1. Global Cabinet & Enclosure Filter Fan Market Overview

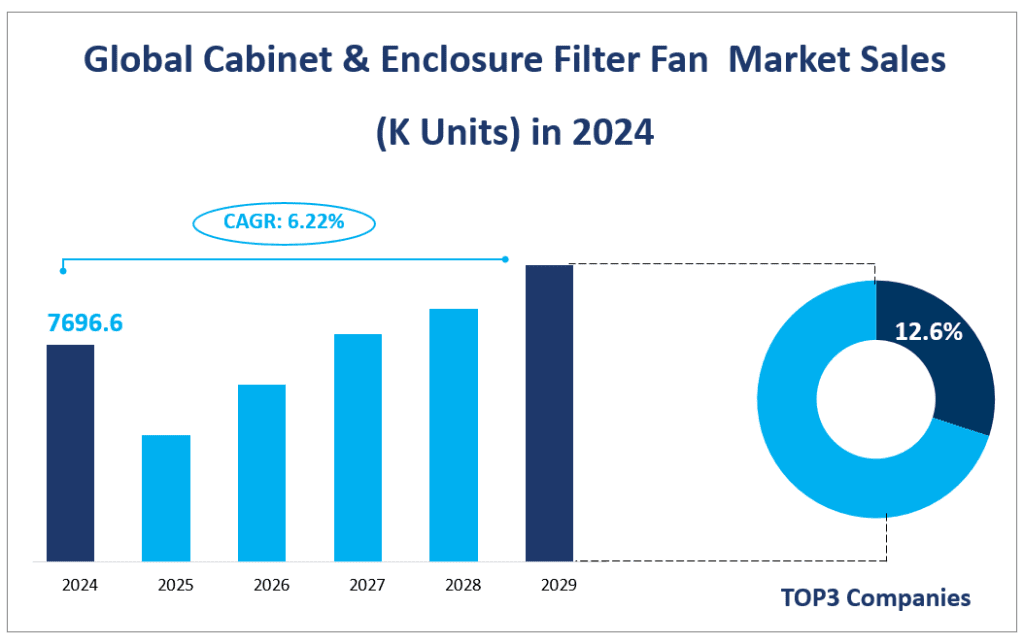

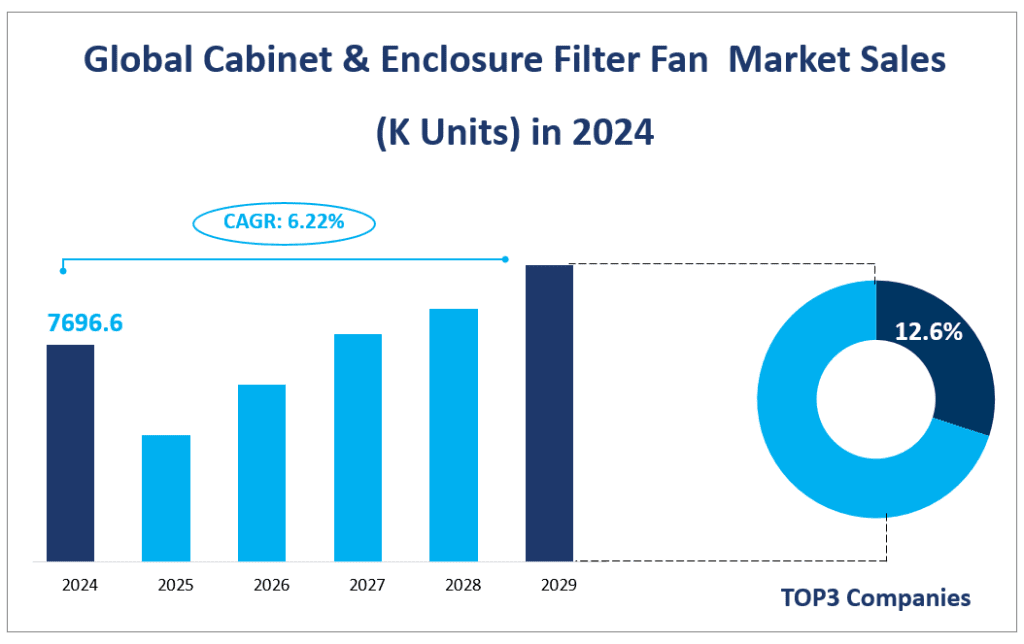

The global cabinet & enclosure filter fan market is a niche yet critical segment within the broader industrial automation and electronics sector. In 2024, the cabinet & enclosure filter fan market sales volume will reach 7696.6 with a CAGR of 6.22%, demonstrating a significant sales volume, and reflecting the increasing demand for efficient cooling solutions in various industrial applications.

