1. Global Heaters for Semiconductor Equipment Market Overview

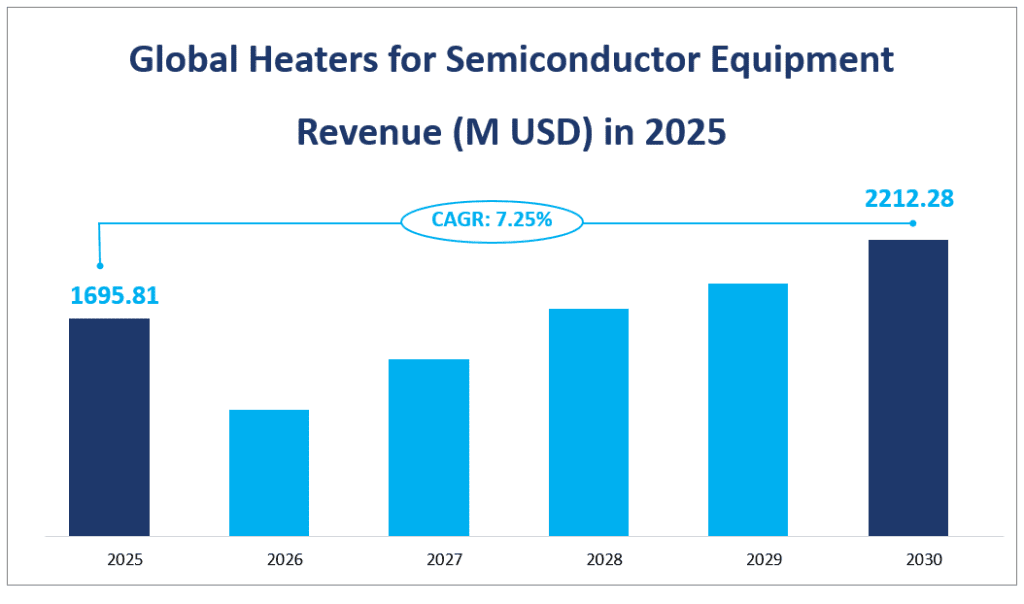

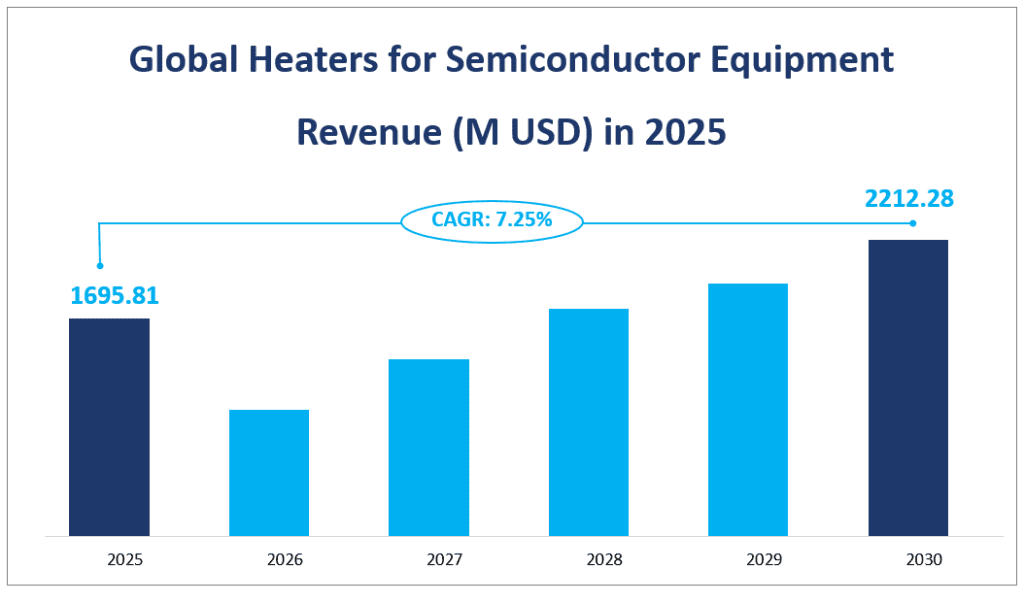

The global heaters for semiconductor equipment market for heaters used in semiconductor equipment is projected to experience significant growth in the coming years. The market revenue is expected to reach $1,695.81 million by 2025, reflecting a robust growth trajectory. The heaters for semiconductor equipment market is anticipated to grow at a compound annual growth rate (CAGR) of 7.25% from 2025 to 2030, indicating a steady increase in demand driven by advancements in semiconductor manufacturing technologies and the growing need for precise temperature control in various processes.

