1. Global Handheld Barcode Scanners Market Overview

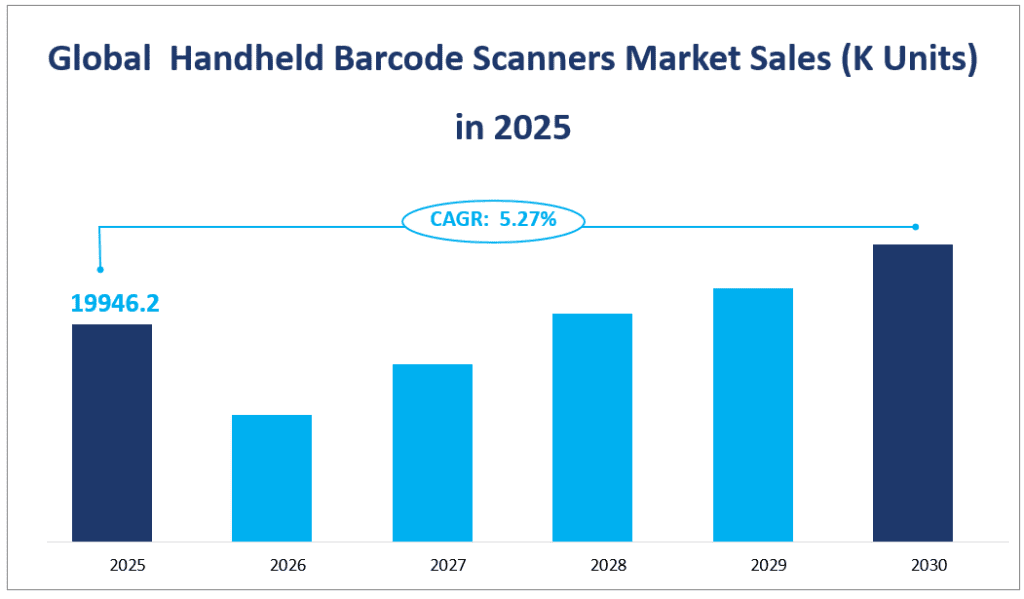

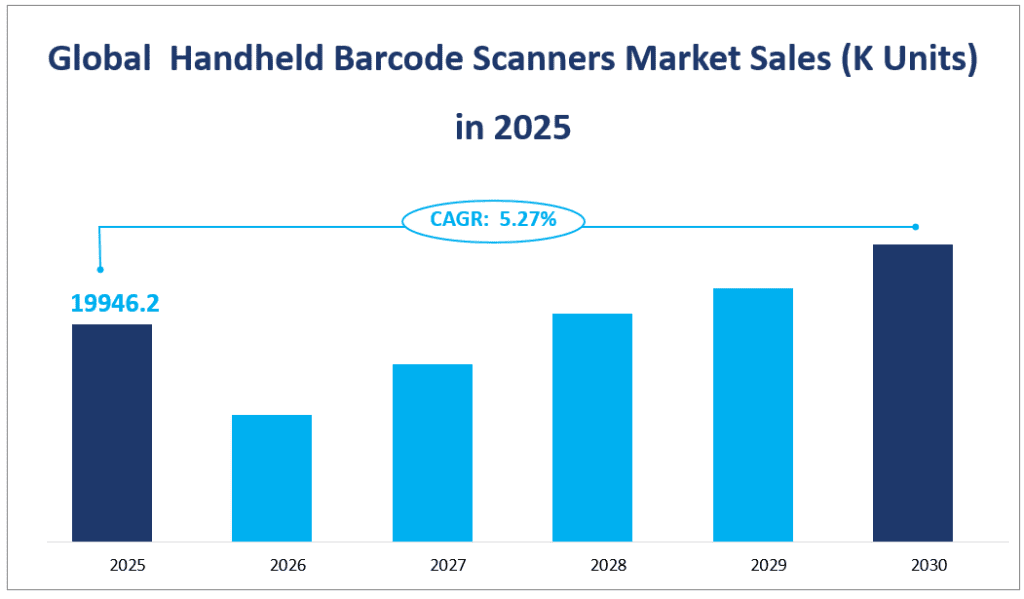

The global handheld barcode scanners market is expected to reach a sales volume of approximately 19,946.2 K Units with a CAGR of 5.27% from 2025 to 2030.

