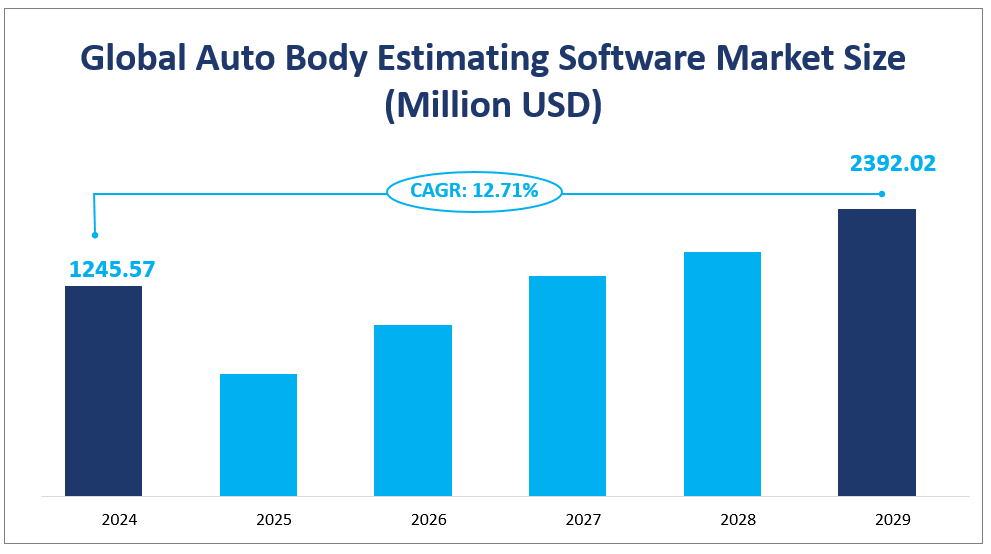

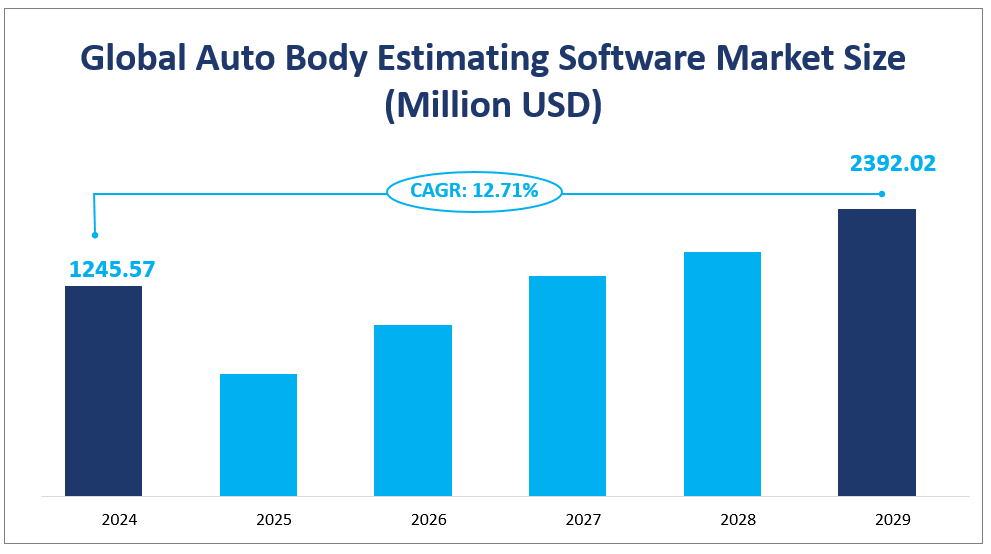

The market revenue of the global Auto Body Estimating Software market will touch $1245.57 million in 2024 with a CAGR of 12.71% from 2024 to 2029. The technological change of vehicles and the reduction of labor resources have increased management expenses and pushed up labor costs. Auto body estimating software is a great instrument to predict Labor Rates, as well as individual hours worked by employees, to control cost and workload. The growing demand of large and medium-sized enterprises will power the Auto Body Estimating Software industry.

1. Auto Body Estimating Software Market Analysis

The market revenue of the global Auto Body Estimating Software market will touch $1245.57 million in 2024 with a CAGR of 12.71% from 2024 to 2029.

