1. Digital Mailroom Services Market Overview

The digital mailroom services market is a burgeoning sector within the information management industry, focusing on automating and streamlining traditional mailroom processes. This market encompasses a range of services from document scanning and capture to data processing and distribution, all aimed at reducing costs and improving access to critical business information. Digital Mailroom Services (DMS) involve using intelligent capture and data processing technologies to digitize paper mail and manage electronic communications, thereby enhancing efficiency and security within an organization. The DMS market is a reflection of the growing need for businesses to adapt to a digital-first approach in managing their mail and document workflows.

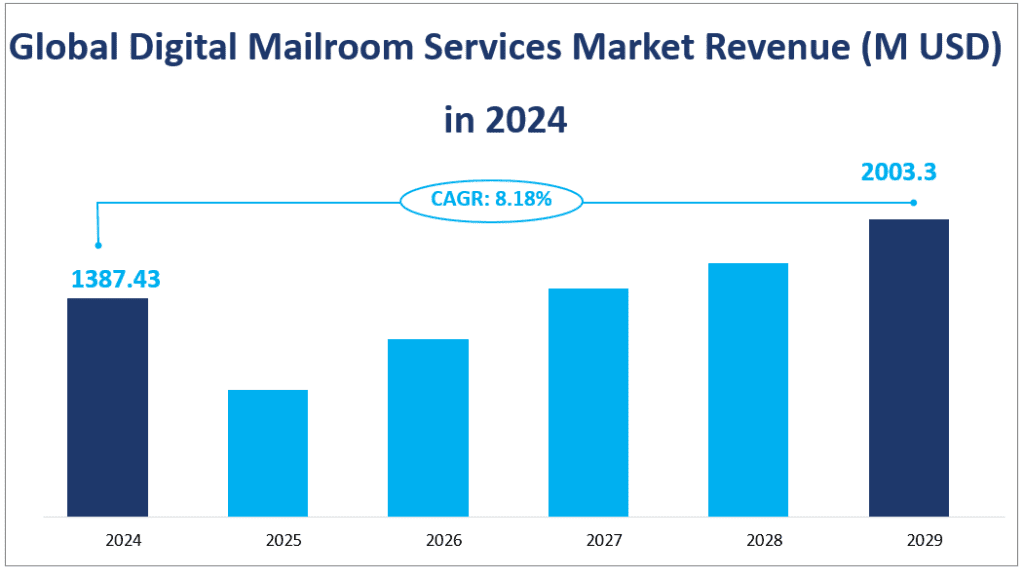

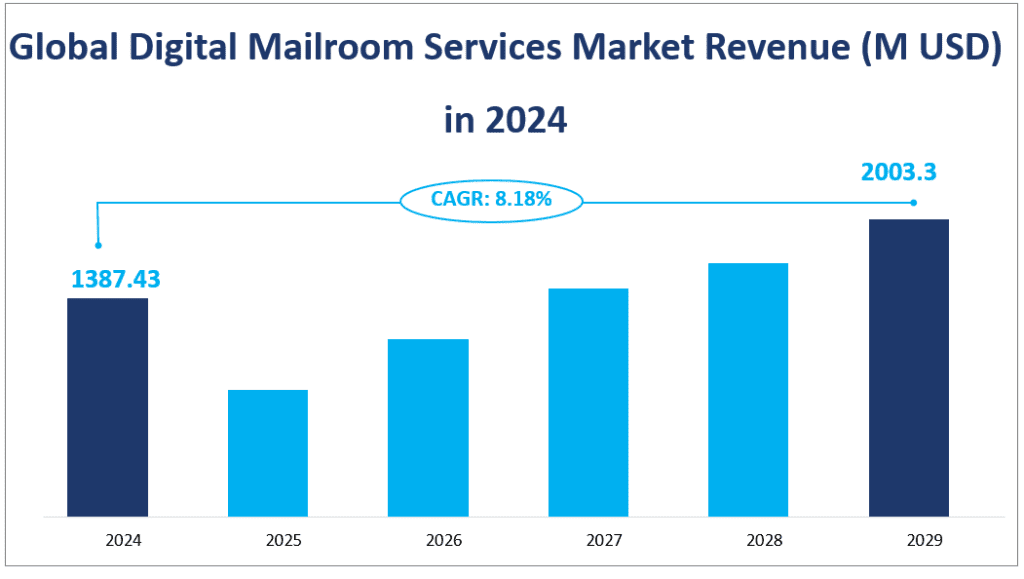

The global market size is projected to reach $1387.43 million in 2024. This growth is set against a backdrop of a compound annual growth rate (CAGR) of 8.18% from 2024 to 2029, indicating a robust expansion in the industry over the next few years. This CAGR signifies the market’s potential to attract more investors and highlights the importance of digital transformation in the business process outsourcing sector.

Global Digital Mailroom Services Market Revenue (M USD) in 2024

2. Driving and Limiting Factors of Digital Mailroom Services Market

The growth of the digital mailroom services market is propelled by several key factors. Firstly, there is a growing concern among organizations about improving the efficiency of their workforce. As businesses continue to grow and adapt to a mobile workforce, the volume of mail, both physical and digital, increases exponentially. Digital mailroom services offer platforms that can significantly enhance productivity and customer service by streamlining the management of incoming mail.

Secondly, the need for improved data tracking and compliance governance is driving the adoption of DMS. The conversion of paper messages into digital images upon receipt not only shortens decision cycles but also ensures that documents can be tracked reliably throughout their lifecycle. This is crucial for maintaining the security and integrity of documents, aligning with a company’s records management policy.

Another driving factor is the improvement in customer service. The electronic management of incoming mail allows for immediate access to customer files, enabling faster response times and enhancing the quality of service provided to clients. This is particularly important as most companies recognize the importance of superior customer service in maintaining a competitive edge.

Lastly, the growing trend of remote work and the reduction in demand for physical office locations are also contributing to the market’s growth. Once mail is digitized, it can be routed to the right personnel regardless of their physical location, reducing the reliance on physical mailrooms and associated real estate costs.

