1. Global CNC Machine Tools Market Definition

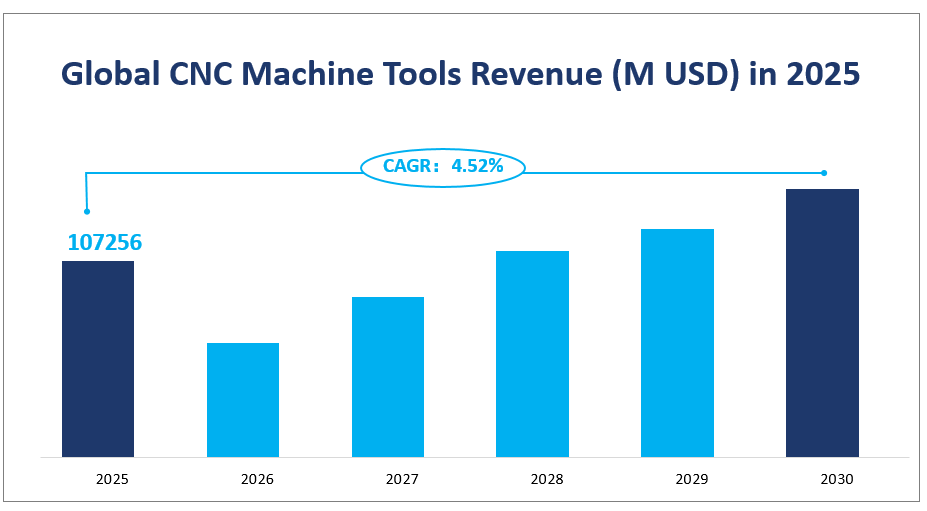

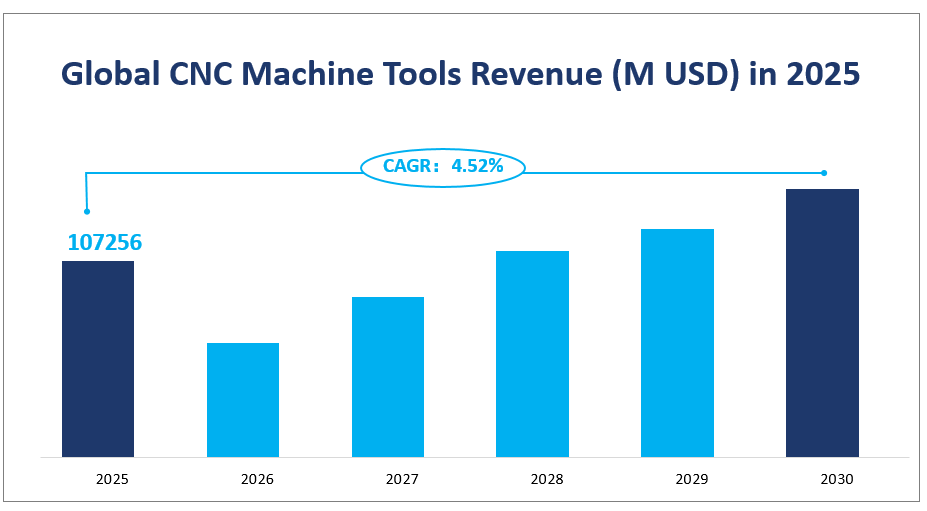

The global CNC Machine Tools market is projected to reach a revenue of $107256 million in 2025 with a CAGR of 4.52% from 2025 to 2030. This growth is driven by increasing demand from various downstream industries, technological advancements, and the need for high-precision manufacturing processes.

CNC Machine Tools, or Computer Numerical Control Machine Tools, are advanced manufacturing devices that use computer programs to control their movements and operations. These machines are designed to automate conventional machining processes, allowing for the production of identical parts in high volumes without compromising on quality. The primary types of CNC Machine Tools include CNC Lathe Machines, CNC Milling Machines, and other specialized machines. These tools are widely used across industries such as automotive, aerospace, electronics, and general machinery for tasks like cutting, milling, drilling, and shaping materials.

