-purpose operational amplifiers have the largest market share, while the low-power amplifiers are expected to have the fastest growth rate.

By application, the industrial segment will occupy the biggest share in 2024.

The operational amplifier market is also segmented based on applications, which include Automotive, Industrial, Medical, and Consumer Electronics.

Automotive: Operational amplifiers in this sector are used for a variety of in-vehicle electronics, including infotainment systems and sensor signal processing. The market production in 2024 is forecasted at 1204.2 M units.

Industrial: Used in industrial automation and control systems, the production is expected to be 1816.0 M units in 2024.

Medical: Operational amplifiers play a crucial role in medical equipment and diagnostics. The 2024 market production is forecasted at 444.5 M units.

Consumer Electronics: These amplifiers are used in a wide range of consumer devices, with a market production of 1105.7 M units in 2024.

In terms of growth, the Automotive application is expected to have the fastest growth rate, driven by the increasing electronic content in vehicles and the advent of electric and autonomous vehicles. The Industrial sector, with its broad utilization of operational amplifiers in automation and control systems, holds the largest market share, reflecting the significant reliance on operational amplifiers in this domain.

Market Production and Consumption in 2024

| Production in 2024 | ||

| By Type | General Purpose | 2790.0 M Units |

| Precision | 611.1 M Units | |

| High Speed | 603.0 M Units | |

| Low Noise | 393.3 M Units | |

| Low Power | 310.3 M Units | |

| Market Consumption in 2024 | ||

| By Application | Automotive | 1262.01 M Units |

| Industrial | 1751.60 M Units | |

| Medical | 448.80 M Units | |

| Consumer Electronics | 988.67 M Units | |

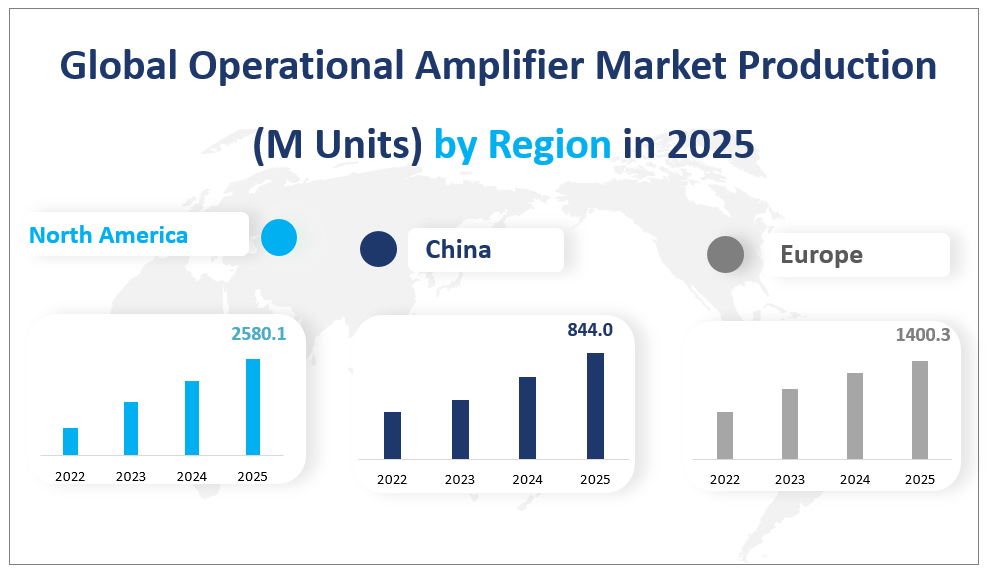

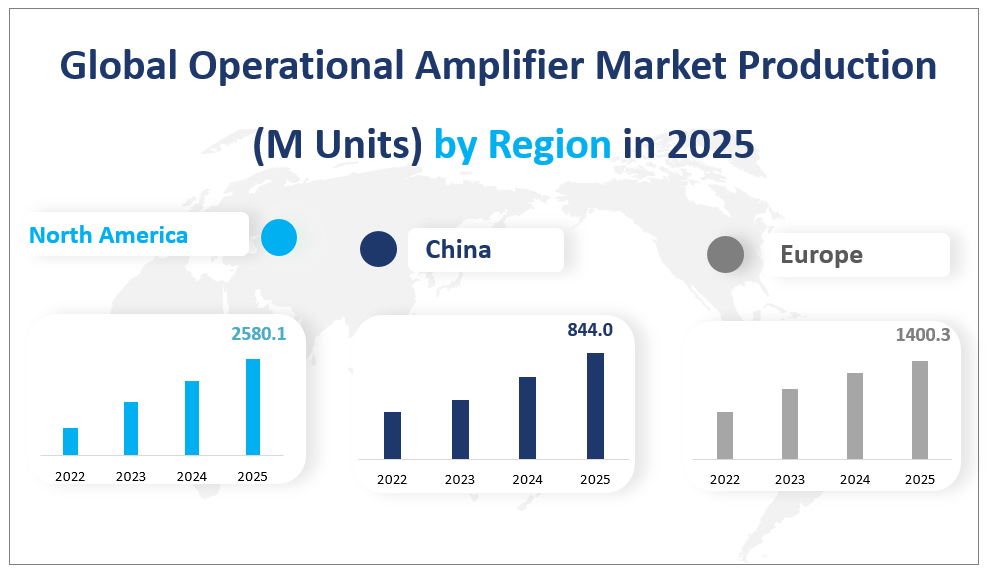

5. Operational Amplifier Regional Market

The operational amplifier (op-amp) market is a dynamic and growing sector within the semiconductor industry, with regions around the world contributing to its expansion.

North America: North America is the largest market with a projected production volume of 2580.1 M Units in 2024, and continues to hold a significant share of global production, primarily due to its leading position in technology and industrial applications.

Europe: Production is expected to be 14 00.3 M Units, maintaining steady growth, which is closely related to strong demand in the high-end manufacturing and automotive sectors in the region.

China: Production is expected to be 844.0 M Units, showing the rapid growth momentum of the Asian market, especially the Chinese market, which is closely related to the Chinese government’s promotion of manufacturing upgrading and technological innovation policies.

