1. Global Thermoelectric Cooler for Optical Transceiver Market

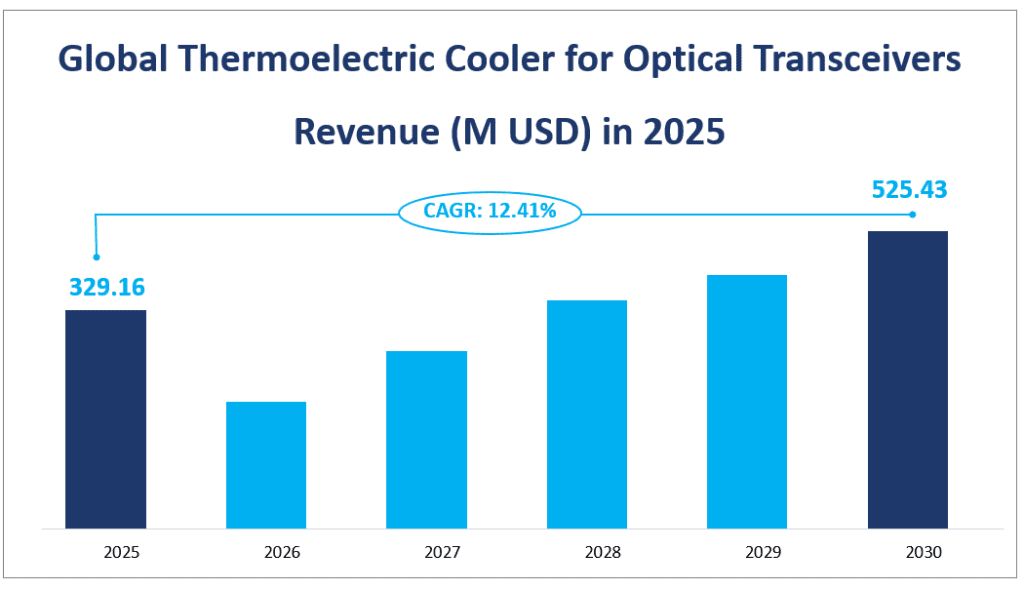

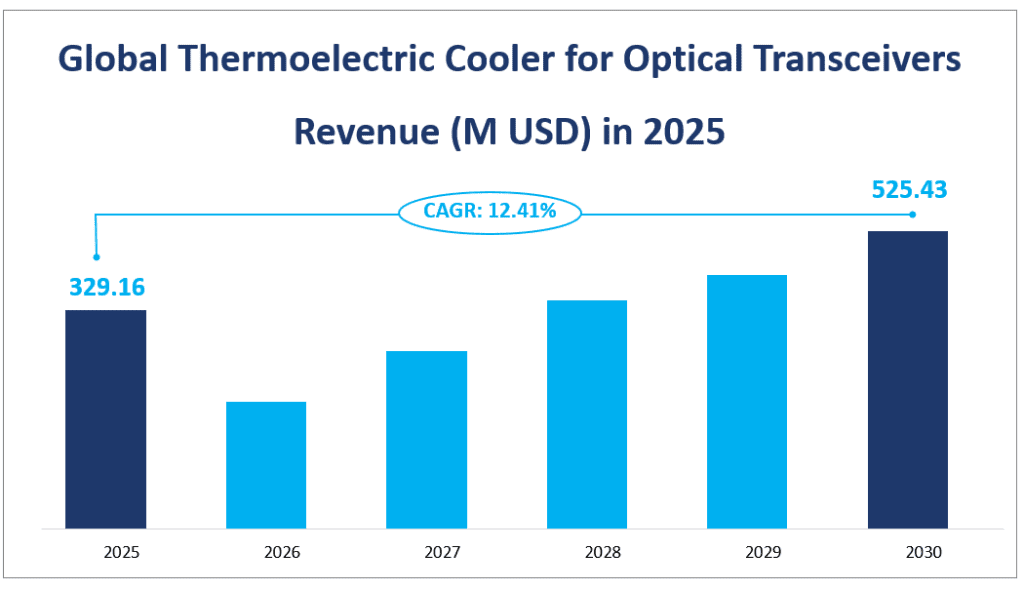

The thermoelectric coolers for optical transceivers are a critical component in managing heat in optical communication devices, the global thermoelectric coolers for optical transceivers market is expected to witness significant growth in the coming years. In 2025, the thermoelectric coolers for optical transceivers market revenue is projected to reach $329.16 million with a CAGR of 12.41% from 2025 to 2030.

A Thermoelectric Cooler, also known as a Peltier cooler, is a semiconductor device that utilizes the Peltier effect to create a temperature difference, enabling active cooling or heating. This technology is vital for maintaining the performance and longevity of optical transceivers, which are integral to data transmission in modern communication networks.

The thermoelectric coolers for optical transceivers market’s growth can be attributed to several driving factors, including the increasing demand for high-speed data communication, the proliferation of data centers, and the growth of 5G networks. As data traffic continues to surge, the need for efficient cooling solutions in optical transceivers becomes more critical. Thermoelectric coolers offer a maintenance-free, reliable, and energy-efficient alternative to traditional cooling methods, making them an attractive choice for the telecommunications industry.

Global Thermoelectric Cooler for Optical Transceivers Revenue (M USD) in 2025

2. Driving Factors of the Thermoelectric Cooler for Optical Transceiver Market

The growth of the thermoelectric cooler for optical transceivers market is propelled by several key factors. Firstly, the rapid expansion of the global data center industry has created a surge in demand for efficient cooling solutions. As data centers house thousands of servers generating heat, thermoelectric coolers provide a reliable means of temperature management. Secondly, the advent of 5G technology and the Internet of Things (IoT) is driving the need for high-speed, reliable optical transceivers, which in turn require advanced cooling technologies like thermoelectric coolers.

Another driving factor is the technological innovation in the field of thermoelectric materials. Research and development in materials with higher figures of merit (ZT) are leading to more efficient thermoelectric coolers, which can perform better at lower costs. Additionally, the growing awareness of energy efficiency and the push for green technologies are making thermoelectric coolers, with their solid-state and maintenance-free operation, more appealing to the market.

