1. Global Aircraft Piston Engines Market Outlook

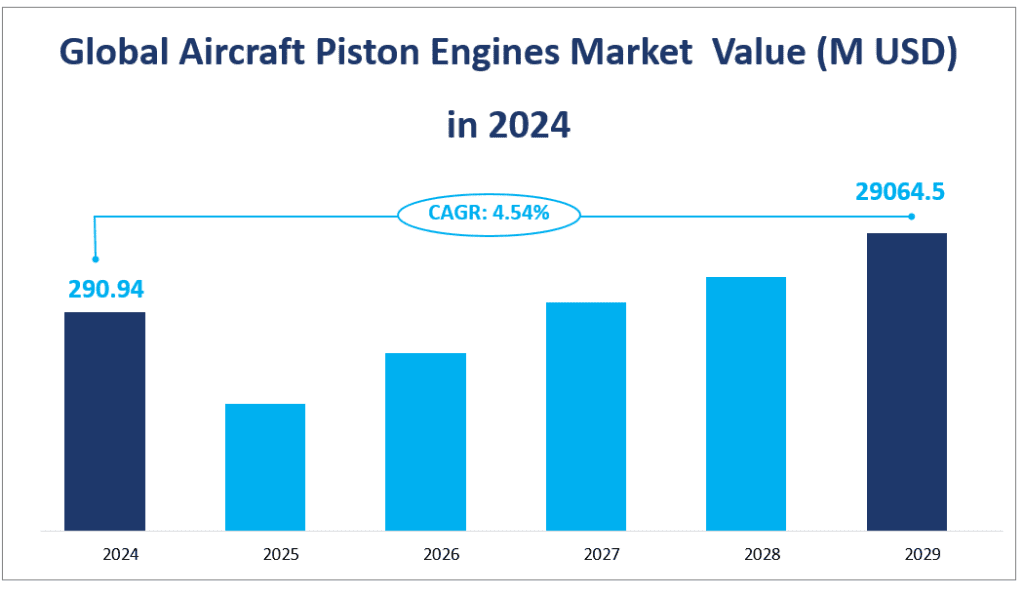

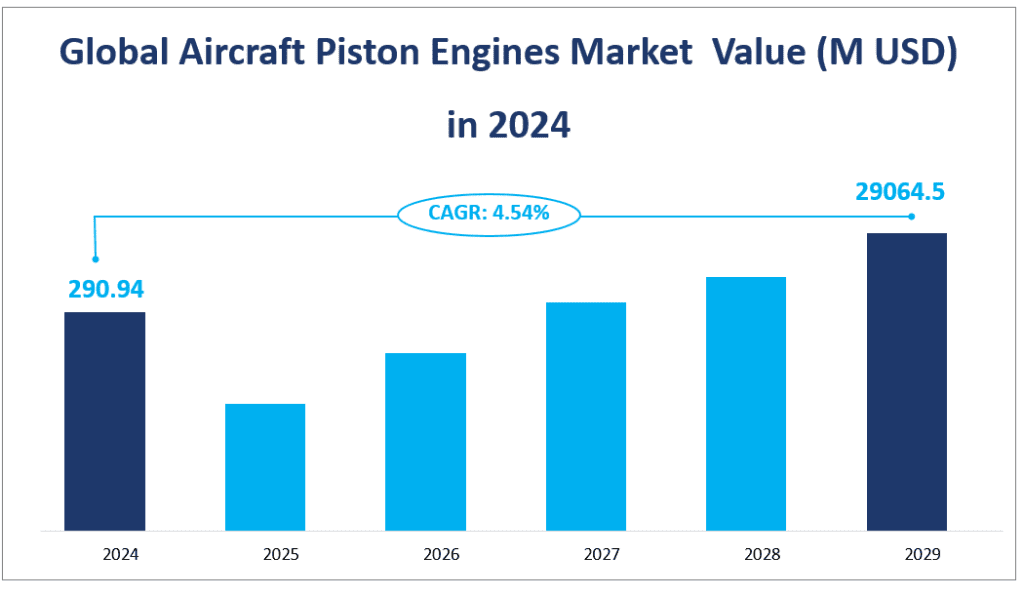

The global aircraft piston engines market, a segment of the broader aviation industry, is anticipated to experience significant growth in the coming years. In 2024, the market revenue is projected to reach $290.94 million. This figure is a testament to the enduring importance of piston engines in various aircraft applications, despite the rise of more modern propulsion systems. The CAGR for the aircraft piston engines market from 2024 to 2029 is 4.54%, reflecting the market’s resilience and potential for expansion.

