1. Global Artificial Casings Market Analysis

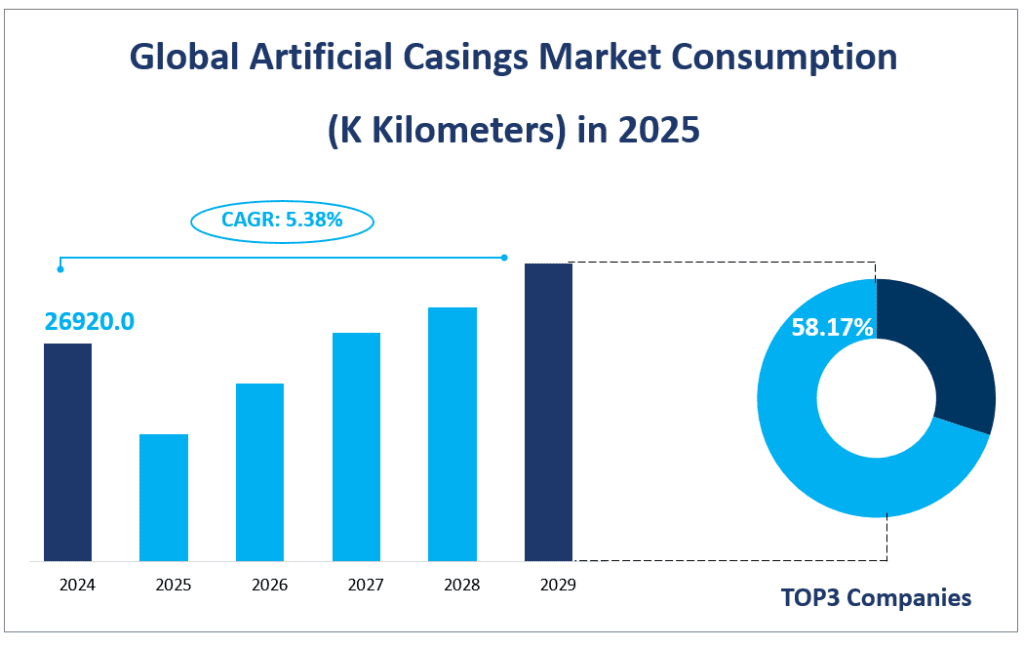

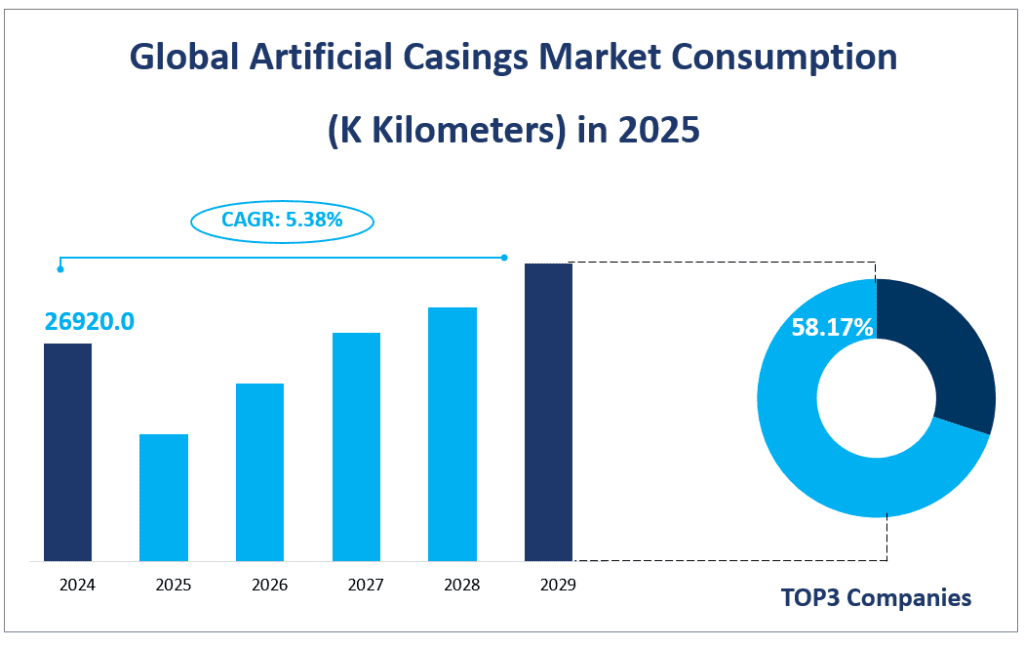

The artificial casings market consumption in 2025 is projected to reach 26920.0 K Kilometers with a CAGR of 5.38% from 2025 to 2030. Artificial casings, defined as synthetic or natural material-based casings that mimic the function of natural casings used for wrapping sausages and other meat products, are categorized into collagen casing, cellulose casing, fibrous casing, and plastic casing. This market’s expansion is attributed to the growing demand for processed meats and the advantages offered by artificial casings, such as consistency in size and shape, strength, and ease of handling.

This growth is fueled by the increasing preference for processed meats globally, the need for efficient and consistent production processes in the meat industry, and the advantages of artificial casings over natural ones, such as uniformity and the ability to withstand high-speed processing. The market is also influenced by technological advancements in material science, which allow for the development of more innovative and efficient artificial casings.

Global Artificial Casings Market Consumption (K Kilometers) in 2025

2. Driving Factors and Limiting Factors of the Artificial Casings Market

The artificial casings market is propelled by several driving factors. Firstly, the global demand for processed meats is on the rise, which directly impacts the need for artificial casings. The advantages of artificial casings, such as their strength, uniformity, and ease of handling, make them a preferred choice in high-speed and automated meat processing industries. Additionally, the growing trend of using multi-functional and innovative packaging solutions in the food industry contributes to the market’s growth. Technological advancements have enabled the development of new types of artificial casings that offer improved functionality and sustainability, appealing to both manufacturers and consumers.

The market is also influenced by the increasing awareness of food safety and the need for hygienic and consistent food packaging solutions. Artificial casings, being steerable and free from natural casings’ variability, meet these requirements effectively. Furthermore, the global population’s shift towards convenience foods and ready-to-eat meals has amplified the demand for artificial casings, as they facilitate the production of such products.

