1.Globaler Marktüberblick und Prognose für industrielle Bäckereiausrüstung

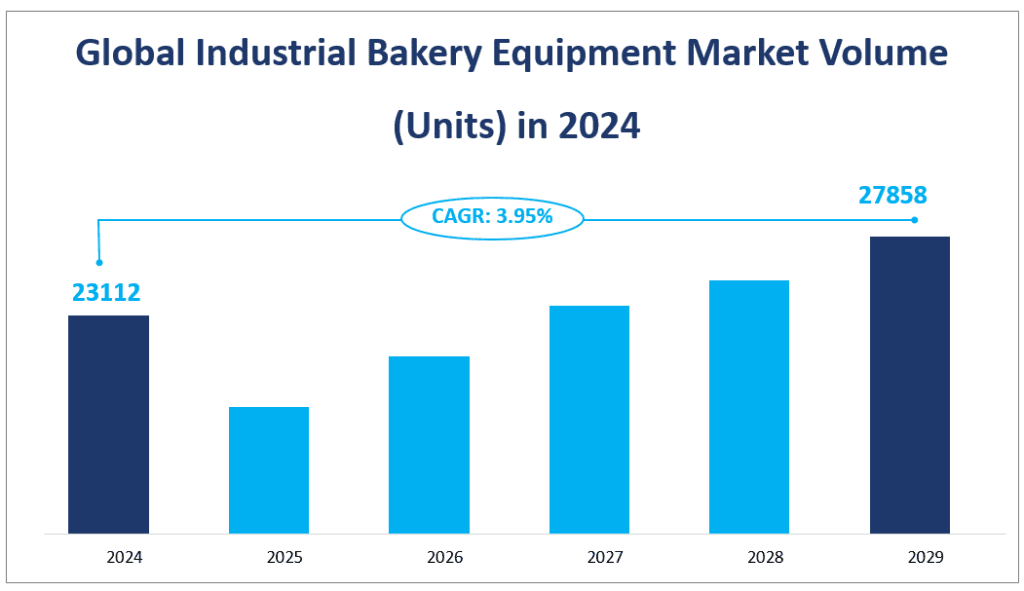

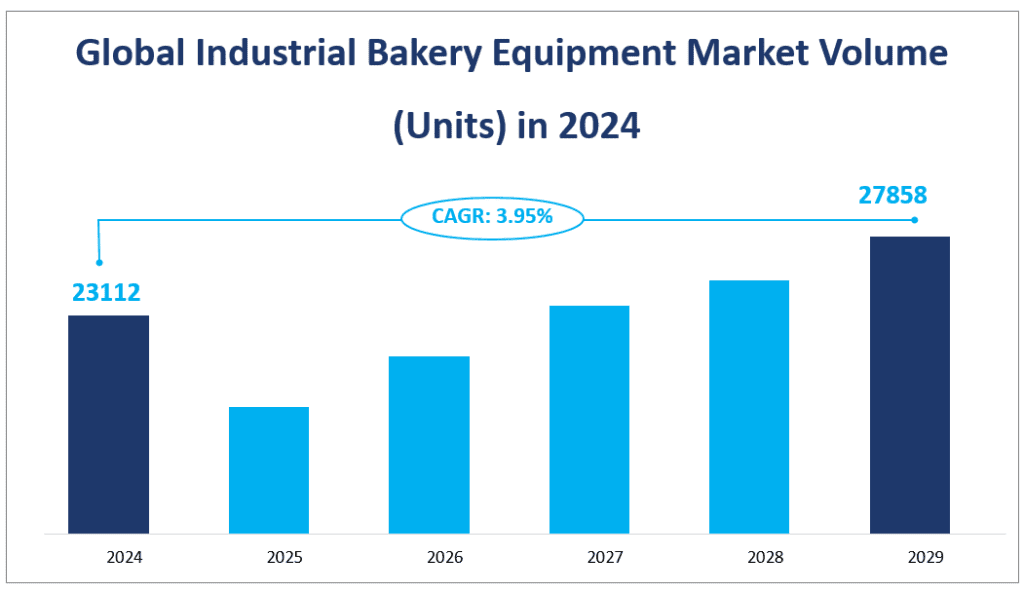

Der globale Markt für industrielle Bäckereiausrüstung ist ein dynamischer Sektor, der in den letzten Jahren ein erhebliches Wachstum verzeichnet hat. Im Jahr 2024 wird das Marktvolumen weltweit 23112 Einheiten erreichen, mit einer CAGR von 3,951 TP3T von 2024 bis 2029.

Der Markt für industrielle Bäckereiausrüstung umfasst eine Reihe von Gerätetypen, von denen jeder eine bestimmte Funktion bei der Herstellung von Backwaren im großen Maßstab erfüllt. Dazu gehören unter anderem mechanische und elektrische Teigausrollmaschinen, Teigblock-Ausrollmaschinen, Zuführanlagen, Aufbereitungssysteme und Industrielinien. Der Markt wird durch die steigende Nachfrage nach automatisierten und effizienten Backlösungen angetrieben, die unerlässlich sind, um den wachsenden weltweiten Appetit auf Backwaren zu befriedigen.

