1. Global Container Screening Market Analysis

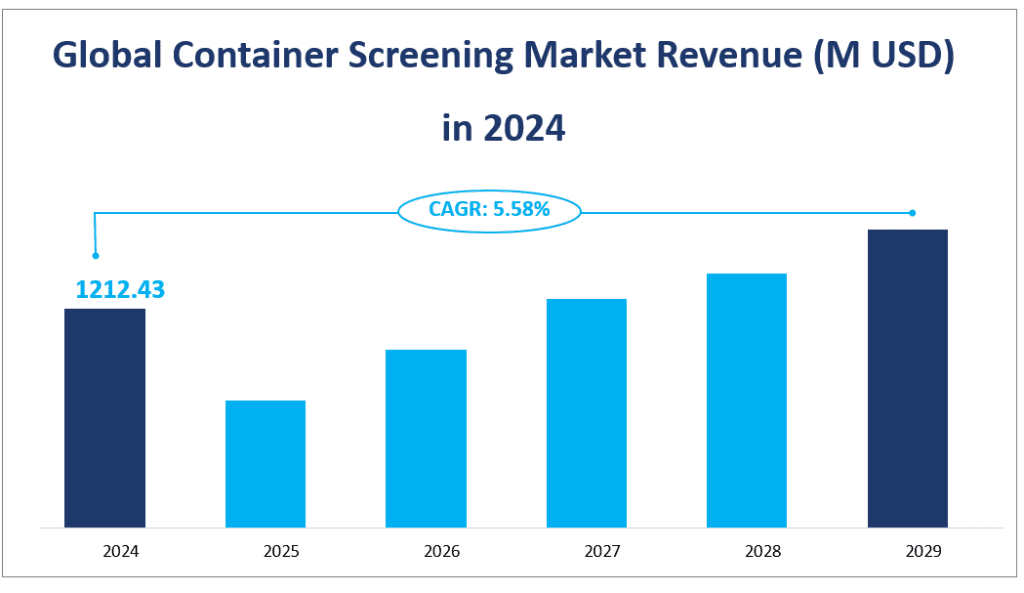

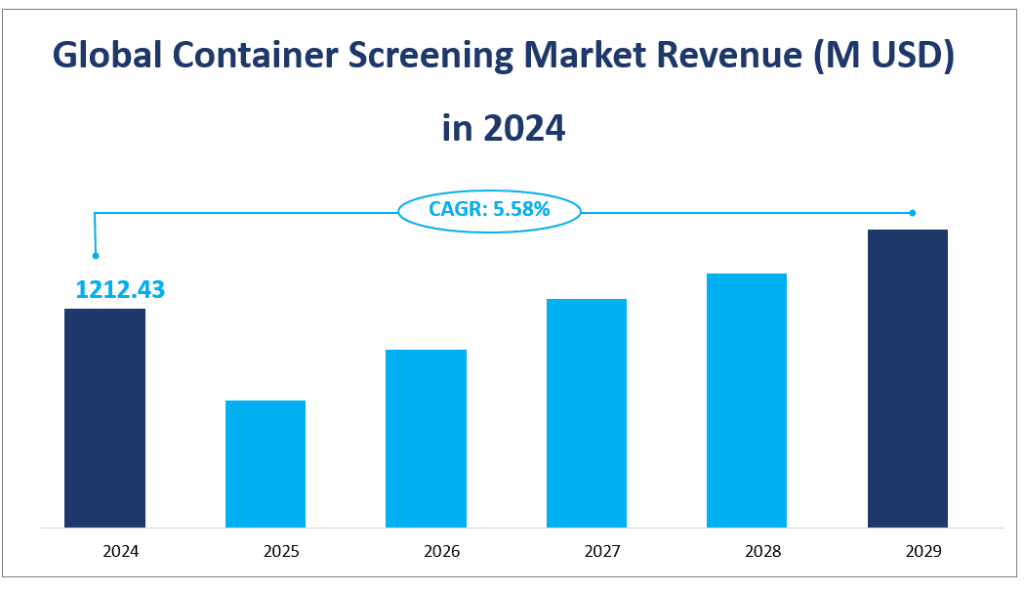

The global Container Screening market has been undergoing a transformative phase, with technological advancements and increasing security concerns driving its growth. In 2024, the market revenue is projected to reach $1212.43 million, reflecting a robust CAGR of 5.58% from 2024 to 2029, indicating a period of significant expansion.

