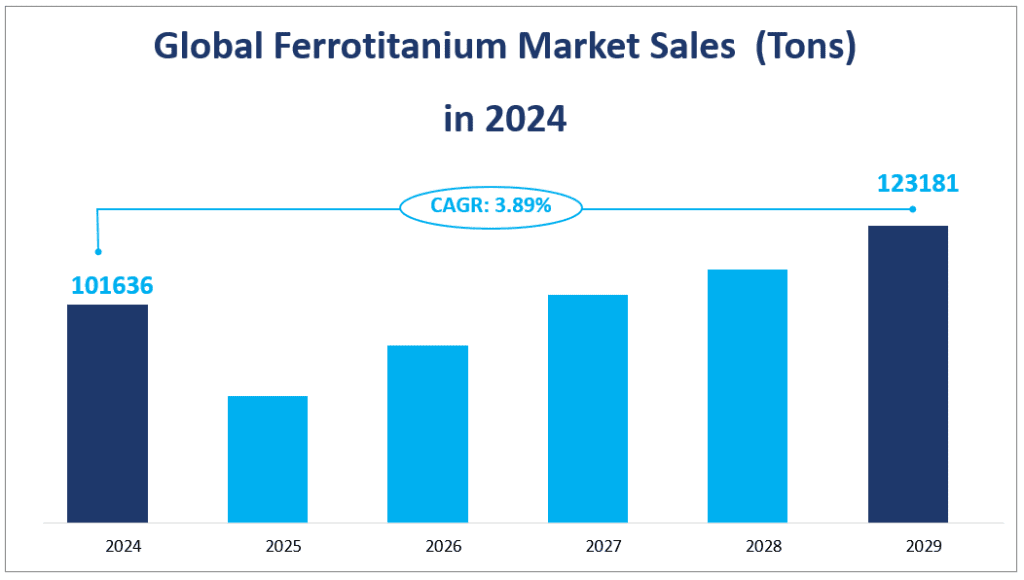

1. Global Ferrotitanium Market Sales Forecast

The global ferrotitanium market is projected to reach a sales volume of 101,636 tons in 2024, showcasing a robust Compound Annual Growth Rate (CAGR) of 3.89% from 2024 to 2029. Ferrotitanium, a ferroalloy composed of titanium and iron with occasional trace carbon, is primarily utilized in the alloying, deoxidation, and degassing of high-grade steels and alloys. This alloy is crucial in the production of low-carbon steels and as a stabilizer to prevent the formation of chromium carbide at grain boundaries in stainless steel. The Ferrotitanium market’s growth is influenced by various factors, including the increasing demand for steel, technological advancements in production processes, and the need for stronger and more durable materials in various industries.

The forecasted growth is a testament to the essential role Ferrotitanium plays in the metallurgical industry, particularly in the production of high-strength and corrosion-resistant steel grades.

Global Ferrotitanium Market Sales (Tons) in 2024

2. Driving Factors of Ferrotitanium Market Growth

Several driving factors propel the growth of the Ferrotitanium market. The increasing demand for steel, particularly in the construction, automotive, and aerospace industries, has led to a surge in the requirement for Ferrotitanium as an essential alloying element. The Ferrotitanium market is also benefiting from technological advances that have increased production efficiency and reduced costs, making Ferrotitanium’s market production more economical and efficient. In addition, there is a growing global demand for high-performance materials, especially in the field of renewable energy and new energy vehicles, and these applications are driving the demand in the Ferrotitanium market.

3. Limiting Factors of Ferrotitanium Market Growth

However, the Ferrotitanium market’s growth is not without limitations. Raw material price fluctuations pose a significant risk to Ferrotitanium manufacturers. Titanium, a key component in Ferrotitanium, is subject to market volatility, which can impact production costs and, consequently, the overall market stability. Additionally, stringent environmental regulations and the need for sustainable production practices are challenging for manufacturers, especially in regions with evolving environmental policies. The requirement to invest in cleaner production technologies and waste management systems can be a financial burden for companies, affecting their competitiveness.

Another limiting factor is the Ferrotitanium market’s reliance on a few major players. The concentration of production among a handful of companies can lead to supply chain vulnerabilities and limit the market’s ability to respond to sudden changes in demand. Moreover, the entry of new competitors may be hindered by high capital requirements and the need for specialized technical knowledge, which can slow down market innovation and growth.