Heaters for semiconductor equipment are essential components in the manufacturing of semiconductors, utilized in processes such as chemical vapor deposition (CVD), etching, and other critical steps that require stringent temperature management. These heaters are primarily categorized into two types: ceramic heaters and metal heaters. Ceramic heaters, often made from aluminum nitride (AlN), are favored for their excellent thermal conductivity and ability to maintain uniform temperatures across semiconductor wafers. Metal heaters, on the other hand, are typically constructed from stainless steel alloys, providing good thermal conductivity and durability.

The increasing complexity of semiconductor devices and the rising demand for high-performance materials are key factors propelling the growth of the heaters for semiconductor equipment market. As semiconductor manufacturers strive to enhance production efficiency and yield, the need for high-quality heating solutions becomes paramount. Additionally, the global push towards advanced technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), is further driving the demand for semiconductors, thereby boosting the market for related equipment, including heaters.

Global Heaters for Semiconductor Equipment Revenue (M USD) in 2025

2. Driving Factors of Heaters for Semiconductor Equipment Market

The growth of the global heaters for semiconductor equipment market is influenced by several driving factors. Firstly, the rapid expansion of the semiconductor industry, particularly in emerging markets like China and India, is a significant catalyst. These countries are investing heavily in semiconductor manufacturing capabilities to achieve self-sufficiency and reduce reliance on foreign technology. Government initiatives and funding aimed at bolstering local semiconductor production are leading to increased demand for semiconductor equipment, including heaters.

Secondly, technological advancements in heater design and materials are enhancing performance and efficiency. Innovations such as improved thermal management systems and energy-efficient heating solutions are making heaters more effective in semiconductor manufacturing processes. As manufacturers seek to optimize production and reduce energy costs, the adoption of advanced heating technologies is expected to rise.

Moreover, the increasing complexity of semiconductor devices necessitates precise temperature control during manufacturing. As devices become smaller and more intricate, the importance of maintaining uniform heating across wafers becomes critical. This trend is driving the demand for high-performance heaters that can meet the stringent requirements of modern semiconductor fabrication processes.

3. Limiting Factors of Heaters for Semiconductor Equipment Market

However, the heaters for semiconductor equipment market also faces several limiting factors that could hinder growth. One of the primary challenges is the high capital investment required for semiconductor manufacturing equipment, including heaters. The initial costs associated with purchasing and installing advanced heating systems can be a barrier for smaller manufacturers, potentially limiting their ability to compete in the market.

Additionally, fluctuations in raw material prices can impact the cost of heater production. The semiconductor industry is sensitive to changes in the prices of materials such as aluminum and various alloys used in heater manufacturing. Any significant price increases can lead to higher production costs, which may be passed on to consumers, affecting overall heaters for semiconductor equipment market demand.

In conclusion, while the global heaters for semiconductor equipment market are poised for growth driven by technological advancements and increasing demand from the semiconductor industry, challenges such as high capital costs, raw material price fluctuations, and geopolitical tensions must be navigated to sustain this growth trajectory.

4. Global Heaters for Semiconductor Equipment Market Segment

Product Type Analysis

The global heaters for semiconductor equipment market is segmented into two primary product types: Ceramic Heaters and Metal Heaters.

Ceramic Heaters

Ceramic heaters, particularly those made from aluminum nitride (AlN), are renowned for their thermal conductivity and electrical insulation properties. They are co-sintered with resistance heating elements to provide excellent thermal uniformity and reduce metal contamination. In 2025, the market revenue for ceramic heaters is projected to reach $1,402.17 million. This product type holds the largest market share of heaters for semiconductor equipment market, attributed to its superior heat distribution and corrosion resistance, which are critical in high-temperature semiconductor processes.

