1. Analyse des revenus et de la croissance du marché mondial des logiciels de cockpit numérique

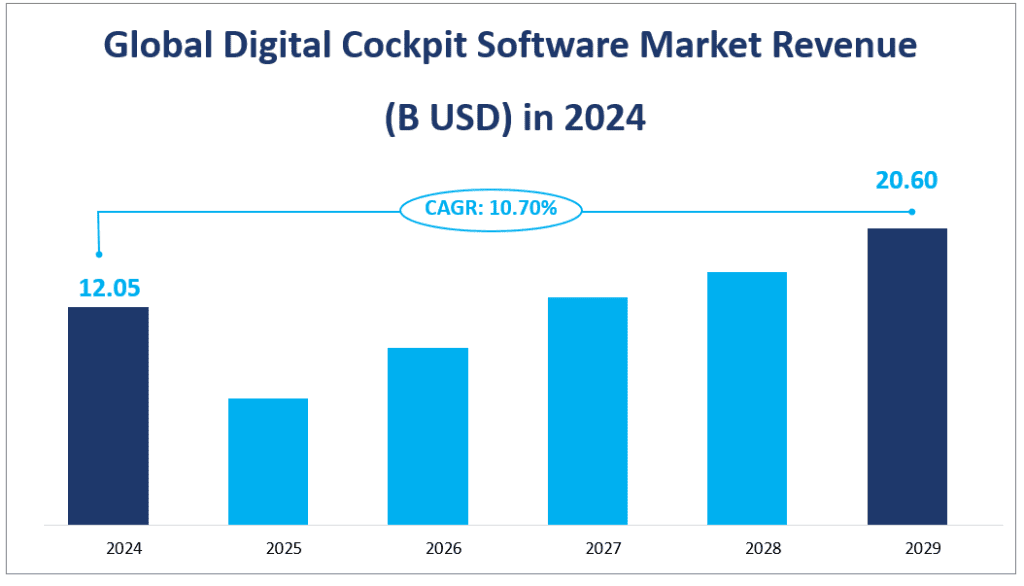

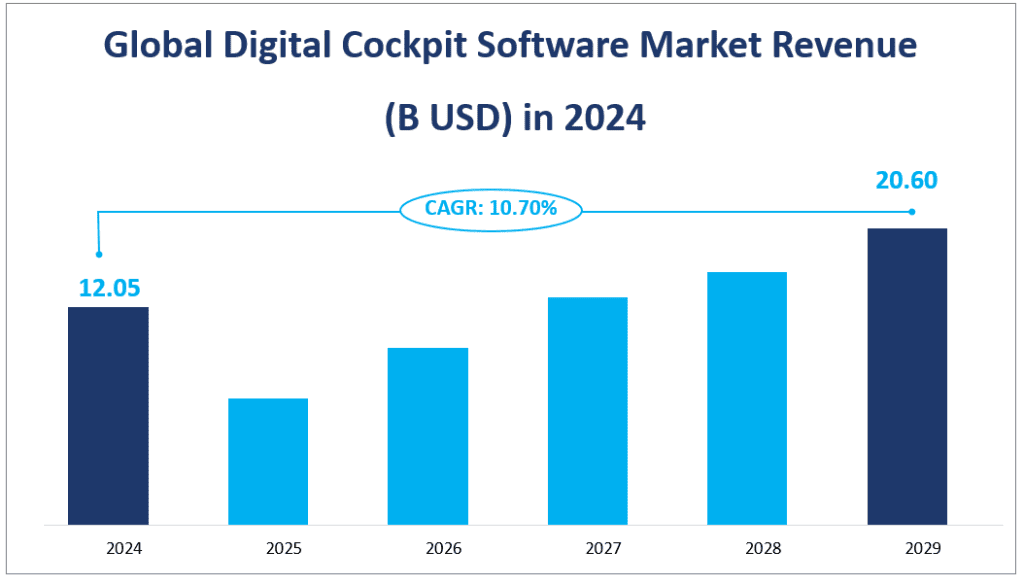

Le marché des logiciels de cockpit numérique est un secteur en plein essor au sein de l'industrie automobile, qui devrait connaître une croissance significative dans les années à venir. En 2024, le chiffre d'affaires du marché mondial des logiciels de cockpit numérique devrait atteindre 12,05 milliards de dollars, ce qui représente une augmentation substantielle par rapport aux années précédentes. Cette croissance devrait se poursuivre, avec un taux de croissance annuel composé (TCAC) de 11,341 TP3T attendu de 2024 à 2029. Le TCAC indique une expansion saine et constante, reflétant le potentiel du marché et l'adoption croissante des logiciels de cockpit numérique dans divers types de véhicules.