3. Limiting Factors of the Thermoelectric Cooler for Optical Transceiver Market

However, the thermoelectric cooler for optical transceivers market faces certain challenges that could limit its growth. One of the primary constraints is the high production cost of thermoelectric coolers compared to traditional cooling systems. The materials used in these coolers, such as bismuth telluride and lead telluride, are often expensive and require complex manufacturing processes. This high cost can be a barrier to entry for smaller companies and may limit the market’s growth until costs are reduced through further technological advancements and economies of scale.

The thermoelectric cooler for optical transceivers market also faces intense competition, with many players vying for market share. This competition can lead to price wars, which may erode profit margins and hinder investment in research and development. Additionally, the market is sensitive to fluctuations in raw material prices and global supply chain disruptions, which can impact production and sales.

In conclusion, while the thermoelectric cooler for optical transceivers market is poised for significant growth due to technological advancements and increasing demand from key industries, it must also navigate challenges related to high production costs and market competition. Addressing these issues will be crucial for the market to achieve its full potential and continue its upward trajectory.

4. Thermoelectric Cooler for Optical Transceiver Market Segment

Types of Thermoelectric Cooler for the Optical Transceiver Market

The Thermoelectric Cooler for Optical Transceiver market is segmented into two primary product types: Single Stage Module and Multiple Stage Modules.

Single Stage Module: This type of thermoelectric cooler typically produces a maximum temperature difference of 70°C between its hot and cold sides. They are compact and often used in applications where a simple cooling solution is required. In terms of market revenue, the Single Stage Module is expected to generate a significant sum, reflecting its widespread adoption and the maturity of the technology. By 2025, the Single Stage Module is projected to command the largest market share with 70.86%, underpinned by its established presence in the market and the reliability of the technology.

