1. Global Indoor Air Quality Meter Market Outlook

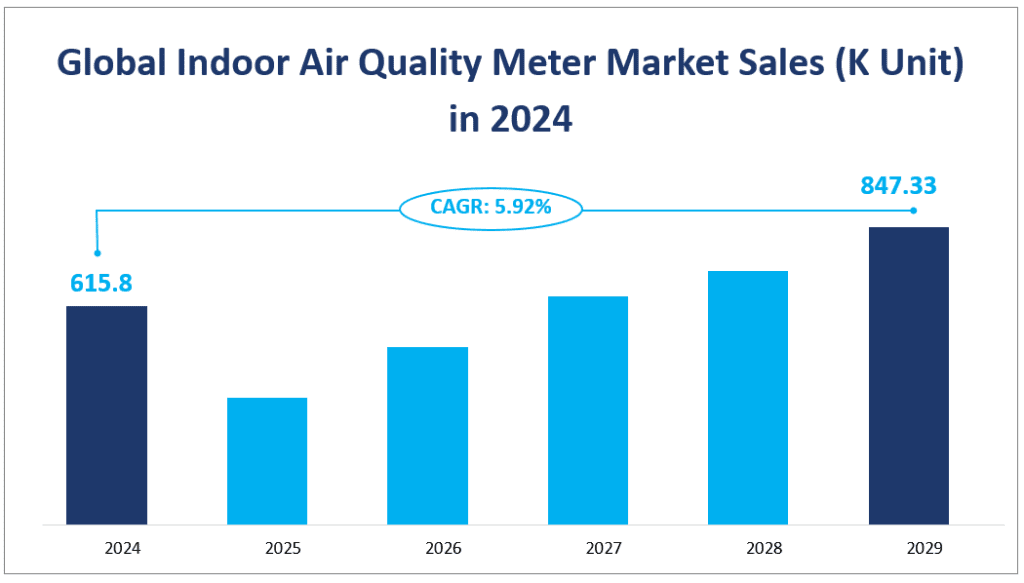

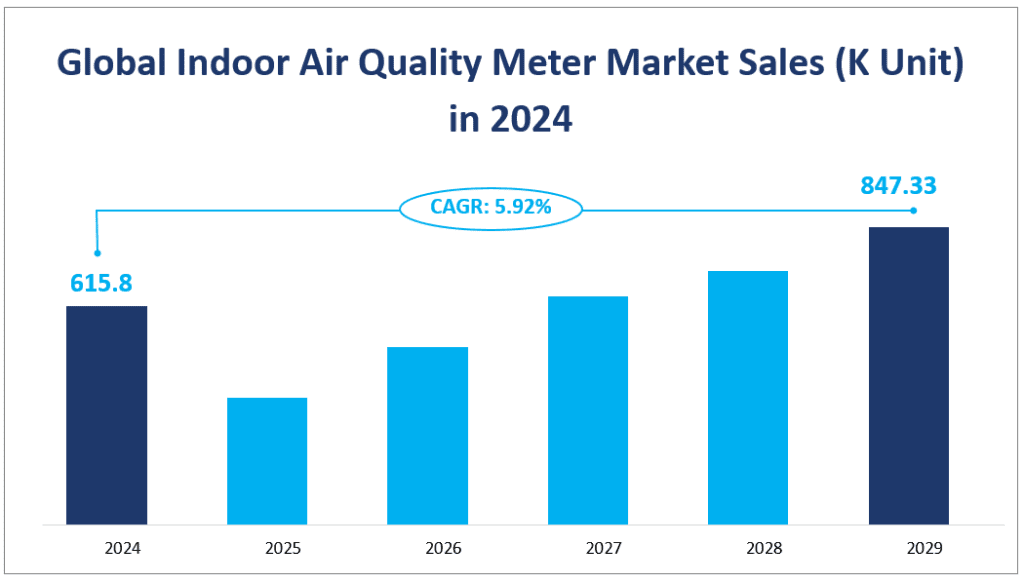

The global Indoor Air Quality meter market is poised for significant growth, reflecting the increasing attention to clean air standards worldwide. In 2024, the market is projected to reach sales of 615.8 thousand units with a CAGR of 5.92% from 2024 to 2029. The IAQ meter, a crucial device for assessing the air quality within enclosed spaces, measures critical parameters such as carbon monoxide (CO), carbon dioxide (CO2), volatile organic compounds (VOCs), and other toxic gases. These pollutants, if unchecked, can lead to respiratory issues, allergic reactions, and increased illness rates, underscoring the necessity for IAQ meters in both commercial and residential settings.

The market’s growth is fueled by a heightened awareness of the health implications of poor indoor air quality, technological advancements in sensor technology, and the growing demand for energy-efficient buildings. The IAQ meter market is segmented by regions, with North America, Europe, Asia Pacific, South America, the Middle East & Africa, each contributing significantly to the global sales. The CAGR for the next few years indicates a steady increase, reflecting the market’s potential to expand further as more industries and consumers prioritize health and safety standards.

Global Indoor Air Quality Meter Market Sales (K Unit)

2. Driving Factors of the Indoor Air Quality Meter Market

Several factors are propelling the growth of the indoor air quality meter market. Primarily, the increasing concern over health and the quality of life due to poor indoor air quality is a significant driver. The World Health Organization (WHO) estimates that indoor air pollution is responsible for a substantial number of respiratory diseases, making the IAQ meter an essential tool for health-conscious consumers and businesses alike.

Technological advancements have also played a crucial role in market growth. Modern indoor air quality meters offer real-time data, are more accurate, and are designed to measure a broader range of pollutants, enhancing their appeal to a wider customer base. Additionally, the push for energy-efficient and ‘green’ buildings has increased the demand for IAQ meters, as these devices help maintain optimal air quality while reducing energy consumption.

