1. Global Alumina and Bauxite Market Outlook

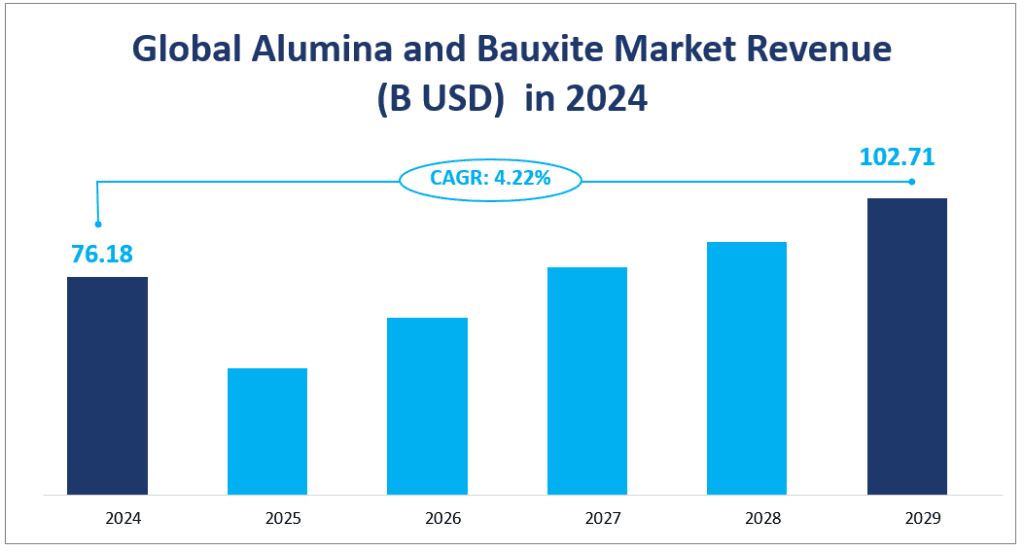

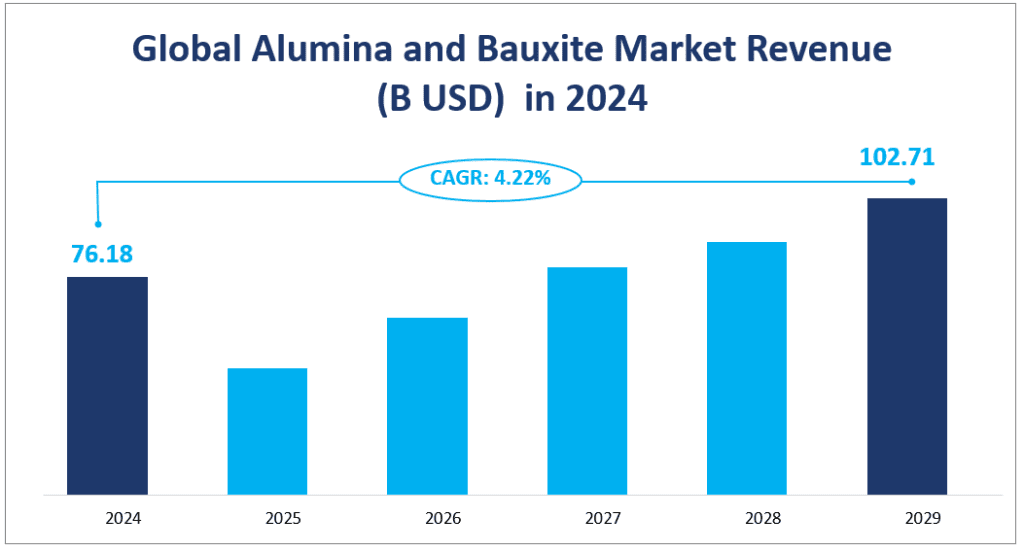

In 2024, the global alumina and bauxite market revenue is projected to reach $76.18 billion with a CAGR of 4.22% from 2024 to 2029.

Aluminum is the third richest element in the earth’s crust. There are many minerals containing aluminum. Bauxite is the most common raw material for producing alumina to extract metallic aluminum. The raw material for producing primary aluminum is alumina, which is a white powder refined from bauxite. The report includes alumina and bauxite.

