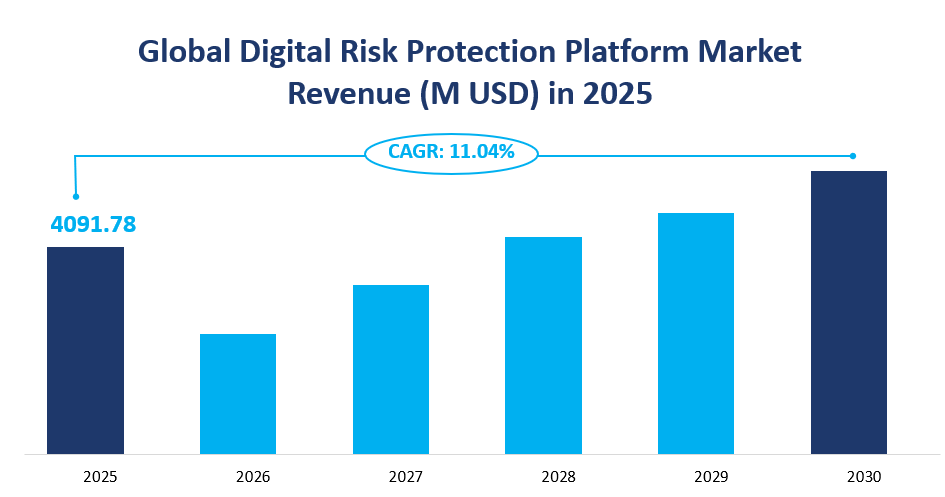

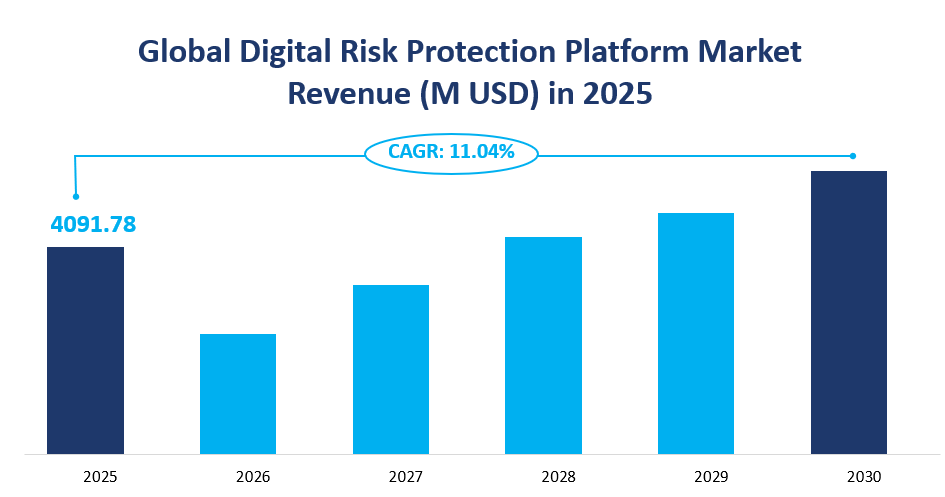

1. Market Value and Growth Rate

The global Digital Risk Protection Platform market is projected to reach a significant milestone in the coming years. By 2025, the market value is estimated to be around 4091.78 million USD. This growth is driven by a steady Compound Annual Growth Rate (CAGR) of 11.04% from 2025 to 2030.

Definition of Digital Risk Protection Platform

A Digital Risk Protection Platform is a comprehensive solution designed to safeguard businesses from various digital threats. It combines advanced threat intelligence with data leak detection engines to monitor and mitigate risks across multiple digital channels, including social media, web domains, and the dark web. These platforms are essential for identifying and neutralizing potential threats before they can cause significant damage. They provide real-time alerts and automated responses to emerging risks, ensuring that organizations can maintain a secure digital presence.

The platforms also offer robust analytics and reporting capabilities, allowing businesses to gain insights into their digital risk landscape and make informed decisions to enhance their security posture.

Figure Global Digital Risk Protection Platform Market Revenue (M USD) in 2025

2. Driving Factors and Limiting Factors of Market Growth

The growth of the Digital Risk Protection Platform market is influenced by several key factors. On the positive side, the increasing demand for robust cybersecurity solutions is a primary driver. As businesses continue to expand their digital footprints, they face a growing number of cyber threats, including data breaches, phishing attacks, and ransomware. This has led to a heightened awareness of the need for advanced digital risk protection solutions. Additionally, the rise in digital transformation initiatives across industries has further fueled the market growth. Companies are investing heavily in smart technologies and automation, which increases their reliance on digital platforms and, consequently, the need for comprehensive security measures.