Multiple Stage Modules: Designed to achieve higher temperature differences than single-stage modules, these are essentially stacked or cascaded modules. They are utilized in scenarios where a more substantial temperature differential is necessary for optimal performance. Despite their higher complexity and cost, Multiple Stage Modules are gaining traction due to their enhanced capabilities. By 2025, this type is expected to exhibit the fastest growth rate in terms of market revenue with a share of 29.14%. The increasing demand for advanced cooling solutions in high-performance optical transceivers is driving the growth of multiple-stage modules, positioning them as a key player in the market’s future.

In 2025, the market revenue for Single Stage Modules is anticipated to reach a substantial figure, with a significant share of the overall market. However, it is the multiple-stage modules that are expected to see the most rapid growth, driven by technological advancements and the need for more efficient cooling solutions in data-intensive applications.

The choice between single-stage and multiple-stage modules often depends on the specific requirements of the optical transceiver application. While Single Stage Modules offer a cost-effective solution for basic cooling needs, Multiple Stage Modules provide the high-performance cooling necessary for advanced applications, such as high-speed data transmission and next-generation communication technologies.

As the market continues to evolve, the competition between these two product types will shape the direction of technological development and innovation. The biggest market share will likely remain with Single Stage Modules due to their established market presence and cost-effectiveness, but the fastest growth rate will be claimed by Multiple Stage Modules, reflecting the market’s shift towards more sophisticated cooling technologies.

Applications of the Thermoelectric Cooler for Optical Transceiver Market

Telecom: This application refers to the exchange of information over significant distances by electronic means, encompassing all types of voice, data, and video transmission. The Telecom sector has been a traditional adopter of thermoelectric coolers due to the critical need for maintaining the performance of optical transceivers in communication infrastructure. By 2025, the Telecom application is expected to hold the largest market share of 28.78% in terms of revenue. This is attributed to the ongoing expansion of telecommunications networks globally and the increasing demand for reliable and efficient cooling solutions in this sector.

Datacom: Data communication pertains to the transmission of digital data between computers, facilitated by either cable media or wireless media. The Datacom application has been growing rapidly, with the Internet being the most prominent example. By 2025, the Datacom application is projected to exhibit the fastest growth rate in market revenue with a share of 71.22%. This growth is fueled by the exponential increase in data traffic, the proliferation of data centers, and the need for high-performance cooling solutions to manage the heat generated by dense data processing.

The market revenue for the Telecom application is expected to remain substantial in 2025, given its established demand and the continuous expansion of global communication networks. However, it is the Datacom application that is anticipated to experience the most rapid growth, driven by the unprecedented surge in data usage and the consequent need for advanced cooling technologies in data centers.

The distinction between Telecom and Datacom applications is becoming increasingly significant as the market evolves. While Telecom applications continue to require reliable cooling solutions for maintaining existing communication infrastructure, Datacom applications are at the forefront of driving market growth due to the explosive growth in data traffic and the need for high-performance data processing capabilities.

Thermoelectric Cooler for Optical Transceiver Market Revenue and Share by Segment