Les logiciels de cockpit numérique, également appelés logiciels d’infodivertissement et d’assistance à la conduite, fournissent l’infrastructure des cockpits numériques utilisés par une variété de véhicules. Ils permettent aux composants matériels d’interagir avec les conducteurs et les passagers, en connectant le véhicule au cloud et en accordant l’accès à des services à distance. Au-delà de la simple connectivité, les logiciels de cockpit numérique offrent des analyses et une suite de fonctions essentielles pour les véhicules modernes, notamment la navigation, le diagnostic à distance, l’infodivertissement et la reconnaissance vocale. Ces logiciels sont essentiels pour transformer les véhicules en appareils intelligents et connectés, améliorant l’expérience de conduite avec un contenu d’infodivertissement personnalisé, une assistance à la conduite avancée et une intégration transparente avec d’autres appareils intelligents.

Chiffre d'affaires du marché mondial des logiciels de cockpit numérique (B USD) en 2024

2. Facteurs déterminants du marché des logiciels de cockpit numérique

La croissance du marché des logiciels de cockpit numérique est stimulée par plusieurs facteurs clés. Tout d’abord, la demande des consommateurs est un facteur déterminant, les consommateurs modernes attendant plus que de simples moyens de transport de leur véhicule. Ils recherchent un espace de vie mobile et intelligent qui offre une connectivité, des systèmes de divertissement avancés et des interactions intuitives grâce à la reconnaissance vocale et gestuelle. Cette tendance oblige les constructeurs automobiles à intégrer des logiciels de cockpit numérique pour répondre aux demandes du marché en matière de sécurité, de commodité, de confort et de personnalisation de l’expérience de conduite.

Deuxièmement, les avancées technologiques jouent un rôle crucial. Les performances des puces embarquées, la plate-forme informatique de base des cockpits intelligents, se sont considérablement améliorées, permettant l'exécution d'applications logicielles plus complexes. L'introduction de l'architecture de domaine a également donné un nouvel élan au développement des véhicules intelligents, conduisant à l'adoption des mises à niveau Over-The-Air (OTA), qui permettent une création de valeur continue tout au long du cycle de vie du véhicule.

3. Limitation Facteurs du marché des logiciels de cockpit numérique

Malgré une croissance prometteuse, le marché des logiciels de cockpit numérique est confronté à certaines limites. Les risques potentiels en matière de sécurité constituent un défi de taille, car les fonctionnalités croissantes des cockpits numériques, notamment les services de mise en réseau et le contrôle à distance, introduisent de nouvelles vulnérabilités en matière de sécurité. La protection des données personnelles sensibles traitées par le logiciel est primordiale pour maintenir la confiance des utilisateurs et l'acceptation du marché.

Les risques techniques constituent également un obstacle. La complexité des logiciels de cockpit numérique augmente avec l’intégration de fonctions avancées telles que l’intelligence artificielle et l’analyse de données volumineuses. Cette complexité entraîne des défis en termes de développement, de déploiement et de maintenance, pouvant entraîner des coûts plus élevés et des risques de sécurité accrus.

En résumé, le marché mondial des logiciels de cockpit numérique est en pleine croissance, porté par la demande des consommateurs en matière de fonctionnalités de véhicules intelligents et d’innovation technologique. Cependant, il doit faire face à des risques potentiels en matière de sécurité et de technique pour soutenir sa croissance. À mesure que le marché évolue, il sera essentiel que les parties prenantes relèvent ces défis pour assurer l’expansion et le succès continus des solutions logicielles de cockpit numérique.

4. Analyse du segment de marché mondial des logiciels de cockpit numérique

Analyse des types de produits

Le marché des logiciels de cockpit numérique est segmenté en trois principaux types de produits : les logiciels d'application, les systèmes d'exploitation et hyperviseurs, et les intergiciels.

Logiciel d'application

Les logiciels d'application, qui font référence aux programmes qui interagissent directement avec les utilisateurs, s'exécutant sur le système d'exploitation du cockpit intelligent, utilisant les services et les interfaces fournis par le middleware pour réaliser diverses fonctions spécifiques et répondre aux besoins des utilisateurs, devraient générer les revenus les plus élevés en 2024. Avec un chiffre d'affaires de 18861,58 millions de TP4T, ce segment détient la plus grande part de marché, représentant 73,521 TP3T du marché total. Le taux de croissance de ce segment est également significatif, indiquant sa domination sur le marché et la forte demande d'applications orientées utilisateur qui améliorent l'expérience de conduite.