Metal Heaters

Metal heaters, predominantly constructed from stainless steel alloys, are valued for their metal conductivity and formability. Despite their lower market revenue projection of $293.64 million in 2025 compared to ceramic heaters, metal heaters offer a cost-effective solution with adequate performance for certain semiconductor equipment applications. They are particularly useful in environments where the magnetic properties of metals are beneficial.

In terms of growth rate, ceramic heaters are expected to maintain a steady growth, reflecting the industry’s preference for their advanced thermal management capabilities.

End User Analysis

The application landscape of heaters for semiconductor equipment market is diverse, catering to different stages of semiconductor manufacturing. The primary applications include Semiconductor Equipment Companies and Fabs (fabrication plants).

Semiconductor Equipment Companies

Semiconductor equipment companies utilize heaters as integral components in the manufacturing of semiconductor devices. These heaters are employed in various processes such as film formation, etching, and other critical steps that require precise temperature control. In 2025, the market revenue for this application is anticipated to be $1,648.32 million. This segment dominates the heaters for semiconductor equipment market share, reflecting the broad integration of heaters across multiple semiconductor manufacturing processes.

Fabs

Fabs, or semiconductor fabrication plants, require heaters for in-process heating and temperature maintenance. The market revenue for fabs is projected to reach $47.49 million in 2025. While this represents a smaller market share compared to semiconductor equipment companies, fabs are characterized by their rapid growth rate.

The distinction in market share and growth rates between these applications can be attributed to the varying scales of operations and the specific heating requirements at different stages of semiconductor manufacturing. Semiconductor equipment companies, being at the forefront of device fabrication, incorporate heaters into a wide array of equipment, thus capturing a larger portion of the market. Fabs, however, are experiencing rapid growth due to the increasing complexity of semiconductor devices, which necessitates more sophisticated heating solutions to maintain the quality and performance of the final products.

In conclusion, the global heaters for semiconductor equipment market is characterized by a diverse product and application landscape, with ceramic heaters and semiconductor equipment companies holding the largest market shares. While ceramic heaters lead in terms of revenue, metal heaters, and fabs exhibit the fastest growth rates, indicating emerging trends and opportunities within the semiconductor manufacturing industry.

Market Revenu and Share by Segment

| Market Revenue in 2025 | Market Share in 2025 | ||

| By Type | Ceramic Heaters for Semiconductor Equipment | 1402.17 M USD | 82.57% |