In conclusion, while the Ferrotitanium market is expected to grow steadily over the next few years, it must navigate various challenges to sustain this growth. The market’s success will depend on its ability to adapt to changing market conditions, invest in sustainable technologies, and maintain a balance between supply and demand.

4. Global Ferrotitanium Market Segment Analysis

The Ferrotitanium market is segmented into various product types, each serving distinct purposes within the metallurgical industry. In 2024, the market is expected to showcase a diverse range of product types, including Ferrotitanium 35%, Ferrotitanium 70%, and others. These product types are crucial for different steel manufacturing processes, each with its unique chemical composition and application.

Ferrotitanium 35%

Ferrotitanium 35% is an alloy containing approximately 35% titanium. It is primarily produced through an aluminothermic reaction and is used for its ability to deoxidize and stabilize stainless steel, preventing the formation of chromium carbide at grain boundaries. In 2024, Ferrotitanium 35% is projected to have a market sales volume of 26,833 tons. Despite its importance, it is not the largest in terms of market share, but it holds a significant position due to its widespread use in the production of low-carbon steels.

Ferrotitanium 70%

Ferrotitanium 70%, containing roughly 70% titanium, is produced by melting titanium scrap and iron in an induction furnace. This type is used for its higher titanium content, which provides greater strength and improved properties in steel alloys. In 2024, it is expected to dominate the market with sales of 61,008 tons. Ferrotitanium 70% holds the largest market share and is anticipated to grow at a steady pace due to its application in high-strength steel and alloys.

Other Types

The “other” category includes specialty Ferrotitanium alloys with varying titanium contents, tailored to meet specific industry requirements. These niche products are expected to have a combined market sales volume of 13,794 tons in 2024. While they may not individually hold a large market share, their collective contribution is significant, offering customized solutions for particular applications.

In terms of market share, Ferrotitanium 70% dominates with the largest share, attributed to its high titanium content, which is in high demand for the production of superior quality steels and alloys. It is also expected to maintain a consistent growth rate due to its performance in enhancing the strength and durability of steel products.

On the other hand, Ferrotitanium 35%, while not the largest in market share, exhibits a steady growth rate due to its broader application in the steel industry. It is an essential alloy for the production of low-carbon steels and plays a critical role in stabilizing stainless steel, which is why it continues to be a popular choice among manufacturers.

The “other” types, although holding a smaller market share, are growing at a rapid pace due to the increasing demand for specialized alloys in niche applications. The flexibility in定制化 solutions and the ability to meet specific industry needs are driving factors for the growth of these product types.

Global Ferrotitanium Market Applications Analysis

The Ferrotitanium market is segmented into various applications, each playing a significant role in the metallurgical industry. In 2024, the market is expected to showcase a diverse range of applications, including Stainless Steel Stabilizer, Molten Metal Additives, and others. These applications are crucial for different steel manufacturing processes, each with its unique role and importance.

Stainless Steel Stabilizer

Stainless Steel Stabilizer is the primary application of Ferrotitanium, accounting for the largest market share. It is used to prevent the formation of chromium carbide at grain boundaries in stainless steel, enhancing the steel’s resistance to corrosion and improving its overall properties. In 2024, the market sales volume for Stainless Steel Stabilizer is projected to reach 78,316 tons. This application’s dominance is due to the extensive use of stainless steel in various industries, including construction, automotive, and consumer goods.

Molten Metal Additive

Molten Metal Additive is another significant application of Ferrotitanium, used to impart strength to molten metal in foundries without changing other ratios. In 2024, it is expected to have a market sales volume of 13,679 tons. While it may not have the largest market share, it exhibits a growing trend due to its importance in the production of high-strength alloys and its role in the foundry industry.

Other Applications

The “other” category includes niche applications of Ferrotitanium that cater to specific industry needs. These applications are expected to have a combined market sales volume of 9,641 tons in 2024. Although they may not individually hold a large market share, their collective contribution is significant, offering specialized solutions for particular applications.

In terms of market share, the Stainless Steel Stabilizer application dominates, attributed to the extensive use of stainless steel across various industries. Its importance in enhancing the properties of stainless steel ensures its leading position in the market.

On the other hand, Molten Metal Additive, while not the largest in Ferrotitanium market share, shows the fastest growth rate due to the increasing demand for high-strength alloys in the automotive and aerospace industries. Its role in improving the strength and durability of metals makes it a popular choice among manufacturers.

The “other” applications, although holding a smaller Ferrotitanium market share, are growing at a rapid pace due to the increasing demand for specialized alloys in niche applications. The need for customized solutions and the ability to meet specific industry requirements are driving factors for the growth of these applications.