Système d'exploitation et hyperviseur

Le segment Systèmes d'exploitation et hyperviseurs comprend les principales plateformes logicielles qui contrôlent et gèrent les appareils numériques à l'intérieur du véhicule, coordonnent les ressources matérielles et fournissent un environnement pour exécuter les applications. En 2024, ce segment devrait générer un chiffre d'affaires de 1046,25 millions de TP4T, capturant une part de marché de 8,681 TP3T. Bien que ce chiffre soit considérablement inférieur à celui des logiciels d'application, le segment devrait afficher un taux de croissance robuste, reflétant le besoin croissant de systèmes d'exploitation sophistiqués pour prendre en charge les fonctionnalités avancées du poste de pilotage.

Intergiciel

Les intergiciels des logiciels de cockpit numérique facilitent le développement, l'intégration et l'exploitation des applications en fournissant un ensemble standard de services et de protocoles. Ce segment devrait générer un chiffre d'affaires de $2145,18 millions en 2024, avec une part de marché de 17.80%. Les intergiciels, bien que moins dominants que les logiciels d'application, sont essentiels au bon fonctionnement de l'écosystème du cockpit numérique et devraient croître à un rythme soutenu.

Parmi ces types de produits, les logiciels d'application détiennent la plus grande part de marché et devraient conserver leur position de leader en raison de la forte demande d'applications centrées sur l'utilisateur. Cependant, le segment des systèmes d'exploitation et des hyperviseurs est connu pour son taux de croissance le plus rapide, ce qui indique une évolution potentielle vers des environnements d'exploitation de cockpit numérique plus complexes et plus performants.

Analyse d'application

Le marché des logiciels de cockpit numérique s'applique à deux applications principales : les voitures particulières et les véhicules utilitaires.

Voitures de tourisme

Les voitures particulières, qui comprennent les berlines, les mini-fourgonnettes et les petits bus pouvant accueillir jusqu'à 9 sièges, constituent le domaine d'application dominant des logiciels de cockpit numérique. En 2024, cette application devrait générer un chiffre d'affaires de $9599,77 millions, ce qui représente une part de marché importante de 79,65%. Le taux de croissance de cette application est également substantiel, soulignant l'adoption croissante des logiciels de cockpit numérique sur le marché des véhicules de tourisme pour améliorer la sécurité, le confort et le divertissement des conducteurs et des passagers.

Véhicules commerciaux

Les véhicules commerciaux, conçus pour le transport de marchandises ou pour la location, le paiement ou le profit, constituent un autre domaine d'application important pour les logiciels de cockpit numérique. Le chiffre d'affaires du marché pour cette application en 2024 devrait être de $2453,23 millions, avec une part de marché de 20,35%. Bien que le chiffre d'affaires soit inférieur à celui des voitures particulières, le taux de croissance est notable, indiquant la demande croissante de logiciels de cockpit numérique dans les flottes commerciales pour améliorer l'efficacité opérationnelle et l'assistance au conducteur.

Dans le segment des applications, les voitures particulières détiennent la plus grande part de marché et devraient continuer à dominer en raison de la forte demande de systèmes avancés d'infodivertissement et d'assistance à la conduite dans les véhicules personnels. Cependant, les véhicules utilitaires affichent le taux de croissance le plus rapide, ce qui suggère une tendance croissante vers l'adoption de logiciels de cockpit numérique dans le secteur du transport commercial pour optimiser la logistique et améliorer la sécurité du conducteur.

En conclusion, le marché des logiciels de cockpit numérique se caractérise par une gamme diversifiée de types de produits et d'applications, chacun avec sa dynamique de marché unique. Les logiciels d'application et les voitures particulières dominent le marché en termes de chiffre d'affaires et de part de marché, tandis que les systèmes d'exploitation et les hyperviseurs et les véhicules utilitaires affichent les taux de croissance les plus prometteurs, indiquant la direction de l'évolution du marché et les domaines d'investissement potentiels.

