1. Embedded Real-Time Operating Systems for the IoT Market Insights

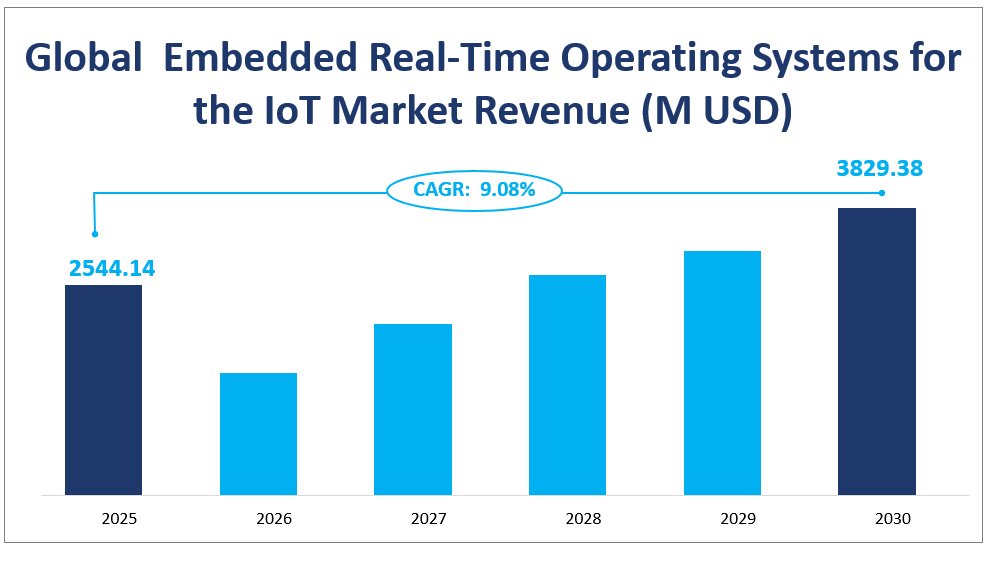

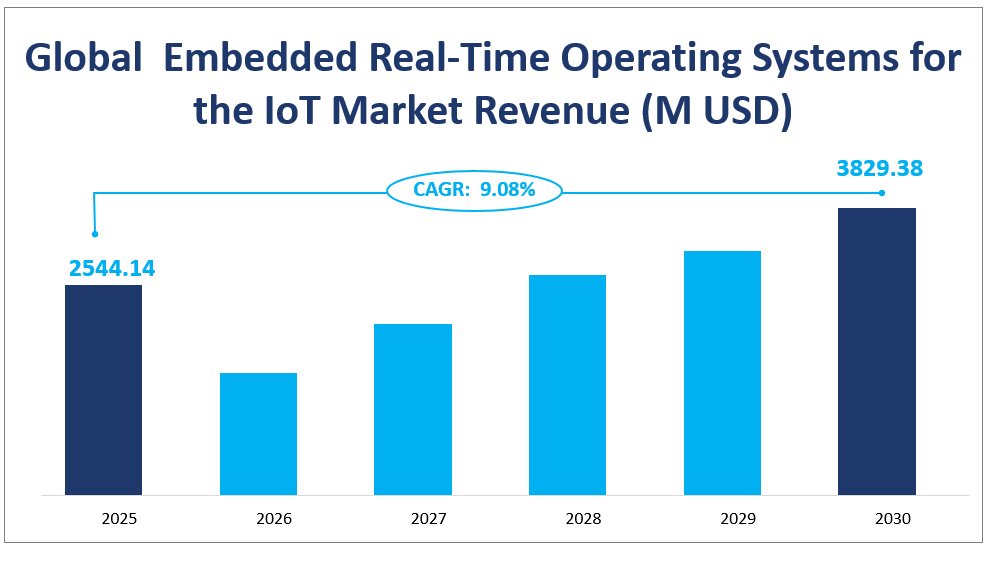

The global Embedded Real-Time Operating Systems for the IoT market size is expected to grow to $2544.14 million in 2025 with a CAGR of 9.08% from 2025 to 2030.