Aircraft piston engines, also known as reciprocating engines, are internal combustion engines that convert pressure into rotational motion using one or more reciprocating pistons. They are the lifeblood of many general aviation aircraft, including light sport aircraft, ultralight aircraft, and drones. These engines operate on similar principles to automobile engines but are adapted for aviation use with features such as dual ignition systems for redundancy and safety, and air cooling to reduce weight. The market for these engines is segmented by type, wing type, and geography, with a focus on providing a detailed dissection of the market across various data points.

Global Aircraft Piston Engines Market Value (M USD) in 2024

2. Driving Factors of the Aircraft Piston Engines Market

The growth of the aircraft piston engines market is driven by several key factors. Firstly, the global demand for general aviation aircraft, which heavily rely on piston engines, is on the rise. These aircraft are used for a variety of purposes, including flight training, recreational flying, and aerial work such as agriculture and surveying. The growing popularity of sport and recreational aviation is a significant contributor to the market’s expansion.

Secondly, technological advancements are playing a crucial role in enhancing the performance and efficiency of piston engines. Innovations such as fuel injection systems, improved materials for better heat resistance, and advancements in engine management systems are making these engines more reliable and environmentally friendly.

Thirdly, the aircraft piston engines market is also influenced by the need for more sustainable aviation practices. With a push towards reducing emissions, there is a renewed interest in piston engines for their lower pollution levels compared to some jet engines. This is particularly relevant in light of global efforts to combat climate change and the aviation industry’s commitment to reducing its environmental impact.

3. Limiting Factors of the Aircraft Piston Engines Market

Despite the positive outlook, the aircraft piston engines market faces certain challenges that could limit its growth. One of the primary constraints is the increasing adoption of more advanced propulsion systems, such as turboprops and electric engines, which offer better performance at higher altitudes and speeds. These alternatives are gaining traction in certain segments of the aviation market, potentially reducing the demand for piston engines.

Another limiting factor is the high entry barrier to the aircraft piston engine market. The production of these engines requires sophisticated technology, strict quality control, and significant capital investment. This makes it difficult for new players to enter the market, which could limit innovation and competition.

Additionally, the aircraft piston engines market is subject to strict regulatory oversight, which can impact the development and certification of new engine models. The cost and time required for compliance with these regulations can be substantial, potentially hindering the introduction of new products to the market.

In conclusion, the global aircraft piston engines market is at a crossroads where traditional technology meets modern innovation. While the market is expected to grow steadily, it must navigate the challenges posed by emerging technologies and regulatory hurdles to maintain its position in the aviation industry.

4. Analysis of Aircraft Piston Engines Market Segment

Analysis of Aircraft Piston Engines Market by Types

The aircraft piston engines market is categorized into various product types, each with distinct characteristics and market performances.

Below 150 HP Engines: These engines are designed for lighter aircraft and have a horsepower rating below 150. They are commonly used in ultralight and light sport aircraft where lower power is sufficient. The Below 150 HP Engines segment, despite being the smallest in terms of market revenue, shows promising growth due to the rising interest in affordable aviation and flight training. These engines are also seeing advancements in fuel efficiency and reduced emissions, making them attractive to environmentally conscious consumers. The market value of this type will be $74.33 million in 2024.

150-300 Hp Engines: Engines in this category provide a balance between power and efficiency, suitable for a broader range of general aviation aircraft. The 150-300 HP engines segment is a cornerstone of the aircraft piston engines market. Its large market share is a result of its versatility and the wide range of aircraft it can power. This segment is expected to maintain steady growth as it continues to meet the needs of the general aviation sector. The market value of this type will be $161.17 million in 2024.

Above 300 HP Engines: These high-horsepower engines are utilized in larger aircraft that require more power for takeoff and performance at higher weights and altitudes. The Above 300 HP engines segment, while having a smaller market share, is crucial for larger aircraft that require higher power outputs. This segment is expected to see growth, albeit at a slower pace, due to the niche market it serves and the higher costs associated with these engines. The market value of this type will be $55.44 million in 2024.

The 150-300 HP engines hold the largest market share, reflecting the high demand for engines that provide a good balance of power and efficiency for a wide range of general aviation aircraft. This segment is expected to continue its dominance due to the broad application spectrum of these engines.

