1. Global Bioreactors and Fermenters Market Analysis

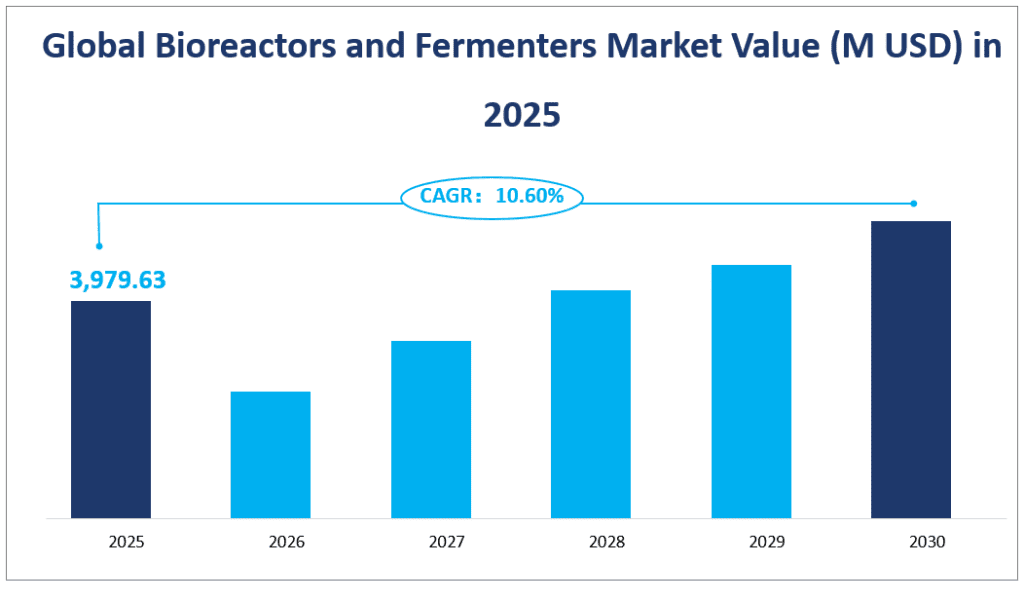

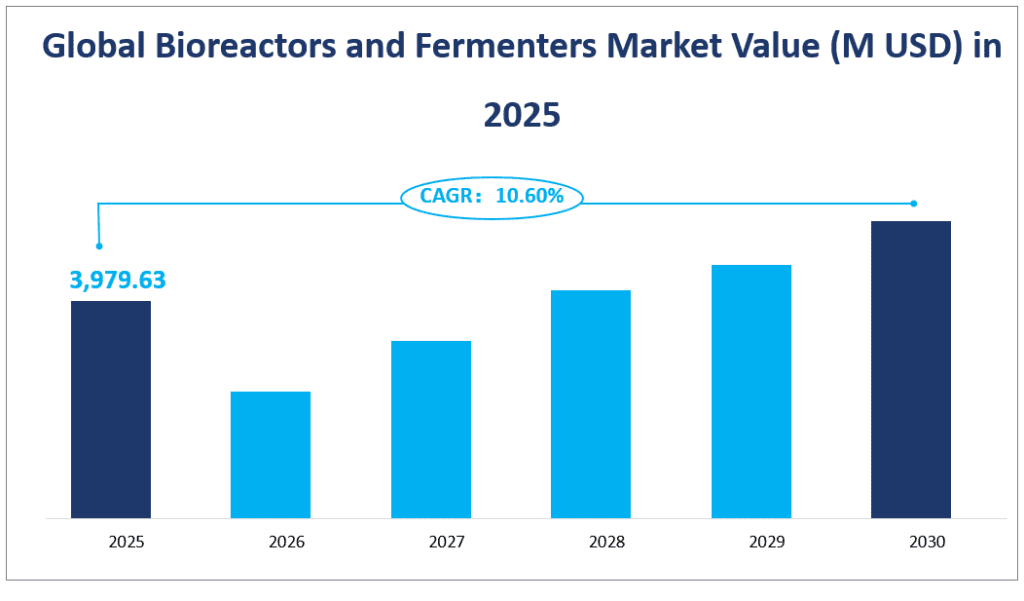

The global Bioreactors and fermenters market will reach a value of $3,979.63 million with a CAGR of 10.60% from 2025 to 2030.

