1. 글로벌 중국어 학습 시장 개요

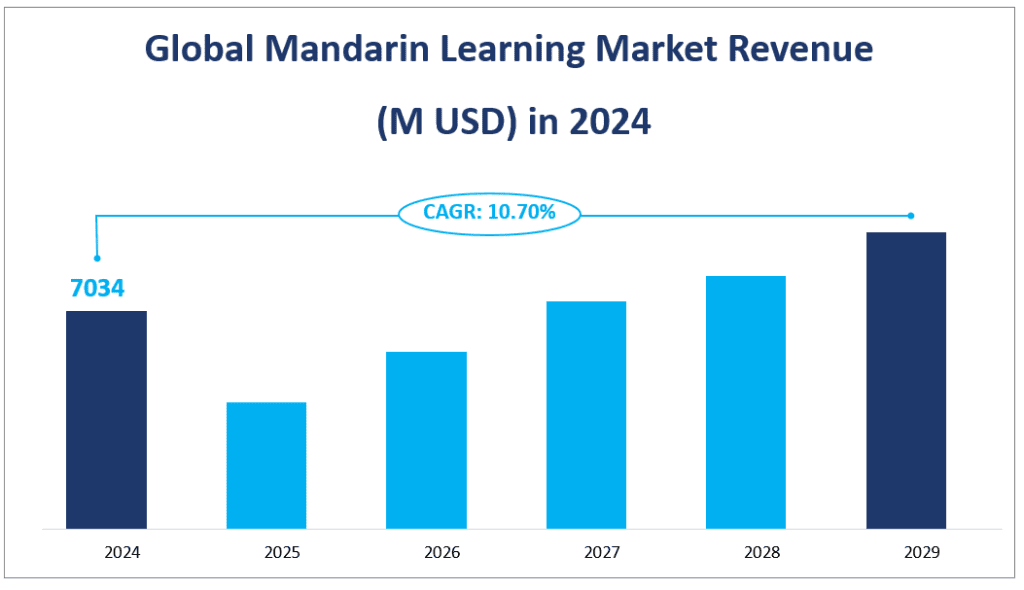

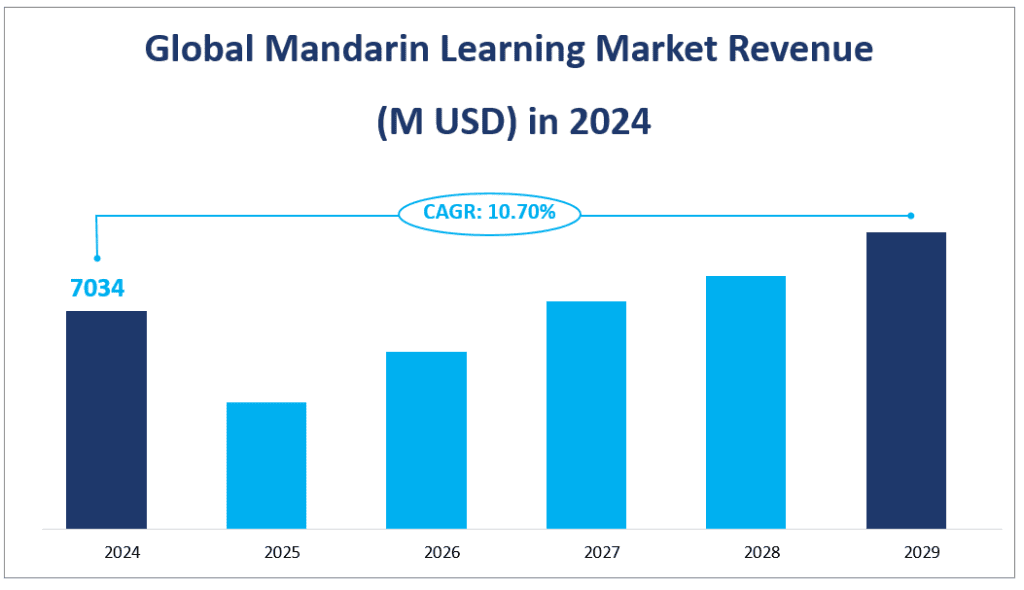

글로벌 만다린어 학습 시장은 향후 몇 년 동안 상당한 수익을 창출할 것으로 예상되며, 2024년에는 $7,034백만 달러의 수익이 발생할 것으로 추산됩니다. 이 수치는 2024년부터 2029년까지 약 10.70%의 연평균 성장률(CAGR)이 예상되는 강력한 성장 궤적을 보여줍니다. 시장 성장은 중국의 경제적 영향력 증가와 전 세계적으로 만다린어 사용자 수 증가에 힘입어 만다린어 학습에 대한 글로벌 관심 증가에 의해 촉진되었습니다.

표준 중국어라고도 불리는 만다린어는 세계에서 가장 널리 사용되는 언어입니다. 여기에는 음조, 발음, 어휘 및 구문에 대한 연구와 중국어 문자 읽기 및 쓰기가 포함됩니다. 만다린어 학습에 대한 수요는 비즈니스의 세계화, 문화 교류, 중국인 해외 거주자 및 관광객의 증가를 포함한 다양한 요인으로 인해 급증했습니다. 전 세계의 교육 기관은 만다린어를 커리큘럼에 통합하여 국제 커뮤니케이션 및 무역에 중요한 언어로서의 중요성을 인식하고 있습니다.

중국어 학습 시장은 온라인과 오프라인 학습 모드로 구분됩니다. 유연성과 접근성으로 인해 엄청난 인기를 얻은 온라인 학습은 시장 수익의 상당 부분을 차지할 것으로 예상됩니다. 반면 오프라인 학습은 특히 대면 상호 작용을 선호하는 지역에서 여전히 전통적이고 널리 받아들여지는 방법입니다. 디지털 학습 플랫폼과 리소스의 가용성이 증가함에 따라 학습자가 언어에 참여하는 방식이 변화하고 있으며, 개인이 전 세계 어디에서나 양질의 교육을 쉽게 받을 수 있게 되었습니다.