3. Limiting Factors of Digital Mailroom Services Market

Despite the growth drivers, the digital mailroom services market also faces certain challenges. One of the primary limitations is the lack of professional talent. The R&D capabilities of DMS companies are heavily dependent on the availability and cultivation of skilled professionals, which is currently in short supply.

Additionally, consumer concerns about data security pose a significant challenge. As data becomes an increasingly valuable resource, the risk of privacy breaches and cyber threats increases accordingly.

In conclusion, while the digital mailroom services market is set to experience significant growth in the coming years, it must also navigate challenges related to talent acquisition and data security to sustain its expansion. Companies operating in this space must prioritize research and development, introduce innovative solutions, and enhance services to gain a competitive advantage and increase their market share.

4. Digital Mailroom Services Market Segment

Product Types

The Digital Mailroom Services (DMS) market is segmented into two primary product types: Internal and Outsourced.

Internal Digital Mailroom Services

Internal DMS refers to the in-house management and operation of digital mailroom processes. Companies that opt for this type of service typically have the infrastructure and expertise to handle the digitization and management of their mail and documents internally. This approach allows for greater control over the security and processing of sensitive information. According to the report, the market size for Internal DMS is projected to reach $434.63 million in 2024. This type of service is favored by organizations that prioritize data privacy and have the resources to maintain their mailroom operations.

Outsourced Digital Mailroom Services

Conversely, Outsourced DMS involves partnering with a third-party service provider to manage all aspects of digital mailroom operations, from scanning to distribution. This type of service is particularly attractive to companies that lack the personnel, space, or desire to invest in scanning technology. Outsourcing can significantly reduce operational costs and improve efficiency. The Outsourced DMS market size is expected to reach $952.80 million in 2024, indicating a larger market share compared to the Internal DMS.

Out of the two product types, Outsourced DMS holds the largest market share and is projected to continue its dominance through 2024. This is attributed to the increasing trend of businesses outsourcing non-core activities to focus on their core competencies and the benefits of reduced costs and specialized services provided by external vendors. In terms of growth rate, Internal DMS is expected to show a faster growth rate due to the rising need for in-house control over sensitive data, especially in industries with strict data privacy regulations.