| Market Revenue in 2024 | Market Share in 2024 | ||

| By Type | Single Stage Module | 233.26 M USD | 70.86% |

| Multiple Stage Modules | 95.90 M USD | 29.14% | |

| By Application | Telecom | 94.72 M USD | 28.78% |

| Datacom | 234.44 M USD | 71.22% |

5. Regional Thermoelectric Cooler for Optical Transceiver Market

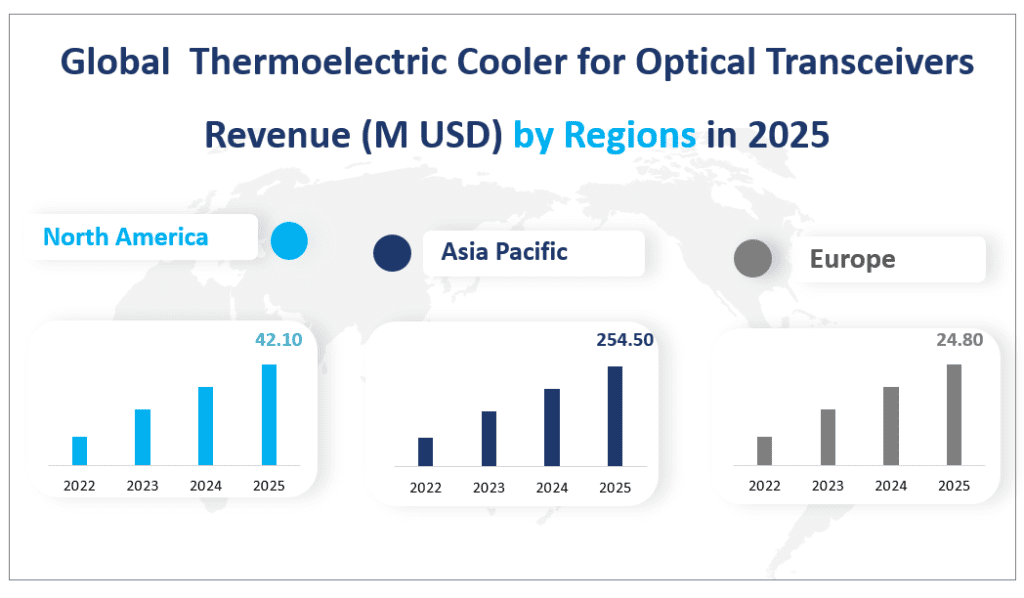

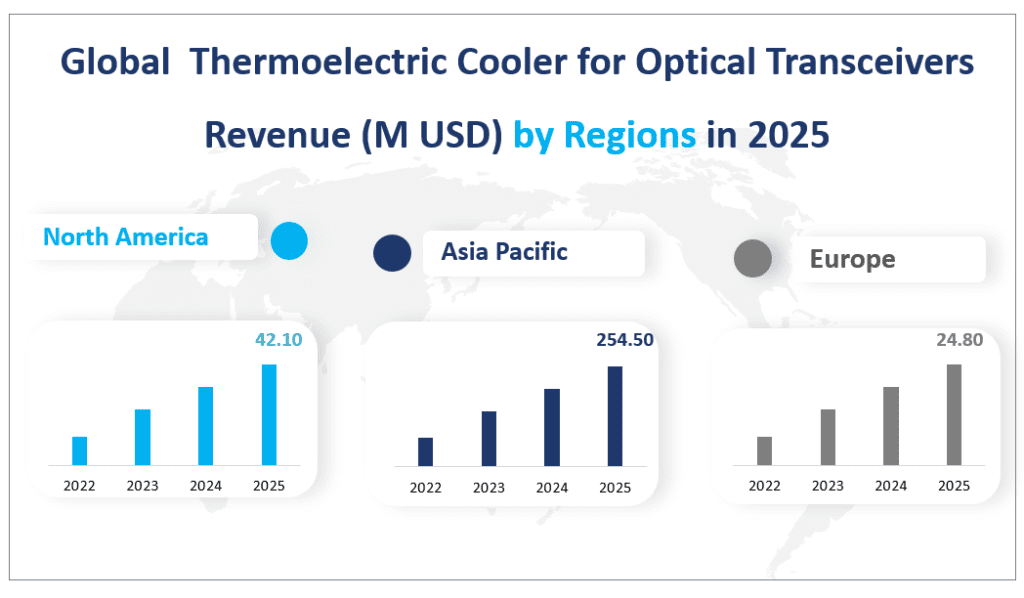

Asia-Pacific

The Asia-Pacific region is anticipated to be the largest revenue contributor in 2025, driven by the rapid growth of the electronics and telecommunications industries, particularly in China, Japan, and South Korea. The region’s market revenue is expected to be substantial with $254.50 million in 2025. This growth is attributed to the presence of major manufacturers, a strong electronics supply chain, and the increasing demand for high-speed data transmission in the region.