Das Marktvolumen wird von verschiedenen regionalen Faktoren beeinflusst, darunter Wirtschaftsentwicklung, Bevölkerungswachstum und Veränderungen der Verbraucherpräferenzen. Nordamerika, Europa und der asiatisch-pazifische Raum tragen wesentlich zum Marktvolumen bei, wobei jede Region unterschiedliche Merkmale und Wachstumspotenziale aufweist.

Globales Marktvolumen für industrielle Bäckereiausrüstung (Einheiten) im Jahr 2024

2. Antriebsfaktoren des Marktes für industrielle Bäckereiausrüstung

Das Wachstum des globalen Marktes für industrielle Bäckereiausrüstung wird von mehreren treibenden Faktoren vorangetrieben. Einer der Haupttreiber ist die Nachfrage nach Backwaren, die durch die köstlichen, praktischen und gesunden Eigenschaften von Backwaren befeuert wird. Backwaren sind in vielen Ländern zu einem Grundnahrungsmittel geworden, was zu einer kontinuierlichen Expansion des Marktes für industrielle Bäckereiausrüstung führt. Die Entwicklung der Bäckereiindustrie selbst ist ein weiterer wichtiger Treiber, da der steigende Pro-Kopf-Verbrauch von Brot und anderen Backwaren die Nachfrage nach neuen Geräten und speziellen Systemen für die Backwarenverarbeitung erhöht.

Technologische Fortschritte spielen eine entscheidende Rolle für das Marktwachstum. Automatisierung, Intelligenz und Industrie 4.0-Initiativen verändern die Branche, reduzieren den Einsatz von Produktionslinienbedienern, stabilisieren die Produktqualität und verbessern die Produktionseffizienz. Auch die Entwicklung von KI- und IoT-Technologien verändert die Branche und ermöglicht intelligentere und datengesteuertere Lösungen.

3. Limitierende Faktoren des Marktes für industrielle Bäckereiausrüstung

Das Marktwachstum ist jedoch nicht ohne Einschränkungen. Eines der größten Hindernisse sind die hohen Kosten, die mit großen, automatischen Bäckereimaschinen und -geräten verbunden sind. Hohe Geräte- und Einrichtungskosten können potenzielle Nutzer abschrecken, insbesondere in kostensensiblen Märkten oder bei Start-ups. Darüber hinaus ist die Branche mit bestimmten Markteintrittsbarrieren konfrontiert, darunter technisches Know-how, Kapitalanforderungen und Markenbekanntheit, die den Zustrom neuer Wettbewerber begrenzen.

Ein weiterer limitierender Faktor sind die Auswirkungen der Inflation auf die Branche. Steigende Material-, Produktions- und Arbeitskosten aufgrund des Inflationsdrucks können die Gewinnmargen drücken und die Gesamtmarktnachfrage nach Industriebäckereiausrüstung beeinträchtigen. Hersteller müssen möglicherweise Kosteneinsparungsmaßnahmen umsetzen und alternative Beschaffungsstrategien erkunden, um wettbewerbsfähig zu bleiben.

Zusammenfassend lässt sich sagen, dass der globale Markt für industrielle Bäckereiausrüstung in den kommenden Jahren ein erhebliches Wachstum verzeichnen wird, das durch die steigende Nachfrage nach Backwaren, technologische Fortschritte und die Entwicklung der Bäckereibranche angetrieben wird. Um dieses Wachstum aufrechtzuerhalten, müssen jedoch Herausforderungen wie hohe Kosten und Inflationsdruck bewältigt werden. Das Verständnis dieser treibenden und begrenzenden Faktoren ist für die Beteiligten von entscheidender Bedeutung, um fundierte Entscheidungen zu treffen und in diesem Wettbewerbsumfeld effektive Strategien zu entwickeln.

4. Marktsegment Industrielle Bäckereiausrüstung

Produkttypen auf dem Markt für industrielle Bäckereiausrüstung

Mechanische Teigausrollmaschinen sind Geräte, mit denen Teig in gleichmäßige Platten einer bestimmten Dicke gepresst wird. Sie sind unerlässlich, um gleichmäßige Teigschichten zu erzeugen, was für viele Arten von Backwaren entscheidend ist. Im Jahr 2024 hatten mechanische Teigausrollmaschinen ein Marktvolumen von 5.262 Einheiten und hielten aufgrund ihrer Vielseitigkeit und Präzision bei der Teigverarbeitung einen erheblichen Marktanteil.

Elektrische Blechschneidemaschinen arbeiten mit Strom und bieten im Vergleich zu ihren mechanischen Gegenstücken einen höheren Automatisierungsgrad und eine höhere Genauigkeit bei der Formgebung und Dickenkontrolle. Mit einem Marktvolumen von 4.783 Einheiten im Jahr 2024 gewinnen elektrische Blechschneidemaschinen aufgrund von Fortschritten in der Automatisierungstechnologie und der Nachfrage nach Präzision bei der Produktion großer Stückzahlen an Popularität.

