1.Global Chemical Peel Market Overview

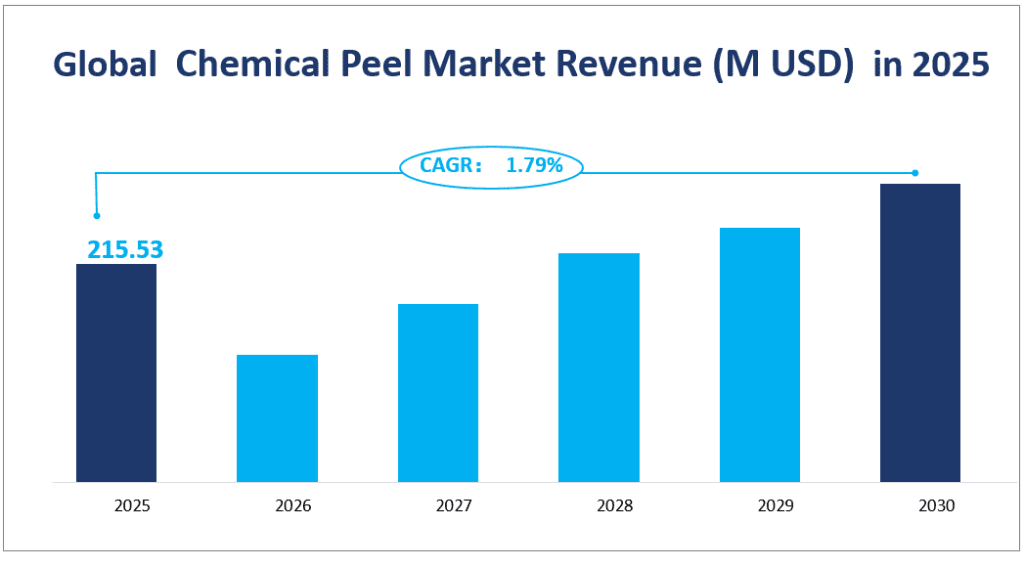

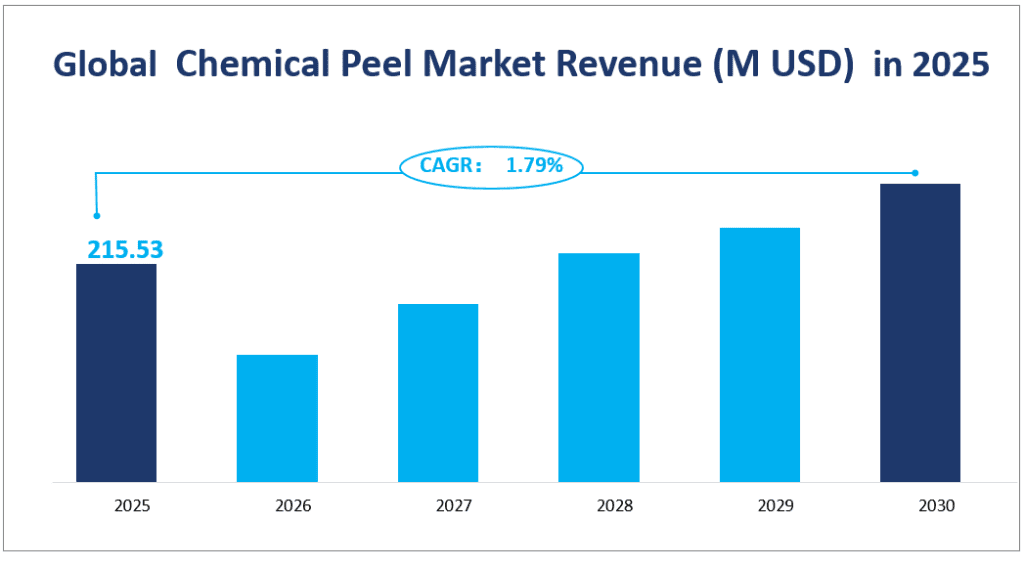

The global chemical peel market is projected to reach a revenue of $215.53 million in 2025 with a CAGR of 1.79% from 2025 to 2030.