Chiffre d'affaires et part de marché par segment

| Chiffre d'affaires du marché (M USD) en 2024 | Part de marché en 2024 | ||

| Par type | Logiciel d'application | 8861.58 | 73.52% |

| Système opérateur | 1046.25 | 8.68% | |

| Intergiciel | 2145.18 | 17.80% | |

| Par application | Voitures de tourisme | 9599.77 | 79.65% |

| Véhicule utilitaire | 2453.23 | 20.35% |

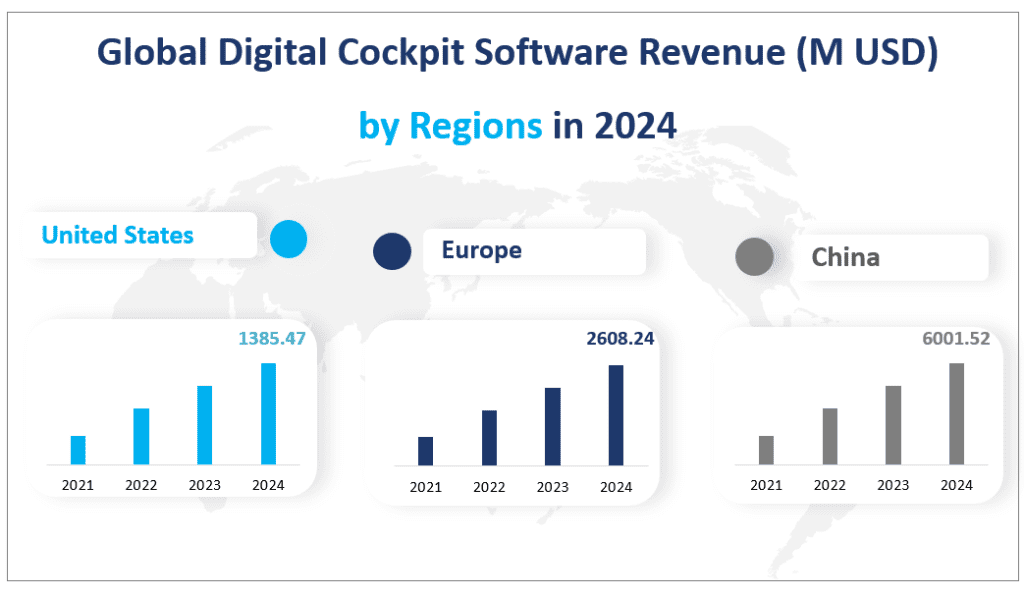

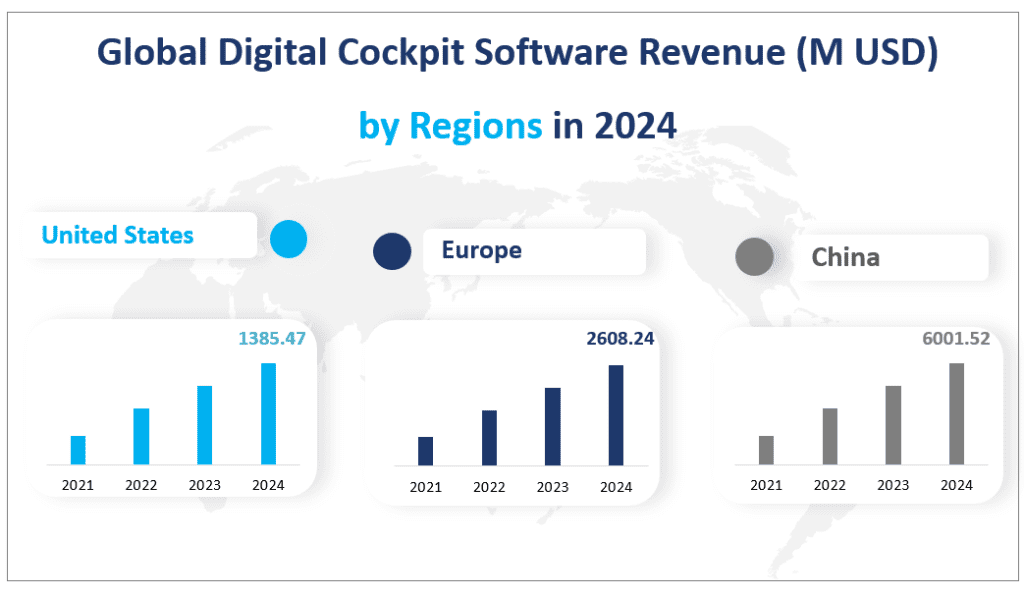

5. Chiffre d'affaires du marché mondial des logiciels de cockpit numérique par région en 2024

Le marché mondial des logiciels de cockpit numérique est un secteur dynamique et en pleine expansion au sein de l'industrie automobile, avec différentes régions présentant des niveaux variables de pénétration et de croissance du marché. En 2024, les revenus du marché dans les principales régions sont révélateurs de la demande mondiale de solutions avancées de cockpit numérique.