Teigblock-Rollmaschinen werden verwendet, um gepressten Teig in bestimmte Formen und Größen zu schneiden, die zum direkten Backen oder zur Weiterverarbeitung geeignet sind. Im Jahr 2024 hatten diese Maschinen ein Marktvolumen von 2.735 Einheiten und spielten eine entscheidende Rolle in den Anfangsphasen der Herstellung von Brot und anderen Backwaren.

Förderer sind dafür verantwortlich, Rohstoffe wie Mehl, Wasser und Hefe in einem vorgegebenen Verhältnis und in einer vorgegebenen Reihenfolge zum Mischer zu transportieren und so eine gleichmäßige Teigmischung sicherzustellen. Mit einem Marktvolumen von 2.432 Einheiten im Jahr 2024 sind Förderer für die Effizienz und Konsistenz des Backprozesses von grundlegender Bedeutung.

Make-up-Systeme verarbeiten Teig in bestimmte Formen und Größen, einschließlich Schritten wie Pressen, Schneiden und Formen. Diese Systeme verbessern die Produktionseffizienz und die Produktqualitätskonsistenz. Im Jahr 2024 betrug das Marktvolumen für Make-up-Systeme 2.847 Einheiten, was den Fokus der Branche auf die Rationalisierung der Abläufe und die Reduzierung der Handarbeit widerspiegelt.

Industrielle Linien beziehen sich auf eine Reihe automatisierter oder halbautomatischer Geräte und Arbeitsstationen, die für die Massenproduktion von Backwaren verwendet werden. Diese Linien umfassen mehrere Schritte wie Mischen, Gären, Formen, Backen, Kühlen und Verpacken. Industrielle Linien hatten im Jahr 2024 mit 1.947 Einheiten das höchste Marktvolumen, was auf die Präferenz für integrierte Lösungen in der Backindustrie hinweist.

Unter diesen Produkttypen halten Industrieanlagen den größten Marktanteil, was den Trend zu integrierten und automatisierten Produktionssystemen in der Backindustrie widerspiegelt. Elektrische Ausrollmaschinen verzeichnen die schnellste Wachstumsrate aufgrund der steigenden Nachfrage nach hochpräzisen und automatisierten Geräten, was mit dem Streben der Branche nach technologischer Innovation und Effizienz einhergeht.

Analyse der Marktanwendungen für industrielle Bäckereiausrüstung

Für die Herstellung von Croissants sind spezielle Geräte erforderlich, um den berühmten Schichtteig herzustellen. Mit einem Marktvolumen von 3.009 Stück im Jahr 2024 halten Croissants einen erheblichen Marktanteil, was auf die weltweite Beliebtheit dieses Frühstücksklassikers zurückzuführen ist.

Donuts erfordern Geräte, die den einzigartigen Prozess des Schneidens und Frittierens von Teig bewältigen können. Das Marktvolumen für Donuts betrug im Jahr 2024 2.381 Einheiten, was die anhaltende Attraktivität von Donuts in verschiedenen Kulturen widerspiegelt.

Pizza-Produktionsgeräte (neu) sind auf die speziellen Anforderungen der Pizzateigzubereitung und -formung ausgelegt. Mit einem Marktvolumen von 2.171 Einheiten im Jahr 2024 wächst die Pizzaausrüstung, da der Pizzamarkt weltweit expandiert.

Anlagen zur Herstellung von Brot und Brötchen sind für die weltweit am meisten konsumierten Backwaren unverzichtbar. Dieses Segment hatte im Jahr 2024 mit 7.285 Einheiten das größte Marktvolumen, was auf die große Nachfrage nach Brot und Brötchen in verschiedenen Regionen hinweist.

Für die Herstellung von Gebäck werden Geräte benötigt, die empfindliche Teige und Füllungen verarbeiten können. Das Marktvolumen für Gebäck betrug im Jahr 2024 4.563 Einheiten, was die Bedeutung von Gebäck auf dem globalen Bäckereimarkt verdeutlicht.

Sonstige Backwaren umfassen eine breite Produktpalette mit jeweils spezifischen Produktionsanforderungen. Diese Kategorie hatte im Jahr 2024 ein Marktvolumen von 3.703 Einheiten, was die Vielfalt innerhalb des Bäckereisektors unterstreicht.

Unter diesen Anwendungen hat Brot und Brötchen den größten Marktanteil, was die weltweite Nachfrage nach diesen Produkten widerspiegelt. Croissants verzeichneten im Jahr 2024 die schnellste Wachstumsrate, wahrscheinlich aufgrund des zunehmenden globalen Trends zu Spezialitäten-Cafés und der Kombination von Croissants mit Gourmet-Kaffee.

Zusammenfassend lässt sich sagen, dass der globale Markt für industrielle Bäckereiausrüstung durch eine Vielzahl von Produkttypen und Anwendungen gekennzeichnet ist, von denen jede ihre eigene Marktdynamik hat. Marktanteile und Wachstumsraten geben Aufschluss über die Vorlieben und Trends innerhalb der Backbranche und unterstreichen die Bedeutung der Automatisierung und die globale Attraktivität bestimmter Backwaren.