Applications of the Digital Mailroom Services Market

The Digital Mailroom Services market caters to a variety of applications, including BFSI (Banking, Financial Services, and Insurance), Retail, Government, Legal Services, Healthcare, and Others. Each application leverages DMS to enhance the efficiency, security, and accessibility of mail and document management.

BFSI Sector

The BFSI sector is a major contributor to the DMS market, with a significant market size projected at $585.18 million in 2024. This sector requires high levels of security and efficiency in managing financial documents and customer data, making DMS a critical component of their operations.

Retail Sector

The Retail sector, with a market size of $113.52 million in 2024, utilizes DMS to manage the influx of customer communications, invoices, and other documents associated with e-commerce and traditional retail operations.

Government Sector

Government agencies are projected to have a market size of $98.45 million in 2024. They rely on DMS to streamline public services, manage records, and ensure compliance with data protection regulations.

Legal Services Sector

Legal Services, with a market size of $139.32 million in 2024, demand DMS for managing case files, legal documents, and correspondence, which are often sensitive and require high security.

Healthcare Sector

The Healthcare sector is expected to have a market size of $243.67 million in 2024. DMS is crucial in this sector for managing patient records, insurance claims, and other confidential health-related documents.

The ‘Others’ category, including various industries not specifically mentioned, is projected to reach a market size of $207.30 million in 2024.

Among these applications, BFSI holds the largest market share due to the high demand for secure and efficient document management in financial transactions and regulatory compliance. However, the Healthcare sector is expected to exhibit the fastest growth rate, driven by the increasing digitization of patient records and the need for secure management of sensitive health information.

In conclusion, the Outsourced product type and the BFSI application dominate the Digital Mailroom Services market in terms of market share. Meanwhile, the Internal product type and the Healthcare application show the fastest growth rates, indicating shifting market dynamics and emerging opportunities within the DMS industry.