A chemical peel is a cosmetic procedure that involves the application of a chemical solution to the skin to remove its top layers. This process promotes the growth of new, healthier skin, resulting in a smoother and more youthful appearance. Chemical peels are commonly used to treat various skin conditions, including acne, fine lines, wrinkles, and hyperpigmentation. They can be categorized into different types based on their strength and application, such as facial peels and other specialized peels.

Global Chemical Peel Market Revenue (M USD) in 2025

2. Driving Factors of Chemical Peel Market

Increasing Consumer Awareness: The rising awareness of skincare treatments and the benefits of chemical peels has significantly contributed to market growth. Consumers are becoming more educated about the advantages of these procedures in addressing various skin concerns, leading to increased demand.

Aging Population: The global increase in the elderly population has created a larger market for anti-aging treatments. Chemical peels are particularly effective in reducing the appearance of fine lines and wrinkles, making them an attractive option for older individuals seeking to maintain a youthful appearance.

Medical Tourism: The rise in medical tourism has also played a role in boosting the chemical peel market. Many countries, especially those in Asia, have become popular destinations for cosmetic procedures due to their advanced medical facilities and lower costs. This trend has increased the overall demand for chemical peels globally.

Technological Advancements: Innovations in chemical peel formulations and application techniques have improved the efficacy and safety of these procedures. Advanced formulations now offer better results with minimal downtime, making them more appealing to consumers.

3. Limiting Factors of Chemical Peel Market Growth

Product Formulation Challenges: Developing effective and safe chemical peel market formulations requires significant research and development efforts. Ensuring that these products meet regulatory standards and deliver consistent results can be a challenge for manufacturers.

Counterfeit Products: The presence of counterfeit skincare products in the market poses a significant threat to the growth of the legitimate chemical peel market. These counterfeit products not only undermine the market but also pose risks to consumer safety.

Regulatory Hurdles: The lack of uniform regulatory structures and transparency in patent protection laws can hinder the growth of the chemical peel market. Companies often face difficulties in navigating complex regulatory environments, which can delay product launches and limit market expansion.

Declining R&D Investments: In some cases, companies may reduce their investments in research and development due to economic uncertainties or shifting priorities. This can slow down the innovation process and limit the introduction of new and improved chemical peel market products.

4. Analysis of Chemical Peel Market Segment

Product Types

Facial peels are the most prominent product type within the chemical peel market. These peels are specifically designed to address a variety of facial skin issues, including fine lines, wrinkles, acne scars, and hyperpigmentation. In 2025, facial peels are expected to generate a revenue of $151.74 million, accounting for approximately 70.40% of the total market revenue. This dominant market share is attributed to the high demand for facial rejuvenation treatments and the effectiveness of facial peels in delivering visible results with minimal downtime.

Other peels encompass a range of chemical peel solutions designed for various parts of the body beyond the face. These peels are used to treat skin conditions such as hyperpigmentation, acne, and signs of aging on areas like the neck, hands, and chest. In 2025, the revenue generated by other peels is projected to be $63.79 million, representing 29.60% of the total market revenue.

Chemical Peel Market by Application in 2025

Dermatology clinics are the leading application area for chemical peels, driven by the high demand for professional skincare treatments and the expertise of dermatologists in administering these procedures. In 2025, the sales of chemical peels in dermatology clinics are projected to reach 3,760,000 units, accounting for approximately 79.77% of the total market sales. This dominant market share is attributed to the growing consumer preference for specialized skincare treatments and the increasing number of dermatology clinics worldwide.