North America

North America is projected to be the second-largest revenue contributor, with the United States being a key player in the market. The region’s strong focus on technological innovation and the presence of major data center operators and telecom companies contribute to this growth. The market in North America is expected to grow steadily with a revenue of $42.10 million in 2025, reflecting the region’s commitment to advancing optical communication technologies.

Europe

Europe, with its strong industrial base and technological advancements, is expected to hold a significant share with a market revenue of $24.80 million in 2025. Countries like Germany, France, and the UK are expected to contribute substantially to the region’s growth, driven by investments in 5G infrastructure and data center expansion.

Latin America and Middle East & Africa

While these regions are expected to have a smaller share of the market revenue compared to the others, they are not to be overlooked. Latin America, with countries like Brazil and Mexico, and the Middle East & Africa, with the UAE and Saudi Arabia as key players, are expected to show significant growth rates. The market in these regions is poised for rapid expansion due to increasing digitalization and the need for advanced communication infrastructure.

Among these regions, the Asia-Pacific market is expected to be the fastest-growing, driven by the rapid economic development and the increasing demand for advanced cooling solutions in the optical transceiver industry. The region’s focus on technological innovation and the growing need for energy-efficient cooling solutions position it as a leader in the market’s expansion.

In summary, the global Thermoelectric Cooler for Optical Transceiver market is expected to be dominated by the Asia-Pacific region in terms of revenue, with North America and Europe following closely. However, it is the Asia-Pacific region that is projected to exhibit the fastest growth, making it a key area for market players to focus on in their strategic planning and expansion efforts.

Global Thermoelectric Cooler for Optical Transceivers Revenue (M USD) by Regions in 2025

6. Top Five Companies in the Thermoelectric Cooler for Optical Transceiver Market

Established in 1980, Ferrotec is a leading manufacturer with a global presence, known for its advanced material, component, and assembly solutions. The company offers a range of thermoelectric modules and has been a significant contributor to the market, with a substantial sales revenue in 2024. Ferrotec’s products are used in various applications, including automotive climate control, cooling chillers, and optical communications.

Founded in 1966, KELK Ltd. specializes in the production and sales of thermoelectric modules and temperature control equipment. With a strong presence in Japan and a focus on innovation, KELK Ltd. has carved a niche for itself in the market, offering products like Thermo’s module and generation module.

Founded in 2008, Phononic is a relatively younger company making waves in the market with its solid-state cooling and heating technology. The company has been recognized for its disruptive technology and has partnered with Fabrinet to scale global production, catering to the growing demand from optical communications and other sectors.

Established in 1992, Kryotherm has its roots in the research and development of thermoelectric modules for the military and aerospace industries. The company has since expanded its focus to civilian applications and offers a range of micro thermoelectric Peltier modules for optoelectronics.

