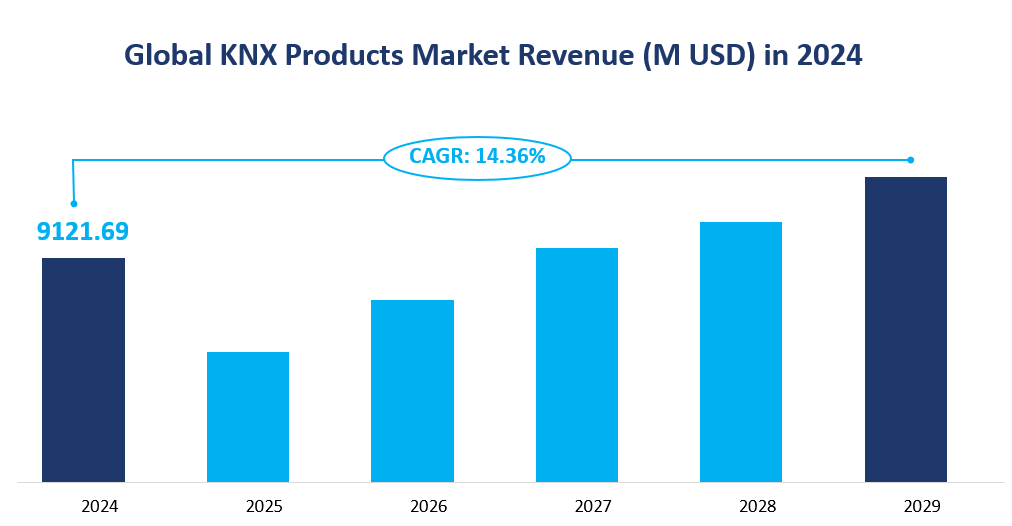

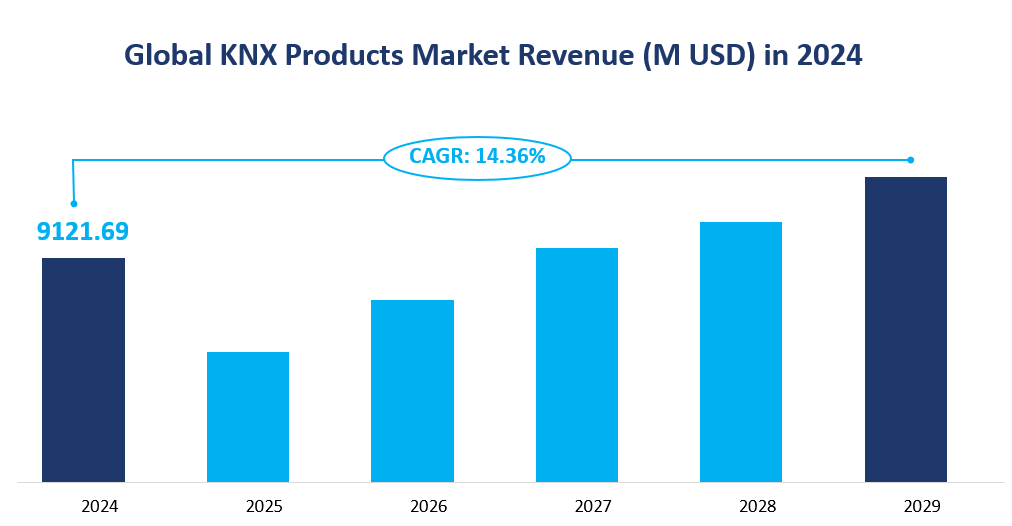

1. Global KNX Products Market Value and Growth Forecast

The global KNX Products market is projected to reach a value of approximately $9,121.69 million USD by the year 2024. This growth is indicative of a robust compound annual growth rate (CAGR) of 14.36% from 2024 to 2029. The KNX standard, which is a widely recognized protocol for home and building automation, facilitates the integration of various devices and systems to enhance energy efficiency, comfort, and security in residential and commercial buildings.

KNX Products encompass a broad range of applications, including energy management, HVAC systems, lighting control, and security systems. The KNX standard is based on a decentralized communication architecture, which allows devices from different manufacturers to communicate seamlessly over a common bus system. This interoperability is a significant advantage, as it enables users to mix and match products from various vendors without compatibility issues.