The market is also influenced by stringent government regulations and standards for indoor air quality, particularly in regions with high pollution levels. These regulations mandate the use of IAQ meters in certain industries, thereby driving market penetration.

3. Limiting Factors of the Indoor Air Quality Meter Market

Despite the promising outlook, the indoor air quality meter market faces challenges that could limit its growth. One of the primary constraints is the high initial cost of advanced IAQ meters, which can be a barrier for small and medium-sized enterprises (SMEs) with limited budgets. Additionally, the complexity of some IAQ meters may require specialized training for operation and maintenance, adding to the overall cost for users.

Another limiting factor is the lack of awareness about the long-term health benefits of maintaining good indoor air quality in certain regions, particularly in developing countries. This lack of awareness can result in lower demand for IAQ meters.

In conclusion, the global IAQ meter market is at a critical juncture, with significant potential for growth due to increasing health concerns and technological advancements. However, challenges such as high initial costs, lack of awareness, and market competition must be addressed to achieve sustainable growth. As the world moves towards a future focused on health and sustainability, the IAQ meter market is set to play a pivotal role in ensuring the quality of the air we breathe indoors.

4. Indoor Air Quality Meter Market Segment

The global indoor air quality meter market is segmented into two primary product types: Portable and Stationary. Each type serves a distinct purpose and caters to different market demands, shaping the overall market landscape.

Portable IAQ Meters

Portable IAQ meters are designed for mobility and ease of use. They are compact, battery-operated devices that can be carried to various locations to measure air quality parameters. These meters are particularly useful for real-time monitoring in dynamic environments such as construction sites, schools, hospitals, and even homes. In 2024, the portable indoor air quality meter market is projected to reach sales of 535.4 thousand units, reflecting a significant market share and growth trajectory. The portable segment’s dominance is attributed to its versatility and the increasing demand for on-site air quality assessments.