Global CNC Machine Tools Revenue (M USD) in 2025

2. Driving Factors of the CNC Machine Tools Market

Increased Demand from Downstream Industries: The automotive, aerospace, and electronics sectors are major consumers of CNC Machine Tools. The need for high-precision components and the ability to produce complex parts efficiently drive the demand for these machines. For instance, the automotive industry relies heavily on CNC machines to manufacture engine parts, chassis components, and other critical elements.

Technological Advancements: The integration of CNC machines with advanced technologies such as IoT, AI, and automation has significantly enhanced their capabilities. These advancements allow for real-time monitoring, predictive maintenance, and improved operational efficiency, making CNC machines more attractive to manufacturers.

Environmental and Energy Efficiency: Modern CNC machines are designed to be more energy-efficient and environmentally friendly. This aligns with global trends towards sustainable manufacturing and helps reduce the overall carbon footprint of manufacturing operations.

Rising Adoption in Emerging Markets: Countries like China, India, and Brazil are experiencing rapid industrialization, leading to increased demand for CNC Machine Tools. The growth of manufacturing sectors in these regions is driving the market forward, as companies seek to modernize their production facilities.

3. Limiting Factors of the CNC Machine Tools Market

High Initial Investment Costs: CNC Machine Tools are expensive to purchase and install. The high initial investment required can be a barrier for small and medium-sized enterprises (SMEs), limiting their adoption in certain markets.

Technical Complexity and Maintenance: These machines require skilled operators and regular maintenance to ensure optimal performance. The lack of trained personnel and the high costs associated with maintenance and repairs can deter some companies from investing in CNC technologies.

Intense Competition: The CNC Machine Tools market is highly competitive, with several established players and new entrants vying for market share. This competition can lead to price wars and reduced profit margins, making it challenging for companies to sustain growth.

Regulatory and Policy Constraints: Stringent regulations and policies related to manufacturing standards, environmental compliance, and safety can add to the operational costs and complexities for manufacturers. These factors can slow down the adoption of CNC machines in some regions.

In conclusion, the global CNC Machine Tools market is poised for significant growth, driven by increasing demand from key industries and technological advancements. However, challenges such as high costs, technical complexities, and intense competition must be addressed to ensure sustained market expansion.

4. CNC Machine Tools Market Segment

Product Types

CNC Lathe Machines are designed for turning operations, where the workpiece rotates while the cutting tool moves along the surface to shape the material. These machines are widely used in industries such as automotive, aerospace, and general machinery due to their ability to produce high-precision cylindrical parts. The market for CNC Lathe Machines is driven by the increasing demand for high-precision components and the need for efficient production processes.

CNC Lathe Machines hold the largest market share in 2025, with a projected revenue of $46914 million and a market share of 43.74%. This dominance is attributed to the widespread use of CNC Lathe Machines in various industries and their ability to produce high-precision cylindrical parts efficiently.

CNC Milling Machines are versatile tools used for cutting and shaping various materials, including metals, plastics, and composites. These machines are equipped with rotating cutting tools that move along multiple axes to create complex shapes and features. The market for CNC Milling Machines is driven by the growing demand for precision components in industries such as automotive, aerospace, and electronics.

CNC Milling Machines are the fastest-growing segment, with a revenue of $31499 million in 2025. This growth is driven by the increasing demand for complex and precision components in industries such as automotive, aerospace, and electronics. The versatility and high precision of CNC Milling Machines make them essential tools for modern manufacturing processes.

CNC Machine Tools Market by Application

Automotive is the fastest-growing application. This growth is driven by the increasing demand for lightweight and high-performance vehicles, especially in emerging markets. The automotive industry’s need for advanced manufacturing technologies and precision components makes it a key driver of CNC Machine Tools with a consumption of 535.0 K Units in 2025.

