1. Global Niobium Pentoxide Market Analysis

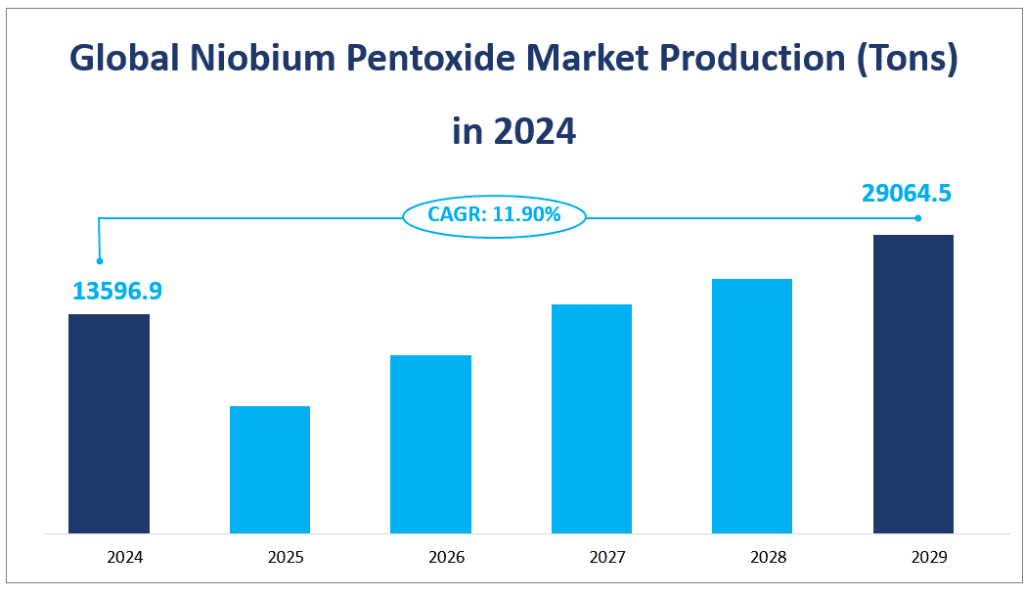

The global niobium pentoxide market estimated production for 2024 stands at 13596.9 tons, showcasing an impressive upward trajectory with a CAGR of 11.90% from 2024 and 2029, indicating a robust expansion in the industry.

Niobium pentoxide, with the chemical formula Nb2O5, is an inorganic compound that serves as a precursor to all materials made of niobium. It is a colorless, insoluble solid, known for its stability and acid-resistant properties. This compound is crucial in various applications, including the production of niobium metal, optical glass, and ceramics. The market’s growth can be attributed to the increasing demand from high-tech industries such as electronics, precision ceramics, and precision glass industries, among others.

Looking forward, the niobium pentoxide market is expected to benefit from the growing demand for niobium in the electronics industry, where niobium pentoxide is used in the production of multilayer ceramic capacitors (MLCC) and other electronic components. The increasing use of niobium in aerospace and defense applications will also contribute to the market’s growth. Despite the promising outlook, the market faces challenges such as the high substitutability of niobium pentoxide and the harsh conditions required for its participation in chemical reactions, which may hinder its widespread adoption in certain applications.

Global Niobium Pentoxide Market Production (Tons) in 2024

2. Driving Factors of the Niobium Pentoxide Market

The primary driving factor is the expanding application landscape of niobium pentoxide. Its use in the production of niobium metal, which is vital for various industries, fuels market growth. The compound’s role in enhancing the refractive index of optical glass and the capacity of MLCCs without posing health risks, as opposed to lead oxide, is another significant factor. The increasing demand from the electronics industry, particularly for components like surface acoustic wave (SAW) filters used in mobile devices, further propels market expansion.

Economic development and industrial innovation also play a crucial role in the market’s growth. The report indicates that the niobium pentoxide market has benefited from the economic upswing and technological advancements, leading to an explosion in industry user demand and enriching the application scenarios of the compound.