3. Limiting Factors of the Artificial Casings Market

Despite the growth, the artificial casings market faces certain challenges. One of the primary limiting factors is the environmental impact of non-degradable artificial casings, which can contribute to waste and pollution. The industry is under scrutiny to develop and adopt biodegradable and eco-friendly alternatives. Additionally, the high initial cost of production for new entrants can be a barrier, as the market is capital-intensive, requiring significant investments in technology and production facilities.

The market also faces intense competition, with numerous players vying for market share. This competition can lead to price wars, which may affect the profitability of companies operating in the sector. Moreover, fluctuations in raw material prices, driven by global economic conditions and geopolitical factors, can impact the cost-effectiveness of producing artificial casings.

Another challenge is the changing consumer preferences and dietary trends. As health consciousness grows, consumers may opt for natural and organic products over processed ones, potentially affecting the demand for artificial casings. Lastly, regulatory changes and food safety standards can influence the market, as companies must comply with stringent regulations, which may add to their operational costs.

4. Global Artificial Casings Market Segment

Product Types Analysis

The global artificial casings market is segmented into various product types, each with distinct characteristics and market consumption levels. By 2025, the market consumption for each type is anticipated to reflect the diverse needs of the meat processing industry. The four main types of artificial casings are collagen casing, cellulose casing, fibrous casing, and plastic casing.

Collagen Casing: Collagen casings are edible and typically made from collagen derived from animal hides. Known for their high elasticity and consistent caliber, these casings are suitable for a variety of sausages and processed meats. In 2025, collagen casings are projected to consume 13337.0 K Kilometers, holding the largest market share due to their versatility and widespread use in the industry.