Hospitals and recreation centers represent another significant application area for chemical peels. These facilities often offer a range of cosmetic and therapeutic treatments, including chemical peels, to address various skin conditions and aesthetic concerns. In 2025, the sales of chemical peels in hospitals and recreation centers are projected to reach 953,500 units, representing 20.23% of the total market sales.

| Market Revenue (M USD) in 2025 | Market Share in 2025 | ||

| By Type | Facial Peels | 151.74 | 70.40% |

| Other Peels | 63.79 | 29.60% | |

| Market Sales (K Units) in 2025 | Market Share in 2025 | ||

| By Application | Dermatology clinics | 3760.0 | 79.77% |

| Hospitals and recreation centers | 953.5 | 20.23% |

5. Regional Chemical Peel Market

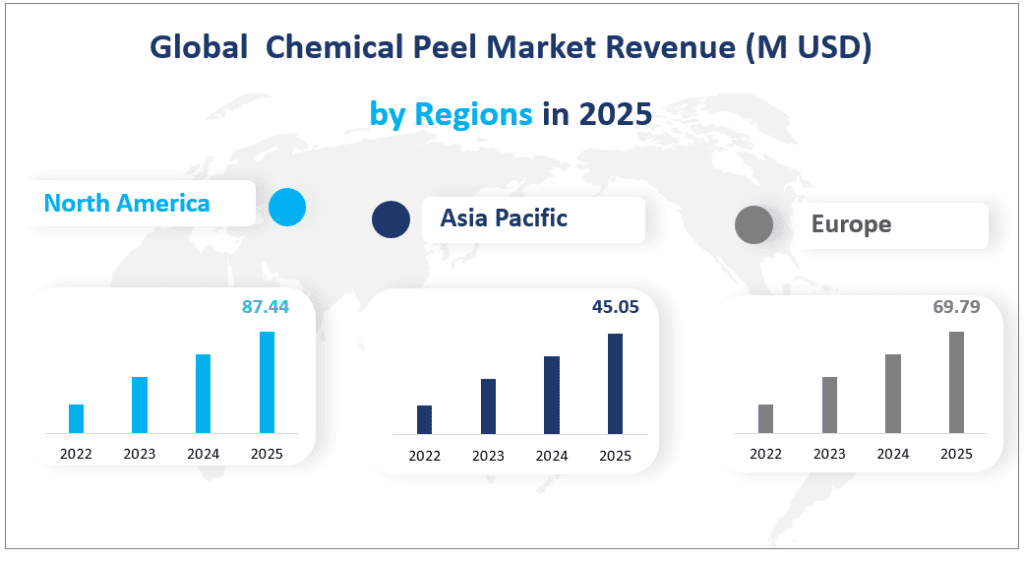

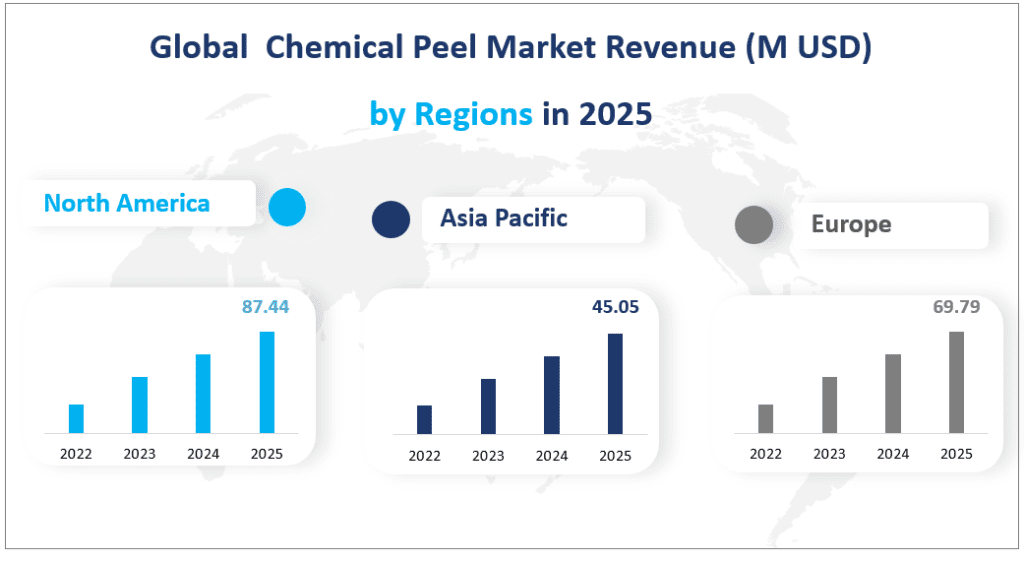

North America remains the largest regional market for chemical peels, driven by a high demand for advanced skincare treatments and a robust healthcare infrastructure. In 2025, the region is projected to generate a revenue of $87.44 million. The United States, in particular, is a key driver of this market, with a strong presence of leading manufacturers and high consumer awareness of cosmetic procedures.

