1. Industrial Ethanol Market Analysis

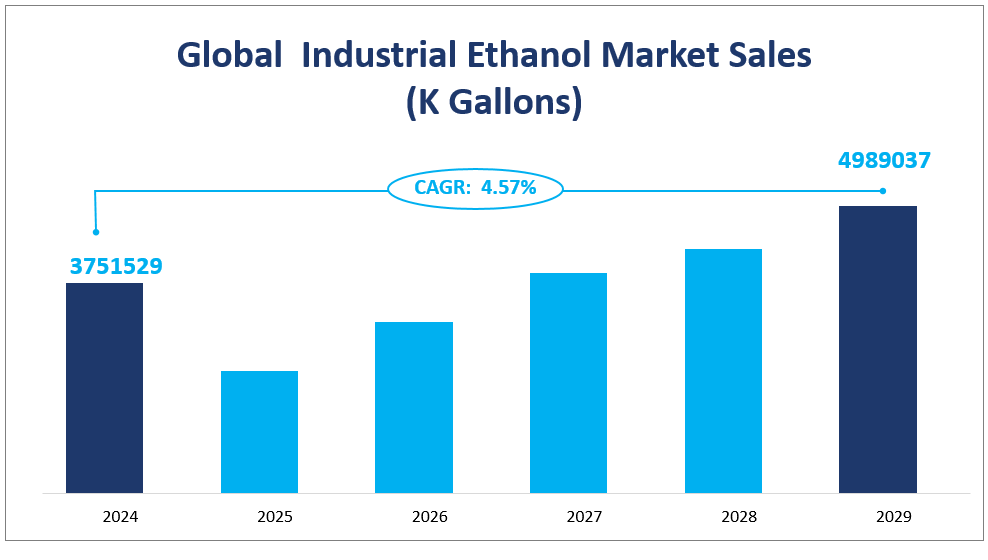

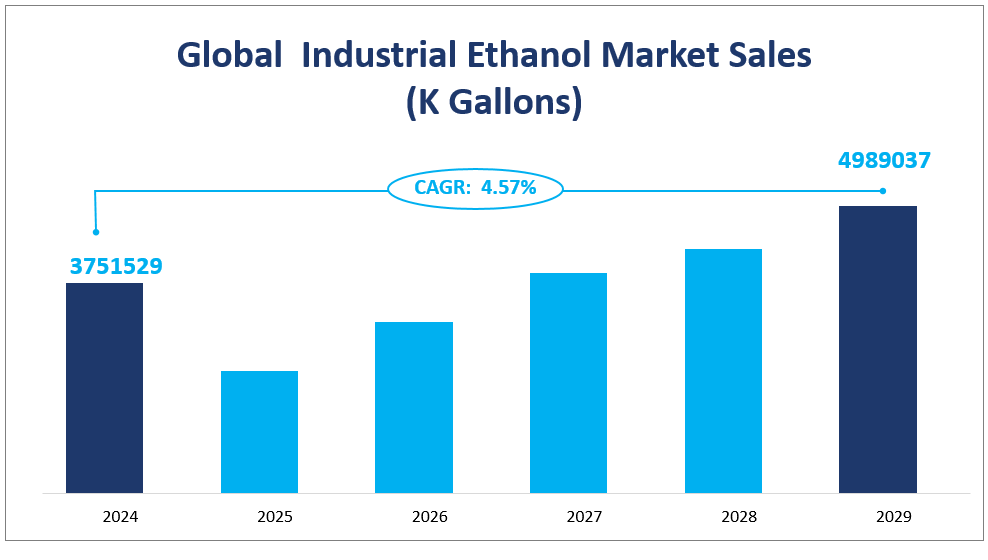

According to Maia Research, the global industrial ethanol market sales will be 3751529 K Gallons in 2024 with a CAGR of 4.57% from 2024 to 2029.

Industrial alcohol, that is, alcohol used in industry, is also called denatured alcohol. The purity of industrial ethanol is generally above 95%. Industrial ethanol is mainly produced in two ways: synthesis and brewing, which contain a certain number of impurities such as methanol, aldehydes, and organic acids. The general cost of synthesis is very low and the ethanol content is high. The general ethanol content of brewed industrial ethanol is greater than or equal to 95%.

Global Industrial Ethanol Market Sales

2. Market Driving Factors

Technology Continues to Improve.

