1. Global Construction Hoist Market Analysis

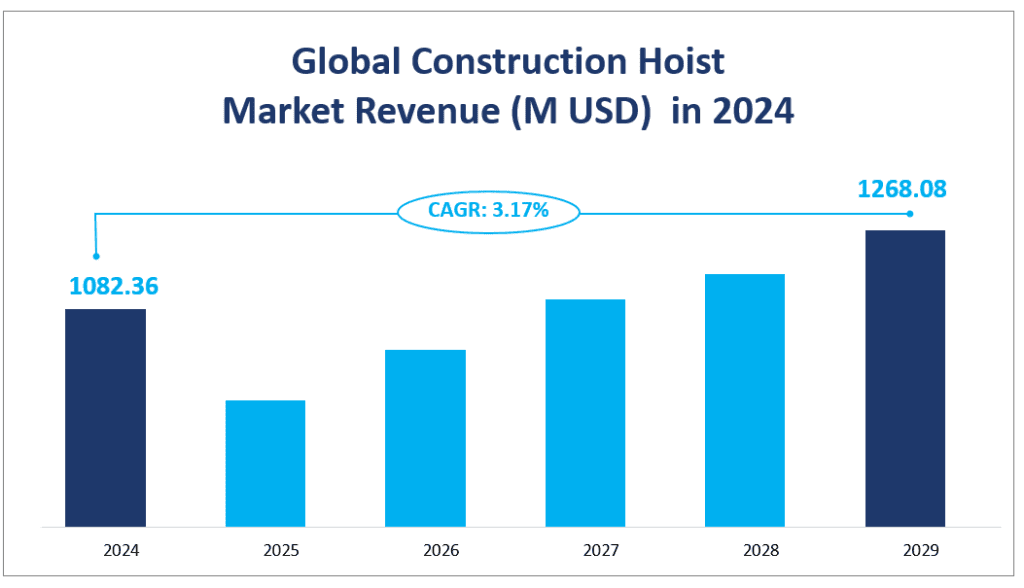

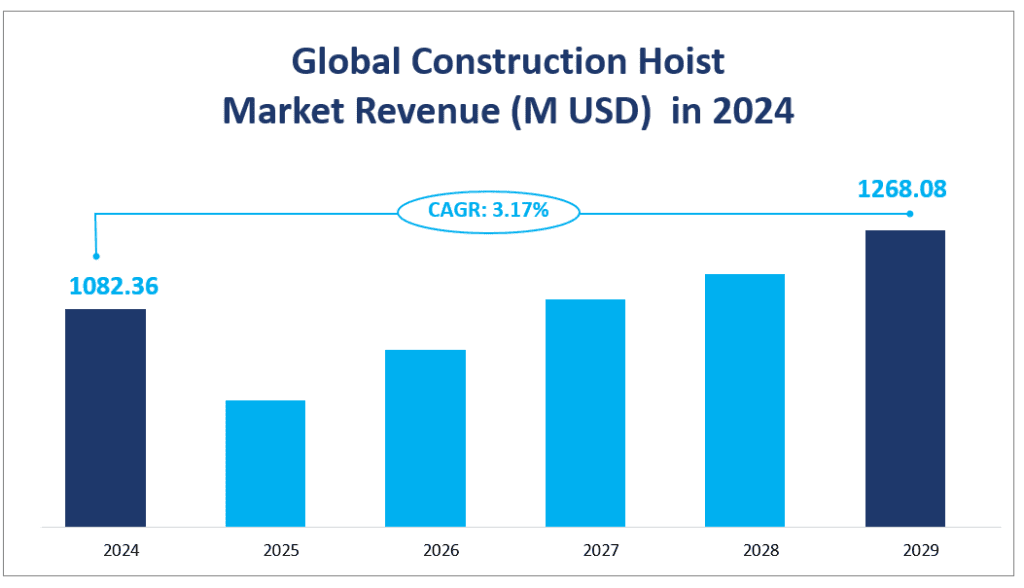

The global construction hoist market value will reach $1082.36 million in 2024 with a CAGR of 3.17% from 2024 to 2029. It is a segment of the construction machinery industry that specializes in the vertical transportation of people and materials on construction sites. A construction hoist, also known as a construction elevator, is an essential piece of equipment in the construction and engineering sectors, facilitating the efficient movement of workers, building materials, and construction tools vertically within a construction site. These hoists are categorized by their load-bearing capacities into three types: below 2 tons, 2-3 tons, and above 3 tons, each serving different construction needs.