Auto body estimating software is developed to help auto mechanics and managers in workshops estimate the repair work required after a car crash. The software is used to draw up a detailed and precise estimate professionally in the shortest time. Automotive workshops need such software to manage their workflow. These programs offer a range of digital tools and features, e.g. maintenance management, inventory control, invoicing and billing, reporting, etc. The technological change of vehicles and the reduction of labor resources have increased management expenses and pushed up labor costs. Auto body estimating software is a great instrument to predict Labor Rates, as well as individual hours worked by employees, to control cost and workload. The growing demand of large and medium-sized enterprises will power the Auto Body Estimating Software industry.

Global Auto Body Estimating Software Market Size

2. Market Dynamics

Increasing Vehicle Ownership

The increase in global vehicle ownership has led to a growing demand for efficient maintenance solutions, which is one of the major factors driving the growth of the global body estimation software market. Advances in maintenance technology, especially the integration of artificial intelligence (AI) and machine learning algorithms, have increased the accuracy of maintenance estimates and accelerated the estimation process. The increased emphasis on customer-centric service is driving companies to adopt body estimation software to provide faster and more accurate service. This software helps to easily maintain records, automate daily tasks, continuously track customers, inventory, reports, and vehicle history, and establish contact with important major parts dealers, databases, and various diagnoses. Auto Body Estimating Software can help shops make budgets for body repairs, and help shops save money in the long run with affordable budgets. Shop can generate estimates for multiple cars, saving time and effort when managing multiple repair shops at once, and gaining more benefits. In addition, customers can easily book a schedule at a suitable time and date, and let the shop know which repairs and services they need in particular. These advantages are the main factors driving the demand growth of Auto Body Estimating Software.

Increased Security Risks

Software connected to the Internet is facing an increasing risk of network attack, and in some cases, companies may be blackmailed and threatened. Software connected to the Internet is facing an increasing risk of network attacks. The rapid development of the Internet has brought about the digital age. The data needs to be saved in the account. The use of the Internet will pose a threat to the company’s information security. Therefore, companies can use cloud-based software, which is more secure. Software needs to be continuously upgraded to solve the security problem. The labor cost of the Auto Body Estimating Software industry will be more obvious. The main reasons for this high labor cost are as follows: First, the development and design of Auto Body Estimating Software is relatively complicated. Enterprises have a great demand for workers with certain skills and proficiency. Enterprises will pay higher wages if they want to hire them. Moreover, when the actual development experience of these talents is mature, enterprises need to pay higher wages if they want to retain these talents. Secondly, to cultivate the ability and level of the company’s workers, it is necessary to train them regularly, or even go on business trips to study. However, a large amount of costs and expenses incurred in the process of personnel training can only be paid by enterprises themselves, thus increasing the cost burden of enterprises.

3. By Segment

The market is divided into cloud-based and on-premises categories based on types, the on-premises segment contributes the largest share in 2024.

Cloud-based software is a more advanced form of web-based applications. It usually has advanced functions, such as access to a wider range of services, software development solutions, storage, and on-demand computing cycles. In addition to allowing data to be stored in the cloud, users can also cache data locally.

On-premises software is installed and runs on computers on the premises of the person or organization using the software, rather than at a remote facility such as a server farm or cloud. The Software consists of database and modules that are combined to particularly serve the unique needs of large organizations regarding the automation of corporate-wide business system and its functions. The market size of this type is $806.38 million with a share of 64.74% in 2024.

Based on applications, the market is divided into small and medium-sized enterprises (SMEs) and large enterprises. The small and medium enterprises (SMEs) segment occupies the biggest share.

SMEs often have limited budgets, and body estimation software provides a cost-effective solution to help them achieve efficient maintenance management and estimation at a lower cost. Body estimation software can improve work efficiency and reduce the time and potential errors of manual estimation, which is especially important for small and medium-sized enterprises with limited resources. With advances in technologies such as artificial intelligence and machine learning, body estimation software has become more accurate and easy to use, enabling SMEs to adopt these technologies to improve the accuracy of maintenance estimates. Many software solutions are designed for businesses of all sizes, offering flexible features that can scale as the company grows and are suitable for the growth needs of SMEs.