Handheld barcode scanners are essential tools designed to capture and decode barcodes, which are widely used for inventory management, point-of-sale transactions, and data tracking. These devices offer a convenient and efficient way to streamline operations, reduce human error, and enhance productivity. They are particularly valuable in environments where quick and accurate data capture is crucial, such as supermarkets, warehouses, hospitals, and manufacturing plants. The ability to read both one-dimensional and two-dimensional barcodes has further expanded their utility, making them indispensable in modern business operations.

Global Handheld Barcode Scanners Market Sales (K Units) in 2025

2. Driving Factors of Handheld Barcode Scanners Market

The growth of the global handheld barcode scanners market is driven by several key factors. Firstly, the increasing adoption of barcode technology in retail and wholesale sectors is a significant driver. Retailers worldwide are leveraging barcode scanners to manage inventory, track sales, and enhance customer experiences. The ability to quickly scan barcodes at checkout counters not only speeds up transactions but also reduces errors and improves overall operational efficiency.

In the logistics and warehousing industry, handheld barcode scanners play a crucial role in improving inventory management and supply chain visibility. Warehouses can accurately track shipments, manage inventory levels, and streamline operations, leading to cost savings and enhanced productivity. The use of barcode scanners in industrial manufacturing is also on the rise, as they help in tracking production processes, managing quality control, and ensuring compliance with industry standards.

The healthcare sector is another major driver of market growth. Hospitals and healthcare facilities are increasingly using barcode scanners to manage patient records, track medications, and ensure accurate billing. This not only improves patient safety but also enhances the overall efficiency of healthcare operations. Additionally, the growing popularity of mobile payments and digital transactions has further boosted the demand for handheld barcode scanners, as they can read QR codes and other digital barcodes.

3. Limiting Factors of Handheld Barcode Scanners Market

Despite the numerous advantages and growing demand, the market for handheld barcode scanners faces several challenges. One of the primary limiting factors is the high initial investment required for purchasing and implementing barcode scanning systems. Small and medium-sized enterprises (SMEs) may find it difficult to afford the upfront costs, which can act as a barrier to entry.

Technical barriers also pose a challenge. Barcode scanners require sophisticated optical systems, decoding algorithms, and embedded software, which necessitate continuous research and development. Companies with limited R&D capabilities may struggle to keep up with technological advancements, thereby limiting their market competitiveness. Additionally, the need for specialized training to operate and maintain these devices can be a deterrent for some businesses.

Intellectual property issues are another concern. Leading companies in the barcode scanner market hold numerous patents and copyrights, which can create barriers for new entrants. The cost and complexity of navigating intellectual property disputes can be prohibitive for startups and smaller firms, limiting market competition and innovation.

4. Handheld Barcode Scanners Market Segment

Product Types

Among the product types, the 2D Imager Scanners are expected to hold the largest market share, with sales reaching 8,800.3 thousand units. This type of scanner is highly versatile and capable of reading both one-dimensional and two-dimensional barcodes, making it suitable for a wide range of applications from retail to industrial manufacturing. The ability to decode complex QR codes and other matrix barcodes gives 2D Imager Scanners a significant edge in modern business operations, driving their market dominance.

On the other hand, Laser Scanners are expected to have the fastest growth rate, with a projected sales volume of 6,803.7 thousand units by 2025. This type of scanner is known for its durability and ability to read barcodes from a distance, making it ideal for use in logistics and warehousing environments. The increasing demand for efficient inventory management and supply chain optimization is fueling the rapid adoption of Laser Scanners. Their ability to handle large volumes of scanning tasks without compromising accuracy further supports their growth trajectory.

Linear Imager Scanners are also a significant part of the market, with projected sales of 4,342.3 thousand units in 2025. These scanners are particularly popular in retail environments due to their ability to read barcodes quickly and accurately. While they may not have the same versatility as 2D Imager Scanners, their specialized function in reading linear barcodes efficiently makes them a preferred choice for many retailers. The market share of Linear Imager Scanners is expected to remain stable, driven by the consistent demand for reliable scanning solutions in point-of-sale applications.

Analysis of Applications

Retail and Wholesale is projected to be the largest application segment, with sales reaching 7,017.1 thousand units in 2025. This segment includes supermarkets, convenience stores, and other retail environments where barcode scanners are essential for managing inventory and processing transactions. The increasing adoption of barcode scanning technology in retail operations is driven by the need for efficiency, accuracy, and customer satisfaction. Retailers are leveraging handheld barcode scanners to streamline checkout processes, reduce waiting times, and enhance overall operational efficiency.