The market’s growth can be attributed to several factors, including the global trend of urbanization and population growth, which increases the demand for housing, commercial spaces, and infrastructure. As urban areas expand, there is a corresponding rise in the need for construction projects, which in turn drives the demand for construction hoists. Additionally, the market is influenced by the expansion of market channels and the potential for capturing new markets, especially in regions with developing economies where infrastructure development is a priority.

However, the market also faces challenges that could limit growth. These include the increasing emphasis on environmental protection and energy conservation, which requires construction hoist manufacturers to adopt more sustainable practices and technologies. The highly competitive nature of the market, with a few large companies dominating the share, poses a challenge for smaller players looking to establish a foothold. Moreover, global economic fluctuations, such as inflation and macroeconomic downturns, can impact the cost of raw materials and the overall demand for construction hoists.

Global Construction Hoist Market Revenue (M USD) in 2024

2. Driving Factors of the Construction Hoist Market

The growth of the global construction hoist market is propelled by several key factors. Urbanization and population growth are at the forefront, with the United Nations predicting that the world’s urban population will continue to increase, leading to a higher demand for residential, commercial, and public infrastructure. This trend is accompanied by the expansion of market channels, as manufacturers increasingly turn to online platforms and international trade to reach a broader customer base. The potential for growth in emerging markets is particularly significant, as these regions undertake extensive development projects that require the use of construction hoists.

Technological advancements also play a crucial role in driving market growth. Innovations in construction hoist design and functionality, such as energy-efficient models and those with enhanced safety features, attract customers and contribute to the market’s expansion. Furthermore, the introduction of multi-functional hoists that can be adapted to various construction projects is expected to gain popularity among customers, further boosting market growth.

3. Limiting Factors of the Construction Hoist Market

Despite the positive outlook, the construction hoist market faces several challenges that could hinder its growth. One of the primary limiting factors is the increasing focus on environmental protection and energy conservation. Construction hoist manufacturers must comply with stricter environmental regulations and may face higher costs associated with the development and production of greener products. This could impact profit margins and the overall competitiveness of the industry.

Market competition is another significant challenge. The market is highly competitive, with a few large companies holding a significant share. These companies leverage their brand power, technological prowess, and extensive distribution networks to maintain their market position, making it difficult for new entrants and smaller companies to compete effectively.

Economic factors, such as global inflation and macroeconomic downturns, also pose risks to the market. Inflation can lead to increased costs for raw materials and production inputs, squeezing profit margins and potentially leading to a decrease in demand for construction hoists as consumers’ purchasing power declines. A sluggish global economy can result in reduced investment in construction projects, thereby affecting the demand for construction hoists.

4. Analysis of Global Construction Hoist Market by Product Type and Application

Product Type Analysis

The global construction hoist market is segmented into three primary product types based on load-bearing capacity: below 2 tons, 2-3 tons, and above 3 tons. Each type caters to different construction needs and has distinct market characteristics.

Below 2-Ton Construction Hoists

The “below 2-ton” segment includes hoists designed for lighter loads, suitable for low-to-mid-rise construction projects. In 2024, this segment generated a revenue of $169.32 million. Despite its importance, this segment holds the smallest market share and has a relatively stable growth rate, reflecting the market’s shift towards higher-capacity hoists.

2-3 Ton Construction Hoists

The “2-3 ton” segment is a dominant player in the market, catering to a broad range of construction projects. With a revenue of $552.11 million in 2024, this segment commands the largest market share. Its popularity stems from its versatility and ability to handle a wide array of materials and personnel, making it a staple in many construction sites. The segment also exhibits a healthy growth rate, indicating its continued relevance in the market.

Above 3-Ton Construction Hoists

The “above 3-ton” segment includes heavy-duty hoists designed for lifting heavier construction materials and equipment. In 2024, this segment generated a revenue of $360.92 million. While it holds a significant market share, it experiences a slower growth rate compared to the 2-3-ton segment, due in part to the specialized nature of projects that require such heavy-lifting capabilities.