Global Alumina and Bauxite Market Revenue (B USD) in 2024

2. Driving Factors of Alumina and Bauxite Market

Several driving factors propel the growth of the alumina and bauxite market. Primarily, the increasing demand from the refractory industry, which utilizes alumina and bauxite products for steel production, is a significant contributor. The use of alumina refractories extends the service life of steel containers and aids in the production of cleaner steel, thereby boosting market demand.

Another driving factor is the continuous growth in demand for non-metallurgical bauxite, which has a wide range of applications beyond metallurgy. These include refractories, abrasives, high alumina cement, aluminum chemicals, and more. The diversification of applications for bauxite and alumina products ensures a steady increase in market demand.

Positive government policies also play a crucial role in fostering the growth of the alumina and bauxite industry. For instance, governments in bauxite-rich regions are focusing on creating employment opportunities and promoting local economic development through bauxite production, which in turn stimulates market growth.

3. Limiting Factors of Alumina and Bauxite Market

Despite the positive driving forces, the market faces certain limiting factors that could impede growth. The impact of the COVID-19 pandemic has been profound, with aluminum processing enterprises delaying their resumption of work and production, affecting import and export trade. This has led to a decline in the sales volume of aluminum products, thereby increasing inventory pressure on enterprises and adding to the production costs due to necessary pandemic precautions.

Furthermore, the industry faces fierce competition, with a few large companies controlling a significant share of the market. These companies have strong integration capabilities and a complete industrial chain system, making it challenging for smaller companies to compete. Smaller companies need to improve their refining processes to produce high-quality alumina and expand their market share.

While the market is driven by increased demand from the refractory industry and positive government policies, it must navigate challenges posed by the pandemic and intense competition. Understanding these dynamics is crucial for stakeholders to make informed decisions and capitalize on the opportunities within the market.

4. Analysis of Alumina and Bauxite Market Segment

Analysis of Alumina and Bauxite Types

Non-Metallurgical Products

Non-metallurgical products, which include refractories, abrasives, high alumina cement, aluminum chemicals, and active bauxite, are used in a variety of applications outside of metal extraction. These products are crucial in industries such as construction, chemical manufacturing, and abrasive production. In 2024, the market revenue for non-metallurgical products is projected to be $7205.08 million. This segment is expected to grow due to the increasing demand for high-quality abrasives and the expanding construction industry.

Metallurgical Products

Metallurgical products are predominantly used in the aluminum industry for extracting metal aluminum and as raw materials for high-alumina cement. This category is the backbone of the alumina and bauxite market, accounting for the majority of the market share. In 2024, the market revenue for metallurgical products is anticipated to reach $70.70 billion. The growth in this segment is driven by the increasing demand for aluminum in various industries, including automotive, aerospace, and packaging.

Among the two product types, metallurgical products hold the largest market share, primarily due to the vast application of alumina in aluminum production. The share of metallurgical products in the market is expected to continue its dominance, underpinned by the growing global demand for aluminum.

In terms of growth rate, non-metallurgical products are expected to have the fastest growing rate. This is attributed to the increasing use of alumina in the production of composite fibers, industrial catalysts, and purification agents, which are critical for the development of new materials and environmental protection technologies. The diversification of applications for non-metallurgical products is a key factor in driving this growth.

Analysis of Alumina and Bauxite Applications

Paints

Alumina and bauxite are used in the paint industry for the production of aluminum pigments and extenders. In 2024, the market revenue for paints is projected to be $7964.99 million. This application sector is expected to grow steadily due to the increasing demand for aluminum-based pigments in the paint and coating industry.

Composite Fibers

Composite fibers, which include materials like fiberglass, are strengthened with alumina and bauxite. The market revenue for composite fibers in 2024 is anticipated to be $10.32 billion. The growth in this segment is driven by the increasing use of composite materials in the automotive and aerospace industries.

Abrasive

The abrasive application sector uses alumina and bauxite for the production of grinding and polishing compounds. In 2024, the market revenue for abrasive is expected to be $11.79 billion. This segment is expected to grow due to the increasing demand for precision finishing in manufacturing industries.