3. Limiting Factors of the Niobium Pentoxide Market

On the other hand, the market faces challenges that could limit its growth. The high substitutability of niobium pentoxide is a significant concern, as it can be replaced by other oxides in many of its applications, leading to price competition and market volatility. The harsh conditions required for chemical reactions involving niobium pentoxide also pose a challenge, particularly in industrial applications where the reduction of niobium pentoxide to metal niobium demands specific and often costly processes.

Another limiting factor is the unbalanced development of the niobium pentoxide market. The market is highly monopolized, with a few major producers controlling a significant share. This concentration can lead to price instability and hinder the entry of new players, thus limiting the market’s potential for diversification and innovation.

In conclusion, while the global niobium pentoxide market presents lucrative growth, it is also confronted with challenges that could impede its progress. A strategic approach that addresses these factors will be essential for stakeholders to capitalize on the market’s potential and ensure sustainable growth in the coming years.

4. Analysis of Niobium Pentoxide Market Segment

Different Product Types

The niobium pentoxide market is divided into three primary grades: Industrial Grade Niobium Pentoxide, 3N Niobium Pentoxide, and 4N Niobium Pentoxide. Industrial Grade Niobium Pentoxide is utilized in large-scale industrial applications due to its high stability and acid resistance. The 3N grade, indicating 99.9% purity, is used in more specialized applications requiring higher purity levels, while the 4N grade, or 99.99% purity, is employed in the most demanding applications where ultra-high purity is necessary.

Industrial Grade Niobium Pentoxide holds the largest market share, accounting for 87.36% of the total production in 2024. This is attributed to its widespread use in various industries, particularly in the production of niobium metal, which is a significant consumer of niobium pentoxide. The 3N Niobium Pentoxide follows with a market share of 8.12%, while the 4N grade captures 4.52% of the market. However, in terms of growth rate, the 4N Niobium Pentoxide exhibits the fastest growth, indicating a surge in demand for higher purity grades in specialized applications.

The differing growth rates can be attributed to the increasing need for high-purity niobium compounds in high-tech industries, such as electronics and aerospace, where the properties of niobium pentoxide are crucial for performance. The 3N grade also shows healthy growth, reflecting its importance in applications requiring slightly lower purity levels but still demanding high standards.

Analysis of Different Applications

The applications of the niobium pentoxide market are diverse, spanning across various industries. The primary applications of the niobium pentoxide market include Niobium Metal, Optical Glass, and Ceramics. Niobium Metal is the dominant application, where niobium pentoxide is reduced to metallic niobium for use in various alloys and superalloys. Optical Glass utilizes niobium pentoxide to enhance the refractive index and reduce dispersion, leading to lighter and thinner lenses. Ceramics application involves the use of niobium pentoxide as a dopant to improve the properties of ceramic materials.

Niobium Metal application accounts for the largest market share, with 85.90% of the total consumption in 2024. This application’s significance stems from the extensive use of niobium in the steel industry and other metallurgical applications. Optical Glass follows with a market share of 3.06%, and Ceramics capture 6.89% of the market. In terms of growth, the “Others” category, which includes emerging applications, exhibits the fastest growth rate. This rapid growth suggests a surge in demand for niobium pentoxide in new and innovative applications beyond traditional uses.

The growth in the “Others” category could be attributed to the increasing use of niobium pentoxide in advanced technologies, such as electronics and energy storage, where its unique properties offer significant advantages. The Ceramics application also shows a steady growth rate, indicating the ongoing development and innovation in ceramic materials that leverage the properties of the niobium pentoxide market.

In conclusion, the niobium pentoxide market is characterized by a diverse range of product types and applications, each with its market dynamics. While Industrial Grade Niobium Pentoxide and Niobium Metal applications dominate the market in terms of production and consumption, the 4N grade and the “Others” category in applications show the most promising growth prospects, indicating the niobium pentoxide market evolution and the emergence of new opportunities in high-tech industries.

