1. Global Freeze Dried Fruit Market Overview

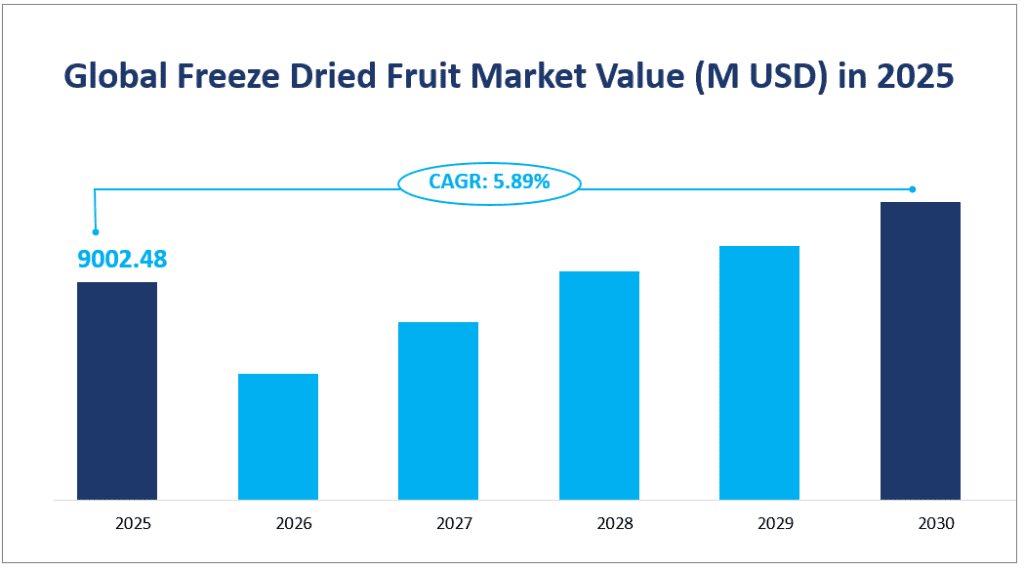

The global freeze-dried fruit market is projected to reach a revenue of $9,002.48 million in 2025 with a CAGR of the global freeze-dried fruit market estimated to be 5.89% from 2025 to 2030.

Freeze drying, also known as lyophilization, is a preservation process that removes moisture from fruits through a vacuum system. This method not only extends the shelf life of fruits significantly but also retains their nutritional value, flavor, and texture. The process involves freezing the fruit and then reducing the surrounding pressure to allow the frozen water in the fruit to sublimate directly from the solid to the gas phase, bypassing the liquid phase. This results in a lightweight, shelf-stable product that can be easily transported and stored without refrigeration. The versatility of freeze-dried fruits makes them suitable for various applications, including as healthy snacks, ingredients in baked goods, and additions to cereals and yogurt.

Global Freeze Dried Fruit Market Value (M USD) in 2025

2. Driving Factors of Freeze Dried Fruit Market

The growth of the global freeze-dried fruit market is influenced by several key factors. On the positive side, the increasing adoption of healthy lifestyles and the rising demand for convenient, nutritious food options are major drivers. Consumers are becoming more health-conscious and are seeking products that offer high nutritional value without the need for artificial preservatives. Freeze-dried fruits fit this criterion perfectly, as they retain most of their vitamins, minerals, and fiber content while being easy to consume.

Another significant driver is the expanding food processing industry, which has a growing demand for ready-to-eat and convenience food products. Freeze dried fruits are increasingly being used in snacks, bakery products, and confectionery items due to their long shelf life and ability to maintain texture and flavor. Additionally, the rising popularity of adventure sports and expeditions has led to an increased demand for lightweight, high-energy food products, further boosting the market for freeze dried fruits.