Market Revenue and Share by Segment in 2024

| Market Revenue in 2024 | Market Share in 2024 | ||

| By Type | Cloud-based | 439.19 M USD | 35.26% |

| On-premises | 806.38 M USD | 64.74% | |

| By Application | Small and Medium Enterprises (SMEs) | 749.95 M USD | 60.21% |

| Large Enterprises | 495.61M USD | 39.79% |

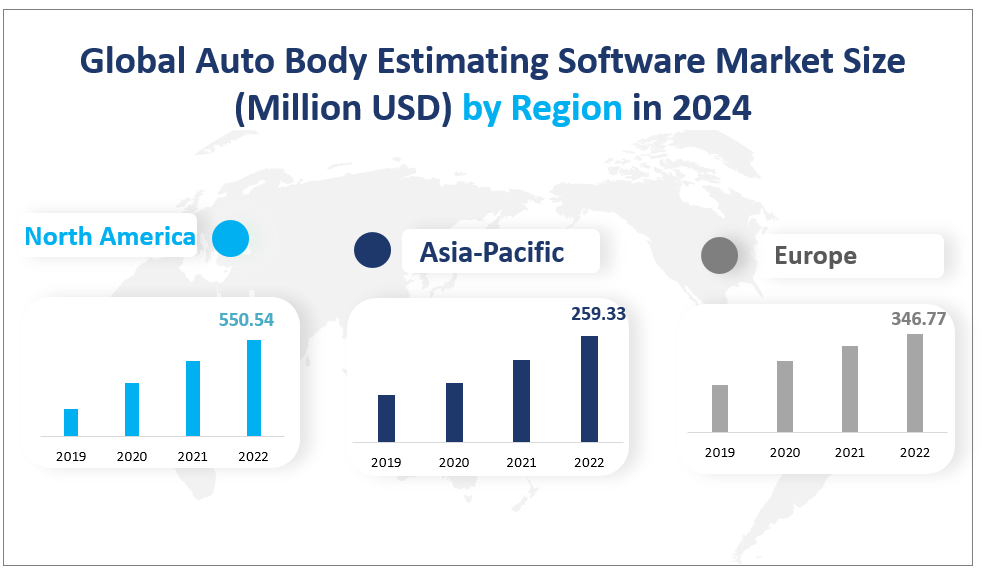

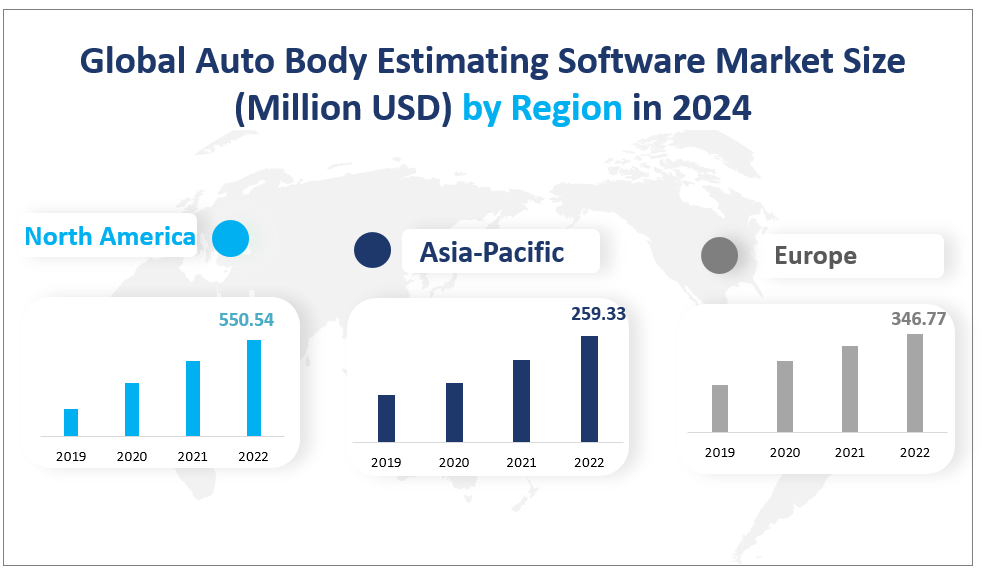

4. Regional Market

North America leads the global market.