Application Analysis

The construction hoist market is also segmented by application into residential, commercial, and industrial sectors, each with its own unique demands and market dynamics.

Residential Construction Hoists

Residential construction hoists are crucial for the construction of high-rise residential buildings and other housing projects. In 2024, this application generated a sales volume of $267.44 million. It holds a substantial market share and is characterized by a healthy growth rate, driven by the global demand for new housing and urbanization trends.

Commercial Construction Hoists

Commercial construction hoists are used in the construction of shopping malls, theaters, and other commercial facilities. With a revenue of $579.71 million in 2024, this application also commands a significant market share. The growth rate is moderate, reflecting the steady demand for commercial infrastructure development.

Industrial Construction Hoists

Industrial construction hoists are essential for the construction of large factories and other industrial facilities. In 2024, this application generated a revenue of $235.20 million. While it holds a smaller market share compared to residential and commercial applications, it exhibits a steady growth rate due to the ongoing need for industrial expansion and modernization.

The “2-3 ton” product type and the “residential” application sector have the biggest market shares in their respective categories, reflecting their broad applicability and significant demand in the market. In terms of growth rate, the “below 2 ton” product type and the “residential” application sector show the fastest growth, indicating a market trend towards lighter hoists for residential construction and the continued expansion of urban housing projects.