The cabinet & enclosure filter fan market is defined by its role in maintaining optimal temperatures within electrical cabinets and network cabinets. These fans not only facilitate heat dissipation but also prevent dust and other contaminants from entering the enclosure, ensuring the longevity and performance of electronic components. The market’s growth is influenced by the increasing use of electrical cabinets in various industries, including telecommunications, power, oil and gas, transportation, and residential and office buildings. Additionally, the rising demand for network cabinets in data centers and the shift towards renewable energy infrastructure have bolstered the market’s expansion.

Global Cabinet & Enclosure Filter Fan Market Sales (K Units) in 2024

2. Driving Factors of the Cabinet & Enclosure Filter Fan Market

The growth of the cabinet & enclosure filter fan market is propelled by several key factors. One of the primary drivers is the increased use of electrical cabinets in developing countries due to rapid urbanization and industrialization. As power and industrial infrastructures expand, the need for workplace and workforce protection grows, leading to a higher demand for electromechanical equipment and components that require enclosures for safety and aesthetics.

The demand for network cabinets has also been a significant growth driver. With the rise of data centers and the increasing reliance on cloud technologies, the need for efficient cooling systems to regulate temperature and humidity levels within network cabinets has become crucial. This has led to an increased demand for cabinet and enclosure filter fans, which play a vital role in maintaining the optimal operating conditions for network equipment.

Another driving factor is the trend towards sustainable development. As environmental concerns grow, there is a shift towards energy-efficient resources and sustainably manufactured components. Filter fan businesses are adapting by implementing the use of recycled materials and focusing on developing high-efficiency motor technology to reduce energy costs.

3. Limiting Factors of the Cabinet & Enclosure Filter Fan Market

However, the cabinet & enclosure filter fan market growth is not without constraints. One of the limiting factors is the threat of substitution. Alternative cooling solutions, such as heat exchangers and vortex enclosure cooling systems, can pose a challenge to the market share of filter fan players, especially in environments with high dust and dirt levels or where regular maintenance is not feasible.

Maintenance difficulty is another factor that may hinder market growth. Filter fans require regular maintenance to ensure optimal performance, which can be labor-intensive and costly, particularly in remote locations or for businesses with high maintenance costs. The risk of component failure due to inadequate maintenance can lead to unplanned downtime and additional expenses, making adopting filter fans less attractive for some potential users.

In conclusion, while the global cabinet & enclosure filter fan market is driven by the need for efficient cooling solutions in various industrial applications, it also faces challenges from alternative cooling technologies and maintenance requirements. Despite these limitations, the market is expected to continue growing, driven by the increasing demand for electrical and network cabinets, technological advancements, and a focus on sustainability.

4. Analysis of the Cabinet & Enclosure Filter Fan Market Segment

Product Types

The Cabinet & Enclosure Filter Fan market is segmented into three distinct product types: Less than 100CFM, 100-300CFM, and More than 300CFM. Each type is designed to cater to different airflow capacity requirements for various enclosure sizes and applications.

Less than 100CFM: This segment includes products with lower airflow capacity, suitable for smaller enclosures or cabinets. In 2024, the sales volume for this type will reach 4,169 K Units. Despite its lower capacity, this segment holds a significant market share due to the widespread use of smaller enclosures in various industries.

100-300CFM: Comprising medium-sized products, this segment is ideal for enclosures requiring moderate airflow. The sales volume for 100-300CFM products in 2024 is 2,435 K Units. This type is particularly popular in applications where a balance between airflow and enclosure size is needed.

More than 300CFM: This segment includes high-capacity fans designed for larger enclosures that demand significant airflow for efficient cooling and ventilation. The sales volume for this type in 2024 is 1,092.6 K Units. While this segment has the smallest sales volume among the three, it is crucial for applications requiring high airflow, such as large industrial machinery and data centers.