États-Unis

Le marché américain contribue de manière significative au chiffre d'affaires mondial des logiciels de cockpit numérique, avec un chiffre d'affaires prévu de 1385,47 millions de dollars en 2024. Le marché automobile mature de la région et les avancées technologiques la positionnent comme un acteur clé du secteur. Le marché américain se caractérise par une forte demande de véhicules de haute technologie et une propension à adopter rapidement de nouvelles technologies, ce qui contribue à sa part de marché substantielle.

Europe

L'Europe suit de près avec un chiffre d'affaires prévu de $2608,24 millions en 2024. L'accent mis par la région sur les normes de sécurité automobile et les systèmes avancés d'aide à la conduite (ADAS) a stimulé la demande de logiciels de cockpit numérique sophistiqués. En outre, la présence de grands constructeurs automobiles et une forte concentration sur la recherche et le développement ont soutenu la croissance du marché.

Chine

La Chine se distingue comme le plus grand marché régional en termes de chiffre d'affaires, avec une prévision impressionnante de 1,52 million de TP4T en 2024. La croissance rapide de l'industrie automobile, combinée à la volonté du gouvernement de promouvoir les véhicules intelligents et les véhicules électriques (VE), a créé un terrain fertile pour le marché des logiciels de cockpit numérique. La large base de consommateurs de la Chine et la demande croissante de voitures connectées ont encore accéléré la croissance du marché.

Japon

Le marché japonais devrait générer 1421 millions de dollars en 2024. La région est connue pour son industrie automobile à la pointe de la technologie et la demande de logiciels de cockpit numérique de haute qualité reste forte. L'accent mis par le Japon sur l'ingénierie de précision et l'innovation dans la technologie automobile a permis de maintenir sa position sur le marché mondial.

Parmi ces régions, la Chine apparaît comme le plus grand marché en termes de chiffre d'affaires, grâce à son énorme marché automobile et aux initiatives du gouvernement visant à promouvoir les véhicules intelligents et électriques. En ce qui concerne les régions à la croissance la plus rapide, l'Asie du Sud-Est se distingue par son développement économique rapide et sa demande croissante de fonctionnalités automobiles de haute technologie, ce qui laisse présager un avenir prometteur pour le marché des logiciels de cockpit numérique dans la région.

Chiffre d'affaires mondial des logiciels de cockpit numérique (en millions USD) par régions en 2024

6. Les cinq premières entreprises du marché des logiciels de cockpit numérique

HARMAN International, filiale de Samsung Electronics, est un fournisseur leader de technologies connectées pour les marchés de l'automobile, de la consommation et des entreprises.

Fondée en 1991, Neusoft propose une gamme de solutions et de services informatiques, notamment des logiciels de cockpit numérique. L'entreprise est connue pour son orientation vers la technologie logicielle et les solutions industrielles, avec une portée mondiale.

TomTom, fondée en 1991 et basée à Amsterdam, est un important fournisseur d'équipements de cartographie, de navigation et de GPS. Les logiciels de cockpit numérique de la société sont conçus pour améliorer l'expérience connectée en voiture.

Cerence, leader mondial de l'interaction basée sur l'IA pour le transport, collabore avec les plus grands constructeurs automobiles pour innover dans les expériences embarquées. Le logiciel de cockpit numérique de Cerence est à la pointe de l'interaction multimodale intégrée.

BlackBerry Limited est réputé pour ses solutions logicielles de sécurité, notamment la plateforme QNX pour cockpits numériques. La plateforme est conçue pour partager des périphériques matériels physiques entre les systèmes d'exploitation, offrant ainsi une solution robuste pour les cockpits numériques.

