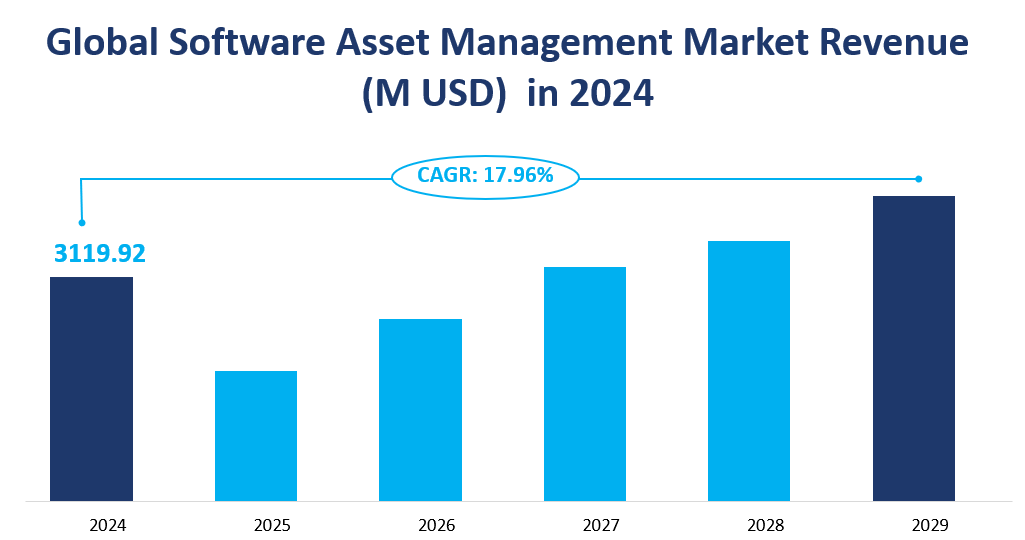

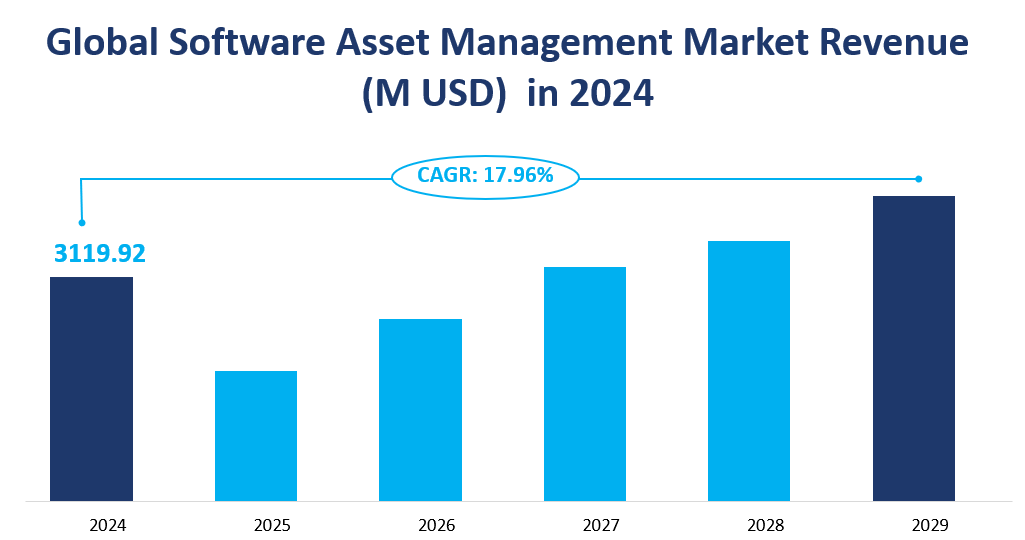

1. Software Asset Management Market Value and Growth Projections

The global Software Asset Management market is poised for significant growth, with a market value projected to reach 3119.92 million USD in 2024, with a compound annual growth rate (CAGR) of 17.96% from 2024 to 2029.

Software Asset Management is a business practice that involves managing and optimizing an organization’s software assets. It encompasses activities such as planning, procurement, deployment, maintenance, optimization, and disposal of all software owned or used by an organization.

The primary goal of SAM is to ensure cost savings, compliance assurance, risk reduction, and efficiency improvement by monitoring, evaluating, and enhancing these activities.