Cellulose Casing: Made from viscose, a form of cellulose obtained from wood or cotton processing, cellulose casings are not edible and are valued for their high strength and consistent quality. The market consumption for cellulose casings in 2025 is estimated at 7206.5 K Kilometers, making it a significant player in the market, though not the largest.

Fibrous Casing: Fibrous casings combine regenerated cellulose with special paper, offering excellent strength and diameter uniformity. They are not edible and are known for their versatility in sausage production. The consumption of fibrous casings is predicted to be 2136.0 K Kilometers in 2025, showing a steady growth rate.

Plastic Casing: Plastic casings, made from materials like polyvinylidene chloride (PVDC) and polyamide, offer good barrier properties and can be sterilized through high-temperature cooking. Despite being the smallest in consumption volume at 4240.6 K Kilometers in 2025, plastic casings exhibit the fastest growth rate due to their increasing use in innovative meat products and convenience foods.

Among these product types, collagen casing retains the largest market share, primarily due to its edibility and the nutritional benefits it offers. It is also favored for its ability to enhance the sensory properties of meat products. On the other hand, plastic casing shows the fastest growth rate, attributed to the increasing demand for convenience and the development of new materials that provide better barrier properties.

Applications Analysis of Artificial Casings Market

The applications of the artificial casings market are segmented into offline and online sales channels, each with unique consumption patterns and growth trajectories.

Offline Application: This segment refers to the traditional sale of artificial casing products through physical stores and food markets. In 2025, the offline application is expected to consume 19815.8 K Kilometers, maintaining the largest market share due to the continued preference for in-person shopping in many regions.

Online Application: With the rise of e-commerce and online grocery shopping, the online application of artificial casings has been growing rapidly. By 2025, it is projected to consume 7104.2 K Kilometers, showing the fastest growth rate among applications. This trend is driven by the convenience of online shopping and the increasing integration of technology in food retail.

The offline application holds the largest market share, a testament to the enduring role of traditional retail in the meat industry. However, the online application is the fastest-growing segment, reflecting a global shift towards digital commerce and the convenience it offers to consumers. The online channel is also benefitting from advancements in cold chain logistics and the expansion of global food e-commerce platforms.

In conclusion, the product types and applications within the global artificial casings market are diverse, with collagen casing leading in market share and plastic casing showing the most rapid growth. Similarly, while offline applications dominate in market share, online applications are experiencing explosive growth, indicating a significant shift in consumer behavior and market dynamics. These trends are shaping the future of the artificial casings industry, influencing the strategies of manufacturers and retailers alike.

