1. Global Serious Game Market Definition

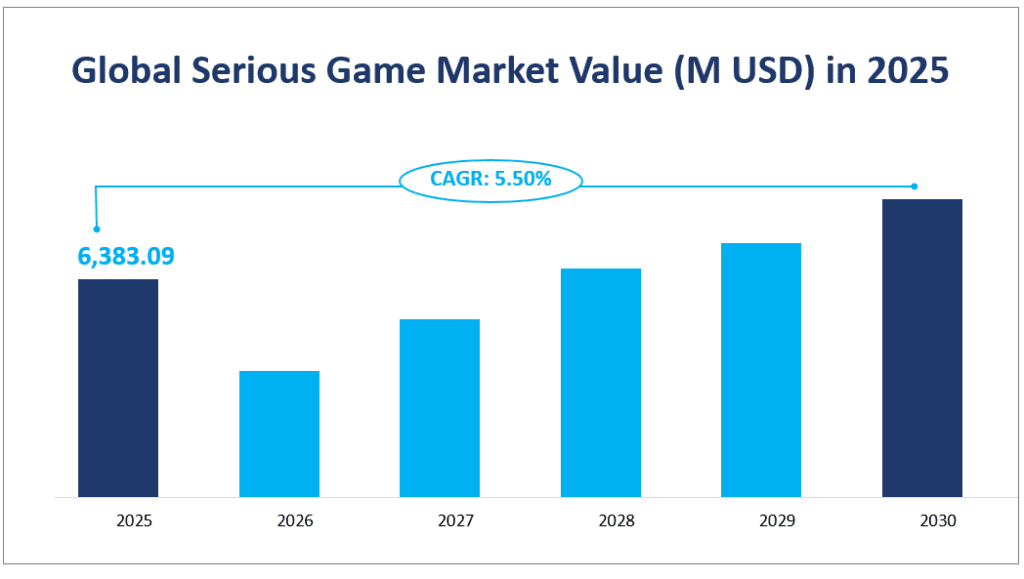

The global Serious Game market size is expected to reach $6,383.09 million with a CAGR of 10.91% from 2025 to 2030.

Serious Games, often referred to as “games with a purpose,” are designed to achieve specific educational, training, or problem-solving objectives, rather than purely for entertainment. Unlike traditional video games, Serious Games integrates learning strategies, knowledge, and game elements to teach specific skills, knowledge, and attitudes. They are used across various fields, including education, healthcare, aerospace, defense, and government, to promote learning and behavior change. The strength of Serious Games lies in their ability to combine entertainment and education, making learning more engaging and effective.

Global Serious Game Market Value (M USD) in 2025

2. Driving Factors of the Serious Game Market

Technological Advancements: The rapid development of technology, especially in the areas of VR and AR, has significantly enhanced the capabilities of Serious Games. These technologies provide a more immersive and interactive experience, making Serious Games more effective for training and education purposes.

Increasing Digitalization: The widespread adoption of digital devices and the increasing penetration of the internet have created a favorable environment for the growth of the Serious Game market. More people are now able to access and engage with Serious Games, expanding the potential user base.

Growing Demand for Innovative Training Solutions: In today’s fast-paced world, traditional training methods are often insufficient. Serious Games offer a more engaging and effective alternative, making them an attractive option for businesses, educational institutions, and government agencies looking to improve their training programs.

Government Support: Governments around the world are recognizing the potential of Serious Games and are providing support through policies and funding. For example, initiatives like the LUDUS project in Europe aim to promote the use of Serious Games in education.

Multi-Domain Applications: Serious Games are not limited to a single industry. Their applications span across multiple sectors, including education, healthcare, aerospace, defense, and government. This versatility ensures a steady demand for Serious Games across various markets.

3. Limiting Factors of the Serious Game Market

Lack of Paying Users: One of the primary challenges faced by the Serious Game market is the limited number of paying users. While the concept of Serious Games is gaining acceptance, many potential users are still hesitant to invest in these solutions, limiting the market’s growth potential.

Talent Shortage: The development and implementation of Serious Games require specialized skills and knowledge. There is a shortage of professionals who can effectively design, develop, and deploy Serious Games, especially in emerging markets.

Unbalanced Regional Development: The Serious Game market is not evenly developed across regions. Developed regions like North America and Europe have a higher penetration rate while developing regions are still in the early stages of adoption. This imbalance can slow down the overall market growth.