Europe is the second-largest regional market for chemical peels, with a projected revenue of $69.79 million in 2025. The region’s market is driven by a high demand for cosmetic treatments, particularly in countries like Germany, France, and the UK. European consumers are known for their preference for high-quality skincare products and procedures, which has led to a steady growth in the chemical peel market.

The Asia-Pacific region is the fastest-growing market for chemical peels, driven by rapid economic development, increasing disposable incomes, and a growing demand for cosmetic treatments. In 2025, the region is projected to generate a revenue of $45.05 million.

The Middle East and Africa region is another growing market for chemical peels, with a projected revenue of $7.14 million in 2025. The region’s market is driven by increasing disposable incomes, a growing demand for cosmetic treatments, and a significant presence of dermatology clinics in countries like Turkey and the GCC countries.

Global Chemical Peel Market Revenue (M USD) by Regions in 2025

6. Analysis of the Top 3 Companies in the Chemical Peel Market

Company Introduction and Business Overview:

PCA Skin is a leading provider of chemical peel products, with a strong focus on developing innovative and effective skincare solutions. Established in 1990, the company has a global presence and is known for its high-quality formulations and professional-grade treatments. PCA Skin’s products are designed to address a variety of skin conditions, including acne, hyperpigmentation, and signs of aging.

Products Offered:

PCA Skin offers a wide range of chemical peel products, including PCA PEEL© HYDROQUINONE FREE, which is ideal for sensitive skin types and those allergic to hydroquinone. The company’s products are formulated with key ingredients such as lactic acid, salicylic acid, citric acid, and kojic acid, which help to rejuvenate and improve the appearance of the skin.

In 2020, PCA Skin generated a revenue of $35.26 million.

Company Introduction and Business Overview:

SkinMedica is a renowned company in the skincare industry, specializing in the development and marketing of advanced skincare products. Established in 2000, the company is known for its high-quality formulations and commitment to innovation. SkinMedica’s products are designed to address a variety of skin conditions, including acne, hyperpigmentation, and signs of aging.

Products Offered:

SkinMedica offers a range of chemical peel products, including the Illuminize Peel®, which is designed to provide vibrant and radiant-looking skin with minimal downtime. The company’s products are formulated with key ingredients such as glycolic acid, salicylic acid, and lactic acid, which help to rejuvenate and improve the appearance of the skin.

In 2020, SkinMedica generated a revenue of $28.72 million.

Company Introduction and Business Overview:

Skin Tech Pharma Group is a leading company in the chemical peel market, specializing in the development and manufacturing of high-quality skincare products. Established in 1996, the company is based in Spain and has a global presence. Skin Tech Pharma Group is known for its commitment to innovation and the development of unique formulations that address a variety of skin conditions.

Products Offered:

Skin Tech Pharma Group offers a range of chemical peel products, including the Easy Droxy Versicolor Peel, which is designed to treat young skin problems such as acne and early photo-aging. The company’s products are formulated with key ingredients such as alpha hydroxy acids and kojic acid, which help to rejuvenate and improve the appearance of the skin.

In 2020, Skin Tech Pharma Group generated a revenue of $16.89 million.