In terms of growth rate, the Below 150 HP engines are projected to have the fastest growth rate. This growth can be attributed to the increasing popularity of ultralight and light sport aircraft, which are more accessible and cost-effective for recreational pilots and flight training.

Analysis of Aircraft Piston Engines Market by Application

The aircraft piston engines market is also segmented by application, with each segment serving a distinct purpose within the aviation industry.

The Light Aircraft segment is a staple of the general aviation market, offering a platform for personal transportation and flight training. While it holds a significant market share with a market value of $86.99 million in 2024, its growth rate is moderate due to the maturity of this market segment.

The Ultralight Aircraft segment is the smallest in terms of market revenue of $1.80 million in 2024 but offers the simplest and most accessible form of aviation. Its growth rate is stable, reflecting the niche market of ultralight enthusiasts.

The Light Sport Aircraft (LSA) segment is a key driver of the aircraft piston engines market, with a large market share and steady growth with a revenue of $123.81 million in 2024. The appeal of LSAs lies in their ease of operation and lower cost compared to traditional general aviation aircraft.

The Special Light-Sport Aircraft (S-LSA) segment is a specialized market with specific regulations with a revenue of $13.67 million in 2024, serving a niche audience of pilots and enthusiasts.

The Unmanned Aerial Systems (UAS) segment is the fastest-growing application with a value of $49.11 million in 2024, driven by technological advancements and the expanding use of drones in various industries. This segment is expected to continue its rapid growth as drone technology becomes more sophisticated and accessible.

In conclusion, the aircraft piston engines market is served by a variety of applications, each with its market dynamics. The Light Sport Aircraft (LSA) application leads in market share, while the Unmanned Aerial Systems (UAS) application shows the most rapid growth. As the aviation industry advances, these applications will continue to evolve, presenting new opportunities and challenges for the aircraft piston engines market.