Market Revenue by Segment in 2024

| Market Revenue in 2024 | ||

| By Type | Below 2 ton | 169.32 M USD |

| 2-3 ton | 552.11 M USD | |

| Above 3 ton | 360.92 M USD | |

| By Application | Residential | 267.44 M USD |

| Commercial | 579.71 M USD | |

| Industrial | 235.20 M USD |

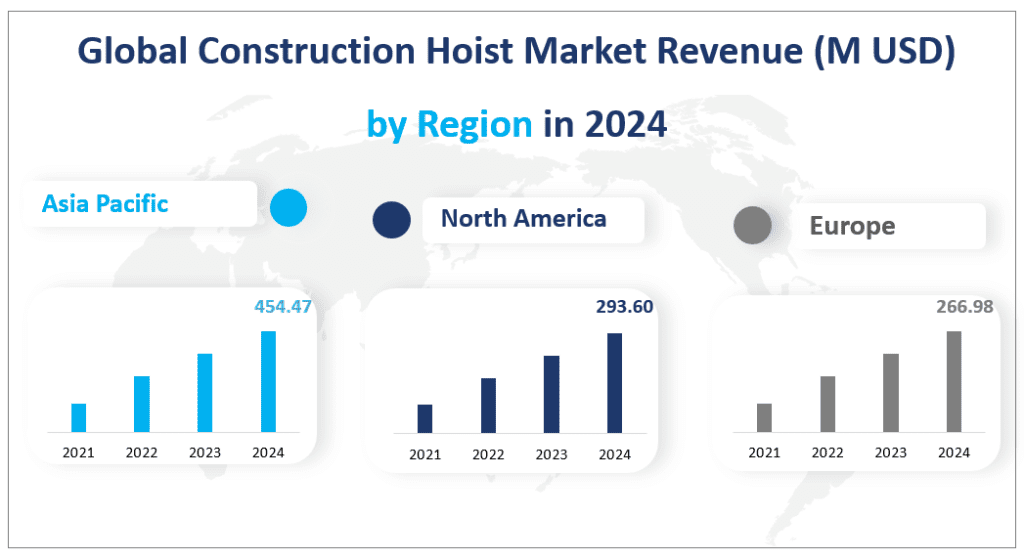

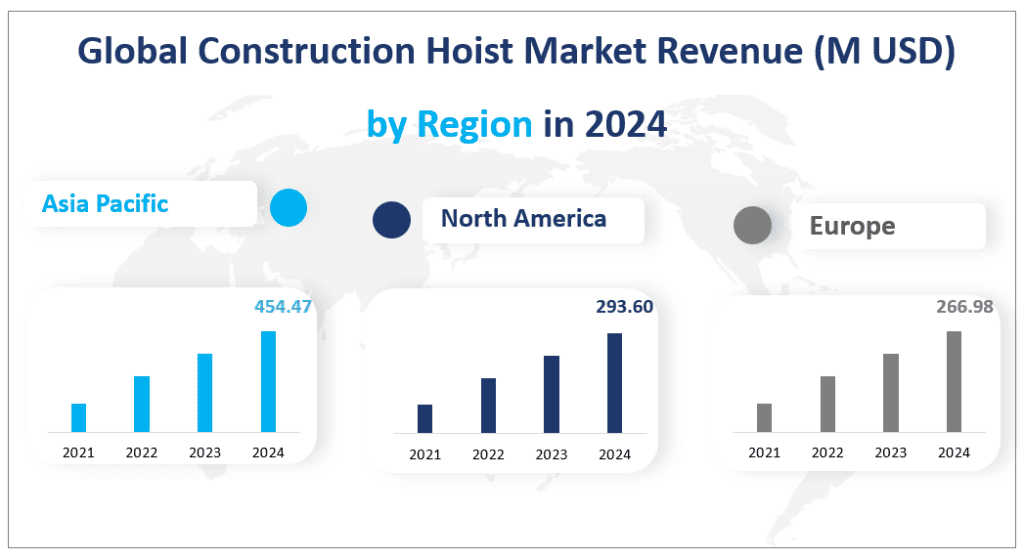

5. Global Construction Hoist Market by Region

North America

North America, with a revenue of $293.60 million in 2024, holds the position as the biggest regional market by revenue. This region’s dominance can be attributed to its robust construction industry, technological advancements, and the presence of major construction hoist manufacturers. The region’s market is characterized by a mature demand for construction hoists, with a focus on safety and efficiency in construction projects.

Asia-Pacific

The Asia-Pacific region is identified as the fastest-growing region, with a market revenue of $454.47 million in 2024. The growth in this region is fueled by rapid urbanization, a surge in infrastructure development, and the growing demand for high-rise residential and commercial construction. China, in particular, contributes significantly to this growth, driving the market with its large-scale construction projects.

Europe

Europe follows closely with a market revenue of $266.98 million in 2024. The region’s market is influenced by the presence of established construction companies and a strong focus on technological innovation within the construction hoist sector. Countries like Germany and France are key contributors to the region’s market revenue, with a demand for advanced construction equipment.

Latin America

Latin America’s market revenue stands at $34.33 million in 2024. While it is not the largest or the fastest-growing market, it shows potential for growth due to increasing infrastructure investments, particularly in countries like Brazil and Mexico, which are undergoing significant construction activities.

Middle East and Africa

The Middle East and Africa region contributes $32.98 million to the market revenue in 2024. The region is experiencing growth, driven by the development of oil and gas infrastructure and the construction of large-scale commercial and residential projects, especially in countries like Saudi Arabia and the United Arab Emirates.

Global Construction Hoist Market Revenue (M USD) by Region in 2024

6. Top Five Companies in the Construction Hoist Market

Introduction and Business Overview: Zoomlion, established in 1992, is a leading manufacturer of construction and agricultural machinery. The company specializes in a wide range of equipment, including concrete equipment, road construction machinery, and tower cranes.

Products Offered: Zoomlion offers a variety of construction hoists, known for their high efficiency, safety, and intelligence. Their models are widely used in housing and bridge construction.

Introduction and Business Overview: XCMG, founded in 1943, is a renowned manufacturer and distributor of construction equipment, offering a diverse portfolio that includes tower cranes, loaders, and excavators.

Products Offered: XCMG’s construction hoists are known for their high-speed operation and modular structure assembly, suitable for various construction projects.

Introduction and Business Overview: Dahan, established in 2000, is a major player in the production of tower cranes and construction lifts, integrating R&D, production, sales, and service.

Products Offered: Dahan’s construction hoists are recognized for their reliability and efficiency, catering to both Asian and European markets.

Introduction and Business Overview: Alimak, founded in 1948, is a global leader in the design and manufacturing of vertical access solutions, including high-quality elevators and construction hoists.

Products Offered: Alimak’s construction hoists are built on proven technology, offering sustainability, efficiency, and enhanced productivity in the construction industry.

Introduction and Business Overview: Fangyuan, established in 1970, is a professional construction machinery manufacturer with a focus on concrete mixing plants, tower cranes, and construction lifts.