Major Players

| Company Name | Plants Distribution | Headquarters |

| Ferrotec | USA, Germany, Japan, and China | Japan |

| KELK Ltd. (Komatsu) | Mainly in Japan | Hiratsuka, Japan |

| Phononic | Mainly in the US | Durham, NC, USA |

| Kryotherm | Mainly in Russia | Saint-Petersburg, Russia |

1 Study Coverage

1.1 Thermoelectric Cooler for Optical Transceiver Product Introduction

1.2 Market by Type

1.2.1 Global Thermoelectric Cooler for Optical Transceiver Market Size Growth Rate by Type

1.2.2 Different Type of Thermoelectric Cooler for Optical Transceiver

1.3 Market by Application

1.3.1 Global Thermoelectric Cooler for Optical Transceiver Market Size Growth Rate by Application

1.3.2 Different Application of Thermoelectric Cooler for Optical Transceiver

1.4 Study Objectives

1.5 Years Considered

2 Executive Summary

2.1 Global Thermoelectric Cooler for Optical Transceiver Market Size Estimates and Forecasts

2.1.1 Global Thermoelectric Cooler for Optical Transceiver Revenue 2016-2027

2.1.2 Global Thermoelectric Cooler for Optical Transceiver Sales 2016-2027

2.2 Thermoelectric Cooler for Optical Transceiver Market Size by Region: 2016 Versus 2021 Versus 2027

2.3 Thermoelectric Cooler for Optical Transceiveres Historical Market Size by Region (2016-2021)

2.3.1 Global Thermoelectric Cooler for Optical Transceiver Retrospective Market Scenario in Sales by Region: 2016-2021

2.3.2 Global Thermoelectric Cooler for Optical Transceiver Retrospective Market Scenario in Revenue by Region: 2016-2021

2.4 Thermoelectric Cooler for Optical Transceiveres Market Estimates and Projections by Region (2022-2027)

2.4.1 Global Thermoelectric Cooler for Optical Transceiver Sales Forecast by Region (2022-2027)

2.4.2 Global Thermoelectric Cooler for Optical Transceiveres Revenue Forecast by Region (2022-2027)

3 Global Thermoelectric Cooler for Optical Transceiver Competitor Landscape by Players

3.1 Global Top Thermoelectric Cooler for Optical Transceiver Sales by Manufacturers

3.1.1 Global Thermoelectric Cooler for Optical Transceiver Sales by Manufacturer (2016-2021)

3.1.2 Global Thermoelectric Cooler for Optical Transceiver Sales Market Share by Manufacturer (2016-2020)

3.2 Global Thermoelectric Cooler for Optical Transceiver Revenue Manufacturers by Revenue

3.2.1 Key Thermoelectric Cooler for Optical Transceiveres Manufacturers Covered: Ranking by Revenue

3.2.2 Global Thermoelectric Cooler for Optical Transceiver Revenue by Manufacturer (2016-2021)

3.2.3 Global Thermoelectric Cooler for Optical Transceiver Revenue Share by Manufacturer (2016-2021)

3.2.4 Global Top 3 Companies by Thermoelectric Cooler for Optical Transceiver Revenue in 2020

3.2.5 Global Thermoelectric Cooler for Optical Transceiver Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

3.3 Global Thermoelectric Cooler for Optical Transceiver Price by Manufacturer (2016-2021)

3.4 Global Thermoelectric Cooler for Optical Transceiver Manufacturing Base Distribution

3.4.1 Thermoelectric Cooler for Optical Transceiver Manufacturers Manufacturing Base Distribution, Headquarters

3.4.2 Date of Establishment of Major Players

3.5 Manufacturers Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type

4.1 Global Thermoelectric Cooler for Optical Transceiver Market Size by Type (2016-2021)

4.1.1 Global Thermoelectric Cooler for Optical Transceiver Sales by Type (2016-2021)

4.1.2 Global Thermoelectric Cooler for Optical Transceiver Revenue by Type (2016-2021)

4.1.3 Thermoelectric Cooler for Optical Transceiver Average Selling Price (ASP) by Type (2016-2021)

4.2 Global Thermoelectric Cooler for Optical Transceiver Market Size Forecast by Type (2022-2027)