Market Consumption and Share by Segment

| Market Consumption (K Kilometers) in 2024 | Market Share in 2024 | ||

| By Type | Collagen Casing | 13337.0 | 49.54% |

| Cellulose Casing | 7206.5 | 26.77% | |

| Fibrous Casing | 2136.0 | 7.93% | |

| Plastic Casing | 4240.6 | 15.75% | |

| By Application | Online | 19815.8 | 73.61% |

| Offline | 7104.2 | 26.39% |

5. Regional Market Consumption Analysis

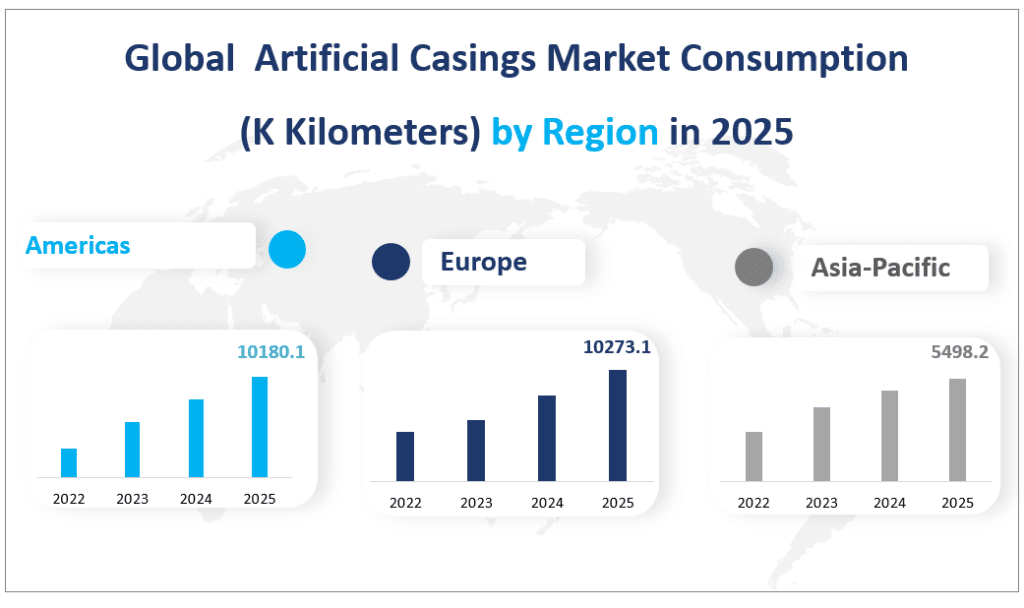

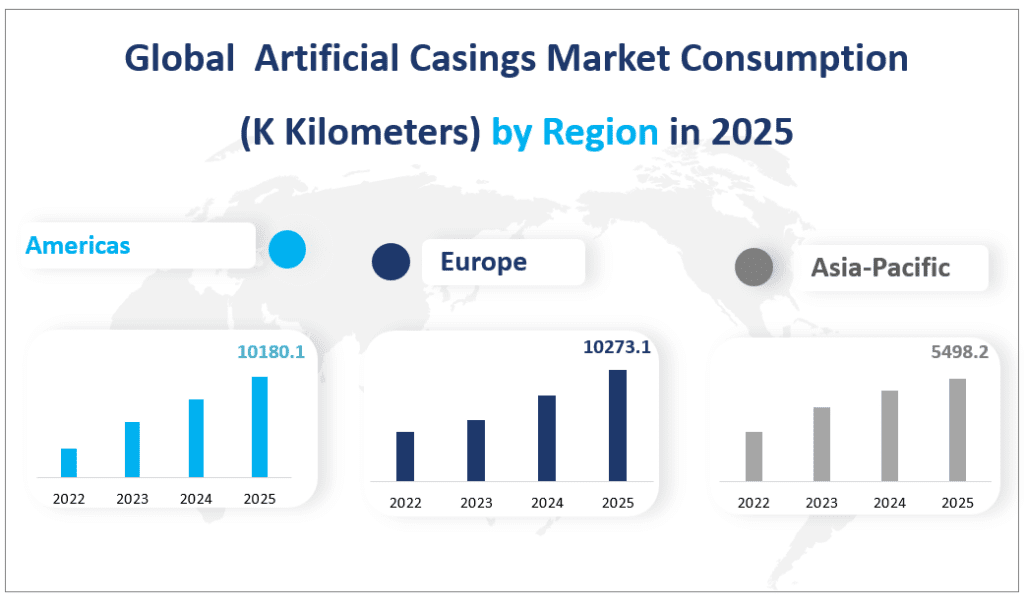

The global artificial casings market is a diverse and expansive industry, with consumption patterns varying significantly across regions. By 2025, the market is expected to witness a shift in consumption dynamics.

Americas: The Americas region, driven by the United States, is anticipated to lead in terms of revenue, with a projected consumption of 10180.1 K Kilometers in 2025. The region’s dominance can be attributed to the high demand for processed meats and the well-established meat processing industry. The United States, in particular, is known for its large-scale production facilities and technological advancements in meat processing, which drive the demand for artificial casings.

Europe: Europe follows closely, with a consumption forecast of 10273.1 K Kilometers in 2025. The region is characterized by a strong presence of meat processing companies and a growing trend towards convenience foods. Germany, France, and the United Kingdom are key contributors to the region’s consumption, with Germany leading in technological innovation in the meat industry.