Market Revenu by Segment

| Market Revenue in 2024 (M USD) | ||

| By Type | Below 150 Hp Engines | 74.33 |

| 150-300 Hp Engines | 161.17 | |

| Above 300 Hp Engines | 55.44 | |

| By Application | Light Aircraft | 86.99 |

| Ultralight Aircraft | 1.80 | |

| Light Sport Aircraft (LSA) | 123.81 | |

| Special Light Sport Aircraft (S-LSA) | 13.67 | |

| UAS | 49.11 | |

| Others | 15.57 |

5. Regional Analysis of the Aircraft Piston Engines Market

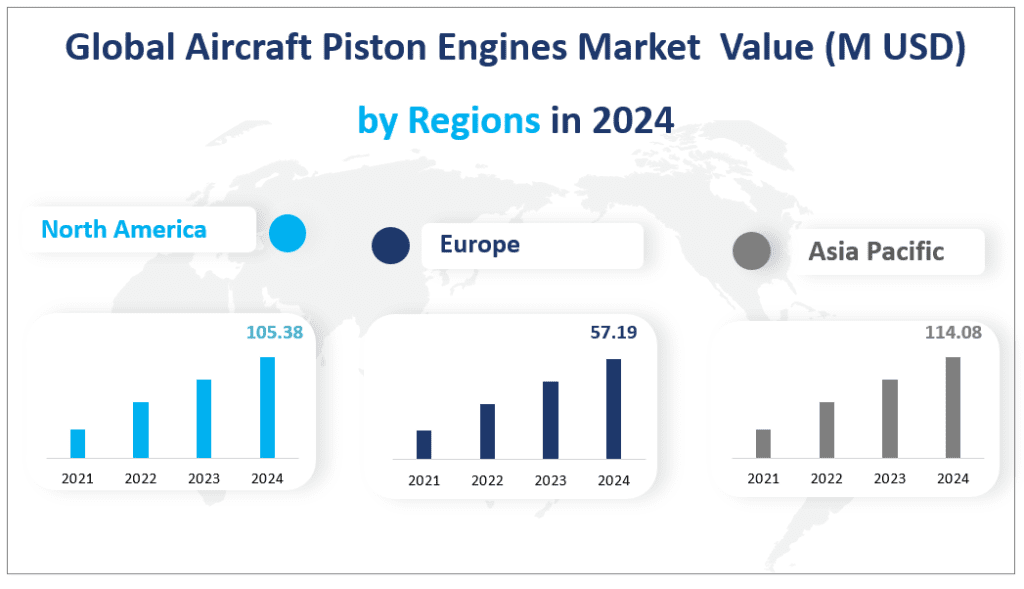

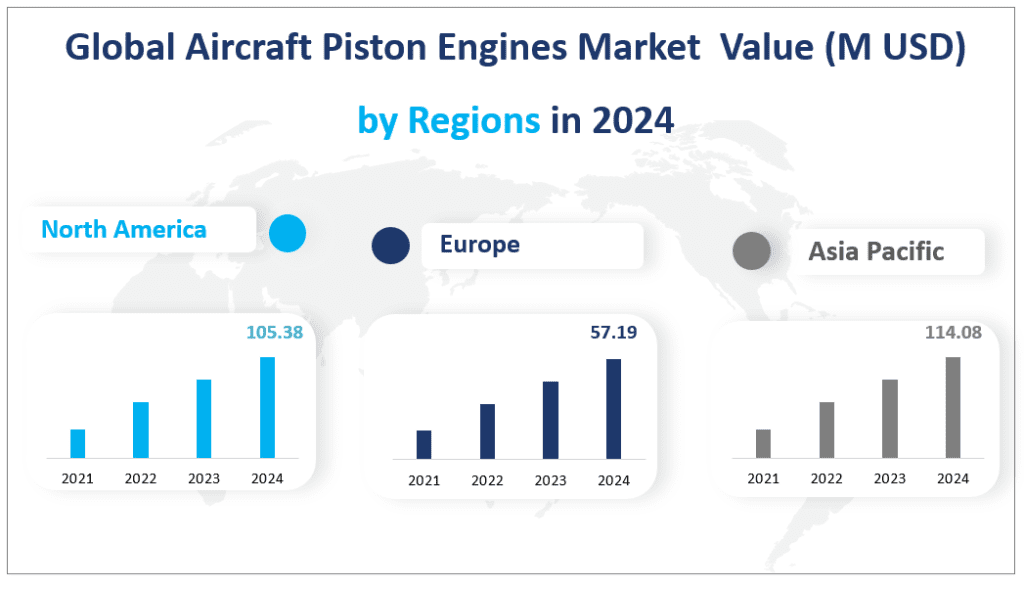

North America: With a revenue of $105.38 million in 2024, North America emerges as the largest regional market for aircraft piston engines. This region’s dominance can be attributed to its strong aviation industry, advanced technology, and the presence of key market players in the aircraft piston engines sector.

Europe: The European market is projected to generate $57.19 million in 2024. Europe’s significant share in the market is due to its well-established aviation sector and the presence of several key manufacturers and suppliers of aircraft piston engines.

Asia Pacific: The Asia Pacific region is expected to contribute $114.08 million in 2024. The growth in this region is fueled by the increasing demand for aircraft piston engines in countries like China and India, driven by the expansion of their aviation industries and the growing need for general aviation aircraft.

Latin America: Latin America is projected to have a market revenue of $6.06 million in 2024. While this region has a smaller share compared to others, it shows growth potential, particularly in countries like Brazil and Mexico, which are investing in their aviation sectors.

Middle East & Africa: This region is expected to generate $8.23 million in 2024. The Middle East, with its growing aviation market, particularly in countries like the UAE and Saudi Arabia, contributes significantly to this figure.

The North American region stands out as the biggest regional market by revenue, driven by the strong presence of established aircraft manufacturers and a robust aviation infrastructure. The region’s mature market and continuous investment in R&D for advanced piston engine technologies contribute to its leading position.

In terms of growth, the Asia Pacific region is identified as the fastest-growing market. The rapid expansion of the aviation industry in countries like China and India, along with the increasing demand for general aviation aircraft, is driving the market revenue in this region. The CAGR for Asia Pacific is projected to be 7.72% from 2024 to 2030, indicating a promising future for the aircraft piston engines market in this region.

Global Aircraft Piston Engines Market Value (M USD) in 2024

6. Analysis of the Top Five Companies in the Aircraft Piston Engines Market

The aircraft piston engines market is dominated by a few key players who contribute significantly to the market’s overall revenue and innovation.

Introduction and Business Overview: Rotax, established in 1920, is a leading manufacturer of internal combustion engines, with a global presence. Rotax is known for its high-performance engines used in various applications, including aircraft.

Products: Rotax offers a range of piston engines, including the 916 IS A series, known for their power-to-weight ratio and reliability.