Inappropriate Game Design: The success of Serious Games heavily depends on their design. If a game fails to achieve its intended objectives or provide an engaging experience, it may not be adopted by users. Poorly designed games can hinder the market’s growth by creating negative perceptions.

Market Competition: The Serious Game market is becoming increasingly competitive, with new players entering the field. This competition can lead to price wars and reduced profit margins, making it difficult for companies to sustain their growth.

4. Analysis of the Serious Game Market Segment

Product Types

Mobile-based Serious Games are designed for smartphones and tablets, leveraging the widespread accessibility and convenience of these devices. In 2025, the market size for mobile-based Serious Games is estimated to reach $2,558.40 million. This segment is characterized by its flexibility and ease of use, making it suitable for a wide range of applications, from educational games for children to training tools for professionals. The growth rate of mobile-based Serious Games is robust, driven by the increasing penetration of mobile devices and the continuous development of mobile gaming technology.

PC-based Serious Games are designed for personal computers, offering more complex and immersive experiences compared to their mobile counterparts. By 2025, the market size for PC-based Serious Games is projected to be $3,457.29 million. This segment is known for its high-quality graphics, detailed simulations, and extensive functionality, making it ideal for professional training, complex educational programs, and strategic simulations.

Among the different product types, PC-based Serious Games hold the largest market share with 40.05% in 2025. This segment’s dominance is attributed to its ability to provide high-quality, immersive experiences that are essential for professional training and complex simulations.

Different Applications in the Serious Game Market

The healthcare sector is another significant consumer of Serious Games, using these tools to improve patient outcomes and enhance medical training. By 2025, the market size for Serious Games in healthcare is projected to be $754.58 million. This segment is characterized by its focus on patient education, medical training, and rehabilitation.

The aerospace and defense sector is a key consumer of Serious Games, using these tools to enhance training and simulation programs. By 2025, the market size for Serious Games in aerospace and defense is estimated to reach $625.61 million. This segment is characterized by its focus on complex simulations and training scenarios, making Serious Games an essential tool for preparing personnel for challenging environments.

The government sector is another significant consumer of Serious Games, using these tools to enhance training programs and improve public services. By 2025, the market size for Serious Games in government is projected to be $652.81 million. This segment is characterized by its focus on public service training, emergency management, and policy education.

The “Other” category includes a diverse range of applications, such as media and advertising, energy, automotive, and more. By 2025, the market size for this category is estimated to be $556.72 million. While this segment is smaller compared to education, healthcare, aerospace, and defense, it still plays a significant role in the overall Serious Game market.

Among the different applications, education holds the largest market share in 2025 with 43.44%. This segment’s dominance is attributed to its widespread adoption and the significant impact of Serious Games on enhancing the learning experience.

In terms of growth rate, the healthcare segment exhibits the fastest growth, driven by the increasing demand for interactive patient education and medical training tools. The ability to provide immersive and engaging experiences makes Serious Games an attractive choice for the healthcare sector, leading to a robust growth rate in this segment.