Japan: With an estimated production volume of 508.9 million units, Japan continues to remain competitive in the global market with its deep base in the precision electronics and automotive industries.

The North American region emerges as the biggest regional market by production in 2024. This dominance can be attributed to the strong presence of leading op-amp manufacturers, advanced research and development capabilities, and the region’s well-established industrial and automotive sectors. The United States, in particular, is home to several key players in the op-amp market, driving innovation and production.

The Asia Pacific region, led by China, stands out as the fastest-growing region in the op-amp market. The growth is fueled by several factors, including the rapid industrialization of countries like China and India, increased foreign investments, and the growing demand for consumer electronics and automotive applications in the region.

The op-amp market in Asia Pacific is also characterized by a competitive landscape, with local manufacturers rapidly expanding their production capacities and improving their product offerings to cater to the increasing demand. The region’s cost-effective manufacturing capabilities and proximity to growing consumer markets make it an attractive hub for op-amp production.

Global Operational Amplifier Market Production (M Units) by Region in 2025

6. Market Competition

Company Introduction and Business Overview: Texas Instruments (TI) is a global semiconductor company headquartered in Dallas, Texas. Established in 1930, TI has a long history of innovation in the semiconductor industry, offering a wide range of products including op-amps, embedded processors, and wireless technologies.

Products: TI’s op-amp portfolio includes general-purpose, precision, high-speed, low-noise, and low-power amplifiers. Their products are known for their high performance and reliability, making them suitable for a variety of applications from industrial to consumer electronics.

Company Introduction and Business Overview: STMicroelectronics, established in 1987, is a leading global semiconductor company with a broad range of product offerings, including op-amps, microcontrollers, and discrete components. The company operates primarily in Europe and has a strong presence in the automotive and industrial sectors.

Products: ST’s op-amp products are recognized for their energy efficiency and performance in various applications, from medical devices to advanced consumer electronics.

Company Introduction and Business Overview: Analog Devices, founded in 1965, is a multinational semiconductor company that designs and manufactures a wide range of high-performance analog, mixed-signal, and digital signal-processing integrated circuits. ADI’s products are used in virtually all types of electronic equipment.

Products: ADI offers a comprehensive portfolio of op-amps, known for their precision and robustness in demanding applications such as data conversion and signal conditioning.