| Metal Heaters for Semiconductor Equipment | 293.64 M USD | 17.43% | |

| By Application | Semiconductor Equipment Company | 1648.32 M USD | 97.25% |

| Fabs | 47.49 M USD | 2.75% |

5. Regional Heaters for Semiconductor Equipment Market

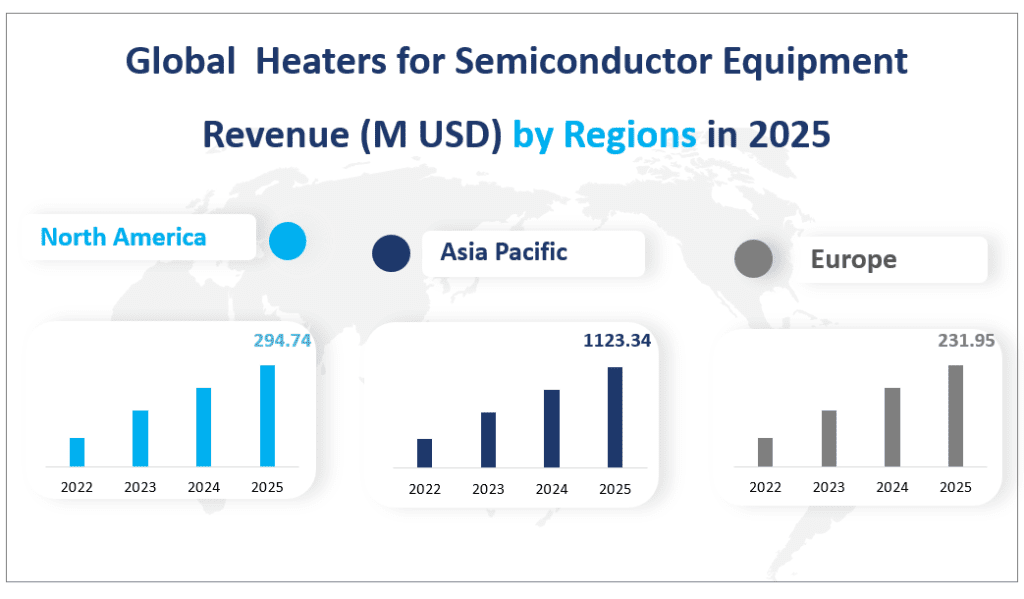

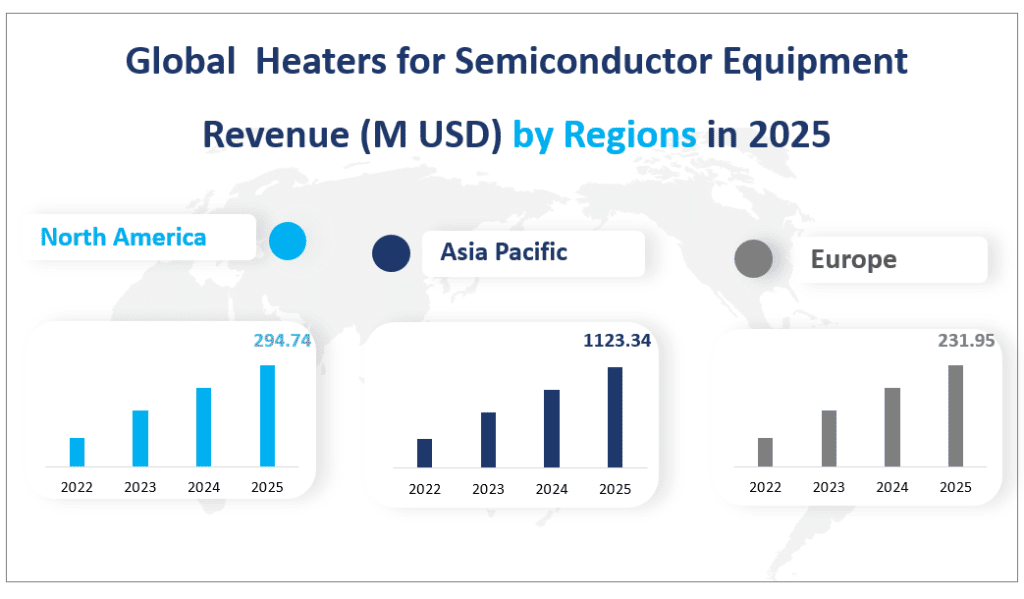

Asia Pacific: The Asia Pacific region is anticipated to be the largest heaters for semiconductor equipment market, with a projected revenue of $1123.34 million in 2025. This dominance can be attributed to the presence of major semiconductor manufacturers, particularly in countries like China, Japan, and South Korea. The region’s rapid industrialization, coupled with substantial investments in semiconductor technology, has created a favorable environment for the growth of heater demand. The increasing complexity of semiconductor devices and the need for advanced manufacturing processes further drive the demand for high-performance heating solutions.

North America: Following Asia Pacific, North America is expected to generate significant revenue, estimated at $294.74 million in 2025. The United States, in particular, is home to several leading semiconductor companies and research institutions, fostering innovation and technological advancements in the industry. The region’s focus on developing cutting-edge semiconductor technologies and maintaining a competitive edge in the global market contributes to the steady demand for heaters for semiconductor equipment market.

Europe: Europe is projected to contribute approximately $231.95 million to the heaters for semiconductor equipment market in 2025. The European semiconductor industry is characterized by a strong emphasis on sustainability and energy efficiency, leading to increased investments in advanced heating technologies. Countries like Germany and France are key players in the semiconductor equipment market, driving demand for high-quality heating solutions.

Latin America: The Latin American heaters for semiconductor equipment market is expected to generate around $18.26 million in revenue in 2025. While this represents a smaller share of the global market, the region is gradually developing its semiconductor manufacturing capabilities, which may lead to increased demand for heaters in the coming years.

Middle East & Africa: The Middle East and Africa region is projected to contribute approximately $27.51 million in 2025. Although this market is still emerging, there is growing interest in developing semiconductor manufacturing facilities, which could drive future demand for heating solutions.