APAC: The Asia-Pacific region is projected to consume 5498.2 K Kilometers in 2025, reflecting a significant growth in the meat processing sector. China’s rapid economic growth and increasing meat consumption are key factors driving the region’s demand for artificial casings. Additionally, the growing preference for convenience and processed foods in countries like Japan and Australia also contributes to the region’s consumption.

Middle East & Africa: Although smaller in comparison, the Middle East and Africa are expected to show the fastest growth rate, with a consumption forecast of 968.6 K Kilometers in 2025. The region’s growth is fueled by increasing urbanization, rising incomes, and a growing demand for processed foods, particularly in countries like Saudi Arabia and the United Arab Emirates.

Among these regions, the Americas stand out as the biggest regional market by revenue, driven by the established meat industry and technological advancements in meat processing. Meanwhile, the Middle East & Africa region exhibit the fastest growth, owing to the region’s economic development and the increasing demand for modern food products.

Global Artificial Casings Market Consumption (K Kilometers) by Region in 2025

6. Analysis of the Top Five Companies

The top 3 companies are Viscofan SA, Viskase Companies, and Devro plc with a share of 58.17% in 2024.

Viscofan SA: Established in 1975 and headquartered in Spain, Viscofan SA is a leading manufacturer and distributor of casings and films for the food industry. The company offers a range of products, including cellulose, collagen, fibrous, and plastic casings, used in the production of various types of sausages and processed meats. Viscofan operates globally, with manufacturing plants across several countries.

Viskase Companies: Founded in 1925 and based in the USA, Viskase Companies Inc. is a major player in the casings market. The company manufactures and distributes casings for the food processing industry, including non-edible cellulose, plastic, and fibrous casings for processed meat products. Viskase markets its products under various brand names, catering to a wide range of meat products.

Devro plc: Established in 1950 and headquartered in the UK, Devro PLC specializes in manufacturing and selling casings for the food industry, with a focus on collagen products for sausage, salami, ham, and other prepared meat manufacturers. The company’s products are known for their quality and innovation, catering to markets in North America, South America, Europe, and Asia Pacific.

DAT-Schaub Group: With a history dating back to 1893 and headquartered in Denmark, DAT-Schaub A/S produces, markets, and sells natural and artificial casings. The company offers a variety of products, including hog, sheep, and beef casings, as well as flexible films and other packaging products, serving customers primarily in Europe, North America, South America, and Asia.

ViskoTeepak: Established in 1952 and headquartered in Finland, ViskoTeepak is a leading international manufacturer of fibrous, cellulose, and plastic casings for the food industry. The company is known for its extensive selection of fibrous casings and its ability to produce casings with a wide diameter range, catering to various meat processing needs globally.

Major Players

| Company Name | Headquarters | Sales Region |

| Viscofan SA | Spain | Worldwide |

| Viskase Companies | USA | Worldwide |

| Devro plc | UK | Mainly in North America, South America, Europe and Asia Pacific |

| DAT-Schaub Group | Denmark | Mainly in Europe, North America, South America, and Asia |

| ViskoTeepak | Finland | Mainly in Europe, North America, and Asia Pacific |

| Shenguan Holdings (Group) Limited | China | Mainly in Asia |

| FIBRAN, S.A | Spain | Mainly in Europe and the Middle East |

| SHANDONG HAIAOS | China | Mainly in Asia |

| Kalle GmbH | Germany | Mainly in Europe and North America |

| Nippi | Japan | Mainly in Asia and North America |

| FABIOS S.A | Poland | Mainly in Europe, Asia, America, and Australia |

| Columbit Group (Colpak) | South Africa | Mainly in Europe, Oceania, and the United States |

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Artificial Casings Consumption 2019-2030