The aerospace and defense industry requires high-precision and complex components with a market share of 11.48% in 2025, making CNC Machine Tools essential for manufacturing landing gear, engine components, and other critical parts. The increasing demand for advanced aircraft and defense systems drives the need for precision machining. The growth of this sector is supported by government investments in defense and aerospace technologies.

The electronics industry uses CNC Machine Tools to produce precision components such as printed circuit boards, semiconductor components, and electronic enclosures. The increasing demand for miniaturized and high-performance electronic devices drives the need for advanced manufacturing technologies. The growth of the electronics industry, especially in emerging markets, is a key factor driving the consumption of CNC Machine Tools in this sector.

General Machinery holds the largest market share in 2025, with a projected consumption of 664.2 K units and a market share of 25.56%. This dominance is attributed to the widespread use of CNC Machine Tools in the general machinery industry, driven by the increasing demand for precision machinery and efficient production processes.

In conclusion, the CNC Machine Tools market is characterized by diverse product types and applications, each contributing differently to the overall market dynamics. CNC Lathe Machines hold the largest market share by revenue, while CNC Milling Machines are the fastest-growing product type. In terms of applications, General Machinery has the largest market share by consumption, while the Automotive industry is the fastest-growing application.

Market Revenue and Share by Segment

| Revenue (M USD) in 2025 | Market Share in 2025 | ||

| By Type | CNC Lathe Machines | 46914 | 43.74% |

| CNC Milling Machines | 31499 | 29.37% | |

| Consumption (K Units) in 2025 | Market Share in 2025 | ||

| By Application | Automobile | 535.0 | 20.59% |

| Aerospace/Defense | 298.3 | 11.48% | |

| Electronics/Electrical | 492.7 | 18.96% | |

| General Machinery | 664.2 | 25.56% | |

| Others | 608.6 | 23.42% |

5. Regional CNC Machine Tools Market

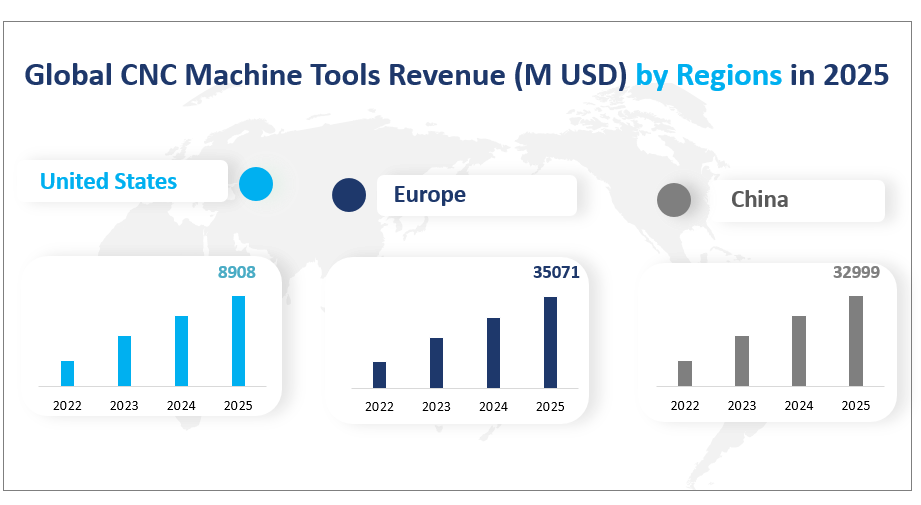

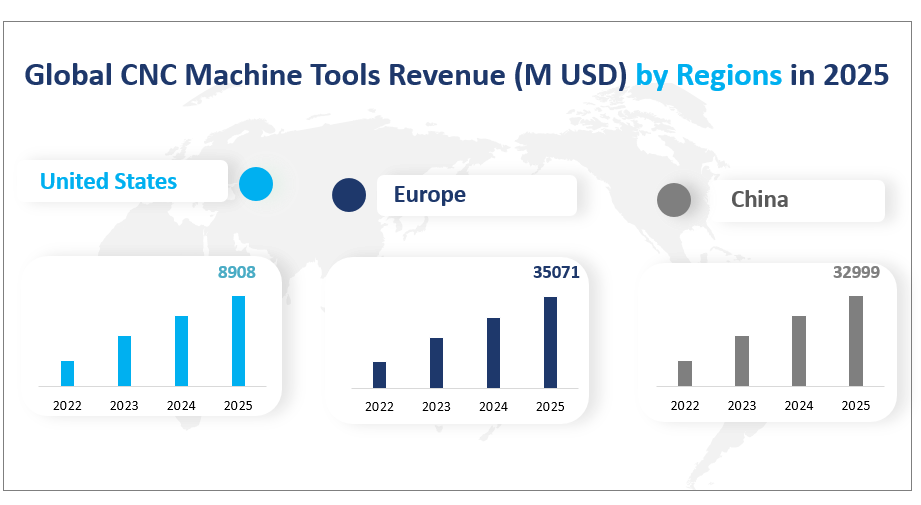

The United States market is driven by the automotive and aerospace industries, which require high-precision CNC machines for manufacturing complex components. The region also benefits from technological advancements and a strong focus on innovation, which keeps the demand for advanced CNC tools steady with revenue of $8908 million in 2025.