Ethanol manufacturing technology is constantly innovating. According to the development process of technology and technology, ethanol is generally divided into the following categories: the first generation of grain ethanol with corn, wheat, and other grain crops as raw materials; The first generation of non-grain ethanol with cassava, sugar cane, sweet sorghum stalk and other cash crops as raw materials; Second-generation cellulose ethanol using corncob, corn straw and other cellulose materials as raw materials and third-generation microalgae ethanol using carbohydrates in microalgae as raw materials. The second-generation cellulosic ethanol uses cellulosic materials as raw materials to fully exploit the value of biomass resources. At present, microalgae ethanol is still in the research and development stage, and various technical bottlenecks are gradually overcome, which has not yet reached the industrial production level. The continuous improvement of ethanol production technology, product quality, and environmental protection standards, brings new opportunities for the development of industrial ethanol.

3. Market Restraining Factors

Industrial Ethanol is Flammable and Explosive.

Ethanol is flammable and irritating. Its vapor and air can form an explosive mixture, which will cause combustion and explosion when exposed to open flame and high heat. Contact with an oxidant causes a chemical reaction or combustion. In a fire scene, heated containers are in danger of explosion. Its vapor is heavier than air and can spread to a considerable distance at a lower place, and it will catch fire and backfire when encountering a fire source.

Excessive consumption of alcoholic beverages can cause many injuries to the human body, especially the liver, which is an important organ because it helps to remove toxins from the body. Long-term drinking increases the risk of chronic liver inflammation, which is often called cirrhosis. Other adverse reactions include loss of memory and understanding, slow motor response, balance problems and ataxia, blurred vision, and sensory disturbance. The increase in people’s health awareness may hinder demand to a certain extent, thus limiting market growth.

4. Market Segmentation

By Type

Based on type, the industrial ethanol agriculture ethanol market is divided into synthetic ethanol and agriculture ethanol. The agricultural ethanol market accounts for the largest share of 91.33% in 2024. The sale volume of this type is 3413891 K Gallons in 2024.

Agriculture Ethanol is mainly produced by fermentation. The fermentation method can use various agricultural products, forest products, industrial by-products, agricultural by-products, and wild plants containing sugar, starch, or cellulose as raw materials. The whole production process is divided into raw material cooking, saccharifying agent preparation, saccharification (hydrolysis), yeast preparation, fermentation, and distillation. In some countries rich in agricultural and sideline products, fermentation is still the main method to produce ethanol. The production of industrial ethanol is gradually transitioning to bio-based ethanol to reduce dependence on fossil fuels. Agricultural ethanol, as a bio-based fuel, helps reduce dependence on traditional fossil fuels. The growing demand for agricultural ethanol in the biofuels sector, especially in the United States, where 98% of gasoline contains some amount of ethanol, is driving the growth of the agricultural ethanol market.

The synthesis method uses ethylene as raw material to produce ethanol. With the rapid development of the petrochemical industry, the output of ethanol produced by synthetic methods is increasing. However, the ethanol produced by this method is mixed with isomeric higher alcohols, which has a paralyzing effect on people and is not suitable for food, beverage, medicine, and spices. Therefore, even in countries with developed petrochemical industries, fermentation ethanol still occupies a certain proportion. At present, the main synthesis method used in industry is direct hydration of ethylene, that is, hydration of ethylene on a solid catalyst impregnated with phosphoric acid. The obtained dilute ethanol solution needs rectification and purification to remove part of the water and by-products. The highest concentration of ethanol obtained by the ordinary distillation method is only 95.6%, and it can be further processed industrially to finally obtain absolute ethanol with a purity of 99.5%.

By Application

Based on application, the market is segmented into Food & Beverage, Cosmetics & Personal Care, and Chemicals & Solvents, among them, the Chemicals & Solvents industry contributes the largest share of 52.32%, and the sales volume of this industry is 1950795 K Gallons in 2024.

Industrial Ethanol is used to make alcoholic beverages. As a food additive, ethanol can help evenly distribute food coloring, as well as enhance the flavor of food extracts. Industrial Ethanol is a common ingredient in many cosmetics and beauty products. It acts as an astringent to help clean skin, as a preservative in lotions, and to help ensure that lotion ingredients do not separate, and it helps hairspray adhere to the hair. Because industrial ethanol is effective in killing microorganisms like bacteria, fungi, and viruses, it is a common ingredient in many hand sanitizers. Industrial Ethanol mixes easily with water and many organic compounds and makes an effective solvent for use in paints, lacquers, and varnish.