글로벌 중국어 학습 시장 수익 (M USD) 2024년

2. 중국어 학습 시장의 추진 요인

글로벌 만다린어 학습 시장의 성장은 여러 가지 추진 요인에 의해 영향을 받습니다. 첫째, 국제 비즈니스와 외교에서 만다린어가 중요한 언어로 인식되는 것이 중요한 원동력입니다. 중국이 글로벌 경제적 영향력을 계속 확대함에 따라, 만다린어에 대한 능숙함은 중국 시장에 참여하려는 전문가에게 필수적인 기술이 되고 있습니다. 이러한 추세는 특히 중국과 강력한 무역 관계를 맺고 있는 국가에서 두드러지는데, 이러한 국가에서는 기업이 직원의 의사소통과 협업을 강화하기 위해 언어 교육에 투자하고 있습니다.

둘째, 온라인 학습 플랫폼의 확산은 만다린어를 가르치고 배우는 방식에 혁명을 일으켰습니다. 온라인 과정의 편리함 덕분에 학습자는 자신의 속도에 맞춰 공부할 수 있어 더 많은 청중이 만다린어를 접할 수 있습니다. 또한 대화형 앱과 AI 기반 튜터링과 같은 언어 학습에 기술을 통합함으로써 학습 경험이 더욱 매력적이고 효과적이 되었습니다. 디지털 교육으로의 이러한 변화는 일상 생활에서 기술을 사용하는 데 익숙한 젊은 세대에게 특히 매력적입니다.

3. 중국어 학습 시장 성장의 제한 요소

그러나 만다린 학습 시장은 성장을 방해할 수 있는 몇 가지 제한 요인에도 직면해 있습니다. 가장 큰 과제 중 하나는 자격을 갖춘 만다린 교사가 부족하다는 것입니다. 특히 언어 학습에 대한 수요가 빠르게 증가하는 지역에서는 더욱 그렇습니다. 많은 교육 기관이 필요한 전문성과 경험을 갖춘 강사를 찾는 데 어려움을 겪고 있으며, 이는 일관되지 않은 교육 품질과 학생 불만으로 이어질 수 있습니다.