Marktvolumen nach Segmenten

| Marktvolumen (Einheiten) im Jahr 2024 | ||

| Nach Typ | Mechanische Ausrollmaschinen | 5262 |

| Elektrische Ausrollmaschinen | 4783 | |

| Teigblock-Rollmaschine | 2735 | |

| Zuführung | 2432 | |

| Make-up-System | 2847 | |

| Industrielle Linien | 1947 | |

| Sonstiges | 3106 | |

| Nach Anwendung | Croissants | 3009 |

| Donuts | 2381 | |

| Pizza (neu) | 2171 | |

| Brot & Brötchen | 7285 | |

| Gebäck | 4563 | |

| Andere Backwaren | 3703 |

5. Globaler Marktverbrauch für industrielle Bäckereiausrüstung nach Regionen

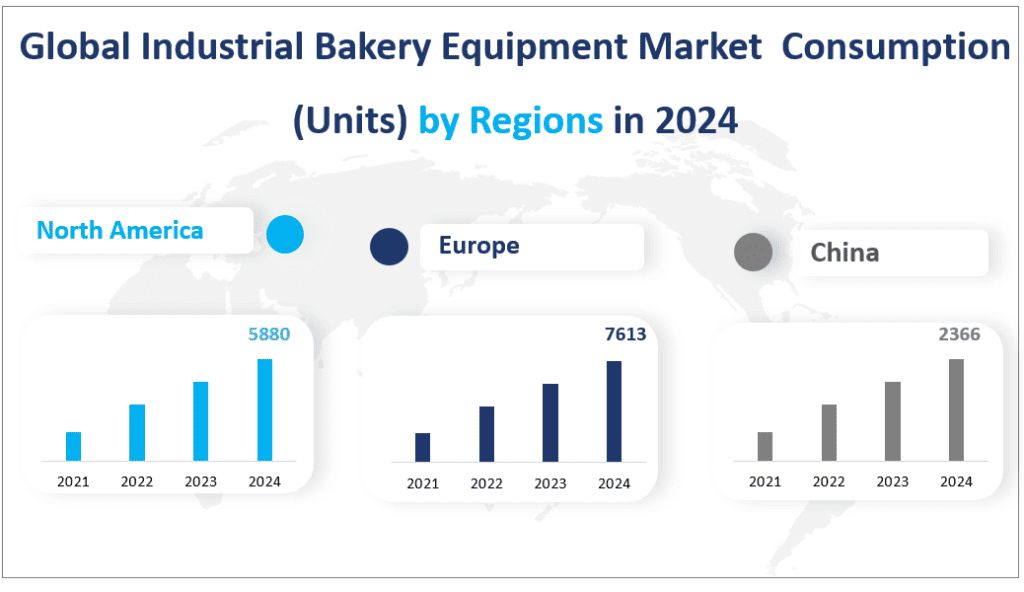

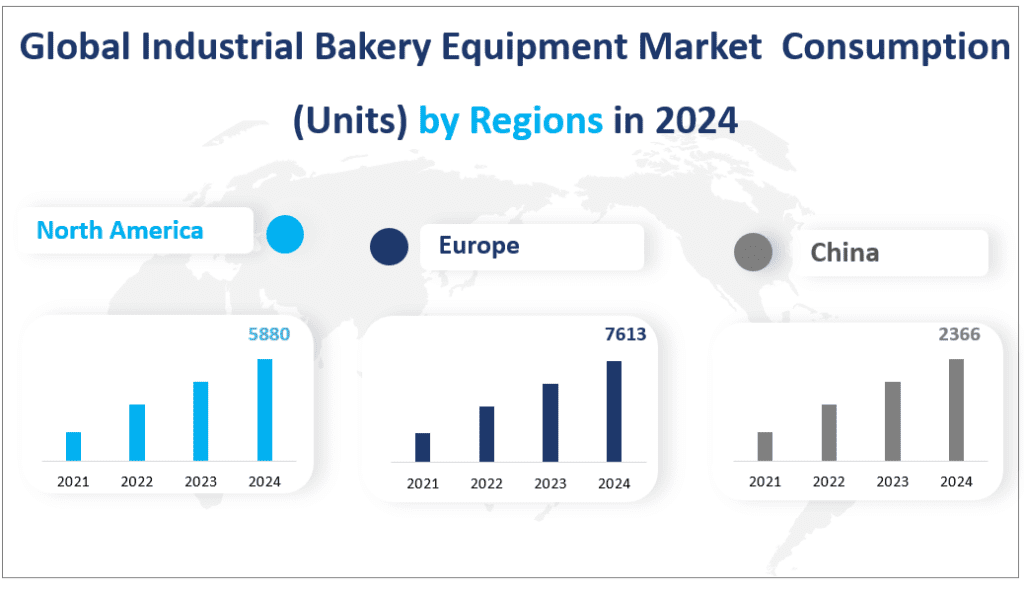

Der globale Markt für industrielle Bäckereigeräte ist eine vielfältige und expandierende Branche. In den verschiedenen Regionen ist der Verbrauch unterschiedlich, was auf eine Reihe von Faktoren zurückzuführen ist, darunter wirtschaftliche Entwicklung, Bevölkerungsgröße und kulinarische Traditionen.