Company Introduction and Business Overview: ROHM Semiconductor is a global leader in the design and manufacture of semiconductors and electronic components. Established in 1958, ROHM has a diverse product lineup, including a broad selection of op-amps for various applications.

Products: ROHM’s op-amp offerings cater to different market needs, from low-power consumption to high-speed signal processing.

Company Introduction and Business Overview: onsemi, established in 1999, is a global semiconductor supplier company based in Phoenix, Arizona. The company offers a wide range of products, including power and signal management, logic, discrete, and custom devices for various applications.

Products: onsemi’s op-amp portfolio is designed to meet the needs of automotive, communications, computing, and industrial markets, among others.

Major Players

| Company Name | Plant Locations | Sales Regions |

| Texas Instruments | Mainly in the US | Worldwide |

| STMicroelectronics | Mainly in Europe | Worldwide |

| Analog Devices | Mainly in the United States, Ireland, and the Philippines | Worldwide |

| ROHM | Mainly in Japan, Korea, Malaysia, Thailand, the Philippines, and China | Worldwide |

| onsemi | North America, Europe, and the Asia Pacific | Worldwide |

| Microchip Technology | Mainly in the US, Thailand, Philippines | Worldwide |

| Renesas Electronics | Mainly in Asia | Worldwide |

| KEC | Mainly in South Korea | Worldwide |

| Nisshinbo Micro Devices | Mainly in Japan | Worldwide |

1 Operational Amplifier Market Overview

1.1 Product Overview and Scope of Operational Amplifier

1.2 Operational Amplifier Segment by Type

1.2.1 Global Operational Amplifier Market Size Growth Rate Analysis by Type 2022 VS 2028

1.2.2 Types of Operational Amplifier

1.3 Operational Amplifier Segment by Applications

1.3.1 Operational Amplifier Revenue Comparison by Application: 2022 VS 2028

1.3.2 Application of Operational Amplifier

1.4 Global Market Growth Prospects

1.4.1 Global Operational Amplifier Revenue Estimates and Forecasts (2017-2028)

1.4.2 Global Operational Amplifier Production Estimates and Forecasts (2017-2028)

1.5 Global Operational Amplifier Market by Region

2 Market Competition by Manufacturers

2.1 Global Operational Amplifier Production Market Share by Manufacturer

2.2 Global Operational Amplifier Revenue Market Share by Manufacturer (2017-2022)

2.3 Operational Amplifier Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

2.4 Global Operational Amplifier Average Price by Manufacturers (2017-2022)

2.5 Manufacturers Operational Amplifier Production Sites, Established Time

2.6 Operational Amplifier Market Competitive Situation and Trends

2.6.1 Operational Amplifier Market Concentration Rate

2.6.2 Global Top 3 and Top 6 Players Market Share by Revenue

2.6.3 Mergers & Acquisitions, Expansion

3 Production by Region

3.1 Global Production of Operational Amplifier by Regions (2017-2022)

3.2 Global Operational Amplifier Revenue and Market Share by Regions

3.3 Global Operational Amplifier Production, Revenue, Price and Gross Margin (2017-2022)

3.4 North America Operational Amplifier Production

3.4.1 North America Operational Amplifier Production Growth Rate (2017-2022)

3.4.2 North America Operational Amplifier Production, Revenue, Price and Gross Margin (2017-2022)

3.5 Europe Operational Amplifier Production

3.5.1 Europe Operational Amplifier Production Growth Rate (2017-2022)

3.5.2 Europe Operational Amplifier Production, Revenue, Price and Gross Margin (2017-2022)

3.6 China Operational Amplifier Production

3.6.1 China Operational Amplifier Production Growth Rate (2017-2022)

3.6.2 China Operational Amplifier Production, Revenue, Price and Gross Margin (2017-2022)

3.7 Japan Operational Amplifier Production

3.7.1 Japan Operational Amplifier Production Growth Rate (2017-2022)

3.7.2 Japan Operational Amplifier Production, Revenue, Price and Gross Margin (2017-2022)

