1. 仮想発電所(VPP)の市場価値と定義

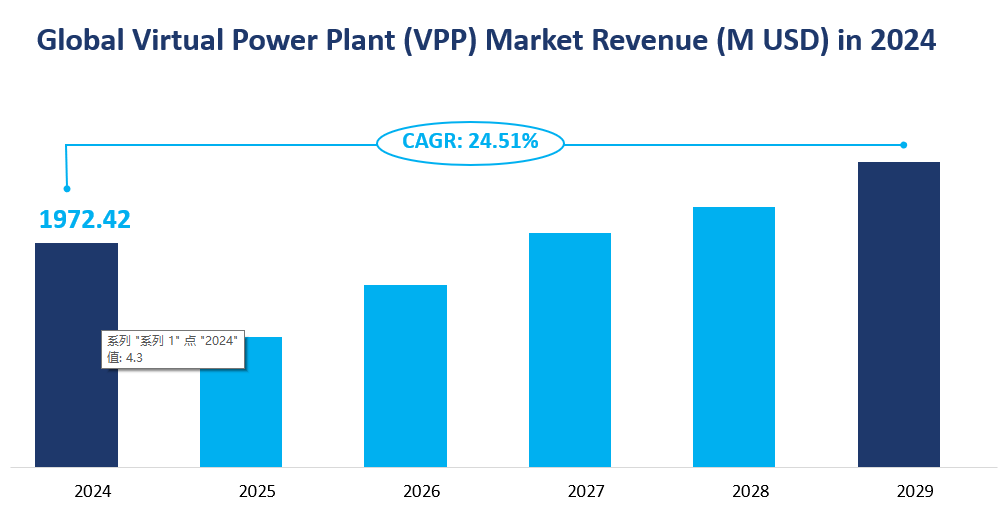

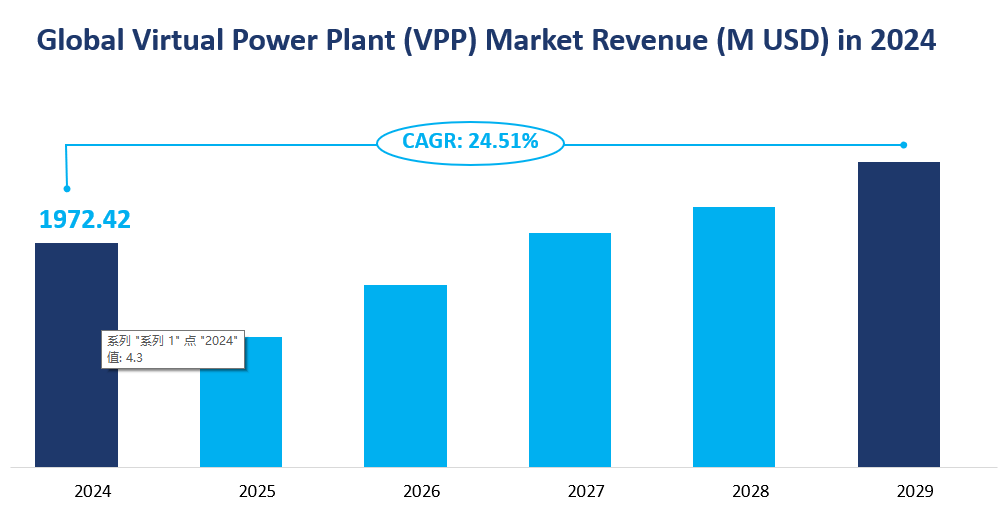

世界の仮想発電所(VPP)市場は、2024年までに約$1,972.42百万ドルに達すると予測されています。これは大きな成長軌道を示しており、2024年から2029年までの年間複合成長率(CAGR)は約24.51%と予想されています。市場の拡大は、再生可能エネルギー源の電力システムへの統合の増加、エネルギー効率に対する需要の高まり、柔軟なエネルギー管理ソリューションの必要性によって推進されています。