The invention of EMI shielding film provides a solution for the electromagnetic shielding of FPC and has a good application effect. EMI shielding film can effectively suppress electromagnetic interference, and at the same time can reduce the attenuation of the transmission signal in the FPC, and reduce the incompleteness of the transmission signal. It has become an important raw material for FPC and is widely used in electronic products such as smartphones and tablets.

Many fields today rely on digital technology. In addition, devices require immediate and automatic responses to external conditions to successfully handle many operations, and in many cases, they may be critical. Real-time embedded solutions can help simplify a large number of processes and improve the quality of life. The independent functions in the embedded software help the hardware achieve a higher execution rate, increase efficiency, and optimize productivity. This will promote the demand for Embedded Real-Time Operating Systems in other manufacturing and product development departments.

Global Embedded Real-Time Operating Systems for the IoT Market Revenue (M USD)

2. Market Driving Forces

Increase in demand for IoT

With the advancement of technologies such as artificial intelligence and cloud computing, the application technology of the Internet of Things has also received more attention. In the context of big data, efficient management promotes an increase in the demand for the IoT. As sensors and actuators are added to everyday devices, more embedded programmers will be needed to write corresponding IoT applications. In the application of the Internet of Things, RTOS plays an important “bridge” role between the terminal and the cloud. Cloud service providers provide RTOS to allow users to develop faster and accelerate the implementation of IoT projects. The open-source RTOS provides flexible and free configuration and provides possible choices for various application requirements. The rich middleware or components also attract many developers. This will promote the development of the Embedded Real-Time Operating Systems industry.

3. Market Constraints

The embedded real-time operating system cannot be self-improved and upgraded, it needs to be completed with the aid of a general-purpose computer and requires specialized development tools and environments. This poses challenges to the development of the industry and limits the development of the market. Operating system software licenses and IP infringements will have cost impacts on system development and use, as well as industry ecology. Operating system software licensing and IP violations will further hinder the development of the Internet of Things (IoT) real-time operating system market.

4. Market Segment

Among different product types, the Hard Real-Time Operating System segment will contribute the largest market share in 2024.

Soft Real-Time Operating System: A soft real-time system is a system whose operation is degraded if results are not produced according to the specified timing requirement. In a soft real-time system, the meeting deadline is not compulsory for every time for task but the process should get processed and give the result. Even the soft real-time systems cannot miss the deadline for every task or process according to the priority it should meet the deadline or can miss the deadline. The estimated market value in 2025 is $163.08 million and the market share is expected to be 6.41%, due to increased demand for flexible and cost-effective solutions.

Hard Real-Time Operating System: Hard real-time is a system whose operation is incorrect and whose result is not produced according to time constraints. A hard real-time system (also known as an immediate real-time system) is hardware or software that must operate within the confines of a stringent deadline. The application may be considered to have failed if it does not complete its function within the allotted period. Examples of hard real-time systems include components of pacemakers, anti-lock brakes, and aircraft control systems. The estimated market value in 2025 is $2381.06 million and the market share is expected to be 93.59%, due to increased demand for high reliability and rigorous real-time performance.

The largest segment by application is Indirect Sales, with a market share of 71.26% in 2024.

Direct Sales: The direct channels are organized and managed by the manufacturers themselves. Direct marketing is directly to consumers and is difficult to manage on a large scale, but it usually allows manufacturers to establish better connections with their consumer groups. By controlling all aspects of the channel, manufacturers can better control how goods are delivered. They have more control over eliminating inefficiencies, adding new services, and setting prices.

Indirect Sales: Indirect sales are the sale of goods or services by third parties (such as partners or affiliates) rather than company personnel. Indirect sales can be used in conjunction with the company’s direct sales work, and can also be used to replace the hiring of sales staff. Indirect sales are usually carried out through distributors, such as specialty stores and large retailers. The estimated market value in 2025 is $1812.95 million and the market share is expected to be 71.26%.