게다가 표준화된 교육 자료와 커리큘럼이 부족하면 학습자에게 혼란을 줄 수 있습니다. 지역마다 사용하는 리소스가 달라 학습 성과에 차이가 생길 수 있습니다. 이러한 불일치로 인해 잠재적인 학생들은 받을 교육의 질과 효과에 대해 확신이 서지 않아 중국어 공부를 하지 않을 수 있습니다.

결론적으로, 글로벌 중국어 학습 시장은 수요 증가와 기술 발전에 힘입어 상당한 성장을 이룰 것으로 예상되지만, 잠재력을 최대한 실현하려면 교사의 가용성과 교육의 일관성과 관련된 과제를 해결해야 합니다.

4. 중국어 학습 시장 세그먼트

글로벌 만다린 학습 시장의 제품 유형

글로벌 중국어 학습 시장은 온라인 학습과 오프라인 학습이라는 두 가지 주요 제품 유형으로 특징지어집니다. 각 유형은 다양한 학습자 선호도와 기술적 적응성에 맞춰 시장의 다양성과 성장에 기여합니다.

온라인 학습은 인터넷을 통해 중국어 학습을 용이하게 하는 교육 플랫폼과 도구를 말합니다. 여기에는 원격, 유연하고 종종 대화형 학습 경험을 제공하는 웹사이트, 모바일 애플리케이션 및 디지털 과정이 포함됩니다. 온라인 학습 세그먼트는 2024년에 $2,744.5백만의 수익을 창출할 것으로 예상됩니다. 이러한 유형의 학습은 접근성, 저렴함 및 자신의 속도에 맞춰 학습할 수 있는 능력으로 인해 특히 매력적입니다. 이 세그먼트의 빠른 성장은 인터넷의 침투 증가와 전 세계적으로 디지털 기기의 확산에 기인할 수 있습니다.

반면 오프라인 학습은 전통적인 교실 환경, 직접 튜터링, 만다린어를 직접 가르치는 언어 학교를 포함합니다. 이 방법은 상호 작용적이고 몰입적인 특성으로 인해 가치가 있으며, 직접적인 소통과 문화 교류가 가능합니다. 오프라인 학습 세그먼트는 2024년에 $4,289.5백만의 수익을 창출할 것으로 예상됩니다. 온라인 학습의 증가에도 불구하고 오프라인 학습은 포괄적이고 매력적인 교육 경험을 제공하는 효과성으로 인해 상당한 시장 점유율을 유지하고 있습니다.

시장 점유율 측면에서 오프라인 학습은 글로벌 중국어 학습 시장을 지배하며 2024년 전체 시장의 약 60.98%를 차지합니다. 그러나 온라인 학습은 빠르게 성장하고 있으며 두 제품 유형 중에서 가장 빠른 성장률을 나타냅니다. 이러한 성장은 기술의 발전, 원격 학습의 편의성, 유연한 교육 옵션에 대한 수요 증가에 의해 촉진됩니다.

글로벌 중국어 학습 시장의 응용

글로벌 만다린 학습 시장의 애플리케이션은 어린이, 청소년, 성인의 세 가지 주요 범주로 구분됩니다. 각 애플리케이션은 다양한 연령대와 학습 목표를 대상으로 하며, 전 세계 만다린 학습자의 다양한 요구를 반영합니다.

Kid는 12세 이하 어린이를 대상으로 하는 세그먼트를 말합니다. 이 세그먼트는 어린 학습자를 참여시키기 위해 상호 작용적이고 재미있는 방법을 사용하여 조기 언어 습득과 문화 몰입에 중점을 둡니다. 2024년에 Kid 세그먼트는 $1,598.2m의 수익을 창출할 것으로 예상됩니다. Teenager는 13-17세의 개인을 대상으로 하는 세그먼트를 말합니다. 이 연령대는 종종 학업 진급이나 미래의 직업 기회를 위한 언어 능력을 보완하기 위해 중국어 학습을 추구합니다. Teenager 세그먼트는 2024년에 $2,971.7m의 수익을 창출할 것으로 예상됩니다. 이는 상당한 시장 점유율과 강력한 성장 궤적을 나타내며 가장 빠르게 성장하는 애플리케이션 세그먼트가 되었습니다.