In terms of market share, the 100-300CFM segment holds the biggest market share in 2024, accounting for a substantial portion of the total sales volume. This can be attributed to the broad range of applications that fall within the moderate airflow requirement, making this segment versatile and widely applicable.

The Less than 100CFM segment, despite having the highest sales volume, has a lower market share compared to the 100-300CFM segment. This is due to the lower price point and smaller size of the products, which typically result in lower revenue generation despite higher unit sales.

The More than 300CFM segment, while having the smallest sales volume, has the potential for the fastest growth rate. This is because high-capacity fans are increasingly in demand in rapidly growing sectors such as data centers and large-scale industrial facilities, which require robust cooling solutions to handle the heat generated by powerful equipment.

Analysis of Different Applications

The Cabinet & Enclosure Filter Fan market is also segmented by application into Electrical Cabinets, Network Cabinets, and Others. Each application has its own specific requirements and market dynamics.

Electrical Cabinets: This application segment includes cabinets that protect electrical or electronic equipment and prevent electric shock. The sales volume for electrical cabinets in 2024 is 5,525.6 K Units. This segment holds the biggest market share due to the widespread use of electrical cabinets across various industries.

Network Cabinets: Used to house network equipment such as routers, switches, and patch panels in data centers, network cabinets have a sales volume of 1,426.1 K Units in 2024. This segment is growing rapidly due to the increasing demand for data storage and processing capabilities.

Others: This segment includes other sectors such as industrial machinery and telecommunications, which also use filter fans to maintain a suitable environment inside their cabinets or enclosures. The sales volume for this segment in 2024 is 745 K Units.

In terms of market share, the Electrical Cabinets application has the biggest market share in 2024, reflecting the broad and diverse use of electrical cabinets in protecting a wide array of electrical and electronic equipment.

The Network Cabinets application, while having a smaller sales volume, showed the fastest growing rate. This growth is driven by the exponential growth of data centers and the need for efficient cooling solutions to maintain the performance and longevity of network equipment.

In conclusion, the product type with the biggest market share in 2024 was the 100-300CFM segment, while the More than 300CFM segment showed the fastest growth rate. In terms of applications, electrical cabinets had the biggest market share, and network cabinets exhibited the fastest growth rate. These dynamics reflect the evolving demands of the industries served by the cabinet and enclosure filter fan market.