仮想発電所 (VPP) は、中央制御システムを通じて調整される分散型発電ユニットとエネルギー貯蔵システムのネットワークとして定義されます。この革新的なアプローチにより、太陽光や風力などの再生可能エネルギー源や、従来の発電所やエネルギー貯蔵システムなど、さまざまなエネルギー資源を集約できます。VPP の主な目的は、エネルギーの生成、消費、貯蔵を最適化し、電力供給の信頼性と効率性を高めることです。

VPP は、高度な情報通信技術 (ICT) を使用して、個々のエネルギー資産のパフォーマンスを監視および管理することで機能します。これには、エネルギーの生産と消費の予測、需要に基づいたエネルギー リソースのディスパッチ、エネルギー市場への参加による電力の取引が含まれます。複数の分散型エネルギー リソース (DER) の容量を集約することにより、VPP はグリッド オペレーターに柔軟で応答性の高いエネルギー供給を提供できます。これは、リアルタイムで需要と供給のバランスをとるために不可欠です。

VPP の概念は、カーボン ニュートラルと持続可能なエネルギー システムへの世界的な移行という文脈において特に重要です。各国が温室効果ガスの排出を削減し、よりクリーンなエネルギー源への移行を目指す中、VPP は再生可能エネルギーを既存の電力網に統合するための実行可能なソリューションを提供します。VPP により、小規模なエネルギー生産者と消費者の参加が促進され、エネルギーの安全性と回復力を高める分散型エネルギー環境が促進されます。

形 2024年の世界仮想発電所(VPP)市場収益(百万米ドル)

2. 仮想発電所(VPP)市場の成長の推進要因と制限要因

仮想発電所 (VPP) 市場の成長は、いくつかの推進要因の影響を受けています。主な推進要因の 1 つは、世界の発電構成における再生可能エネルギーの割合の増加です。各国が化石燃料への依存を減らし、炭素排出量を削減することを目指しているため、太陽光、風力、水力などの再生可能エネルギー源の統合が不可欠になっています。VPP は、再生可能エネルギーの間欠性と変動性を管理することでこの統合を促進し、安定した信頼性の高い電力供給を保証します。

もう 1 つの重要な推進要因は、エネルギー生成および貯蔵技術に関連するコストの低下です。バッテリー貯蔵システム、ソーラー パネル、その他の再生可能技術の急速な進歩により、消費者や企業がこれらのソリューションに投資することが経済的に実現可能になりました。VPP はこれらの進歩を活用してエネルギー使用を最適化し、参加者の全体的なエネルギー コストを削減できるため、消費者とエネルギー プロバイダーの両方にとって魅力的な選択肢となります。

しかし、VPP 市場には成長を妨げる可能性のあるいくつかの制限要因もあります。主な課題の 1 つは、デジタル技術と IoT デバイスへの依存に関連するサイバーセキュリティ リスクです。VPP はさまざまなエネルギー リソースからデータを集約するため、サイバー攻撃に対して脆弱になり、運用が中断され、電力網の安定性が損なわれる可能性があります。堅牢なサイバーセキュリティ対策を確保することは、VPP の継続的な発展にとって不可欠です。

さらに、VPP システムの導入に伴う高額な初期費用は、市場の小規模企業にとって障壁となる可能性があります。人工知能やビッグデータ分析などの高度なテクノロジーの統合には、多大な投資と専門知識が必要です。小規模企業は、これらのテクノロジーに投資するリソースを持つ大企業との競争に苦戦する可能性があり、市場への参加とイノベーションが制限される可能性があります。

3. バーチャルパワープラント(VPP)市場の技術革新と企業活動

仮想発電所 (VPP) 市場では、将来を形作る重要な技術革新が起こっています。重要なトレンドの 1 つは、人工知能 (AI) と機械学習を VPP システムに統合することです。これらの技術により、エネルギーの生産と消費をより正確に予測できるようになり、VPP はリソースの割り当てを最適化し、全体的な効率を向上させることができます。AI 主導の分析により、需要応答機能も強化され、VPP は市場の状況や消費者の行動に基づいてリアルタイムで運用を調整できるようになります。