Bioreactors and fermenters are essential components in modern biotechnology and pharmaceutical industries. These devices are specifically designed to provide optimal conditions for the growth of microorganisms, animal cells, and other biological entities used in the production of vaccines, antibodies, recombinant proteins, and other biopharmaceutical products. Bioreactors are engineered to control critical parameters such as temperature, pH, oxygen levels, and nutrient supply, ensuring consistent and scalable production processes. Fermenters, on the other hand, are primarily used for microbial fermentation processes, which are crucial for the production of biofuels, enzymes, and other biochemicals. The versatility and efficiency of these systems make them indispensable in both research and industrial settings.

Global Bioreactors and Fermenters Value (M USD) in 2025

2. Driving Factors of Bioreactors and Fermenters Market

One of the most significant drivers is the rapid advancement in biotechnology and pharmaceutical research. The increasing complexity of biological processes and the demand for high-quality, scalable production systems have led to a greater reliance on advanced bioreactor and fermenter technologies. Additionally, the growing number of biopharmaceutical companies and Contract Research Organizations (CROs) has created a substantial demand for these devices, further fueling market expansion.

Another critical factor driving the market is the increasing focus on recombinant protein technology and the production of monoclonal antibodies. These products require precise control over growth conditions, which can only be achieved through the use of sophisticated bioreactors. Moreover, the trend towards single-use bioreactors and fermenters is gaining momentum. These disposable systems offer several advantages, including reduced contamination risks, lower costs, and faster setup times. The increasing adoption of single-use technologies in both research and production settings is expected to drive further growth in the market.

3. Limiting Factors of Bioreactors and Fermenters Market

Despite the numerous drivers, the bioreactors and fermenters market also faces certain challenges that could potentially limit its growth. One of the primary limiting factors is the high initial investment required for the purchase and installation of these systems. The cost of advanced bioreactors and fermenters can be prohibitive for smaller companies and research institutions, which may restrict their adoption in certain segments of the market.

Another challenge is the need for highly skilled personnel to operate and maintain these complex systems. The lack of adequately trained professionals can hinder the effective utilization of bioreactors and fermenters, thereby limiting their market penetration. Additionally, the regulatory environment surrounding the use of these devices can be complex and stringent, particularly in the pharmaceutical and biotechnology sectors. Compliance with these regulations can add to the overall cost and complexity of using bioreactors and fermenters.

Furthermore, the market is highly competitive, with a few major players dominating the industry. This concentration of market power can make it difficult for new entrants to gain a foothold, potentially stifling innovation and limiting the overall growth of the market. Finally, the market is also subject to fluctuations in raw material prices and supply chain disruptions, which can impact the production and cost of bioreactors and fermenters.

4. Bioreactors and Fermenters Market Segment

Product Types

Single-use Bioreactors are expected to hold a market value of $1728.89 million by 2025. These bioreactors have gained popularity due to their flexibility, reduced risk of contamination, and ease of use, especially in the production of vaccines and biopharmaceuticals. The growth rate for single-use bioreactors is anticipated to be robust, driven by the increasing demand from the biopharmaceutical sector and the ongoing trend towards disposable technologies. The market share for single-use bioreactors is projected to be 43.44% by 2025, making it the dominant product type in the market.

Multiple-use Bioreactors, on the other hand, are projected to have a market value of $2250.74 million by 2025. These bioreactors are designed for repeated use and are often preferred for large-scale production processes. They offer cost-effectiveness and durability, making them suitable for long-term industrial applications. Despite having a slightly lower market share of 56.56% by 2025, multiple-use bioreactors continue to play a crucial role in the industry, especially for established manufacturers with large-scale production needs.