Market Production and Share by Segment

| Market Production (Tons) in 2024 | Market Share in 2024 | ||

| By Type | Industrial Grade Niobium Pentoxide | 11878.3 | 87.36% |

| 3N Niobium Pentoxide | 1104.1 | 8.12% | |

| 4N Niobium Pentoxide | 614.6 | 4.52% | |

| By Application | Niobium Metal | 11679.7 | 85.90% |

| Optical Glass | 415.8 | 3.06% | |

| Ceramic | 936.5 | 6.89% |

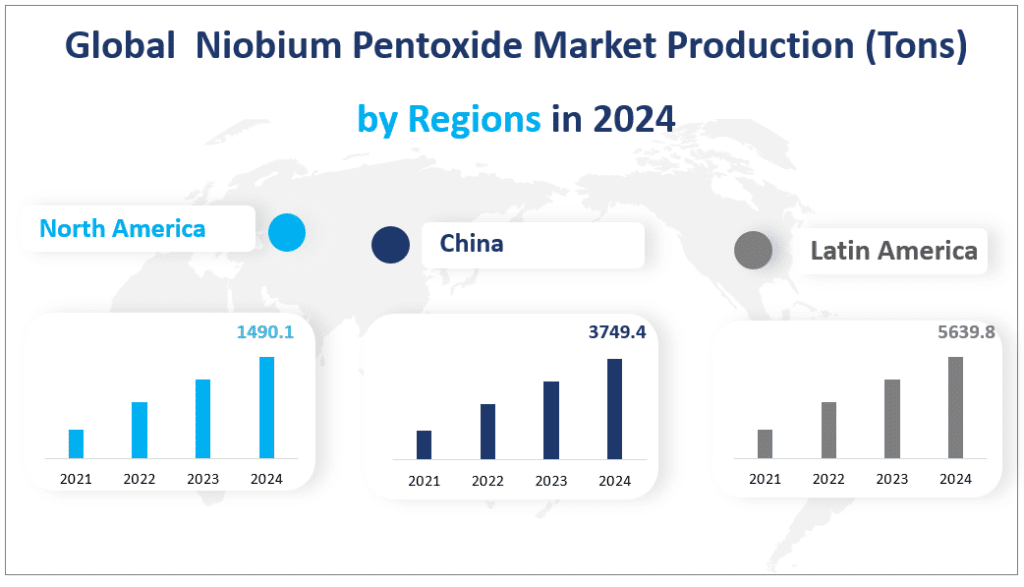

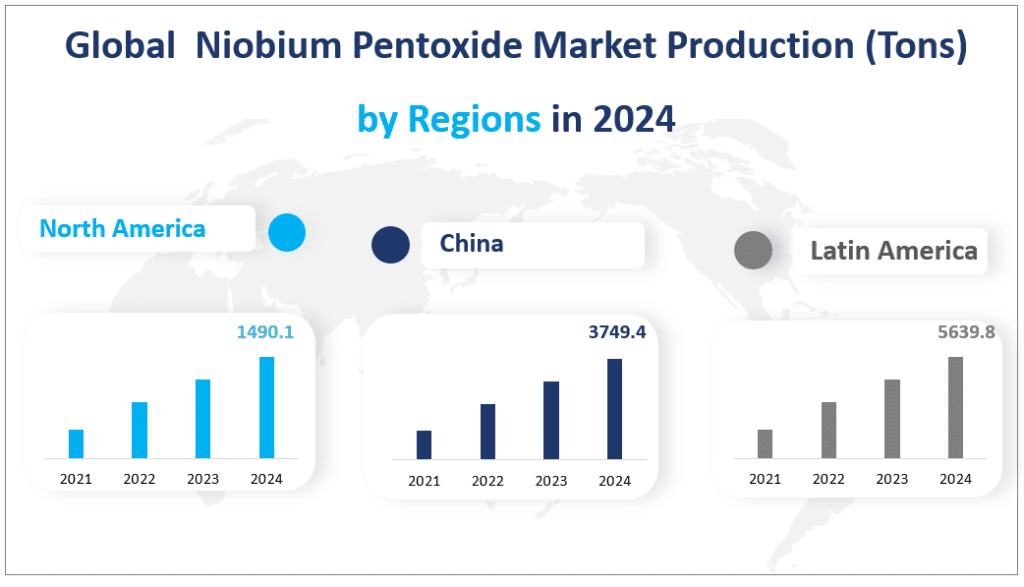

5. Regional Niobium Pentoxide Market Analysis

The global niobium pentoxide market is a dynamic landscape with varying regional contributions to its overall production.