The growing demand in North America for efficient and cost-effective solutions to manage and streamline repair processes is one of the key factors driving the market. The increasing number of independent repair shops in North America and their need to remain competitive is also driving the market. With the increase in the number of connected vehicles, these vehicles require sophisticated software solutions for diagnosis and repair, thus driving the growth of the body estimation software market. The growing demand for mobile solutions that can be used anytime, anywhere is driving the market, especially for software solutions that are easy to use and can be accessed from any device. The integration of artificial intelligence (AI) and machine learning algorithms improves the accuracy of repair estimates, speeds up the estimation process, improves customer experience, and streamlines workflows. Digital transformation Trends: Digital transformation trends in the automotive industry are also contributing to the development of creative estimation solutions, with North America leading the way in this regard. The market revenue of North America is $550.54 million in 2024 with a CAGR of 9.25% from 2024 to 2029.

Road traffic accidents are the leading cause of death worldwide for people between the ages of 5 and 20. In terms of income, the proportion of low – and middle-income countries and regions in the world is more than three times that of high-income countries and regions. Southeast Asia is one of the regions worst affected by road traffic accidents, with 20.7 deaths per 100,000 people. The increase in traffic accidents in Asia Pacific will drive the demand for the automotive repair industry and is an emerging market for the automotive body estimation software industry. The growth of the body estimation software market in APAC is driven by several drivers, including the growing demand for accurate and effective collision repair procedures, the increasing complexity of vehicles, the need for cutting-edge software solutions in repair shops, and the application of artificial intelligence (AI) and machine learning technologies to reduce estimation time and improve evaluation accuracy. The trend of digital transformation in the automotive industry has facilitated the development of innovative estimation solutions, which is also an important factor driving the growth of the auto body estimation software market in APAC. The market revenue of APAC is $259.33 million in 2024 with a CAGR of 10.47% from 2024 to 2029.

Global Auto Body Estimating Software Market Size by Region

5. Market Competition

The industry concentrate rate is high. The market share of the top three companies in 2024 was 42.56%. The top three companies are CCC ONE, Solera Inc., and Alldata, with a revenue market share of 20.28%, 13.19%, and 9.06% in 2024.

CCC ONE: CCC is transforming the trillion-dollar automotive and insurance industries through the power and scale of connected data platforms. Cloud-based SaaS solutions leverage the latest in AI, IoT, telematics, customer experience, mobile, and digital workflow technologies to create deep, actionable insights that help clients drive business and change lives. CCC has continued to innovate throughout its 40-year history, building scale through its extensive client partnerships while delivering industry-leading first-to-market solutions.

Solera Inc.: Solera is the global leader in vehicle lifecycle management software-as-a-service, data, and services. Through four lines of business – vehicle claims, vehicle repairs, vehicle solutions, and fleet solutions – Solera is home to many leading brands in the vehicle lifecycle ecosystem, including Identifix, Audatex, DealerSocket, Omnitracs, LoJack, Spireon, eDriving/Mentor, Explore, cap hpi, Autodata, and others. Solera empowers its customers to succeed in the digital age by providing them with a “one-stop-shop” solution that streamlines operations, offers data-driven analytics, and enhances customer engagement, which Solera believes helps customers drive sales, promote customer retention, and improve profit margins. Solera serves over 300,000 global customers and partners in 100+ countries.

ALLDATA: ALLDATA is the industry’s choice for unedited OEM automotive repair and collision information. Founded in 1986, the Elk Grove, Calif.-based company has more than 115,000 subscribers worldwide who rely on ALLDATA for diagnostics tools, OEM-accurate mechanical and collision repair information, and shop management software.

Mitchell: Mitchell International, Inc. delivers smart technology solutions and services to the auto insurance, collision repair, and workers’ compensation markets. Through deep industry expertise, connections throughout the insurance ecosystem, and advanced technology such as artificial intelligence, extended reality, and cloud-based solutions, Mitchell enables its customers and clients to succeed in today’s ever-changing environment. Together with Coventry and Genex Services, Mitchell is part of the Enlyte family of businesses.