The KNX system supports multiple communication media, including twisted pair wiring, powerline networking, radio frequency, infrared, and Ethernet. This versatility allows for flexible installation options in diverse environments, making it suitable for both new constructions and retrofitting existing buildings. The KNX protocol is also scalable, meaning it can be implemented in small residential settings as well as large commercial complexes.

The increasing demand for smart home technologies and energy-efficient solutions is driving the growth of the KNX Products market. Consumers are becoming more aware of the benefits of automation, such as reduced energy consumption and enhanced convenience. Furthermore, government initiatives promoting energy efficiency and sustainability are further propelling the adoption of KNX systems. As the market evolves, continuous technological advancements are expected to enhance the capabilities of KNX Products, making them even more attractive to consumers and businesses alike.

Figure Global KNX Products Market Revenue (M USD) in 2024

2. Driving and Limiting Factors of KNX Products Market Growth

The growth of the KNX Products market is influenced by several driving factors. Firstly, the increasing demand for energy-efficient solutions is a primary driver. As global awareness of climate change and energy conservation rises, consumers and businesses are seeking ways to reduce their energy consumption. KNX Products, with their ability to optimize energy use through intelligent automation, are well-positioned to meet this demand.

Secondly, the proliferation of smart home technologies is significantly contributing to market growth. Consumers are increasingly adopting smart devices that offer convenience, security, and energy savings. KNX Products provide a comprehensive solution for integrating these devices, allowing users to control various systems from a single interface. This integration enhances the user experience and encourages further adoption of KNX technologies.

Additionally, government regulations and incentives promoting energy efficiency are driving market growth. Many countries are implementing policies that encourage the use of smart technologies in buildings, further boosting the demand for KNX Products.

However, the KNX Products market also faces several limiting factors. One of the primary challenges is the high initial cost associated with the installation of KNX systems. While the long-term savings on energy bills can offset these costs, the upfront investment may deter some consumers, particularly in regions with lower disposable incomes.

Another limiting factor is the complexity of the KNX system. While the protocol offers significant advantages in terms of flexibility and interoperability, the installation and configuration can be complicated, requiring skilled professionals. This complexity may hinder adoption among less tech-savvy consumers and smaller contractors.

Lastly, competition from alternative automation technologies poses a challenge to the KNX Products market. Other protocols and systems, such as Zigbee and Z-Wave, offer simpler solutions that may appeal to consumers looking for easy-to-install options. As the market continues to evolve, KNX Products must address these challenges to maintain their competitive edge.

3. Technology Innovation and Corporate Activities in the KNX Products Market

The KNX Products market is characterized by ongoing technological innovation and strategic corporate activities, including mergers and acquisitions. One of the most significant trends in the market is the continuous development of smart technologies that enhance the functionality of KNX systems. Innovations such as advanced sensors, smart actuators, and improved user interfaces are making KNX Products more efficient and user-friendly.

For instance, manufacturers are increasingly integrating Internet of Things (IoT) capabilities into their KNX Products, allowing for remote monitoring and control via smartphones and tablets. This integration not only enhances user convenience but also enables real-time data analysis for better energy management and system performance.

Moreover, the rise of artificial intelligence (AI) and machine learning is influencing the KNX Products market. These technologies can optimize building automation systems by learning user preferences and adjusting settings accordingly. For example, AI algorithms can analyze historical data to predict energy usage patterns, allowing for more efficient operation of HVAC systems and lighting.

In terms of corporate activities, the KNX Products market has witnessed several strategic mergers and acquisitions aimed at expanding product portfolios and enhancing market presence. For example, major players like Schneider Electric and ABB have been actively acquiring smaller companies specializing in automation technologies to bolster their KNX offerings. These acquisitions allow larger firms to integrate innovative solutions into their existing product lines, enhancing their competitive advantage.

Additionally, partnerships between KNX manufacturers and technology firms are becoming more common. Collaborations with software developers and IoT companies enable KNX Products to leverage cutting-edge technologies, further enhancing their capabilities and appeal to consumers.

4. Product Types of KNX Products in 2024

The KNX Products market is diverse, encompassing various product types that serve different aspects of building automation and control. By 2024, the market size for each product type will reflect the evolving demands of smart building technologies.

Energy Management systems, which aim to optimize energy consumption, are expected to reach a market size of $885.30 million USD in 2024. This product type is crucial for reducing operational costs and environmental impact, making it a significant segment within the KNX Products market.