Bioreactors and Fermenters Market by Applications

Biopharmaceutical Companies are expected to consume the most bioreactors and fermenters by 2025, with a projected consumption of 13743 units. These companies are the primary drivers of market demand, as they rely heavily on bioreactors and fermenters for the production of vaccines, antibodies, and other biopharmaceutical products.

Contract Research Organizations (CROs) are also significant consumers, with an expected consumption of 7886 units by 2025. CROs play a crucial role in the development and testing of new biopharmaceutical products, driving the demand for bioreactors and fermenters in research and development settings.

Academic and Research Institutes are projected to consume 18423 units by 2025. These institutions are essential for advancing biotechnological research and innovation, driving the demand for bioreactors and fermenters in academic settings.

Market Value and Share by Segment

| Market Value (M USD) in 2025 | Market Share in 2025 | ||

| By Type | Single-use Bioreactors | 1728.89 | 43.44% |

| Multiple-use Bioreactors | 2250.74 | 56.56% | |

| Consumption (Units) in 2025 | Market Share in 2025 | ||

| By Application | Biopharmaceutical Companies | 13743 | 33.15% |

| CROs | 7886 | 19.02% | |

| Academic and Research Institute | 18423 | 44.44% |

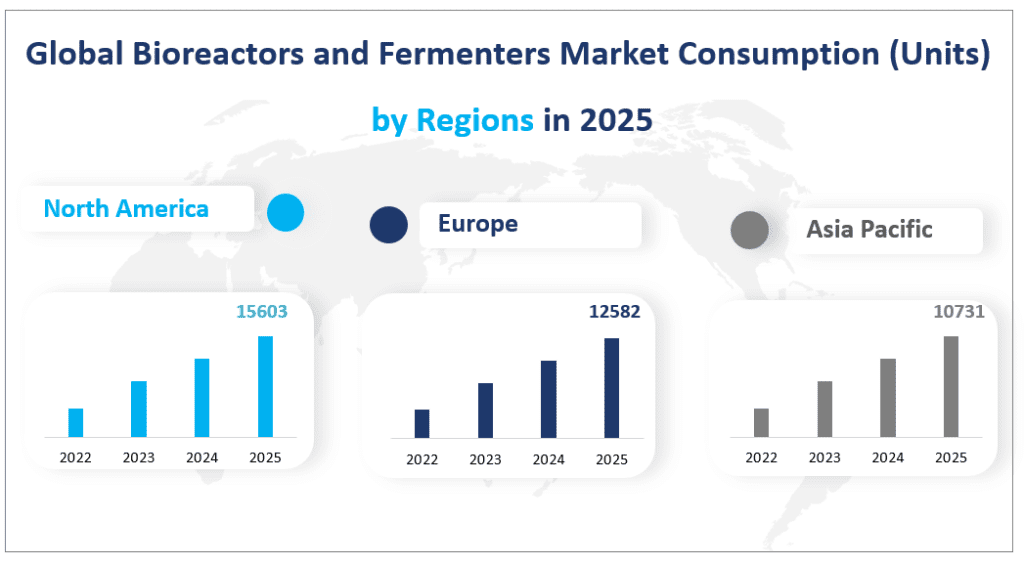

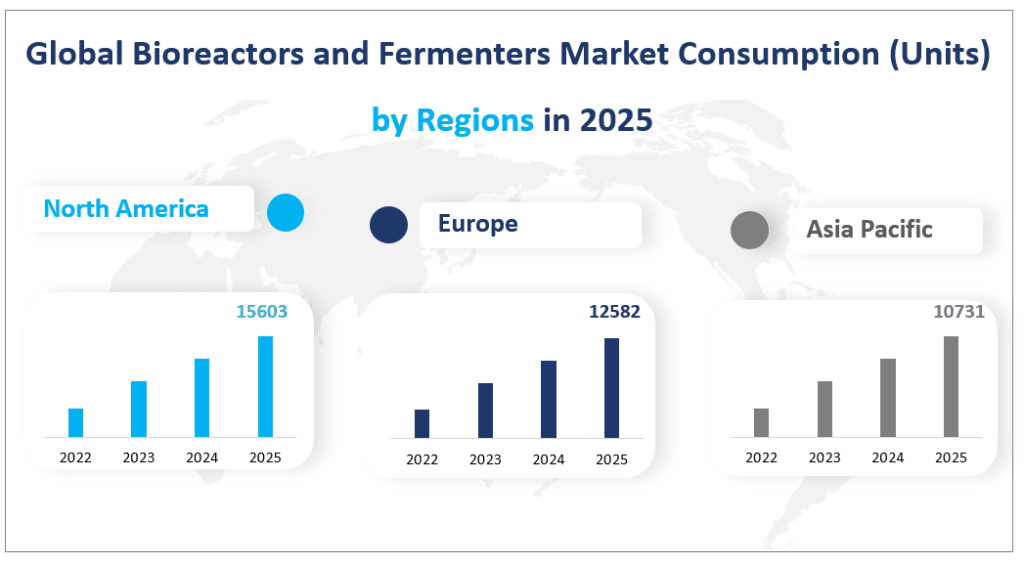

5. Regional Analysis of the Global Bioreactors and Fermenters

North America is projected to be the largest regional market by consumption, with an estimated 15603 units consumed by 2025. This region’s dominance is driven by the presence of major biopharmaceutical companies and advanced research institutions, which rely heavily on bioreactors and fermenters for both research and production.

Europe is another significant market, with an expected consumption of 12582 units by 2025. European countries are known for their strong pharmaceutical and biotechnology sectors, which drive the demand for advanced bioprocessing technologies.

Asia-Pacific is poised to be the fastest-growing region, with a projected consumption of 10731 units by 2025. This region’s rapid growth is driven by the increasing number of biopharmaceutical companies, expanding research capabilities, and growing demand for biotechnology solutions.