3. Limiting Factors of Freeze Dried Fruit Market

However, there are also some limiting factors that could hinder the growth of this market. One of the primary challenges is the high cost associated with the manufacturing of freeze dried fruits. The equipment required for freeze-drying is expensive, and the process itself is costlier compared to other drying techniques such as infused drying or spray drying. This can limit the market’s expansion, especially in regions where cost is a significant concern.

Another potential limitation is the presence of certain risks associated with the consumption of freeze dried fruits. These products can be prone to contamination by toxigenic fungi and bacteria, which may degrade over time and pose health risks. Ensuring the safety and quality of freeze-dried fruits is crucial for maintaining consumer trust and market growth.

4. Global Freeze Dried Fruit Market Segment

Product Types

Apples: The market value of freeze-dried apples in 2025 is projected to be $865.65 million. Apples are a popular choice due to their natural sweetness, versatility in recipes, and high fiber content. They are widely used in snacks, cereals, and baking products. The growth rate of freeze-dried apples is steady, driven by their widespread appeal and health benefits.

Strawberries: Freeze-dried strawberries are expected to have a market value of $2,210.57 million in 2025. Strawberries are known for their vibrant color and sweet flavor, making them a favorite in various applications such as smoothies, yogurt toppings, and desserts. The growth rate of freeze-dried strawberries is relatively high, driven by their popularity in the health and wellness sector.

Blackberries: The market value of freeze-dried blackberries is anticipated to reach $1,019.58 million in 2025. Blackberries are valued for their rich antioxidant content and tart flavor, which makes them ideal for use in health supplements, snacks, and confectionery products. The growth rate of freeze-dried blackberries is significant, as consumers increasingly seek out products with high nutritional value.

Among these types, strawberries hold the largest market share, attributed to their widespread use in various food applications and their appeal to health-conscious consumers. The fastest-growing type is blackberries, driven by the increasing demand for antioxidant-rich products and their versatility in both sweet and savory applications.

Analysis of Different Applications

Retail: In 2025, the retail sector is expected to consume 291,160 tons of freeze-dried fruits. Retail applications encompass direct sales to consumers through supermarkets, convenience stores, and specialty shops. Freeze-dried fruits are popular in this sector due to their long shelf life, convenience, and nutritional value. They are often sold as standalone snacks or as ingredients in ready-to-eat products. The growth rate of retail consumption is steady, driven by the increasing demand for healthy and convenient food options.

Food Processing Industry: The food processing industry is projected to consume 184,388 tons of freeze-dried fruits in 2025. This sector includes manufacturers of breakfast cereals, snacks, and confectionery products. Freeze-dried fruits are used as ingredients to enhance flavor, texture, and nutritional content. The growth rate of the food processing industry’s consumption is significant, driven by the expanding demand for ready-to-eat and convenience food products.

Among these applications, retail holds the largest market share, attributed to the direct consumer demand for healthy snacks and the increasing popularity of freeze-dried fruits as a convenient food option. The fastest-growing application is the food processing industry, driven by the expanding food processing sector and the increasing demand for products with high nutritional value and long shelf life.