HVAC Systems, responsible for heating, ventilation, and air conditioning, will see the largest market share in 2024, with a projected value of $1967.92 million USD. The growth of this segment is driven by the need for energy-efficient climate control systems in both residential and commercial settings.

Blinds & Shutters, which offer automated control of sunlight and privacy, are anticipated to reach a market size of $431.18 million USD in 2024. The increasing demand for comfort and aesthetic control in buildings contributes to the growth of this product type.

Metering systems, used for monitoring energy and resource consumption, are projected to have a market size of $491.98 million USD in 2024. The importance of accurate data for energy management cannot be overstated, making this a vital component of the KNX ecosystem.

Remote Control systems, enabling the operation of devices from a distance, are expected to reach $1265.17 million USD in 2024. The convenience and flexibility offered by remote control systems are key factors in their market growth.

Among all product types, HVAC Systems are projected to have the largest market share in 2024, while Blinds & Shutters are expected to exhibit the fastest growth rate, with a CAGR of 18.54% from 2024 to 2029. This growth is attributed to the increasing focus on energy conservation and the need for automated shading solutions in modern architecture.

Table KNX Products Market Sizes and Shares by Type (2024)

|

Product Type |

Market Size (M USD) |

Market Share (%) |

|---|---|---|

|

Energy Management |

885.30 |

9.71 |

|

HVAC Systems |

1967.92 |

21.57 |

|

Blinds & Shutters |

431.18 |

4.73 |

|

Metering |

491.985 |

5.39 |

|

Remote Control |

1265.17 |

13.87 |

|

Monitoring Systems |

1465.07 |

15.66 |

|

Fire & Smoke Detection |

431.41 |

4.57 |

|

White Goods |

1087.40 |

11.92 |

|

Lighting |

832.702 |

9.56 |

|

Others |

263.565 |

5.66 |

5. Applications of the KNX Products Market in 2024

The KNX Products market is segmented into various applications, each serving a distinct function within the realms of residential and commercial building management.

Commercial Building applications are expected to dominate the market in 2024, with a projected market size of $6497.10 million USD. The demand for advanced automation and control systems in commercial settings, driven by the need for efficiency and cost savings, is the primary factor contributing to this segment’s growth.

Residential Building applications are also expected to see significant growth, with a market size of $2117.52 million USD in 2024. The rising trend of smart homes and the desire for increased comfort and convenience in living spaces are propelling the demand for KNX Products in the residential sector.

Among the applications, Commercial Building holds the largest market share, aligning with the trend of urbanization and the growth of commercial infrastructure globally. However, the Residential Building application is anticipated to have the fastest growth rate, reflecting the growing interest in smart home technologies and the increasing disposable income of consumers seeking enhanced living experiences.

Table KNX Products Market Sizes and Shares by Application (2024)

|

Application Type |

Market Size (M USD) |

Market Share (%) |

|---|---|---|

|

Commercial Building |

6497.10 |

71.23 |

|

Residential Building |

2117.52 |

23.55 |

|

Others |

507.06 |

5.65 |

6. KNX Products Market Analysis: Regional Revenue Projections for 2024

The global KNX Products market is a dynamic and expanding sector, with significant growth projected across various regions by 2024. The market is driven by the increasing demand for intelligent building automation and control solutions, which KNX Products effectively address. Let’s delve into the projected market sizes for major regions and identify the largest and fastest-growing markets by revenue.

North America: A Steady Growth Trajectory

In 2024, the North American market is anticipated to reach a revenue of $780.11 million USD. This region has shown a consistent growth pattern, with a projected increase from $523.86 million USD in 2021. The steady growth can be attributed to the region’s strong economic foundation and the increasing adoption of smart home and building technologies.

Europe: The Dominant Market

Europe is projected to be the largest regional market for KNX Products in 2024, with an impressive revenue of $4793.17 million USD. The region’s significant market share is driven by its advanced infrastructure and the early adoption of automation technologies. The market is expected to grow from $3200.83 million USD in 2021, reflecting a strong upward trend.

Asia Pacific: The Fastest Growing Market

The Asia Pacific region is set to be the fastest-growing market for KNX Products by 2024, with an estimated revenue of $3214.14 million USD. This region’s rapid growth is fueled by the rapid urbanization, industrialization, and the increasing demand for energy-efficient buildings. The market size is expected to grow from $2065.61 million USD in 2021, indicating a significant expansion.