Container screening refers to the process of inspecting cargo containers to identify and mitigate potential security threats before they reach their destinations. Utilizing technologies such as gamma imaging, X-ray imaging, and radiation detection, container screening systems are crucial for real-time inspection of sealed containers, content classification, and discrimination. These systems are vital for enhancing security in ports, airports, and border crossings, ensuring the safe and efficient movement of trade.

The market’s growth can be attributed to the increasing global trade volume, the need for advanced security measures against illicit activities, and the adoption of innovative screening technologies. The Container Screening market is poised to benefit from the rising demand for efficient cargo inspection solutions, which are essential for maintaining security without hampering the flow of international trade.

Global Container Screening Market Revenue (M USD) in 2024

2. Driving Factors of Container Screening Market

Economic Development and Trade Expansion: The growth of the global economy and the subsequent increase in international trade have led to a higher demand for container screening solutions. As more goods are transported across borders, the need for secure and efficient screening processes becomes more critical.

Technological Innovations: Advancements in imaging technology, artificial intelligence, and data analytics have enabled the development of more accurate and efficient container screening systems. These technologies not only improve detection capabilities but also enhance the overall speed of the screening process.

Security Concerns: The persistent threat of terrorism and the illicit trafficking of drugs and weapons have heightened the need for stringent security measures. Container screening is a frontline defense in combating these threats, making it a priority for governments and private entities involved in logistics.

Regulatory Compliance: Increasingly strict regulations and standards for cargo security have compelled companies to invest in advanced screening technologies to ensure compliance and avoid hefty penalties.

3. Limiting Factors of Container Screening Market

High Initial Investment: The cost of acquiring and maintaining advanced container screening equipment can be prohibitive for some companies, especially small and medium-sized enterprises (SMEs). This high initial investment acts as a barrier to entry for new market players.

Technological Challenges: While technology has been a driving factor, it also presents challenges in the form of rapid obsolescence and the need for continuous updates and maintenance. Companies must keep pace with technological advancements to stay competitive.

Fluctuating Raw Material Prices: The cost of raw materials used in the manufacturing of screening systems can fluctuate, affecting the overall cost and pricing strategy of container screening solutions.

Geographical and Political Risks: Global political tensions and trade disputes can impact the demand for container screening solutions. Changes in trade policies and sanctions can lead to market volatility and affect the growth of the industry.

In conclusion, the Container Screening market is set to experience significant growth in the coming years, driven by economic development, technological innovation, and heightened security concerns. However, challenges such as high initial investment, technological challenges, and geopolitical risks may limit the market’s growth potential. Despite these obstacles, the market is expected to continue its upward trajectory, offering substantial opportunities for stakeholders to innovate and expand their reach in the global security landscape.

4. Container Screening Market Segment Analysis

The container screening industry plays a pivotal role in global security, ensuring the safe and efficient flow of cargo across international borders.

Product Types of Container Screening Market

Container screening systems are categorized into two primary types: Mobile Screening Systems and Fixed Screening Systems.

Mobile Screening System: These are portable units designed for flexibility and can be deployed at various locations as needed. They are composed of a generator, X-ray source, conveyor belt, and operator console. Mobile systems are ideal for inspecting small to medium-sized containers and are known for their quick setup and ease of use. Projected to generate a revenue of $527.24 million, this type of system is expected to maintain its significance in the market due to its versatility and the increasing need for rapid deployment in various security scenarios

Fixed Screening System: Permanently installed at specific locations, fixed systems are designed for inspecting large containers. They offer higher accuracy and efficiency compared to mobile systems and are used in high-volume cargo inspection areas. With a projected revenue of $685.19 million, fixed systems are anticipated to hold the largest market share. This can be attributed to their higher inspection capabilities and the growing demand for permanent security solutions at key logistics hubs.