성인은 18세 이상의 개인을 위한 세그먼트를 말합니다. 이 세그먼트에는 다양한 실용적인 이유로 중국어를 배우고자 하는 전문가, 언어 애호가 및 여행자가 포함됩니다. 성인 세그먼트는 2024년에 $2,464.0백만의 수익을 창출할 것으로 예상됩니다. 10대 세그먼트에 비해 성장률이 낮지만 가장 큰 시장 점유율을 차지하며 2024년 전체 시장의 약 35.03%를 차지합니다.

결론적으로, 성인용 애플리케이션 세그먼트는 가장 큰 시장 점유율을 가지고 있으며, 직업적 또는 개인적 이유로 언어 능력을 향상시키고자 하는 광범위한 성인 학습자에 의해 주도되고 있습니다. 한편, 10대 세그먼트는 가장 빠른 성장률을 보이며, 학업 및 경력 지향적 동기로 인해 10대의 중국어 학습이 증가하는 추세임을 보여줍니다. 비교적 규모가 작지만 어린이 세그먼트는 지속적인 성장을 보이며, 글로벌 시장에서 조기 언어 교육의 중요성을 강조합니다.

세그먼트별 시장 수익 및 점유율

| 2024년 시장 수익(M USD) | 2024년 시장점유율 | ||

| 유형별로 | 온라인 학습 | 2744.5 | 39.02% |

| 오프라인 학습 | 4289.5 | 60.98% | |

| 응용 프로그램으로 | 어린이 | 1598.2 | 22.72% |

| 10대 | 2971.7 | 442.25% | |

| 성인 | 2464.0 | 35.03% |

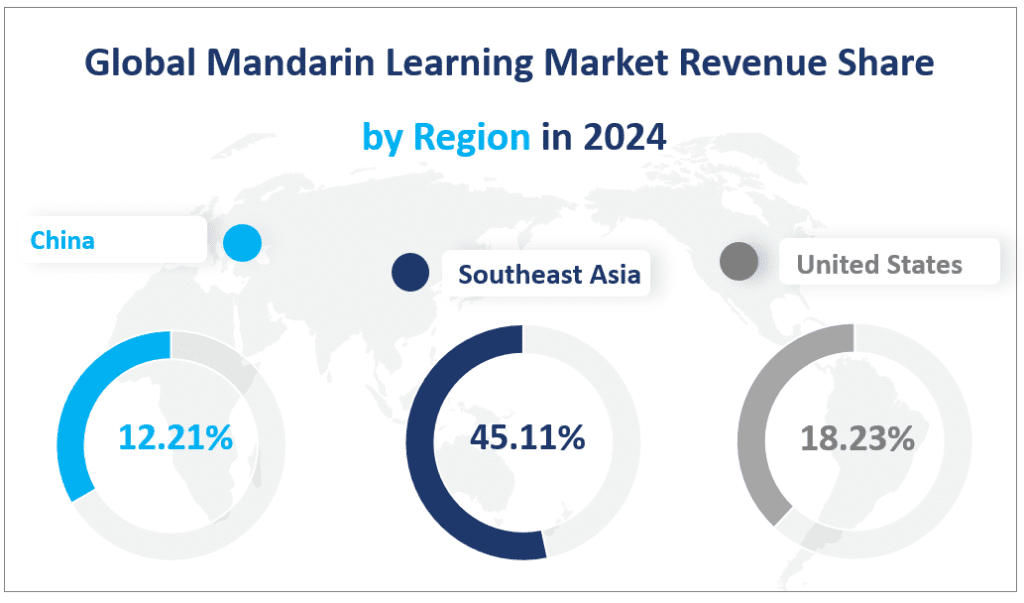