2.1.2 Artificial Casings Consumption CAGR by Region

2.2 Artificial Casings Segment by Type

2.2.1 Collagen Casing

2.2.2 Cellulose Casing

2.2.3 Fibrous Casing

2.2.4 Plastic Casing

2.3 Artificial Casings Consumption by Type

2.3.1 Global Artificial Casings Consumption Market Share by Type (2019-2024)

2.3.2 Global Artificial Casings Value and Market Share by Type (2019-2024)

2.3.3 Global Artificial Casings Sale Price by Type (2019-2024)

2.4 Artificial Casings Segment by Application

2.5 Artificial Casings Consumption by Application

2.5.1 Global Artificial Casings Consumption Market Share by Application (2019-2024)

2.5.2 Global Artificial Casings Value and Market Share by Application (2019-2024)

2.5.3 Global Artificial Casings Price by Application (2019-2024)

3 Global Artificial Casings by Players

3.1 Global Artificial Casings Production Market Share by Players

3.1.1 Global Artificial Casings Production by Players (2019-2024)

3.1.2 Global Artificial Casings Production Market Share by Players (2019-2024)

3.2 Global Artificial Casings Value Market Share by Players

3.2.1 Global Artificial Casings Value by Players (2019-2024)

3.2.2 Global Artificial Casings Value Market Share by Players (2019-2024)

3.3 Global Artificial Casings Sale Price by Players

3.4 Global Artificial Casings Manufacturing Base Distribution, Production Area, Type Types by Players

3.4.1 Global Artificial Casings Sales Area by Players

3.4.2 Players Artificial Casings Headquarters

3.5 Market Concentration Rate Analysis

3.5.1 Competition Landscape Analysis

3.6 New Types and Potential Entrants

3.7 Mergers & Acquisitions, Expansion

4 Artificial Casings by Regions

4.1 Artificial Casings by Regions

4.1.1 Global Artificial Casings Consumption by Regions

4.1.2 Global Artificial Casings Value by Regions

4.2 Americas Artificial Casings Consumption Growth

4.3 APAC Artificial Casings Consumption Growth

4.4 Europe Artificial Casings Consumption Growth

4.5 Middle East & Africa Artificial Casings Consumption Growth

5 Americas

5.1 Americas Artificial Casings Consumption by Countries

5.1.1 Americas Artificial Casings Consumption by Countries (2019-2024)

5.1.2 Americas Artificial Casings Value by Countries (2019-2024)

5.2 Americas Artificial Casings Consumption by Types

5.3 Americas Artificial Casings Consumption by Applications

5.4 United States

5.5 Canada

5.6 Mexico

6 APAC

6.1 APAC Artificial Casings Consumption by Countries

6.1.1 APAC Artificial Casings Consumption by Countries

6.1.2 APAC Artificial Casings Value by Countries

6.2 APAC Artificial Casings Consumption by Types

6.3 APAC Artificial Casings Consumption by Applications

6.4 China

6.5 Japan

6.6 Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

7 Europe

7.1 Europe Artificial Casings Consumption by Countries

7.1.1 Europe Artificial Casings Consumption by Countries

7.1.2 Europe Artificial Casings Value by Countries

7.2 Europe Artificial Casings Consumption by Types

7.3 Europe Artificial Casings Consumption by Applications

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

7.9 Spain

8 Middle East & Africa

8.1 Middle East & Africa Artificial Casings Consumption by Countries

8.1.1 Middle East & Africa Artificial Casings Consumption by Countries

8.1.2 Middle East & Africa Artificial Casings Value by Countries

8.2 Middle East & Africa Artificial Casings Consumption by Types

8.3 Middle East & Africa Artificial Casings Consumption by Applications

8.4 Egypt

8.5 South Africa

8.6 Israel

8.7 Turkey

8.8 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.2 Market Challenges and Impact