By implementing SAM practices, companies gain better insights into software usage and value, manage licensing effectively, and enhance system security and data integrity.

Figure Global Software Asset Management Market Revenue (M USD) in 2024

2. Driving Factors and Limiting Factors of Software Asset Management Market Growth

The growth of the Software Asset Management market is influenced by several driving factors.

One of the primary advantages of Software Asset Management is its focus on ensuring that only approved applications are introduced into the local computing environment and that software licenses are fully and appropriately utilized.

This not only helps in identifying and removing unwanted software but also in managing the company’s operational expenses such as ongoing licensing costs, upgrade costs, and manufacturer support.

The increased awareness of enterprise software asset management, driven by the need for cybersecurity, is another factor propelling the market. Cyberattacks are becoming more frequent and sophisticated, and SAM functions play a crucial role in protecting company systems and maintaining network security.

However, the market growth is not without challenges. One of the restraining factors is the initial high cost associated with implementing comprehensive SAM solutions. Many organizations, especially small to medium enterprises (SMEs), find the upfront investment daunting.

The complexity involved in deploying and integrating SAM tools with existing IT infrastructure can also hinder the market growth. Organizations, especially smaller ones, often lack the sufficient staff, expertise, and tools to implement an effective SAM program, making it difficult to keep up with licensing models and agreements.

3. Technology Innovation, Mergers, and Acquisitions in the Software Asset Management Market

The SAM market is witnessing significant technology innovation, with advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) being integrated into SAM tools.

These technologies automate many manual processes involved in software asset management, bringing efficiency, accuracy, and predictive capabilities.

AI-based asset management software can provide organizations with a range of services based on acquired data, including real-time notifications, alarms, predictive analytics, automated data insights, reporting, and more. This integration of AI and ML is improving the customer experience and increasing the efficiency and accuracy of operational workflows.

In addition to technological advancements, the SAM market is also characterized by strategic mergers and acquisitions. These activities are shaping the market landscape and consolidating the position of key players.

For instance, Flexera’s acquisition of Snow Software is a notable development that broadens its portfolio for technology value optimization. Such mergers and acquisitions not only strengthen the market presence of the companies involved but also contribute to the overall growth and innovation within the SAM market.

4. Product Types of Software Asset Management: Definitions and Market Size in 2024

Software Asset Management (SAM) encompasses various product types, primarily categorized into two main segments: On-premises and Cloud-based solutions. Each type serves distinct needs and has unique market dynamics.

On-Premises Software Asset Management

On-premises SAM solutions require organizations to install and manage software within their own IT infrastructure. This type of SAM allows for greater control over software assets, as organizations can customize the system to meet specific internal policies and security protocols.

The market size for on-premises SAM is projected to reach approximately 416.79 million USD in 2024. Despite being a traditional approach, on-premises solutions are witnessing a gradual decline in market share due to the increasing shift towards cloud-based alternatives.

Cloud Software Asset Management

In contrast, cloud-based SAM solutions leverage cloud technology to manage software assets over the internet. This model offers flexibility, scalability, and ease of access, allowing organizations to manage software assets from anywhere with an internet connection.

The cloud SAM market is expected to reach around 2703.13 million USD in 2024, making it the dominant product type in the SAM landscape.

The cloud segment is characterized by its rapid growth, with a projected CAGR of 18.21% from 2024 to 2029, indicating a strong preference among organizations for cloud solutions.

Market Share and Growth Rates

In terms of market share, cloud-based SAM solutions hold the largest portion of the market, accounting for approximately 86.64% of the total SAM market in 2024 and On-premises SAM solutions hold 13.36% of the total SAM market in 2024.

Table Market Sizes and Shares by Product Types

|

Product Type |

Market Size (M USD) in 2024 |

Market Share (%) in 2024 |

|---|---|---|

|

On-premises |

416.79 |

13.36 |

|

Cloud |

2703.13 |

86.64 |

|

Total |

3119.92 |

100.00 |

5. Applications of Software Asset Management: Definitions and Market Size in 2024

The Software Asset Management market is segmented into various applications, each serving different sectors and industries. The primary applications include Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Manufacturing, Retail and Consumer Goods, and Government.

Banking, Financial Services, and Insurance (BFSI)

The BFSI sector is one of the largest consumers of SAM solutions, with a projected market size of approximately 811.93 million USD in 2024.