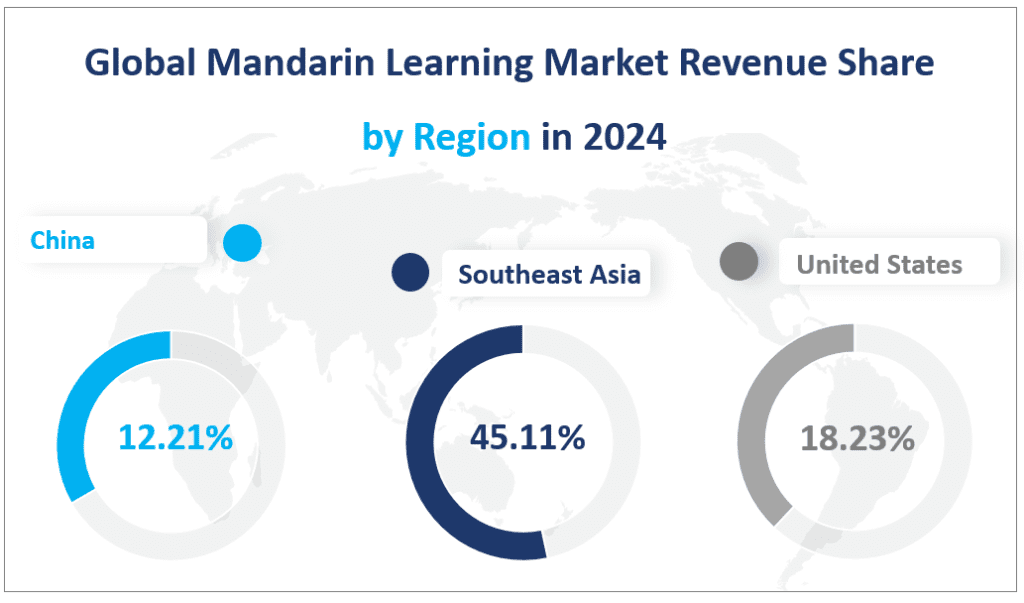

5. 중국어 학습 시장의 지역 분석

미국: 미국은 2024년에 $1,282.4m의 수익을 창출할 것으로 예상되어 글로벌 만다린 학습 시장에 가장 큰 기여를 하는 나라 중 하나가 되었습니다. 이 나라의 강력한 경제와 글로벌 무역 및 외교에서의 전략적 중요성은 전문가와 학생 모두에게 만다린 학습에 대한 수요를 촉진했습니다.

유럽: 풍부한 문화 유산과 강력한 교육적 초점을 갖춘 유럽은 2024년에 $754.4백만의 수익을 창출할 것으로 예상됩니다. 이 지역의 다양한 언어적 환경과 국제 비즈니스에서 만다린의 중요성이 커지면서 이러한 상당한 시장 점유율이 형성되었습니다.

중국: 만다린어의 발상지인 중국은 중요한 시장으로, 2024년에 1조 4천 8백 58.9백만 달러의 수익을 창출했습니다. 이 나라의 급속한 경제 성장과 세계 경제 강국으로서의 역할로 인해 만다린어 학습은 중국에서 또는 중국과 함께 사업을 하는 외국인에게 필수적인 기술이 되었습니다.

일본: 일본은 2024년에 시장에 $101.8백만 달러를 기여할 것으로 예상됩니다. 중국과의 근접성과 역사적, 문화적 유대 관계로 인해 중국어 학습 자료에 대한 수요가 꾸준히 증가했습니다.

동남아시아: 이 지역은 2024년에 $3,173.1m의 가장 높은 수익을 창출할 것으로 예상되어 수익 면에서 가장 큰 지역 시장이 되었습니다. 중국과의 문화적 친화성과 글로벌 시장과의 경제적 통합이 커지면서 만다린 학습이 급증했습니다.