Market Sales Volume by Segment

| Market Sales Volume (K Units) in 2024 | ||

| By Type | Less than 100CFM | 4169.0 |

| 100-300CFM | 2435.0 | |

| More than 300CFM | 1092.6 | |

| By Application | Electrical Cabinets | 5525.6 |

| Network Cabinets | 1426.1 | |

| Others | 745.0 |

5. Regional Cabinet & Enclosure Filter Fan Market

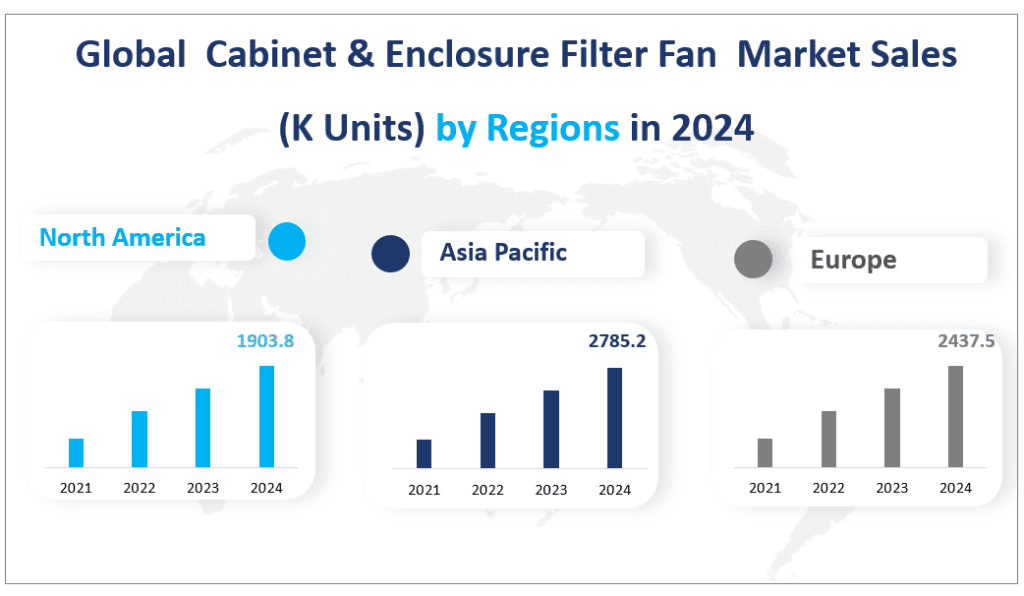

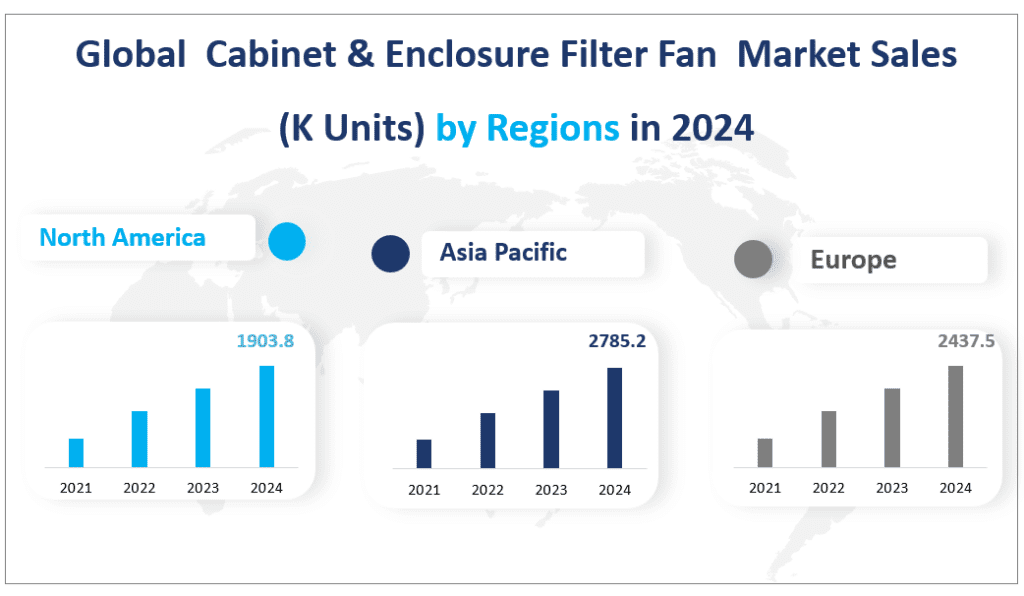

Asia Pacific: With a sales volume of 2,785.2 K Units in 2024, Asia Pacific emerges as the largest regional cabinet & enclosure filter fan market. This region’s dominance can be attributed to the rapid industrialization and technological advancements in countries like China, Japan, and South Korea, which have a high demand for efficient cooling solutions in electrical and network cabinets.

Europe: Europe follows with a sales volume of 2,437.5 K Units. The region’s mature industrial sector and stringent environmental regulations have driven the demand for high-quality filter fans, making it a significant market player.

North America: North America records a sales volume of 1,903.8 K Units. The region’s well-established industrial base and technologically advanced data centers contribute to its substantial market share.

Latin America: With a sales volume of 345.2 K Units, Latin America is a growing market with potential for expansion, particularly in countries like Brazil and Mexico, which are experiencing industrial growth.

Middle East & Africa: This region has a sales volume of 224.9 K Units. While it is currently the smallest market, it presents opportunities for growth due to increasing industrial activities and infrastructure development.

The Asia Pacific region stands out as the biggest regional cabinet & enclosure filter fan market by sales volume in 2024. This is largely due to the region’s booming manufacturing sector and the rapid expansion of data centers, which require sophisticated cooling solutions to maintain optimal operating conditions for sensitive electronic equipment.

The Asia Pacific region is also identified as the fastest-growing cabinet & enclosure filter fan market. The growth is fueled by the region’s economic development, the increasing demand for energy-efficient products, and the push for sustainable manufacturing practices. Additionally, the rapid urbanization and industrialization in countries like China and India have led to a surge in the demand for electrical cabinets and network cabinets, thereby driving the cabinet & enclosure filter fans market.

