1. Carbon Management Software Market Development

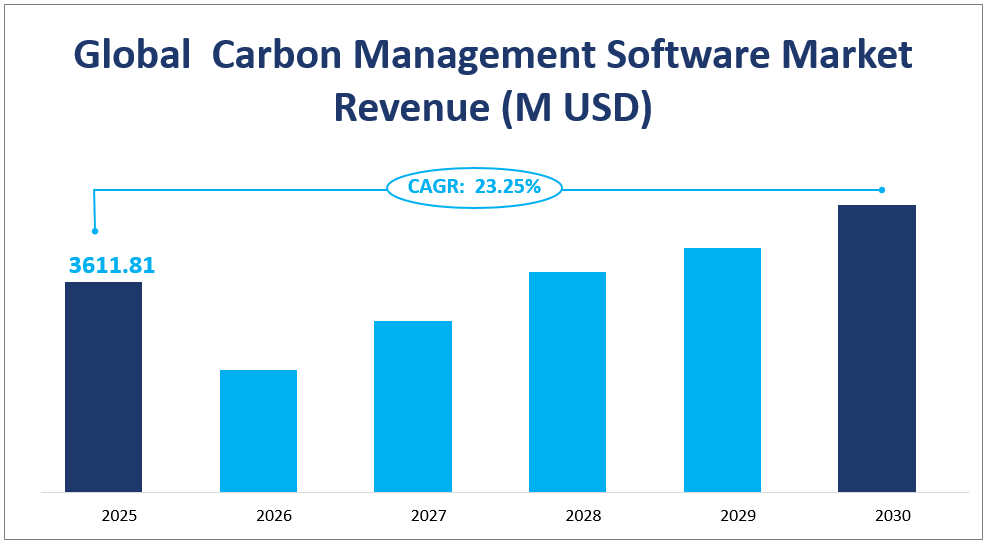

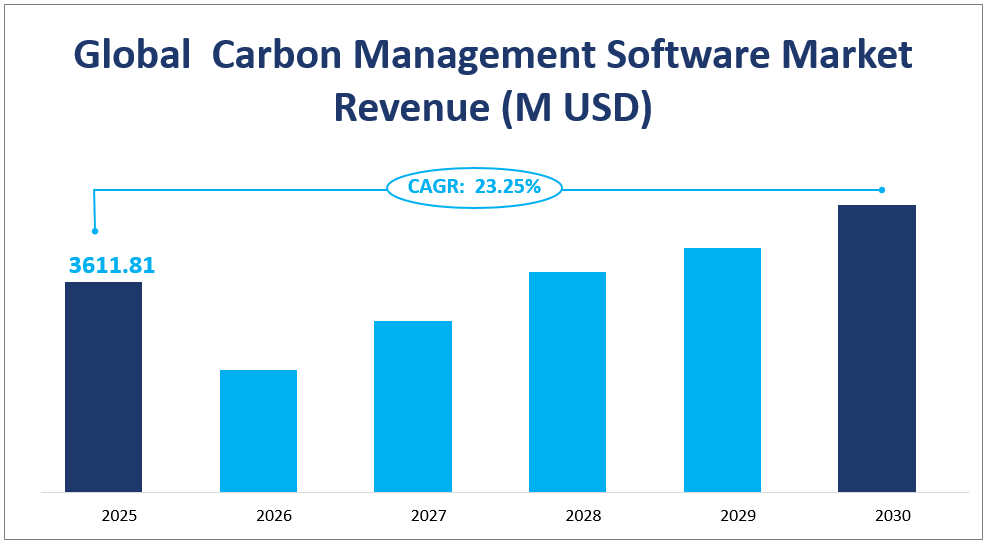

The global Carbon Management Software market size is expected to be $3611.81 million by 2024 with a CAGR of 23.25% from 2025 to 2030.

Carbon Management Software includes a wide range of processes involving emission management. Carbon management helps enterprises and organizations determine their carbon emission levels and take effective carbon utilization measures. The major drivers for the market growth include the launch of new carbon management software and solutions, increasing focus on green initiatives, and the adoption of cloud solutions.

Global Carbon Management Software Market Revenue (M USD)

2. Market Drivers

Innovations in artificial intelligence (AI), machine learning (ML), and big data analytics are enhancing the capabilities of carbon management software, enabling it to track and more accurately predict emissions in real-time, providing actionable insights to businesses and improving decision-making processes. Cloud computing and the Internet of Things (IoT) are playing an important role in the evolution of carbon management software, providing greater flexibility and scalability, and allowing businesses to access their carbon management data from anywhere in the world. As awareness of climate change increases, more industries are expected to adopt carbon management software.