Acteurs majeurs

| Nom de l'entreprise | Répartition du marché |

| HARMAN International | Mondial |

| Neusoft | Mondial |

| TomTom | Principalement en Europe, en Asie-Pacifique et en Amérique du Nord |

| Cérence | Principalement en Amérique du Nord, en Europe et en Asie |

| BlackBerry Limitée | Mondial |

| MONTAVISTA SOFTWARE, LLC. (Mentor Graphics) | Mondial |

| iFlytek | Principalement en Asie et en Europe |

| ThunderSoft | Mondial |

| Garmin | Mondial |

| Systèmes Wind River, Inc. | Principalement en Amérique, en Europe et en Asie-Pacifique |

| Informatique Kotei | Principalement en Asie |

| Intellias | Principalement dans les Amériques, en Europe, au Moyen-Orient et en Inde |

| KPIT Technologies Ltd | Principalement en Asie, en Europe et en Amérique du Nord |

| Groupe SenseTime Inc. | Principalement en Asie, en Amérique du Nord et au Moyen-Orient |

| NavInfo | Principalement en Asie et en Europe |

| Airbiquity Inc | Principalement en Amérique, en Europe et en Asie-Pacifique |

1 Aperçu du marché

1.1 Présentation du produit et portée du logiciel Digital Cockpit

1.1.1 Couverture du marché

1.1.2 Définition du marché

1.2 Analyse du marché par type

1.3 Analyse du marché par application

1.4 Analyse du marché par région

1.4.1 Comparaison de la taille du marché mondial des logiciels de cockpit numérique (chiffre d'affaires) et du TCAC (%) par région (2019-2024)

1.4.2 État et perspectives du marché des logiciels de cockpit numérique aux États-Unis (2019-2024)

1.4.3 État et perspectives du marché européen des logiciels de cockpit numérique (2019-2024)

1.4.4 État et perspectives du marché chinois des logiciels de cockpit numérique (2019-2024)

1.4.5 État et perspectives du marché japonais des logiciels de cockpit numérique (2019-2024)

1.4.6 État et perspectives du marché indien des logiciels de cockpit numérique (2019-2024)

1.4.7 État et perspectives du marché des logiciels de cockpit numérique en Asie du Sud-Est (2019-2024)

1.4.8 État et perspectives du marché des logiciels de cockpit numérique en Amérique latine (2019-2024)

1.4.9 État et perspectives du marché des logiciels de cockpit numérique au Moyen-Orient et en Afrique (2019-2024)