Stationary IAQ Meters

Stationary IAQ meters, on the other hand, are fixed in one location and are typically used for continuous, long-term monitoring. They are more comprehensive and often connected to building management systems for automated control and data logging. These meters are crucial for maintaining optimal air quality in stable environments such as offices, hotels, and industrial facilities. The stationary segment is expected to achieve sales of 80.4 thousand units in 2024. While this is a smaller market share compared to portable meters, it exhibits a steady growth rate due to the need for continuous monitoring in controlled settings.

Among the two product types, portable indoor air quality meters hold the largest market share, accounting for approximately 86.94% of the total sales in 2024. This is due to their wide applications and the increasing preference for real-time, flexible air quality monitoring solutions. The portable segment also exhibits the fastest growth rate, driven by technological advancements that enhance measurement accuracy and user convenience.

The stationary segment, while having a smaller market share, is not without its growth opportunities. It is expected to capture a growing share of the market as the need for integrated building management systems and long-term data collection for air quality becomes more prevalent, especially in the context of smart buildings and sustainable infrastructure development.

The applications of IAQ meters are diverse, spanning various sectors that require air quality monitoring to ensure health, safety, and efficiency. The four primary applications are Industrial, Commercial, Academic, and Household.

Industrial Application

Industrial applications refer to the use of indoor air quality meters in manufacturing facilities, warehouses, and other industrial settings where air quality can be compromised by machinery, chemicals, or processes. In 2024, the industrial segment is projected to reach sales of 183.3 thousand units. This application holds the largest market share due to the stringent health and safety regulations in industrial sectors worldwide.

Commercial Application

The commercial sector includes offices, retail spaces, hotels, and other business environments where maintaining air quality is crucial for occupant comfort and productivity. With sales reaching 116.8 thousand units in 2024, the commercial application is a significant segment, driven by the growing awareness of the impact of indoor air quality on employee well-being and customer satisfaction.

Academic Application

Academic institutions, including schools and universities, rely on IAQ meters to ensure a healthy learning environment. The academic segment is expected to achieve sales of 167.3 thousand units in 2024. This application’s growth is fueled by the recognition of the link between air quality and cognitive function, particularly in educational settings.

Household

Household use of indoor air quality meters is becoming increasingly popular as homeowners become more conscious of the air they breathe. This segment is projected to reach sales of 148.4 thousand units in 2024. The household application’s growth rate is the fastest, indicating a rising trend in consumer demand for home air quality monitoring and improvement.

Among the applications, the industrial segment has the largest market share, driven by regulatory compliance and the need for robust air quality management in heavy industrial settings. However, household applications are experiencing the fastest growth rate, reflecting a consumer-led trend towards healthier living environments and the adoption of smart home technologies.