Industrial Catalyst

Alumina and bauxite are used as catalysts in various chemical processes. The market revenue for industrial catalysts in 2024 is projected to be $17.36 billion. This application has the largest market share and is expected to grow due to the increasing demand for catalysts in the petrochemical and refining industries.

Purification Agent

Alumina and bauxite are used in water treatment and purification processes. The market revenue for purification agents in 2024 is anticipated to be $11.85 billion. This segment is expected to grow as environmental concerns drive the need for advanced water treatment solutions.

Proppant

Proppants, used in oil and gas well stimulation, are made from alumina and bauxite. The market revenue for proppant in 2024 is expected to be $10.22 billion. This application is expected to grow with the increasing demand for sustainable energy solutions.

Among the various applications, industrial catalysts hold the largest market share, driven by the significant demand from the petrochemical industry. This application is also expected to have one of the fastest growth rates due to the increasing need for efficient catalysts in chemical processes.

The fastest-growing application is expected to be composite fibers, as the demand for lightweight and strong materials in the automotive and aerospace industries continues to rise. The use of alumina and bauxite in these fibers provides the necessary strength and durability, driving the growth of this application sector.

Market Revenue by Segment

| Market Revenue in 2024 | ||

| By Type | Non-Metallurgical Products | 7205.08 M USD |

| Metallurgical Products | 70.70 B USD | |

| By Application | Paints | 7964.99 M USD |

| Composite Fibers | 10.32 B USD | |

| Abrasive | 11.79 B USD | |

| Industrial Catalyst | 17.36 B USD | |

| Purification Agent | 11.85 B USD | |

| Proppant | 10.22 B USD |

5.Global Alumina and Bauxite Market by Region

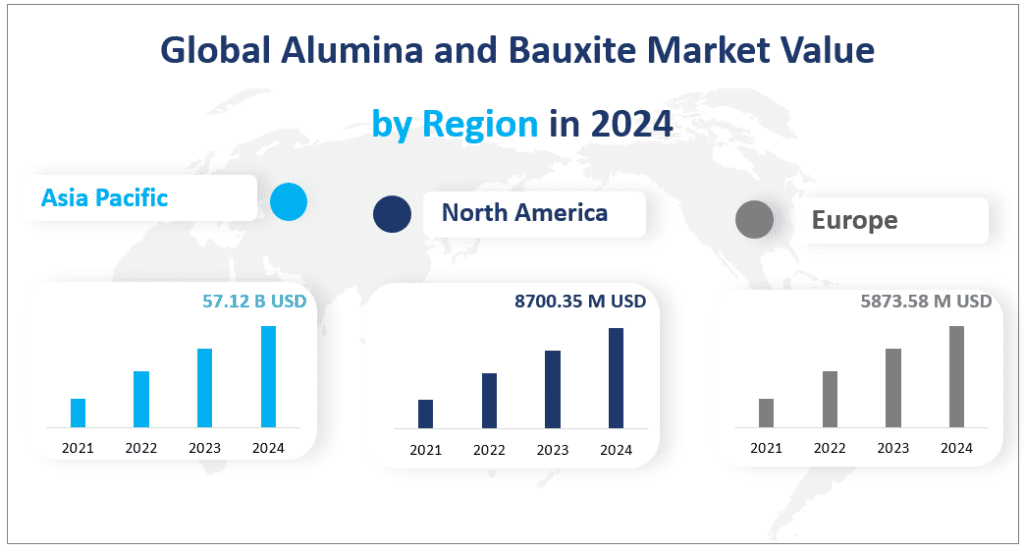

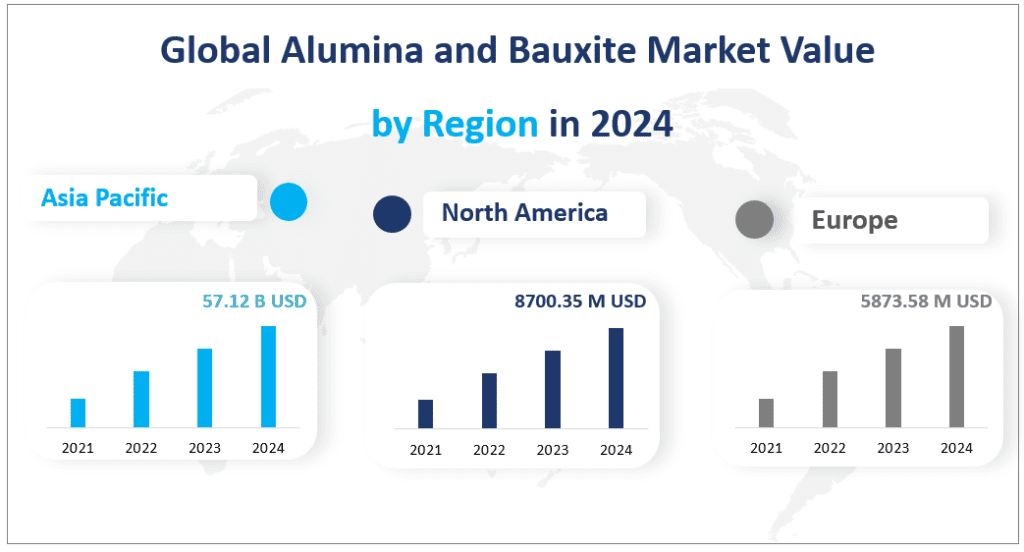

Asia-Pacific

The Asia-Pacific region is anticipated to be the largest revenue contributor in 2024, with a projected revenue of $57.12 billion. This region’s dominance can be attributed to the rapid industrialization and growth of key economies such as China, India, and Australia, which have a high demand for alumina and bauxite in various industries, including construction, automotive, and aerospace.

North America

North America is expected to generate a revenue of $8700.35 million in 2024. The region’s mature markets, particularly the United States, contribute to this figure with a stable demand for alumina and bauxite products, driven by the continuous need for aluminum in various sectors.

Europe