Europe is the largest regional market by revenue in 2025, with a projected revenue of $35071 million. Europe’s dominance is attributed to its strong industrial base, advanced manufacturing capabilities, and supportive government policies. The region’s strength in precision engineering and advanced manufacturing technologies also contributes to its substantial market share. Additionally, Europe benefits from a well-established industrial base and supportive government policies.

Asia Pacific is the fastest-growing region, with a growth rate of 7.39%. This rapid growth is driven by rapid industrialization, increasing demand for high-precision manufacturing, and government initiatives to boost manufacturing capabilities in countries like China and India.

Global CNC Machine Tools Revenue (M USD) by Regions in 2025

6. Analysis of the Top 3 Companies in the CNC Machine Tools Market

Yamazaki Mazak

Company Introduction and Business Overview: Founded in 1919 in Japan, Yamazaki Mazak is a global leader in the manufacturing of CNC Machine Tools. The company offers a comprehensive range of products, including multi-tasking machines, CNC turning centers, vertical and horizontal machining centers, and laser cutting machines. Mazak is known for its innovative technologies and high-quality products, which are used in various industries such as automotive, aerospace, and general machinery.

Products Offered: Mazak’s product portfolio includes the INTEGREX series of multi-tasking machines, the SLANT TURN series of CNC turning centers, and the VARIAXIS series of vertical machining centers. These machines are designed for high precision and efficiency, making them ideal for complex manufacturing processes.

TRUMPF

Company Introduction and Business Overview: Established in 1923 in Germany, TRUMPF is a leading manufacturer of CNC Machine Tools and industrial laser equipment. The company is known for its innovative technologies and high-quality products, which are used in various industries such as automotive, aerospace, and electronics. TRUMPF’s global presence and strong focus on research and development have helped it maintain a significant market share.

Products Offered: TRUMPF offers a wide range of CNC machines, including the TRUMPF TruLaser series of laser cutting machines, the TRUMPF TruPunch series of punching machines, and the TRUMPF TruTurn series of turning centers. These machines are designed for high precision and efficiency, making them ideal for complex manufacturing processes.

Amada

Company Introduction and Business Overview: Founded in 1946 in Japan, Amada is a global leader in the manufacturing of CNC Machine Tools and metalworking equipment. The company offers a comprehensive range of products, including CNC punching machines, laser cutting machines, and bending machines. Amada is known for its innovative technologies and high-quality products, which are used in various industries such as automotive, electronics, and general machinery.