Middle East and Africa are expected to consume 1339 units by 2025. While this region has a smaller consumption compared to others, it is growing steadily, driven by increasing investments in healthcare and biotechnology.

South America is also expected to see growth, with a projected consumption of 1205 units by 2025. The region’s growth is driven by the increasing demand for biopharmaceuticals and the expansion of research capabilities.

Global Bioreactors and Fermenters Market Consumption (Units) by Regions in 2025

6. Analysis of the Top 3 Companies in the Bioreactors and Fermenters Market

Company Introduction and Business Overview:

Danaher Corporation, through its subsidiary Pall, is a global leader in the design, manufacturing, and marketing of advanced bioprocessing technologies. Established in 1969 and headquartered in Washington, D.C., Danaher Corporation operates through four platforms: Life Sciences, Diagnostics, Water Quality, and Environmental & Applied Solutions. The company’s acquisition of General Electric Life Sciences in 2019 further strengthened its position in the biopharmaceutical market.

Products Offered:

Danaher Corporation (Pall) offers a comprehensive range of bioreactors and fermenters, including the Allegro™ XRS 25 Bioreactor System and the Allegro™ STR Single-use Stirred Tank Bioreactors. These products are designed for scalability, flexibility, and high performance, making them ideal for both research and industrial applications.

Company Introduction and Business Overview:

Sartorius AG, founded in 1870 and headquartered in Germany, is a leading international supplier of pharmaceutical and laboratory equipment. The company operates through two divisions: Bioprocess Solutions and Lab Products & Services. Bioprocess Solutions focuses on filtration, fluid management, fermentation, and purification, while Lab Products & Services provides laboratory instruments and consumables.

Products Offered:

Sartorius AG offers a range of bioreactors and fermenters, including the BiostatSTR® Gen.3 single-use bioreactors and the Ambr® 250 High Throughput bioreactor system. These products are designed for flexibility, scalability, and high throughput, making them suitable for both process development and commercial manufacturing.