Market Size and Share by Segment

| Market Size (M USD) in 2024 | Market Share in 2024 | ||

| By Type | Internal | 434.63 | 31.33% |

| Outsourced | 952.80 | 68.67% | |

| By Application | BFSI | 585.18 | 42.18% |

| Retail | 113.52 | 8.18% | |

| Government | 98.45 | 7.10% | |

| Legal Services | 139.32 | 10.04% | |

| Healthcare | 243.67 | 17.56% | |

| Others | 207.30 | 14.94% |

5. Regional Digital Mailroom Services Market Overview

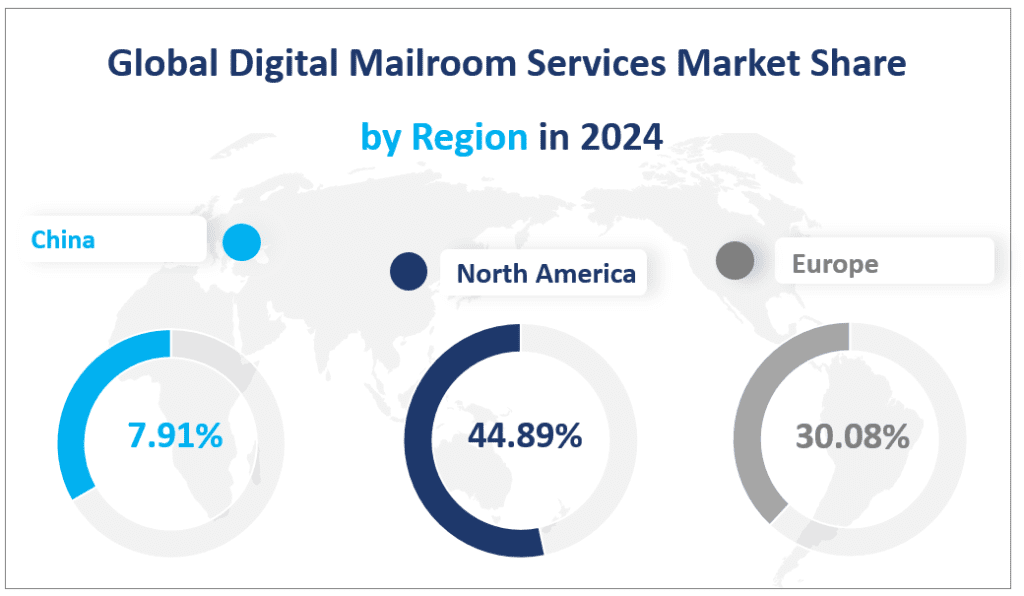

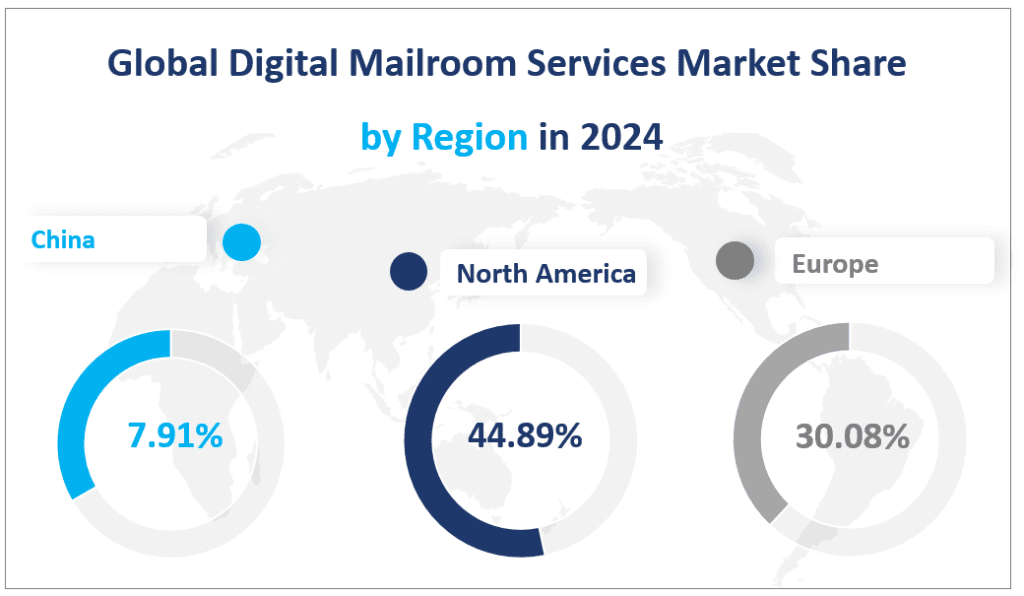

North America

North America has long been a dominant player in the digital mailroom services market, driven by the region’s technological advancements and the early adoption of digital transformation strategies by businesses. In 2024, the market size in North America is projected to be $622.83 million, maintaining its position as the largest regional market. The region’s growth can be attributed to the high demand for efficient document management systems, particularly in sectors like BFSI and healthcare, which are heavily regulated and require secure handling of sensitive information.

Europe

Europe follows closely behind North America, with a market size of $417.31 million in 2024. The region has been actively investing in digital infrastructure, which has accelerated the adoption of digital mailroom services. Countries like Germany, the UK, and France have been at the forefront of this trend, driving market growth with their mature markets and the need for streamlined operations in a diverse range of industries.

China

China’s digital mailroom services market is expected to reach $109.81 million in 2024. The rapid digitization of businesses and the government’s push for a paperless office environment have contributed to the market’s growth. The country’s large population and the increasing need for efficient document management in sectors like retail and e-commerce have also played a significant role in boosting the market.

Japan

Japan’s market size is projected to be $70.72 million in 2024. The country’s aging population and the need for efficient healthcare documentation have created a demand for digital mailroom services. Additionally, Japan’s strong technology sector and the adoption of advanced document management systems have supported the market’s growth.

Southeast Asia

Southeast Asia is expected to have a market size of $21.85 million in 2024. The region’s growth is driven by rapid economic development and the increasing need for efficient document management systems in emerging industries. Countries like Singapore, Indonesia, and Thailand are leading the way in adopting digital mailroom services.