Products Offered: Amada’s product portfolio includes the Amada EG series of CNC punching machines, the Amada LCG series of laser cutting machines, and the Amada HEM series of bending machines. These machines are designed for high precision and efficiency, making them ideal for complex manufacturing processes.

Major Players

| Company Name | Plant Locations | Market Distribution |

| Yamazaki Mazak | Mainly in APAC, Europe, and North America | Mainly in APAC, Europe, and the Americas |

| DMG MORI | Mainly in Europe, North America, and Asia | Worldwide |

| TRUMPF | Mainly in Europe, North America, and Asia | Mainly in Europe, the Americas and Asia |

| Amada | Mainly in Asia, Europe, and North America | Mainly in APAC, Europe, the Americas and Africa |

| OKUMA | Mainly in Asia | Mainly in APAC, Europe, the Americas and Africa |

| Makino | Mainly in Asia, North America and Europe | Worldwide |

| Haas Automation | Mainly in North America | Worldwide |

| GROB | Mainly in Europe, Asia, and North America | Worldwide |

| Hyundai WIA Machine Tools | Mainly in Asia, Europe, and North America | Worldwide |

| HELLER | Mainly in Europe, Asia, and the Americas | Worldwide |

| EMAG Group | Mainly in Europe, Asia, and North America | Worldwide |

| JTEKT | Mainly in Asia, North America and Europe | Worldwide |

| Create Century | China | China |

| Baoji Machine Tool | China | Worldwide |

| DMTG | China | Worldwide |

| Haitian Precision Machinery | Mainly in Asia | Mainly in Asia, the Americas and the Middle East |