Market Size and Share by Segment

| Market Size in 2025 | Market Share in 2025 | ||

| By Type | Soft Real-Time Operating System | 163.08 M USD | 6.41% |

| Hard Real-Time Operating System | 2381.06 M USD | 93.59% | |

| By Application | Direct Sales | 731.19 M USD | 28.74% |

| Indirect Sales | 1812.95 M USD | 71.26% |

5. Regional Market

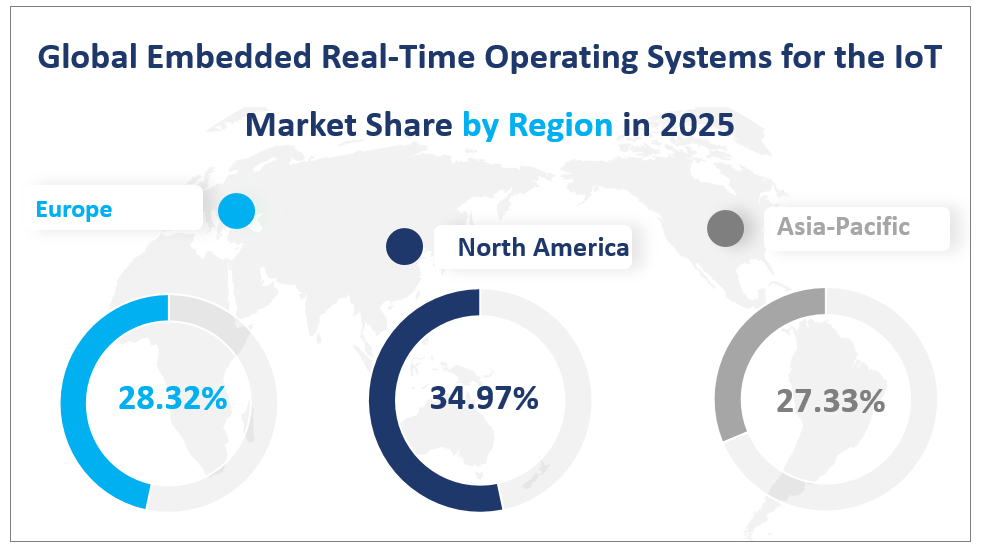

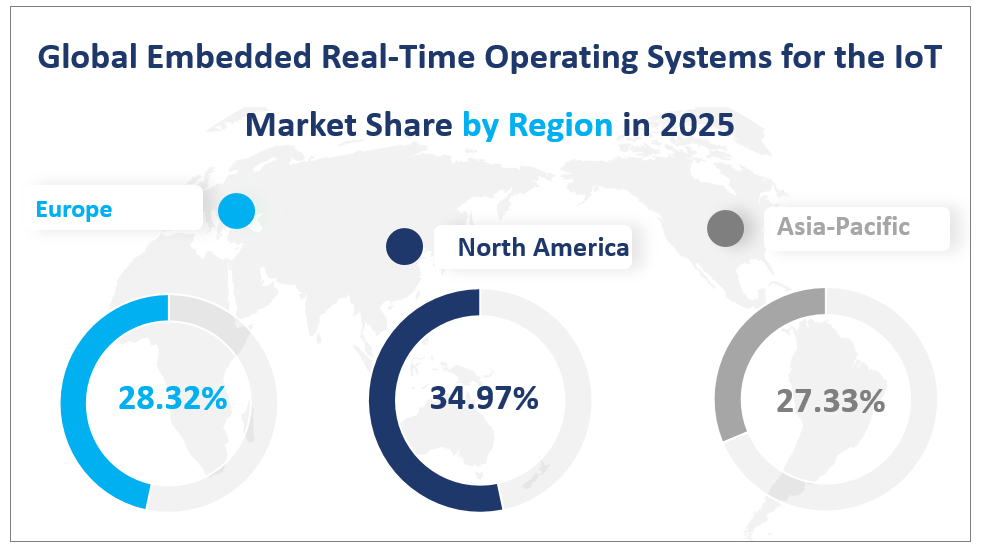

North America: North America holds a significant share of the global embedded systems market, which is expected to reach 34.97% in 2025, driven by increased investments in automation and software, as well as rising investments in IoT technologies. The increasing adoption of IoT solutions by consumers is driving the growth of the North American market. IoT technology is highly deployed in electric vehicles (EVs), and manufacturers are investing in increasing EV supply to meet growing consumer demand. With the advent of 5G networks, mobile connectivity has improved, further accelerating investment in IoT-based solutions. Large enterprises continue to invest resources in IoT as they increasingly leverage technology as part of their business plans by quickly modifying IoT plans and executing long-term IoT deals. The expansion of the automotive industry is driving the growth of the embedded systems market. Major players in the North American market are collaborating to develop high-performance embedded systems for autonomous vehicles. For example, Magna International has partnered with BlackBerry Limited to develop next-generation ADAS solutions to drive market growth.