가장 빠르게 성장하는 지역은 동남아시아입니다. 이러한 성장은 이 지역의 경제 발전과 세계 무역 및 외교에서 만다린의 중요성 증가에 의해 주도됩니다.

글로벌 중국어 학습 시장 수익 점유율 202년 지역별4

6. 글로벌 중국어 학습 시장의 상위 5개 회사

글로벌 중국어 학습 시장에는 혁신적인 제품과 서비스로 업계를 형성하고 있는 몇몇 유명 기업이 자리 잡고 있습니다.

소개 및 사업 개요: 2017년에 설립된 LingoAce는 언어 학습을 효과적이고 접근 가능하게 만드는 데 중점을 둔 선도적인 온라인 학습 플랫폼입니다. 학생들을 전문적으로 인증된 교사와 연결하여 만다린 중국어 또는 영어 수업을 제공합니다.

제품: LingoAce는 게임화, 롤플레잉, 애니메이션 스토리텔링을 사용하여 학습을 향상시키는 독점적인 연구 기반 커리큘럼을 제공합니다.

소개 및 사업 개요: 2011년에 설립된 Duolingo Inc는 말하기, 번역, 듣기, 객관식 문제를 제공하는 인기 있는 언어 학습 플랫폼입니다.

제품: Duolingo는 AI와 언어 과학을 통해 개인화된 학습 경험을 제공하며, 흥미로운 연습 문제와 장난기 있는 캐릭터를 선보입니다.

소개 및 사업 개요: 2016년에 설립된 WuKong Education은 전 세계 어린이들이 중국어를 학습할 수 있도록 하는 온라인 교육 플랫폼을 운영합니다.

제품: WuKong Education은 다양한 연령대와 언어적 배경에 맞춰 주요 과정과 보조 과정을 포함한 포괄적인 커리큘럼 시스템을 제공합니다.

소개 및 사업 개요: 1965년에 설립된 EF Education First는 언어, 여행, 문화 교류, 학업에 중점을 둔 글로벌 교육 서비스 제공업체입니다.

제품: EF Education First는 집중 중국어 수업과 해외 유학 프로그램을 포함한 다양한 언어 교육 프로그램을 제공합니다.

소개 및 사업 개요: 1878년에 설립된 Berlitz Corporation은 언어 훈련 및 교육 분야의 글로벌 리더로 기업 고객, 개인 및 기관을 대상으로 프로그램을 제공합니다.

제품: Berlitz는 여러 센터에서 직접 중국어 수업을 제공하며, Berlitz 방식을 사용하여 자연스러운 대화 기술을 장려합니다.

주요 플레이어

| 회사 이름 | 판매 지역 |

| 링고에이스 | 주로 북미, 유럽, 아시아 태평양 지역 |

| 듀오링고 주식회사 | 주로 북미, 유럽, 아시아 |

| 우콩 교육 | 주로 북미와 아시아 태평양 지역 |

| EF 교육 퍼스트 | 세계적인 |

| 베를리츠 코퍼레이션 | 주로 북미, 유럽, 아시아 |

| 로제타 스톤 | 주로 북미, 유럽 |

| 후통 학교 | 주로 아시아, 유럽 |

| 그것은 중국어입니다 | 주로 아시아에서 |

| 링고버스 | 주로 아시아에서 |

| 핸브릿지 만다린 스쿨 | 주로 아시아에서 |

| 부수 | 주로 북미, 유럽 |

| 이탈키 | 주로 유럽과 아시아 태평양 지역 |

| 멤라이즈 | 주로 북미, 유럽, 아시아 태평양 지역 |

| 몬들리 | 주로 북미, 유럽 |

1 중국어 학습 시장 개요

1.1 제품 개요 및 중국어 학습 범위

1.2 유형별 중국어 학습 세그먼트

1.2.1 글로벌 중국어 학습 수익 및 CAGR(%) 유형별 비교(2019-2031)

1.2.2 유형별 중국어 학습 세그먼트

1.3 응용 프로그램별 글로벌 중국어 학습 세그먼트

1.3.1 어플리케이션별 중국어 학습 수익 비교(2019-2031)