Market Value and Share by Segment

| Market Value (M USD) in 2025 | Market Share in 2025 | ||

| By Type | Apples | 865.65 | 9.62% |

| Strawberries | 2210.57 | 24.56% | |

| Blackberries | 1019.58 | 11.33% | |

| Market Consumption (Tons) in 2025 | Market Share in 2025 | ||

| By Application | Retail | 291160 3 | 61.23% |

| Food Processing Industry | 184388 | 38.77% |

5. Regional Freeze Dried Fruit Market

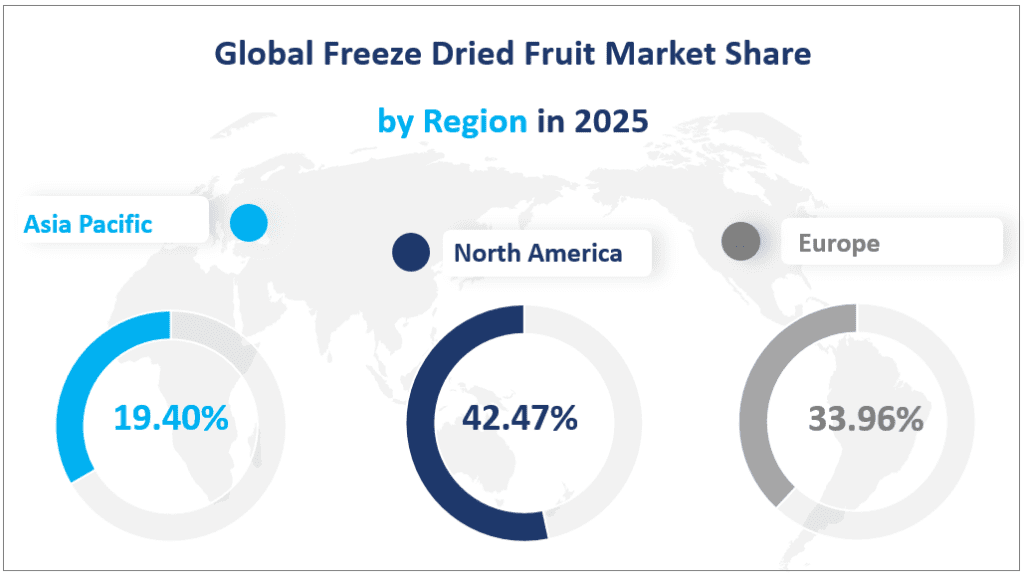

The Americas, comprising North and South America, is anticipated to hold the largest market value in 2025, reaching $3,823.08 million. This region has been at the forefront of the freeze-dried fruit market due to the increasing adoption of healthy lifestyles and the presence of a well-established food and beverage industry. The United States and Canada, in particular, have a high demand for nutritious and convenient food options, driving the market growth. The region’s robust economy and high disposable income levels further support the consumption of premium freeze-dried fruit products.

Europe: Europe is projected to have a market value of $3,057.49 million in 2025. The region’s market growth is driven by the expanding food processing sector and the increasing demand for ready-to-eat and convenience food products. European consumers are highly health-conscious, and the market for organic and natural food products is growing rapidly. The presence of numerous food processing companies in countries like Germany, France, and Italy also contributes to the demand for freeze-dried fruits as ingredients in various food products.

Asia-Pacific: The Asia-Pacific region is expected to reach a market value of $1,746.68 million in 2025. This region is experiencing rapid growth due to the increasing consumption of processed food and the rising preference for ready-to-eat meals. The market is driven by the expanding middle class, rising disposable incomes, and the increasing penetration of retail formats. Countries like China, Japan, and South Korea are major markets for freeze-dried fruits, with China showing significant potential for future growth due to its large population and growing health consciousness.

Middle East & Africa: The Middle East & Africa region is projected to have a market value of $375.22 million in 2025. The market growth in this region is influenced by the increasing demand for healthy and convenient food options, particularly in countries like the GCC countries, Egypt, and South Africa. The region’s growing population and improving economic conditions are driving the demand for freeze-dried fruits, both as standalone snacks and as ingredients in various food products.

Among these regions, the Americas holds the largest market value, driven by its strong economy, high disposable income levels, and increasing demand for healthy and convenient food options. The fastest-growing region is the Asia-Pacific, driven by its expanding middle class, rising disposable incomes, and increasing consumption of processed food. This region’s dynamic market conditions and growing consumer base present significant opportunities for market expansion.

Global Freeze Dried Fruit Market Share by Region in 2025

6. Analysis of Top 3 Companies of Freeze Dried Fruit Market

Introduction and Business Overview: Chaucer Foods Ltd., established in 1982, is a leading company in the fruit and vegetable preserving and specialty food manufacturing industry. The company is headquartered in Forest Grove, OR, USA, and operates worldwide. Chaucer Foods is known for its high-quality freeze-dried fruit products, which are used in various applications, including snacks, cereals, and confectionery.