Among these regions, Asia Pacific not only holds the largest market share but is also the fastest-growing region in the heaters for semiconductor equipment market. The region’s CAGR is expected to be robust, driven by the rapid expansion of semiconductor manufacturing capabilities, increasing demand for advanced technologies, and government initiatives aimed at promoting local production. As countries in the Asia Pacific region continue to invest in semiconductor technologies and infrastructure, the demand for heaters for semiconductor equipment market is likely to accelerate, solidifying the region’s position as a global leader in the semiconductor industry.

In summary, the global heaters for semiconductor equipment market is characterized by significant regional disparities in revenue generation. Asia Pacific stands out as the largest and fastest-growing market, driven by technological advancements and increasing industrial demand. North America and Europe also contribute substantially to the market, while Latin America and the Middle East & Africa represent emerging opportunities for growth.

Global Heaters for Semiconductor Equipment Revenue (M USD) by Regions in 2025

6. Analysis of the Top Five Companies in the Heaters for Semiconductor Equipment Market

The heaters for semiconductor equipment market is dominated by several key players, each contributing to the industry’s growth through innovative products and solutions.

Company Overview: Established in 1897, Sumitomo Electric is a leading manufacturer of electrical and electronic components. Headquartered in Japan, the company operates globally, with a strong presence in Asia Pacific, North America, and Europe.

Products Offered: Sumitomo Electric specializes in various thermal control devices, including ceramic heaters designed for semiconductor fabrication equipment. Their products are known for excellent heat characteristics, superior temperature uniformity, and rapid heating and cooling capabilities.

Company Overview: Founded in 1919, NGK Insulators is a prominent Japanese company specializing in ceramic products. The company is recognized for its innovative solutions in the semiconductor industry, particularly in thermal management.

Products Offered: NGK Insulators offers a range of ceramic heaters made from aluminum nitride, known for their outstanding thermal conductivity and corrosion resistance. These heaters are essential for maintaining precise temperatures in semiconductor manufacturing processes.

Company Overview: MiCo Ceramics, established in 1996 and headquartered in South Korea, focuses on the development and manufacturing of advanced ceramic materials for semiconductor applications.

Products Offered: The company provides high-performance aluminum nitride (AlN) heaters, which are widely used in chemical vapor deposition (CVD) and other high-temperature processes in semiconductor manufacturing.

Company Overview: Established in 1994, BOBOO Hitech is a South Korean company specializing in semiconductor equipment components. The company is known for its commitment to quality and innovation.

Products Offered: BOBOO Hitech manufactures a variety of heaters, including ceramic and metal options, tailored for semiconductor applications. Their products are designed to meet the rigorous demands of the semiconductor manufacturing process.

CoorsTek

Company Overview: Founded in 1910, CoorsTek is a leading manufacturer of technical ceramics based in the USA. The company serves various industries, including semiconductor manufacturing, with a focus on high-performance materials.

Products Offered: CoorsTek offers a range of semiconductor-grade ceramic heaters and components, including aluminum nitride (AlN) and silicon nitride (Si3N4) heaters, known for their reliability and efficiency in semiconductor applications.

Major Players

| Company Name | Headquarters | Business Distribution |

| Sumitomo Electric | Japan | Mainly in Asia Pacific, North America and Europe |

| NGK Insulators | Japan | Mainly in Asia Pacific, North America, Europe |

| MiCo Ceramics Co., Ltd. | South Korea | Mainly in Asia |

| BOBOO Hitech | South Korea | Mainly in Asia |

| CoorsTek | USA | Mainly in North America, Asia and Europe |

| NIBE Industrier AB | Sweden | Mainly in Europe, North America, APAC |

| Semixicon | USA | Mainly in North America |

| Tinicum Incorporated | USA | Mainly in North America, Europe and Asia |

| KSM Component | South Korea | Mainly in Asia and North America |

| BACH Resistor Ceramics | Germany | Europe and North America |

| Fralock Holdings | USA | Mainly in North America |

| Cast Aluminum Solutions | USA | Europe, Asia, and North and South America |

| Tempco Electric Heater Corporation | USA | Mainly in Europe Oceania and North America |