企業の合併や買収も、VPP 市場で重要な役割を果たしています。大手エネルギー企業は、VPP 機能を強化し、再生可能エネルギー資産のポートフォリオを拡大するために、小規模なテクノロジー企業を買収するケースが増えています。たとえば、シェルによる大手仮想発電所運営会社 Next Kraftwerke の買収は、この傾向を象徴しています。このような戦略的な動きにより、大企業は革新的なテクノロジーと専門知識を活用し、より洗練された VPP ソリューションの開発を促進できます。

さらに、エネルギー プロバイダー、テクノロジー企業、研究機関間のパートナーシップにより、VPP 分野でのコラボレーションとイノベーションが促進されています。これらのパートナーシップは、VPP のパフォーマンスと拡張性を高める新しいビジネス モデルとテクノロジーの開発を目指しています。たとえば、電気自動車 (EV) を VPP に統合することに重点を置いた取り組みが勢いを増しています。EV は、グリッドの安定性と柔軟性に貢献するモバイル エネルギー ストレージ ユニットとして機能できるためです。

4. 仮想発電所(VPP)市場の製品タイプ

仮想発電所 (VPP) 市場は、運用制御 (OC) モデルと機能管理 (FM) モデルという 2 つの主要な製品タイプに分類されます。各タイプは、VPP フレームワーク内で異なる役割を果たし、エネルギー管理と最適化のさまざまな側面に対応します。

運用管理 (OC) モデル:

OC モデルは、単一資産の直接的な運用管理に重点を置いています。資産を個別に制御および管理し、VPP エコシステム内での効率的な運用を確保するように設計されています。2024 年までに、OC モデルはエネルギー市場での広範な採用と確立された存在感を反映して、大きな市場シェアを獲得すると予測されています。

機能管理(FM)モデル:

一方、FM モデルは、分散型エネルギー源の管理と集約に重点を置いています。コスト、発熱、エネルギー市場価格などの要素を考慮して、接続された資産を最適化することを目的としています。2024 年までに、FM モデルは、よりスマートで持続可能なエネルギー システムへの移行においてますます好まれるエネルギー管理に対する総合的なアプローチにより、最も速い成長率を示すことが予想されています。

OCモデルの市場価値は2024年に$8億9,911万に達すると予想され、FMモデルは$1,073.32万に達すると予測されています。FMモデルの市場規模が大きいのは、その包括的な管理機能と統合エネルギーソリューションの需要の高まりによるものです。それにもかかわらず、OCモデルの市場は無視できず、VPPソリューションの多様性とエネルギー市場のさまざまなニーズを示しています。

FM モデルは 2024 年に最大の市場シェアを獲得し、VPP 市場全体のかなりの割合を占めると予想されています。成長の面では、どちらのモデルも堅調な拡大が見込まれますが、FM モデルは、持続可能なエネルギー慣行への世界的な移行に沿った、急速な採用と集中型エネルギー管理ソリューションの好みの高まりを反映して、最も速い成長率を示すと予測されています。

2024年の全タイプの市場規模とシェア表

|

タイプ |

時価総額(百万米ドル) |

市場シェア(%) |

|---|---|---|

|

OC モデル |

899.11 |

45.58% |

|

FMモデル |

1073.32 |

54.42% |

5. 仮想発電所(VPP)の応用

VPP 市場は、商業、工業、住宅の 3 つの主要な用途に分かれています。各セクターは、特定のエネルギー管理ニーズを満たすために VPP を活用しています。

商業部門:

商業部門には、信頼性が高く費用対効果の高いエネルギーソリューションを必要とする企業が含まれます。2024 年までに、商業施設の大きなエネルギー需要と効率的なエネルギー管理の必要性により、商業アプリケーションが最大の市場シェアを占めると予想されます。

産業部門:

製造業と重工業を含む産業部門は、運用効率とエネルギーコストの最適化のために VPP に依存しています。2024 年までに、産業アプリケーションは大幅な市場成長を示すことが予測されており、これはエネルギー集約型プロセスへのこの部門の重点とエネルギー最適化の推進を反映しています。