Latin America emerges as the largest niobium pentoxide market, with a significant share of the global production. In 2023, Latin America held a market share of 44.73%, a slight decrease from 50.12% in 2018, indicating a consolidation in the market. This region’s dominance can be attributed to the presence of abundant niobium resources and the presence of key players like CBMM, which is headquartered in Brazil and contributes substantially to the global supply.

China stands out as the fastest-growing region in the global niobium pentoxide market. The market in China is expected to grow due to the country’s rapid economic development, increasing demand from downstream industries, and continuous technological innovations. The production in China is projected to increase from 3,629.4 tons in 2023 to 3,749.4 tons in 2024, reflecting a steady growth pattern. The growth in China’s market is also supported by the government’s initiatives to promote high-tech industries, which are significant consumers of niobium pentoxide.

The growth in these regions can be attributed to several factors, including the increasing use of niobium pentoxide in high-tech applications, the expansion of end-use industries such as electronics and aerospace, and the strategic investments by major players to enhance production capacities. Additionally, the growth in regions like China and Latin America is also influenced by the presence of supportive government policies and the ongoing development of infrastructure projects that demand advanced materials like niobium pentoxide.

While regions like Latin America and China lead in terms of production and growth, they also face challenges such as the concentration of raw material sources and the need for sustainable mining practices. The market also needs to address the issue of price volatility due to the monopolistic nature of the industry. However, the growth opportunities are substantial, particularly in regions where there is a focus on diversifying applications and expanding into new markets.

In conclusion, the global niobium pentoxide market is characterized by regional disparities in production and growth. Latin America leads by revenue, while China exhibits the fastest growth, highlighting the importance of these regions in shaping the future of the niobium pentoxide market. As the market continues to evolve, it will be crucial for regions to capitalize on their strengths while addressing the challenges to maintain a competitive edge in the global arena.

Global Niobium Pentoxide Market Production (Tons) by Regions in 2024

6. Analysis of the Top Five Companies in the Niobium Pentoxide Market

The niobium pentoxide market concentrate rate is high. The top three companies are CBMM, Ximei Group, and Mitsui Kinzoku with a revenue market share of 43.64%, 9.85%, and 6.45% in 2024.

Introduction and Business Overview: CBMM, headquartered in Brazil, is the world’s leading producer of niobium products. The company specializes in the processing and technology of niobium, extracted from its pyrochlore mine near the city of Araxá in Minas Gerais. CBMM serves over 400 customers across more than 40 countries.

Products: CBMM offers a range of niobium products, including standard-grade ferro-niobium, vacuum-grade ferro-niobium, nickel-niobium, high-purity niobium oxide, and optical-grade niobium oxide.

Introduction and Business Overview: Ximei Group, listed in Hong Kong, operates Ximei Resources (Guangdong) Co., Ltd. on the Chinese mainland. The group is committed to becoming a world leader in tantalum and niobium manufacturing, providing solutions for various industries including aerospace, automobile, electronics, and medical treatment.

Products: Ximei Group’s niobium pentoxide is available in different grades with purities ranging from 99.0% to 99.6%.

Introduction and Business Overview: Solikamsk Magnesium Works, based in Russia, processes and produces magnesium and other rare metals, including niobium and tantalum. The company serves primarily the European and North American markets.

Products: The company offers chemically pure niobium pentoxide used in various high-tech applications.

Introduction and Business Overview: Mitsui Kinzoku, established in 1950 and headquartered in Japan, operates in the manufacturing and sales of functional materials, electronic materials, and nonferrous metal smelting.

Products: Mitsui Kinzoku provides tantalum oxide, niobium oxide, and niobium hydroxide for optical lenses, electroceramics, and single crystals.

Ningxia Orient Tantalum Industry Co

Introduction and Business Overview: Ningxia Orient Tantalum Industry Co, based in China, is engaged in the research, development, and production of rare metals like tantalum, niobium, beryllium, and titanium. The company’s products are used in electronics, metallurgy, chemical industry, aviation, aerospace, and nuclear industry.