Logistics and Warehousing is another significant application area, with projected sales of 5,509.2 thousand units by 2025. The growth in this segment is driven by the increasing complexity of supply chains and the need for precise inventory management. Handheld barcode scanners enable warehouse staff to quickly and accurately track shipments, manage inventory levels, and ensure timely delivery of goods. The ability to integrate these scanners with warehouse management systems further enhances their utility, making them indispensable in modern logistics operations.

Industrial Manufacturing is also a key application area, with sales expected to reach 2,978.0 thousand units in 2025. In manufacturing environments, barcode scanners are used to track production processes, manage quality control, and ensure compliance with industry standards. The ability to capture and analyze data in real time helps manufacturers optimize their operations, reduce downtime, and improve overall productivity.

Healthcare is another important application segment, with projected sales of 3,466.7 thousand units in 2025. The use of barcode scanners in healthcare facilities is driven by the need for accurate patient identification, medication tracking, and inventory management. Scanners are used to read barcodes on patient wristbands, medication labels, and medical equipment, ensuring that the right treatments are administered and that inventory levels are accurately tracked. The increasing focus on patient safety and operational efficiency in healthcare settings is driving the rapid adoption of barcode scanning technology.

Market Sales and Share by Segment

| Sales (K Units) in 2025 | Market Share in 2025 | ||

| By Type | Laser Scanner | 6803.7 | 34.11% |

| Linear Imager Scanner | 4342.3 | 21.77% | |

| 2D Imager Scanner | 8800.3 | 44.12% | |

| By Application | Retail and Wholesale | 7017.1 | 35.18% |

| Logistics and Warehousing | 5509.2 | 27.62% | |

| Industrial Manufacturing | 2978.0 | 14.93% | |

| Healthcare | 3466.7 | 17.38% |

5. Regional Handheld Barcode Scanners Market

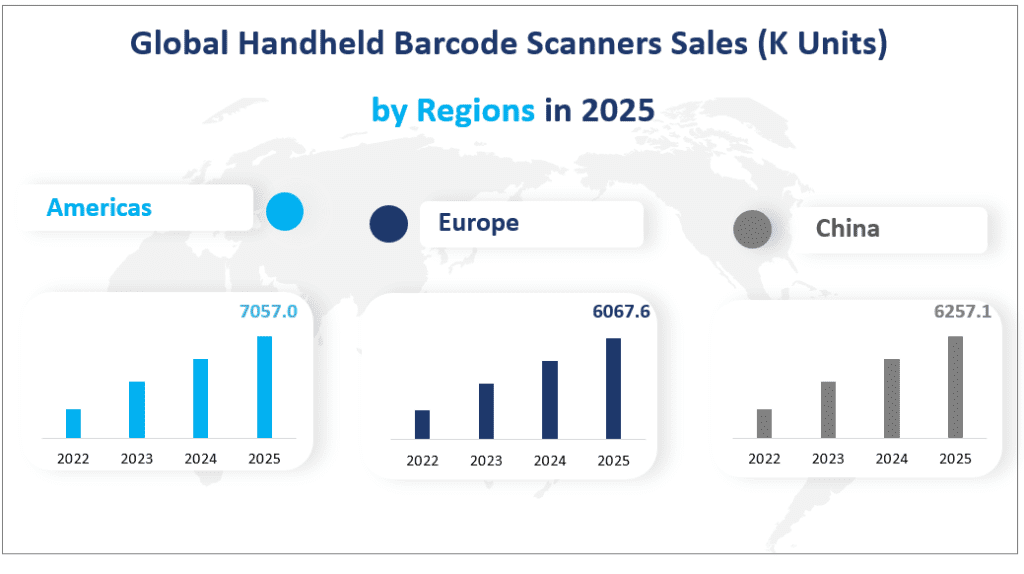

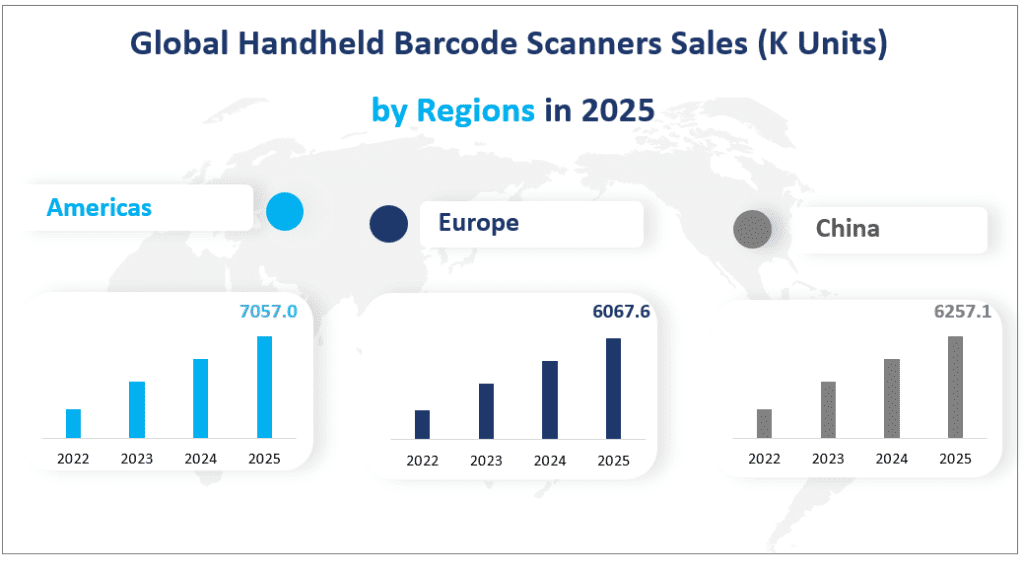

The Americas, primarily driven by the United States and Canada, is expected to remain a significant market for handheld barcode scanners. By 2025, the region is projected to achieve sales of 7,057.0 thousand units. The strong presence of major players, advanced technological infrastructure, and high adoption rates in retail, logistics, and healthcare sectors contribute to its robust market position. The United States, in particular, is a major consumer of barcode scanners, driven by the need for efficient inventory management and customer service in large retail chains and logistics operations.