住宅部門:

個々の世帯を含む住宅部門では、エネルギー管理とコスト削減のために VPP を導入するケースが増えています。2024 年までに、エネルギー効率に対する意識の高まりとスマート ホーム テクノロジーの導入の増加により、住宅アプリケーションは最も急速な成長率を示すことが予想されます。

商業用途は2024年に$8億2,423万の市場価値に達すると予想され、産業用途は$5億2,050万、住宅用途は$6億2,769万に達すると予想されています。商業部門の市場規模が大きいことは、その広範なエネルギー管理要件を示しており、住宅部門の急速な成長は、エネルギー意識の高い家庭の増加傾向を浮き彫りにしています。

商業部門は2024年に最大の市場シェアを占め、VPP市場全体のかなりの部分を占めると予想されています。しかし、住宅部門は最も高い成長率を示すことが予測されており、住宅市場におけるエネルギー効率の高いソリューションの需要拡大と、VPPをスマートホーム技術に統合する傾向の高まりを強調しています。

表 2024 年の全アプリケーションの市場規模とシェア

|

応用 |

時価総額(百万米ドル) |

市場シェア(%) |

|---|---|---|

|

コマーシャル |

824.23 |

41.79% |

|

産業 |

520.50 |

26.39% |

|

居住の |

627.69 |

31.82% |

6. 2024年の仮想発電所(VPP)市場の地域分析

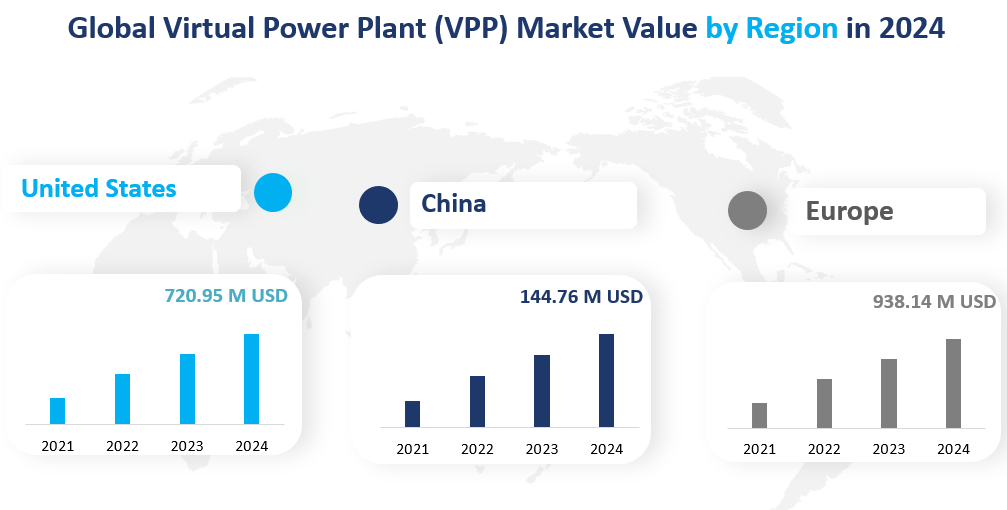

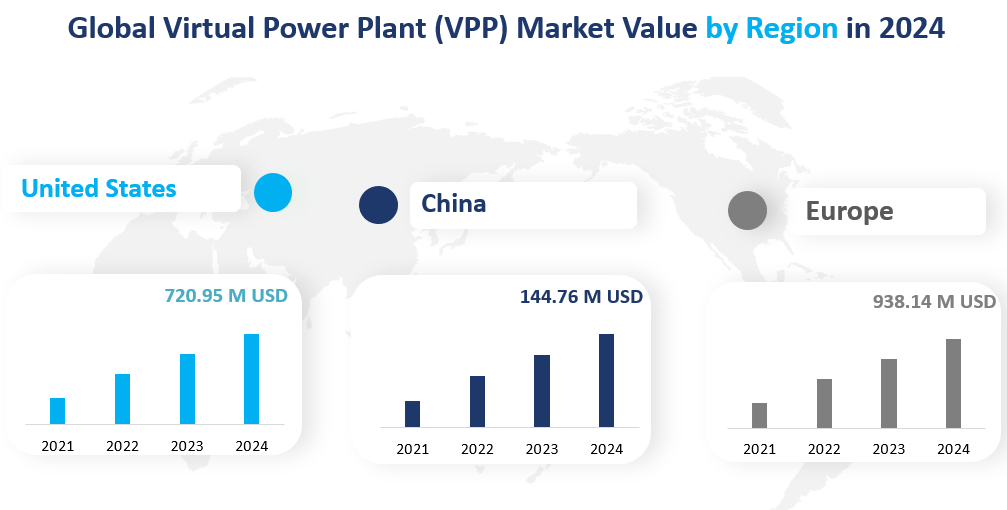

仮想発電所 (VPP) 市場は、世界のエネルギー業界においてダイナミックかつ急速に成長している分野です。2024 年には、市場はさまざまな地域間で大きな違いを示すことが予想され、それぞれが独自の成長軌道と収益の可能性を秘めています。この分析では、米国、ヨーロッパ、中国、日本、インド、東南アジアにおける VPP の市場規模に焦点を当て、収益で最大の市場と最も急速に成長している地域を特定します。

アメリカ合衆国

2024年には、米国のVPP市場収益は約$7億2,095万ドルになると予測されています。成長率は24.02%と推定されており、さらなる拡大のための強固な基盤を備えた堅固な市場であることを示しています。

ヨーロッパ