Traditionally, industries such as manufacturing and energy have been the main users of CMS, but other industries such as retail, finance, and technology are beginning to recognize its importance. The demand for regulatory compliance and reporting is growing. Governments around the world are implementing stricter environmental regulations that require companies to report their carbon emissions more accurately and transparently. Carbon management software simplifies this process by automating data collection and reporting.

3. Market Development Constraints

In the future, if the company’s research and development speed cannot keep up with the industry development trend or the update speed of the mobile terminal operating system, the company will not be able to maintain the technological advantage of message push business. In addition, if the company lags behind its competitors in data mining, analysis, and modeling technologies, it will directly affect the quality of data service, thus reducing the company’s ability to acquire customers or causing customer loss. The main factors holding back the market are data security-related issues caused by a high reliance on technology and data integration. Carbon Management Software is related to data functions and can be the target of various cyber-attacks. Therefore, network security and data protection became a problem facing Carbon Management Software.

4. Market Segment

Among different product types, the Count Direct CO2 segment will contribute the largest market share in 2025.

The report mainly divides the market into two segments: Count Direct CO2 and Count Indirect CO2. Direct emissions are emissions from sources that are owned or controlled by the reporting entity. Indirect emissions are emissions that are a consequence of the activities of the reporting entity but occur at sources owned or controlled by another entity.

With the increase in climate regulations and other mandatory disclosures consistent with the TCFD, the growing need for companies to quantify and reduce their carbon emissions is driving the development of carbon management software. The increase in companies fulfilling net zero commitments, with more than 4,000 companies now approving SBTi targets, has increased the demand for carbon management software to help meet these targets. Innovations in artificial intelligence (AI), machine learning (ML), and big data analytics are enhancing the capabilities of carbon management software, enabling it to track and more accurately predict emissions in real-time, providing actionable insights to businesses and improving decision-making processes. The use of real-time data analytics in carbon management is on the rise. Organizations are increasingly seeking software solutions that provide instant insight into their carbon footprint, enabling more flexible decision-making. The Count Direct CO2 segment will contribute a market size of $2648.2 million in 2025 with a share of 73.32%.

By application, the Energy segment will occupy the biggest share in 2025.

The carbon management software is mainly applied in Energy, Manufacturing and Construction, Transportation, and others.

The increasing number of government regulations and policies around the world aimed at reducing carbon emissions is driving organizations to adopt energy management software to ensure compliance and effectively track carbon footprints. Due to the growing demand for energy efficiency and sustainability, the market for carbon management software is growing rapidly in regions such as Asia, the Middle East, and Latin America. Businesses and organizations in these regions are seeking solutions to reduce their carbon footprint and energy consumption. As technological advances make carbon and energy management software solutions more accessible and cost-effective, even small and medium-sized businesses are finding it feasible to adopt carbon and energy management systems. The power and utility industry uses carbon and energy management software to improve resource utilization and optimize energy conservation, carbon, and sustainability investments. This powerful software enables companies to understand and track the potential environmental impacts of their energy production and use. Carbon and energy management software has been a boon to the oil and gas industry, enabling companies to monitor greenhouse gas emissions and calculate the exact emissions generated by each transaction. The energy segment will contribute a market size of $1455.1 million in 2025 with a share of 40.29%.