1.5 Taille et prévisions du marché mondial des logiciels de cockpit numérique

2 profils de joueurs

2.1 HARMAN International

2.1.1 Profils des sociétés HARMAN International

2.1.2 Logiciel et services HARMAN International Digital Cockpit

2.1.3 Valeur, marge brute et brute du logiciel Digital Cockpit de HARMAN International

2.2 Neusoft

2.2.1 Profils des entreprises Neusoft

2.2.2 Logiciel et services Neusoft Digital Cockpit

2.2.3 Valeur, marge brute et marge brute du logiciel Neusoft Digital Cockpit

2.3 TomTom

2.3.1 Profils des entreprises TomTom

2.3.2 Logiciel et services TomTom Digital Cockpit

2.3.3 Valeur, marge brute et marge brute du logiciel TomTom Digital Cockpit

2.4 Cérence

2.4.1 Profils des entreprises Cerence

2.4.2 Logiciel Cerence Digital Cockpit et services

2.4.3 Valeur, marge brute et marge brute du logiciel Cerence Digital Cockpit

2.5 BlackBerry Limitée

2.5.1 Profils de la société BlackBerry Limited

2.5.2 Logiciel et services BlackBerry Limited Digital Cockpit

2.5.3 Valeur, marge brute et valeur brute du logiciel BlackBerry Limited Digital Cockpit

2.6 MONTAVISTA SOFTWARE, LLC. (Mentor Graphics)

2.6.1 Profils d'entreprise de MONTAVISTA SOFTWARE, LLC. (Mentor Graphics)

2.6.2 MONTAVISTA SOFTWARE, LLC. (Mentor Graphics) Logiciel et services Digital Cockpit

2.6.3 MONTAVISTA SOFTWARE, LLC.(Mentor Graphics) Valeur, marge brute et marge brute du logiciel Digital Cockpit

2.7 iFlytek

2.7.1 Profils des sociétés iFlytek

2.7.2 Logiciel et services iFlytek Digital Cockpit

2.7.3 Valeur, valeur brute et marge brute du logiciel iFlytek Digital Cockpit

2.8 ThunderSoft

2.8.1 Profils des sociétés ThunderSoft

2.8.2 Logiciel et services ThunderSoft Digital Cockpit

2.8.3 Valeur, marge brute et brute du logiciel ThunderSoft Digital Cockpit

2.9 Garmin

2.9.1 Profils des entreprises Garmin

2.9.2 Logiciel et services Garmin Digital Cockpit

2.9.3 Valeur, marge brute et marge brute du logiciel Garmin Digital Cockpit

2.10 Systèmes Wind River, Inc.

2.10.1 Profils des sociétés Wind River Systems, Inc.

2.10.2 Logiciel et services de cockpit numérique de Wind River Systems, Inc.

2.10.3 Valeur, marge brute et marge brute du logiciel Digital Cockpit de Wind River Systems, Inc.

2.11 Kotei Informatique

2.11.1 Profils des entreprises Kotei Informatics

2.11.2 Logiciel et services de cockpit numérique de Kotei Informatics

2.11.3 Valeur, marge brute et marge brute du logiciel Digital Cockpit de Kotei Informatics

2.12 Intellias

2.12.1 Profils des entreprises Intellias

2.12.2 Logiciel et services Intellias Digital Cockpit

2.12.3 Valeur, marge brute et marge brute du logiciel Intellias Digital Cockpit

2.13 KPIT Technologies Ltd

2.13.1 Profils des sociétés KPIT Technologies Ltd

2.13.2 Logiciel et services de cockpit numérique de KPIT Technologies Ltd

2.13.3 Valeur, marge brute et brute du logiciel Digital Cockpit de KPIT Technologies Ltd

2.14 Groupe SenseTime Inc.

2.14.1 Profils des sociétés SenseTime Group Inc.

2.14.2 SenseTime Group Inc. Logiciel de cockpit numérique et services

2.14.3 Valeur, marge brute et marge brute du logiciel Digital Cockpit de SenseTime Group Inc.

2.15 NavInfo

2.15.1 Profils d'entreprise NavInfo

2.15.2 Logiciel et services NavInfo Digital Cockpit

2.15.3 Valeur, marge brute et valeur brute du logiciel NavInfo Digital Cockpit

2.16 Airbiquity Inc

2.16.1 Profils des sociétés Airbiquity Inc

2.16.2 Logiciel et services de cockpit numérique d'Airbiquity Inc

2.16.3 Valeur, marge brute et valeur brute du logiciel Digital Cockpit d'Airbiquity Inc

3 Environnement concurrentiel : par joueurs

3.1 Chiffre d'affaires mondial des logiciels de cockpit numérique et part de marché des principaux acteurs

3.2 Part de marché des 3 principaux fabricants de logiciels de cockpit numérique en 2023

3.3 Part de marché des 5 principaux fabricants de logiciels de cockpit numérique en 2023

4 Analyse de la chaîne industrielle

4.1 Analyse de la structure des coûts d'exploitation du logiciel Digital Cockpit

4.1.1 Structure des coûts d'exploitation du logiciel Digital Cockpit

4.1.2 Coût de main d'œuvre du logiciel Digital Cockpit

4.2 Analyse des clients

5 Dynamique et tendances du marché des logiciels de cockpit numérique

5.1 Pilotes

5.2 Restrictions

5.3 Opportunités

5.4 Défis

5.5 L'impact de la situation régionale sur les industries de logiciels de cockpit numérique

5.6 L'impact de l'inflation sur les industries de logiciels de cockpit numérique

5.7 Le pouvoir transformateur de l'IA sur les industries de logiciels de cockpit numérique

5.8 Développement économique à l’ère du changement climatique

5.9 Actualités et politiques de l'industrie par région

5.9.1 Actualités de l'industrie des logiciels de cockpit numérique

5.9.2 Politiques de l'industrie des logiciels de cockpit numérique

5.10 Analyse des cinq forces de Porter

5.10.1 Menace des nouveaux entrants

5.10.2 Pouvoir de négociation des fournisseurs

5.10.3 Pouvoir de négociation des acheteurs

5.10.4 Menace de substitution

5.10.5 Rivalité concurrentielle

6 segments du marché mondial des logiciels de cockpit numérique par type (2019-2024)

6.1 Chiffre d'affaires mondial des logiciels de cockpit numérique par type (2019-2024)

6.2 Chiffre d'affaires et taux de croissance des logiciels de cockpit numérique mondiaux par type (2019-2024)

6.2.1 Chiffre d'affaires mondial des logiciels de cockpit numérique et taux de croissance des logiciels d'application (2019-2024)

6.2.2 Chiffre d'affaires mondial des logiciels Digital Cockpit et taux de croissance du système d'exploitation et de l'hyperviseur (2019-2024)

6.2.3 Chiffre d'affaires mondial des logiciels de cockpit numérique et taux de croissance des intergiciels (2019-2024)

7 segments du marché mondial des logiciels de cockpit numérique par application (2019-2024)