India

India’s digital mailroom services market is projected to reach $42.64 million in 2024. The country’s growing IT sector and the need for efficient document management in the BFSI sector have been key drivers of market growth. Additionally, the government’s push for digitalization has opened up new opportunities for the market.

Central & South America

Central & South America’s market size is expected to be $33.81 million in 2024. The region’s growth is attributed to the increasing need for secure document management in sectors like BFSI and government, as well as the growing adoption of digital technologies.

Among these regions, Southeast Asia stands out as the fastest-growing region for digital mailroom services, driven by rapid economic development and the increasing adoption of digital technologies in businesses and government offices.

Global Digital Mailroom Services Market Share by Region in 2024

6. Top Five Companies in the Digital Mailroom Services Market

Introduction and Business Overview

Iron Mountain is a leading provider of storage and information management services, offering solutions such as records management, data management, and document management. The company specializes in managing critical business documents, electronic information, medical data, and historical artifacts.

Products Offered

Iron Mountain’s digital mailroom solution is a SaaS offering that allows authorized employees to access and receive digitized versions of critical business mail, boosting collaboration and productivity through automated workflows.

Introduction and Business Overview

Xerox Holdings is a document management technology and services company, known for its printing and publishing systems, copiers, and fax machines. It offers managed document services, including managed print services and multi-channel communication services, along with digital solutions like workflow automation services and content management.

Products Offered

Xerox’s Digital Mailroom Service digitizes information from all communication sources, leveraging Xerox® DocuShare® to automate mailroom workflows and deliver vital information quickly.

Introduction and Business Overview

Konica Minolta is engaged in business technologies, industrial, and healthcare businesses. It manufactures business and industrial imaging products, including copiers, laser printers, and multi-functional peripherals, as well as optical devices and medical and graphic imaging products.

Products Offered

Konica Minolta’s Digital Mailroom speeds up turnaround and processing times, improving downstream processes across the company and ensuring compliance with data protection legislation.

Introduction and Business Overview

Conduent is a business process services company providing solutions for the government and transportation sectors. It operates through segments like Commercial Industries, Government Services, and Transportation, offering services like customer experience, transaction processing, and payment solutions.

Products Offered

Conduent’s digital mailrooms help organizations digitize, simplify, and speed mail processing and delivery, reducing costs and enhancing business agility and continuity.

Introduction and Business Overview

Swiss Post Solutions (SPS) is a global full-service provider of physical and digital document management, offering a comprehensive suite of Document Processing and Business Process Services to support the digital transformation of clients’ business processes.

Products Offered

SPS’s Digital Mailroom Services allow companies to manage both physical and digital communications in a seamless, end-to-end, automated mailroom solution, reducing paper usage and allowing information to be transferred quickly throughout the company.

Major Players

| Company Name | Headquarters | Market Distribution |

| Iron Mountain | US | Worldwide |

| Xerox | US | Mainly in Americas and EMEA |

| Konica Minolta | Japan | Worldwide |

| Conduent | US | Mainly in Europe and Americas |

| Swiss Post Solutions | Switzerland | Europe and US |

| Kodak Alaris | UK | Asia, Europe, and Americas |

| Kofax | US | Worldwide |

| Access | US | US, Canada, Latin America, and the Caribbean |

| Williams Lea | UK | Asia, Europe, and US |

| DATAMARK | US | US, Mexico, and India |

| Vital Records Control | US | US and Bahamas |

| Epiq | US | Asia, North America, Australia & New Zealand, Europe |

| Restore Digital | UK | UK |

| MetaSource | US | US |

| DRS Imaging Services | US | US |

1 Report Overview

1.1 Digital Mailroom Services Product Overview

1.2 Key Market Segments

1.3 Players Covered: Ranking by Digital Mailroom Services Revenue

1.4 Market Analysis by Type

1.4.1 Global Digital Mailroom Services Market Size Growth Rate by Type: 2017-2022

1.5 Market by Application

1.5.1 Global Digital Mailroom Services Market by Application

1.5.2 BFSI

1.5.3 Retail

1.5.4 Government

1.5.5 Legal Services

1.5.6 Healthcare

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Global Digital Mailroom Services Market Perspective (2017-2028)