Products Offered: Chaucer Foods offers a wide range of freeze-dried fruits, including strawberries, apples, and other exotic fruits. Their products are characterized by their natural sweetness, vibrant color, and long shelf life, making them ideal for both retail and food processing applications.

Introduction and Business Overview: Van Drunen Farms, founded in 1856, is a global leader in the growing of culinary herbs and the dehydration of fruit, vegetable, grain, and herbal food ingredients. The company is headquartered in Momence, IL, USA, and operates worldwide. Van Drunen Farms specializes in providing high-quality, all-natural food ingredients to the food processing industry.

Products Offered: Van Drunen Farms offers a diverse range of freeze-dried fruits, including apples, strawberries, and various berries. Their products are known for their natural flavor, color, and nutritional value, making them suitable for use in snacks, cereals, and bakery products.

Introduction and Business Overview: Mercer Foods, LLC, established in 1980, is a leading company in the freeze-drying industry. The company is headquartered in Modesto, CA, USA, and operates worldwide. Mercer Foods is known for its innovative freeze-drying technology and high-quality products, which are used in various food applications.

Products Offered: Mercer Foods offers a wide range of freeze-dried fruits, including apples, strawberries, and other fruits. Their products are characterized by their natural sweetness, vibrant color, and long shelf life, making them ideal for both retail and food processing applications.

Major Players

| Company Name | Headquarters | Business Distribution (Sales Region) |

| Chaucer Foods Ltd. | USA | Worldwide |

| Van Drunen Farms | USA | Worldwide |

| Mercer Foods, LLC. | USA | Worldwide |

| Paradise Fruits | Germany | Mainly in Europe |

| Lyo Italia | Italy | Mainly in Europe, America |

| Crispy Green Inc. | USA | Mainly in America |

| Harmony House Foods, Inc. | USA | Mainly in America |

| Freeze-Dry Foods GmbH | Germany | Worldwide |

| European Freeze Dry | Denmark | Mainly in Europe |

| Frenature | USA | Mainly in America |

| Terry Foods Ltd. | UK | Mainly in Europe |

| Augason Farms | USA | Mainly in America |

| Saraf Foods Ltd. | India | Worldwide |

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Freeze Dried Fruit Consumption 2017-2028