Major Players

| Company Name | Plants Distribution | Sales Region |

| PCA Skin | Mainly in North America | Worldwide |

| SkinMedica | Mainly in North America | Worldwide |

| Skin Tech Pharma Group | Mainly in Europe (Spain) | Worldwide |

| Dermaceutic | Mainly in Europe (Ireland) | Mainly in Europe, North America |

| Philosophy Inc. | Mainly in North America | Mainly in North America |

| Obagi Cosmeceuticals | Mainly in US | Mainly in North America |

| Olay | Mainly in North America, Asia | Worldwide |

| Perfect Image | Mainly in US | Mainly in North America |

| ASDM Beverly Hills | Mainly in US | Mainly in North America |

| Image Skincare | Mainly in US | Mainly in North America, Europe |

| La Roche-Posay | Mainly in North America (Canada) | Mainly in North America and Europe |

| Glytone | Mainly in US | Mainly in US |

| OZNaturals | Mainly in US | Mainly in North America |

Chapter 1: Study Coverage

1.1 Chemical Peel Product Introduction

1.2 Market Segments

1.3 Key Manufacturers Covered

1.4 Market by Type

1.4.1 Global Chemical Peel Market Size Growth Rate by Type

1.4.2 Facial Peels

1.4.3 Other Peels

1.5 Market by Application

1.5.1 Global Chemical Peel Market Size Growth Rate by Application

1.5.2 Dermatology Clinics

1.5.3 Hospitals and Recreation Centers

1.6 Study Objectives

1.7 Years Considered

Chapter 2: Executive Summary

2.1 Global Chemical Peel Market Size

2.1.1 Global Chemical Peel Revenue

2.1.2 Global Chemical Peel Sales

2.2 Chemical Peel Growth Rate by Region

2.2.1 Global Chemical Peel Sales by Region

2.2.2 Global Chemical Peel Revenue by Region

Chapter 3: Breakdown Data by Manufacturer

3.1 Chemical Peel Sales by Manufacturer

3.1.1 Chemical Peel Sales by Manufacturer

3.1.2 Chemical Peel Sales Market Share by Manufacturer

3.2 Chemical Peel Revenue by Manufacturer

3.2.1 Chemical Peel Revenue by Manufacturer

3.2.2 Chemical Peel Revenue Share by Manufacturer

3.2.3 Global Market Concentration Ratio (CR5 and HHI)

3.3 Chemical Peel Price by Manufacturer

3.4 Chemical Peel Manufacturing Base Distribution, Product Types

3.4.1 Chemical Peel Manufacturers Manufacturing Base Distribution, Headquarters

3.4.2 Manufacturers Chemical Peel Business Distribution

3.5 Manufacturers Mergers & Acquisitions, Expansion Plans

Chapter 4: Breakdown Data by Type

4.1 Global Chemical Peel Sales by Type

4.2 Global Chemical Peel Revenue by Type

4.3 Chemical Peel Price by Type

Chapter 5: Breakdown Data by Application

5.1 Global Chemical Peel Breakdown Data by Application

Chapter 6: North America

6.1 North America Chemical Peel by Country

6.1.1 North America Chemical Peel Sales by Country

6.1.2 North America Chemical Peel Revenue by Country

6.1.3 United States

6.1.4 Canada

6.1.5 Mexico

6.2 North America Chemical Peel by Type

6.3 North America Chemical Peel by Application

Chapter 7: Europe

7.1 Europe Chemical Peel by Country

7.1.1 Europe Chemical Peel Sales by Country

7.1.2 Europe Chemical Peel Revenue by Country

7.1.3 Germany

7.1.4 France

7.1.5 UK

7.1.6 Italy

7.1.7 Russia

7.2 Europe Chemical Peel by Type

7.3 Europe Chemical Peel by Application

Chapter 8: Asia Pacific

8.1 Asia Pacific Chemical Peel by Country

8.1.1 Asia Pacific Chemical Peel Sales by Country

8.1.2 Asia Pacific Chemical Peel Revenue by Country

8.1.3 China

8.1.4 Japan

8.1.5 Korea

8.1.6 India

8.1.7 Australia

8.1.8 Indonesia

8.1.9 Malaysia