2.2 Digital Mailroom Services Growth Trends by Region

2.2.1 Digital Mailroom Services Historic Market Share by Regions (2017-2022)

2.2.2 Digital Mailroom Services Forecasted Market Size by Regions (2022-2028)

2.3 Industry Trends and Growth Strategy

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Challenges

2.3.4 Porter’s Five Forces Analysis

2.3.5 Digital Mailroom Services Market Growth Strategy

3 Competition Landscape by Key Players

3.1 Global Digital Mailroom Services Players by Market Size

3.1.1 Global Digital Mailroom Services Revenue by Players (2017-2022)

3.1.2 Global Digital Mailroom Services Revenue Market Share by Players (2017-2022)

3.2 Global Digital Mailroom Services Market Concentration Ratio

3.2.1 Global Digital Mailroom Services Market Concentration Ratio (CR5)

3.2.2 Global Top 6 and Top 3 Companies Revenue in 2021

3.3 Digital Mailroom Services Key Players Head office and Area Served

3.4 Digital Mailroom Services Key Players Established Time

3.5 Mergers & Acquisitions, Expansion Plans

4 Market Size by Type (2017-2028)

4.1 Global Digital Mailroom Services Historic Market Size by Type (2017-2022)

4.2 Global Digital Mailroom Services Forecasted Market Size by Type (2022-2028)

5 Market Size by Application (2017-2028)

5.1 Global Digital Mailroom Services Historic Market Size by Application (2017-2022)

5.2 Global Digital Mailroom Services Forecasted Market Size by Application (2022-2028)

6 North America

6.1 North America Digital Mailroom Services Market Size (2017-2022)

6.2 Digital Mailroom Services Key Players in North America

6.3 North America Digital Mailroom Services Market Size by Type

6.4 North America Digital Mailroom Services Market Size by Application

7 Europe

7.1 Europe Digital Mailroom Services Market Size (2017-2022)

7.2 Digital Mailroom Services Key Players in Europe

7.3 Europe Digital Mailroom Services Market Size by Type

7.4 Europe Digital Mailroom Services Market Size by Application

8 China

8.1 China Digital Mailroom Services Market Size (2017-2022)

8.2 Digital Mailroom Services Key Players in China

8.3 China Digital Mailroom Services Market Size by Type

8.4 China Digital Mailroom Services Market Size by Application

9 Japan

9.1 Japan Digital Mailroom Services Market Size (2017-2022)

9.2 Digital Mailroom Services Key Players in Japan

9.3 Japan Digital Mailroom Services Market Size by Type

9.4 Japan Digital Mailroom Services Market Size by Application

10 Southeast Asia

10.1 Southeast Asia Digital Mailroom Services Market Size (2017-2022)

10.2 Southeast Asia Digital Mailroom Services Market Size by Type

10.3 Southeast Asia Digital Mailroom Services Market Size by Application

11 India

11.1 India Digital Mailroom Services Market Size (2017-2022)

11.2 Digital Mailroom Services Key Players in India

11.3 India Digital Mailroom Services Market Size by Type

11.4 India Digital Mailroom Services Market Size by Application

12 Central & South America

12.1 Central & South America Digital Mailroom Services Market Size (2017-2022)

12.2 Central & South America Digital Mailroom Services Market Size by Type

12.3 Central & South America Digital Mailroom Services Market Size by Application

13 Key Players Profiles

13.1 Iron Mountain

13.1.1 Iron Mountain Company Details

13.1.2 Business Overview

13.1.3 Digital Mailroom Services Introduction

13.1.4 Iron Mountain Value in Digital Mailroom Services Business (2017-2022)

13.1.5 Iron Mountain Recent Development

13.2 Xerox

13.2.1 Xerox Company Details

13.2.2 Business Overview

13.2.3 Digital Mailroom Services Introduction

13.2.4 Xerox Value in Digital Mailroom Services Business (2017-2022)