Introduction and Business Overview: Lycoming, founded in 1845, is a major American manufacturer of aircraft engines, producing horizontally opposed, air-cooled engines.

Products: Lycoming’s product line includes engines like the DEL-120, a diesel cycle engine used in various aviation applications.

Introduction and Business Overview: Established in 1963, Limbach Flugmotoren is a German company known for manufacturing aircraft engines, with a significant presence in Europe and the Far East.

Products: Limbach offers engines like the “L 2400 DT/ET,” a four-cylinder four-stroke boxer engine with advanced features.

Introduction and Business Overview: AVIC, established in 1951, is a diversified state-owned aerospace and defense company headquartered in Beijing, specializing in aircraft manufacturing and engine components.

Products: AVIC offers a range of products, including the Continental CD-135 Jet-A Engine, a turbocharged, four-cylinder inline engine.

Introduction and Business Overview: Austro Engine, established in 2007, is an innovative manufacturer of aircraft engines, primarily serving the European, North American, and Asia Pacific markets.

Products: Austro Engine’s AE300 is a four-cylinder two-liter piston engine that burns jet fuel, offering high performance.

Major Players

| Company Name | Business Distribution Region |

| Rotax | Worldwide |

| Limbach Flugmotoren | Mainly in Europe and the Far East |

| Lycoming | Worldwide |

| AVIC | Worldwide |

| Austro Engine | Mainly in Europe, North America, and Asia Pacific |

| ULPower Aero | Worldwide |

1. Market Definition and Statistical Scope

1.1 Objective of the Study

1.2 Aircraft Piston Engines Market Definition

1.3 Market Scope

1.3.1 Market Segmentation by Type, Wing Type and Marketing Channel

1.3.2 Major Geographies Covered (North America, Europe, Asia Pacific, Middle East & Africa, Latin America)

1.4 Years Considered for the Study (2019-2030)

1.5 Currency Considered (U.S. Dollar)

1.6 Stakeholders

1.7 Global Aircraft Piston Engines Sales Volume, Revenue and Growth Rate by Aircraft Type 2019-2030

1.8 Global Aircraft Piston Engines Sales Volume, Revenue and Growth Rate by Aircraft Weight Classes 2019-2030

2 Key Companies’ Profile

2.1 Competitive Profile

2.1.1 Global Aircraft Piston Engines Sales Volume and Market Share by Companies

2.1.2 Global Aircraft Piston Engines Revenue and Market Share by Companies

2.2 Rotax

2.2.1 Brief Introduction of Rotax

2.2.2 Rotax Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.2.3 Rotax Related Products/Service Introduction

2.2.4 Rotax Business Overview

2.3 Limbach Flugmotoren

2.3.1 Brief Introduction of Limbach Flugmotoren

2.3.2 Limbach Flugmotoren Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.3.3 Limbach Flugmotoren Related Products/Service Introduction

2.3.4 Limbach Flugmotoren Business Overview

2.4 Lycoming

2.4.1 Brief Introduction of Lycoming

2.4.2 Lycoming Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.4.3 Lycoming Related Products/Service Introduction

2.4.4 Lycoming Business Overview

2.5 AVIC

2.5.1 Brief Introduction of AVIC

2.5.2 AVIC Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.5.3 AVIC Related Products/Service Introduction

2.5.4 AVIC Business Overview

2.6 Austro Engine

2.6.1 Brief Introduction of Austro Engine

2.6.2 Austro Engine Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.6.3 Austro Engine Related Products/Service Introduction