Ethanol is widely used as a solvent because of its good solubility and can dissolve many organic matter and some inorganic matter. In coatings, inks, adhesives, and other industries, ethanol is often used in dilution and cleaning processes. Industrial ethanol is an important raw material for many chemical synthesis reactions, such as the synthesis of vinyl acetate, vinyl chloride, ethyl acetate, and other organic compounds. In the industrial process, ethanol is used as a solvent to produce a variety of chemicals, such as acetaldehyde and ethyl acetate.

Market Sales and Share by Segment

| Market Sales in 2024 | Market Share in 2024 | ||

| By Type | Agriculture Ethanol | 3413891 K Gallons | 91.33% |

| Synthetic Ethanol | 300122 K Gallons | 8.67% | |

| By Application | Food & Beverage | 412668 K Gallons | 11.01% |

| Cosmetics & Personal Care | 1200489 K Gallons | 32.56% | |

| Chemicals & Solvents | 1950795 K Gallons | 52.32% |

5.Regional Market

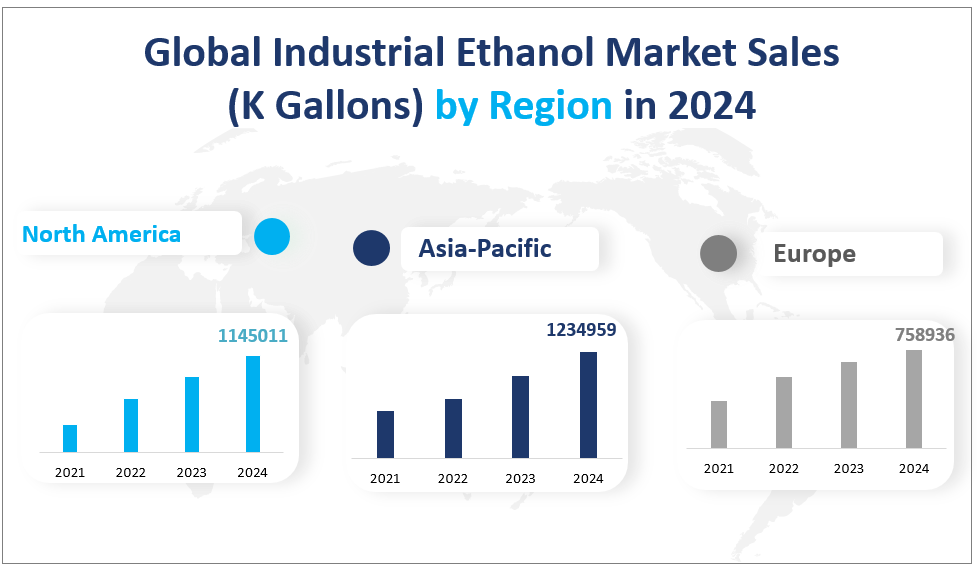

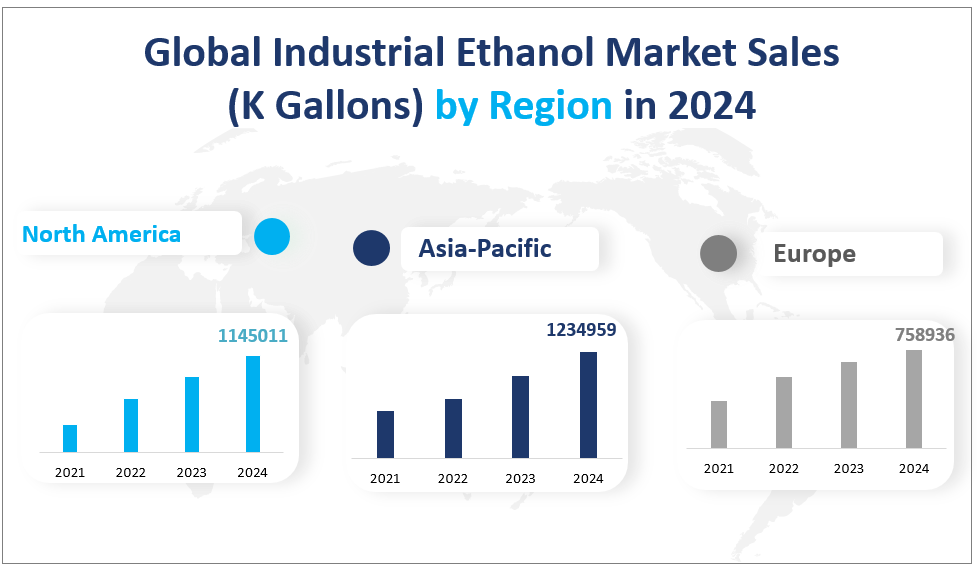

Asia Pacific is one of the fastest-growing regions and the largest market for industrial ethanol. The Asia-Pacific region, especially China and India, is rich in agricultural raw materials such as sugar cane, grains, and corn, which are key feedstocks for the production of industrial ethanol. The high yields and availability of these feedstocks provide a solid foundation for industrial ethanol production in the region. Governments in the Asia-Pacific region are increasingly using methanol as a vehicle fuel, driving the industrial ethanol market. In India, in particular, government policies supported by growing alcohol consumption and production have enabled India to dominate the Asia-Pacific industrial ethanol market. With the rapid economic growth in the Asia-Pacific region, the energy demand is also rising. The increasing use of industrial ethanol as a renewable energy source in fuel production is driving the market. The market sale in North America is 1234959 K Gallons in 2024.

The North American market is dominated by its large population, mass production capacity, and abundant supply of raw materials, which are driving the industrial alcohol market. The region’s economic strength combined with technological advances has placed it at the forefront of industrial ethanol production. North America takes advantage of its resource-rich terrain to contribute to the continued growth and influence of the global industrial ethanol market. The demand for bio-based ethanol is high in North America, especially in the United States, where government regulations require the addition of ethanol to all fuels sold in the US market, which provides policy support for the industrial ethanol market. The market sale in North America is 1145011K Gallons in 2024.