Europe: Europe is expected to be one of the fastest-growing markets in the global IoT operating system market during the forecast period. The increasing development and application of IoT technologies, especially in industrial automation, is driving the growth of the market revenue in this region. For example, the EU-funded IoT Edge Cloud Operating System (ICO) project was launched in Barcelona, and supported by the European Commission through the Horizon Europe program. Inter-enterprise collaborations are also driving the market, such as Siemens merging factory automation solutions with Google Cloud’s data cloud and AI/machine learning capabilities. Europe will occupy a market share of 28.32% in 2025.

Asia-Pacific: The market size of IoT-embedded real-time operating systems in Asia Pacific is growing rapidly, especially in countries such as China, Japan, Australia, and New Zealand. The Asia-Pacific region is active in the development and application of IoT technologies, especially in the areas of smart manufacturing and industrial IoT. Policy support, such as the Chinese government’s support for IoT-focused research and development (R&D) programs, is expected to drive market revenue growth. Asia-Pacific will dominate a market share of 27.33% in 2025.

Global Embedded Real-Time Operating Systems for the IoT Market Share by Region in 2025

6. Market Competition

Wind River: A global leader in delivering software for intelligent connected systems, Wind River offers a comprehensive, edge-to-cloud software portfolio designed to address the challenges and opportunities critical infrastructure companies face when evolving and modernizing their systems as they work to realize the full potential of IoT. Wind River is one of the major players operating in the Embedded Real-Time Operating Systems for the IoT market, holding a share of 20.71% in 2024.

Green Hills Software: Green Hills Software is the worldwide leader in embedded safety and security. Green Hills Software’s technology and services have been chosen by prominent companies in over 50 countries to build their electronic products for everything from MP3 players to jumbo jets.

Blackberry: BlackBerry® QNX® is a trusted provider of commercial operating systems, hypervisors, development tools, support, and services, all of which are built for the world’s most critical embedded systems. BlackBerry QNX helps customers simplify their development work to more effectively launch safe, reliable, and reliable systems. Their technology is trusted in more than 195 million vehicles and deployed in embedded systems worldwide, involving a series of aerospace and defense, automotive, commercial vehicles, heavy machinery, industrial control, medical, railway, and robotics industries.

7. Market Recent Development

April 2024 Infineon Technologies AG and Green Hills Software jointly launched an integrated microcontroller-based processing platform for safety-critical real-time automotive systems. The platform combines Green Hills’ security-certified real-time operating system (RTOS) µVelosity ™ with Infineon’s next-generation security controller AURIX™ TC4x.

In April 2024, BlackBerry announced a partnership with AMD that aims to drive fundamental precision and reliability in the robotics industry by enabling new levels of low latency and high efficiency. The BlackBerry QNX 2024 Developer Conference was successfully held in Shanghai, bringing together global automotive technology experts, industry leaders, and ecological partners to discuss the cutting-edge trends of “software-defined vehicles” and cross-domain convergence.