Market Share of Major Players in 2024

| Market Share in 2024 | |

| CCC ONE | 20.28% |

| Solera Inc. | 13.19% |

| Alldata | 9.06% |

| Mitchell | 7.17% |

| GT Motive | 2.04% |

| Mitchell 1 | 1.34% |

| Web-Est | 1.02% |

| R.O. Writer | 0.55% |

| Others | 45.37% |

| Total | 100.00% |

1 Auto Body Estimating Software Market Overview

1.1 Product Overview and Scope of Auto Body Estimating Software

1.2 Auto Body Estimating Software Segment by Type

1.2.1 Global Auto Body Estimating Software Revenue and CAGR Comparison by Type (2017-2029)

1.2.2 Different Type of Auto Body Estimating Software

1.3 Global Auto Body Estimating Software Segment by Application

1.3.1 Auto Body Estimating Software Consumption (Value) Comparison by Application (2017-2029)

1.3.2 Different Application of Auto Body Estimating Software

1.4 Global Auto Body Estimating Software Market, Region Wise (2017-2029)

1.4.1 Global Auto Body Estimating Software Market Size (Value) and CAGR Comparison by Region (2017-2029)

1.4.2 North America Auto Body Estimating Software Market Status and Prospect (2017-2029)

1.4.3 Europe Auto Body Estimating Software Market Status and Prospect (2017-2029)

1.4.4 Asia Pacific Auto Body Estimating Software Market Status and Prospect (2017-2029)

1.4.5 Middle East and Africa Auto Body Estimating Software Market Status and Prospect (2017-2029)

1.4.6 South America Auto Body Estimating Software Market Status and Prospect (2017-2029)

1.4.7 Consumer Behavior Analysis by Key Regions

1.5 Global Market Size (Value) of Auto Body Estimating Software (2017-2029)

1.6 Industry Trends

1.6.1 SWOT Analysis

1.6.2 Porter’s Five Forces Analysis

1.6.3 Potential Market and Growth Potential Analysis

2 Global Auto Body Estimating Software Market Landscape by Player

2.1 Global Auto Body Estimating Software Revenue and Market Share by Player (2017-2022)

2.2 Auto Body Estimating Software, Business Distribution Area and Revenue Share in 2021 by Player

2.3 Auto Body Estimating Software Market Competitive Situation and Trends

2.3.1 Auto Body Estimating Software Market Concentration Rate

2.3.2 Auto Body Estimating Software Market Share of Top 3 and Top 6 Players

2.3.3 Mergers & Acquisitions, Expansion

3 Upstream and Downstream Analysis

3.1 Auto Body Estimating Software Industrial Chain Analysis

3.2 Downstream Buyers

4 Auto Body Estimating Software Business Cost Analysis

4.1 Business Cost Structure Analysis of Auto Body Estimating Software

4.2 Labor Cost Analysis

4.2.1 Definition of Labor Cost

4.2.2 Labor Cost of North America

4.2.3 Labor Cost of Europe

4.2.4 Labor Cost of Asia-Pacific

4.2.5 Labor Cost of South America

4.2.6 Labor Cost of Middle East

4.2.7 Labor Cost of Africa

4.3 Marketing Cost Analysis

5 Market Dynamics

5.1 Drivers

5.2 Restraints and Challenges

5.3 Opportunities

5.3.1 Advances in Innovation and Technology for Auto Body Estimating Software

5.3.2 Increased Demand in Emerging Markets

5.4 Auto Body Estimating Software Industry Development Trends under COVID-19 Outbreak

5.4.1 Global COVID-19 Status Overview

5.4.2 Influence of COVID-19 Outbreak on Auto Body Estimating Software Industry Development

5.5 Consumer Behavior Analysis

6 Players Profiles

6.1 CCC ONE

6.1.1 CCC ONE Basic Information, Sales Area and Competitors

6.1.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.1.3 CCC ONE Auto Body Estimating Software Market Performance (2017-2022)

6.1.4 CCC ONE Business Overview

6.2 Solera Inc.

6.2.1 Solera Inc. Basic Information, Sales Area and Competitors

6.2.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.2.3 Solera Inc. Auto Body Estimating Software Market Performance (2017-2022)