Market Size and Share by Segment

| Market Size in 2025 | Market Share in 2025 | ||

| By Type | Count Direct CO2 | 2648.2 M USD | 73.32% |

| Count Indirect CO2 | 963.6 M USD | 26.68% | |

| By Application | Energy | 1455.1 M USD | 40.29% |

| Manufacturing and Construction | 592.1 M USD | 16.39% | |

| Transportation | 907.4 M USD | 25.12% |

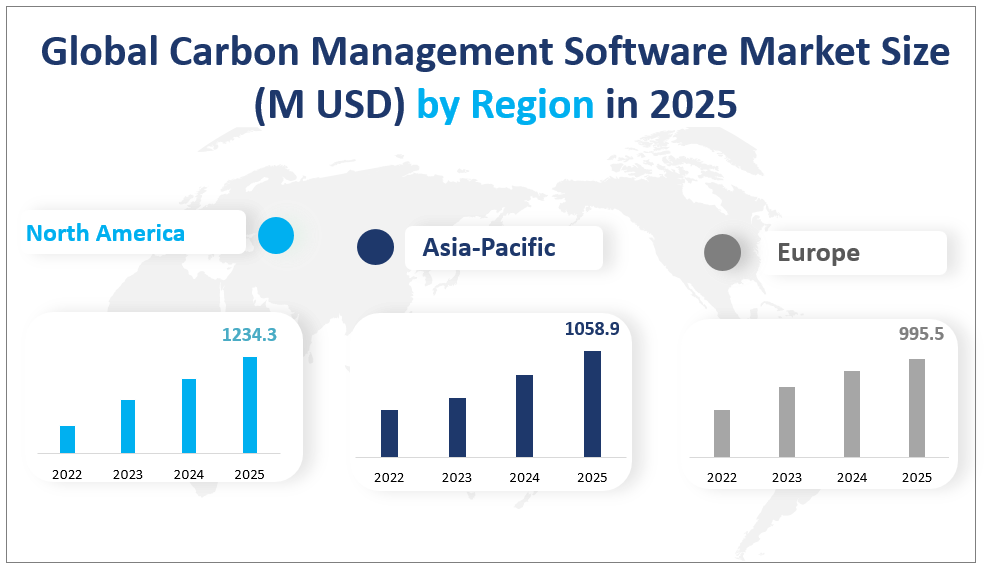

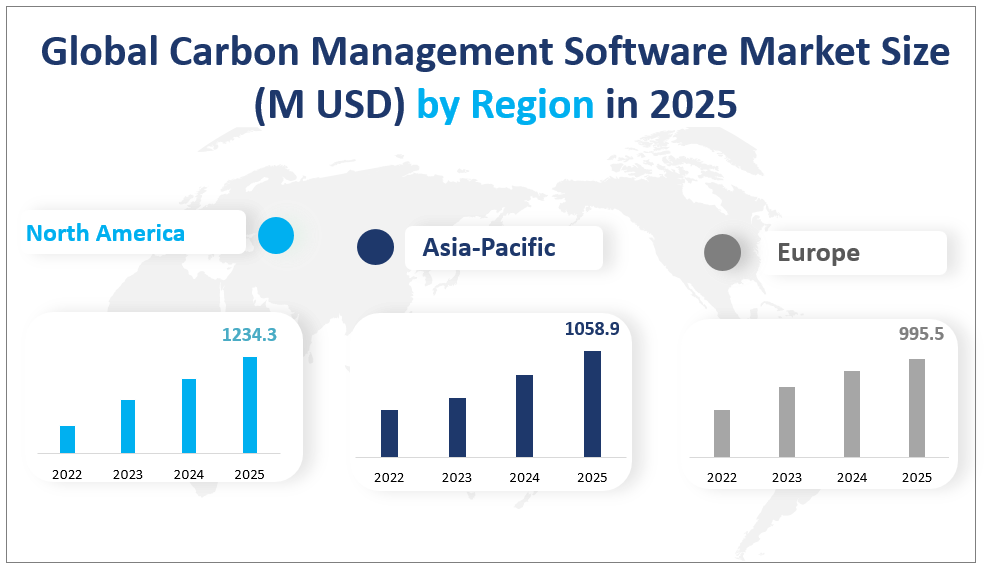

5. Regional Market

North America: North America holds the largest share of the carbon management software market, reaching an annual share of 34.17% in 2025. This growth is driven by strong adoption of carbon management solutions in the United States, where government initiatives, such as those led by the Department of Energy’s Office of Fossil Energy and Carbon Management (FECM), underscore the commitment to advance carbon management technologies through significant investments in research and development. For example, the Bipartisan Infrastructure Act (BIL) sets aside more than $12 billion in funding for carbon management research and development, which is expected to significantly drive demand for carbon management software in North America.

Asia Pacific: With a significant 29.32% market share, the adoption of carbon management software is accelerating in this region due to economic growth, industrialization, and increased environmental awareness. Countries such as China, Japan, and India are investing heavily in renewable energy and carbon reduction initiatives, which are driving the adoption of advanced technologies, including carbon management software, to monitor and reduce emissions across industries.

Global Carbon Management Software Market Size (M USD) by Region

6. Market Competition

Engie SA, IBM Corporation, UL, Sap SE, and Schneider Electric are the five key players in the global Carbon Management Software market. These companies have shown consistent growth in revenue, larger volumes of sales, and a prominent presence in terms of share in the global Carbon Management Software market in the past 5 years.