Latin America: Gradual Expansion

Latin America is projected to reach a market size of $124.91 million USD in 2024. The region’s growth, while steady, is more gradual compared to Asia Pacific. The market is expected to grow from $84.14 million USD in 2021, showing a consistent upward trend.

Middle East & Africa: Emerging Potential

The Middle East & Africa region is anticipated to reach a market size of $239.46 million USD in 2024. This region is characterized as an emerging market with significant potential for growth, growing from $148.91 million USD in 2021.

Figure Global KNX Products Market Value by Region in 2024

7. Top 3 KNX Products Companies Analysis: An In-Depth Look into Market Leaders

7.1 Siemens

Company Introduction and Business Overview:

Siemens, established in 1847, stands as a global powerhouse in engineering and manufacturing. With a strong focus on electrification, automation, and digitalization, Siemens provides a comprehensive suite of products and services for a diverse range of industries. Their commitment to quality and innovation has solidified their position in the KNX Products market.

Products Overview:

Siemens offers a broad spectrum of KNX Products, including but not limited to energy management systems, HVAC solutions, and lighting controls. Their products are designed to deliver optimal ambient conditions, ensuring maximum comfort and energy efficiency. Siemens’ new presence detectors, for instance, integrate CO2, temperature, humidity, and brightness data, allowing for sophisticated control over illumination systems, ventilation, and heating.

Sales Revenue in 2021:

In 2021, Siemens achieved a significant milestone with a sales revenue of $960.78 million USD. This revenue underscores Siemens’ dominant position in the market, driven by their extensive product range and a strong customer base. Their gross margin for the year was 46.56%, indicating a healthy financial performance and a robust business model.

7.2 ABB

Company Introduction and Business Overview:

ABB, founded in 1988, is a multinational corporation specializing in power and automation technologies. With a global presence, ABB operates across segments like power products, power systems, automation products, and robotics. Their focus on innovation and sustainability resonates well with the evolving needs of the KNX Products market.

Products Overview:

ABB’s product portfolio in the KNX domain includes a variety of KNX Switch Actuators, designed to enhance comfort and versatility in residential and commercial applications. Their KNX Actuators range is tailored to meet diverse project requirements, offering solutions that are both functional and adaptable.

Sales Revenue in 2021:

ABB’s sales revenue for 2021 was $687.54 million USD, reflecting a strong performance in the KNX Products market. Their gross margin stood at 42.97%, highlighting their operational efficiency and effective cost management.

7.3 Schneider Electric

Company Introduction and Business Overview:

Schneider Electric, established in 1836, is a renowned manufacturer of electrical power products. They offer a wide array of solutions including car chargers, home security, lighting switches, access control, and more. Schneider Electric’s global reach and commitment to innovation make them a key player in the KNX Products market.

Products Overview:

Schneider Electric’s KNX Bus system is a testament to their dedication to home automation and building management solutions. The system is designed to maximize flexibility, comfort, safety, and profitability, especially for new buildings. Their product range includes system components, interfaces/gateways, push-buttons, binary inputs, movement detectors, environmental sensors, and more.

Sales Revenue in 2022:

In 2022, Schneider Electric recorded a sales revenue of $480.50 million USD, showcasing their substantial market share and the effectiveness of their product offerings. Their gross margin for the year was 46.15%, indicating a solid financial standing and a well-structured business model.