Nordamerika wird mit einem Verbrauch von 5.880 Einheiten im Jahr 2024 die Nase vorn haben, was die starke Wirtschaft und die hohe Nachfrage nach automatisierten Bäckereilösungen in der Region widerspiegelt. Die Vereinigten Staaten, ein wichtiger Akteur in Nordamerika, verfügen über eine beträchtliche Anzahl industrieller Bäckereien, die anspruchsvolle Geräte benötigen, um die hohe Nachfrage nach verschiedenen Backwaren zu decken. Der Verbrauch der Region wird durch die kontinuierliche Expansion des Foodservice-Sektors und die zunehmende Präferenz für Fertiggerichte angetrieben.

Europa folgt dicht dahinter mit einem Verbrauch von 7.613 Einheiten und ist damit der zweitgrößte regionale Markt. Die europäische Backwarenindustrie ist gut etabliert und hat eine lange Tradition sowohl im handwerklichen Backen als auch in der industriellen Produktion. Der Verbrauch in der Region wird durch den Bedarf an Innovationen im Backprozess und die wachsende Nachfrage nach Spezialbroten und -gebäck angeheizt. Die Präsenz zahlreicher reifer Märkte wie Deutschland und Frankreich sowie aufstrebender Volkswirtschaften in Osteuropa trägt erheblich zum hohen Verbrauch in der Region bei.

China ist mit einem Verbrauch von 2.366 Einheiten die am schnellsten wachsende Region. Der chinesische Markt erlebt ein rasantes Wachstum aufgrund der wachsenden Mittelschicht des Landes und einer zunehmenden Vorliebe für westliche Backwaren. Die zunehmende Urbanisierung und der Anstieg des verfügbaren Einkommens haben zu einem Anstieg der Nachfrage nach hochwertigen Bäckereigeräten in China geführt. Die Initiativen der Regierung zur Modernisierung der Lebensmittelindustrie haben die Einführung moderner Bäckereigeräte in der Region weiter beschleunigt.

In Japan wurden 1.615 Einheiten verbraucht. Das stetige Wachstum ist auf die starke Lebensmittelverarbeitungsindustrie des Landes und die Nachfrage nach hochwertigen Bäckereigeräten zurückzuführen. Japan hat einen gut entwickelten Markt für Backwaren, und der Bedarf an Präzision und Effizienz in den Produktionsprozessen treibt die Nachfrage nach fortschrittlichen Bäckereigeräten an.

In Südamerika liegt der Verbrauch bei 1.391 Einheiten, wobei Brasilien einen wesentlichen Beitrag zu dieser Zahl leistet. Die Region verzeichnet aufgrund der steigenden Nachfrage nach Backwaren und der Expansion des Lebensmittelverarbeitungssektors ein Wachstum. Der Verbrauch in der Region dürfte weiter steigen, da die Mittelschicht wächst und die Nachfrage nach Fertiggerichten steigt.

Zusammenfassend lässt sich sagen, dass der globale Markt für industrielle Bäckereiausrüstung durch unterschiedliche Verbrauchsniveaus in den verschiedenen Regionen gekennzeichnet ist. Nordamerika und Europa sind die größten Verbraucher, während China aufgrund seines expandierenden Marktes und seiner Modernisierungsbemühungen die am schnellsten wachsende Region ist.

Globaler Marktverbrauch für industrielle Bäckereiausrüstung (Einheiten) nach Regionen im Jahr 2024

6. Die fünf größten Unternehmen auf dem globalen Markt für industrielle Bäckereiausrüstung

Bühler ist ein Schweizer Unternehmen mit globaler Präsenz, das für sein umfassendes Angebot an Maschinen für die Lebensmittel- und Chemieverarbeitung, Druckguss und Materialhandhabung bekannt ist. Bühler bietet eine Vielzahl von Bäckereigeräten an, darunter Lösungen für Kekse, Plätzchen und Biskuitkuchen. Die Produkte sind auf Effizienz und Vielseitigkeit ausgelegt und decken eine breite Palette von Bäckereianforderungen ab.

Rheonmit Sitz in Japan ist ein führendes Unternehmen in der Entwicklung, Herstellung und dem Vertrieb von Backwarenmaschinen. Rheon ist auf Geräte zur Herstellung von Brot, Croissants, Gebäck und Pizza spezialisiert. Ihre V4-Artisan Bread Line kann verschiedene Brotgrößen herstellen und ist für ihre hohe Kapazität und Automatisierung bekannt.

Kaak-Gruppemit Sitz in den Niederlanden ist seit 1846 ein bedeutender Akteur im Bereich der Bäckereitechnologie. Kaak bietet einen integrierten Ansatz für komplexe und automatisierte Bäckereilinien, von Einzelmaschinen bis hin zu Komplettlösungen. Die Produkte sind auf hygienische Zubereitung und effiziente Arbeitsprozesse ausgelegt.