Ferrotitanium Market Sales and Share in 2024

| Market Sales (Tons) in 2024 | Market Share in 2024 | ||

| By Type | Ferrotitanium 35% | 26833 | 26.40% |

| Ferrotitanium 70% | 61008 | 60.03% | |

| Other | 13794 | 13.57% | |

| By Application | Stainless Steel Stabilizer | 78316 | 77.06% |

| Molten Metal Additive | 13679 | 13.46% | |

| Other | 9641 | 9.49% |

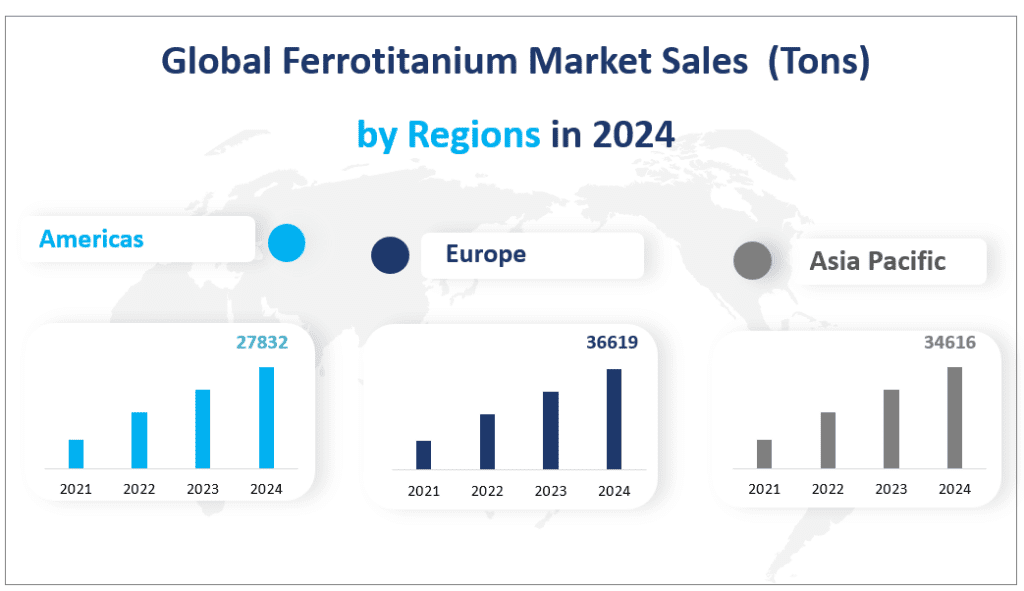

5. Global Ferrotitanium Market Regional Sales Analysis 2024

Americas

The Americas region, comprising North and South America, is anticipated to have a significant share of the global Ferrotitanium market. In 2024, the sales volume is projected to be 27,832 tons. The United States continues to be the driving force in this region, with its robust steel industry and demand for high-strength alloys. The growth in the Americas can be attributed to the region’s industrial expansion and the increasing use of Ferrotitanium in various applications, including aerospace and automotive.

Asia Pacific

The Asia Pacific region is expected to lead the global Ferrotitanium market in terms of sales volume in 2024, with an estimated 34,616 tons. China’s rapid industrialization and the growing demand for stainless steel in countries like India and Japan are significant factors contributing to this region’s dominance. The Asia Pacific region’s market is also characterized by a fast-growing rate due to the expansion of manufacturing industries and the increasing use of Ferrotitanium in high-tech applications.

Europe

Europe, with its well-established steel industry, is expected to have a sales volume of 36,619 tons in 2024. Germany, France, and the UK are key contributors to this region’s market share. The region’s Ferrotitanium market growth can be linked to the continuous demand for high-quality steel and the use of Ferrotitanium in advanced manufacturing processes. Europe’s market is also influenced by strict environmental regulations that promote the use of Ferrotitanium for its ability to improve steel quality without compromising sustainability.

Middle East & Africa

The Middle East and Africa region, though smaller in comparison to other regions, is expected to show a steady growth in Ferrotitanium sales, with an estimated 2,568 tons in 2024. The GCC countries, with their growing industrial sectors, are expected to drive the market in this region. The region’s growth is attributed to the increasing demand for steel in construction and infrastructure development, which requires the use of Ferrotitanium for enhanced material properties.