However, there are also several limiting factors that could hinder the growth of this market. One significant challenge is the lack of trust in digital risk protection platforms among some organizations. Concerns about hidden costs, service quality, and the reliability of service providers can deter businesses from adopting these platforms. Another limiting factor is the high technical barriers to entry.

The digital risk protection industry requires specialized knowledge and expertise, which can be a barrier for new entrants. Established players with a strong market foundation and extensive experience have a competitive advantage, making it difficult for newcomers to gain a foothold. Additionally, budget constraints, particularly among small and medium-sized enterprises (SMEs), can limit the adoption of these platforms, as they may not have the financial resources to invest in advanced security solutions.

3. Technology Innovation and Corporate Mergers and Acquisitions

The Digital Risk Protection Platform market is characterized by continuous technological innovation and strategic corporate activities. Companies are constantly investing in research and development to enhance their platforms with advanced features such as artificial intelligence (AI) and machine learning (ML). These technologies enable more accurate threat detection and faster response times, providing businesses with a proactive approach to digital risk management. For example, platforms like ZeroFOX and Recorded Future leverage AI to analyze vast amounts of data and identify potential threats in real-time.

Corporate mergers and acquisitions have also played a significant role in shaping the market landscape. These strategic moves allow companies to expand their product offerings, enhance their technological capabilities, and strengthen their market positions. For instance, ZeroFOX’s acquisition of Cyveillance has significantly bolstered its threat intelligence capabilities, making it a more formidable player in the digital risk protection space. Similarly, Deloitte’s acquisition of Terbium Labs has expanded its threat intelligence offerings, providing clients with more comprehensive digital risk protection solutions.

4. Product Types of Digital Risk Protection Platform

The Digital Risk Protection Platform market is segmented into two primary product types: Cloud-Based and On-Premise. Each type has distinct characteristics and market dynamics.

Cloud-Based Platforms

Cloud-based digital risk protection platforms leverage cloud computing resources to provide scalable and flexible security solutions. These platforms are deployed over the internet, allowing users to access threat intelligence and risk management tools without the need for extensive on-site infrastructure. The flexibility and ease of deployment make cloud-based solutions particularly attractive to businesses of all sizes, from SMEs to large enterprises.

By 2025, the cloud-based segment is projected to have a market size of 3699.49 million USD, accounting for approximately 90.41% of the total market share. This significant market share is driven by the growing preference for cloud solutions due to their cost-effectiveness, scalability, and ease of maintenance.

On-Premise Platforms

On-premise platforms, in contrast, are installed and operated within the organization’s own data centers. These solutions offer greater control over data and security configurations, making them suitable for organizations with specific compliance requirements or those that prefer to maintain their infrastructure internally. By 2025, the on-premise segment is expected to reach a market size of 401.34 million USD, representing about 9.59% of the total market share. Despite their smaller market share, on-premise solutions remain relevant for certain industries that prioritize data sovereignty and internal control.

In summary, cloud-based platforms dominate the Digital Risk Protection Platform market, driven by their flexibility, scalability, and cost-effectiveness. However, on-premise solutions continue to serve niche markets with specific security and compliance needs.

Table Market Sizes and Market Shares of All Types in 2025

|

Type |

Market Size (M USD) |

Market Share (%) |

|---|---|---|

|

Cloud-Based |

3699.49 |

90.41 |

|

On-Premise |

401.34 |

9.59 |

5. Applications of Digital Risk Protection Platform

The Digital Risk Protection Platform market serves various applications, primarily targeting SMEs and Large Enterprises. Each application segment has unique requirements and market dynamics.

SMEs

Small and Medium-sized Enterprises (SMEs) are a significant segment of the digital risk protection market. These organizations, typically with revenues between 10 million and 1 billion USD, face unique challenges due to their limited resources and often lack robust cybersecurity measures. Digital risk protection platforms help SMEs safeguard their digital assets, protect against cyber threats, and ensure compliance with industry standards.

By 2025, the SME segment is projected to have a market size of 1613.67 million USD, accounting for approximately 39.44% of the total market share. The growth in this segment is driven by increasing awareness of cybersecurity risks and the need for cost-effective solutions.