Fritsch (Multivac), ein deutsches Unternehmen, gilt als der größte deutsche Hersteller von Bäckereimaschinen. Fritsch ist auf eine Reihe von Bäckereimaschinen spezialisiert, wobei der MULTIFLEX L 700 ein herausragendes Produkt ist, das teigschonende Stanz- und Wendeprozesse mit intelligenter Stanz- und Schneidtechnologie kombiniert.

RademacherDas in den Niederlanden ansässige Unternehmen ist für die Entwicklung und Bereitstellung hochwertiger Lösungen für die Lebensmittelindustrie bekannt. Ihr Fachwissen liegt in den Bereichen Automatisierung, Technologie, Hygiene und Leistung. Die Pizzaproduktionslinie von Rademaker eignet sich für eine Vielzahl von Pizzaformen und -größen und bietet ein breites Spektrum an Arbeitsbreiten und Teigkapazitäten.

Hauptakteur

| Name der Firma | Hauptsitz | Vertriebsregion |

| Bühler | Schweiz | Weltweit |

| Rheon | Japan | Weltweit |

| Kaak-Gruppe | Niederlande | Weltweit |

| Fritsch (Multivac) | Deutschland | Weltweit |

| Rademacher | Niederlande | Weltweit |

| Mecatherm | Frankreich | Weltweit |

| AMF Bäckereisysteme | USA | Weltweit |

| RONDO | Schweiz | Hauptsächlich in Europa, Nordamerika, Asien |

| GEA | Deutschland | Weltweit |

| Sinmag | China | Hauptsächlich in China, Europa, Nordamerika, Südostasien |

| Polin | Italien | Hauptsächlich in Europa, Amerika, dem Nahen Osten und dem asiatisch-pazifischen Raum |

| Z-Linie | China | Hauptsächlich in Asien-Pazifik, Europa, Nordamerika |

| Wissenswertes | Italien | Hauptsächlich in Europa, Nordamerika und im asiatisch-pazifischen Raum |

| Moline | USA | Hauptsächlich in Amerika, Europa und im asiatisch-pazifischen Raum |

| Canol | Italien | Vor allem in Europa |

1 Industrielle Bäckereiausrüstung Einführung und Marktüberblick

1.1 Ziele der Studie

1.2 Übersicht über industrielle Bäckereiausrüstung

1.3 Marktumfang und Marktgrößenschätzung für industrielle Bäckereiausrüstung

1.3.1 Marktkonzentrationsverhältnis und Marktreifeanalyse

1.3.2 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von 2019-2030

1.4 Marktsegmentierung

1.4.1 Arten von industriellen Bäckereigeräten

1.4.2 Anwendungen von industriellen Bäckereigeräten

1.4.3 Forschungsregionen

1.5 Marktdynamik

1.5.1 Treiber

1.5.2 Einschränkungen

1.5.3 Chancen

1.6 Branchennachrichten und Richtlinien nach Regionen

1.6.1 Branchennachrichten

1.6.2 Branchenrichtlinien

1.7 Die Auswirkungen der regionalen Situation auf die Industrie für industrielle Bäckereiausrüstung

1.8 Die Auswirkungen der Inflation auf die Industrie für industrielle Bäckereiausrüstung

1.9 Die transformative Kraft der KI in der Industrie für industrielle Bäckereiausrüstung

1.10 Wirtschaftliche Entwicklung im Zeitalter des Klimawandels

1.11 Globaler Automatisierte Bäckereiausrüstung-Wert und Wachstumsrate von 2019-2030

2 Branchenkettenanalyse

2.1 Vorgelagerte Rohstofflieferanten der Industrielle Bäckereiausrüstung-Analyse

2.2 Hauptakteure von Industrielle Bäckereiausrüstung

2.2.1 Hauptakteure der industriellen Bäckereiausrüstung im Jahr 2023

2.2.2 Marktverteilung der wichtigsten Akteure im Jahr 2023

2.3 Analyse der Herstellungskostenstruktur für industrielle Bäckereiausrüstung

2.3.1 Produktionsprozessanalyse

2.3.2 Herstellungskostenstruktur von Industrielle Bäckereiausrüstung

2.3.3 Rohstoffkosten für industrielle Bäckereiausrüstung

2.3.4 Arbeitskosten der industriellen Bäckereiausrüstung

2.4 Marktkanalanalyse für industrielle Bäckereiausrüstung

2.5 Wichtige nachgelagerte Käufer der Industrielle Bäckereiausrüstung-Analyse

3 Globaler Markt für industrielle Bäckereiausrüstung nach Typ

3.1 Globaler Industrielle Bäckereiausrüstung-Wert und Marktanteil nach Typ (2019-2024)

3.2 Globale Industrielle Bäckereiausrüstung-Produktion und Marktanteil nach Typ (2019-2024)

3.3 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate nach Typ (2019-2024)

3.3.1 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von Mechanischen Ausrollmaschinen