Engie SA: ENGIE Impact delivers sustainability solutions and services to corporations, cities, and governments across the globe. Comprised of existing and proven ENGIE Group portfolio businesses, ENGIE Impact brings together a wide range of strategic and technical capabilities, to provide a comprehensive offer to support clients in tackling their complex sustainability challenges from strategy to execution. ENGIE Impact is part of the ENGIE Group, a global leader in the zero-carbon transition. ENGIE Group is a French energy company.

IBM: International Business Machines Corporation (IBM) provides computer solutions. The Company offers application, technology consulting and support, process design and operations, cloud, digital workplace, and network services, as well as business resiliency, strategy, and design solutions.

UL: UL works to help customers, purchasers, and policymakers navigate market risk and complexity. UL builds trust in the safety, security, and sustainability of products, organizations, and supply chains – enabling smarter choices and better lives. A robust suite of offerings includes testing, inspection, auditing, certification, marketing claim verification, training, advisory services, and software solutions.

SAP SE: SAP SE is a multinational software company. The Company develops business software, including e-business and enterprise management software, consults on organizational usage of its applications software, and provides training services. SAP markets its products and services worldwide.

Schneider Electric: Schneider Electric SE is a French multinational company providing energy and automation digital solutions for efficiency and sustainability. It addresses homes, buildings, data centers, infrastructure, and industries, by combining energy technologies, real-time automation, software, and services.

7. Market Recent Development

In August 2024, Schneider Electric, a global specialist in digital transformation in energy management and automation, announced its latest progress on the 2021-2025 Sustainability Impact Index (SSI) Program, with an overall SSI score of 6.78 out of 10 as of the second quarter of 2024. Continued progress towards the annual target of 7.40 points. In the second quarter of 2024, Schneider Electric’s performance in the fight against climate change, efficient use of resources, and other aspects have increased significantly, fully demonstrating its professional ability and firm determination to complete the plan with practical actions.

In the fight against climate change, Schneider Electric’s sustainable impact revenue increased to 74% of total global revenue, helping customers worldwide reduce or avoid 605 million tons of carbon emissions, and these figures are expected to reach 80% and 800 million tons, respectively, by 2025.