ヨーロッパでは、2024 年の VPP 市場収益が約 $9 億 3,814 万ドルに達し、成長率は 23.75% になると予想されています。この地域の持続可能性への取り組みと積極的な再生可能エネルギー目標は、その大きな市場規模と成長の可能性に貢献しています。

中国

中国は、2024年にVPP市場で最も急成長する地域として際立っており、市場収益は1兆4,144億7,476万ドルと予想され、成長率は2,755億1,300万ドルと目覚ましい。同国の急速な工業化と再生可能エネルギー技術への多額の投資が、市場の成長を牽引している。

日本

日本のVPP市場は、2024年に1兆4,248億円の収益に達し、成長率は2,715億1,300万米ドルに達すると予測されています。この地域ではエネルギー効率とエネルギー管理における技術進歩に重点が置かれており、市場の拡大が促進されています。

インド

インドは経済成長とエネルギー需要の増加により、2024年のVPP市場収益が$2407万に達し、成長率は25.74%になると予想されています。同国の再生可能エネルギー容量増強に向けた取り組みが、VPP市場の成長に貢献しています。

東南アジア

東南アジアは、小規模なベースからスタートしているものの、2024年のVPP市場収益は$2753万に達し、成長率は24.77%になると予測されています。この地域の新興経済と持続可能なエネルギーソリューションへの注目の高まりが、市場の成長を牽引しています。

図 2024 年の地域別世界の仮想発電所 (VPP) 市場価値

7. 2023年の仮想発電所(VPP)企業トップ3の分析

7.1 シェル(ネクストクラフトヴェルケ)

会社概要・事業概要:

世界的に認知されているエネルギー企業であるシェルは、1907 年にまで遡る豊かな歴史を持っています。オランダに本社を置くシェルは、世界中で事業を展開し、探査、生産、精製、マーケティングなど、石油およびガス産業のあらゆる側面に携わっています。シェルは Next Kraftwerke を買収したことで、VPP 市場での存在感を大幅に拡大しました。

製品とサービス:

シェルの子会社である Next Kraftwerke は、VPP の運用を専門としています。同社は再生可能エネルギー ネットワークを管理するプラットフォームを提供し、企業や家庭にクリーン エネルギーを供給しています。同社のテクノロジーは、再生可能エネルギー発電機とエネルギー貯蔵のインテリジェントな制御に重点を置き、エネルギーの供給と需要を最適化しています。