Products: The company offers niobium oxide, which is used as raw material for metal niobium, niobium bars, niobium alloys, and other applications.

Major Players

| Company Name | Headquarters | Market Distribution |

| CBMM | Brazil | Worldwide |

| Ximei Group | China | Mainly in China |

| Solikamsk Magnesium Works | Russia | Mainly in Europe and North America |

| Mitsui Kinzoku | Japan | Mainly in Japan |

| Ningxia Orient Tantalum Industry Co | China | Mainly in China |

| KING-TAN Tantalum | China | Mainly in China |

| AMG | Germany | Mainly in Europe and North America |

| Materion | USA | Mainly in Asia, Europe and North America |

| MPIL | India | Mainly in Asia |

| Taki Chemical | Japan | Mainly in Asia |

| Guangdong Lingguang New Material Co | China | Mainly in Asia |

| F&X Electro-Materials Limited | China | Mainly in Asia |

| JX Nippon Mining and Metals Corporation | Japan | Mainly in Asia, Europe and Latin America |

| Jiujiang ZhongAo Tantalum and Niobium Co.,Ltd | China | Mainly in Asia |

1 Niobium Pentoxide Market Overview

1.1 Product Overview and Scope of Niobium Pentoxide

1.2 Niobium Pentoxide Segment by Type

1.2.1 Global Niobium Pentoxide Market Size Growth Rate Analysis by Type 2023 VS 2029

1.2.2 Industrial Grade Niobium Pentoxide

1.2.3 3N Niobium Pentoxide

1.2.4 4N Niobium Pentoxide

1.3 Niobium Pentoxide Segment by Applications

1.3.1 Niobium Pentoxide Value Comparison by Application: 2023 VS 2029

1.3.2 Niobium Metal

1.3.3 Optical Glass

1.3.4 Ceramic

1.4 Global Market Growth Prospects

1.4.1 Global Niobium Pentoxide Revenue Estimates and Forecasts (2018-2029)

1.4.2 Global Niobium Pentoxide Production Estimates and Forecasts (2018-2029)

1.5 Global Niobium Pentoxide Market by Region

1.5.1 Global Niobium Pentoxide Market Size Estimates and Forecasts by Region: 2018 VS 2023 VS 2029

1.5.2 North America Niobium Pentoxide Estimates and Forecasts (2018-2029)

1.5.3 Europe Niobium Pentoxide Estimates and Forecasts (2018-2029)

1.5.4 Asia Pacific Niobium Pentoxide Estimates and Forecasts (2018-2029)

1.5.5 Latin America Niobium Pentoxide Estimates and Forecasts (2018-2029)

2 Market Competition by Manufacturers

2.1 Global Niobium Pentoxide Production Market Share by Manufacturer

2.2 Global Niobium Pentoxide Revenue Market Share by Manufacturer (2018-2023)

2.3 Global Niobium Pentoxide Average Price by Manufacturers (2018-2023)

2.4 Manufacturers Niobium Pentoxide Headquarter and Area Served

2.5 Niobium Pentoxide Market Competitive Situation and Trends

2.5.1 Niobium Pentoxide Market Concentration Rate

2.5.2 Global Top 5 and Top 10 Players Market Share by Revenue

2.5.3 Mergers & Acquisitions, Expansion

3 Production and Capacity by Region

3.1 Global Production of Niobium Pentoxide by Regions (2018-2023)

3.2 Global Niobium Pentoxide Revenue and Market Share by Regions

3.3 Global Niobium Pentoxide Production, Revenue, Price (2018-2023)

3.4 North America Niobium Pentoxide Production

3.4.1 North America Niobium Pentoxide Production Growth Rate (2018-2023)

3.4.2 North America Niobium Pentoxide Production, Revenue, Price (2018-2023)

3.5 Europe Niobium Pentoxide Production

3.5.1 Europe Niobium Pentoxide Production Growth Rate (2018-2023)

3.5.2 Europe Niobium Pentoxide Production, Revenue, Price (2018-2023)

3.6 China Niobium Pentoxide Production

3.6.1 China Niobium Pentoxide Production Growth Rate (2018-2023)

3.6.2 China Niobium Pentoxide Production, Revenue, Price (2018-2023)

3.7 Japan Niobium Pentoxide Production

3.7.1 Japan Niobium Pentoxide Production Growth Rate (2018-2023)

3.7.2 Japan Niobium Pentoxide Production, Revenue, Price (2018-2023)

3.8 Latin America Niobium Pentoxide Production