Major Players

| Major Players |

| Engie SA |

| IBM Corporation |

| UL |

| Sap SE |

| Schneider Electric |

| IHS Markit Ltd |

| Accruent |

| Diligent |

| Enablon |

| Dakota Software |

| Cority Software Inc. |

| Greenstone Ltd |

| Carbonstop |

| Perillon |

| Simble |

1 Carbon Management Software Market Definition and Overview

1.1 Objectives of the Study

1.2 Overview of Carbon Management Software

1.3 Carbon Management Software Market Scope and Market Size Estimation

1.4 Market Segmentation

1.4.1 Types of Carbon Management Software

1.4.2 Applications of Carbon Management Software

1.5 Market Exchange Rate

1.6 Effective Measures to Mitigate GHG Emissions

2 Research Method and Logic

2.1 Methodology

2.2 Research Data Source

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.3 Market Size Estimation

2.2.4 Legal Disclaimer

3 Market Competition Analysis

3.1 Engie SA Market Performance Analysis

3.1.1 Engie SA Basic Information

3.1.2 Product and Service Analysis

3.1.3 Engie SA Value and Gross Margin 2016-2021

3.2 IBM Market Performance Analysis

3.2.1 IBM Basic Information

3.2.2 Product and Service Analysis

3.2.3 IBM Value and Gross Margin 2016-2021

3.3 UL Market Performance Analysis

3.3.1 UL Basic Information

3.3.2 Product and Service Analysis

3.3.3 UL Value and Gross Margin 2016-2021

3.4 Sap SE Market Performance Analysis

3.4.1 Sap SE Basic Information

3.4.2 Product and Service Analysis

3.4.3 Sap SE Value and Gross Margin 2016-2021

3.5 Schneider Electric Market Performance Analysis

3.5.1 Schneider Electric Basic Information

3.5.2 Product and Service Analysis

3.5.3 Schneider Electric Value and Gross Margin 2016-2021

3.6 IHS Markit Ltd Market Performance Analysis

3.6.1 IHS Markit Ltd Basic Information

3.6.2 Product and Service Analysis

3.6.3 IHS Markit Ltd Value and Gross Margin 2016-2021

3.7 Accruent Market Performance Analysis

3.7.1 Accruent Basic Information

3.7.2 Product and Service Analysis

3.7.3 Accruent Value and Gross Margin 2016-2021

3.8 Diligent Market Performance Analysis

3.8.1 Diligent Basic Information

3.8.2 Product and Service Analysis

3.8.3 Diligent Value and Gross Margin 2016-2021

3.9 Enablon Market Performance Analysis

3.9.1 Enablon Basic Information

3.9.2 Product and Service Analysis

3.9.3 Enablon Value and Gross Margin 2016-2021

3.10 Dakota Software Market Performance Analysis

3.10.1 Dakota Software Basic Information

3.10.2 Product and Service Analysis

3.10.3 Dakota Software Value and Gross Margin 2016-2021

3.11 Cority Software Inc. Market Performance Analysis

3.11.1 Cority Software Inc. Basic Information

3.11.2 Product and Service Analysis

3.11.3 Cority Software Inc. Value and Gross Margin 2016-2021

3.12 Greenstone Ltd Market Performance Analysis

3.12.1 Greenstone Ltd Basic Information

3.12.2 Product and Service Analysis

3.12.3 Greenstone Ltd Value and Gross Margin 2016-2021

3.13 Carbonstop Market Performance Analysis

3.13.1 Carbonstop Basic Information

3.13.2 Product and Service Analysis

3.13.3 Carbonstop Value and Gross Margin 2016-2021

3.14 Perillon Market Performance Analysis

3.14.1 Perillon Basic Information

3.14.2 Product and Service Analysis

3.14.3 Perillon Value and Gross Margin 2016-2021

3.15 Simble Market Performance Analysis

3.15.1 Simble Basic Information

3.15.2 Product and Service Analysis

3.15.3 Simble Value and Gross Margin 2016-2021

4 Market Segment by Type, Historical Data and Market Forecasts

4.1 Global Carbon Management Software Market Value by Type 2016-2021

4.2 Global Carbon Management Software Market Value and Growth Rate by Type 2016-2021

4.2.1 Count Direct CO2 — Market Value and Growth Rate

4.2.2 Count Indirect CO2 — Market Value and Growth Rate

4.3 Global Carbon Management Software Market Value Forecast by Type

4.4 Global Carbon Management Software Market Value and Growth Rate by Type Forecast 2021-2026

4.4.1 Count Direct CO2 — Market Value and Growth Rate Forecast

4.4.2 Count Indirect CO2 — Market Value and Growth Rate Forecast

5 Market Segment by Application, Historical Data and Market Forecasts

5.1 Global Carbon Management Software Market Value by Application 2016-2021

5.2 Global Carbon Management Software Market Value and Growth Rate by Application 2016-2021

5.2.1 Energy — Market Value and Growth Rate

5.2.2 Manufacturing and Construction — Market Value and Growth Rate

5.2.3 Transportation — Market Value and Growth Rate

5.3 Global Carbon Management Software Market Value Forecast by Application

5.4 Global Carbon Management Software Market Value and Growth Rate by Application Forecast 2021-2026

5.4.1 Energy — Market Value and Growth Rate Forecast

5.4.2 Manufacturing and Construction — Market Value and Growth Rate Forecast

5.4.3 Transportation — Market Value and Growth Rate Forecast

6 Global Carbon Management Software by Region, Historical Data and Market Forecasts