8.1.10 Philippines

8.1.11 Thailand

8.1.12 Vietnam

8.1.13 Singapore

8.2 Asia Pacific Chemical Peel by Type

8.3 Asia Pacific Chemical Peel by Application

Chapter 9: Central & South America

9.1 Central & South America Chemical Peel by Country

9.1.1 Central & South America Chemical Peel Sales by Country

9.1.2 Central & South America Chemical Peel Revenue by Country

9.1.3 Brazil

9.1.4 Argentina

9.2 Central & South America Chemical Peel by Type

9.3 Central & South America Chemical Peel by Application

Chapter 10: Middle East and Africa

10.1 Middle East and Africa Chemical Peel by Country

10.1.1 Middle East and Africa Chemical Peel Sales by Country

10.1.2 Middle East and Africa Chemical Peel Revenue by Country

10.1.3 GCC Countries

10.1.4 Turkey

10.1.5 Egypt

10.1.6 South Africa

10.2 Middle East and Africa Chemical Peel by Type

10.3 Middle East and Africa Chemical Peel by Application

Chapter 11: Company Profiles

11.1 PCA Skin

11.1.1 Company Profiles

11.1.2 Product Introduction

11.1.3 Sales Data (2015-2020)

11.2 SkinMedica

11.2.1 Company Profiles

11.2.2 Product Introduction

11.2.3 Sales Data (2015-2020)

11.3 Skin Tech Pharma Group

11.3.1 Company Profiles

11.3.2 Product Introduction

11.3.3 Sales Data (2015-2020)

11.4 Dermaceutic

11.4.1 Company Profiles

11.4.2 Product Introduction

11.4.3 Sales Data (2015-2020)

11.5 Philosophy Inc.

11.5.1 Company Profiles

11.5.2 Product Introduction

11.5.3 Sales Data (2015-2020)

11.6 Obagi Cosmeceuticals

11.6.1 Company Profiles

11.6.2 Product Introduction

11.6.3 Sales Data (2015-2020)

11.7 Olay

11.7.1 Company Profiles

11.7.2 Product Introduction

11.7.3 Sales Data (2015-2020)

11.8 Perfect Image

11.8.1 Company Profiles

11.8.2 Product Introduction

11.8.3 Sales Data (2015-2020)

11.9 ASDM Beverly Hills

11.9.1 Company Profiles

11.9.2 Product Introduction

11.9.3 Sales Data (2015-2020)

11.10 Image Skincare

11.10.1 Company Profiles

11.10.2 Product Introduction

11.10.3 Sales Data (2015-2020)

11.11 La Roche-Posay

11.11.1 Company Profiles

11.11.2 Product Introduction

11.11.3 Sales Data (2015-2020)

11.12 Glytone

11.12.1 Company Profiles

11.12.2 Product Introduction

11.12.3 Sales Data (2015-2020)

11.13 OZNaturals

11.13.1 Company Profiles

11.13.2 Product Introduction

11.13.3 Sales Data (2015-2020)

Chapter 12: Future Forecast

12.1 Chemical Peel Market Forecast by Region

12.1.1 Global Chemical Peel Sales Forecast by Region

12.1.2 Global Chemical Peel Revenue Forecast by Region

12.2 Chemical Peel Market Forecast by Type

12.2.1 Global Chemical Peel Sales Forecast by Type

12.2.2 Global Chemical Peel Revenue Forecast by Type

12.3 Chemical Peel Market Forecast by Application

12.4 North America Chemical Peel Forecast

12.5 Europe Chemical Peel Forecast

12.6 Asia Pacific Chemical Peel Forecast

12.7 Central & South America Chemical Peel Forecast

12.8 Middle East and Africa Chemical Peel Forecast

Chapter 13: Market Opportunities, Challenges, Risks and Influences Factors Analysis

13.1 Market Opportunities and Drivers

13.2 Market Challenges

13.3 Market Risks/Restraints

13.4 Porter’s Five Forces Analysis

Chapter 14: Value Chain and Sales Channels Analysis

14.1 Value Chain Analysis

14.2 Chemical Peel Customers

14.3 Sales Channels Analysis

14.3.1 Sales Channels

14.3.2 Distributors

Chapter 15: Research Findings and Conclusion

Chapter 16: Appendix

16.1 Methodology

16.2 Research Data Source