Global Cabinet & Enclosure Filter Fan Market Sales (K Units) by Regions in 2024

6. Analysis of the Top Five Companies in the Cabinet & Enclosure Filter Fan Market

Schneider Electric: A global specialist in energy management and automation, Schneider Electric offers a wide range of cabinet and enclosure filter fans. Known for its innovation and sustainability practices, the company provides solutions that cater to various industrial and commercial needs.

Siemens: Siemens is a technology powerhouse with a broad portfolio of products, including filter fans for cabinets and enclosures. The company is recognized for its commitment to quality and its extensive global presence, serving customers across various industries.

nVent: nVent Electric is known for its electrical connection and protection products. The company offers a variety of filter fans designed for different airflow capacities, meeting the diverse needs of the market.

ABB: ABB is a technology leader in electrification and automation solutions. The company’s product range includes control systems and accessories, such as filter fans, which are integral to maintaining the efficiency and safety of electrical and electronic components within enclosures.

Hubbell: Hubbell is a renowned manufacturer of electrical and electronic products, including cabinet accessories like fan filter kits. The company’s focus on innovation and quality makes it a key player in the market.

Major Players

| Company Name | Headquarters | Market Distribution |

| Schneider Electric | France | Worldwide |

| Siemens | Germany | Worldwide |

| nVent | UK | Mainly in North America, Europe, Asia Pacific, and Middle East |

| ABB | Switzerland | Worldwide |

| Hubbell | USA | Worldwide |

| PFANNENBERG | Germany | Mainly in North America, South America, Europe and Asia |

| DBK Group | Germany | Mainly in North America, Europe and Asia |

| STEGO | Germany | Mainly in North America, South America, Europe and Asia |

| Fandis | Italy | Worldwide |

| Hammond | Canada | Mainly in North America, Europe and Asia |

| Leipole | China | Mainly in Asia, Europe, South America, the Middle East and Africa |

| Alfa Plastic sas | Italy | Mainly in Europe |

| Wenzhou Natural Automation Equipment CO., LTD. | China | Mainly in Asia, EMEA, and South America |

| BEEHE | China | Mainly in Asia |

1. Market Definition and Statistical Scope

1.1 Objective of the Study

1.2 Cabinet & Enclosure Filter Fan Market Definition

1.3 Market Scope

1.4 Years Considered for the Study (2019-2030)

1.5 Currency Considered (U.S. Dollar)

2 Key Companies’ Profile

2.1 Competitive Profile

2.1.1 Global Cabinet & Enclosure Filter Fan Sales Volume and Market Share by Companies

2.1.2 Global Cabinet & Enclosure Filter Fan Revenue and Market Share by Companies

2.2 Schneider Electric

2.2.1 Brief Introduction of Schneider Electric

2.2.2 Schneider Electric Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.2.3 Schneider Electric Related Products/Service Introduction

2.2.4 Schneider Electric Business Overview/Recent Development/Acquisitions

2.3 Siemens

2.3.1 Brief Introduction of Siemens

2.3.2 Siemens Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.3.3 Siemens Related Products/Service Introduction

2.3.4 Siemens Business Overview/Recent Development/Acquisitions

2.4 nVent

2.4.1 Brief Introduction of nVent

2.4.2 nVent Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.4.3 nVent Related Products/Service Introduction

2.4.4 nVent Business Overview/Recent Development/Acquisitions

2.5 ABB

2.5.1 Brief Introduction of ABB

2.5.2 ABB Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.5.3 ABB Related Products/Service Introduction

2.5.4 ABB Business Overview/Recent Development/Acquisitions

2.6 Hubbell

2.6.1 Brief Introduction of Hubbell

2.6.2 Hubbell Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.6.3 Hubbell Related Products/Service Introduction

2.6.4 Hubbell Business Overview/Recent Development/Acquisitions

2.7 PFANNENBERG

2.7.1 Brief Introduction of PFANNENBERG

2.7.2 PFANNENBERG Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.7.3 PFANNENBERG Related Products/Service Introduction