1 Study Coverage

1.1 KNX Products Product Introduction

1.2 Market by Type

1.2.1 Global KNX Products Market Size Growth Rate by Type

1.2.2 Energy Management

1.2.3 HVAC Systems

1.2.4 Blinds & Shutters

1.2.5 Metering

1.2.6 Remote Control

1.2.7 Monitoring Systems

1.2.8 Fire & Smoke Detection

1.2.9 White Goods

1.2.10 Lighting

1.3 Market by Applications

1.3.1 Global KNX Products Market Size Growth Rate by Application

1.3.2 Commercial Building

1.3.3 Residential Building

1.4 Study Objectives

1.5 Years Considered

2 Global KNX Products Production

2.1 Global KNX Products Production Capacity (2019-2029)

2.2 Global KNX Products Production by Region: 2019 VS 2024 VS 2029

2.3 Global KNX Products Production by Region

2.3.1 Global KNX Products Historic Production by Region (2019-2024)

2.3.2 Global KNX Products Forecasted Production by Region (2024-2029)

2.4 North America

2.5 Europe

2.6 China

3 Global KNX Products Sales in Volume & Value Estimates and Forecasts

3.1 Global KNX Products Sales Estimates and Forecasts 2019-2029

3.2 Global KNX Products Revenue Estimates and Forecasts 2019-2029

3.3 Global KNX Products Revenue by Region: 2019 VS 2024 VS 2029

3.4 Global Top KNX Products Regions by Sales

3.4.1 Global Top KNX Products Regions by Sales (2019-2024)

3.4.2 Global Top KNX Products Regions by Sales (2024-2029)

3.5 Global Top KNX Products Regions by Revenue

3.5.1 Global Top KNX Products Regions by Revenue (2019-2024)

3.5.2 Global Top KNX Products Regions by Revenue (2024-2029)

3.6 North America

3.7 Europe

3.8 Asia-Pacific

3.9 Latin America

3.10 Middle East & Africa

4 Competition by Manufacturers

4.1 Global KNX Products Production Capacity by Manufacturers

4.2 KNX Products Sales by Manufacturers

4.2.1 Global Top KNX Products Manufacturers by Sales (2019-2024)

4.2.2 Global Top KNX Products Manufacturers Market Share by Sales (2019-2024)

4.2.3 Global Top 10 and Top 5 Companies by KNX Products Sales in 2024

4.3 KNX Products Revenue by Manufacturers

4.3.1 Global Top KNX Products Manufacturers by Revenue (2019-2024)

4.3.2 Global Top KNX Products Manufacturers Market Share by Revenue (2019-2024)

4.3.3 Global Top 10 and Top 5 Companies by KNX Products Revenue in 2024

4.4 Global KNX Products Sales Price by Manufacturers

4.5 Analysis of Competitive Landscape

4.5.1 Manufacturers Market Concentration Ratio (CR5 and HHI)

4.5.2 Global KNX Products Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

4.5.3 Global KNX Products Manufacturers Headquarters

4.6 Mergers & Acquisitions, Expansion Plans

5 Market Size by Type

5.1 Global KNX Products Sales by Type

5.1.1 Global KNX Products Historical Sales by Type (2019-2024)

5.1.2 Global KNX Products Forecasted Sales by Type (2024-2029)

5.1.3 Global KNX Products Sales Market Share by Type (2019-2029)

5.2 Global KNX Products Revenue by Type

5.2.1 Global KNX Products Historical Revenue by Type (2019-2024)

5.2.2 Global KNX Products Forecasted Revenue by Type (2024-2029)

5.2.3 Global KNX Products Revenue Market Share by Type (2019-2029)

5.3 Global KNX Products Price by Type

5.3.1 Global KNX Products Price by Type (2019-2024)

5.3.2 Global KNX Products Price Forecast by Type (2024-2029)

6 Market Size by Application

6.1 Global KNX Products Sales by Application

6.1.1 Global KNX Products Historical Sales by Application (2019-2024)

6.1.2 Global KNX Products Forecasted Sales by Application (2024-2029)

6.1.3 Global KNX Products Sales Market Share by Application (2019-2029)

6.2 Global KNX Products Revenue by Application

6.2.1 Global KNX Products Historical Revenue by Application (2019-2024)

6.2.2 Global KNX Products Forecasted Revenue by Application (2024-2029)

6.2.3 Global KNX Products Revenue Market Share by Application (2019-2029)

6.3 Global KNX Products Price by Application

6.3.1 Global KNX Products Price by Application (2019-2024)

6.3.2 Global KNX Products Price Forecast by Application (2024-2029)

7 North America