Products Offered: Fangyuan’s construction hoists are designed for lower noise, larger space, and smoother operation, providing a comfortable working environment.

Major Players

| Company Name | Sales Regions |

| Zoomlion | Worldwide |

| XCMG | Worldwide |

| Dahan | Mainly in Asia and Europe |

| Alimak | Worldwide |

| Fangyuan | Mainly in Asia and Europe |

| GEDA | Mainly in Europe, North America and Asia |

| Hongda Construction | Asia, Europe, Africa and North America |

| Zhejiang Construction Machinery | Mainly in Asia |

| Sichuan Construction | Mainly in Asia and Europe |

| Böcker | Mainly in Europe |

| ELECTROELSA | Mainly in Europe |

| Guangxi Construction | Asia, Africa, Europe, Oceania |

| Jaypee | Mainly in Asia |

| STROS | Mainly in Europe and North America |

| XL Industries | Mainly in Europe |

| BetaMax | Mainly in North America |

| GJJ | Mainly in Asia Pacific and the Middle East |

1 Market Overview

1.1 Product Definition and Market Characteristics

1.2 Global Outsourcing Document Scanning Service Market Size

1.3 Market Segmentation

1.4 Global Macroeconomic Analysis

1.5 SWOT Analysis

2 Market Dynamics

2.1 Market Drivers

2.2 Market Constraints and Challenges

2.3 Emerging Market Trends

2.4 Impact of COVID-19

2.4.1 Influence of COVID-19 Outbreak on Outsourcing Document Scanning Service Industry Development

2.4.2 Measures / Proposal against Covid-19

2.4.3 COVID-19 Impact on Global GDP

2.4.4 COVID-19 Impact on World Merchandise Trade

2.4.5 COVID-19 Impact on Commodity prices

3 Associated Industry Assessment

3.1 Downstream Industry Analysis

3.2 Porter’s Five Forces Analysis

3.3 The Impact of Covid-19 From the Perspective of Value Chain

4 Market Competitive Landscape

4.1 Industry Leading Players

4.2 Industry News and Industry Policies

4.2.1 Industry Policies

4.2.2 M&A and Expansion Plans

5 Analysis of Leading Companies

5.1 Iron Mountain

5.1.1 Iron Mountain Company Profile

5.1.2 Iron Mountain Business Overview

5.1.3 Iron Mountain Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.1.4 Iron Mountain Outsourcing Document Scanning Service Product/Service Introduction

5.2 Royal Imaging Services

5.2.1 Royal Imaging Services Company Profile

5.2.2 Royal Imaging Services Business Overview

5.2.3 Royal Imaging Services Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.2.4 Royal Imaging Services Outsourcing Document Scanning Service Product/Service Introduction

5.3 Smooth Solutions

5.3.1 Smooth Solutions Company Profile

5.3.2 Smooth Solutions Business Overview

5.3.3 Smooth Solutions Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.3.4 Smooth Solutions Outsourcing Document Scanning Service Product/Service Introduction

5.4 DRS Imaging

5.4.1 DRS Imaging Company Profile

5.4.2 DRS Imaging Business Overview

5.4.3 DRS Imaging Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.4.4 DRS Imaging Outsourcing Document Scanning Service Product/Service Introduction

5.5 HITS Scanning Solutions

5.5.1 HITS Scanning Solutions Company Profile

5.5.2 HITS Scanning Solutions Business Overview

5.5.3 HITS Scanning Solutions Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.5.4 HITS Scanning Solutions Outsourcing Document Scanning Service Product/Service Introduction

5.6 Advanced Data Solutions

5.6.1 Advanced Data Solutions Company Profile

5.6.2 Advanced Data Solutions Business Overview

5.6.3 Advanced Data Solutions Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.6.4 Advanced Data Solutions Outsourcing Document Scanning Service Product/Service Introduction

5.7 Shoreline Records Management, Inc

5.7.1 Shoreline Records Management, Inc Company Profile

5.7.2 Shoreline Records Management, Inc Business Overview

5.7.3 Shoreline Records Management, Inc Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.7.4 Shoreline Records Management, Inc Outsourcing Document Scanning Service Product/Service Introduction