| Technetics Group | USA | Mainly in Europe, North America, Asia |

| Shin-Etsu MicroSi | Japan | Mainly in Asia |

| Belilove Company – Engineers | USA | Mainly in North America |

1 Market Overview

1.1 Product Definition and Market Characteristics

1.2 Global Heaters for Semiconductor Equipment Market Size

1.3 Market Segmentation

1.4 Regulatory Environment

2 Industry Chain Analysis

2.1 Industry Chain Analysis

2.2 Heaters for Semiconductor Equipment Raw Materials Analysis

2.3 Heaters for Semiconductor Equipment Production Process

2.4 Heaters for Semiconductor Equipment Cost Structure Analysis

2.4.1 Manufacturing Cost Structure of Heaters for Semiconductor Equipment

2.4.2 Raw Material Cost of Heaters for Semiconductor Equipment

2.4.3 Labor Cost of Heaters for Semiconductor Equipment

2.5 Market Channel Analysis

2.6 Major Downstream Customers Analysis

2.7 Alternative Product Analysis

3 Market Dynamics

3.1 Market Drivers

3.2 Market Constraints and Challenges

3.3 Emerging Market Trends

3.4 PESTEL Analysis

3.4.1 Political

3.4.2 Economic

3.4.3 Social

3.4.4 Technological

3.4.5 Environmental

3.4.6 Legal

3.5 Consumer Insights Analysis

3.6 The Impact of Regional Situation on Heaters for Semiconductor Equipment Industries

3.7 The Impact of Inflation on Heaters for Semiconductor Equipment Industries

3.8 The Transformative Power of AI on Heaters for Semiconductor Equipment Industries

3.9 Economic Development in an Era of Climate Change

4 Market Competitive Landscape

4.1 Global Heaters for Semiconductor Equipment Revenue and Market Share by Manufacturer (2019-2024)

4.2 Global Heaters for Semiconductor Equipment Sales Volume and Market Share by Manufacturer (2019-2024)

4.3 Global Heaters for Semiconductor Equipment Price by Manufacturer (2019-2024)

4.4 Heaters for Semiconductor Equipment Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

4.5 Global Key Manufacturers of Heaters for Semiconductor Equipment, Business Region and Headquarters

4.6 Heaters for Semiconductor Equipment Market Competitive Situation and Trends

4.6.1 Heaters for Semiconductor Equipment Market Concentration Rate

4.6.2 Global 3 and 6 Largest Heaters for Semiconductor Equipment Players Market Share by Revenue

4.7 Industry News

5 Global Heaters for Semiconductor Equipment Market Historical Development by Geographic Region (2019-2024)

5.1 Global Heaters for Semiconductor Equipment Market Historical Sales Volume by Geographic Region (2019-2024)

5.2 Global Heaters for Semiconductor Equipment Market Historical Revenue by Geographic Region (2019-2024)

5.3 North America Heaters for Semiconductor Equipment Market Status by Country (2019-2024)

5.3.1 North America Heaters for Semiconductor Equipment Sales Volume by Country (2019-2024)

5.3.2 North America Heaters for Semiconductor Equipment Revenue by Country (2019-2024)

5.3.3 United States Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.3.4 Canada Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4 Europe Heaters for Semiconductor Equipment Market Status by Country (2019-2024)

5.4.1 Europe Heaters for Semiconductor Equipment Sales Volume by Country (2019-2024)

5.4.2 Europe Heaters for Semiconductor Equipment Revenue by Country (2019-2024)

5.4.3 Germany Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4.4 France Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4.5 United Kingdom Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4.6 Spain Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4.7 Italy Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.4.8 Poland Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5 Asia Pacific Heaters for Semiconductor Equipment Market Status by Country (2019-2024)

5.5.1 Asia Pacific Heaters for Semiconductor Equipment Sales Volume by Country (2019-2024)

5.5.2 Asia Pacific Heaters for Semiconductor Equipment Revenue by Country (2019-2024)

5.5.3 China Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5.4 Japan Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5.5 South Korea Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5.6 Southeast Asia Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5.7 India Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.5.8 Australia Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.6 Latin America Heaters for Semiconductor Equipment Market Status by Country (2019-2024)