Europe is another key market, with projected sales of 6,067.6 thousand units by 2025. The region’s market growth is driven by the increasing demand for barcode scanners in retail, healthcare, and manufacturing sectors. Countries like Germany, the UK, and France are major contributors to this growth. The emphasis on improving operational efficiency and reducing human error in various industries has led to the widespread adoption of barcode scanning technology. Additionally, the aging population in Europe has increased the demand for barcode scanners in healthcare settings, further boosting market growth.

The Asia-Pacific region is expected to be the fastest-growing market, with projected sales of 6,257.1 thousand units by 2025. The region’s growth is driven by rapid economic development, increasing urbanization, and the growing adoption of barcode technology in retail, logistics, and manufacturing sectors. China and Japan are major markets within the region, with significant contributions from South Korea, India, and Southeast Asia. The increasing demand for efficient inventory management and supply chain optimization is fueling the adoption of barcode scanners in these countries.

The Middle East & Africa region is also projected to see significant growth, with sales reaching 564.5 thousand units by 2025. The growth in this region is driven by increasing demand for barcode scanners in the healthcare, retail, and logistics sectors. Countries like the UAE, Saudi Arabia, and South Africa are major contributors to this growth. The need for efficient inventory management and improved operational efficiency in various industries is driving the adoption of barcode scanning technology in this region.

Global Handheld Barcode Scanners Sales (K Units) by Regions in 2025

6. Handheld Barcode Scanners Market Top 3 Companies

Company Introduction and Business Overview:

Honeywell is a multinational conglomerate known for its diverse range of products and solutions, including consumer electronics, engineering services, and aerospace systems. Established in 1906, Honeywell has a strong presence in the handheld barcode scanners market, offering a wide range of products designed to meet specific industry needs. The company’s barcode scanners are renowned for their durability, accuracy, and ability to read barcodes in challenging environments.

Products Offered:

Honeywell’s product portfolio includes a variety of handheld barcode scanners, such as the HH480, a low-end 2D image scanner known for its ergonomic design and cost-effectiveness. The company also offers rugged scanners suitable for industrial use, high-density scanners for retail environments, and specialized scanners for healthcare applications. Honeywell’s scanners are designed to provide a long depth of field and high-speed QR code scanning capabilities, ensuring optimal user experience and operational efficiency.

In 2021, Honeywell’s sales revenue from handheld barcode scanners was approximately $300.0 million.