1.3.2 응용 프로그램별 글로벌 중국어 학습 세그먼트

1.4 글로벌 중국어 학습 시장, 지역별(2019-2031)

1.5 중국어 학습의 글로벌 시장 규모(수입) (2019-2031)

2 플레이어별 글로벌 중국어 학습 시장 현황

2.1 글로벌 중국어 학습 수익 및 플레이어별 시장 점유율(2021-2024)

2.2 중국어 학습, 비즈니스 유통 영역

2.3 중국어 학습 시장 경쟁 상황 및 추세

2.3.1 중국어 학습 시장 집중도

2.3.2 상위 3개 및 상위 6개 업체의 중국어 학습 시장 점유율

2.3.3 합병 및 인수, 확장

3 상류 및 하류 분석

3.1 중국어 학습 산업 사슬 분석

3.2 하류 구매자

4 중국어 학습 사업 비용 분석

4.1 중국어 학습의 사업 비용 구조 분석

4.2 노동비 분석

4.2.1 노동비 분석

4.3 마케팅 비용 분석

5 시장 동향

5.1 드라이버

5.2 제약 및 과제

5.3 기회

5.4 소비자 행동 분석

5.5 지역 상황이 중국어 학습 산업에 미치는 영향

5.6 중국어 학습 산업에 대한 인플레이션의 영향

5.7 중국어 학습 산업에 대한 AI의 혁신적 힘

6명의 플레이어 프로필

6.1 링고에이스

6.1.1 LingoAce 기본 정보, 판매 지역

6.1.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.1.3 LingoAce 중국어 학습 시장 성과(2019-2024)

6.1.4 LingoAce 비즈니스 개요

6.2 듀오링고 주식회사

6.2.1 Duolingo Inc 기본 정보, 판매 지역

6.2.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.2.3 Duolingo Inc 중국어 학습 시장 성과(2019-2024)

6.2.4 Duolingo Inc 사업 개요

6.3 우콩교육

6.3.1 WuKong Education 기본 정보, 판매 지역

6.3.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.3.3 WuKong Education 중국어 학습 시장 실적(2019-2024)

6.3.4 WuKong Education 사업 개요

6.4 EF 교육 퍼스트

6.4.1 EF Education First 기본정보, 영업지역

6.4.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.4.3 EF Education First 중국어 학습 시장 성과(2019-2024)

6.4.4 EF Education First 사업 개요

6.5 베를리츠 코퍼레이션

6.5.1 Berlitz Corporation 기본 정보, 판매 지역

6.5.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.5.3 Berlitz Corporation 중국어 학습 시장 성과(2019-2024)

6.5.4 Berlitz Corporation 사업 개요

6.6 로제타스톤

6.6.1 Rosetta Stone 기본 정보, 판매 지역

6.6.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.6.3 Rosetta Stone Mandarin Learning 시장 성과(2019-2024)

6.6.4 Rosetta Stone 비즈니스 개요

6.7 후통 학교

6.7.1 후통 학교 기본 정보, 판매 지역

6.7.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.7.3 후통 스쿨 중국어 학습 시장 실적(2019-2024)

6.7.4 후통 학교 사업 개요

6.8 댓 이즈 만다린

6.8.1 That's Mandarin 기본 정보, 판매 지역

6.8.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.8.3 That's Mandarin 중국어 학습 시장 성과(2019-2024)

6.8.4 That's Mandarin Business 개요

6.9 링고버스

6.9.1 Lingo Bus 기본 정보, 판매 지역

6.9.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.9.3 Lingo Bus 중국어 학습 시장 성과(2019-2024)

6.9.4 Lingo Bus 사업 개요

6.10 핸브릿지 만다린 스쿨

6.10.1 Hanbridge Mandarin School 기본 정보, 판매 지역

6.10.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.10.3 Hanbridge Mandarin School 중국어 학습 시장 성과(2019-2024)