2.6.4 Austro Engine Business Overview

2.7 ULPower Aero

2.7.1 Brief Introduction of ULPower Aero

2.7.2 ULPower Aero Sales Volume, Growth Rate and Global Market Share from 2019-2024

2.7.3 ULPower Aero Related Products/Service Introduction

2.7.4 ULPower Aero Business Overview

3. Global Aircraft Piston Engines Market Segmented by Type

3.1 Global Aircraft Piston Engines Sales Volume, Revenue and Growth Rate by Type 2019-2024

3.2 Below 150 Hp Engines

3.2.1 1-75 Hp Engines

3.2.2 75-150 Hp Engines

3.3 150-300 Hp Engines

3.4 Above 300 Hp Engines

3.5 Global UAS Engines Sales Volume, Revenue and Growth Rate by Type 2019-2024

4 Global Aircraft Piston Engines Market Segmented by Wing Type

4.1 Global Aircraft Piston Engines Sales Volume, Revenue and Growth Rate by Wing Type 2019-2024

4.2 Fixed Wing

4.3 Rotorcraft

5 Aircraft Piston Engines Industry Chain Analysis

5.1 Value Chain Status

5.2 Upstream Raw Material Analysis

5.3 Midstream Major Company Analysis by Sales Area

5.4 Distributors/Traders

5.5 Downstream Major Customer Analysis

5.6 Value Chain Under Regional Situation

6. The Development and Dynamics of Aircraft Piston Engines Market

6.1 Driving Factors of the Market

6.2 Factors Challenging the Market

6.3 Opportunities of the Global Aircraft Piston Engines Market (Regions, Growing/Emerging Downstream Market Analysis)

6.4 Technology Status and Developments in the Aircraft Piston Engines Market

6.5 Industry News

6.6 Market Investment Scenario Strategic Recommendations

6.7 The Impact of Regional Situation on Aircraft Piston Engines Industries

6.8 The Impact of Inflation on Aircraft Piston Engines Industries

6.9 The Transformative Power of AI on Aircraft Piston Engines Industries

6.10 Economic Development in an Era of Climate Change

6.11 Industry SWOT Analysis

6.12 The Development and Dynamics of UAS

7 Global Aircraft Piston Engines Market Segmented by Geography

7.1 Global Aircraft Piston Engines Revenue and Market Share by Region 2019-2024

7.2 Global Aircraft Piston Engines Sales Volume and Market Share by Region 2019-2024

8 North America

8.1 North America Aircraft Piston Engines Sales Volume, Price, Revenue, Gross Margin and Gross Analysis from 2019-2024

8.2 North America Aircraft Piston Engines Sales Volume Analysis from 2019-2024

8.3 North America Aircraft Piston Engines Market by Country

8.3.1 North America Aircraft Piston Engines Sales Volume by Country (2019-2024)

8.3.2 North America Aircraft Piston Engines Revenue by Country (2019-2024)

8.3.3 United States Aircraft Piston Engines Sales Volume and Growth (2019-2024)

8.3.4 Canada Aircraft Piston Engines Sales Volume and Growth (2019-2024)

8.4 North America Aircraft Piston Engines Sales Volume, and Revenue by Type, Aircraft Type, Aircraft Weight Classes and Company from 2019-2024

8.4.1 North America Aircraft Piston Engines Sales Volume by Type

8.4.2 North America Aircraft Piston Engines Sales Volume by Aircraft Type

8.4.3 North America Aircraft Piston Engines Sales Volume by Weight Classes

8.4.4 North America Major 3 Company Aircraft Piston Engines Sales Volume and Revenue

9 Europe

9.1 Europe Aircraft Piston Engines Sales Volume, Price, Revenue, Gross Margin and Gross Analysis from 2019-2024

9.2 Europe Aircraft Piston Engines Sales Volume Analysis from 2019-2024

9.3 Europe Aircraft Piston Engines Market by Country

9.3.1 Europe Aircraft Piston Engines Sales Volume by Country (2019-2024)

9.3.2 Europe Aircraft Piston Engines Revenue by Country (2019-2024)

9.3.3 Germany Aircraft Piston Engines Sales Volume and Growth (2019-2024)

9.3.4 UK Aircraft Piston Engines Sales Volume and Growth (2019-2024)

9.3.5 France Aircraft Piston Engines Sales Volume and Growth (2019-2024)

9.3.6 Italy Aircraft Piston Engines Sales Volume and Growth (2019-2024)

9.3.7 Spain Aircraft Piston Engines Sales Volume and Growth (2019-2024)

9.4 Europe Aircraft Piston Engines Sales Volume, and Revenue by Type, Aircraft Type, Aircraft Weight Classes and Company from 2019-2024

9.4.1 Europe Aircraft Piston Engines Sales Volume by Type

9.4.2 Europe Aircraft Piston Engines Sales Volume by Aircraft Type

9.4.3 Europe Aircraft Piston Engines Sales Volume by Weight Classes

9.4.4 Europe Major 3 Company Aircraft Piston Engines Sales Volume and Revenue

10 Asia Pacific

10.1 Asia Pacific Aircraft Piston Engines Sales Volume, Price, Revenue, Gross Margin and Gross Analysis from 2019-2024

10.2 Asia Pacific Aircraft Piston Engines Sales Volume Analysis from 2019-2024

10.3 Asia Pacific Aircraft Piston Engines Market by Country

10.3.1 Asia Pacific Aircraft Piston Engines Sales Volume by Country (2019-2024)

10.3.2 Asia Pacific Aircraft Piston Engines Revenue by Country (2019-2024)

10.3.3 China Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.3.4 Japan Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.3.5 South Korea Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.3.6 Australia Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.3.7 India Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.3.8 Southeast Asia Aircraft Piston Engines Sales Volume and Growth (2019-2024)