2023年の売上高:

2023年、シェル(ネクストクラフトヴェルケ)は$4億7,144万という大幅な収益を報告しました。この収益は、同社の強力な市場地位とエネルギー分野におけるVPPソリューションの需要の高まりを反映しています。

7.2 スタットクラフト

会社概要・事業概要:

1895 年に設立され、ノルウェーに本社を置く Statkraft は、水力発電の大手企業であり、ヨーロッパの再生可能エネルギー市場の主要プレーヤーです。Statkraft は世界的に事業を展開し、水力発電、風力発電、太陽光発電、ガス火力発電を行い、エネルギー市場事業に携わっています。

製品とサービス:

Statkraft の VPP サービスには、風力、太陽光、バイオエネルギー、水力発電の統合が含まれます。同社のプラットフォームである Statkraft Unity は、再生可能エネルギー発電のシームレスなスケジュール設定を可能にし、発電業者と送電網運用業者の両方に柔軟性を提供します。

2023年の売上高:

Statkraft は 2023 年に $3 億 7,947 万ドルの収益を上げました。このデータは、同社の VPP 市場への多大な貢献と、再生可能エネルギー ソリューションの推進における役割を強調しています。

7.3 エネル

会社概要・事業概要:

エネルは 1962 年に設立され、イタリアに本社を置き、世界 30 か国以上で事業を展開しています。エネルは、グリーン エネルギー、小売、グリッド事業に重点を置き、持続可能性志向のテクノロジーの導入の最前線に立っています。エネル グループの一員であるエネル X は、家庭、企業、スマート シティ向けに革新的なエネルギー ソリューションを提供しています。

製品とサービス:

Enel の VPP ソリューションには、バッテリー、発電機、オンサイト機器などの分散エネルギー資産の集約が含まれます。これらの資産は、需要応答および補助サービス プログラムに参加し、グリッドの安定性と効率性に貢献します。

2023年の売上高:

エネルは、2023年にVPP事業から1兆4千億8,655万ドルの収益を報告した。この収益は、VPP市場におけるエネルの影響力の拡大と、再生可能エネルギーポートフォリオの拡大への取り組みを示すものである。

1 仮想発電所(VPP)市場の概要

1.1 仮想発電所(VPP)の製品概要と範囲

1.2 仮想発電所(VPP)市場の種類別セグメント

1.2.1 世界の仮想発電所(VPP)市場の収益とCAGR(%)の比較(タイプ別)(2019年~2029年)

1.2.2 仮想発電所(VPP)の種類

1.3 世界の仮想発電所(VPP)市場セグメント(アプリケーション別)

1.3.1 仮想発電所(VPP)市場の消費量(価値)のアプリケーション別比較(2019年~2029年)

1.3.2 仮想発電所(VPP)の応用

1.4 世界の仮想発電所(VPP)市場、地域別(2019年~2029年)

1.4.1 世界の仮想発電所(VPP)市場規模(価値)とCAGR(%)の地域別比較(2019年~2029年)

1.4.2 米国の仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.3 欧州仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.4 中国仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.5 日本仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.6 インドの仮想発電所(VPP)市場の現状と展望(2019-2029年)

1.4.7 東南アジアの仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.8 ラテンアメリカの仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.4.9 中東およびアフリカの仮想発電所(VPP)市場の現状と展望(2019年~2029年)

1.5 仮想発電所(VPP)の世界市場規模(価値)(2019年~2029年)

1.6 地域紛争が仮想発電所(VPP)産業に与える影響

1.7 カーボンニュートラルが仮想発電所(VPP)業界に与える影響

2 上流と下流の分析

2.1 仮想発電所(VPP)産業チェーン分析

2.2 下流のバイヤー

2.3 仮想発電所(VPP)の事業コスト構造分析

2.4 人件費分析

2.4.1 人件費分析

2.5 マーケティングコスト分析

3 選手プロフィール

3.1 シェル

3.1.1 シェルの基本情報

3.1.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.1.3 シェル仮想発電所(VPP)市場のパフォーマンス(2019年~2024年)