2.1.2 Freeze Dried Fruit Consumption CAGR by Region

2.2 Freeze Dried Fruit Segment by Type

2.2.1 Apples

2.2.2 Strawberries

2.2.3 Blackberries

2.3 Freeze Dried Fruit Consumption by Type

2.3.1 Global Freeze Dried Fruit Consumption Market Share by Type (2017-2022)

2.3.2 Global Freeze Dried Fruit Value and Market Share by Type (2017-2022)

2.3.3 Global Freeze Dried Fruit Sale Price by Type (2017-2022)

2.4 Freeze Dried Fruit Segment by Application

2.4.1 Retail

2.4.2 Food Processing Industry

2.5 Freeze Dried Fruit Consumption by Application

2.5.1 Global Freeze Dried Fruit Consumption Market Share by Application (2017-2022)

2.5.2 Global Freeze Dried Fruit Value and Market Share by Application (2017-2022)

2.5.3 Global Freeze Dried Fruit Price by Application (2017-2022)

3 Global Freeze Dried Fruit by Players

3.1 Global Freeze Dried Fruit Production Market Share by Players

3.1.1 Global Freeze Dried Fruit Production by Players (2017-2022)

3.1.2 Global Freeze Dried Fruit Production Market Share by Players (2017-2022)

3.2 Global Freeze Dried Fruit Value Market Share by Players

3.2.1 Global Freeze Dried Fruit Value by Players (2017-2022)

3.2.2 Global Freeze Dried Fruit Value Market Share by Players (2017-2022)

3.3 Global Freeze Dried Fruit Sale Price by Players

3.4 Global Freeze Dried Fruit Headquarter, Sales Region by Players

3.4.1 Global Freeze Dried Fruit Headquarter by Players

3.4.2 Players Freeze Dried Fruit Sales Region

3.5 Market Concentration Rate Analysis

3.5.1 Competition Landscape Analysis

3.5.2 Concentration Ratio (CR3, CR5 and CR10) (2017-2022)

3.6 New Types and Potential Entrants

3.7 Mergers & Acquisitions, Expansion

4 Freeze Dried Fruit by Regions

4.1 Freeze Dried Fruit by Regions

4.1.1 Global Freeze Dried Fruit Consumption by Regions

4.1.2 Global Freeze Dried Fruit Value by Regions

4.2 Americas Freeze Dried Fruit Consumption Growth

4.3 APAC Freeze Dried Fruit Consumption Growth

4.4 Europe Freeze Dried Fruit Consumption Growth

4.5 Middle East & Africa Freeze Dried Fruit Consumption Growth

5 Americas

5.1 Americas Freeze Dried Fruit Consumption by Countries

5.1.1 Americas Freeze Dried Fruit Consumption by Countries (2017-2022)

5.1.2 Americas Freeze Dried Fruit Value by Countries (2017-2022)

5.2 Americas Freeze Dried Fruit Consumption by Types

5.3 Americas Freeze Dried Fruit Consumption by Applications

5.4 United States

5.5 Canada

5.6 Mexico

6 APAC

6.1 APAC Freeze Dried Fruit Consumption by Countries

6.1.1 APAC Freeze Dried Fruit Consumption by Countries

6.1.2 APAC Freeze Dried Fruit Value by Countries

6.2 APAC Freeze Dried Fruit Consumption by Types

6.3 APAC Freeze Dried Fruit Consumption by Applications

6.4 China

6.5 Japan

6.6 Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

7 Europe

7.1 Europe Freeze Dried Fruit Consumption by Countries

7.1.1 Europe Freeze Dried Fruit Consumption by Countries

7.1.2 Europe Freeze Dried Fruit Value by Countries

7.2 Europe Freeze Dried Fruit Consumption by Types

7.3 Europe Freeze Dried Fruit Consumption by Applications

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

7.9 Spain

8 Middle East & Africa

8.1 Middle East & Africa Freeze Dried Fruit Consumption by Countries

8.1.1 Middle East & Africa Freeze Dried Fruit Consumption by Countries

8.1.2 Middle East & Africa Freeze Dried Fruit Value by Countries

8.2 Middle East & Africa Freeze Dried Fruit Consumption by Types

8.3 Middle East & Africa Freeze Dried Fruit Consumption by Applications

8.4 Egypt

8.5 South Africa

8.6 Israel

8.7 Turkey

8.8 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.1.1 Growing Demand from Key Regions