Europe is projected to have a market revenue of $5873.58 million in 2024. The region’s strong manufacturing base and the presence of leading companies in the alumina and bauxite industry contribute to its significant share of the global market.

Among these regions, Asia-Pacific is not only the largest but also the fastest-growing market for alumina and bauxite. The region’s CAGR is expected to be higher than the global average, driven by the rapid economic development and industrialization in countries like China and India. The increasing demand for aluminum in these countries for infrastructure development and manufacturing is a key factor in the region’s growth.

The growth in the Asia-Pacific region is also supported by the expansion of downstream industries such as automotive and construction, which are key consumers of alumina and bauxite products. Additionally, the region’s growing middle class and increasing urbanization contribute to the demand for aluminum products, further bolstering the market’s growth.

Global Alumina and Bauxite Market Value by Region in 2024

6. Analysis of the Top Five Companies in the Alumina and Bauxite Market

Alcoa Corporation is a global industry leader in bauxite, alumina, and aluminum products. With a strong portfolio of value-added cast and rolled products and substantial energy assets, Alcoa operates primarily in Australia, Brazil, and Spain.

Rio Tinto Alcan is known for producing iron ore for steel, aluminum for various applications, and copper for wind turbines, among other products. The company’s large-scale and high-quality bauxite mines and alumina refineries contribute to its sales revenue.

Operating in 20 countries across 5 continents, RUSAL is a leading global aluminum industry player. The company is recognized for producing metal with a low carbon footprint, with 90% of its aluminum produced from renewable electricity.

CHALCO (Aluminum Corporation of China Ltd)

CHALCO is a leading enterprise in China’s aluminum industry and the world’s largest producer and supplier of alumina and fine alumina. The company’s main business includes the exploration and mining of bauxite resources, and the production and sales of alumina, primary aluminum, and aluminum alloy products.

Hydro is a global aluminum company with activities throughout the value chain, from bauxite, alumina, and energy generation to the production of primary aluminum and rolled products, as well as recycling.

These top five companies, with their diverse product offerings and global presence, significantly influence the global alumina and bauxite market. Their continued innovation and expansion strategies are key to the industry’s growth and development. Their sales revenue in 2024 underscores their competitive edge and market leadership in the alumina and bauxite sectors.