Company Introduction and Business Overview:

Zebra Technologies is a leading provider of computer peripherals, including barcode scanners, label printers, and RFID solutions. Established in 1969, Zebra is known for its innovative and reliable products that help businesses optimize their operations. The company’s barcode scanners are designed to provide clear and accurate insights, enabling real-time decision-making and workflow optimization across various industries.

Products Offered:

Zebra’s product portfolio includes the CS60 Series Companion Scanner, a versatile device that can adapt to different workflows and environments. The scanner can operate both corded and cordless, making it suitable for handheld and hands-free use. Zebra’s scanners are known for their durability, accuracy, and ability to read barcodes in challenging conditions, making them ideal for retail, logistics, and healthcare applications.

In 2021, Zebra Technologies’ sales revenue from handheld barcode scanners was approximately $268.8 million.

Company Introduction and Business Overview:

Datalogic is an Italian electronics company specializing in the manufacture of barcode scanners, mobile computing devices, sensors, and vision systems. Established in 1972, Datalogic is known for its high-quality products and solutions that improve operational efficiency and productivity. The company’s barcode scanners are designed to meet the needs of various industries, including manufacturing, logistics, and healthcare.

Products Offered:

Datalogic’s product portfolio includes the Gryphon 4200 wireless scanner, a versatile device that offers advanced scanning capabilities and user-friendly features. The scanner is equipped with a “soft line of sight” technology that helps operators easily locate and decode barcodes. Datalogic’s scanners are also designed to withstand harsh industrial environments, making them suitable for use in manufacturing and logistics operations.

In 2021, Datalogic’s sales revenue from handheld barcode scanners was approximately $112.8 million.

Major Players

| Company Name | Plants Distribution | Sales Region |

| Honeywell | US | Worldwide |

| Zebra Technologies | US | Worldwide |

| Datalogic | Italy | Worldwide |

| Denso Wave | Japan | Worldwide |

| Cognex | US | Worldwide |

| Code Corporation | US | Worldwide |

| Bluebird | Korea | Worldwide |

| Opticon | US | Worldwide |

| MINDEO | China | Worldwide |

| Zebex | China | Worldwide |

| SICK | Germany | Worldwide |

| Microscan | US | Worldwide |

| CipherLAB | China | Worldwide |

| Newland | China | Worldwide |

| Argox | China | Worldwide |

| SUNLUX IOT | China | Worldwide |

1 Scope of the Report

1.1 Market Introduction

1.2 Years Considered

1.3 Research Objectives

1.4 Market Research Methodology

1.5 Research Process and Data Source

1.6 Economic Indicators

1.7 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Handheld Barcode Scanners Consumption 2016-2026