Market Size and Share by Segment

| Market Size (M USD) in 2025 | Market Share in 2025 | ||

| By Type | Mobile-based | 2558.40 | 40.08% |

| PC-based | 3457.29 | 54.16% | |

| By Application | Aerospace and Defence | 625.61 | 9.80% |

| Automotive | 357.51 | 5.60% | |

| Education | 2772.86 | 43.44% | |

| Energy | 323.93 | 5.07% | |

| Government | 652.81 | 10.23% | |

| Healthcare | 754.58 | 11.82% | |

| Media and Advertising | 339.08 | 5.31% |

5. Regional Serious Game Market Size by Major Region in 2025

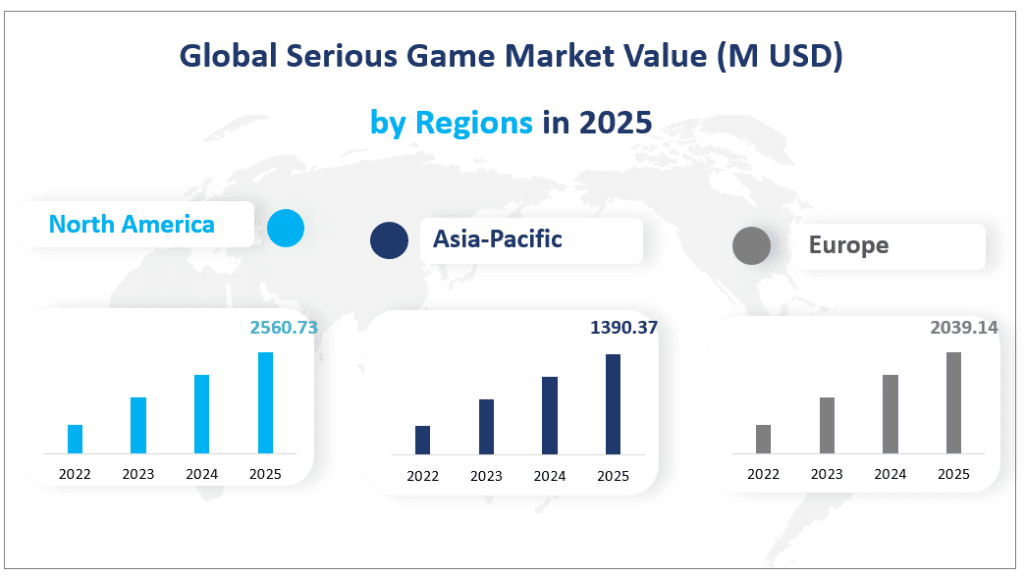

North America remains a dominant player in the Serious Game market, driven by technological advancements, widespread digital infrastructure, and a high demand for innovative training solutions. By 2025, the market size in North America is projected to reach $2560.73 million. This region’s strength lies in its robust technology sector, which continuously pushes the boundaries of what Serious Games can achieve. Companies in North America are at the forefront of integrating cutting-edge technologies such as virtual reality (VR) and augmented reality (AR) into Serious Games, making them more immersive and effective.

Europe is another significant contributor to the Serious Game market, with a projected market size of $2039.14 million by 2025. European countries have been early adopters of Serious Games, leveraging them for a wide range of applications, from education and healthcare to defense and government services. The region’s emphasis on innovation and digital transformation has led to the widespread adoption of Serious Games across various sectors.

The Asia Pacific region is emerging as a fast-growing market for Serious Games, driven by its large population, high internet penetration rate, and a growing number of young people active on social networks and online platforms. By 2025, the market size in the Asia Pacific region is projected to reach $1390.37 million. This region’s growth is fueled by increasing interest from manufacturers and a greater emphasis on the development of Serious Games.

Latin America is also experiencing significant growth in the Serious Game market, driven by increasing digital adoption and a growing demand for innovative training solutions. By 2025, the market size in Latin America is projected to reach $199.26 million. This region’s growth is fueled by its increasing digital literacy and a strong preference for interactive and engaging learning experiences.

The Middle East and Africa region is another emerging market for Serious Games, driven by increasing digital adoption and a growing demand for innovative training solutions. By 2025, the market size in the Middle East and Africa is projected to reach $193.59 million. This region’s growth is fueled by its increasing digital literacy and a strong preference for interactive and engaging learning experiences.

Among the different regions, North America holds the largest market share in 2025. This region’s dominance is attributed to its robust technology sector, widespread digital infrastructure, and high demand for innovative training solutions.

In terms of growth rate, the Asia Pacific region exhibits the fastest growth, driven by its large population, high internet penetration rate, and a growing number of young people active on social networks and online platforms. The ability to provide interactive and engaging experiences makes Serious Games an attractive choice for the Asia Pacific region, leading to a robust growth rate in this segment.

Global Serious Game Market Value (M USD) by Regions in 2025

6. Analysis of the Top 3 Companies in the Serious Game Market

Company Introduction and Business Overview: Microsoft is a global technology giant known for its wide range of software products and services. The company has a strong presence in the Serious Game market, leveraging its expertise in software development and gaming technologies to create innovative solutions. Microsoft’s Serious Game offerings are designed to enhance learning and training experiences across various sectors.

Products Offered: Microsoft’s Serious Game products include educational tools like “Minecraft: Education Edition,” which is specifically designed for classroom use. The company also offers a range of simulation and training tools that leverage its advanced software and gaming technologies.

In 2021, Microsoft’s revenue from its Serious Game business was $667.10 million.

Company Introduction and Business Overview: IBM Corp is a multinational technology and consulting corporation known for its wide range of computer solutions and services. The company has a strong presence in the Serious Game market, leveraging its expertise in technology consulting and support to create innovative solutions. IBM’s Serious Game offerings are designed to enhance learning and training experiences across various sectors.