| SMTCL | Mainly in Asia | Mainly in Asia |

1 Study Coverage

1.1 CNC Machine Tools Product Introduction

1.2 Market by Type

1.2.1 Global CNC Machine Tools Revenue Comparison by Type (2016-2021)

1.2.2 Global CNC Machine Tools Revenue Market Share by Type in 2020

1.2.3 CNC Lathe Machines

1.2.4 CNC Milling Machines

1.3 Market by Applications

1.3.1 Global CNC Machine Tools Revenue (M USD) by Applications (2016-2021)

1.3.2 Automobile

1.3.3 Aerospace/Defense

1.3.4 Electronics/Electrical

1.3.5 General Machinery

1.4 Study Objectives

1.5 Years Considered

2 Executive Summary

2.1 Global CNC Machine Tools Market Size Estimates and Forecasts

2.1.1 Global CNC Machine Tools Revenue Estimates and Forecasts 2016-2026

2.1.2 Global CNC Machine Tools Production Estimates and Forecasts 2016-2026

2.2 Global CNC Machine Tools Market Size by Producing Regions: 2020

2.3 Analysis of Competitive Landscape

2.3.1 Manufacturers Market Concentration Ratio (CR5)

2.3.2 Global CNC Machine Tools Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

2.3.3 Global CNC Machine Tools Manufacturers Geographical Distribution

2.4 Key Trends for CNC Machine Tools Markets & Products

3 Market Size by Manufacturers

3.1 CNC Machine Tools Sales by Manufacturers

3.1.1 CNC Machine Tools Sales by Manufacturers

3.1.2 CNC Machine Tools Sales Market Share by Manufacturers

3.2 CNC Machine Tools Revenue by Manufacturers

3.2.1 CNC Machine Tools Revenue by Manufacturers (2016-2021)

3.2.2 CNC Machine Tools Revenue Share by Manufacturers (2016-2021)

3.3 CNC Machine Tools Price by Manufacturers

3.4 Mergers & Acquisitions, Expansion Plans

4 CNC Machine Tools Production by Regions

4.1 Global CNC Machine Tools Historic Market Facts & Figures by Regions

4.1.1 Global CNC Machine Tools Production Market Share by Regions

4.1.2 Global CNC Machine Tools Revenue Market Share by Regions

4.2 United States

4.2.1 United States CNC Machine Tools Production

4.2.2 United States CNC Machine Tools Revenue

4.2.3 Key Players in United States

4.2.4 United States CNC Machine Tools Import & Export

4.3 Europe

4.3.1 Europe CNC Machine Tools Production

4.3.2 Europe CNC Machine Tools Revenue

4.3.3 Key Players in Europe

4.3.4 Europe CNC Machine Tools Import & Export

4.4 China

4.4.1 China CNC Machine Tools Production

4.4.2 China CNC Machine Tools Revenue

4.4.3 Key Players in China

4.4.4 China CNC Machine Tools Import & Export

4.5 Japan

4.5.1 Japan CNC Machine Tools Production

4.5.2 Japan CNC Machine Tools Revenue

4.5.3 Key Players in Japan

4.5.4 Japan CNC Machine Tools Import & Export

4.6 India

4.6.1 India CNC Machine Tools Production

4.6.2 India CNC Machine Tools Revenue

4.6.3 Key Players in India

4.6.4 India CNC Machine Tools Import & Export

5 CNC Machine Tools Consumption by Regions

5.1 Global CNC Machine Tools Consumption by Regions

5.1.1 Global CNC Machine Tools Consumption by Regions

5.1.2 Global CNC Machine Tools Consumption Market Share by Regions

5.2 North America

5.2.1 North America CNC Machine Tools Consumption by Application

5.2.2 North America CNC Machine Tools Consumption by Countries

5.2.3 United States

5.2.4 Canada

5.2.5 Mexico

5.3 Europe

5.3.1 Europe CNC Machine Tools Consumption by Application

5.3.2 Europe CNC Machine Tools Consumption by Countries

5.3.3 Germany

5.3.4 UK

5.3.5 France

5.3.6 Italy

5.3.7 Russia

5.4 Asia Pacific

5.4.1 Asia Pacific CNC Machine Tools Consumption by Application

5.4.2 Asia Pacific CNC Machine Tools Consumption by Countries

5.4.3 China

5.4.4 Japan

5.4.5 South Korea

5.4.6 India

5.4.7 Australia

5.4.8 Southeast Asia

5.5 South America

5.5.1 South America CNC Machine Tools Consumption by Application

5.5.2 South America CNC Machine Tools Consumption by Countries

5.5.3 Brazil

5.6 Middle East and Africa

5.6.1 Middle East and Africa CNC Machine Tools Consumption by Application

5.6.2 Middle East and Africa CNC Machine Tools Consumption by Countries

5.6.3 UAE

5.6.4 Saudi Arabia

5.6.5 South Africa

6 Market Size by Type

6.1 Global CNC Machine Tools Market Size by Type

6.1.1 Global CNC Machine Tools Production by Type (2016-2021)

6.1.2 Global CNC Machine Tools Revenue by Type (2016-2021)

6.1.3 CNC Machine Tools Price by Type (2016-2021)

6.2 Global CNC Machine Tools Market Forecast by Type (2021-2026)

6.2.1 Global CNC Machine Tools Production Forecast by Type (2021-2026)

6.2.2 Global CNC Machine Tools Revenue Forecast by Type (2021-2026)

6.2.3 Global CNC Machine Tools Price Forecast by Type (2021-2026)