Large Enterprises

Large enterprises, with revenues exceeding 1 billion USD, represent the other major application segment. These organizations handle vast amounts of sensitive data and face sophisticated cyber threats. Digital risk protection platforms are crucial for large enterprises to monitor and mitigate risks across their extensive digital footprints.

By 2025, the large enterprise segment is expected to reach a market size of 2478.12 million USD, representing about 60.56% of the total market share. The dominance of this segment is attributed to the higher investment in advanced security solutions and the critical need to protect their extensive digital infrastructure.

Table Market Sizes and Market Shares of All Applications in 2025

|

Application |

Market Size (M USD) |

Market Share (%) |

|---|---|---|

|

SMEs |

1613.67 |

39.44 |

|

Large Enterprises |

2478.12 |

60.56 |

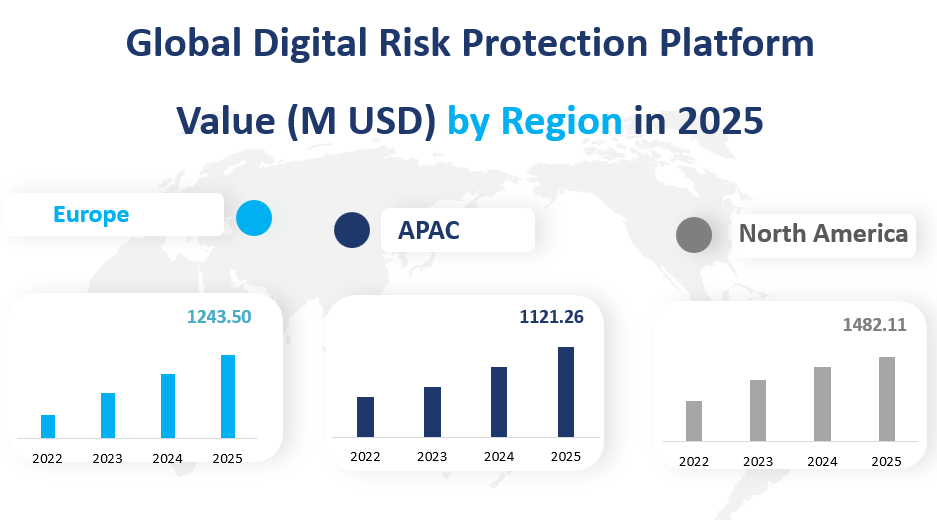

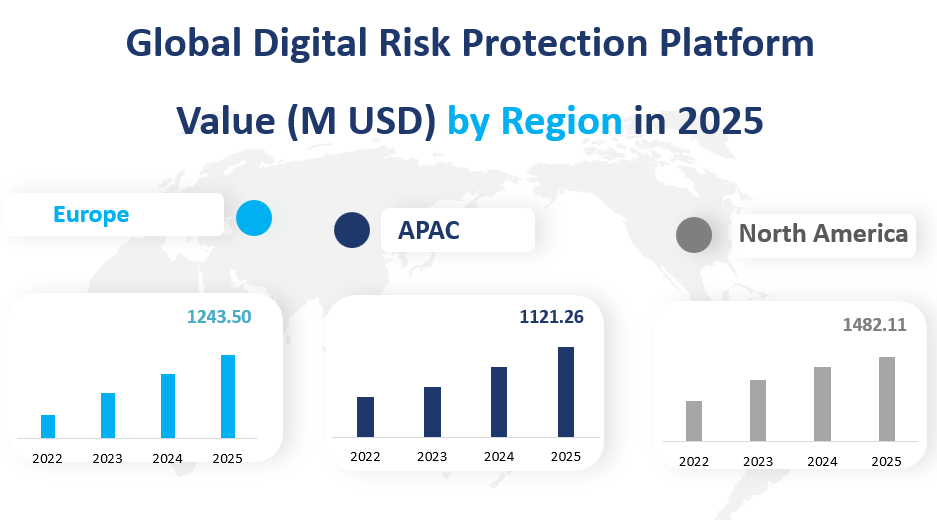

6. Regional Analysis of the Digital Risk Protection Platform Market

North America

North America continues to dominate the Digital Risk Protection Platform market, driven by the presence of leading technology companies and a high demand for advanced cybersecurity solutions. By 2025, the market size in North America is projected to reach 1482.11 million USD, accounting for approximately 36.22% of the global market share. The region’s strong economic foundation and early adoption of digital technologies have positioned it as a leader in the digital risk protection space. The United States, in particular, is a significant contributor, with a market size of 1416.58 million USD, representing 95.58% of the regional market share.