3.1.4 シェルの事業概要

3.1.5 シェルがCOVID-19の課題を克服

3.2 スタットクラフト

3.2.1 Statkraftの基本情報

3.2.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.2.3 Statkraft仮想発電所(VPP)市場のパフォーマンス(2019年~2024年)

3.2.4 Statkraft事業概要

3.2.5 企業がCOVID-19の課題を克服するためのStatkraft

3.3 エネル

3.3.1 エネルの基本情報

3.3.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.3.3 エネル仮想発電所(VPP)市場パフォーマンス(2019年~2024年)

3.3.4 エネルの事業概要

3.3.5 エネルがCOVID-19の課題を克服

3.4 シュナイダーエレクトリック(オートグリッド)

3.4.1 シュナイダーエレクトリック(AutoGrid) 基本情報

3.4.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.4.3 シュナイダーエレクトリック(オートグリッド)仮想発電所(VPP)市場パフォーマンス(2019-2024)

3.4.4 シュナイダーエレクトリック(オートグリッド)事業概要

3.4.5 シュナイダーエレクトリック(オートグリッド)がCOVID-19の課題を克服

3.5 ジェネラック

3.5.1 ジェネラックの基本情報

3.5.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.5.3 ジェネラック仮想発電所(VPP)市場のパフォーマンス(2019年~2024年)

3.5.4 ジェネラックの事業概要

3.5.5 ジェネラック、COVID-19の課題を克服

3.6 シーメンス

3.6.1 シーメンスの基本情報

3.6.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.6.3 シーメンス仮想発電所(VPP)市場のパフォーマンス(2019年~2024年)

3.6.4 シーメンスの事業概要

3.6.5 シーメンスがCOVID-19の課題を克服

3.7 ボッシュ

3.7.1 ボッシュの基本情報

3.7.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.7.3 ボッシュ仮想発電所(VPP)市場のパフォーマンス(2019年~2024年)

3.7.4 ボッシュの事業概要

3.7.5 ボッシュ、COVID-19の課題を克服

3.8 オルマットテクノロジーズ

3.8.1 Ormat Technologiesの基本情報

3.8.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.8.3 Ormat Technologies 仮想発電所 (VPP) 市場のパフォーマンス (2019-2024)

3.8.4 オルマットテクノロジーズ事業概要

3.8.5 企業がCOVID-19の課題を克服するためのOrmat Technologies

3.9 サンバージ・エナジー

3.9.1 サンバージエネルギーの基本情報

3.9.2 仮想発電所(VPP)製品プロファイル、アプリケーション、仕様

3.9.3 Sunverge Energy 仮想発電所 (VPP) 市場のパフォーマンス (2019-2024)

3.9.4 サンバージエネルギー事業概要

3.9.5 サンバージ・エナジー、COVID-19の課題を克服

4 世界の仮想発電所(VPP)市場動向(プレーヤー別)

4.1 世界の仮想発電所(VPP)の収益と市場シェア(2019年~2024年)

4.2 仮想発電所(VPP)市場の競争状況と動向

4.2.1 仮想発電所(VPP)市場集中率

4.2.2 仮想発電所(VPP)市場シェア上位3社と上位6社

4.2.3 合併と買収、拡大

5 世界の仮想発電所(VPP)収益(タイプ別)

5.1 世界の仮想発電所(VPP)の収益と市場シェア(タイプ別)

5.2 世界の仮想発電所(VPP)収益と成長率(タイプ別)(2019年~2024年)

5.2.1 世界の仮想発電所(VPP)収益とOCモデルの成長率(2019年~2024年)

5.2.2 FMモデルの世界の仮想発電所(VPP)収益成長率(2019-2024年)

6 世界の仮想発電所(VPP)市場分析(アプリケーション別)

6.1 世界の仮想発電所(VPP)の消費額と市場シェア(用途別)(2019年~2024年)