Company Introduction and Business Overview:

Thermo Fisher Scientific, established in 2006 and headquartered in the United States, is a global leader in scientific services. The company provides innovative technologies, purchasing convenience, and pharmaceutical services through its industry-leading brands, including Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, and Patheon.

Products Offered:

Thermo Fisher offers a range of bioreactors and fermenters, including the Thermo Scientific HyPerforma Disposable Bioreactor (SUB) and the Thermo Scientific HyPerforma Rocker Bioreactor. These products are designed for flexibility, customization, and high efficiency, making them ideal for both research and industrial applications.

Major Players

| Company Name | Plants Distribution | Sales Region |

| Danaher Corporation (Pall) | Mainly in America | Worldwide |

| Sartorius AG | Mainly in Europe | Mainly in EMEA, America, APAC |

| Thermo Fisher | Mainly in America | Worldwide |

| Merck KGaA | Mainly in Europe | Worldwide |

| Eppendorf AG | Mainly in Europe | Mainly in Europe, Asia, America |

| Infors HT | Mainly in Europe | Worldwide |

| ZETA Holding GmbH | Mainly in Europe | Mainly in Europe, America, APAC |

| Applikon Biotechnology | Mainly in America, Europe | Mainly in America, Europe, Asia, Middle East & Africa |

| Pierre Guerin (DCI-Biolafitte) | Mainly in Europe | Mainly in Europe, America, Asia |

| PBS Biotech, Inc. | Mainly in America | Mainly in America, Europe, Asia |

| Praj Hipurity Systems | Mainly in India | Mainly in Europe, America, Asia |

| Solaris Biotechnology srl | Mainly in Italy | Mainly in Europe, America, Asia |