2.1.2 Handheld Barcode Scanners Consumption CAGR by Region

2.2 Handheld Barcode Scanners Segment by Type

2.2.1 Laser Scanner

2.2.2 Linear Imager Scanner

2.2.3 2D Imager Scanner

2.3 Handheld Barcode Scanners Sales by Type

2.3.1 Global Handheld Barcode Scanners Sales Market Share by Type (2016-2021)

2.3.2 Global Handheld Barcode Scanners Revenue and Market Share by Type (2016-2021)

2.3.3 Global Handheld Barcode Scanners Sale Price by Type (2016-2021)

2.4 Handheld Barcode Scanners Segment by Application

2.4.1 Retail and Wholesale

2.4.2 Logistics and Warehousing

2.4.3 Industrial Manufacturing

2.4.4 Healthcare

2.5 Handheld Barcode Scanners Sales by Application

2.5.1 Global Handheld Barcode Scanners Sales Market Share by Application (2016-2021)

2.5.2 Global Handheld Barcode Scanners Value and Market Share by Application (2016-2021)

3 Global Handheld Barcode Scanners by Players

3.1 Global Handheld Barcode Scanners Sales Market Share by Players

3.1.1 Global Handheld Barcode Scanners Sales by Players (2016-2021)

3.1.2 Global Handheld Barcode Scanners Sales Market Share by Players (2016-2021)

3.2 Global Handheld Barcode Scanners Revenue Market Share by Players

3.2.1 Global Handheld Barcode Scanners Revenue by Players (2016-2021)

3.2.2 Global Handheld Barcode Scanners Revenue Market Share by Players (2016-2021)

3.3 Global Handheld Barcode Scanners Sale Price by Players

3.4 Global Handheld Barcode Scanners Manufacturing Base Distribution, Sales Area, Product Types by Players

3.4.1 Global Handheld Barcode Scanners Manufacturing Base Distribution and Sales Area by Players

3.5 Market Concentration Rate Analysis

3.5.1 Competition Landscape Analysis

3.5.2 Concentration Ratio (CR3, CR5 and CR10) (2020)

3.6 New Products and Potential Entrants

3.7 Mergers & Acquisitions, Expansion

4 Handheld Barcode Scanners by Regions

4.1 Handheld Barcode Scanners by Regions

4.1.1 Global Handheld Barcode Scanners Sales by Regions

4.1.2 Global Handheld Barcode Scanners Value by Regions

4.2 Americas Handheld Barcode Scanners Sales Growth

4.3 APAC Handheld Barcode Scanners Sales Growth

4.4 Europe Handheld Barcode Scanners Sales Growth

4.5 Middle East & Africa Handheld Barcode Scanners Sales Growth

5 Americas

5.1 Americas Handheld Barcode Scanners Sales by Countries

5.1.1 Americas Handheld Barcode Scanners Sales by Countries (2016-2021)

5.1.2 Americas Handheld Barcode Scanners Value by Countries (2016-2021)

5.2 Americas Handheld Barcode Scanners Sales by Types

5.3 Americas Handheld Barcode Scanners Sales by Applications

5.4 United States

5.5 Canada

5.6 Mexico

5.7 Brazil

6 APAC

6.1 APAC Handheld Barcode Scanners Sales by Countries

6.1.1 APAC Handheld Barcode Scanners Sales by Countries

6.1.2 APAC Handheld Barcode Scanners Value by Countries

6.2 APAC Handheld Barcode Scanners Sales by Types

6.3 APAC Handheld Barcode Scanners Sales by Applications

6.4 China

6.5 Japan

6.6 South Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

7 Europe

7.1 Europe Handheld Barcode Scanners Sales by Countries

7.1.1 Europe Handheld Barcode Scanners Sales by Countries

7.1.2 Europe Handheld Barcode Scanners Value by Countries

7.2 Europe Handheld Barcode Scanners Sales by Types

7.3 Europe Handheld Barcode Scanners Sales by Applications

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

8 Middle East & Africa

8.1 Middle East & Africa Handheld Barcode Scanners Sales by Countries

8.1.1 Middle East & Africa Handheld Barcode Scanners Sales by Countries

8.1.2 Middle East & Africa Handheld Barcode Scanners Value by Countries

8.2 Middle East & Africa Handheld Barcode Scanners Sales by Types

8.3 Middle East & Africa Handheld Barcode Scanners Sales by Applications

8.4 Egypt

8.5 South Africa

8.6 Israel

8.7 Turkey

8.8 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.1.1 Growing Demand from Key Regions