4.2.1 Global Thermoelectric Cooler for Optical Transceiver Sales Forecast by Type (2022-2027)

4.2.2 Global Thermoelectric Cooler for Optical Transceiver Revenue Forecast by Type (2022-2027)

4.2.3 Global Thermoelectric Cooler for Optical Transceiver Average Selling Price (ASP) Forecast by Type (2022-2027)

5 Breakdown Data by Application

5.1 Global Thermoelectric Cooler for Optical Transceiver Market Size by Application (2016-2021)

5.1.1 Global Thermoelectric Cooler for Optical Transceiver Sales by Application (2016-2021)

5.1.2 Global Thermoelectric Cooler for Optical Transceiver Revenue by Application (2016-2021)

5.1.3 Thermoelectric Cooler for Optical Transceiver Price by Application (2016-2021)

5.2 Thermoelectric Cooler for Optical Transceiver Market Size Forecast by Application (2022-2027)

5.2.1 Global Thermoelectric Cooler for Optical Transceiver Sales Forecast by Application (2022-2027)

5.2.2 Global Thermoelectric Cooler for Optical Transceiver Revenue Forecast by Application (2022-2027)

5.2.3 Global Thermoelectric Cooler for Optical Transceiver Price Forecast by Application (2022-2027)

6 China by Players, Type and Application

6.1 China Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

6.1.1 China Thermoelectric Cooler for Optical Transceiveres Sales YoY Growth 2016-2027

6.1.2 China Thermoelectric Cooler for Optical Transceiveres Revenue YoY Growth 2016-2027

6.1.3 China Thermoelectric Cooler for Optical Transceiveres Market Share in Global Market 2016-2027

6.2 China Thermoelectric Cooler for Optical Transceiveres Market Size by Players (International and Local Players)

6.2.1 China Top Thermoelectric Cooler for Optical Transceiveres Players by Sales (2020-2021)

6.2.2 China Top Thermoelectric Cooler for Optical Transceiveres Players by Revenue (2020-2021)

6.3 China Thermoelectric Cooler for Optical Transceiveres Historic Market Review by Type (2016-2021)

6.3.1 China Thermoelectric Cooler for Optical Transceiveres Sales Market Share by Type (2016-2021)

6.3.2 China Thermoelectric Cooler for Optical Transceiveres Revenue Market Share by Type (2016-2021)

6.4 China Thermoelectric Cooler for Optical Transceiveres Market Estimates and Forecasts by Type (2022-2027)

6.4.1 China Thermoelectric Cooler for Optical Transceiveres Sales Forecast by Type (2022-2027)

6.4.2 China Thermoelectric Cooler for Optical Transceiveres Revenue Forecast by Type (2022-2027)

6.5 China Thermoelectric Cooler for Optical Transceiveres Historic Market Review by Application (2016-2021)

6.5.1 China Thermoelectric Cooler for Optical Transceiveres Sales Market Share by Application (2016-2021)

6.5.2 China Thermoelectric Cooler for Optical Transceiveres Revenue Market Share by Application (2016-2021)

6.6 China Thermoelectric Cooler for Optical Transceiveres Market Estimates and Forecasts by Application (2022-2027)

6.6.1 China Thermoelectric Cooler for Optical Transceiveres Sales Forecast by Application (2022-2027)

6.6.2 China Thermoelectric Cooler for Optical Transceiveres Revenue Forecast by Application (2022-2027)

7 North America

7.1 North America Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

7.2 North America Thermoelectric Cooler for Optical Transceiver Market Facts & Figures by Country

7.2.1 North America Thermoelectric Cooler for Optical Transceiver Sales by Country

7.2.2 North America Thermoelectric Cooler for Optical Transceiver Revenue by Country

7.2.3 United States

7.2.4 Canada

8 Asia Pacific

8.1 Asia Pacific Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