| Bioengineering AG | Mainly in Switzerland | Mainly in Europe, America, Asia |

1 Bioreactors and Fermenters Market – Research Scope

1.1 Study Goals

1.2 Market Definition and Scope

1.3 Key Market Segments

1.4 Study and Forecasting Years

2 Bioreactors and Fermenters Market – Research Methodology

2.1 Methodology

2.2 Research Data Source

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.3 Market Size Estimation

2.2.4 Legal Disclaimer

3 Bioreactors and Fermenters Market Forces

3.1 Global Bioreactors and Fermenters Market Size

3.2 Top Impacting Factors (PESTEL Analysis)

3.2.1 Political Factors

3.2.2 Economic Factors

3.2.3 Social Factors

3.2.4 Technological Factors

3.2.5 Environmental Factors

3.2.6 Legal Factors

3.3 Industry Trend Analysis

3.4 Industry Trends Under COVID-19

3.4.1 Risk Assessment on COVID-19

3.4.2 Assessment of the Overall Impact of COVID-19 on the Industry

3.4.3 Pre COVID-19 and Post COVID-19 Market Scenario

3.5 Industry Risk Assessment

4 Bioreactors and Fermenters Market – By Geography

4.1 Global Bioreactors and Fermenters Market Value and Market Share by Regions

4.1.1 Global Bioreactors and Fermenters Value by Region (2016-2021)

4.1.2 Global Bioreactors and Fermenters Value Market Share by Regions (2016-2021)

4.2 Global Bioreactors and Fermenters Market Production and Market Share by Major Countries

4.2.1 Global Bioreactors and Fermenters Production by Major Countries (2016-2021)

4.2.2 Global Bioreactors and Fermenters Production Market Share by Major Countries (2016-2021)

4.3 Global Bioreactors and Fermenters Market Consumption and Market Share by Regions

4.3.1 Global Bioreactors and Fermenters Consumption by Regions (2016-2021)

4.3.2 Global Bioreactors and Fermenters Consumption Market Share by Regions (2016-2021)

5 Bioreactors and Fermenters Market – By Trade Statistics

5.1 Global Bioreactors and Fermenters Export and Import

5.2 USA Bioreactors and Fermenters Export and Import (2016-2021)

5.3 Europe Bioreactors and Fermenters Export and Import (2016-2021)

5.4 China Bioreactors and Fermenters Export and Import (2016-2021)

5.5 Japan Bioreactors and Fermenters Export and Import (2016-2021)

5.6 India Bioreactors and Fermenters Export and Import (2016-2021)

6 Bioreactors and Fermenters Market – By Type

6.1 Global Bioreactors and Fermenters Production and Market Share by Types (2016-2021)

6.1.1 Global Bioreactors and Fermenters Production by Types (2016-2021)

6.1.2 Global Bioreactors and Fermenters Production Market Share by Types (2016-2021)

6.2 Global Bioreactors and Fermenters Value and Market Share by Types (2016-2021)

6.2.1 Global Bioreactors and Fermenters Value by Types (2016-2021)

6.2.2 Global Bioreactors and Fermenters Value Market Share by Types (2016-2021)

6.3 Global Bioreactors and Fermenters Production, Price and Growth Rate of Single-use Bioreactors (2016-2021)

6.3.1 Global Single-use Bioreactors Production and Growth Rate (2016-2021)

6.3.2 Global Single-use Bioreactors Price (2016-2021)

6.4 Global Bioreactors and Fermenters Production, Price and Growth Rate of Multiple-use Bioreactors (2016-2021)

6.4.1 Global Multiple-use Bioreactors Production and Growth Rate (2016-2021)

6.4.2 Global Multiple-use Bioreactors Price (2016-2021)

7 Bioreactors and Fermenters Market – By Application

7.1 Global Bioreactors and Fermenters Consumption and Market Share by Applications (2016-2021)

7.1.1 Global Bioreactors and Fermenters Consumption by Applications (2016-2021)

7.1.2 Global Bioreactors and Fermenters Consumption Market Share by Applications (2016-2021)

7.2 Global Bioreactors and Fermenters Consumption and Growth Rate of Biopharmaceutical Companies (2016-2021)

7.3 Global Bioreactors and Fermenters Consumption and Growth Rate of CROs (2016-2021)

7.4 Global Bioreactors and Fermenters Consumption and Growth Rate of Academic and Research Institutes (2016-2021)

8 North America Bioreactors and Fermenters Market

8.1 North America Bioreactors and Fermenters Market Size

8.2 U.S. Bioreactors and Fermenters Market Size

8.3 Canada Bioreactors and Fermenters Market Size

8.4 Mexico Bioreactors and Fermenters Market Size

8.5 The Influence of COVID-19 on North America Market

9 Europe Bioreactors and Fermenters Market Analysis

9.1 Europe Bioreactors and Fermenters Market Size

9.2 Germany Bioreactors and Fermenters Market Size

9.3 United Kingdom Bioreactors and Fermenters Market Size

9.4 France Bioreactors and Fermenters Market Size

9.5 Italy Bioreactors and Fermenters Market Size

9.6 Spain Bioreactors and Fermenters Market Size

9.7 The Influence of COVID-19 on Europe Market

10 Asia-Pacific Bioreactors and Fermenters Market Analysis

10.1 Asia-Pacific Bioreactors and Fermenters Market Size

10.2 China Bioreactors and Fermenters Market Size

10.3 Japan Bioreactors and Fermenters Market Size

10.4 South Korea Bioreactors and Fermenters Market Size

10.5 Southeast Asia Bioreactors and Fermenters Market Size

10.6 India Bioreactors and Fermenters Market Size

10.7 The Influence of COVID-19 on Asia Pacific Market

11 Middle East and Africa Bioreactors and Fermenters Market Analysis

11.1 Middle East and Africa Bioreactors and Fermenters Market Size

11.2 Saudi Arabia Bioreactors and Fermenters Market Size

11.3 UAE Bioreactors and Fermenters Market Size

11.4 South Africa Bioreactors and Fermenters Market Size

11.5 The Influence of COVID-19 on Middle East and Africa Market

12 South America Bioreactors and Fermenters Market Analysis

12.1 South America Bioreactors and Fermenters Market Size

12.2 Brazil Bioreactors and Fermenters Market Size

12.3 The Influence of COVID-19 on South America Market

13 Company Profiles

13.1 Danaher Corporation (Pall)

13.1.1 Danaher Corporation (Pall) Basic Information

13.1.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.1.3 Danaher Corporation (Pall) Bioreactors and Fermenters Market Performance (2016-2021)