5.6.1 Latin America Heaters for Semiconductor Equipment Sales Volume by Country (2019-2024)

5.6.2 Latin America Heaters for Semiconductor Equipment Revenue by Country (2019-2024)

5.6.3 Mexico Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.6.4 Brazil Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.7 Middle East and Africa Heaters for Semiconductor Equipment Market Status by Country (2019-2024)

5.7.1 Middle East and Africa Heaters for Semiconductor Equipment Sales Volume by Country (2019-2024)

5.7.2 Middle East and Africa Heaters for Semiconductor Equipment Revenue by Country (2019-2024)

5.7.3 GCC Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

5.7.4 South Africa Heaters for Semiconductor Equipment Sales Volume, Revenue and Growth (2019-2024)

6 Global Heaters for Semiconductor Equipment Market Historical Development by Product Type (2019-2024)

6.1 Heaters for Semiconductor Equipment Definition by Type

6.2 Global Heaters for Semiconductor Equipment Historical Sales Volume by Product Type (2019-2024)

6.3 Global Heaters for Semiconductor Equipment Historical Revenue by Product Type (2019-2024)

6.4 Global Heaters for Semiconductor Equipment Historical Price by Product Type (2019-2024)

6.5 Global Historical Sales Volume, Revenue and Growth Rate by Product Type (2019-2024)

6.5.1 Global Heaters for Semiconductor Equipment Historical Sales Volume, Revenue and Growth Rate of Ceramic Heaters for Semiconductor Equipment (2019-2024)

6.5.2 Global Heaters for Semiconductor Equipment Historical Sales Volume, Revenue and Growth Rate of Metal Heaters for Semiconductor Equipment (2019-2024)

7 Global Heaters for Semiconductor Equipment Market Historical Development by End User (2019-2024)

7.1 Downstream Market Overview

7.2 Global Heaters for Semiconductor Equipment Historical Sales Volume by End User (2019-2024)

7.3 Global Heaters for Semiconductor Equipment Historical Revenue by End User (2019-2024)

7.4 Global Heaters for Semiconductor Equipment Historical Price by End User (2019-2024)

7.5 Global Historical Sales Volume, Revenue and Growth Rate by End User (2019-2024)

7.5.1 Global Heaters for Semiconductor Equipment Historical Sales Volume, Revenue and Growth Rate of Semiconductor Equipment Company (2019-2024)

7.5.2 Global Heaters for Semiconductor Equipment Historical Sales Volume, Revenue and Growth Rate of Fabs (2019-2024)

8 Leading Companies Profiles

8.1 Sumitomo Electric

8.1.1 Sumitomo Electric Corporation Information

8.1.2 Sumitomo Electric Product Portfolio and Specification

8.1.3 Sumitomo Electric Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.1.4 Sumitomo Electric Business and Markets Served

8.2 NGK Insulators

8.2.1 NGK Insulators Corporation Information

8.2.2 NGK Insulators Product Portfolio and Specification

8.2.3 NGK Insulators Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.2.4 NGK Insulators Business and Markets Served

8.3 MiCo Ceramics Co., Ltd.

8.3.1 MiCo Ceramics Co., Ltd. Corporation Information

8.3.2 MiCo Ceramics Co., Ltd. Product Portfolio and Specification

8.3.3 MiCo Ceramics Co., Ltd. Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.3.4 MiCo Ceramics Co., Ltd. Business and Markets Served

8.4 BOBOO Hitech

8.4.1 BOBOO Hitech Corporation Information

8.4.2 BOBOO Hitech Product Portfolio and Specification

8.4.3 BOBOO Hitech Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.4.4 BOBOO Hitech Business and Markets Served

8.5 CoorsTek

8.5.1 CoorsTek Corporation Information

8.5.2 CoorsTek Product Portfolio and Specification

8.5.3 CoorsTek Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.5.4 CoorsTek Business and Markets Served

8.6 NIBE Industrier AB

8.6.1 NIBE Industrier AB Corporation Information

8.6.2 NIBE Industrier AB Product Portfolio and Specification

8.6.3 NIBE Industrier AB Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.6.4 NIBE Industrier AB Business and Markets Served

8.7 Semixicon

8.7.1 Semixicon Corporation Information

8.7.2 Semixicon Product Portfolio and Specification

8.7.3 Semixicon Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.7.4 Semixicon Business and Markets Served

8.8 Tinicum Incorporated

8.8.1 Tinicum Incorporated Corporation Information

8.8.2 Tinicum Incorporated Product Portfolio and Specification

8.8.3 Tinicum Incorporated Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.8.4 Tinicum Incorporated Business and Markets Served