Major Players

| Company Name | Production Bases | Sales Regions |

| Wind River | USA | Worldwide |

| Green Hills Software | USA | Worldwide |

| BlackBerry | Canada | Worldwide |

| Nucleus | USA | Worldwide |

| NXP | Netherlands | Worldwide |

| Microsoft Express Logic | USA | Worldwide |

| eSOL | Japan | Worldwide |

| Silicon Labs (Micrium) | USA | Worldwide |

| Segger | Germany | Worldwide |

| Sysgo | Germany | Worldwide |

| Lynx Software Technologies | USA | Mainly in North America, Europe, and Asia |

| ENEA | Sweden | Worldwide |

| DDC-I | Denmark | Mainly in North America, Europe, and Asia |

| ARM Keil | Germany | Worldwide |

1 Embedded Real-Time Operating Systems for the IoT Market Definition and Overview

1.1 Objectives of the Study

1.2 Overview of Embedded Real-Time Operating Systems for the IoT

1.3 Embedded Real-Time Operating Systems for the IoT Market Scope and Market Size Estimation

1.4 Market Segmentation

1.4.1 Types of Embedded Real-Time Operating Systems for the IoT

1.4.2 Sales Channels of Embedded Real-Time Operating Systems for the IoT

1.5 Market Exchange Rate

2 Research Method and Logic

2.1 Methodology

2.2 Research Data Source

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.3 Market Size Estimation

3 Market Competition Analysis

3.1 Wind River Market Performance Analysis

3.1.1 Wind River Basic Information

3.1.2 Product and Service Analysis

3.1.3 Wind River Value and Gross Margin 2016-2021

3.2 Green Hills Software Market Performance Analysis

3.2.1 Green Hills Software Basic Information

3.2.2 Product and Service Analysis

3.2.3 Strategies for Company to Deal with the Impact of COVID-19

3.2.4 Green Hills Software Value and Gross Margin 2016-2021

3.3 Blackberry Market Performance Analysis

3.3.1 Blackberry Basic Information

3.3.2 Product and Service Analysis

3.3.3 Blackberry Value and Gross Margin 2016-2021

3.4 Nucleus Market Performance Analysis

3.4.1 Nucleus Basic Information

3.4.2 Product and Service Analysis

3.4.3 Nucleus Value and Gross Margin 2016-2021

3.5 NXP Market Performance Analysis

3.5.1 NXP Basic Information

3.5.2 Product and Service Analysis

3.5.3 Strategies for Company to Deal with the Impact of COVID-19

3.5.4 NXP Value and Gross Margin 2016-2021

3.6 Microsoft Express Logic Market Performance Analysis

3.6.1 Microsoft Express Logic Basic Information

3.6.2 Product and Service Analysis

3.6.3 Microsoft Express Logic Value and Gross Margin 2016-2021

3.7 ESOL Market Performance Analysis

3.7.1 ESOL Basic Information

3.7.2 Product and Service Analysis

3.7.3 ESOL Value and Gross Margin 2016-2021

3.8 Silicon Labs (Micrium) Market Performance Analysis

3.8.1 Silicon Labs (Micrium) Basic Information

3.8.2 Product and Service Analysis

3.8.3 Strategies for Company to Deal with the Impact of COVID-19

3.8.4 Silicon Labs (Micrium) Value and Gross Margin 2016-2021

3.9 Segger Market Performance Analysis

3.9.1 Segger Basic Information

3.9.2 Product and Service Analysis

3.9.3 Strategies for Company to Deal with the Impact of COVID-19

3.9.4 Segger Value and Gross Margin 2016-2021

3.10 Sysgo Market Performance Analysis

3.10.1 Sysgo Basic Information

3.10.2 Product and Service Analysis

3.10.3 Sysgo Value and Gross Margin 2016-2021

3.11 Lynx Software Technologies Market Performance Analysis

3.11.1 Lynx Software Technologies Basic Information

3.11.2 Product and Service Analysis

3.11.3 Lynx Software Technologies Value and Gross Margin 2016-2021

3.12 ENEA Market Performance Analysis

3.12.1 ENEA Basic Information

3.12.2 Product and Service Analysis

3.12.3 ENEA Value and Gross Margin 2016-2021

3.13 DDC-I Market Performance Analysis

3.13.1 DDC-I Basic Information

3.13.2 Product and Service Analysis

3.13.3 DDC-I Value and Gross Margin 2016-2021

3.14 ARM Keil Market Performance Analysis

3.14.1 ARM Keil Basic Information

3.14.2 Product and Service Analysis

3.14.3 ARM Keil Value and Gross Margin 2016-2021

4 Market Segment by Type, Historical Data and Market Forecasts

4.1 Global Embedded Real-Time Operating Systems for the IoT Market Value by Type 2016-2021

4.2 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate by Type 2016-2021

4.2.1 Soft Real Time Operating System — Market Value and Growth Rate

4.2.2 Hard Real Time Operating System — Market Value and Growth Rate

4.3 Global Embedded Real-Time Operating Systems for the IoT Market Value Forecast by Type

4.4 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate by Type Forecast 2021-2026