3.8.1 Latin America Niobium Pentoxide Production Growth Rate (2018-2023)

3.8.2 Latin America Niobium Pentoxide Production, Revenue, Price (2018-2023)

4 Global Niobium Pentoxide Consumption by Region

4.1 Global Niobium Pentoxide Consumption by Regions

4.1.1 Global Niobium Pentoxide Consumption by Region

4.1.2 Global Niobium Pentoxide Consumption Market Share by Region

4.2 North America

4.2.1 North America Niobium Pentoxide Consumption by Country

4.2.2 U.S.

4.2.3 Canada

4.3 Europe

4.3.1 Europe Niobium Pentoxide Consumption by Country

4.3.2 Germany

4.3.3 France

4.3.4 U.K.

4.3.5 Italy

4.3.6 Russia

4.4 Asia Pacific

4.4.1 Asia Pacific Niobium Pentoxide Consumption by Region

4.4.2 China

4.4.3 Japan

4.4.4 South Korea

4.4.5 Taiwan

4.4.6 Southeast Asia

4.4.7 India

4.4.8 Australia

4.5 Latin America

4.5.1 Latin America Niobium Pentoxide Consumption by Country

4.5.2 Mexico

4.5.3 Brazil

5 Production, Revenue, Price Trend by Type

5.1 Global Niobium Pentoxide Production and Market Share by Type (2018-2023)

5.2 Global Niobium Pentoxide Revenue Market Share by Type (2018-2023)

5.3 Global Niobium Pentoxide Price by Type (2018-2023)

6 Consumption by Application

6.1 Global Niobium Pentoxide Consumption Market Share by Applications (2018-2023)

6.2 Global Niobium Pentoxide Consumption Growth Rate by Application (2018-2023)

7 Key Companies Profiled

7.1 CBMM

7.1.1 CBMM Niobium Pentoxide Corporation Information

7.1.2 Niobium Pentoxide Product Portfolio

7.1.3 CBMM Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.2 Ximei Group

7.2.1 Ximei Group Niobium Pentoxide Corporation Information

7.2.2 Niobium Pentoxide Product Portfolio

7.2.3 Ximei Group Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.3 Solikamsk Magnesium Works

7.3.1 Solikamsk Magnesium Works Niobium Pentoxide Corporation Information

7.3.2 Niobium Pentoxide Product Portfolio

7.3.3 Solikamsk Magnesium Works Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.4 Mitsui Kinzoku

7.4.1Mitsui Kinzoku Niobium Pentoxide Corporation Information

7.4.2 Niobium Pentoxide Product Portfolio

7.4.3 Mitsui Kinzoku Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.5 Ningxia Orient Tantalum Industry Co

7.5.1 Ningxia Orient Tantalum Industry Co Niobium Pentoxide Corporation Information

7.5.2 Niobium Pentoxide Product Portfolio

7.5.3 Ningxia Orient Tantalum Industry Co Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.6 KING-TAN Tantalum

7.6.1 KING-TAN Tantalum Niobium Pentoxide Corporation Information

7.6.2 Niobium Pentoxide Product Portfolio

7.6.3 KING-TAN Tantalum Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.7 AMG

7.7.1 AMG Niobium Pentoxide Corporation Information

7.7.2 Niobium Pentoxide Product Portfolio

7.7.3 AMG Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.8 Materion

7.8.1 Materion Niobium Pentoxide Corporation Information

7.8.2 Niobium Pentoxide Product Portfolio

7.8.3 Materion Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.9 MPIL

7.9.1 MPIL Niobium Pentoxide Corporation Information

7.9.2 Niobium Pentoxide Product Portfolio

7.9.3 MPIL Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.10 Taki Chemical

7.10.1 Taki Chemical Niobium Pentoxide Corporation Information

7.10.2 Niobium Pentoxide Product Portfolio

7.10.3 Taki Chemical Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.11 Guangdong Lingguang New Material Co

7.11.1 Guangdong Lingguang New Material Co Niobium Pentoxide Corporation Information

7.11.2 Niobium Pentoxide Product Portfolio

7.11.3 Guangdong Lingguang New Material Co Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.12 F&X Electro-Materials Limited