Major Players

| Company Name | Plant Locations | Market Distribution |

| Alcoa Corporation | Mainly in Australia, Brazil, and Spain | Worldwide |

| Rio Tinto Alcan | Mainly in Europe | Worldwide |

| United Company RUSAL | Mainly in Russia | Worldwide |

| CHALCO | Mainly in China | Worldwide |

| Norsk Hydro ASA | Mainly in Europe | Worldwide |

| BHP Billiton Group | Mainly in US | Worldwide |

| Hindalco Industries | Mainly in India | Worldwide |

| National Aluminum | Mainly in India | Worldwide |

1 Market Overview

1.1 Alumina and Bauxite Introduction

1.2 Market Analysis by Types

1.2.1 Overview: Global Alumina and Bauxite Revenue by Type: 2015 Versus 2019 Versus 2030

1.3 Market Analysis by Application

1.3.1 Overview: Global Alumina and Bauxite Revenue by Application: 2015 Versus 2019 Versus 2030

1.4 Global Alumina and Bauxite Market Size and Forecast (2015-2030)

1.4.1 Global Alumina and Bauxite Revenue and Forecast (2015-2030)

1.4.2 Global Alumina and Bauxite Sales and Forecast (2015-2030)

1.5 Global Alumina and Bauxite Market Size Overview by Geography (2015-2020)

2 Manufacturers Profiles

2.1 Alcoa Corporation

2.1.1 Business Overview

2.1.2 Products Analysis

2.1.3 Alcoa Corporation Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.1.4 SWOT Analysis

2.2 Rio Tinto Alcan

2.2.1 Business Overview

2.2.2 Products Analysis

2.2.3 Rio Tinto Alcan Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.2.4 SWOT Analysis

2.3 United Company RUSAL

2.3.1 Business Overview

2.3.2 Products Analysis

2.3.3 United Company RUSAL Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.3.4 SWOT Analysis

2.4 CHALCO

2.4.1 Business Overview

2.4.2 Products Analysis

2.4.3 CHALCO Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.4.4 SWOT Analysis

2.5 Norsk Hydro ASA

2.5.1 Business Overview

2.5.2 Products Analysis

2.5.3 Norsk Hydro ASA Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.5.4 SWOT Analysis

2.6 BHP Billiton Group

2.6.1 Business Overview

2.6.2 Products Analysis

2.6.3 BHP Billiton Group Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.6.4 SWOT Analysis

2.7 Hindalco Industries

2.7.1 Business Overview

2.7.2 Products Analysis

2.7.3 Hindalco Industries Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.7.4 SWOT Analysis

2.8 National Aluminum

2.8.1 Business Overview

2.8.2 Products Analysis

2.8.3 National Aluminum Alumina and Bauxite Sales, Price, Revenue, Gross Margin

2.8.4 SWOT Analysis

2.9 Industry News

3 Global Alumina and Bauxite Market Competition, by Manufacturer

3.1 Global Alumina and Bauxite Sales and Market Share by Manufacturer

3.2 Global Alumina and Bauxite Revenue and Market Share by Manufacturer

3.3 Asia Alumina and Bauxite Sales and Market Share by Manufacturer

3.4 Asia Alumina and Bauxite Revenue and Market Share by Manufacturer

3.5 Market Concentration Rate

3.5.1 Top 5 Alumina and Bauxite Manufacturer Market Share

3.5.2 Top 3 Alumina and Bauxite Manufacturer in Asia

4 Global Alumina and Bauxite Market Analysis by Regions

4.1 Global Alumina and Bauxite Sales, Revenue and Market Share by Regions

4.1.1 Global Alumina and Bauxite Sales by Regions (2015-2020)

4.1.2 Global Alumina and Bauxite Revenue by Regions (2015-2020)

4.2 Global Alumina and Bauxite Market Sales Forecast by Regions (2020-2030)

4.3 Global Alumina and Bauxite Market Revenue Forecast by Regions (2020-2030)

4.3.1 North America Alumina and Bauxite Market Forecast (2020-2030)