6.1 Global Carbon Management Software Market Value by Region 2016-2021

6.2 Global Carbon Management Software Market Value and Growth Rate by Region 2016-2021

6.2.1 North America

6.2.2 Europe

6.2.3 Asia Pacific

6.2.4 South America

6.2.5 Middle East and Africa

6.3 Global Carbon Management Software Market Value Forecast by Region 2021-2026

6.4 Global Carbon Management Software Market Value and Growth Rate Forecast by Region 2021-2026

6.4.1 North America

6.4.2 Europe

6.4.3 Asia Pacific

6.4.4 South America

6.4.5 Middle East and Africa

7 United State Market Size Analysis 2016-2026

7.1 United State Carbon Management Software Value and Market Growth 2016-2021

7.2 United State Carbon Management Software Market Value Forecast 2021-2026

8 Canada Market Size Analysis 2016-2026

8.1 Canada Carbon Management Software Value and Market Growth 2016-2021

8.2 Canada Carbon Management Software Market Value Forecast 2021-2026

9 Germany Market Size Analysis 2016-2026

9.1 Germany Carbon Management Software Value and Market Growth 2016-2021

9.2 Germany Carbon Management Software Market Value Forecast 2021-2026

10 UK Market Size Analysis 2016-2026

10.1 UK Carbon Management Software Value and Market Growth 2016-2021

10.2 UK Carbon Management Software Market Value Forecast 2021-2026

11 France Market Size Analysis 2016-2026

11.1 France Carbon Management Software Value and Market Growth 2016-2021

11.2 France Carbon Management Software Market Value Forecast 2021-2026

12 Italy Market Size Analysis 2016-2026

12.1 Italy Carbon Management Software Value and Market Growth 2016-2021

12.2 Italy Carbon Management Software Market Value Forecast 2021-2026

13 Spain Market Size Analysis 2016-2026

13.1 Spain Carbon Management Software Value and Market Growth 2016-2021

13.2 Spain Carbon Management Software Market Value Forecast 2021-2026

14 Russia Market Size Analysis 2016-2026

14.1 Russia Carbon Management Software Value and Market Growth 2016-2021

14.2 Russia Carbon Management Software Market Value Forecast 2021-2026

15 China Market Size Analysis 2016-2026

15.1 China Carbon Management Software Value and Market Growth 2016-2021

15.2 China Carbon Management Software Market Value Forecast 2021-2026

16 Japan Market Size Analysis 2016-2026

16.1 Japan Carbon Management Software Value and Market Growth 2016-2021

16.2 Japan Carbon Management Software Market Value Forecast 2021-2026

17 South Korea Market Size Analysis 2016-2026

17.1 South Korea Carbon Management Software Value and Market Growth 2016-2021

17.2 South Korea Carbon Management Software Market Value Forecast 2021-2026

18 Australia Market Size Analysis 2016-2026

18.1 Australia Carbon Management Software Value and Market Growth 2016-2021

18.2 Australia Carbon Management Software Market Value Forecast 2021-2026

19 Thailand Market Size Analysis 2016-2026

19.1 Thailand Carbon Management Software Value and Market Growth 2016-2021

19.2 Thailand Carbon Management Software Market Value Forecast 2021-2026

20 Brazil Market Size Analysis 2016-2026

20.1 Brazil Carbon Management Software Value and Market Growth 2016-2021

20.2 Brazil Carbon Management Software Market Value Forecast 2021-2026

21 Argentina Market Size Analysis 2016-2026

21.1 Argentina Carbon Management Software Value and Market Growth 2016-2021

21.2 Argentina Carbon Management Software Market Value Forecast 2021-2026

22 Chile Market Size Analysis 2016-2026

22.1 Chile Carbon Management Software Value and Market Growth 2016-2021

22.2 Chile Carbon Management Software Market Value Forecast 2021-2026

23 South Africa Market Size Analysis 2016-2026

23.1 South Africa Carbon Management Software Value and Market Growth 2016-2021

23.2 South Africa Carbon Management Software Market Value Forecast 2021-2026

24 Egypt Market Size Analysis 2016-2026

24.1 Egypt Carbon Management Software Value and Market Growth 2016-2021

24.2 Egypt Carbon Management Software Market Value Forecast 2021-2026

25 UAE Market Size Analysis 2016-2026

25.1 UAE Carbon Management Software Value and Market Growth 2016-2021

25.2 UAE Carbon Management Software Market Value Forecast 2021-2026

26 Saudi Arabia Market Size Analysis 2016-2026

26.1 Saudi Arabia Carbon Management Software Value and Market Growth 2016-2021

26.2 Saudi Arabia Carbon Management Software Market Value Forecast 2021-2026

27 Market Dynamic Analysis and Development Suggestions

27.1 Market Drivers

27.2 Market Development Constraints

27.3 PEST Analysis

27.3.1 Political Factors

27.3.2 Economic Factors

27.3.3 Social Factors

27.3.4 Technological Factors

27.4 Industry Trends Under COVID-19

27.4.1 Risk Assessment on COVID-19

27.4.2 Assessment of the Overall Impact of COVID-19 on the Industry

27.4.3 Pre COVID-19 and Post COVID-19 Market Scenario

27.5 Market Entry Strategy Analysis

27.5.1 Market Definition

27.5.2 Client

27.5.3 Price

27.6 Advice on Entering the Market