13.2.5 Xerox Recent Development

13.3 Konica Minolta

13.3.1 Konica Minolta Company Details

13.3.2 Business Overview

13.3.3 Digital Mailroom Services Introduction

13.3.4 Konica Minolta Value in Digital Mailroom Services Business (2017-2022)

13.3.5 Konica Minolta Recent Development

13.4 Conduent

13.4.1 Conduent Company Details

13.4.2 Business Overview

13.4.3 Digital Mailroom Services Introduction

13.4.4 Conduent Value in Digital Mailroom Services Business (2017-2022)

13.4.5 Conduent Recent Development

13.5 Swiss Post Solutions

13.5.1 Swiss Post Solutions Company Details

13.5.2 Business Overview

13.5.3 Digital Mailroom Services Introduction

13.5.4 Swiss Post Solutions Value in Digital Mailroom Services Business (2017-2022)

13.5.5 Swiss Post Solutions Recent Development

13.6 Kodak Alaris

13.6.1 Kodak Alaris Company Details

13.6.2 Business Overview

13.6.3 Digital Mailroom Services Introduction

13.6.4 Kodak Alaris Value in Digital Mailroom Services Business (2017-2022)

13.6.5 Kodak Alaris Recent Development

13.7 Kofax

13.7.1 Kofax Company Details

13.7.2 Business Overview

13.7.3 Digital Mailroom Services Introduction

13.7.4 Kofax Value in Digital Mailroom Services Business (2017-2022)

13.7.5 Kofax Recent Development

13.8 Access

13.8.1 Access Company Details

13.8.2 Business Overview

13.8.3 Digital Mailroom Services Introduction

13.8.4 Access Value in Digital Mailroom Services Business (2017-2022)

13.8.5 Access Recent Development

13.9 Williams Lea

13.9.1 Williams Lea Company Details

13.9.2 Business Overview

13.9.3 Digital Mailroom Services Introduction

13.9.4 Williams Lea Value in Digital Mailroom Services Business (2017-2022)

13.9.5 Williams Lea Recent Development

13.10 DATAMARK

13.10.1 DATAMARK Company Details

13.10.2 Business Overview

13.10.3 Digital Mailroom Services Introduction

13.10.4 DATAMARK Value in Digital Mailroom Services Business (2017-2022)

13.10.5 DATAMARK Recent Development

13.11 Vital Records Control

13.11.1 Vital Records Control Company Details

13.11.2 Business Overview

13.11.3 Digital Mailroom Services Introduction

13.11.4 Vital Records Control Value in Digital Mailroom Services Business (2017-2022)

13.12 Epiq

13.12.1 Epiq Company Details

13.12.2 Business Overview

13.12.3 Digital Mailroom Services Introduction

13.12.4 Epiq Value in Digital Mailroom Services Business (2017-2022)

13.12.5 Epiq Recent Development

13.13 Restore Digital

13.13.1 Restore Digital Company Details

13.13.2 Business Overview

13.13.3 Digital Mailroom Services Introduction

13.13.4 Restore Digital Value in Digital Mailroom Services Business (2017-2022)

13.14 MetaSource

13.14.1 MetaSource Company Details

13.14.2 Business Overview

13.14.3 Digital Mailroom Services Introduction

13.14.4 MetaSource Value in Digital Mailroom Services Business (2017-2022)

13.14.5 MetaSource Recent Development

13.15 DRS Imaging Services

13.15.1 DRS Imaging Services Company Details

13.15.2 Business Overview

13.15.3 Digital Mailroom Services Introduction

13.15.4 DRS Imaging Services Value in Digital Mailroom Services Business (2017-2022)

14 Market Forecast 2022-2028

14.1 Market Size Forecast by Region

14.2 North America

14.3 Europe

14.4 China

14.5 Japan

14.6 Southeast Asia

14.7 India

14.8 Central & South America

14.9 Market Size Forecast by Type (2022-2028)

14.10 Market Size Forecast by Application (2022-2028)

15 Analyst’s Viewpoints/Conclusions

16 Appendix

16.1 Methodology

16.2 Research Data Source

16.2.1 Secondary Data

16.2.2 Primary Data

16.2.3 Market Size Estimation

16.2.4 Legal Disclaimer