7 Market Size by Application

7.1 Global CNC Machine Tools Consumption Historic Breakdown by Application (2016-2021)

7.1.1 Global CNC Machine Tools Consumption by Application

7.1.2 Global CNC Machine Tools Consumption Market Share by Application (2016-2021)

7.2 Global CNC Machine Tools Consumption Forecast by Application (2021-2026)

7.2.1 Global CNC Machine Tools Consumption Forecast by Application

7.2.2 Global CNC Machine Tools Consumption Market Share Forecast by Application (2021-2026)

8 Corporate Profile

8.1 Yamazaki Mazak

8.1.1 Company Basic Information

8.1.2 Product Overview

8.1.3 Yamazaki Mazak CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.2 DMG MORI

8.2.1 Company Basic Information

8.2.2 Product Overview

8.2.3 DMG MORI CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.3 TRUMPF

8.3.1 Company Basic Information

8.3.2 Product Overview

8.3.3 TRUMPF CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.4 Amada

8.4.1 Company Basic Information

8.4.2 Product Overview

8.4.3 Amada CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.5 OKUMA

8.5.1 Company Basic Information

8.5.2 Product Overview

8.5.3 OKUMA CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.6 Makino

8.6.1 Company Basic Information

8.6.2 Product Overview

8.6.3 Makino CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.7 Haas Automation

8.7.1 Company Basic Information

8.7.2 Product Overview

8.7.3 Haas Automation CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.8 GROB

8.8.1 Company Basic Information

8.8.2 Product Overview

8.8.3 GROB CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.9 Hyundai WIA Machine Tools

8.9.1 Company Basic Information

8.9.2 Product Overview

8.9.3 Hyundai WIA Machine Tools CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.10 HELLER

8.10.1 Company Basic Information

8.10.2 Product Overview

8.10.3 HELLER CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.11 EMAG Group

8.11.1 Company Basic Information

8.11.2 Product Overview

8.11.3 EMAG Group CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.12 JTEKT

8.12.1 Company Basic Information

8.12.2 Product Overview

8.12.3 JTEKT CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.13 Create Century

8.13.1 Company Basic Information

8.13.2 Product Overview

8.13.3 Create Century CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.14 Baoji Machine Tool

8.14.1 Company Basic Information

8.14.2 Product Overview

8.14.3 Baoji Machine Tool CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.15 DMTG

8.15.1 Company Basic Information

8.15.2 Product Overview

8.15.3 DMTG CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.16 Haitian Precision Machinery

8.16.1 Company Basic Information

8.16.2 Product Overview

8.16.3 Haitian Precision Machinery CNC Machine Tools Sales, Price, Revenue, Gross Margin

8.17 SMTCL

8.17.1 Company Basic Information

8.17.2 Product Overview

8.17.3 SMTCL CNC Machine Tools Sales, Price, Revenue, Gross Margin

9 CNC Machine Tools Production Forecasts by Region

9.1 Global CNC Machine Tools Revenue Forecast by Region (2021-2026)

9.2 Global CNC Machine Tools Production Forecast by Regions (2021-2026)

9.3 Key CNC Machine Tools Production Regions Forecast

9.3.1 United States

9.3.2 Europe

9.3.3 China

9.3.4 Japan

9.3.5 India

10 CNC Machine Tools Consumption Forecast by Region

10.1 Global CNC Machine Tools Consumption Forecast by Region

10.2 North America CNC Machine Tools Consumption and Growth Rate Forecast by Countries 2021-2026

10.3 Europe CNC Machine Tools Consumption and Growth Rate Forecast by Countries 2021-2026

10.4 Asia Pacific CNC Machine Tools Consumption and Growth Rate Forecast by Countries 2021-2026

10.5 South America CNC Machine Tools Consumption and Growth Rate Forecast by Countries 2021-2026

10.6 Middle East and Africa CNC Machine Tools Consumption and Growth Rate Forecast by Countries 2021-2026

11 Value Chain and Sales Channels Analysis

11.1 CNC Machine Tools Value Chain Analysis

11.2 Sales Channels Analysis

11.2.1 CNC Machine Tools Sales Channels

11.2.2 CNC Machine Tools Distributors

11.3 CNC Machine Tools Customers

12 Market Opportunities & Challenges, Risks and Influences Factors Analysis

12.1 CNC Machine Tools Market Trends

12.2 CNC Machine Tools Market Opportunities and Drivers

12.3 CNC Machine Tools Market Challenges

12.4 Porter’s Five Forces Analysis

13 Key Findings

14 Appendix

14.1 Methodology

14.2 Research Data Source