3.3.2 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von elektrischen Ausrollmaschinen

3.3.3 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate der Teigblock-Rollmaschine

3.3.4 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von Feeder

3.3.5 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von Make-up-System

3.3.6 Globaler Industrielle Bäckereiausrüstung-Wert und Wachstumsrate von Industrielinien

3.4 Globale Industrielle Bäckereiausrüstung-Preisanalyse nach Typ (2019-2024)

4 Markt für industrielle Bäckereiausrüstung, nach Anwendung

4.1 Überblick über den Downstream-Markt

4.2 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Marktanteil nach Anwendung (2019-2024)

4.3 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate nach Anwendung (2019-2024)

4.3.1 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate von Croissants (2019-2024)

4.3.2 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate von Donuts (2019-2024)

4.3.3 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate von Pizza (neu) (2019-2024)

4.3.4 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate von Brot und Brötchen (2019-2024)

4.3.5 Globaler Industrielle Bäckereiausrüstung-Verbrauch und Wachstumsrate von Gebäck (2019-2024)

4.4 Weltweiter Industrielle Bäckereiausrüstung-Verbrauch und Marktanteil nach Endverbraucher (2019-2030)

5 Globale Produktion von industriellen Bäckereigeräten, Wert nach Regionen (2019-2024)

5.1 Globaler Industrielle Bäckereiausrüstung-Wert und Marktanteil nach Regionen (2019-2024)

5.2 Globale Industrielle Bäckereiausrüstung-Produktion und Marktanteil nach Regionen (2019-2024)

5.3 Globale Produktion, Wert, Preis und Bruttomarge von Industriellen Bäckereigeräten (2019-2024)

5.4 Produktion, Wert, Preis und Bruttomarge von industriellen Bäckereigeräten in Nordamerika (2019-2024)

5.5 Europa Industrielle Bäckereiausrüstung Produktion, Wert, Preis und Bruttomarge (2019-2024)

5.6 Produktion, Wert, Preis und Bruttomarge von Industriebäckereiausrüstungen in China (2019-2024)

5.7 Produktion, Wert, Preis und Bruttomarge von Industriebäckereiausrüstungen in Japan (2019-2024)

5.8 Naher Osten und Afrika Industrielle Bäckerei Ausrüstung Produktion, Wert, Preis und Bruttomarge (2019-2024)

5.9 Produktion, Wert, Preis und Bruttomarge von industriellen Bäckereigeräten in Indien (2019-2024)

5.10 Produktion, Wert, Preis und Bruttomarge von industriellen Bäckereigeräten in Südamerika (2019-2024)

6 Globale Produktion, Verbrauch, Export, Import von industriellen Bäckereigeräten nach Regionen (2019-2024)

6.1 Weltweiter Industrielle Bäckereiausrüstung-Verbrauch nach Regionen (2019-2024)

6.2 Nordamerika Industrielle Bäckerei Ausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.3 Europa Industrielle Bäckereiausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.4 China Industrielle Bäckereiausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.5 Japan Industrielle Bäckereiausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.6 Naher Osten und Afrika Industrielle Bäckerei Ausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.7 Indien Industrielle Bäckereiausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