2.7.4 PFANNENBERG Business Overview/Recent Development/Acquisitions

2.8 DBK Group

2.8.1 Brief Introduction of DBK Group

2.8.2 DBK Group Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.8.3 DBK Group Related Products/Service Introduction

2.8.4 DBK Group Business Overview/Recent Development/Acquisitions

2.9 STEGO

2.9.1 Brief Introduction of STEGO

2.9.2 STEGO Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.9.3 STEGO Related Products/Service Introduction

2.9.4 STEGO Business Overview/Recent Development/Acquisitions

2.10 Fandis

2.10.1 Brief Introduction of Fandis

2.10.2 Fandis Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.10.3 Fandis Related Products/Service Introduction

2.10.4 Fandis Business Overview/Recent Development/Acquisitions

2.11 Hammond

2.11.1 Brief Introduction of Hammond

2.11.2 Hammond Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.11.3 Hammond Related Products/Service Introduction

2.11.4 Hammond Business Overview/Recent Development/Acquisitions

2.12 Leipole

2.12.1 Brief Introduction of Leipole

2.12.2 Leipole Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.12.3 Leipole Related Products/Service Introduction

2.12.4 Leipole Business Overview/Recent Development/Acquisitions

2.13 Alfa Plastic sas

2.13.1 Brief Introduction of Alfa Plastic sas

2.13.2 Alfa Plastic sas Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.13.3 Alfa Plastic sas Related Products/Service Introduction

2.13.4 Alfa Plastic sas Business Overview/Recent Development/Acquisitions

2.14 Wenzhou Natural Automation Equipment CO., LTD.

2.14.1 Brief Introduction of Wenzhou Natural Automation Equipment CO., LTD.

2.14.2 Wenzhou Natural Automation Equipment CO., LTD. Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.14.3 Wenzhou Natural Automation Equipment CO., LTD. Related Products/Service Introduction

2.14.4 Wenzhou Natural Automation Equipment CO., LTD. Business Overview/Recent Development/Acquisitions

2.15 BEEHE

2.15.1 Brief Introduction of BEEHE

2.15.2 BEEHE Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.15.3 BEEHE Related Products/Service Introduction

2.15.4 BEEHE Business Overview/Recent Development/Acquisitions

3. Global Cabinet & Enclosure Filter Fan Market Segmented by Type

3.1 Global Cabinet & Enclosure Filter Fan Sales Volume, Revenue and Growth Rate by Type 2019-2024

3.2 Less than 100CFM

3.3 100-300CFM

3.4 More than 300CFM

4 Global Cabinet & Enclosure Filter Fan Market Segmented by Downstream Industry

4.1 Global Cabinet & Enclosure Filter Fan Sales Volume, Revenue and Growth Rate by Downstream Industry 2019-2024

4.2 Electrical Cabinets

4.3 Network Cabinets

5 Cabinet & Enclosure Filter Fan Industry Chain Analysis

5.1 Value Chain Status

5.2 Upstream Raw Material Analysis

5.3 Major Company Analysis (by Headquarters, by Market Distribution)

5.4 Cabinet & Enclosure Filter Fan Distributors List

5.5 Cabinet & Enclosure Filter Fan Customers

5.6 Value Chain Under Regional Situation

6. The Development and Dynamics of Cabinet & Enclosure Filter Fan Market

6.1 Cabinet & Enclosure Filter Fan Growth Drivers

6.2 Cabinet & Enclosure Filter Fan Market Restraints

6.3 Cabinet & Enclosure Filter Fan Market Opportunities

6.5 Industry News

6.4 Technology Status and Developments in the Cabinet & Enclosure Filter Fan Market

6.6 Market Investment Scenario Strategic Recommendations

6.7 The Impact of Regional Situation on Cabinet & Enclosure Filter Fan Industries

6.8 The Impact of Inflation on Cabinet & Enclosure Filter Fan Industries

6.9 The Transformative Power of AI on Cabinet & Enclosure Filter Fan Industries

6.10 Economic Development in an Era of Climate Change

6.11 Industry SWOT Analysis

7 Global Cabinet & Enclosure Filter Fan Market Segmented by Geography

7.1 Global Cabinet & Enclosure Filter Fan Revenue and Market Share by Region 2019-2024

7.2 Global Cabinet & Enclosure Filter Fan Sales Volume and Market Share by Region 2019-2024

8 North America

8.1 North America Cabinet & Enclosure Filter Fan Sales Volume, Price, Revenue, Gross Margin (%) and Gross Analysis from 2019-2024