Global Industrial Ethanol Market Sales (K Gallons) by Region in 2024

6.Market Competition

After a period of development, the industry is in a maturity stage. With the continuous upgrading of products, the expansion of downstream industries, and the development of technology and the economy, the market continues to expand. The Industrial Ethanol market is primarily a highly competitive international market. Market concentration is relatively low. The market share of the top three companies in 2020 was 12.39%. Companies with higher market share are basically from the US.

ADM: Archer-Daniels-Midland Company procures, transports, stores, and merchandises agricultural commodities and products. The Company processes oilseeds, corn, milo, oats, barley, peanuts, and wheat. Archer-Daniels-Midland also processes produce products that have primarily two end uses including food or feed ingredients.

Alto Components, Inc.: Alto Ingredients, Inc. (PEIX), formerly known as Pacific Ethanol, Inc., is a leading producer of specialty alcohols and essential ingredients. Alto Ingredients, Inc. is a producer and marketer of specialty alcohols and essential ingredients and the producer of specialty alcohols. The Company is focused on four key markets Health, Home & Beauty, Food & Beverage, Essential Ingredients, and Renewable Fuels.

Cargill: Cargill is one of the largest private companies in the United States. The company has four main operating divisions including agriculture, animal nutrition and protein, food, and financial and industrial services. It is also a producer of industrial alcohol for use in both food and non-food applications. Its distillery products are derived from corn and other grains, including rye, barley, wheat, barley malt, and milo, and its ingredient products are derived from wheat flour.

Sasol: Sasol is a global chemicals and energy company. Sasol harnesses knowledge and expertise to integrate sophisticated technologies and processes into world-scale operating facilities. Sasol safely and sustainably sourced, produced, and marketed a range of high-quality products in 27 countries, creating value for stakeholders.

Grain Processing: Grain Processing Corporation manufactures and markets corn food products. The Company offers maltodextrins, starches, oil, and corn syrup products. Grain Processing serves customers worldwide.