8.2 Asia Pacific Thermoelectric Cooler for Optical Transceiver Market Facts & Figures by Country

8.2.1 Asia Pacific Thermoelectric Cooler for Optical Transceiver Sales by Country

8.2.2 Asia Pacific Thermoelectric Cooler for Optical Transceiver Revenue by Country

8.2.3 China

8.2.4 Japan

8.2.5 South Korea

8.2.6 India

8.2.7 Australia

8.2.8 Southeast Asia

9 Europe

9.1 Europe Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

9.2 Europe Thermoelectric Cooler for Optical Transceiver Market Facts & Figures by Country

9.2.1 Europe Thermoelectric Cooler for Optical Transceiver Sales by Country

9.2.2 Europe Thermoelectric Cooler for Optical Transceiver Revenue by Country

9.2.3 Germany

9.2.4 France

9.2.5 U.K.

9.2.6 Italy

9.2.7 Russia

10 Latin America

10.1 Latin America Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

10.2 Latin America Thermoelectric Cooler for Optical Transceiver Market Facts & Figures by Country

10.2.1 Latin America Thermoelectric Cooler for Optical Transceiver Sales by Country

10.2.2 Latin America Thermoelectric Cooler for Optical Transceiver Revenue by Country

10.2.3 Mexico

10.2.4 Brazil

11 Middle East and Africa

11.1 Middle East and Africa Thermoelectric Cooler for Optical Transceiveres Market Size YoY Growth 2016-2027

11.2 Middle East and Africa Thermoelectric Cooler for Optical Transceiver Market Facts & Figures by Country

11.2.1 Middle East and Africa Thermoelectric Cooler for Optical Transceiver Sales by Country

11.2.2 Middle East and Africa Thermoelectric Cooler for Optical Transceiver Revenue by Country

11.2.3 Turkey

11.2.4 Saudi Arabia

11.2.5 UAE

11.2.6 South Africa

12 Company Profiles

12.1 Ferrotec

12.1.1 Ferrotec Corporation Information

12.1.2 Ferrotec Business Overview and Recent Development

12.1.3 Ferrotec Thermoelectric Cooler for Optical Transceiver Sales, Revenue and Gross Margin (2016-2021)

12.1.4 Ferrotec Thermoelectric Cooler for Optical Transceiver Products Offered

12.2 KELK Ltd. (Komatsu)

12.2.1 KELK Ltd. (Komatsu) Corporation Information

12.2.2 KELK Ltd. (Komatsu) Business Overview and Recent Development

12.2.3 KELK Ltd. (Komatsu) Thermoelectric Cooler for Optical Transceiver Sales, Revenue and Gross Margin (2016-2021)

12.2.4 KELK Ltd. (Komatsu) Thermoelectric Cooler for Optical Transceiver Products Offered

12.3 Phononic

12.3.1 Phononic Corporation Information

12.3.2 Phononic Business Overview and Recent Development

12.3.3 Phononic Thermoelectric Cooler for Optical Transceiver Sales, Revenue and Gross Margin (2016-2021)

12.3.4 Phononic Thermoelectric Cooler for Optical Transceiver Products Offered

12.4 Kryotherm

12.4.1 Kryotherm Corporation Information

12.4.2 Kryotherm Business Overview and Recent Development

12.4.3 Kryotherm Thermoelectric Cooler for Optical Transceiver Sales, Revenue and Gross Margin (2016-2021)

12.4.4 Kryotherm Thermoelectric Cooler for Optical Transceiver Products Offered

13 Market Drivers, Opportunities, Challenges and Risks Factors Analysis

13.1 Thermoelectric Cooler for Optical Transceiveres Industry Trends

13.2 Thermoelectric Cooler for Optical Transceiveres Market Drivers

13.3 Thermoelectric Cooler for Optical Transceiveres Market Challenges

13.4 Thermoelectric Cooler for Optical Transceiveres Market Restraints

14 Value Chain and Sales Channels Analysis

14.1 Value Chain Analysis

14.2 Thermoelectric Cooler for Optical Transceiver Customers

14.3 Sales Channels Analysis

14.3.1 Sales Channels

14.3.2 Distributors

15 Research Finding and Conclusion

16 Appendix

16.1 Methodology

16.2 Research Data Source

16.2.1 Secondary Data

16.2.2 Primary Data

16.2.3 Market Size Estimation

16.2.4 Legal Disclaimer