Market Sales and Share by Segment

| Market Sales (K Unit) in 2024 | Market Share in 2024 | ||

| By Type | Portable | 535.4 | 86.94% |

| Stationary | 80.4 | 13.06% | |

| By Application | Industrial | 183.3 | 29.77% |

| Commercial | 116.8 | 18.96% | |

| Academic | 167.3 | 27.17% | |

| Household | 148.4 | 24.09% |

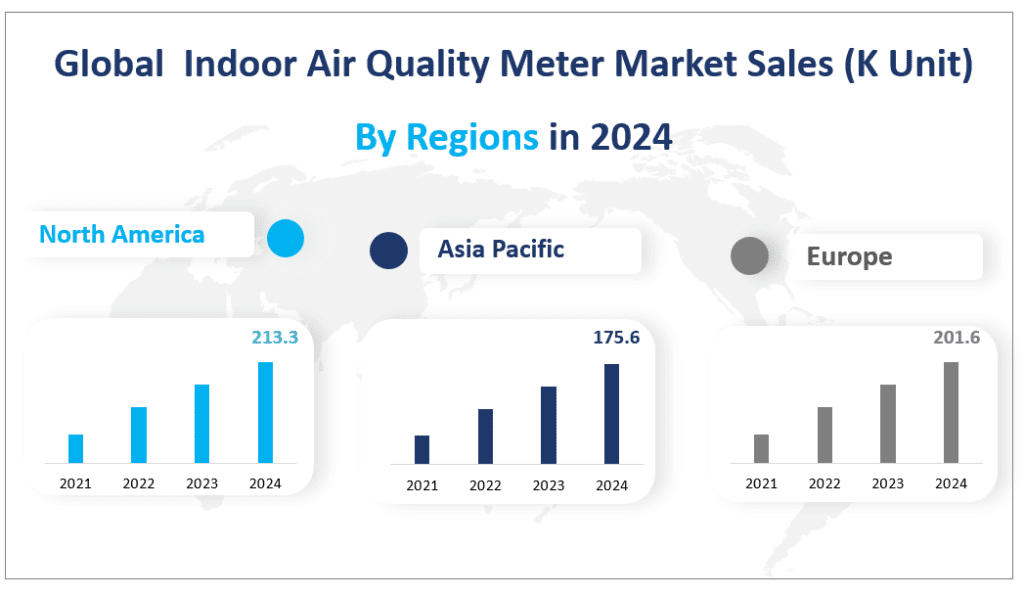

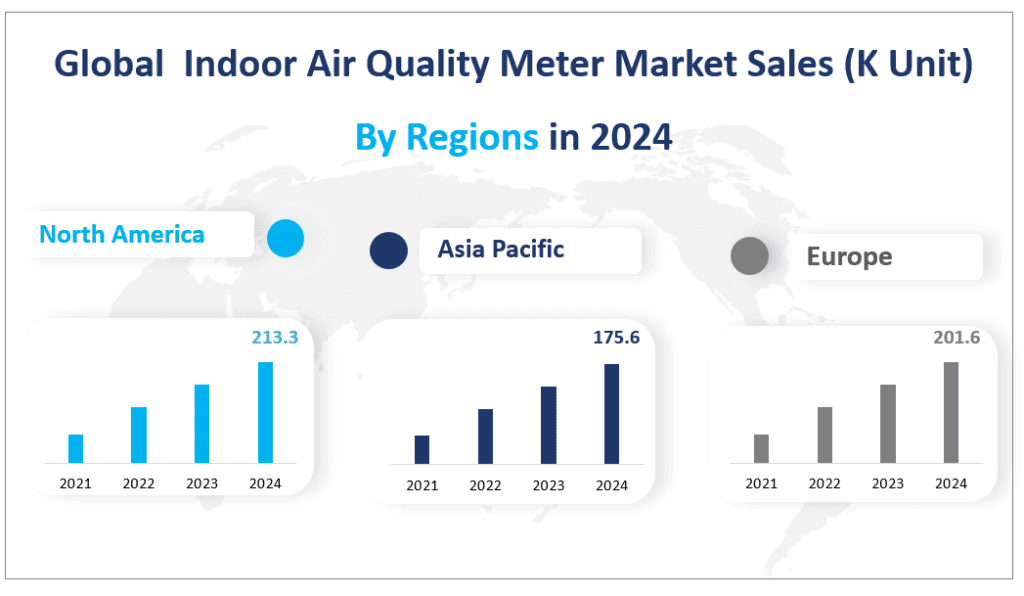

5. Global Indoor Air Quality Meter Market Sales by Region

North America: The Biggest Regional Market by Sales

North America, with its strong emphasis on environmental standards and health regulations, stands out as the largest regional market by revenue in the indoor air quality meters industry. In 2024, the region is projected to achieve sales of 213.3 thousand units, maintaining a substantial market share. The United States, as a key player in this region, drives the demand for IAQ meters due to stringent regulations and a growing focus on energy-efficient buildings and health-conscious consumer trends.