4.3.2 Europe Alumina and Bauxite Market Forecast (2020-2030)

4.3.3 Asia-Pacific Alumina and Bauxite Market Forecast (2020-2030)

4.3.4 South America Alumina and Bauxite Market Forecast (2020-2030)

4.3.5 Middle East & Africa Alumina and Bauxite Market Forecast (2020-2030)

4.4 North America Alumina and Bauxite Sales and Growth (2015-2020)

4.5 Europe Alumina and Bauxite Sales and Growth (2015-2020)

4.6 Asia-Pacific Alumina and Bauxite Sales and Growth (2015-2020)

4.7 South America Alumina and Bauxite Sales and Growth (2015-2020)

4.8 Middle East and Africa Alumina and Bauxite Sales and Growth (2015-2020)

5 North America Alumina and Bauxite by Countries

5.1 North America Alumina and Bauxite Sales, Revenue and Market Share by Countries

5.1.1 North America Alumina and Bauxite Sales by Countries (2015-2020)

5.1.2 North America Alumina and Bauxite Revenue by Countries (2015-2020)

5.1.3 North America Alumina and Bauxite Market Size and Forecast by Country (2020-2030)

5.2 United States Alumina and Bauxite Market Size and Forecast (2015-2030)

5.3 Canada Alumina and Bauxite Market Size and Forecast (2015-2030)

5.4 Mexico Alumina and Bauxite Market Size and Forecast (2015-2030)

6 Europe Alumina and Bauxite by Countries

6.1 Europe Alumina and Bauxite Sales, Revenue and Market Share by Countries

6.1.1 Europe Alumina and Bauxite Sales by Countries (2015-2020)

6.1.2 Europe Alumina and Bauxite Revenue by Countries (2015-2020)

6.1.3 Europe Alumina and Bauxite Market Size and Forecast by Country (2020-2030)

6.2 Germany Alumina and Bauxite Market Size and Forecast (2015-2030)

6.3 United Kingdom Alumina and Bauxite Market Size and Forecast (2015-2030)

6.4 France Alumina and Bauxite Market Size and Forecast (2015-2030)

6.5 Russia Alumina and Bauxite Market Size and Forecast (2015-2030)

6.6 Italy Alumina and Bauxite Market Size and Forecast (2015-2030)

6.7 Spain Alumina and Bauxite Market Size and Forecast (2015-2030)

7 Asia-Pacific Alumina and Bauxite by Countries

7.1 Asia-Pacific Alumina and Bauxite Sales, Revenue and Market Share by Countries

7.1.1 Asia-Pacific Alumina and Bauxite Sales by Countries (2015-2020)

7.1.2 Asia-Pacific Alumina and Bauxite Revenue by Countries (2015-2020)

7.1.3 Asia-Pacific Alumina and Bauxite Market Size and Forecast by Country (2020-2030)

7.2 China Alumina and Bauxite Market Size and Forecast (2015-2030)

7.3 Japan Alumina and Bauxite Market Size and Forecast (2015-2030)

7.4 Korea Alumina and Bauxite Market Size and Forecast (2015-2030)

7.5 India Alumina and Bauxite Market Size and Forecast (2015-2030)

7.6 Southeast Asia Alumina and Bauxite Market Size and Forecast (2015-2030)

7.7 Australia Alumina and Bauxite Market Size and Forecast (2015-2030)

7.8 Taiwan Alumina and Bauxite Market Size and Forecast (2015-2030)

8 South America Alumina and Bauxite by Countries

8.1 South America Alumina and Bauxite Sales, Revenue and Market Share by Countries

8.1.1 South America Alumina and Bauxite Sales by Countries (2015-2020)

8.1.2 South America Alumina and Bauxite Revenue by Countries (2015-2020)

8.1.3 South America Alumina and Bauxite Market Size and Forecast by Country (2020-2030)

8.2 Brazil Alumina and Bauxite Market Size and Forecast (2015-2030)

8.3 Argentina Alumina and Bauxite Market Size and Forecast (2015-2030)

8.4 Columbia Alumina and Bauxite Market Size and Forecast (2015-2030)

8.5 Chile Alumina and Bauxite Market Size and Forecast (2015-2030)