Products Offered: IBM’s Serious Game products include educational and training tools that leverage its advanced software and technology solutions. The company also offers simulation and training tools that are designed to enhance professional development and learning outcomes.

In 2021, IBM Corp’s revenue from its Serious Game business was $134.06 million.

Company Introduction and Business Overview: Applied Research Associates is a research and engineering company known for its innovative solutions in the Serious Game market. The company leverages its expertise in simulation and training technologies to create engaging and effective learning experiences. Applied Research Associates’ Serious Game offerings are designed to enhance learning and training experiences across various sectors.

Products Offered: Applied Research Associates’ Serious Game products include simulation and training tools that leverage its advanced technology solutions. The company also offers educational and training tools that are designed to enhance professional development and learning outcomes.

In 2021, Applied Research Associates’ revenue from its Serious Game business was $18.29 million.

Major Players

| Company Name | Headquarters | Area Served |

| Microsoft | US | Worldwide |

| IBM Corp | US | Worldwide |

| Applied Research Associates | US | Worldwide |

| Revelian (Criteria Corp) | US | Worldwide |

| BreakAway Games | US | Worldwide |

| Promotion Software GmbH | Germany | Worldwide |

| Diginext (CS Group) | France | Worldwide |

| Grendel Games | Netherlands | Worldwide |

| Serious Game Interactive | Denmark | Worldwide |

| MPS Interactive Systems | India | Worldwide |

| Designing Digitally | US | Worldwide |

| L.I.B. Businessgames BV | Netherlands | Worldwide |

| Chaos Theory Games Pty. Ltd. | Australia | Worldwide |

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Serious Game Market Size Growth Rate by Type (2016-2027)

1.5 Market by Application

1.5.1 Global Serious Game Market Share by Application (2016-2027)

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Serious Game Market Size

2.2 Serious Game Growth Trends by Region

2.2.1 Serious Game Market Size by Region (2016-2027)

2.2.2 Serious Game Market Share by Region (2016-2021)

2.3 Serious Game Industry Dynamic

2.3.1 Serious Game Market Trends

2.3.2 Serious Game Market Drivers

2.3.3 Serious Game Market Challenges

2.3.4 Serious Game Market Restraints

3 Competition Landscape by Key Players

3.1 Global Serious Game Players by Market Size

3.1.1 Global Serious Game Revenue by Players (2016-2021)

3.1.2 Global Serious Game Revenue Market Share by Players (2016-2021)

3.2 Global Serious Game Market Concentration Ratio

3.2.1 Global Serious Game Market Concentration Ratio (CR5 and HHI)

3.2.2 Global Top 10 and Top 5 Companies Revenue in 2020

3.3 Serious Game Key Players Head office

3.4 Establishment Date of Serious Game Major Players

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type

4.1 Global Serious Game Historic Market Size by Type (2016-2021)

4.2 Global Serious Game Forecasted Market Size by Type (2021-2027)

5 Breakdown Data by Application

5.1 Global Serious Game Historic Market Size by Application (2016-2021)

5.2 Global Serious Game Forecasted Market Size by Application (2021-2027)

6 North America

6.1 North America Serious Game Market Size (2016-2027)

6.2 North America Serious Game Market Size by Type

6.3 North America Serious Game Market Size by Application

6.4 North America Serious Game Market Size by Country

6.4.1 North America Serious Game Market Size by Country (2016-2027)

6.4.2 United States

6.4.3 Canada

7 Europe

7.1 Europe Serious Game Market Size (2016-2027)

7.2 Europe Serious Game Market Size by Type

7.3 Europe Serious Game Market Size by Application

7.4 Europe Serious Game Market Size by Country

7.4.1 Europe Serious Game Market Size by Country (2016-2027)

7.4.2 Germany

7.4.3 France

7.4.4 U.K.

7.4.5 Italy

7.4.6 Russia

7.4.7 Nordic

8 Asia Pacific

8.1 Asia Pacific Serious Game Market Size (2016-2027)

8.2 Asia Pacific Serious Game Market Size by Type

8.3 Asia Pacific Serious Game Market Size by Application

8.4 Asia Pacific Serious Game Market Size by Country

8.4.1 Asia Pacific Serious Game Market Size by Country (2016-2027)

8.4.2 China

8.4.3 Japan

8.4.4 South Korea

8.4.5 Southeast Asia

8.4.6 India

8.4.7 Australia

9 Latin America

9.1 Latin America Serious Game Market Size (2016-2027)

9.2 Latin America Serious Game Market Size by Type

9.3 Latin America Serious Game Market Size by Application

9.4 Latin America Serious Game Market Size by Country

9.4.1 Latin America Serious Game Market Size by Country (2016-2027)

9.4.2 Mexico

9.4.3 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Serious Game Market Size (2016-2027)