Among these regions, the Asia Pacific stands out as the largest regional Ferrotitanium market by sales, driven by China’s significant industrial demand and the overall economic growth in the region. The fastest-growing region is expected to be the Middle East & Africa, due to the rapid industrialization and infrastructure development in countries like the United Arab Emirates and Saudi Arabia, which are driving the demand for high-quality steel and, consequently, Ferrotitanium.

In conclusion, the Ferrotitanium market is influenced by regional industrial development and the demand for high-strength steel. The Asia Pacific region leads in sales volume, while the Middle East & Africa region shows the fastest growth. These trends are expected to continue, shaping the global Ferrotitanium market future.

Global Ferrotitanium Market Sales (Tons) by Regions in 2024

6. Analysis of the Top Five Companies in the Ferrotitanium Market

AMG Chrome Limited, established in 1938 and headquartered in the UK, is a leading manufacturer of specialty products for the aluminum, steel, superalloy, hard-facing, welding, and glass industries. The company offers a range of products, including Ferro Titanium 70%, produced using an induction furnace. AMG Chrome Limited’s business overview highlights its position as a specialized manufacturer with a global sales reach.

Global Titanium, established in 1937 and based in the USA, is an integrated manufacturer of titanium metallurgical products. The company processes all types of titanium scraps and produces ferrotitanium, among other products. Global Titanium’s business is focused on recycling materials to produce titanium metallurgical products for various industries.

VSMPO-AVISMA, founded in 1933 and headquartered in Russia, is a vertically integrated company and the world’s largest manufacturer of ingots and mill products in titanium alloys. The company also manufactures extruded products of aluminum alloys and mill products of alloy steels and nickel-based alloys. VSMPO-AVISMA’s products are widely used in various industries, including power engineering and shipbuilding.

Kluchevskiy Ferroalloy Plant, established in 2005 and located in Russia, is the only manufacturer in Russia and the former USSR producing a wide range of unique ferroalloys and alloying agents. The plant’s products are used in the metallurgical industry for alloying, deoxidation, and detoxifying of steels and alloys.

Arconic, established in 2016 and headquartered in the USA, is a leading provider of aluminum sheet, plate, and extrusions, as well as innovative architectural products. The company’s products advance various markets, including automotive, aerospace, and construction. Arconic’s involvement in the Ferrotitanium market is through its production of specialty alloys and materials.

Major Players

| Manufacturer | Headquarters | Area Served |

| AMG Chrome Limited | Rotherham, South Yorkshire, England | Worldwide |

| Global Titanium | Detroit, MI, USA | Worldwide |

| VSMPO-AVISMA | Moscow, Russia | Mainly in Europe, North America and Asia |

| Kluchevskiy Ferroalloy Plant | Dvurechensk, Sverdlovsk region, Russia | Mainly in Europe |

| Arconic | New Kensington, PA, USA | Mainly in North America and Asia |

| Cronimet | Karlsruhe, Germany | Mainly in Europe and North America |

| OSAKA Titanium | Amagasaki, Hyogo, Japan | Mainly in Asia |

| Jinzhou Guangda Ferroalloy | Jinzhou City, Liaoning Province, China | Mainly in Asia, Europe and North America |

| Mottram | Sheffield, South Yorkshire, UK | Mainly in Europe |

| ZTMC | Zaporozhye, Ukraine | Mainly in Europe |

| Metalliage | Saint-Hubert, QC, Canada | Mainly in Europe, America and Asia |

| Guotai Industrial | Jinzhou City, Liaoning Province, China | Mainly in Europe, Asia and America |

| Hengtai Special Alloy | Jinzhou City, China | Mainly in Asia |

| Bansal Brothers | New Delhi, India | Mainly in Europe and Asia |

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Research Process and Data Source

1.5.1 Secondary Data

1.5.2 Primary Data

1.5.3 Market Size Estimation

1.5.4 Legal Disclaimer

1.6 Economic Indicators

1.7 Currency Considered

1.8 Description of The Use of Acronyms in The Report

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Ferrotitanium Annual Sales 2017-2028