7.1 Chiffre d'affaires mondial des logiciels de cockpit numérique par application (2019-2024)

7.2 Chiffre d'affaires et taux de croissance des logiciels de cockpit numérique mondial par application (2019-2024)

7.2.1 Chiffre d'affaires mondial des logiciels de cockpit numérique et taux de croissance des voitures particulières (2019-2024)

7.2.2 Chiffre d'affaires mondial des logiciels de cockpit numérique et taux de croissance des véhicules commerciaux (2019-2024)

8 segments du marché mondial des logiciels de cockpit numérique par région (2019-2024)

8.1 Chiffre d'affaires et part de marché des logiciels de cockpit numérique mondiaux, par région (2019-2024)

8.2 Chiffre d'affaires et marge brute du logiciel Global Digital Cockpit (2019-2024)

8.3 Chiffre d'affaires et marge brute des logiciels Digital Cockpit aux États-Unis (2019-2024)

8.3.1 Analyse SWOT du logiciel Digital Cockpit aux États-Unis

8.4 Chiffre d'affaires et marge brute du logiciel Digital Cockpit Europe (2019-2024)

8.4.1 Analyse SWOT du logiciel Digital Cockpit Europe

8.5 Chiffre d'affaires et marge brute du logiciel China Digital Cockpit (2019-2024)

8.5.1 Analyse SWOT du logiciel China Digital Cockpit

8.6 Chiffre d'affaires et marge brute du logiciel Digital Cockpit au Japon (2019-2024)

8.6.1 Analyse SWOT du logiciel Digital Cockpit au Japon

8.7 Chiffre d'affaires et marge brute du logiciel Digital Cockpit en Inde (2019-2024)

8.7.1 Analyse SWOT du logiciel India Digital Cockpit

8.8 Chiffre d'affaires et marge brute des logiciels Digital Cockpit en Asie du Sud-Est (2019-2024)

8.8.1 Analyse SWOT du logiciel Digital Cockpit pour l'Asie du Sud-Est

8.9 Chiffre d'affaires et marge brute des logiciels Digital Cockpit en Amérique latine (2019-2024)

8.9.1 Analyse SWOT du logiciel Digital Cockpit en Amérique latine

8.10 Chiffre d'affaires et marge brute des logiciels Digital Cockpit au Moyen-Orient et en Afrique (2019-2024)

8.10.1 Analyse SWOT du logiciel Digital Cockpit au Moyen-Orient et en Afrique

9 Prévisions du marché mondial des logiciels de cockpit numérique par type

9.1 Prévisions de revenus des logiciels de cockpit numérique mondiaux par type (2024-2029)

9.1.1 Prévisions de revenus du marché des logiciels d'application (2024-2029)

9.1.2 Prévisions de revenus du marché des systèmes d'exploitation et des hyperviseurs (2024-2029)

9.1.3 Prévisions de revenus du marché des intergiciels (2024-2029)

10 Prévisions du marché mondial des logiciels de cockpit numérique par application

10.1 Prévisions de revenus des logiciels de cockpit numérique mondiaux par application (2024-2029)

10.1.1 Prévisions de revenus du marché des voitures particulières (2024-2029)

10.1.2 Prévisions de revenus du marché des véhicules commerciaux (2024-2029)

11 Prévisions du marché mondial des logiciels de cockpit numérique par région

11.1 Prévisions de revenus des logiciels de cockpit numérique mondiaux par région (2024-2029)

11.1.1 Prévisions de revenus des logiciels de cockpit numérique mondiaux par région (2024-2029)

11.2 Prévisions de revenus et de taux de croissance du marché américain (2024-2029)

11.3 Prévisions de revenus et de taux de croissance du marché européen (2024-2029)

11.4 Prévisions de revenus et de taux de croissance du marché chinois (2024-2029)

11.5 Prévisions de revenus et de taux de croissance du marché japonais (2024-2029)

11.6 Prévisions de revenus et de taux de croissance du marché indien (2024-2029)

11.7 Prévisions de revenus et de taux de croissance du marché de l'Asie du Sud-Est (2024-2029)

11.8 Prévisions de revenus et de taux de croissance du marché de l'Amérique latine (2024-2029)

11.9 Prévisions de revenus et de taux de croissance du marché du Moyen-Orient et de l'Afrique (2024-2029)

12 Annexe

12.1 Méthodologie

12.2 Source des données de recherche

12.2.1 Données secondaires

12.2.2 Données primaires

12.2.3 Estimation de la taille du marché

12.2.4 Avis de non-responsabilité juridique