Major Players

| Plant Locations | Market Distribution | |

| ADM | North America, Asia Pacific, Europe | Worldwide |

| Alto Components, Inc. | Europe, North America | Worldwide |

| Cargill | Mainly in Europe | Worldwide |

| MGP Ingredients, Inc. | Mainly in USA | Worldwide |

| Sasol | Mainly in the Middle East and Africa and USA | Worldwide |

| Grain Processing | Mainly in USA | Worldwide |

| CropEnergies AG | Germany and France | Mainly in Europe and the Americas |

| Mitsubishi Chemical Corporation | Mainly in Japan | Mainly in Asia |

| Glacial Lakes Energy | Mainly in USA | Mainly in North America |

| COFCO | Mainly in China and Thailand | Mainly in Asia |

| POET Biorefining | Mainly in USA | Mainly in North America |

| Green Plains | Mainly in USA | Mainly in North America |

| Zhongrong Technology Corporation Ltd. | China | Mainly in China |

| Chippewa Valley Ethanol | USA | Mainly in North America |

Chapter 1 Industrial Ethanol Market Overview

1.1 Industrial Ethanol Definition

1.2 Global Industrial Ethanol Market Size Status and Outlook (2016-2030)

1.3 Global Industrial Ethanol Market Size Comparison by Region (2016-2030)

1.4 Global Industrial Ethanol Market Size Comparison by Type (2016-2030)

1.5 Global Industrial Ethanol Market Size Comparison by Application (2016-2030)

1.6 Global Industrial Ethanol Market Size Comparison by Sales Channel (2016-2030)

1.7 Industrial Ethanol Market Dynamics (COVID-19 Impacts)

1.7.1 Market Drivers/Opportunities

1.7.2 Market Challenges/Risks

1.7.3 Market News (Mergers/Acquisitions/Expansion)

1.7.4 COVID-19 Impacts on Current Market

1.7.5 Post-Strategies of COVID-19 Outbreak

Chapter 2 Industrial Ethanol Market Segment Analysis by Player

2.1 Global Industrial Ethanol Sales and Market Share by Player (2019-2021)

2.2 Global Industrial Ethanol Revenue and Market Share by Player (2019-2021)

2.3 Global Industrial Ethanol Average Price by Player (2019-2021)

2.4 Players Competition Situation & Trends

2.5 Conclusion of Segment by Player

Chapter 3 Industrial Ethanol Market Segment Analysis by Type

3.1 Global Industrial Ethanol Market by Type

3.1.1 Agriculture Ethanol

3.1.2 Synthetic Ethanol

3.2 Global Industrial Ethanol Sales and Market Share by Type (2016-2021)

3.3 Global Industrial Ethanol Revenue and Market Share by Type (2016-2021)

3.4 Global Industrial Ethanol Average Price by Type (2016-2021)

3.5 Conclusion of Segment by Type

Chapter 4 Industrial Ethanol Market Segment Analysis by Application

4.1 Global Industrial Ethanol Market by Application

4.1.1 Food & Beverage

4.1.2 Cosmetics & Personal Care

4.1.3 Chemicals & Solvents

4.2 Global Industrial Ethanol Sales and Market Share by Application (2016-2021)

4.3 Leading Consumers of Industrial Ethanol by Application in 2020

4.4 Conclusion of Segment by Application

Chapter 5 Industrial Ethanol Market Segment Analysis by Sales Channel

5.1 Global Industrial Ethanol Market by Sales Channel

5.1.1 Direct Channel

5.1.2 Distribution Channel

5.2 Global Industrial Ethanol Sales and Market Share by Sales Channel (2016-2021)

5.3 Sales Channel Analysis of Industrial Ethanol

5.3.1 Direct Channel

5.3.2 Distribution Channel

5.4 Conclusion of Segment by Sales Channel

Chapter 6 Industrial Ethanol Market Segment Analysis by Region

6.1 Global Industrial Ethanol Market Size and CAGR by Region (2016-2030)

6.2 Global Industrial Ethanol Sales and Market Share by Region (2016-2021)

6.3 Global Industrial Ethanol Revenue and Market Share by Region (2016-2021)

6.4 North America

6.4.1 North America Market by Country

6.4.2 North America Industrial Ethanol Market Share by Type

6.4.3 North America Industrial Ethanol Market Share by Application

6.4.4 United States

6.4.5 Canada

6.4.6 Mexico

6.5 Europe

6.5.1 Europe Market by Country

6.5.2 Europe Industrial Ethanol Market Share by Type

6.5.3 Europe Industrial Ethanol Market Share by Application

6.5.4 Germany

6.5.5 UK

6.5.6 France

6.5.7 Italy

6.5.8 Russia

6.5.9 Spain

6.6 Asia-Pacific

6.6.1 Asia-Pacific Market by Country

6.6.2 Asia-Pacific Industrial Ethanol Market Share by Type

6.6.3 Asia-Pacific Industrial Ethanol Market Share by Application

6.6.4 China

6.6.5 Japan

6.6.6 South Korea

6.6.7 India

6.6.8 Southeast Asia

6.6.9 Australia

6.7 South America

6.7.1 South America Market by Country