2.1.2 World Current & Future Analysis for Ferrotitanium by Geographic Region, 2017, 2022

2.2 Ferrotitanium Segment by Type

2.2.1 Ferrotitanium 35%

2.2.2 Ferrotitanium 70%

2.3 Ferrotitanium Sales by Type

2.3.1 Global Ferrotitanium Sales Market Share by Type (2017-2022)

2.3.2 Global Ferrotitanium Revenue and Market Share by Type (2017-2022)

2.3.3 Global Ferrotitanium Sale Price by Type (2017-2022)

2.4 Ferrotitanium Segment by Application

2.4.1 Stainless Steel Stabilizer

2.4.2 Molten Metal Additive

2.5 Ferrotitanium Sales by Application

2.5.1 Global Ferrotitanium Sales Market Share by Application (2017-2022)

2.5.2 Global Ferrotitanium Revenue and Market Share by Application (2017-2022)

2.5.3 Global Ferrotitanium Price by Application (2017-2022)

3 Global Ferrotitanium by Company

3.1 Global Ferrotitanium Breakdown Data by Company

3.1.1 Global Ferrotitanium Annual Sales by Company (2020-2022)

3.1.2 Global Ferrotitanium Sales Market Share by Company (2020-2022)

3.2 Global Ferrotitanium Revenue Market Share by Company

3.2.1 Global Ferrotitanium Revenue by Company (2017-2022)

3.2.2 Global Ferrotitanium Revenue Market Share by Company (2020-2022)

3.3 Global Ferrotitanium Sale Price by Company

3.4 Global Ferrotitanium Manufacturing Base Distribution, Production Area, Type Types by Company

3.4.1 Global Ferrotitanium Manufacturing Base Distribution and Production Area by Company

3.4.2 Company Ferrotitanium Established Time

3.5 Market Concentration Rate Analysis

3.5.1 Competition Landscape Analysis

3.5.2 Concentration Ratio (CR5) (2020-2022)

3.6 New Types and Potential Entrants

3.7 Mergers & Acquisitions, Expansion

4 World Historic Review for Ferrotitanium by Geographic Region

4.1 World Historic Ferrotitanium Market Size by Geographic Region (2017-2022)

4.1.1 Global Ferrotitanium Annual Sales by Geographic Region (2017-2022)

4.1.2 Global Ferrotitanium Annual Revenue by Geographic Region

4.2 Americas Ferrotitanium Sales Growth

4.3 APAC Ferrotitanium Sales Growth

4.4 Europe Ferrotitanium Sales Growth

4.5 Middle East & Africa Ferrotitanium Sales Growth

5 Americas

5.1 Americas Ferrotitanium Sales by Countries

5.1.1 Americas Ferrotitanium Sales by Countries (2017-2022)

5.1.2 Americas Ferrotitanium Revenue by Countries (2017-2022)

5.2 Americas Ferrotitanium Sales by Types

5.3 Americas Ferrotitanium Sales by Applications

5.4 United States

5.5 Canada

5.6 Mexico

5.7 Brazil

6 APAC

6.1 APAC Ferrotitanium Sales by Countries

6.1.1 APAC Ferrotitanium Sales by Countries

6.1.2 APAC Ferrotitanium Revenue by Countries

6.2 APAC Ferrotitanium Sales by Types

6.3 APAC Ferrotitanium Sales by Applications

6.4 China

6.5 Japan

6.6 Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

7 Europe

7.1 Europe Ferrotitanium Sales by Countries

7.1.1 Europe Ferrotitanium Sales by Countries

7.1.2 Europe Ferrotitanium Revenue by Countries

7.2 Europe Ferrotitanium Sales by Types

7.3 Europe Ferrotitanium Sales by Applications

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

8 Middle East & Africa

8.1 Middle East & Africa Ferrotitanium Sales by Countries

8.1.1 Middle East & Africa Ferrotitanium Sales by Countries

8.1.2 Middle East & Africa Ferrotitanium Revenue by Countries

8.2 Middle East & Africa Ferrotitanium Sales by Types

8.3 Middle East & Africa Ferrotitanium Sales by Applications

8.4 South Africa

8.5 Turkey

8.6 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Growth Opportunities

9.2 Market Challenges and Risks

9.3 Market Trends

10 Manufacturing Cost Structure Analysis

10.1 Raw Material and Suppliers

10.2 Manufacturing Cost Structure Analysis of Ferrotitanium

10.3 Manufacturing Process Analysis of Ferrotitanium

10.4 Industry Chain Structure of Ferrotitanium