The Fixed Screening System is predicted to have the biggest market share in 2024, reflecting its dominance in high-volume inspection environments. However, the Mobile Screening System is expected to exhibit the fastest growth rate, driven by the need for rapid response capabilities in dynamic security situations and the increasing adoption of mobile technologies across various applications.

The growth in the mobile segment is also influenced by advancements in technology, which allow for enhanced imaging and detection capabilities in smaller, more portable systems. Additionally, the rising number of temporary security checkpoints and the need for on-demand screening solutions contribute to the robust growth of the mobile screening system market.

In conclusion, while fixed screening systems continue to hold a significant portion of the market due to their established presence in major ports and borders, the mobile screening system is gaining ground with its rapid deployment and flexibility advantages. As the global trade and security landscape continues to evolve, both types of systems will play critical roles in ensuring the safe and efficient movement of goods worldwide.

Applications Container Screening Market

The container screening market serves a multitude of applications, each with its unique set of challenges and requirements.

Maritime: With a projected revenue of $417.85 million, the maritime sector is expected to maintain its position as the largest market share holder due to the high volume of global trade that relies on sea transport. Container screening in the maritime sector involves the inspection of cargo containers in ports and other maritime facilities. It is crucial for ensuring the security of international seaborne trade.

Aviation: Projected to generate $59.33 million in revenue, the aviation sector is anticipated to experience steady growth due to the increasing demand for secure air cargo transportation. This application pertains to the inspection of containers and cargo in airports and other aviation-related facilities, playing a critical role in aviation security.

Land Transportation: Forecasted to reach $274.15 million in revenue, land transportation is set to expand as the need for secure cargo movement on land increases. Container screening for land transportation focuses on inspecting cargo on railways, roads, and other land-based logistics channels.

Defense: Expected to generate $407.78 million, the defense sector is a significant market for container screening, driven by the continuous need for enhanced security measures. Defense applications involve the use of container screening technology for security checks at military installations, borders, and other defense-related facilities.

The Maritime application is predicted to hold the largest market share in 2024, reflecting the immense scale of global seaborne trade and the necessity for stringent security measures in ports. However, the Defense application is expected to exhibit the fastest growth rate, driven by escalating security concerns and the need for advanced detection technologies in defense sectors worldwide.

The growth in the defense sector can be attributed to the increasing global focus on counter-terrorism measures, border security, and the detection of weapons of mass destruction. Additionally, the rising number of security threats and the integration of advanced technologies such as AI and machine learning in container screening systems contribute to the robust growth of this application segment.

In conclusion, while the maritime application continues to dominate the container screening market due to the vast volume of sea trade, the defense application is on the cusp of rapid expansion. As security threats evolve and new technologies emerge, the container screening market must adapt to meet the growing demands of various applications, ensuring the safety and efficiency of global cargo movement.