9.3 Market Trends

9.4 Impact of Russia and Ukraine War

10 Marketing, Distributors and Customer

10.1 Sales Channel

10.1.1 Direct Channels

10.1.2 Indirect Channels

10.2 Artificial Casings Distributors

10.3 Artificial Casings Customer

11 Global Artificial Casings Market Forecast

11.1 Global Artificial Casings Consumption and Value Forecast

11.2 Global Artificial Casings Consumption Forecast by Regions

11.2.1 Global Artificial Casings Forecast by Regions (2024-2030)

11.2.2 Global Artificial Casings Value Forecast by Regions 2024-2030

11.3 Americas Forecast by Countries

11.3.1 United States Market Forecast

11.3.2 Canada Market Forecast

11.3.3 Mexico Market Forecast

11.4 APAC Forecast by Countries

11.4.1 China Market Forecast

11.4.2 Japan Market Forecast

11.4.3 Korea Market Forecast

11.4.4 Southeast Asia Market Forecast

11.4.5 India Market Forecast

11.4.6 Australia Market Forecast

11.5 Europe Forecast by Countries

11.5.1 Germany Market Forecast

11.5.2 France Market Forecast

11.5.3 UK Market Forecast

11.5.4 Italy Market Forecast

11.5.5 Russia Market Forecast

11.5.6 Spain Market Forecast

11.6 Middle East & Africa Forecast by Countries

11.6.1 Egypt Market Forecast

11.6.2 South Africa Market Forecast

11.6.3 Israel Market Forecast

11.6.4 Turkey Market Forecast

11.6.5 GCC Countries Market Forecast

11.7 Global Artificial Casings Market Forecast by Type

11.8 Global Artificial Casings Market Forecast by Application

12 Key Players Analysis

12.1 Competitive Profile

12.2 Viscofan SA

12.2.1 Company Profiles

12.2.2 Artificial Casings Type Introduction

12.2.3 Viscofan SA Sales, Price, Value, Gross, Gross Margin 2019-2024

12.3 Viskase Companies

12.3.1 Company Profiles

12.3.2 Artificial Casings Type Introduction

12.3.3 Viskase Companies Sales, Price, Value, Gross, Gross Margin 2019-2024

12.4 Devro plc

12.4.1 Company Profiles

12.4.2 Artificial Casings Type Introduction

12.4.3 Devro plc Sales, Price, Value, Gross, Gross Margin 2019-2024

12.5 DAT-Schaub Group

12.5.1 Company Profiles

12.5.2 Artificial Casings Type Introduction

12.5.3 DAT-Schaub Group Sales, Price, Value, Gross, Gross Margin 2019-2024

12.6 ViskoTeepak

12.6.1 Company Profiles

12.6.2 Artificial Casings Type Introduction

12.6.3 ViskoTeepak Sales, Price, Value, Gross, Gross Margin 2019-2024

12.7 Shenguan Holdings (Group) Limited

12.7.1 Company Profiles

12.7.2 Artificial Casings Type Introduction

12.7.3 Shenguan Holdings (Group) Limited Sales, Price, Value, Gross, Gross Margin 2019-2024

12.8 FIBRAN, S.A

12.8.1 Company Profiles

12.8.2 Artificial Casings Type Introduction

12.8.3 FIBRAN, S.A Sales, Price, Value, Gross, Gross Margin 2019-2024

12.9 SHANDONG HAIAOS

12.9.1 Company Profiles

12.9.2 Artificial Casings Type Introduction

12.9.3 SHANDONG HAIAOS Sales, Price, Value, Gross, Gross Margin 2019-2024

12.10 Kalle GmbH

12.10.1 Company Profiles

12.10.2 Artificial Casings Type Introduction

12.10.3 Kalle GmbH Sales, Price, Value, Gross, Gross Margin 2019-2024

12.11 Nippi

12.11.1 Company Profiles

12.11.2 Artificial Casings Type Introduction

12.11.3 Nippi Sales, Price, Value, Gross, Gross Margin 2019-2024

12.12 FABIOS S.A

12.12.1 Company Profiles

12.12.2 Artificial Casings Type Introduction

12.12.3 FABIOS S.A Sales, Price, Value, Gross, Gross Margin 2019-2024

12.13 Columbit Group (Colpak)

12.13.1 Company Profiles

12.13.2 Artificial Casings Type Introduction

12.13.3 Columbit Group (Colpak) Sales, Price, Value, Gross, Gross Margin 2019-2024

13 Appendix

13.1 Methodology

13.2 Research Data Source

13.2.1 Secondary Data

13.2.2 Primary Data

13.2.3 Market Size Estimation

13.2.4 Legal Disclaimer