5.8 Armstrong Archives

5.8.1 Armstrong Archives Company Profile

5.8.2 Armstrong Archives Business Overview

5.8.3 Armstrong Archives Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.8.4 Armstrong Archives Outsourcing Document Scanning Service Product/Service Introduction

5.9 The Crowley Company

5.9.1 The Crowley Company Company Profile

5.9.2 The Crowley Company Business Overview

5.9.3 The Crowley Company Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.9.4 The Crowley Company Outsourcing Document Scanning Service Product/Service Introduction

5.10 Blue-Pencil Information Security

5.10.1 Blue-Pencil Information Security Company Profile

5.10.2 Blue-Pencil Information Security Business Overview

5.10.3 Blue-Pencil Information Security Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.10.4 Blue-Pencil Information Security Outsourcing Document Scanning Service Product/Service Introduction

5.11 Flatworld Solutions

5.11.1 Flatworld Solutions Company Profile

5.11.2 Flatworld Solutions Business Overview

5.11.3 Flatworld Solutions Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.11.4 Flatworld Solutions Outsourcing Document Scanning Service Product/Service Introduction

5.12 Access Scanning Document Services

5.12.1 Access Scanning Document Services Company Profile

5.12.2 Access Scanning Document Services Business Overview

5.12.3 Access Scanning Document Services Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.12.4 Access Scanning Document Services Outsourcing Document Scanning Service Product/Service Introduction

5.13 Scanning Company

5.13.1 Scanning Company Company Profile

5.13.2 Scanning Company Business Overview

5.13.3 Scanning Company Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.13.4 Scanning Company Outsourcing Document Scanning Service Product/Service Introduction

5.14 Cube Records Management Services

5.14.1 Cube Records Management Services Company Profile

5.14.2 Cube Records Management Services Business Overview

5.14.3 Cube Records Management Services Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.14.4 Cube Records Management Services Outsourcing Document Scanning Service Product/Service Introduction

5.15 Chicago Records Management

5.15.1 Chicago Records Management Company Profile

5.15.2 Chicago Records Management Business Overview

5.15.3 Chicago Records Management Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.15.4 Chicago Records Management Outsourcing Document Scanning Service Product/Service Introduction

5.16 Pacific Records Management

5.16.1 Pacific Records Management Company Profile

5.16.2 Pacific Records Management Business Overview

5.16.3 Pacific Records Management Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.16.4 Pacific Records Management Outsourcing Document Scanning Service Product/Service Introduction

5.17 NexGen Data Entry Services

5.17.1 NexGen Data Entry Services Company Profile

5.17.2 NexGen Data Entry Services Business Overview

5.17.3 NexGen Data Entry Services Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.17.4 NexGen Data Entry Services Outsourcing Document Scanning Service Product/Service Introduction

5.18 Filescan Solutions

5.18.1 Filescan Solutions Company Profile

5.18.2 Filescan Solutions Business Overview

5.18.3 Filescan Solutions Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.18.4 Filescan Solutions Outsourcing Document Scanning Service Product/Service Introduction