Market Revenue by Segment

| Market Revenue (M USD) in 2024 | ||

| By Type | Mobile Screening System | 527.24 |

| Fixed Screening System | 685.19 | |

| By Application | Maritime | 417.85 |

| Aviation | 59.33 | |

| Land Transportation | 274.15 | |

| Defense | 407.78 | |

| Others | 53.32 |

5. Regional Container Screening Market Analysis and Forecast for 2024

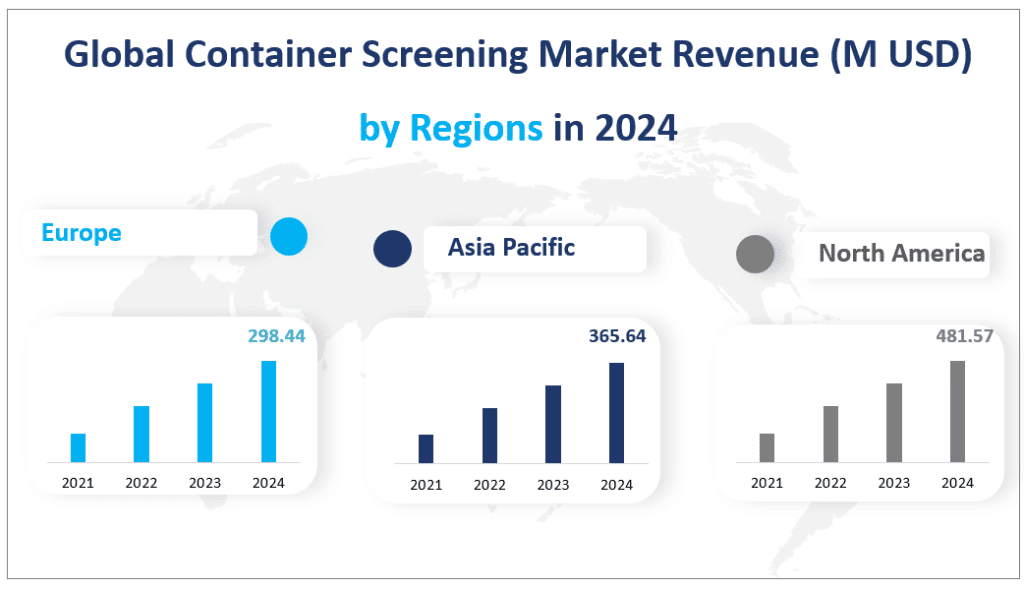

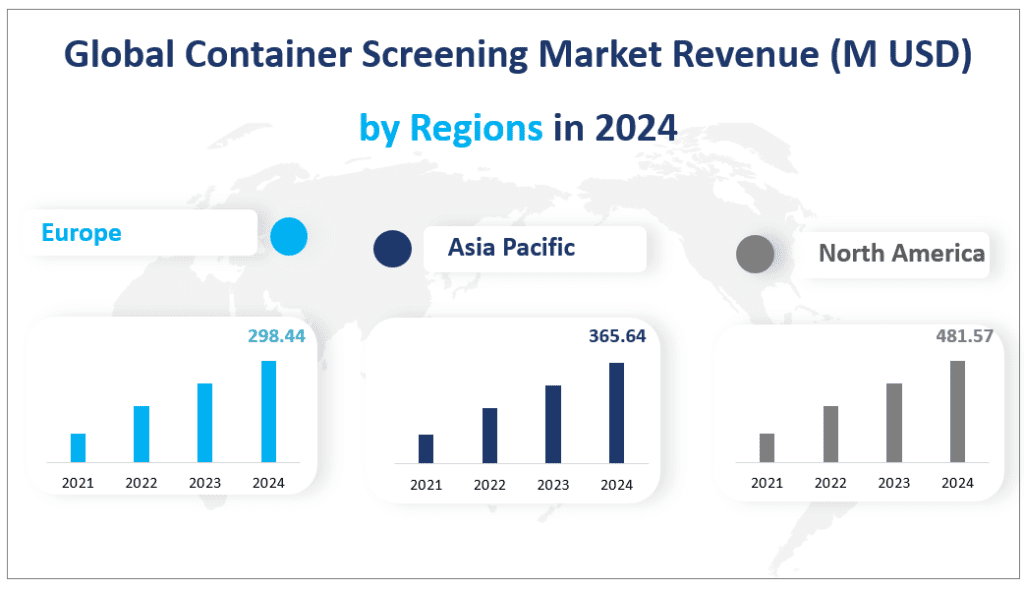

North America: The Largest Revenue Market

North America has consistently been the largest revenue contributor to the global container screening industry, with a significant market revenue of $481.57 million in 2024. This region’s dominance can be attributed to its well-established ports, stringent security regulations, and the high adoption rate of advanced screening technologies. The United States, being a key player in this region, continues to invest heavily in security infrastructure, driving the demand for container screening systems. The market in North America is characterized by a mature industry with a focus on technological innovation and service excellence.

Asia Pacific: The Fastest-Growing Region

The Asia Pacific region emerges as the fastest-growing market for container screening systems with a revenue of $365.64 million in 2024. This growth is fueled by the rapid economic development in countries like China, India, and South Korea, which are experiencing a surge in international trade. The region’s ports are expanding, and there is a heightened focus on security measures to protect against illicit activities. The Asia Pacific market is not only growing in terms of quantity but also in the quality of checking systems being deployed, with a shift towards more advanced and automated technologies.