8.2 North America Cabinet & Enclosure Filter Fan Sales Volume Analysis from 2019-2024

8.3 North America Cabinet & Enclosure Filter Fan Market by Country

8.3.1 North America Cabinet & Enclosure Filter Fan Sales Volume by Country (2019-2024)

8.3.2 North America Cabinet & Enclosure Filter Fan Revenue by Country (2019-2024)

8.3.3 United States Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

8.3.4 Canada Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9 Europe

9.1 Europe Cabinet & Enclosure Filter Fan Sales Volume, Price, Revenue, Gross Margin (%) and Gross Analysis from 2019-2024

9.2 Europe Cabinet & Enclosure Filter Fan Sales Volume Analysis from 2019-2024

9.3 Europe Cabinet & Enclosure Filter Fan Market by Country

9.3.1 Europe Cabinet & Enclosure Filter Fan Sales Volume by Country (2019-2024)

9.3.2 Europe Cabinet & Enclosure Filter Fan Revenue by Country (2019-2024)

9.3.3 Germany Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.4 UK Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.5 France Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.6 Italy Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.7 Spain Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.8 Russia Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.9 Netherlands Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.10 Turkey Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.11 Switzerland Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

9.3.12 Sweden Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10 Asia Pacific

10.1 Asia Pacific Cabinet & Enclosure Filter Fan Sales Volume, Price, Revenue, Gross Margin (%) and Gross Analysis from 2019-2024

10.2 Asia Pacific Cabinet & Enclosure Filter Fan Sales Volume Analysis from 2019-2024

10.3 Asia Pacific Cabinet & Enclosure Filter Fan Market by Country

10.3.1 Asia Pacific Cabinet & Enclosure Filter Fan Sales Volume by Country (2019-2024)

10.3.2 Asia Pacific Cabinet & Enclosure Filter Fan Revenue by Country (2019-2024)

10.3.3 China Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.4 Japan Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.5 South Korea Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.6 Australia Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.7 India Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.8 Indonesia Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.9 Philippines Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

10.3.10 Malaysia Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

11 Latin America

11.1 Latin America Cabinet & Enclosure Filter Fan Sales Volume, Price, Revenue, Gross Margin (%) and Gross Analysis from 2019-2024

11.2 Latin America Cabinet & Enclosure Filter Fan Sales Volume Analysis from 2019-2024

11.3 Latin America Cabinet & Enclosure Filter Fan Market by Country

11.3.1 Latin America Cabinet & Enclosure Filter Fan Sales Volume by Country (2019-2024)

11.3.2 Latin America Cabinet & Enclosure Filter Fan Revenue by Country (2019-2024)

11.3.3 Brazil Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

11.3.4 Mexico Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

11.3.5 Argentina Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

12 Middle East & Africa

12.1 Middle East & Africa Cabinet & Enclosure Filter Fan Sales Volume, Price, Revenue, Gross Margin (%) and Gross Analysis from 2019-2024

12.2 Middle East & Africa Cabinet & Enclosure Filter Fan Sales Volume Analysis from 2019-2024

12.3 Middle East & Africa Cabinet & Enclosure Filter Fan Market by Country

12.3.1 Middle East & Africa Cabinet & Enclosure Filter Fan Sales Volume by Country (2019-2024)

12.3.2 Middle East & Africa Cabinet & Enclosure Filter Fan Revenue by Country (2019-2024)

12.3.3 Saudi Arabia Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

12.3.4 UAE Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

12.3.5 Egypt Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

12.3.6 South Africa Cabinet & Enclosure Filter Fan Sales Volume and Growth (2019-2024)

13. Global Cabinet & Enclosure Filter Fan Market Forecast by Geography, Type, and Downstream Industry 2024-2030

13.1 Forecast of the Global Cabinet & Enclosure Filter Fan Market from 2024-2030 by Region

13.2 Global Cabinet & Enclosure Filter Fan Sales Volume and Growth Rate Forecast by Type (2024-2030)

13.3 Global Cabinet & Enclosure Filter Fan Sales Volume and Growth Rate Forecast by Downstream Industry (2024-2030)

14 Appendix

14.1 Methodology

14.2 Research Data Source

14.2.1 Secondary Data

14.2.2 Primary Data

14.2.3 Market Size Estimation

14.2.4 Legal Disclaimer