Asia Pacific: The Fastest-Growing Region

The Asia Pacific region is expected to be the fastest-growing market for indoor air quality meters, with sales projected to reach 175.6 thousand units in 2024. This growth can be attributed to the rapid industrialization and urbanization in countries like China and India, coupled with increasing environmental concerns and a rising middle class that demands better living conditions. The region’s growth is also fueled by government initiatives promoting green technologies and sustainable development.

Europe: A Stable Contributor to the Market

Europe, with its well-established environmental policies, is expected to maintain a stable position in the indoor air quality meter market, with sales projected at 201.6 thousand units in 2024. The region’s emphasis on sustainability and energy efficiency continues to drive the demand for IAQ meters, particularly in countries with advanced building standards and a strong focus on public health.

South America and Middle East & Africa: Emerging Markets

South America and the Middle East & Africa, while smaller in comparison to the other regions, are emerging as significant markets for IAQ meters. South America is expected to reach sales of 18.1 thousand units in 2024, with Brazil being a key contributor due to its growing industrial sector and increasing environmental awareness. The Middle East & Africa, projected to achieve sales of 7.1 thousand units, is seeing growth driven by investments in infrastructure and a rising focus on indoor environmental quality, particularly in the UAE and Saudi Arabia.

Global Indoor Air Quality Meter Market Sales (K Unit) By Region in 2024

6. Top Five Companies in the Indoor Air Quality Meter Market

Introduction and Business Overview:

Vaisala, established in 1936, is a global leader in manufacturing measuring and controlling devices, with a strong focus on weather and industrial measurement solutions.

Products:

Vaisala offers a range of IAQ meters, including the CARBOCAP® Carbon Dioxide Probe GMP251, which is known for its stability and accuracy in measuring CO2 levels.

Introduction and Business Overview:

Bacharach, founded in 1909, provides HVAC-R gas instrumentation and energy management solutions, serving customers worldwide.

Products:

Bacharach’s product line includes the PCA® 400 Combustion & Emissions Analyzer, a versatile tool for commercial and industrial applications.

Introduction and Business Overview:

TESTO, established in 1957, designs and manufactures portable test and measurement instruments, including IAQ meters.

Products:

TESTO’s CO2 meter is a durable and cost-effective instrument for monitoring indoor air quality.

Introduction and Business Overview:

TSI Incorporated, founded in 1961, manufactures a wide range of measurement instruments, including IAQ monitors.

Products:

TSI’s Q-TRAK INDOOR AIR QUALITY MONITOR 7575 is a quick and accurate tool for assessing key IAQ parameters.

Introduction and Business Overview:

Amphenol Corporation, established in 1932, designs, manufactures, and markets electrical, electronic, and fiber optic connectors, as well as IAQ monitors.

Products:

Amphenol’s Handheld IAQ Monitors – T7000 Series | Telaire are known for their stability and durability in measuring IAQ.