7.12.1 F&X Electro-Materials Limited Niobium Pentoxide Corporation Information

7.12.2 Niobium Pentoxide Product Portfolio

7.12.3 F&X Electro-Materials Limited Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.13 JX Nippon Mining and Metals Corporation

7.13.1 JX Nippon Mining and Metals Corporation Niobium Pentoxide Corporation Information

7.13.2 Niobium Pentoxide Product Portfolio

7.13.3 JX Nippon Mining and Metals Corporation Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

7.14 Jiujiang ZhongAo Tantalum and Niobium Co.,Ltd

7.14.1 Jiujiang ZhongAo Tantalum and Niobium Co.,Ltd Niobium Pentoxide Corporation Information

7.14.2 Niobium Pentoxide Product Portfolio

7.14.3 Jiujiang ZhongAo Tantalum and Niobium Co.,Ltd Niobium Pentoxide Production, Revenue, Price and Gross Margin (2018-2023)

8 Niobium Pentoxide Manufacturing Cost Analysis

8.1 Niobium Pentoxide Key Raw Materials Analysis

8.1.1 Key Raw Materials

8.1.2 Key Raw Materials Price Trend

8.1.3 Key Suppliers of Raw Materials

8.2 Proportion of Manufacturing Cost Structure

8.2.1 Raw Materials

8.2.2 Labor Cost

8.2.3 Manufacturing Expenses

8.3 Manufacturing Process Analysis of Niobium Pentoxide

8.4 Niobium Pentoxide Industrial Chain Analysis

9 Marketing Channel, Distributors and Customers

9.1 Marketing Channel

9.1.1 Direct Marketing

9.1.2 Indirect Marketing

9.2 Niobium Pentoxide Distributors List

9.3 Niobium Pentoxide Customers

10 Market Dynamics

10.1 Niobium Pentoxide Growth Drivers

10.2 Niobium Pentoxide Market Challenges

10.3 Niobium Pentoxide Market Restraints

10.4 Influence Factors

11 Production and Supply Forecast

11.1 Global Forecasted Production of Niobium Pentoxide by Region (2023-2029)

11.2 North America Niobium Pentoxide Production, Revenue Forecast (2023-2029)

11.3 Europe Niobium Pentoxide Production, Revenue Forecast (2023-2029)

11.4 China Niobium Pentoxide Production, Revenue Forecast (2023-2029)

11.5 Japan Niobium Pentoxide Production, Revenue Forecast (2023-2029)

11.6 Latin America Niobium Pentoxide Production, Revenue Forecast (2023-2029)

12 Consumption and Demand Forecast

12.1 Global Forecasted Demand of Niobium Pentoxide

12.2 North America Consumption of Niobium Pentoxide by Country

12.3 Europe Consumption of Niobium Pentoxide by Country

12.4 Asia Pacific Niobium Pentoxide Consumption of Niobium Pentoxide by Country

12.5 Latin America Niobium Pentoxide Consumption of Niobium Pentoxide by Country

13 Forecast by Type and by Application (2023-2029)

13.1 Global Production, Revenue and Price Forecast by Type (2023-2029)

13.1.1 Global Forecasted Production of Niobium Pentoxide by Type (2023-2029)

13.1.2 Global Forecasted Revenue of Niobium Pentoxide by Type (2023-2029)

13.1.3 Global Forecasted Price of Niobium Pentoxide by Type (2023-2029)

13.2 Global Forecasted Consumption of Niobium Pentoxide by Application (2023-2029)

14 Research Findings and Conclusion

15 Appendix

15.1 Methodology

15.2 Research Data Source

15.2.1 Secondary Data

15.2.2 Primary Data

15.2.3 Market Size Estimation

15.2.4 Legal Disclaimer