9 Middle East & Africa Alumina and Bauxite by Countries

9.1 Middle East & Africa Alumina and Bauxite Sales, Revenue and Market Share by Countries

9.1.1 Middle East & Africa Alumina and Bauxite Sales by Countries (2015-2020)

9.1.2 Middle East & Africa Alumina and Bauxite Revenue by Countries (2015-2020)

9.1.3 Middle East & Africa Alumina and Bauxite Market Size and Forecast by Country (2020-2030)

9.2 Saudi Arabia Alumina and Bauxite Market Size and Forecast (2015-2030)

9.3 Turkey Alumina and Bauxite Market Size and Forecast (2015-2030)

9.4 Egypt Alumina and Bauxite Market Size and Forecast (2015-2030)

9.5 South Africa Alumina and Bauxite Market Size and Forecast (2015-2030)

9.6 Nigeria Alumina and Bauxite Market Size and Forecast (2015-2030)

10 Global Alumina and Bauxite Market Segment by Types

10.1 Global Alumina and Bauxite Sales, Revenue and Market Share by Types (2015-2020)

10.1.1 Global Alumina and Bauxite Sales and Market Share by Types (2015-2020)

10.1.2 Global Alumina and Bauxite Revenue and Market Share by Types (2015-2020)

10.1.3 Global Alumina and Bauxite Price by Type (2015-2020)

10.2 Global Alumina and Bauxite Market Size and Forecast by Type (2020-2030)

10.2.1 Global Alumina and Bauxite Sales and Forecast by Type (2020-2030)

10.2.2 Global Alumina and Bauxite Revenue and Forecast by Type (2020-2030)

10.2.3 Global Alumina and Bauxite Price and Forecast by Type (2020-2030)

11 Asia Alumina and Bauxite Market Segment by Types

11.1 Asia Alumina and Bauxite Sales, Revenue and Market Share by Types (2015-2020)

11.1.1 Asia Alumina and Bauxite Sales and Market Share by Types (2015-2020)

11.1.2 Asia Alumina and Bauxite Revenue and Market Share by Types (2015-2020)

11.1.3 Asia Alumina and Bauxite Price by Type (2015-2020)

11.2 Asia Alumina and Bauxite Market Size and Forecast by Type (2020-2030)

11.2.1 Asia Alumina and Bauxite Sales and Forecast by Type (2020-2030)

11.2.2 Asia Alumina and Bauxite Revenue and Forecast by Type (2020-2030)

11.2.3 Asia Alumina and Bauxite Price and Forecast by Type (2020-2030)

12 Global Alumina and Bauxite Market Segment by Application

12.1 Global Alumina and Bauxite Sales, Revenue and Market Share by Application (2015-2020)

12.1.1 Global Alumina and Bauxite Sales and Market Share by Application (2015-2020)

12.1.2 Global Alumina and Bauxite Revenue and Market Share by Application (2015-2020)

12.1.3 Global Alumina and Bauxite Price by Application (2015-2020)

12.2 Global Alumina and Bauxite Market Size and Forecast by Application (2020-2030)

12.2.1 Global Alumina and Bauxite Sales and Forecast by Application (2020-2030)

12.2.2 Global Alumina and Bauxite Revenue and Forecast by Application (2020-2030)

12.2.3 Global Alumina and Bauxite Price and Forecast by Application (2020-2030)

12.3 Global Alumina Market Sales Forecast (2020-2030)

12.4 Global Alumina Market Revenue Forecast (2020-2030)

12.5 Global Alumina Market Price Forecast (2020-2030)

12.6 Global Bauxite Market Sales Forecast (2020-2030)

12.7 Global Bauxite Market Revenue Forecast (2020-2030)

12.8 Global Bauxite Market Price Forecast (2020-2030)

13 Sales Channel, Distributors, Traders and Dealers

13.1 Sales Channel Status

13.1.1 Direct Channel

13.1.2 Indirect Channel

13.2 Distributors

13.3 Customers of Alumina and Bauxite

13.4 Market Dynamics

13.4.1 Opportunities

13.4.2 Risk

13.4.3 Driving Force

14 Research Findings and Conclusion

15 Appendix

15.1 Methodology

15.2 Research Data Source