Major Players

| Company Name | Plant Locations | Market Distribution |

| Vaisala | Worldwide | Worldwide |

| Bacharach | Mainly in North America | Worldwide |

| TESTO | Mainly in Europe and North America | Worldwide |

| TSI | Mainly in Europe, North America, Asia Pacific | Worldwide |

| Amphenol | Worldwide | Worldwide |

| E Instruments | Mainly in USA and Europe | Worldwide |

| Kanomax | Mainly in USA | Worldwide |

| DWYER | USA | Worldwide |

| Rotronic | Worldwide | Worldwide |

| Extech | Mainly in North America and Asia Pacific | Worldwide |

| GrayWolf | Mainly in Ireland and USA | Worldwide |

| FLUKE | Mainly in the US, UK, Asia, and the Netherlands | Worldwide |

| Aeroqual | Mainly in New Zealand | Worldwide |

| Honeywell Analytics | Mainly in USA and China | Worldwide |

| CETCI | Mainly in Canada | Worldwide |

| Sper Scientific | Mainly in USA | Worldwide |

| MadgeTech | USA | Worldwide |

PART 01: EXECUTIVE SUMMARY

1.1 World Market Overview

1.1.1 Global Indoor Air Quality Solutions Market Size 2016-2026

1.1.2 Indoor Air Quality Solutions Market Size by Region

1.2 Indoor Air Quality Solutions Revenue by Type

1.2.1 Global Indoor Air Quality Solutions Revenue Market Share by Type (2021-2026)

1.3 Indoor Air Quality Solutions Segment by Application

1.3.1 Commercial

1.3.2 Residential

1.3.3 Industrial

PART 02: SCOPE OF THE REPORT

2.1 Market Introduction

2.2 Research Objectives

2.3 Years Considered

2.4 Market Research Methodology

2.5 Economic Indicators

2.6 Currency Considered

PART 03: MARKET LANDSCAPE

3.1 Business Ecosystem

3.2 Market Characteristics

3.3 Market Segmentation Analysis

PART 04: MARKET SIZING

4.1 Market Definition

4.2 Market Sizing 2020

4.3 Market Size and Forecast 2021-2026

PART 05: FIVE FORCES ANALYSIS

5.1 Bargaining power of buyers

5.2 Bargaining power of suppliers

5.3 Threat of new entrants

5.4 Threat of substitutes

5.5 Threat of rivalry

5.6 Market condition

PART 06: MARKET SEGMENTATION BY TYPE

6.1 Global Indoor Air Quality Solutions Revenue and Market Share by Type (2016-2026)

6.2 Global Indoor Air Quality Solutions Value and Growth Rate by Type (2016-2026)

6.2.1 Global Indoor Air Quality Solutions Value and Growth Rate of Equipment

6.2.2 Global Indoor Air Quality Solutions Value and Growth Rate of Services

PART 07: MARKET SEGMENTATION BY APPLICATION

7.1 Global Indoor Air Quality Solutions Revenue and Market Share by Application (2016-2026)

7.2 Global Indoor Air Quality Solutions Revenue and Growth Rate by Application (2021-2026)

7.2.1 Global Indoor Air Quality Solutions Revenue and Growth Rate of Commercial (2016-2026)

7.2.2 Global Indoor Air Quality Solutions Revenue and Growth Rate of Residential (2016-2026)

7.2.3 Global Indoor Air Quality Solutions Revenue and Growth Rate of Industrial (2016-2026)

PART 08: CUSTOMER LANDSCAPE

PART 09: GEOGRAPHIC LANDSCAPE

9.1 APAC Indoor Air Quality Solutions Market Size and Forecast

9.1.1 Asia-Pacific Indoor Air Quality Solutions Revenue by Countries (2016-2026)

9.2 Europe Indoor Air Quality Solutions Market Size and Forecast

9.2.1 Europe Indoor Air Quality Solutions Revenue by Countries (2016-2026)

9.3 North America Indoor Air Quality Solutions Market Size and Forecast

9.3.1 North America Indoor Air Quality Solutions Revenue by Countries (2016-2026)

9.4 South America Indoor Air Quality Solutions Market Size and Forecast

9.4.1 South America Indoor Air Quality Solutions Revenue by Countries (2016-2026)

9.5 MEA Indoor Air Quality Solutions Market Size and Forecast

9.5.1 Middle East and Africa Indoor Air Quality Solutions Revenue by Countries (2016-2026)

PART 10: DECISION FRAMEWORK

PART 11: DRIVERS AND CHALLENGES

11.1 Market Drivers

11.2 Market Challenges

PART 12: MARKET TRENDS

12.1 Growing Recyclability of Indoor Air Quality Solutions

12.2 The rise of indoor air quality testing equipment

PART 13: VENDOR LANDSCAPE

13.1 Overview

13.2 Landscape Disruption

13.3 Competitive Scenario

PART 14: VENDOR ANALYSIS

14.1 Carrier

14.1.1 Carrier Company Details

14.1.2 Company Product Offered

14.1.3 Carrier Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.1.4 Carrier Indoor Air Quality Solutions Business Overview