10.2 Middle East & Africa Serious Game Market Size by Type

10.3 Middle East & Africa Serious Game Market Size by Application

10.4 Middle East & Africa Serious Game Market Size by Country

10.4.1 Middle East & Africa Serious Game Market Size by Country (2016-2027)

10.4.2 Turkey

10.4.3 Saudi Arabia

10.4.4 UAE

11 Key Players Profiles

11.1 Microsoft

11.1.1 Microsoft Company Details

11.1.2 Company Description and Business Overview

11.1.3 Serious Game Introduction

11.1.4 Microsoft Revenue in Serious Game Business (2016-2021)

11.2 IBM Corp

11.2.1 IBM Corp Company Details

11.2.2 Company Description and Business Overview

11.2.3 Serious Game Introduction

11.2.4 IBM Corp Revenue in Serious Game Business (2016-2021)

11.3 Applied Research Associates

11.3.1 Applied Research Associates Company Details

11.3.2 Company Description and Business Overview

11.3.3 Serious Game Introduction

11.3.4 Applied Research Associates Revenue in Serious Game Business (2016-2021)

11.4 Revelian (Criteria Corp)

11.4.1 Revelian (Criteria Corp) Company Details

11.4.2 Company Description and Business Overview

11.4.3 Serious Game Introduction

11.4.4 Revelian (Criteria Corp) Revenue in Serious Game Business (2016-2021)

11.5 BreakAway Games

11.5.1 BreakAway Games Company Details

11.5.2 Company Description and Business Overview

11.5.3 Serious Game Introduction

11.5.4 BreakAway Games Revenue in Serious Game Business (2016-2021)

11.6 Promotion Software GmbH

11.6.1 Promotion Software GmbH Company Details

11.6.2 Company Description and Business Overview

11.6.3 Serious Game Introduction

11.6.4 Promotion Software GmbH Revenue in Serious Game Business (2016-2021)

11.7 Diginext (CS Group)

11.7.1 Diginext (CS Group) Company Details

11.7.2 Company Description and Business Overview

11.7.3 Serious Game Introduction

11.7.4 Diginext (CS Group) Revenue in Serious Game Business (2016-2021)

11.8 Grendel Games

11.8.1 Grendel Games Company Details

11.8.2 Company Description and Business Overview

11.8.3 Serious Game Introduction

11.8.4 Grendel Games Revenue in Serious Game Business (2016-2021)

11.9 Serious Game Interactive

11.9.1 Serious Game Interactive Company Details

11.9.2 Company Description and Business Overview

11.9.3 Serious Game Introduction

11.9.4 Serious Game Interactive Revenue in Serious Game Business (2016-2021)

11.10 MPS Interactive Systems

11.10.1 MPS Interactive Systems Company Details

11.10.2 Company Description and Business Overview

11.10.3 Serious Game Introduction

11.10.4 MPS Interactive Systems Revenue in Serious Game Business (2016-2021)

11.11 Designing Digitally

11.11.1 Designing Digitally Company Details

11.11.2 Company Description and Business Overview

11.11.3 Serious Game Introduction

11.11.4 Designing Digitally Revenue in Serious Game Business (2016-2021)

11.12 L.I.B. Businessgames BV

11.12.1 L.I.B. Businessgames BV Company Details

11.12.2 Company Description and Business Overview

11.12.3 Serious Game Introduction

11.12.4 L.I.B. Businessgames BV Revenue in Serious Game Business (2016-2021)

11.13 Chaos Theory Games Pty. Ltd.

11.13.1 Chaos Theory Games Pty. Ltd. Company Details

11.13.2 Company Description and Business Overview

11.13.3 Serious Game Introduction

11.13.4 Chaos Theory Games Pty. Ltd. Revenue in Serious Game Business (2016-2021)

12 Analyst’s Viewpoints/Conclusions

13 Appendix

13.1 Methodology

13.2 Research Data Source

13.2.1 Secondary Data

13.2.2 Primary Data

13.2.3 Market Size Estimation

13.2.4 Legal Disclaimer