8.9 KSM Component

8.9.1 KSM Component Corporation Information

8.9.2 KSM Component Product Portfolio and Specification

8.9.3 KSM Component Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.9.4 KSM Component Business and Markets Served

8.10 BACH Resistor Ceramics

8.10.1 BACH Resistor Ceramics Corporation Information

8.10.2 BACH Resistor Ceramics Product Portfolio and Specification

8.10.3 BACH Resistor Ceramics Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.10.4 BACH Resistor Ceramics Business and Markets Served

8.11 Fralock Holdings

8.11.1 Fralock Holdings Corporation Information

8.11.2 Fralock Holdings Product Portfolio and Specification

8.11.3 Fralock Holdings Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.11.4 Fralock Holdings Business and Markets Served

8.12 Cast Aluminum Solutions

8.12.1 Cast Aluminum Solutions Corporation Information

8.12.2 Cast Aluminum Solutions Product Portfolio and Specification

8.12.3 Cast Aluminum Solutions Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.12.4 Cast Aluminum Solutions Business and Markets Served

8.13 Tempco Electric Heater Corporation

8.13.1 Tempco Electric Heater Corporation Corporation Information

8.13.2 Tempco Electric Heater Corporation Product Portfolio and Specification

8.13.3 Tempco Electric Heater Corporation Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.13.4 Tempco Electric Heater Corporation Business and Markets Served

8.14 Technetics Group

8.14.1 Technetics Group Corporation Information

8.14.2 Technetics Group Product Portfolio and Specification

8.14.3 Technetics Group Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.14.4 Technetics Group Business and Markets Served

8.15 Shin-Etsu MicroSi

8.15.1 Shin-Etsu MicroSi Corporation Information

8.15.2 Shin-Etsu MicroSi Product Portfolio and Specification

8.15.3 Shin-Etsu MicroSi Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.15.4 Shin-Etsu MicroSi Business and Markets Served

8.16 Belilove Company-Engineers

8.16.1 Belilove Company-Engineers Corporation Information

8.16.2 Belilove Company-Engineers Product Portfolio and Specification

8.16.3 Belilove Company-Engineers Heaters for Semiconductor Equipment Performance Analysis (2019-2024)

8.16.4 Belilove Company-Engineers Business and Markets Served

9 Global Heaters for Semiconductor Equipment Market Forecast by Product Type and End User (2024-2032)

9.1 Global Heaters for Semiconductor Equipment Market Forecast by Product Type (2024-2032)

9.1.1 Global Heaters for Semiconductor Equipment Sales Volume (K Units), Revenue Forecast and Growth Rate of Ceramic Heaters for Semiconductor Equipment (2024-2032)

9.1.2 Global Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth Rate of Metal Heaters for Semiconductor Equipment (2024-2032)

9.2 Global Heaters for Semiconductor Equipment Market Forecast by End User (2024-2032)

9.2.1 Global Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth Rate of Semiconductor Equipment Company (2024-2032)

9.2.2 Global Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth Rate of Fabs (2024-2032)

10 Global Heaters for Semiconductor Equipment Market Forecast by Geographic Region (2024-2032)

10.1 Global Heaters for Semiconductor Equipment Sales Volume and Revenue Forecast by Geographic Region (2024-2032)

10.2 North America Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.2.1 United States Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.2.2 Canada Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3 Europe Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.1 Germany Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.2 France Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.3 United Kingdom Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.4 Spain Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.5 Italy Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.3.6 Poland Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4 Asia Pacific Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.1 China Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.2 Japan Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.3 South Korea Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.4 Southeast Asia Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.5 India Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.4.6 Australia Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.5 Latin America Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.5.1 Mexico Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.5.2 Brazil Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.6 Middle East and Africa Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.6.1 GCC Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

10.6.2 South Africa Heaters for Semiconductor Equipment Sales Volume, Revenue Forecast and Growth (2024-2032)

11 Appendix

11.1 Methodology

11.2 Research Data Source

11.2.1 Secondary Data

11.2.2 Primary Data

11.2.3 Market Size Estimation

11.2.4 Legal Disclaimer