13.2 Sartorius AG

13.2.1 Sartorius AG Basic Information

13.2.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.2.3 Sartorius AG Bioreactors and Fermenters Market Performance (2016-2021)

13.3 Thermo Fisher

13.3.1 Thermo Fisher Basic Information

13.3.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.3.3 Thermo Fisher Bioreactors and Fermenters Market Performance (2016-2021)

13.4 Merck KGaA

13.4.1 Merck KGaA Basic Information

13.4.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.4.3 Merck KGaA Bioreactors and Fermenters Market Performance (2016-2021)

13.5 Eppendorf AG

13.5.1 Eppendorf AG Basic Information

13.5.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.5.3 Eppendorf AG Bioreactors and Fermenters Market Performance (2016-2021)

13.6 Infors HT

13.6.1 Infors HT Basic Information

13.6.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.6.3 Infors HT Bioreactors and Fermenters Market Performance (2016-2021)

13.7 ZETA Holding GmbH

13.7.1 ZETA Holding GmbH Basic Information

13.7.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.7.3 ZETA Holding GmbH Bioreactors and Fermenters Market Performance (2016-2021)

13.8 Applikon Biotechnology

13.8.1 Applikon Biotechnology Basic Information

13.8.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.8.3 Applikon Biotechnology Bioreactors and Fermenters Market Performance (2016-2021)

13.9 Pierre Guerin (DCI-Biolafitte)

13.9.1 Pierre Guerin (DCI-Biolafitte) Basic Information

13.9.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.9.3 Pierre Guerin (DCI-Biolafitte) Bioreactors and Fermenters Market Performance (2016-2021)

13.10 PBS Biotech, Inc.

13.10.1 PBS Biotech, Inc. Basic Information

13.10.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.10.3 PBS Biotech, Inc. Bioreactors and Fermenters Market Performance (2016-2021)

13.11 Praj Hipurity Systems

13.11.1 Praj Hipurity Systems Basic Information

13.11.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.11.3 Praj Hipurity Systems Bioreactors and Fermenters Market Performance (2016-2021)

13.12 Solaris Biotechnology srl

13.12.1 Solaris Biotechnology srl Basic Information

13.12.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.12.3 Solaris Biotechnology srl Bioreactors and Fermenters Market Performance (2016-2021)

13.13 Bioengineering AG

13.13.1 Bioengineering AG Basic Information

13.13.2 Bioreactors and Fermenters Product Profiles, Application and Specification

13.13.3 Bioengineering AG Bioreactors and Fermenters Market Performance (2016-2021)

14 Market Forecast – By Regions

14.1 North America Bioreactors and Fermenters Market Forecast (2021-2026)

14.2 Europe Bioreactors and Fermenters Market Forecast (2021-2026)

14.3 Asia-Pacific Bioreactors and Fermenters Market Forecast (2021-2026)

14.4 Middle East and Africa Bioreactors and Fermenters Market Forecast (2021-2026)

14.5 South America Bioreactors and Fermenters Market Forecast (2021-2026)

15 Market Forecast – By Type and Applications

15.1 Global Bioreactors and Fermenters Market Forecast by Types (2021-2026)

15.1.1 Global Bioreactors and Fermenters Market Forecast Production and Market Share by Types (2021-2026)

15.1.2 Global Bioreactors and Fermenters Market Forecast Value and Market Share by Types (2021-2026)

15.2 Global Bioreactors and Fermenters Market Forecast by Applications (2021-2026)