4.4.1 Soft Real Time Operating System — Market Value and Growth Rate Forecast

4.4.2 Hard Real Time Operating System — Market Value and Growth Rate Forecast

5 Market Segment by Sales Channel, Historical Data and Market Forecasts

5.1 Global Embedded Real-Time Operating Systems for the IoT Market Value by Sales Channel 2016-2021

5.2 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate by Sales Channel 2016-2021

5.2.1 Direct Sales — Market Value and Growth Rate

5.2.2 Indirect Sales — Market Value and Growth Rate

5.3 Global Embedded Real-Time Operating Systems for the IoT Market Value Forecast by Sales Channel

5.4 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate by Sales Channel Forecast 2021-2026

5.4.1 Direct Sales — Market Value and Growth Rate Forecast

5.4.2 Indirect Sales — Market Value and Growth Rate Forecast

6 Global Embedded Real-Time Operating Systems for the IoT by Region, Historical Data and Market Forecasts

6.1 Global Embedded Real-Time Operating Systems for the IoT Market Value by Region 2016-2021

6.2 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate by Region 2016-2021

6.2.1 North America

6.2.2 Europe

6.2.3 Asia Pacific

6.2.4 South America

6.2.5 Middle East and Africa

6.3 Global Embedded Real-Time Operating Systems for the IoT Market Value Forecast by Region 2021-2026

6.4 Global Embedded Real-Time Operating Systems for the IoT Market Value and Growth Rate Forecast by Region 2021-2026

6.4.1 North America

6.4.2 Europe

6.4.3 Asia Pacific

6.4.4 South America

6.4.5 Middle East and Africa

7 United State Market Size Analysis 2016-2026

7.1 United State Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

7.2 United State Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

8 Canada Market Size Analysis 2016-2026

8.1 Canada Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

8.2 Canada Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

9 Germany Market Size Analysis 2016-2026

9.1 Germany Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

9.2 Germany Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

10 UK Market Size Analysis 2016-2026

10.1 UK Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

10.2 UK Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

11 France Market Size Analysis 2016-2026

11.1 France Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

11.2 France Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

12 Italy Market Size Analysis 2016-2026

12.1 Italy Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

12.2 Italy Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

13 Spain Market Size Analysis 2016-2026

13.1 Spain Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

13.2 Spain Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

14 Russia Market Size Analysis 2016-2026

14.1 Russia Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

14.2 Russia Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

15 China Market Size Analysis 2016-2026

15.1 China Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

15.2 China Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

16 Japan Market Size Analysis 2016-2026

16.1 Japan Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

16.2 Japan Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

17 South Korea Market Size Analysis 2016-2026

17.1 South Korea Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

17.2 South Korea Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

18 Australia Market Size Analysis 2016-2026

18.1 Australia Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

18.2 Australia Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

19 Thailand Market Size Analysis 2016-2026

19.1 Thailand Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

19.2 Thailand Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

20 Brazil Market Size Analysis 2016-2026

20.1 Brazil Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

20.2 Brazil Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

21 Argentina Market Size Analysis 2016-2026

21.1 Argentina Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

21.2 Argentina Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

22 Chile Market Size Analysis 2016-2026

22.1 Chile Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

22.2 Chile Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

23 South Africa Market Size Analysis 2016-2026

23.1 South Africa Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

23.2 South Africa Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

24 Egypt Market Size Analysis 2016-2026

24.1 Egypt Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

24.2 Egypt Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

25 UAE Market Size Analysis 2016-2026

25.1 UAE Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

25.2 UAE Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

26 Saudi Arabia Market Size Analysis 2016-2026

26.1 Saudi Arabia Embedded Real-Time Operating Systems for the IoT Value and Market Growth 2016-2021

26.2 Saudi Arabia Embedded Real-Time Operating Systems for the IoT Market Value Forecast 2021-2026

27 Market Dynamic Analysis and Development Suggestions

27.1 Market Drivers

27.2 Market Development Constraints

27.3 PEST Analysis

27.3.1 Political Factors

27.3.2 Economic Factors

27.3.3 Social Factors

27.3.4 Technological Factors

27.4 Industry Trends Under COVID-19

27.4.1 Risk Assessment on COVID-19

27.4.2 Assessment of the Overall Impact of COVID-19 on the Industry

27.5 Market Entry Strategy Analysis

27.5.1 Market Definition

27.5.2 Client

27.5.3 Distribution Model

27.5.4 Product Messaging and Positioning

27.5.5 Price

27.6 Advice on Entering the Market