6.8 Südamerika Industrielle Bäckerei Ausrüstung Produktion, Verbrauch, Export, Import (2019-2024)

7 Globaler Marktstatus für industrielle Bäckereiausrüstung nach Regionen

7.1 Nordamerika Industrielle Bäckerei Ausrüstung Marktstatus

7.2 Europa Industrielle Bäckerei Ausrüstung Marktstatus

7.3 Marktstatus für industrielle Bäckereiausrüstung in China

7.4 Marktstatus für industrielle Bäckereiausrüstung in Japan

7.5 Mittlerer Osten und Afrika Industrielle Bäckerei Ausrüstung Marktstatus

7.6 Marktstatus für industrielle Bäckereiausrüstung in Indien

7.7 Südamerika Industrielle Bäckerei Ausrüstung Marktstatus

8 Wettbewerbslandschaft

8.1 Wettbewerbsprofil

8.2 Bühler

8.2.1 Firmenprofile

8.2.2 Industrielle Bäckereiausrüstung Produkteinführung

8.2.3 Bühler Produktion, Wert, Preis, Bruttomarge 2019-2024

8.3 Rheon

8.3.1 Firmenprofile

8.3.2 Industrielle Bäckereiausrüstung Produkteinführung

8.3.3 Rheon Produktion, Wert, Preis, Bruttomarge 2019-2024

8.4 Kaak-Gruppe

8.4.1 Firmenprofile

8.4.2 Industrielle Bäckereiausrüstung Produkteinführung

8.4.3 Kaak Group Produktion, Wert, Preis, Bruttomarge 2019-2024

8.5 Fritsch (Multivac)

8.5.1 Firmenprofile

8.5.2 Industrielle Bäckereiausrüstung Produkteinführung

8.5.3 Fritsch (Multivac) Produktion, Wert, Preis, Bruttomarge 2019-2024

8.6 Rademacher

8.6.1 Firmenprofile

8.6.2 Industrielle Bäckereiausrüstung Produkteinführung

8.6.3 Rademaker-Produktion, Wert, Preis, Bruttomarge 2019–2024

8.7 Mekatherm

8.7.1 Firmenprofile

8.7.2 Industrielle Bäckereiausrüstung Produkteinführung

8.7.3 Mecatherm Produktion, Wert, Preis, Bruttomarge 2019-2024

8.8 AMF Bäckereisysteme

8.8.1 Firmenprofile

8.8.2 Industrielle Bäckereiausrüstung Produkteinführung

8.8.3 AMF Bakery Systems Produktion, Wert, Preis, Bruttomarge 2019-2024

8.9 RONDO

8.9.1 Firmenprofile

8.9.2 Industrielle Bäckereiausrüstung Produkteinführung

8.9.3 RONDO Produktion, Wert, Preis, Bruttomarge 2019-2024

8.10 GEA

8.10.1 Firmenprofile

8.10.2 Industrielle Bäckereiausrüstung Produkteinführung

8.10.3 GEA-Produktion, Wert, Preis, Bruttomarge 2019-2024

8.11 Sinmag

8.11.1 Firmenprofile

8.11.2 Industrielle Bäckereiausrüstung Produkteinführung

8.11.3 Sinmag Produktion, Wert, Preis, Bruttomarge 2019-2024

8.12 Polin

8.12.1 Firmenprofile

8.12.2 Industrielle Bäckereiausrüstung Produkteinführung

8.12.3 Polin Produktion, Wert, Preis, Bruttomarge 2019-2024

8.13 Z-Linie

8.13.1 Firmenprofile

8.13.2 Industrielle Bäckereiausrüstung Produkteinführung

8.13.3 Z-Line-Produktion, Wert, Preis, Bruttomarge 2019-2024

8.14 Wissenswertes

8.14.1 Firmenprofile

8.14.2 Industrielle Bäckereiausrüstung Produkteinführung

8.14.3 Trivi-Produktion, Wert, Preis, Bruttomarge 2019-2024

8.15 Moline

8.15.1 Firmenprofile

8.15.2 Industrielle Bäckereiausrüstung Produkteinführung

8.15.3 Moline Produktion, Wert, Preis, Bruttomarge 2019-2024

8.16 Canol

8.16.1 Firmenprofile

8.16.2 Industrielle Bäckereiausrüstung Produkteinführung

8.16.3 Canol Produktion, Wert, Preis, Bruttomarge 2019-2024

9 Globale Marktanalyse und Prognose für industrielle Bäckereiausrüstung nach Typ und Anwendung

9.1 Globale Marktwert- und Volumenprognose für industrielle Bäckereiausrüstung nach Typ (2024-2030)

9.1.1 Marktwert- und Volumenprognose für mechanische Querschneider (2024-2030)

9.1.2 Marktwert- und Volumenprognose für elektrische Bleche (2024-2030)

9.1.3 Marktwert- und Volumenprognose für Teigblock-Rollmaschinen (2024-2030)

9.1.4 Feeder-Marktwert- und Volumenprognose (2024-2030)

9.1.5 Marktwert- und Volumenprognose für Make-up-Systeme (2024-2030)

9.1.6 Marktwert- und Volumenprognose für Industrieversicherungen (2024-2030)

9.2 Globale Marktwert- und Volumenprognose für industrielle Bäckereiausrüstung nach Anwendung (2024-2030)

9.2.1 Croissants-Marktwert- und Volumenprognose (2024-2030)

9.2.2 Donuts-Marktwert- und Volumenprognose (2024-2030)

9.2.3 Pizza (neu) Marktwert- und Volumenprognose (2024-2030)

9.2.4 Marktwert- und Volumenprognose für Brot und Brötchen (2024-2030)

9.2.5 Marktwert- und Volumenprognose für Gebäck (2024-2030)

10 Marktanalyse und Prognose für industrielle Bäckereiausrüstung nach Regionen

10.1 Produktions- und Verbrauchsprognose für den nordamerikanischen Markt (2024-2030)

10.2 Produktions- und Verbrauchsprognose für den europäischen Markt (2024-2030)

10.3 Produktions- und Verbrauchsprognose für den chinesischen Markt (2024-2030)

10.4 Produktions- und Verbrauchsprognose für den japanischen Markt (2024-2030)

10.5 Marktproduktions- und Verbrauchsprognose für den Nahen Osten und Afrika (2024-2030)

10.6 Produktions- und Verbrauchsprognose für den indischen Markt (2024-2030)

10.7 Südamerika Marktproduktions- und Verbrauchsprognose (2024-2030)

11 Machbarkeitsanalyse für neue Projekte

11.1 SWOT-Analyse für Branchenbarrieren und neue Marktteilnehmer

12 Anhang

12.1 Methodik

12.2 Forschungsdatenquelle

12.2.1 Sekundärdaten

12.2.2 Primärdaten

12.2.3 Schätzung der Marktgröße

12.2.4 Haftungsausschluss