Europe

Europe is another major player in the digital risk protection market, with a projected market size of 1243.50 million USD by 2025. This represents about 30.39% of the global market share. The region’s robust regulatory environment, particularly concerning data protection and privacy, has spurred the adoption of advanced digital risk protection solutions. Key countries such as Germany, the UK, and France are driving the market growth, with Germany alone contributing 248.60 million USD, or 19.99% of the regional market share.

Asia-Pacific

The Asia-Pacific region is emerging as a significant market for digital risk protection platforms, driven by rapid digital transformation and increasing awareness of cybersecurity threats. By 2025, the market size in the Asia-Pacific region is expected to reach 1121.26 million USD, accounting for approximately 27.40% of the global market share. China and Japan are the leading markets within the region, with China contributing 448.40 million USD, or 39.99% of the regional market share. The region’s growth is further supported by increasing investments in smart technologies and automation solutions.

Latin America

Latin America is also experiencing growth in the digital risk protection market, driven by increasing digital adoption and the need for robust cybersecurity measures. By 2025, the market size in Latin America is projected to reach 130.32 million USD, representing about 3.18% of the global market share. Brazil and Mexico are the key markets, with Brazil contributing 51.03 million USD, or 39.16% of the regional market share.

Middle East & Africa

The Middle East & Africa region is another important market, with a projected size of 114.60 million USD by 2025, accounting for approximately 2.80% of the global market share. The region’s growth is driven by increasing digitalization efforts and the need to protect critical infrastructure. Turkey, Saudi Arabia, and the UAE are key contributors, with Turkey contributing 52.79 million USD, or 46.06% of the regional market share.

Figure Global Digital Risk Protection Platform Value (M USD) by Region in 2025

7. Analysis of the Top 3 Companies in the Digital Risk Protection Platform Market

7.1. RSA Security

Company Introduction and Business Overview

RSA Security LLC, established in 1982, is a prominent player in the cybersecurity and digital risk management industry. Headquartered in the USA, RSA Security operates globally, providing a wide range of cybersecurity solutions. The company is renowned for its integrated risk management, omnichannel fraud prevention, and threat detection products, serving clients worldwide. RSA Security’s mission is to help organizations manage digital risk and protect their digital assets from various cyber threats.

Products Offered

RSA Security offers a comprehensive suite of products designed to address various aspects of digital risk protection. One of its flagship products is the Archer IT & Security Risk Management platform. This platform supports major digital business initiatives, enables security teams, and facilitates IT compliance. It allows organizations to document and report on IT risks, security vulnerabilities, audit findings, regulatory obligations, and issues across their technology infrastructure. The robust reporting features enable accurate communication with the board and senior management about the organization’s technology risk. RSA Security also provides solutions for integrated risk management, fraud prevention, and threat detection.

Sales Revenue in 2021

In 2021, RSA Security reported a sales revenue of 433.02 million USD in the digital risk protection platform business. The company’s gross revenue for the same period was 304.46 million USD, with a gross margin of 70.31%. RSA Security’s consistent revenue growth underscores its strong market position and the effectiveness of its comprehensive cybersecurity solutions.

7.2. Proofpoint

Company Introduction and Business Overview

Proofpoint, Inc., founded in 2002 and headquartered in the USA, is a leading provider of enterprise software solutions focused on cybersecurity. The company offers a range of on-demand data protection solutions, including threat protection, regulatory compliance, archiving and governance, and secure communication. Proofpoint serves clients worldwide, helping them secure their digital assets and protect against various cyber threats.

Products Offered

Proofpoint’s Digital Risk Protection platform is a key offering that secures brands and customers against digital security risks across web domains, social media, and the deep and dark web. It is the only solution that provides a holistic defense for all digital engagement channels. The platform protects companies from domain squatters, typo phishing campaigns, and other infringing domains. It also helps organizations gain situational awareness of potential social media threats against key executives and locations. Proofpoint’s comprehensive suite of products ensures robust protection against a wide range of digital threats.

Sales Revenue in 2021

In 2021, Proofpoint reported a sales revenue of 447.88 million USD in the digital risk protection platform business. The company’s gross revenue for the same period was 294.99 million USD, with a gross margin of 65.86%. Proofpoint’s strong financial performance reflects its leadership in providing advanced cybersecurity solutions and its ability to meet the evolving needs of its clients.