9.1.2 Growing Demand from Downstream Demand

9.2 Market Challenges and Impact

9.3 Market Trends

9.4 COVID-19 Influence on Freeze Dried Fruit Market

10 Marketing, Distributors and Customer

10.1 Sales Channel

10.1.1 Direct Channel

10.1.2 Indirect Channel

10.2 Freeze Dried Fruit Distributors

10.3 Freeze Dried Fruit Customer

11 Global Freeze Dried Fruit Market Forecast

11.1 Global Freeze Dried Fruit Consumption Forecast

11.2 Global Freeze Dried Fruit Consumption Forecast by Regions

11.2.1 Global Freeze Dried Fruit Forecast by Regions (2022-2028)

11.2.2 Global Freeze Dried Fruit Value Forecast by Regions 2022-2028

11.3 Americas Forecast by Countries

11.3.1 United States Market Forecast

11.3.2 Canada Market Forecast

11.3.3 Mexico Market Forecast

11.4 APAC Forecast by Countries

11.4.1 China Market Forecast

11.4.2 Japan Market Forecast

11.4.3 Korea Market Forecast

11.4.4 Southeast Asia Market Forecast

11.4.5 India Market Forecast

11.4.6 Australia Market Forecast

11.5 Europe Forecast by Countries

11.5.1 Germany Market Forecast

11.5.2 France Market Forecast

11.5.3 UK Market Forecast

11.5.4 Italy Market Forecast

11.5.5 Russia Market Forecast

11.5.6 Spain Market Forecast

11.6 Middle East & Africa Forecast by Countries

11.6.1 Egypt Market Forecast

11.6.2 South Africa Market Forecast

11.6.3 Israel Market Forecast

11.6.4 Turkey Market Forecast

11.6.5 GCC Countries Market Forecast

11.7 Global Freeze Dried Fruit Market Forecast by Type

11.8 Global Freeze Dried Fruit Market Forecast by Application

12 Key Players Analysis

12.1 Competitive Profile

12.2 Chaucer Foods Ltd.

12.2.1 Company Profiles

12.2.2 Freeze Dried Fruit Type Introduction

12.2.3 Chaucer Foods Ltd. Production, Value, Price, Gross Margin 2017-2022

12.3 Van Drunen Farms

12.3.1 Company Profiles

12.3.2 Freeze Dried Fruit Type Introduction

12.3.3 Van Drunen Farms Production, Value, Price, Gross Margin 2017-2022

12.4 Mercer Foods, LLC.

12.4.1 Company Profiles

12.4.2 Freeze Dried Fruit Type Introduction

12.4.3 Mercer Foods, LLC. Production, Value, Price, Gross Margin 2017-2022

12.5 Paradise Fruits

12.5.1 Company Profiles

12.5.2 Freeze Dried Fruit Type Introduction

12.5.3 Paradise Fruits Production, Value, Price, Gross Margin 2017-2022

12.6 Lyo Italia

12.6.1 Company Profiles

12.6.2 Freeze Dried Fruit Type Introduction

12.6.3 Lyo Italia Production, Value, Price, Gross Margin 2017-2022

12.7 Crispy Green Inc.

12.7.1 Company Profiles

12.7.2 Freeze Dried Fruit Type Introduction

12.7.3 Crispy Green Inc. Production, Value, Price, Gross Margin 2017-2022

12.8 Harmony House Foods, Inc.

12.8.1 Company Profiles

12.8.2 Freeze Dried Fruit Type Introduction

12.8.3 Harmony House Foods, Inc. Production, Value, Price, Gross Margin 2017-2022

12.9 Freeze-Dry Foods GmbH

12.9.1 Company Profiles

12.9.2 Freeze Dried Fruit Type Introduction

12.9.3 Freeze-Dry Foods GmbH Production, Value, Price, Gross Margin 2017-2022

12.10 European Freeze Dry

12.10.1 Company Profiles

12.10.2 Freeze Dried Fruit Type Introduction

12.10.3 European Freeze Dry Production, Value, Price, Gross Margin 2017-2022

12.11 Frenature

12.11.1 Company Profiles

12.11.2 Freeze Dried Fruit Type Introduction

12.11.3 Frenature Production, Value, Price, Gross Margin 2017-2022

12.12 Terry Foods Ltd.

12.12.1 Company Profiles

12.12.2 Freeze Dried Fruit Type Introduction

12.12.3 Terry Foods Ltd. Production, Value, Price, Gross Margin 2017-2022

12.13 Augason Farms

12.13.1 Company Profiles

12.13.2 Freeze Dried Fruit Type Introduction

12.13.3 Augason Farms Production, Value, Price, Gross Margin 2017-2022

12.14 Saraf Foods Ltd.

12.14.1 Company Profiles

12.14.2 Freeze Dried Fruit Type Introduction

12.14.3 Saraf Foods Ltd. Production, Value, Price, Gross Margin 2017-2022

13 Research Findings and Conclusion

14 Appendix

14.1 Methodology 14.2 Research Data Source