14.1.5 Carrier News

14.2 Daikin Industries Ltd.

14.2.1 Daikin Industries Ltd. Company Details

14.2.2 Company Product Offered

14.2.3 Daikin Industries Ltd. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.2.4 Daikin Industries Ltd. Indoor Air Quality Solutions Business Overview

14.2.5 Daikin Industries Ltd. News

14.3 Trane Technologies plc

14.3.1 Trane Technologies plc Company Details

14.3.2 Company Product Offered

14.3.3 Trane Technologies plc Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.3.4 Trane Technologies plc Indoor Air Quality Solutions Business Overview

14.3.5 Trane Technologies plc News

14.4 Panasonic Corp.

14.4.1 Panasonic Corp. Company Details

14.4.2 Company Product Offered

14.4.3 Panasonic Corp. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.4.4 Panasonic Corp. Indoor Air Quality Solutions Business Overview

14.4.5 Panasonic Corp. News

14.5 Lennox International Inc.

14.5.1 Lennox International Inc. Company Details

14.5.2 Company Product Offered

14.5.3 Lennox International Inc. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.5.4 Lennox International Inc. Indoor Air Quality Solutions Business Overview

14.5.5 Lennox International Inc. News

14.6 Unilever PLC

14.6.1 Unilever PLC Company Details

14.6.2 Company Product Offered

14.6.3 Unilever PLC Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.6.4 Unilever PLC Indoor Air Quality Solutions Business Overview

14.6.5 Unilever PLC News

14.7 3M Co.

14.7.1 3M Co. Company Details

14.7.2 Company Product Offered

14.7.3 3M Co. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.7.4 3M Co. Indoor Air Quality Solutions Business Overview

14.7.5 3M Co. News

14.8 Honeywell International, Inc

14.8.1 Honeywell International, Inc Company Details

14.8.2 Company Product Offered

14.8.3 Honeywell International, Inc Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.8.4 Honeywell International, Inc Indoor Air Quality Solutions Business Overview

14.8.5 Honeywell International, Inc News

14.9 Camfil AB

14.9.1 Camfil AB Company Details

14.9.2 Company Product Offered

14.9.3 Camfil AB Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.9.4 Camfil AB Indoor Air Quality Solutions Business Overview

14.9.5 Camfil AB News

14.10 Kingclean

14.10.1 Kingclean Company Details

14.10.2 Company Product Offered

14.10.3 Kingclean Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.10.4 Kingclean Indoor Air Quality Solutions Business Overview

14.10.5 Kingclean News

14.11 Veolia

14.11.1 Veolia Company Details

14.11.2 Company Product Offered

14.11.3 Veolia Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.11.4 Veolia Indoor Air Quality Solutions Business Overview

14.11.5 Veolia News

14.12 Aeroqual Ltd.

14.12.1 Aeroqual Ltd. Company Details

14.12.2 Company Product Offered

14.12.3 Aeroqual Ltd. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.12.4 Aeroqual Ltd. Indoor Air Quality Solutions Business Overview

14.12.5 Aeroqual Ltd. News

14.13 TSI Inc.

14.13.1 TSI Inc. Company Details

14.13.2 Company Product Offered

14.13.3 TSI Inc. Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.13.4 TSI Inc. Indoor Air Quality Solutions Business Overview

14.13.5 TSI Inc. News

14.14 Trion IAQ

14.14.1 Trion IAQ Company Details

14.14.2 Company Product Offered

14.14.3 Trion IAQ Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.14.4 Trion IAQ Indoor Air Quality Solutions Business Overview

14.14.5 Trion IAQ News

14.15 Aire Serv

14.15.1 Aire Serv Company Details

14.15.2 Company Product Offered

14.15.3 Aire Serv Indoor Air Quality Solutions Value, Gross, Gross Margin (2016-2021)

14.15.4 Aire Serv Indoor Air Quality Solutions Business Overview

14.15.5 Aire Serv News