7.3. FireEye

Company Introduction and Business Overview

FireEye, Inc., established in 2004 and headquartered in the USA, is a prominent cybersecurity company known for its intelligence-led security solutions. FireEye combines world-class technology with unparalleled frontline human expertise, including industry-recognized services and nation-state grade threat intelligence. The company operates globally, providing comprehensive cybersecurity solutions to protect organizations from advanced cyber threats.

Products Offered

FireEye’s Digital Threat Monitoring platform is a key product that helps organizations identify threats to their assets outside their perimeter and across the deep and dark web. The platform searches black markets, social media, and paste sites for signs of compromise, providing knowledge of attacks before they happen. It is tailored specifically to the organization’s security needs, enabling proactive steps to defend against attacks and mitigate damage. FireEye also offers tailored investigations and intelligence services, leveraging its analysts’ expertise to provide comprehensive threat protection.

Sales Revenue in 2021

In 2021, FireEye reported a sales revenue of 204.31 million USD in the digital risk protection platform business. The company’s gross revenue for the same period was 145.84 million USD, with a gross margin of 71.38%. FireEye’s robust financial performance highlights its strong market presence and the effectiveness of its advanced cybersecurity solutions in protecting organizations from sophisticated cyber threats.

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Digital Risk Protection Platform Market Size Growth Rate by Type: 2020 VS 2025 VS 2030

1.2.2 Cloud Based

1.2.3 On-premise

1.3 Market Analysis by Application

1.3.1 Global Digital Risk Protection Platform Market Share by Application: 2020 VS 2025 VS 2030

1.3.2 SMEs

1.3.3 Large Enterprises

1.4 Study Objectives

1.5 Years Considered

2 Global Growth Trends

2.1 Global Digital Risk Protection Platform Market Perspective (2020-2030)

2.2 Global Digital Risk Protection Platform Growth Trends by Regions

2.2.1 Digital Risk Protection Platform Market Size by Regions: 2020 VS 2025 VS 2030

2.2.2 Digital Risk Protection Platform Historic Market Size by Regions (2020-2025)

2.2.3 Digital Risk Protection Platform Forecasted Market Size by Regions (2025-2030)

2.3 Digital Risk Protection Platform Industry Dynamic

2.3.1 Digital Risk Protection Platform Market Trends

2.3.2 Digital Risk Protection Platform Market Drivers

2.3.3 Digital Risk Protection Platform Market Challenges

2.3.4 Digital Risk Protection Platform Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Digital Risk Protection Platform Players by Revenue