4 Global Operational Amplifier Consumption by Region

4.1 Global Operational Amplifier Consumption by Regions

4.1.1 Global Operational Amplifier Consumption by Region

4.1.2 Global Operational Amplifier Consumption Market Share by Region

4.2 North America

4.2.1 North America Operational Amplifier Consumption by Country

4.2.2 U.S.

4.2.3 Canada

4.3 Europe

4.3.1 Europe Operational Amplifier Consumption by Country

4.3.2 Germany

4.3.3 France

4.3.4 U.K.

4.3.5 Italy

4.3.6 Russia

4.4 Asia Pacific

4.4.1 Asia Pacific Operational Amplifier Consumption by Region

4.4.2 China

4.4.3 Japan

4.4.4 South Korea

4.4.5 Southeast Asia

4.4.6 India

4.4.7 Australia

4.5 Latin America

5 Production, Revenue, Price Trend by Type

5.1 Global Operational Amplifier Production and Market Share by Type (2017-2022)

5.2 Global Operational Amplifier Revenue Market Share by Type (2017-2022)

5.3 Global Operational Amplifier Price by Type (2017-2022)

6 Consumption by Application

6.1 Global Operational Amplifier Consumption Market Share by Applications (2017-2022)

6.2 Global Operational Amplifier Consumption Growth Rate by Application (2017-2022)

7 Key Companies Profiled

7.1 Texas Instruments

7.2 STMicroelectronics

7.3 Analog Devices

7.4 ROHM

7.5 Onsemi

7.6 Microchip Technology

7.7 Renesas Electronics

7.8 KEC

7.9 Nisshinbo Micro Devices

8 Operational Amplifier Manufacturing Cost Analysis

8.1 Operational Amplifier Key Raw Materials Analysis

8.1.1 Key Raw Materials

8.1.2 Key Raw Materials Price Trend

8.1.3 Suppliers of Raw Materials

8.2 Proportion of Manufacturing Cost Structure

8.2.1 Raw Materials

8.2.2 Labor Cost

8.2.2.1 Definition of Labor Cost

8.2.2.2 Labor Cost of North America

8.2.2.3 Labor Cost of Europe

8.2.2.4 Labor Cost of Asia-Pacific

8.2.2.5 Labor Cost of South America

8.2.2.6 Labor Cost of Middle East

8.2.2.7 Labor Cost of Africa

8.2.3 Manufacturing Cost Structure

8.3 Manufacturing Process Analysis of Operational Amplifier

8.4 Operational Amplifier Industrial Chain Analysis

9 Marketing Channel, Distributors and Customers

9.1 Marketing Channel

9.1.1 Direct Marketing

9.1.2 Indirect Marketing

9.2 Operational Amplifier Distributors List

9.3 Operational Amplifier Customers

10 Market Dynamics

10.1 Operational Amplifier Industry Trends

10.2 Operational Amplifier Growth Drivers

10.3 Operational Amplifier Market Challenges

10.4 Operational Amplifier Market Restraints

10.5 Influence Factors

11 Production Forecast

11.1 Global Forecasted Production of Operational Amplifier by Region (2023-2028)

11.2 North America Operational Amplifier Production, Revenue Forecast (2023-2028)

11.3 Europe Operational Amplifier Production, Revenue Forecast (2023-2028)

11.4 China Operational Amplifier Production, Revenue Forecast (2023-2028)

11.5 Japan Operational Amplifier Production, Revenue Forecast (2023-2028)

12 Consumption and Demand Forecast

12.1 Global Forecasted Demand of Operational Amplifier

12.2 North America Consumption of Operational Amplifier by Country

12.3 Europe Consumption of Operational Amplifier by Country

12.4 Asia Pacific Operational Amplifier Consumption of Operational Amplifier by Country

12.5 Latin America Operational Amplifier Consumption of Operational Amplifier by Country

13 Forecast by Type and by Application (2023-2028)

13.1 Global Production, Revenue and Price Forecast by Type (2023-2028)

13.1.1 Global Forecasted Production of Operational Amplifier by Type (2023-2028)

13.1.2 Global Forecasted Revenue of Operational Amplifier by Type (2023-2028)

13.1.3 Global Forecasted Price of Operational Amplifier by Type (2023-2028)

13.2 Global Forecasted Consumption of Operational Amplifier by Application (2023-2028)

14 Research Findings and Conclusion

15 Appendix

15.1 Methodology

15.2 Research Data Source

15.2.1 Secondary Data

15.2.2 Primary Data

15.2.3 Market Size Estimation

15.2.4 Legal Disclaimer