6.2 世界の仮想発電所(VPP)の消費額と用途別成長率(2019年~2024年)

6.2.1 世界の仮想発電所(VPP)消費額と商業用発電の成長率(2019年~2024年)

6.2.2 世界の仮想発電所(VPP)消費額と産業用発電の成長率(2019年~2024年)

6.2.3 世界の住宅用仮想発電所(VPP)消費額と成長率(2019年~2024年)

7 世界の仮想発電所(VPP)収益、地域別(2019年~2024年)

7.1 世界の仮想発電所(VPP)の収益と市場シェア、地域別(2019年~2024年)

7.2 世界の仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.3 米国の仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.3.1 COVID-19下における米国の仮想発電所(VPP)市場

7.4 欧州の仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.4.1 COVID-19下における欧州の仮想発電所(VPP)市場

7.5 中国の仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.5.1 COVID-19下における中国の仮想発電所(VPP)市場

7.6 日本における仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.6.1 COVID-19下における日本の仮想発電所(VPP)市場

7.7 インドの仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.7.1 COVID-19下におけるインドの仮想発電所(VPP)市場

7.8 東南アジアの仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.8.1 COVID-19下における東南アジアの仮想発電所(VPP)市場

7.9 ラテンアメリカの仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.9.1 COVID-19下におけるラテンアメリカの仮想発電所(VPP)市場

7.10 中東およびアフリカの仮想発電所(VPP)の価値と粗利益(2019年~2024年)

7.10.1 COVID-19下における中東およびアフリカの仮想発電所(VPP)市場

8 世界の仮想発電所(VPP)市場予測(2024-2029年)

8.1 世界の仮想発電所(VPP)収益予測(2024~2029年)

8.2 世界の仮想発電所(VPP)収益予測、地域別(2024~2029年)

8.2.1 米国の仮想発電所(VPP)収益予測(2024~2029年)

8.2.2 欧州の仮想発電所(VPP)収益予測(2024~2029年)

8.2.3 中国の仮想発電所(VPP)収益予測(2024~2029年)

8.2.4 日本における仮想発電所(VPP)収益予測(2024~2029年)

8.2.5 インドの仮想発電所(VPP)収益予測(2024~2029年)

8.2.6 東南アジアの仮想発電所(VPP)収益予測(2024~2029年)

8.2.7 ラテンアメリカの仮想発電所(VPP)収益予測(2024~2029年)

8.2.8 中東およびアフリカの仮想発電所(VPP)収益予測(2024~2029年)

8.3 世界の仮想発電所(VPP)収益予測(タイプ別)(2024~2029年)

8.3.1 世界の仮想発電所(VPP)収益とOCモデルの成長率(2024~2029年)

8.3.2 世界の仮想発電所(VPP)収益とFMモデルの成長率(2024〜2029年)

8.4 世界の仮想発電所(VPP)の用途別消費額予測(2024~2029年)

8.4.1 世界の仮想発電所(VPP)消費額と商業用発電の成長率(2024-2029年)

8.4.2 世界の仮想発電所(VPP)消費額と産業用発電の成長率(2024-2029年)

8.4.3 世界の住宅用仮想発電所(VPP)消費額と成長率(2024-2029年)

8.5 COVID-19 下における仮想発電所 (VPP) 市場予測

9 業界の見通し

9.1 仮想発電所(VPP)市場の推進要因分析

9.2 仮想発電所(VPP)市場の制約と課題

9.3 仮想発電所(VPP)市場機会分析

9.4 新興市場の動向

9.5 仮想発電所(VPP)業界の技術の現状と動向

9.6 製品リリースのニュース

9.7 消費者嗜好分析

9.8 COVID-19流行下における仮想発電所(VPP)産業の発展動向

9.8.1 世界のCOVID-19感染状況の概要

9.8.2 COVID-19の流行が仮想発電所(VPP)産業の発展に与える影響

10 付録

10.1 方法論

10.2 研究データソース

10.2.1 二次データ

10.2.2 一次データ

10.2.3 市場規模の推定

10.2.4 法的免責事項