3.1.1 Global Top Digital Risk Protection Platform Revenue by Players (2020-2025)

3.1.2 Global Digital Risk Protection Platform Revenue Market Share by Players (2020-2025)

3.2 Global Digital Risk Protection Platform Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

3.3 Players Covered: Ranking by Digital Risk Protection Platform Revenue

3.4 Global Digital Risk Protection Platform Market Concentration Ratio

3.4.1 Global Digital Risk Protection Platform Market Concentration Ratio (CR5 and HHI) & (2020-2025)

3.4.2 Global Top 10 and Top 5 Companies by Digital Risk Protection Platform Revenue in 2020

Figure the

3.5 Digital Risk Protection Platform Key Players Head office

3.6 Digital Risk Protection Platform Key Players Area Served

3.7 Established Date of International Manufacturers

3.8 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type

4.1 Global Digital Risk Protection Platform Historic Market Size by Type (2020-2025)

4.2 Global Digital Risk Protection Platform Forecasted Market Size by Type (2025-2030)

5 Breakdown Data by Application

5.1 Global Digital Risk Protection Platform Historic Market Size by Application (2020-2025)

5.2 Global Digital Risk Protection Platform Forecasted Market Size by Application (2025-2030)

6 North America

6.1 North America Digital Risk Protection Platform Market Size (2020-2030)

6.2 North America Digital Risk Protection Platform Market Size by Type

6.2.1 North America Digital Risk Protection Platform Market Size by Type (2020-2025)

6.2.2 North America Digital Risk Protection Platform Market Size by Type (2025-2030)

6.2.3 North America Digital Risk Protection Platform Market Size by Type (2020-2030)

6.3 North America Digital Risk Protection Platform Market Size by Application

6.3.1 North America Digital Risk Protection Platform Market Size by Application (2020-2025)

6.3.2 North America Digital Risk Protection Platform Market Size by Application (2025-2030)

6.3.3 North America Digital Risk Protection Platform Market Size by Application (2020-2030)

6.4 North America Digital Risk Protection Platform Market Size by Country

6.4.1 North America Digital Risk Protection Platform Market Size by Country (2020-2025)

6.4.2 North America Digital Risk Protection Platform Market Size by Country (2025-2030)

6.4.3 United States

6.4.4 Canada

7 Europe

7.1 Europe Digital Risk Protection Platform Market Size (2020-2030)

7.2 Europe Digital Risk Protection Platform Market Size by Type

7.2.1 Europe Digital Risk Protection Platform Market Size by Type (2020-2025)

7.2.2 Europe Digital Risk Protection Platform Market Size by Type (2025-2030)

7.2.3 Europe Digital Risk Protection Platform Market Size by Type (2020-2030)

7.3 Europe Digital Risk Protection Platform Market Size by Application

7.3.1 Europe Digital Risk Protection Platform Market Size by Application (2020-2025)

7.3.2 Europe Digital Risk Protection Platform Market Size by Application (2025-2030)

7.3.3 Europe Digital Risk Protection Platform Market Size by Application (2020-2030)

7.4 Europe Digital Risk Protection Platform Market Size by Country

7.4.1 Europe Digital Risk Protection Platform Market Size by Country (2020-2025)

7.4.2 Europe Digital Risk Protection Platform Market Size by Country (2025-2030)

7.4.3 Germany

7.4.4 France

7.4.5 U.K.

7.4.6 Italy

7.4.7 Russia

7.4.8 Nordic

8 Asia-Pacific

8.1 Asia-Pacific Digital Risk Protection Platform Market Size (2020-2030)

8.2 Asia-Pacific Digital Risk Protection Platform Market Size by Type

8.2.1 Asia-Pacific Digital Risk Protection Platform Market Size by Type (2020-2025)

8.2.2 Asia-Pacific Digital Risk Protection Platform Market Size by Type (2025-2030)

8.2.3 Asia-Pacific Digital Risk Protection Platform Market Size by Type (2020-2030)

8.3 Asia-Pacific Digital Risk Protection Platform Market Size by Application

8.3.1 Asia-Pacific Digital Risk Protection Platform Market Size by Application (2020-2025)

8.3.2 Asia-Pacific Digital Risk Protection Platform Market Size by Application (2025-2030)

8.3.3 Asia-Pacific Digital Risk Protection Platform Market Size by Application (2020-2030)

8.4 Asia-Pacific Digital Risk Protection Platform Market Size by Country

8.4.1 Asia-Pacific Digital Risk Protection Platform Market Size by Country (2020-2025)

8.4.2 Asia-Pacific Digital Risk Protection Platform Market Size by Country (2025-2030)

8.4.3 China

8.4.4 Japan

8.4.5 South Korea

8.4.6 Southeast Asia

8.4.7 India

8.4.8 Australia

9 Latin America

9.1 Latin America Digital Risk Protection Platform Market Size (2020-2030)

9.2 Latin America Digital Risk Protection Platform Market Size by Type

9.2.1 Latin America Digital Risk Protection Platform Market Size by Type (2020-2025)

9.2.2 Latin America Digital Risk Protection Platform Market Size by Type (2025-2030)

9.2.3 Latin America Digital Risk Protection Platform Market Size by Type (2020-2030)

9.3 Latin America Digital Risk Protection Platform Market Size by Application

9.3.1 Latin America Digital Risk Protection Platform Market Size by Application (2020-2025)

9.3.2 Latin America Digital Risk Protection Platform Market Size by Application (2025-2030)

9.3.3 Latin America Digital Risk Protection Platform Market Size by Application (2020-2030)

9.4 Latin America Digital Risk Protection Platform Market Size by Country

9.4.1 Latin America Digital Risk Protection Platform Market Size by Country (2020-2025)

9.4.2 Latin America Digital Risk Protection Platform Market Size by Country (2025-2030)

9.4.3 Mexico

9.4.4 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Digital Risk Protection Platform Market Size (2020-2030)