9.1.2 Growing Demand from Key Applications and Potential Industries

9.2 Market Challenges and Impact

9.3 Market Trends

10 Marketing, Distributors and Customer

10.1 Sales Channel

10.1.1 Direct Channels

10.1.2 Indirect Channels

10.2 Handheld Barcode Scanners Distributors

10.3 Handheld Barcode Scanners Customer

11 Global Handheld Barcode Scanners Market Forecast

11.1 Global Handheld Barcode Scanners Sales Forecast

11.2 Global Handheld Barcode Scanners Sales Forecast by Regions

11.2.1 Global Handheld Barcode Scanners Forecast by Regions (2021-2026)

11.2.2 Global Handheld Barcode Scanners Value Forecast by Regions 2021-2026

11.3 Handheld Barcode Scanners Market Forecast by Product

11.3.1 Global Handheld Barcode Scanners Sales Forecast by Product 2021-2026

11.3.2 Global Handheld Barcode Scanners Value Forecast by Product 2021-2026

11.3.3 Americas Sales Forecast

11.3.4 APAC Sales Forecast

11.3.5 Europe Sales Forecast

11.3.6 Middle East & Africa Sales Forecast

11.4 Americas Forecast by Countries

11.4.1 United States Market Forecast

11.4.2 Canada Market Forecast

11.4.3 Mexico Market Forecast

11.4.4 Brazil Market Forecast

11.5 APAC Forecast by Countries

11.5.1 China Market Forecast

11.5.2 Japan Market Forecast

11.5.3 South Korea Market Forecast

11.5.4 Southeast Asia Market Forecast

11.5.5 India Market Forecast

11.5.6 Australia Market Forecast

11.6 Europe Forecast by Countries

11.6.1 Germany Market Forecast

11.6.2 France Market Forecast

11.6.3 UK Market Forecast

11.6.4 Italy Market Forecast

11.6.5 Russia Market Forecast

11.7 Middle East & Africa Forecast by Countries

11.7.1 Egypt Market Forecast

11.7.2 South Africa Market Forecast

11.7.3 Israel Market Forecast

11.7.4 Turkey Market Forecast

11.7.5 GCC Countries Market Forecast

11.8 Global Handheld Barcode Scanners Market Forecast by Type

11.9 Global Handheld Barcode Scanners Market Forecast by Application

12 Key Players Analysis

12.1 Competitive Profile

12.2 Honeywell

12.2.1 Company Profiles

12.2.2 Handheld Barcode Scanners Product Introduction

12.2.3 Honeywell Sales, Revenue, Price, Gross Margin 2016-2021

12.3 Zebra Technologies

12.3.1 Company Profiles

12.3.2 Handheld Barcode Scanners Product Introduction

12.3.3 Zebra Technologies Sales, Revenue, Price, Gross Margin 2016-2021

12.4 Datalogic

12.4.1 Company Profiles

12.4.2 Handheld Barcode Scanners Product Introduction

12.4.3 Datalogic Sales, Revenue, Price, Gross Margin 2016-2021

12.5 Denso Wave

12.5.1 Company Profiles

12.5.2 Handheld Barcode Scanners Product Introduction

12.5.3 Denso Wave Sales, Revenue, Price, Gross Margin 2016-2021

12.6 COGNEX

12.6.1 Company Profiles

12.6.2 Handheld Barcode Scanners Product Introduction

12.6.3 COGNEX Sales, Revenue, Price, Gross Margin 2016-2021

12.7 Code Corporation

12.7.1 Company Profiles

12.7.2 Handheld Barcode Scanners Product Introduction

12.7.3 Code Corporation Sales, Revenue, Price, Gross Margin 2016-2021

12.8 Bluebird

12.8.1 Company Profiles

12.8.2 Handheld Barcode Scanners Product Introduction

12.8.3 Bluebird Sales, Revenue, Price, Gross Margin 2016-2021

12.9 Opticon

12.9.1 Company Profiles

12.9.2 Handheld Barcode Scanners Product Introduction

12.9.3 Opticon Sales, Revenue, Price, Gross Margin 2016-2021

12.10 MINDEO

12.10.1 Company Profiles

12.10.2 Handheld Barcode Scanners Product Introduction

12.10.3 MINDEO Sales, Revenue, Price, Gross Margin 2016-2021

12.11 Zebex

12.11.1 Company Profiles

12.11.2 Handheld Barcode Scanners Product Introduction

12.11.3 Zebex Sales, Revenue, Price, Gross Margin 2016-2021

12.12 SICK

12.12.1 Company Profiles

12.12.2 Handheld Barcode Scanners Product Introduction

12.12.3 SICK Sales, Revenue, Price, Gross Margin 2016-2021

12.13 Microscan

12.13.1 Company Profiles

12.13.2 Handheld Barcode Scanners Product Introduction

12.13.3 Microscan Sales, Revenue, Price, Gross Margin 2016-2021

12.14 CipherLAB

12.14.1 Company Profiles

12.14.2 Handheld Barcode Scanners Product Introduction

12.14.3 CipherLAB Sales, Revenue, Price, Gross Margin 2016-2021

12.15 Newland

12.15.1 Company Profiles

12.15.2 Handheld Barcode Scanners Product Introduction

12.15.3 Newland Sales, Revenue, Price, Gross Margin 2016-2021

12.16 Argox

12.16.1 Company Profiles

12.16.2 Handheld Barcode Scanners Product Introduction

12.16.3 Argox Sales, Revenue, Price, Gross Margin 2016-2021

12.17 SUNLUX IOT

12.17.1 Company Profiles

12.17.2 Handheld Barcode Scanners Product Introduction

12.17.3 SUNLUX IOT Sales, Revenue, Price, Gross Margin 2016-2021

13 Research Findings and Conclusion

14 Appendix

14.1 Methodology

14.2 Research Data Source