11 Marketing, Distributors and Customer

11.1 Sales Channel

11.1.1 Direct Channel

11.1.2 Indirect Channel

11.2 Ferrotitanium Distributors

11.3 Ferrotitanium Customer

12 World Forecast Review for Ferrotitanium by Geographic Region

12.1 Global Ferrotitanium Market Size Forecast by Region

12.1.1 Global Ferrotitanium Forecast by Regions (2022-2028)

12.1.2 Global Ferrotitanium Revenue Forecast by Regions 2022-2028

12.2 Americas Forecast by Countries

12.3 APAC Forecast by Countries

12.4 Europe Forecast by Countries

12.5 Middle East & Africa Forecast by Countries

12.6 Global Ferrotitanium Market Forecast by Type

12.7 Global Ferrotitanium Market Forecast by Application

13 Key Company Analysis

13.1 AMG Chrome Limited

13.1.1 Company Profiles

13.1.2 Ferrotitanium Type Introduction

13.1.3 AMG Chrome Limited Sales, Revenue, Price, Gross Margin 2017-2022

13.1.4 AMG Chrome Limited Main Business Overview

13.1.5 AMG Chrome Limited Latest Developments

13.2 Global Titanium

13.2.1 Company Profiles

13.2.2 Ferrotitanium Type Introduction

13.2.3 Global Titanium Sales, Revenue, Price, Gross Margin 2017-2022

13.2.4 Global Titanium Main Business Overview

13.3 VSMPO-AVISMA

13.3.1 Company Profiles

13.3.2 Ferrotitanium Type Introduction

13.3.3 VSMPO-AVISMA Sales, Revenue, Price, Gross Margin 2017-2022

13.3.4 VSMPO-AVISMA Main Business Overview

13.3.5 VSMPO-AVISMA Latest Developments

13.4 Kluchevskiy Ferroalloy Plant

13.4.1 Company Profiles

13.4.2 Ferrotitanium Type Introduction

13.4.3 Kluchevskiy Ferroalloy Plant Sales, Revenue, Price, Gross Margin 2017-2022

13.4.4 Kluchevskiy Ferroalloy Plant Main Business Overview

13.5 Arconic

13.5.1 Company Profiles

13.5.2 Ferrotitanium Type Introduction

13.5.3 Arconic Sales, Revenue, Price, Gross Margin 2017-2022

13.5.4 Arconic Main Business Overview

13.5.5 Arconic Latest Developments

13.6 Cronimet

13.6.1 Company Profiles

13.6.2 Ferrotitanium Type Introduction

13.6.3 Cronimet Sales, Revenue, Price, Gross Margin 2017-2022

13.6.4 Cronimet Main Business Overview

13.6.5 Cronimet Latest Developments

13.7 OSAKA Titanium

13.7.1 Company Profiles

13.7.2 Ferrotitanium Type Introduction

13.7.3 OSAKA Titanium Sales, Revenue, Price, Gross Margin 2017-2022

13.7.4 OSAKA Titanium Main Business Overview

13.7.5 OSAKA Titanium Latest Developments

13.8 Jinzhou Guangda Ferroalloy

13.8.1 Company Profiles

13.8.2 Ferrotitanium Type Introduction

13.8.3 Jinzhou Guangda Ferroalloy Sales, Revenue, Price, Gross Margin 2017-2022

13.8.4 Jinzhou Guangda Ferroalloy Main Business Overview

13.9 Mottram

13.9.1 Company Profiles

13.9.2 Ferrotitanium Type Introduction

13.9.3 Mottram Sales, Revenue, Price, Gross Margin 2017-2022

13.9.4 Mottram Main Business Overview

13.10 ZTMC

13.10.1 Company Profiles

13.10.2 Ferrotitanium Type Introduction

13.10.3 ZTMC Sales, Revenue, Price, Gross Margin 2017-2022

13.10.4 ZTMC Main Business Overview

13.11 Metalliage

13.11.1 Company Profiles

13.11.2 Ferrotitanium Type Introduction

13.11.3 Metalliage Sales, Revenue, Price, Gross Margin 2017-2022

13.11.4 Metalliage Main Business Overview

13.12 Guotai Industrial

13.12.1 Company Profiles

13.12.2 Ferrotitanium Type Introduction

13.12.3 Guotai Industrial Sales, Revenue, Price, Gross Margin 2017-2022

13.12.4 Guotai Industrial Main Business Overview

13.13 Hengtai Special Alloy

13.13.1 Company Profiles

13.13.2 Ferrotitanium Type Introduction

13.13.3 Hengtai Special Alloy Sales, Revenue, Price, Gross Margin 2017-2022

13.13.4 Hengtai Special Alloy Main Business Overview

13.14 Bansal Brothers

13.14.1 Company Profiles

13.14.2 Ferrotitanium Type Introduction

13.14.3 Bansal Brothers Sales, Revenue, Price, Gross Margin 2017-2022

13.14.4 Bansal Brothers Main Business Overview