10.2 Middle East & Africa Digital Risk Protection Platform Market Size by Type

10.2.1 Middle East & Africa Digital Risk Protection Platform Market Size by Type (2020-2025)

10.2.2 Middle East & Africa Digital Risk Protection Platform Market Size by Type (2025-2030)

10.2.3 Middle East & Africa Digital Risk Protection Platform Market Size by Type (2020-2030)

10.3 Middle East & Africa Digital Risk Protection Platform Market Size by Application

10.3.1 Middle East & Africa Digital Risk Protection Platform Market Size by Application (2020-2025)

10.3.2 Middle East & Africa Digital Risk Protection Platform Market Size by Application (2025-2030)

10.3.3 Middle East & Africa Digital Risk Protection Platform Market Size by Application (2020-2030)

10.4 Middle East & Africa Digital Risk Protection Platform Market Size by Country

10.4.1 Middle East & Africa Digital Risk Protection Platform Market Size by Country (2020-2025)

10.4.2 Middle East & Africa Digital Risk Protection Platform Market Size by Country (2025-2030)

10.4.3 Turkey

10.4.4 Saudi Arabia

10.4.5 UAE

11 Key Players Profiles

11.1 RSA Security

11.1.1 RSA Security Company Details

11.1.2 Digital Risk Protection Platform Introduction

11.1.3 RSA Security Revenue in Digital Risk Protection Platform Business (2020-2025)

11.1.4 RSA Security Recent Development

11.2 Proofpoint

11.2.1 Proofpoint Company Details

11.2.2 Digital Risk Protection Platform Introduction

11.2.3 Proofpoint Revenue in Digital Risk Protection Platform Business (2020-2025)

11.2.4 Proofpoint Recent Development

11.3 FireEye

11.3.1 FireEye Company Details

11.3.2 Digital Risk Protection Platform Introduction

11.3.3 FireEye Revenue in Digital Risk Protection Platform Business (2020-2025)

11.3.4 FireEye Recent Development

11.4 Recorded Future

11.4.1 Recorded Future Company Details

11.4.2 Digital Risk Protection Platform Introduction

11.4.3 Recorded Future Revenue in Digital Risk Protection Platform Business (2020-2025)

11.5 PhishLabs

11.5.1 PhishLabs Company Details

11.5.2 Digital Risk Protection Platform Introduction

11.5.3 PhishLabs Revenue in Digital Risk Protection Platform Business (2020-2025)

11.6 Group-IB

11.6.1 Group-IB Company Details

11.6.2 Digital Risk Protection Platform Introduction

11.6.3 Group-IB Revenue in Digital Risk Protection Platform Business (2020-2025)

11.7 IntSights

11.7.1 IntSights Company Details

11.7.2 Digital Risk Protection Platform Introduction

11.7.3 IntSights Revenue in Digital Risk Protection Platform Business (2020-2025)

11.8 ZeroFOX

11.8.1 ZeroFOX Company Details

11.8.2 Digital Risk Protection Platform Introduction

11.8.3 ZeroFOX Revenue in Digital Risk Protection Platform Business (2020-2025)

11.9 RiskIQ

11.9.1 RiskIQ Company Details

11.9.2 Digital Risk Protection Platform Introduction

11.9.3 RiskIQ Revenue in Digital Risk Protection Platform Business (2020-2025)

11.10 Cyberint

11.10.1 Cyberint Company Details

11.10.2 Digital Risk Protection Platform Introduction

11.10.3 Cyberint Revenue in Digital Risk Protection Platform Business (2020-2025)

11.11 Digital Shadows

11.11.1 Digital Shadows Company Details

11.11.2 Digital Risk Protection Platform Introduction

11.11.3 Digital Shadows Revenue in Digital Risk Protection Platform Business (2020-2025)

11.12 Axur

11.12.1 Axur Company Details

11.12.2 Digital Risk Protection Platform Introduction

11.12.3 Axur Revenue in Digital Risk Protection Platform Business (2020-2025)

11.13 Safeguard Cyber

11.13.1 Safeguard Cyber Company Details

11.13.2 Digital Risk Protection Platform Introduction

11.13.3 Safeguard Cyber Revenue in Digital Risk Protection Platform Business (2020-2025)

11.14 ID Agent

11.14.1 ID Agent Company Details

11.14.2 Digital Risk Protection Platform Introduction

11.14.3 ID Agent Revenue in Digital Risk Protection Platform Business (2020-2025)

12 Analyst’s Viewpoints/Conclusions

13 Appendix

13.1 Methodology

13.2 Research Data Source