Europe: A Stable Contributor

Europe, with its well-developed ports and a strong emphasis on security, remains a stable contributor to the global container screening market with a revenue of $298.44 million in 2024. Countries like Germany, the UK, and France have robust security infrastructures, and their demand for container screening systems is primarily driven by the need to upgrade existing technologies. While the growth rate in Europe may not be as rapid as in the Asia Pacific, it still plays a crucial role in the global market due to its high revenue generation.

South America and Middle East & Africa: Emerging Markets

South America and the Middle East & Africa, while not as significant as the other regions in terms of revenue, are emerging as potential growth markets. These regions are witnessing an increase in trade activities and are gradually adopting container-screening technologies to enhance security. Brazil and Argentina in South America, along with GCC countries in the Middle East, are investing in port security, which is expected to boost the demand for container screening systems.

In conclusion, the global container screening market is a dynamic landscape with different regions contributing to its growth in various ways. While North America leads in revenue generation, the Asia Pacific region shows the most promising growth potential. As the industry continues to evolve, stakeholders need to understand these regional dynamics to capitalize on the opportunities presented by the global container screening market.

Global Container Screening Market Revenue (M USD) by Regions in 2024

6. Top Three Companies in the Global Container Screening Industry

Nuctech: A Leader in Security Inspection Solutions

Nuctech, established in 1997 and headquartered in China, is a renowned supplier of security inspection products and solutions. With a global sales reach, Nuctech specializes in linear feeder container/vehicle inspection systems, radioactive material monitoring systems, and X-ray inspection systems. In the latest year, Nuctech reported impressive sales revenue, solidifying its position as a tier-one player in the container screening market.

OSI Systems: Innovating in Electronic Systems

OSI Systems, founded in 1986 and based in the USA, is a vertically integrated designer and manufacturer of specialized electronic systems for homeland security, healthcare, defense, and aerospace. The company’s Eagle® G60 ZBx cargo and vehicle inspection systems are known for their high-quality transmission and Z Backscatter® imaging technology. OSI Systems has been performing strongly in terms of sales revenue, making it a significant competitor in the container screening market.

Leidos: Providing Scientific and Technical Services

Leidos Holdings, Inc., established in 1969 and headquartered in the USA, offers scientific, engineering, systems integration, and technical services. The company’s VACIS® MLX Mobile Light X-ray Inspection System is designed for maneuverability and advanced high-energy imaging. Leidos has a substantial market share, with its sales revenue reflecting its strong presence in the container screening market.