6.7.2 South America Industrial Ethanol Market Share by Type

6.7.3 South America Industrial Ethanol Market Share by Application

6.7.4 Brazil

6.7.5 Argentina

6.7.6 Colombia

6.7.7 Chile

6.8 Middle East & Africa

6.8.1 Middle East & Africa Market by Country

6.8.2 Middle East & Africa Industrial Ethanol Market Share by Type

6.8.3 Middle East & Africa Industrial Ethanol Market Share by Application

6.8.4 Egypt

6.8.5 Saudi Arabia

6.8.6 UAE

6.8.7 South Africa

6.8.8 Nigeria

6.9 Conclusion of Segment by Region

Chapter 7 Profile of Leading Industrial Ethanol Players

7.1 ADM

7.1.1 Company Snapshot

7.1.2 Product/Service Offered

7.1.3 ADM Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.1.4 COVID-19 Impact on ADM

7.2 Alto Components, Inc.

7.2.1 Company Snapshot

7.2.2 Product/Service Offered

7.2.3 Alto Components, Inc. Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.2.4 COVID-19 Impact on Alto Components, Inc.

7.3 Cargill

7.3.1 Company Snapshot

7.3.2 Product/Service Offered

7.3.3 Cargill Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.3.4 COVID-19 Impact on Cargill

7.4 MGP Ingredients, Inc.

7.4.1 Company Snapshot

7.4.2 Product/Service Offered

7.4.3 MGP Ingredients, Inc. Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.4.4 COVID-19 Impact on MGP Ingredients, Inc.

7.5 Sasol

7.5.1 Company Snapshot

7.5.2 Product/Service Offered

7.5.3 Sasol Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.5.4 COVID-19 Impact on Sasol

7.6 Grain Processing

7.6.1 Company Snapshot

7.6.2 Product/Service Offered

7.6.3 Grain Processing Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.6.4 COVID-19 Impact on Grain Processing

7.7 CropEnergies AG

7.7.1 Company Snapshot

7.7.2 Product/Service Offered

7.7.3 CropEnergies AG Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.7.4 COVID-19 Impact on CropEnergies AG

7.8 Mitsubishi Chemical Corporation

7.8.1 Company Snapshot

7.8.2 Product/Service Offered

7.8.3 Mitsubishi Chemical Corporation Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.8.4 COVID-19 Impact on Mitsubishi Chemical Corporation

7.9 Glacial Lakes Energy

7.9.1 Company Snapshot

7.9.2 Product/Service Offered

7.9.3 Glacial Lakes Energy Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.10 COFCO

7.10.1 Company Snapshot

7.10.2 Product/Service Offered

7.10.3 COFCO Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.10.4 COVID-19 Impact on COFCO

7.11 POET Biorefining

7.11.1 Company Snapshot

7.11.2 Product/Service Offered

7.11.3 POET Biorefining Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.11.4 COVID-19 Impact on POET Biorefining

7.12 Green Plains

7.12.1 Company Snapshot

7.12.2 Product/Service Offered

7.12.3 Green Plains Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.12.4 COVID-19 Impact on Green Plains

7.13 Zhongrong Technology Corporation Ltd.

7.13.1 Company Snapshot

7.13.2 Product/Service Offered

7.13.3 Zhongrong Technology Corporation Ltd. Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.14 Chippewa Valley Ethanol

7.14.1 Company Snapshot

7.14.2 Product/Service Offered

7.14.3 Chippewa Valley Ethanol Industrial Ethanol Business Performance (Production, Price, Revenue, Gross Margin and Market Share)

7.14.4 COVID-19 Impact on Chippewa Valley Ethanol

Chapter 8 Upstream and Downstream Analysis of Industrial Ethanol

8.1 Industrial Chain of Industrial Ethanol

8.2 Upstream of Industrial Ethanol

8.2.1 Raw Materials

8.2.2 Labor Cost

8.2.3 Manufacturing Expenses

8.2.4 Manufacturing Cost Structure

8.2.5 Manufacturing Process

8.3 Downstream of Industrial Ethanol

8.3.1 Leading Distributors/Dealers of Industrial Ethanol

8.3.2 Leading Consumers of Industrial Ethanol

Chapter 9 Development Trend of Industrial Ethanol (2021-2030)

9.1 Global Industrial Ethanol Market Size (Sales and Revenue) Forecast (2021-2030)

9.2 Global Industrial Ethanol Market Size and CAGR Forecast by Region (2021-2030)

9.3 Global Industrial Ethanol Market Size and CAGR Forecast by Type (2021-2030)

9.4 Global Industrial Ethanol Market Size and CAGR Forecast by Application (2021-2030)

9.5 Global Industrial Ethanol Market Size Forecast by Sales Channel (2021-2030)

10 Appendix

10.1 Methodology

10.2 Research Data Source

10.2.1 Secondary Data

10.2.2 Primary Data

10.2.3 Market Size Estimation

10.2.4 Legal Disclaimer