7.1 North America KNX Products Market Size by Type 2019-2029

7.1.1 North America KNX Products Sales by Type (2019-2029)

7.1.2 North America KNX Products Revenue by Type (2019-2029)

7.2 North America KNX Products Market Size by Application 2019-2029

7.2.1 North America KNX Products Sales by Application (2019-2029)

7.2.2 North America KNX Products Revenue by Application (2019-2029)

7.3 North America KNX Products Market Size by Country 2019-2029

7.3.1 North America KNX Products Sales by Country (2019-2029)

7.3.2 North America KNX Products Revenue by Country (2019-2029)

7.3.3 U.S.

7.3.4 Canada

8 Europe

8.1 Europe KNX Products Market Size by Type 2019-2029

8.1.1 Europe KNX Products Sales by Type (2019-2029)

8.1.2 Europe KNX Products Revenue by Type (2019-2029)

8.2 Europe KNX Products Market Size by Application 2019-2029

8.2.1 Europe KNX Products Sales by Application (2019-2029)

8.2.2 Europe KNX Products Revenue by Application (2019-2029)

8.3 Europe KNX Products Market Size by Country 2019-2029

8.3.1 Europe KNX Products Sales by Country (2019-2029)

8.3.2 Europe KNX Products Revenue by Country (2019-2029)

8.3.3 Germany

8.3.4 France

8.3.5 U.K.

8.3.6 Italy

8.3.7 Russia

9 Asia Pacific

9.1 Asia Pacific KNX Products Market Size by Type 2019-2029

9.1.1 Asia Pacific KNX Products Sales by Type (2019-2029)

9.1.2 Asia Pacific KNX Products Revenue by Type (2019-2029)

9.2 Asia Pacific KNX Products Market Size by Application 2019-2029

9.2.1 Asia Pacific KNX Products Sales by Application (2019-2029)

9.2.2 Asia Pacific KNX Products Revenue by Application (2019-2029)

9.3 Asia Pacific KNX Products Market Size by Country 2019-2029

9.3.1 Asia Pacific KNX Products Sales by Country (2019-2029)

9.3.2 Asia Pacific KNX Products Revenue by Country (2019-2029)

9.3.3 China

9.3.4 Japan

9.3.5 South Korea

9.3.6 India

9.3.7 Australia

9.3.8 China Taiwan

9.3.9 Indonesia

9.3.10 Thailand

9.3.11 Malaysia

10 Latin America

10.1 Latin America KNX Products Market Size by Type 2019-2029

10.1.1 Latin America KNX Products Sales by Type (2019-2029)

10.1.2 Latin America KNX Products Revenue by Type (2019-2029)

10.2 Latin America KNX Products Market Size by Application 2019-2029

10.2.1 Latin America KNX Products Sales by Application (2019-2029)

10.2.2 Latin America KNX Products Revenue by Application (2019-2029)

10.3 Latin America KNX Products Market Size by Country 2019-2029

10.3.1 Latin America KNX Products Sales by Country (2019-2029)

10.3.2 Latin America KNX Products Revenue by Country (2019-2029)

10.3.3 Mexico

10.3.4 Brazil

10.3.5 Argentina

11 Middle East and Africa

7.1 Middle East and Africa KNX Products Market Size by Type 2019-2029

11.1.1 Middle East and Africa KNX Products Sales by Type (2019-2029)

11.1.2 Middle East and Africa KNX Products Revenue by Type (2019-2029)

11.2 Middle East and Africa KNX Products Market Size by Application 2019-2029

11.2.1 Middle East and Africa KNX Products Sales by Application (2019-2029)

11.2.2 Middle East and Africa KNX Products Revenue by Application (2019-2029)

11.3 Middle East and Africa KNX Products Market Size by Country 2019-2029

11.3.1 Middle East and Africa KNX Products Sales by Country (2019-2029)

11.3.2 Middle East and Africa KNX Products Revenue by Country (2019-2029)

11.3.3 Turkey

11.3.4 Saudi Arabia

11.3.5 UAE

12 Corporate Profile

12.1 Siemens

12.1.1 Company Corporation Information

12.1.2 Business Overview and Related Developments

12.1.3 Product Overview

12.1.4 Siemens KNX Products Sales, Price, Revenue, Gross Margin

12.2 ABB

12.2.1 Company Corporation Information

12.2.2 Business Overview and Related Developments

12.2.3 Product Overview

12.2.4 ABB KNX Products Sales, Price, Revenue, Gross Margin

12.3 Schneider Electric

12.3.1 Company Corporation Information

12.3.2 Business Overview and Related Developments

12.3.3 Product Overview

12.3.4 Schneider Electric KNX Products Sales, Price, Revenue, Gross Margin

12.4 Hager Group

12.4.1 Company Corporation Information