Major Players

| Company Name | Headquarters | Sales Region |

| Nuctech | China | Worldwide |

| OSI Systems | USA | Worldwide |

| Leidos | USA | Mainly in North America, Europe, Africa, Oceania |

| Smiths Detection | UK | Mainly in North America, Europe, Asia, Oceania |

| LINEV Systems | USA | Mainly in North America, Europe, the Middle East |

| HTDS | France | Mainly in Europe, Africa |

| Astrophysics | USA | Mainly in Europe, America, Asia |

| Decision Sciences | USA | Mainly in North America |

| CGN Begood Technology | China | Mainly in Asia |

| VMI Security Systems | Brazil | Mainly in America, Europe |

1 Market Overview

1.1 Container Screening Definition

1.2 Assumptions

1.3 Research Scope

1.4 Major Country Wise Market Analysis

1.4.1 North America

1.4.2 Europe

1.4.3 Asia-Pacific

1.4.4 South America

1.4.5 Middle East and Africa

2 Major Segmentation (Classification, Application and etc.) Analysis

2.1 Brief Introduction by Major Application

2.1.1 Maritime

2.1.2 Aviation

2.1.3 Land Transportation

2.1.4 Defence

2.2 Brief Introduction by Major Type

2.2.1 Mobile Screening System

2.2.2 Fixed Screening System

3 Production Market Analysis

3.1 Global Production Market Analysis

3.1.1 2017-2022 Global Production Analysis

3.1.2 2017-2022 Global Production Market Share by Regions

3.2 Regional Production Market Analysis

3.2.1 United States Market

3.2.2 Europe Market

3.2.3 China Market

4 Sales Market Analysis

4.1 Global Sales Market Analysis

4.1.1 2017-2022 Global Sales Volume, Sales Price and Sales Revenue Analysis

4.2 Regional Sales Market Analysis

4.2.1 2017-2022 Regional Market Performance and Market Share

4.2.2 North America Market

4.2.3 Europe Market

4.2.4 Asia-Pacific Market

4.2.5 South America Market

4.2.6 Middle East & Africa Market

5 Sales Market Comparison Analysis by Countries

5.1 North America

5.2 Europe

5.3 Asia-Pacific

5.4 South America

5.5 Middle East & Africa

6 Major Manufacturers Sales Market Comparison Analysis

6.1 Global Major Manufacturers Sales Market Comparison Analysis

6.2 Global Major Manufacturers Revenue Market Comparison Analysis

6.3 Global Container Screening Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

7 Marketing Channel Analysis

7.1 Marketing Channel Status

7.2 Major Distributors Analysis

8 Industry Chain Analysis

8.1 Major Raw Materials

8.2 Manufacturing Analysis

8.2.1 Manufacturing Process

8.2.2 Manufacturing Cost Structure

8.2.3 Manufacturing Plants Distribution Analysis

8.3 Industry Chain Structure Analysis

9 Global and Regional Market Forecast

9.1 Production Market Forecast

9.2 Sales Market Forecast

9.2.1 Global Market Forecast

9.2.2 North America Container Screening Market Forecast by Regions

9.2.2 Europe Container Screening Market Forecast by Regions

9.2.3 Asia Pacific Container Screening Market Forecast by Regions

9.2.4 South America Container Screening Market Forecast by Regions

9.2.5 Middle East and Africa Container Screening Market Forecast by Regions

9.3 Major Classification Forecast

9.3.1 Major Classification Forecast

9.3.2 Mobile Screening System Forecast

9.3.3 Fixed Screening System Forecast

9.4 Major Application Forecast

10 Major Manufacturers Analysis

10.1 Nuctech

10.1.1 Nuctech Basic Information

10.1.2 Container Screening Product Profiles, Application and Specification

10.1.3 Nuctech Container Screening Market Performance (2017-2022)

10.2 OSI Systems

10.2.1 OSI Systems Basic Information

10.2.2 Container Screening Product Profiles, Application and Specification

10.2.3 OSI Systems Container Screening Market Performance (2017-2022)

10.3 Leidos

10.3.1 Leidos Basic Information

10.3.2 Container Screening Product Profiles, Application and Specification

10.3.3 Leidos Container Screening Market Performance (2017-2022)

10.4 Smiths Detection

10.4.1 Smiths Detection Basic Information

10.4.2 Container Screening Product Profiles, Application and Specification

10.4.3 Smiths Detection Container Screening Market Performance (2017-2022)

10.5 LINEV Systems

10.5.1 LINEV Systems Basic Information

10.5.2 Container Screening Product Profiles, Application and Specification

10.5.3 LINEV Systems Container Screening Market Performance (2017-2022)

10.6 HTDS

10.6.1 HTDS Basic Information

10.6.2 Container Screening Product Profiles, Application and Specification

10.6.3 HTDS Container Screening Market Performance (2017-2022)

10.7 Astrophysics

10.7.1 Astrophysics Basic Information

10.7.2 Container Screening Product Profiles, Application and Specification

10.7.3 Astrophysics Container Screening Market Performance (2017-2022)

10.8 Decision Sciences

10.8.1 Decision Sciences Basic Information

10.8.2 Container Screening Product Profiles, Application and Specification

10.8.3 Decision Sciences Container Screening Market Performance (2017-2022)

10.9 CGN Begood Technology

10.9.1 CGN Begood Technology Basic Information

10.9.2 Container Screening Product Profiles, Application and Specification

10.9.3 CGN Begood Technology Container Screening Market Performance (2017-2022)

10.10 VMI Security Systems

10.10.1 VMI Security Systems Basic Information

10.10.2 Container Screening Product Profiles, Application and Specification

10.10.3 VMI Security Systems Container Screening Market Performance (2017-2022)

11 New Project Investment Feasibility Analysis

11.1 New Project SWOT Analysis

12 Conclusion

13 Appendix

13.1 Methodology

13.2 Research Data Source

13.2.1 Secondary Data

13.2.2 Primary Data

13.2.3 Market Size Estimation

13.2.4 Legal Disclaimer