6.10.4 Hanbridge Mandarin School 사업 개요

6.11 부수

6.11.1 Busuu 기본 정보, 판매 지역

6.11.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.11.3 Busuu Mandarin Learning 시장 성과(2019-2024)

6.11.4 Busuu 사업 개요

6.12 이탈키

6.12.1 Italki 기본 정보, 판매 지역

6.12.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.12.3 Italki 중국어 학습 시장 성과(2019-2024)

6.12.4 Italki 비즈니스 개요

6.13 멤라이즈

6.13.1 Memrise 기본 정보, 판매 지역

6.13.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.13.3 Memrise 중국어 학습 시장 성과(2019-2024)

6.13.4 Memrise 사업 개요

6.14 월간

6.14.1 Mondly 기본 정보, 판매 지역

6.14.2 중국어 학습 제품 프로필, 응용 프로그램 및 사양

6.14.3 Mondly 중국어 학습 시장 성과(2019-2024)

6.14.4 Mondly 사업 개요

7 글로벌 만다린 학습 수익, 지역별(2019-2024)

7.1 글로벌 중국어 학습 수익 및 시장 점유율, 지역별(2019-2024)

7.2 글로벌 만다린 학습 수익 및 총 마진(2019-2024)

7.3 미국 중국어 학습 수익 및 총 마진(2019-2024)

7.4 유럽 중국어 학습 수익 및 총 마진(2019-2024)

7.5 중국 중국어 학습 수익 및 총 마진(2019-2024)

7.6 일본 중국어 학습 수익 및 총 마진(2019-2024)

7.7 호주 만다린 학습 수익 및 총 마진(2019-2024)

7.8 동남아시아 중국어 학습 수익 및 총 마진(2019-2024)

7.9 라틴 아메리카 중국어 학습 수익 및 총 마진(2019-2024)

7.10 중동 및 아프리카 중국어 학습 수익 및 총 마진(2019-2024)

8 글로벌 중국어 학습 수익 추세(유형별)

8.1 유형별 글로벌 중국어 학습 수익 및 시장 점유율

8.2 유형별 글로벌 중국어 학습 수익 성장률(2019-2024)

8.2.1 온라인 학습의 글로벌 중국어 학습 수익 성장률(2019-2024)

8.2.2 오프라인 학습의 글로벌 중국어 학습 수익 성장률(2019-2024)

9 글로벌 중국어 학습 시장 분석(응용 프로그램별)

9.1 글로벌 중국어 학습 수익 및 애플리케이션별 시장 점유율(2019-2024)

9.2 글로벌 중국어 학습 수익 성장률(2019-2024)

9.2.1 글로벌 만다린어 학습 수익 성장률(2019-2024)

9.2.2 10대 글로벌 중국어 학습 수익 성장률(2019-2024)

9.2.3 성인의 글로벌 중국어 학습 수익 성장률(2019-2024)

10 글로벌 만다린 학습 시장 전망 (2024-2031)

10.1 글로벌 중국어 학습 수익 예측(2024-2031)

10.2 글로벌 중국어 학습 수익 예측, 지역별(2024-2031)

10.2.1 미국 중국어 학습 수익 예측(2024-2031)

10.2.2 유럽 중국어 학습 수익 예측(2024-2031)

10.2.3 중국 중국어 학습 수익 예측(2024-2031)

10.2.4 일본 중국어 학습 수익 예측(2024-2031)

10.2.5 호주 중국어 학습 수익 예측(2024-2031)

10.2.6 동남아시아 중국어 학습 수익 예측(2024-2031)

10.2.7 라틴 아메리카 중국어 학습 수익 예측(2024-2031)

10.2.8 중동 및 아프리카 중국어 학습 수익 예측(2024-2031)

10.3 유형별 글로벌 중국어 학습 수익 예측(2024-2031)

10.4 글로벌 중국어 학습 수익 예측(2024-2031)

11 부록

11.1 방법론

11.2 연구 데이터 소스

11.2.1 2차 데이터

11.2.2 기본 데이터

11.2.3 시장 규모 추정

11.2.4 법적 고지사항