12.4.2 Business Overview and Related Developments

12.4.3 Product Overview

12.4.4 Hager Group KNX Products Sales, Price, Revenue, Gross Margin

12.5 Legrand

12.5.1 Company Corporation Information

12.5.2 Business Overview and Related Developments

12.5.3 Product Overview

12.5.4 Legrand KNX Products Sales, Price, Revenue, Gross Margin

12.6 Gira

12.6.1 Company Corporation Information

12.6.2 Business Overview and Related Developments

12.6.3 Product Overview

12.6.4 Gira KNX Products Sales, Price, Revenue, Gross Margin

12.7 Somfy

12.7.1 Company Corporation Information

12.7.2 Business Overview and Related Developments

12.7.3 Product Overview

12.7.4 Somfy KNX Products Sales, Price, Revenue, Gross Margin

12.8 STEINEL

12.8.1 Company Corporation Information

12.8.2 Business Overview and Related Developments

12.8.3 Product Overview

12.8.4 STEINEL KNX Products Sales, Price, Revenue, Gross Margin

12.9 JUNG

12.9.1 Company Corporation Information

12.9.2 Business Overview and Related Developments

12.9.3 Product Overview

12.9.4 JUNG KNX Products Sales, Price, Revenue, Gross Margin

12.10 Johnson Controls

12.10.1 Company Corporation Information

12.10.2 Business Overview and Related Developments

12.10.3 Product Overview

12.10.4 Johnson Controls KNX Products Sales, Price, Revenue, Gross Margin

12.11 Weinzierl Engineering GmbH

12.11.1 Company Corporation Information

12.11.2 Business Overview and Related Developments

12.11.3 Product Overview

12.11.4 Weinzierl Engineering GmbH KNX Products Sales, Price, Revenue, Gross Margin

12.12 Urmet

12.12.1 Company Corporation Information

12.12.2 Business Overview and Related Developments

12.12.3 Product Overview

12.12.4 Urmet KNX Products Sales, Price, Revenue, Gross Margin

12.13 Theben AG

12.13.1 Company Corporation Information

12.13.2 Business Overview and Related Developments

12.13.3 Product Overview

12.13.4 Theben AG KNX Products Sales, Price, Revenue, Gross Margin

12.14 HDL

12.14.1 Company Corporation Information

12.14.2 Business Overview and Related Developments

12.14.3 Product Overview

12.14.4 HDL KNX Products Sales, Price, Revenue, Gross Margin

12.15 GVS

12.15.1 Company Corporation Information

12.15.2 Business Overview and Related Developments

12.15.3 Product Overview

12.15.4 GVS KNX Products Sales, Price, Revenue, Gross Margin

12.16 B.E.G.

12.16.1 Company Corporation Information

12.16.2 Business Overview and Related Developments

12.16.3 Product Overview

12.16.4 B.E.G. KNX Products Sales, Price, Revenue, Gross Margin

12.17 Tiansu

12.17.1 Company Corporation Information

12.17.2 Business Overview and Related Developments

12.17.3 Product Overview

12.17.4 Tiansu KNX Products Sales, Price, Revenue, Gross Margin

12.18 JOBO Smartech

12.18.1 Company Corporation Information

12.18.2 Business Overview and Related Developments

12.18.3 Product Overview

12.18.4 JOBO Smartech KNX Products Sales, Price, Revenue, Gross Margin

12.19 DALITEK

12.19.1 Company Corporation Information

12.19.2 Business Overview and Related Developments

12.19.3 Product Overview

12.19.4 DALITEK KNX Products Sales, Price, Revenue, Gross Margin

13 Industry Chain and Sales Channels Analysis

13.1 KNX Products Industry Chain Analysis

13.2 KNX Products Key Raw Materials

13.2.1 Key Raw Materials

13.2.2 Raw Materials Key Suppliers

13.3 KNX Products Production Mode & Process

13.4 KNX Products Sales and Marketing

13.4.1 KNX Products Sales Channels

13.4.2 KNX Products Distributors

13.5 KNX Products Customers

14 Market Drivers, Opportunities, Challenges and Risks Factors Analysis

14.1 KNX Products Industry Trends

14.2 KNX Products Market Drivers

14.3 KNX Products Market Challenges

14.4 KNX Products Market Restraints

14.5 Influence of COVID-19 Outbreak on KNX Products Industry Development

15 Research Findings and Conclusion

16 Appendix

16.1 Methodology

16.2 Research Data Source

16.2.1 Secondary Data

16.2.2 Primary Data

16.2.3 Market Size Estimation

16.2.4 Legal Disclaimer