10.4 Asia Pacific Aircraft Piston Engines Sales Volume, and Revenue by Type, Aircraft Type, Aircraft Weight Classes and Company from 2019-2024

10.4.1 Asia Pacific Aircraft Piston Engines Sales Volume and Revenue by Type

10.4.2 Asia Pacific Aircraft Piston Engines Sales Volume and Revenue by Aircraft Type

10.4.3 Asia Pacific Aircraft Piston Engines Sales Volume and Revenue by Weight Classes

10.4.4 Asia Pacific Major 3 Company Aircraft Piston Engines Sales Volume and Revenue

11 Latin America

11.1 Latin America Aircraft Piston Engines Sales Volume, Price, Revenue, Gross Margin and Gross Analysis from 2019-2024

11.2 Latin America Aircraft Piston Engines Sales Volume Analysis from 2019-2024

11.3 Latin America Aircraft Piston Engines Market by Country

11.3.1 Latin America Aircraft Piston Engines Sales Volume by Country (2019-2024)

11.3.2 Latin America Aircraft Piston Engines Revenue by Country (2019-2024)

11.3.3 Brazil Aircraft Piston Engines Sales Volume and Growth (2019-2024)

11.3.4 Mexico Aircraft Piston Engines Sales Volume and Growth (2019-2024)

11.3.5 Argentina Aircraft Piston Engines Sales Volume and Growth (2019-2024)

11.4 Latin America Aircraft Piston Engines Sales Volume, and Revenue by Type, Aircraft Type, Aircraft Weight Classes and Company from 2019-2024

11.4.1 Latin America Aircraft Piston Engines Sales Volume and Revenue by Type

11.4.2 Latin America Aircraft Piston Engines Sales Volume and Revenue by Aircraft Type

11.4.3 Latin America Aircraft Piston Engines Sales Volume and Revenue by Weight Classes

12 Middle East & Africa

12.1 Middle East & Africa Aircraft Piston Engines Sales Volume, Price, Revenue, Gross Margin and Gross Analysis from 2019-2024

12.2 Middle East & Africa Aircraft Piston Engines Sales Volume Analysis from 2019-2024

12.3 Middle East & Africa Aircraft Piston Engines Market by Country

12.3.1 Middle East & Africa Aircraft Piston Engines Sales Volume by Country (2019-2024)

12.3.2 Middle East & Africa Aircraft Piston Engines Revenue by Country (2019-2024)

12.3.3 Saudi Arabia Aircraft Piston Engines Sales Volume and Growth (2019-2024)

12.3.4 UAE Aircraft Piston Engines Sales Volume and Growth (2019-2024)

12.3.5 Egypt Aircraft Piston Engines Sales Volume and Growth (2019-2024)

12.3.6 South Africa Aircraft Piston Engines Sales Volume and Growth (2019-2024)

12.4 Middle East & Africa Aircraft Piston Engines Sales Volume, and Revenue by Type, Aircraft Type, Aircraft Weight Classes and Company from 2019-2024

12.4.1 Middle East & Africa Aircraft Piston Engines Sales Volume and Revenue by Type

12.4.2 Middle East & Africa Aircraft Piston Engines Sales Volume and Revenue by Aircraft Type

12.4.3 Middle East & Africa Aircraft Piston Engines Sales Volume and Revenue by Weight Classes

13. Global Aircraft Piston Engines Market Forecast by Geography, Type, and Wing Type 2024-2030

13.1 Forecast of the Global Aircraft Piston Engines Market from 2024-2030 by Region

13.2 Global Aircraft Piston Engines Sales Volume and Growth Rate Forecast by Type (2024-2030)

13.3 Global Aircraft Piston Engines Sales Volume and Growth Rate Forecast by Wing Type (2024-2030)

14 Appendix

14.1 Methodology

14.2 Research Data Source

14.2.1 Secondary Data

14.2.2 Primary Data

14.2.3 Market Size Estimation

14.2.4 Legal Disclaimer