5.19 Microimage Technologies

5.19.1 Microimage Technologies Company Profile

5.19.2 Microimage Technologies Business Overview

5.19.3 Microimage Technologies Outsourcing Document Scanning Service Revenue, Gross and Gross Margin (2016-2021)

5.19.4 Microimage Technologies Outsourcing Document Scanning Service Product/Service Introduction

6 Market Analysis and Forecast, By Product Types

6.1 Global Outsourcing Document Scanning Service Revenue and Market Share by Types (2016-2021)

6.2 Global Outsourcing Document Scanning Service Market Forecast by Types (2021-2026)

6.3 Global Outsourcing Document Scanning Service Market Revenue Forecast, by Types (2021-2026)

6.3.1 Paper Scanning Market Revenue Forecast (2021-2026)

6.3.2 Microfilm Scanning Market Revenue Forecast (2021-2026)

6.3.3 Monitoring Strip Scanning Market Revenue Forecast (2021-2026)

6.3.4 Blueprint Scanning Market Revenue Forecast (2021-2026)

7 Market Analysis and Forecast, By Applications

7.1 Global Outsourcing Document Scanning Service Revenue and Market Share by Applications (2016-2021)

7.2 Global Outsourcing Document Scanning Service Market Forecast Revenue and Market Share by Applications (2021-2026)

7.3 Global Revenue and Growth Rate by Applications (2016-2021)

7.3.1 Global Outsourcing Document Scanning Service Revenue and Growth Rate of BFSI (2016-2021)

7.3.2 Global Outsourcing Document Scanning Service Revenue and Growth Rate of Healthcare (2016-2021)

7.3.3 Global Outsourcing Document Scanning Service Revenue and Growth Rate of Government (2016-2021)

7.3.4 Global Outsourcing Document Scanning Service Revenue and Growth Rate of Legal (2016-2021)

7.4 Global Outsourcing Document Scanning Service Market Revenue Forecast, by Applications (2021-2026)

7.4.1 BFSI Market Revenue Forecast (2021-2026)

7.4.2 Healthcare Market Revenue Forecast (2021-2026)

7.4.3 Government Market Revenue Forecast (2021-2026)

7.4.4 Legal Market Revenue Forecast (2021-2026)

8 Market Analysis and Forecast, By Regions

8.1 Global Outsourcing Document Scanning Service Market Revenue by Regions (2016-2021)

8.2 Global Outsourcing Document Scanning Service Market Forecast by Regions (2021-2026)

9 North America Outsourcing Document Scanning Service Market Analysis

9.1 Market Overview and Prospect Analysis

9.2 North America Outsourcing Document Scanning Service Market Revenue and Growth Rate (2016-2021)

9.3 North America Outsourcing Document Scanning Service Market Forecast

9.4 The Influence of COVID-19 on North America Market

9.5 North America Outsourcing Document Scanning Service Market Analysis by Country

9.5.1 U.S. Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

9.5.2 Canada Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

9.5.3 Mexico Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10 Europe Outsourcing Document Scanning Service Market Analysis

10.1 Market Overview and Prospect Analysis

10.2 Europe Outsourcing Document Scanning Service Market Revenue and Growth Rate (2016-2021)

10.3 Europe Outsourcing Document Scanning Service Market Forecast

10.4 The Influence of COVID-19 on Europe Market

10.5 Europe Outsourcing Document Scanning Service Market Analysis by Country

10.5.1 Germany Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10.5.2 United Kingdom Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10.5.3 France Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10.5.4 Italy Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10.5.5 Spain Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

10.5.6 Russia Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

11 Asia-Pacific Outsourcing Document Scanning Service Market Analysis

11.1 Market Overview and Prospect Analysis

11.2 Asia-Pacific Outsourcing Document Scanning Service Market Revenue and Growth Rate (2016-2021)

11.3 Asia-Pacific Outsourcing Document Scanning Service Market Forecast

11.4 The Influence of COVID-19 on Asia Pacific Market

11.5 Asia-Pacific Outsourcing Document Scanning Service Market Analysis by Country

11.5.1 China Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

11.5.2 Japan Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

11.5.3 South Korea Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

11.5.4 Australia Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

11.5.5 India Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

12 South America Outsourcing Document Scanning Service Market Analysis

12.1 Market Overview and Prospect Analysis

12.2 South America Outsourcing Document Scanning Service Market Revenue and Growth Rate (2016-2021)

12.3 South America Outsourcing Document Scanning Service Market Forecast

12.4 The Influence of COVID-19 on South America Market

12.5 South America Outsourcing Document Scanning Service Market Analysis by Country

12.5.1 Brazil Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

12.5.2 Argentina Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

12.5.3 Colombia Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

13 Middle East and Africa Outsourcing Document Scanning Service Market Analysis

13.1 Market Overview and Prospect Analysis

13.2 Middle East and Africa Outsourcing Document Scanning Service Market Revenue and Growth Rate (2016-2021)

13.3 Middle East and Africa Outsourcing Document Scanning Service Market Forecast

13.4 The Influence of COVID-19 on Middle East and Africa Market

13.5 Middle East and Africa Outsourcing Document Scanning Service Market Analysis by Country

13.5.1 UAE Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

13.5.2 Egypt Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

13.5.3 South Africa Outsourcing Document Scanning Service Revenue (M USD) and Growth Rate

14 Conclusions and Recommendations

14.1 Key Market Findings and Prospects

14.2 Advice for Investors

15 Appendix

15.1 Methodology

15.2 Research Data Source