6.2.4 Solera Inc. Business Overview

6.3 Alldata

6.3.1 Alldata Basic Information, Sales Area and Competitors

6.3.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.3.3 Alldata Auto Body Estimating Software Market Performance (2017-2022)

6.3.4 Alldata Business Overview

6.4 Mitchell

6.4.1 Mitchell Basic Information, Sales Area and Competitors

6.4.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.4.3 Mitchell Auto Body Estimating Software Market Performance (2017-2022)

6.4.4 Mitchell Business Overview

6.5 GT Motive

6.5.1 GT Motive Basic Information, Sales Area and Competitors

6.5.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.5.3 GT Motive Auto Body Estimating Software Market Performance (2017-2022)

6.5.4 GT Motive Business Overview

6.6 Mitchell 1

6.6.1 Mitchell 1 Basic Information, Sales Area and Competitors

6.6.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.6.3 Mitchell 1 Auto Body Estimating Software Market Performance (2017-2022)

6.6.4 Mitchell 1 Business Overview

6.7 Web-Est

6.7.1 Web-Est Basic Information, Sales Area and Competitors

6.7.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.7.3 Web-Est Auto Body Estimating Software Market Performance (2017-2022)

6.7.4 Web-Est Business Overview

6.8 R.O. Writer

6.8.1 R.O. Writer Basic Information, Sales Area and Competitors

6.8.2 Auto Body Estimating Software Product Profiles, Application and Specification

6.8.3 R.O. Writer Auto Body Estimating Software Market Performance (2017-2022)

6.8.4 R.O. Writer Business Overview

7 Global Auto Body Estimating Software Revenue, Region Wise (2017-2022)

7.1 Global Auto Body Estimating Software Revenue, Market Share, Region Wise (2017-2022)

7.2 Global Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.3 North America Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.3.1 North America Market Under COVID-19

7.4 Europe Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.4.1 Europe Market Under COVID-19

7.5 Asia Pacific Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.5.1 Asia Pacific Market Under COVID-19

7.6 Middle East and Africa Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.6.1 Middle East and Africa Market Under COVID-19

7.7 South America Auto Body Estimating Software Revenue and Gross Margin (2017-2022)

7.7.1 South America Market Under COVID-19

8 Global Auto Body Estimating Software Revenue (Value) Trend by Type

8.1 Global Auto Body Estimating Software Revenue (Value) and Market Share by Type

9 Global Auto Body Estimating Software Market Analysis by Application

9.1 Global Auto Body Estimating Software Consumption Value and Market Share by Application (2017-2022)

9.2 Global Auto Body Estimating Software Consumption Value Growth Rate by Application (2017-2022)

9.2.1 Global Auto Body Estimating Software Consumption Value Growth Rate of Small and Medium Enterprises (SMEs) (2017-2022)

9.2.2 Global Auto Body Estimating Software Consumption Value Growth Rate of Large Enterprises (2017-2022)

10 Global Auto Body Estimating Software Market Forecast (2022-2029)

10.1 Global Auto Body Estimating Software Revenue Forecast (2022-2029)

10.2 Global Auto Body Estimating Software Revenue Forecast, Region Wise (2022-2029)

10.2.1 North America Auto Body Estimating Software Revenue Forecast (2022-2029)

10.2.2 Europe Auto Body Estimating Software Revenue Forecast (2022-2029)

10.2.3 Asia Pacific Auto Body Estimating Software Revenue Forecast (2022-2029)

10.2.4 Middle East and Africa Auto Body Estimating Software Revenue Forecast (2022-2029)

10.2.5 South America Auto Body Estimating Software Revenue Forecast (2022-2029)

10.3 Global Auto Body Estimating Software Revenue Forecast by Type (2022-2029)

10.4 Global Auto Body Estimating Software Consumption Value Forecast by Application (2022-2029)

10.5 Market Forecast Under COVID-19

11 Research Findings and Conclusion

12 Appendix

12.1 Methodology

12.2 Research Data Source

12.2.1 Secondary Data

12.2.2 Primary Data

12.2.3 Market Size Estimation

12.2.4 Legal Disclaimer