This application is critical as financial institutions require stringent compliance with licensing and regulatory standards. The complexity of software usage in this sector necessitates robust SAM practices to manage risks and ensure compliance.

IT and Telecom

The IT and Telecom sector is another significant application area, expected to reach around 597.02 million USD in 2024. SAM solutions in this sector focus on managing software licenses to ensure compliance and optimize software usage, which is crucial for maintaining operational efficiency.

Manufacturing

The manufacturing sector is projected to see a market size of approximately 468.19 million USD in 2024. SAM solutions help manufacturers manage software assets that are integral to production processes, ensuring that software is utilized efficiently and compliance is maintained.

Retail and Consumer Goods

The retail sector is expected to reach a market size of about 504.69 million USD in 2024. SAM solutions in retail streamline software management processes, helping businesses optimize costs and improve operational efficiency.

Government

The government sector, while smaller in comparison, is projected to reach around 183.51 million USD in 2024. SAM solutions in this area are essential for managing software assets across various departments, ensuring compliance with licensing agreements and optimizing software usage.

Market Share and Growth Rates

Among these applications, the BFSI sector holds the largest market share, accounting for approximately 26.27% of the total SAM market in 2024. This dominance is driven by the critical need for compliance and risk management in financial operations.

In terms of growth rates, the fastest-growing application is the Retail and Consumer Goods sector, with a projected CAGR of 17.79%.

This growth is fueled by the increasing digitalization of retail operations and the need for effective software management to enhance customer experiences and operational efficiency.

Table Market Sizes and Shares by Applications

|

Application |

Market Size (M USD) in 2024 |

Market Share (%) in 2024 |

|---|---|---|

|

Banking, Financial Services, and Insurance |

811.93 |

26.27 |

|

IT and Telecom |

597.02 |

19.15 |

|

Manufacturing |

468.19 |

15.06 |

|

Retail and Consumer Goods |

504.69 |

16.09 |

|

Government |

183.51 |

5.96 |

|

Others |

1053.06 |

17.77 |

|

Total |

3119.92 |

100.00 |

6. Software Asset Management Market Sizes by Major Region in 2024

The Software Asset Management market is geographically diverse, with significant variations in market sizes and growth rates across different regions. The major regions analyzed include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

North America

North America is projected to be the largest regional market for SAM solutions, with an estimated market size of approximately 1220.21 million USD in 2024.

The region’s dominance is attributed to the high adoption of advanced technologies and the presence of numerous key players in the software industry.

The increasing focus on compliance and risk management in various sectors, particularly in BFSI and IT, further drives the demand for SAM solutions in this region.

Europe

Europe is expected to follow closely, with a projected market size of around 861.74 million USD in 2024.

The European market is characterized by stringent regulatory requirements, particularly in the financial and healthcare sectors, which necessitate effective software asset management practices. The region is also witnessing a growing trend towards cloud-based SAM solutions, contributing to its overall market growth.

Asia-Pacific

The Asia-Pacific region is anticipated to experience significant growth, with a market size projected at approximately 855.32 million USD in 2024. This region is witnessing rapid digital transformation across various industries, leading to increased investments in SAM solutions.

Countries like China and India are at the forefront of this growth, driven by their expanding IT sectors and the rising demand for compliance and efficiency in software management.

South America

In South America, the SAM market is expected to reach about 90.35 million USD in 2024. While smaller compared to other regions, the market is growing steadily as organizations recognize the importance of managing software assets effectively.

The retail and consumer goods sector is particularly driving this growth, as companies seek to optimize costs and improve operational efficiency.

Middle East & Africa

The Middle East & Africa region is projected to have a market size of approximately 92.29 million USD in 2024. The growth in this region is driven by increasing investments in technology and the growing need for compliance in various sectors, including government and finance.

Figure Global Software Asset Management Market Value by Region in 2024

7. Analysis of the Top 3 Companies in the Software Asset Management Market

7.1 ServiceNow

Company Introduction and Business Overview

ServiceNow, founded in 2004 and headquartered in Santa Clara, California, is a leading provider of cloud-based software solutions that help organizations streamline their operations and improve service delivery.

The company specializes in digital workflows, enabling businesses to automate and optimize their processes across various departments, including IT, HR, customer service, and security.

ServiceNow’s platform is designed to enhance productivity, reduce operational costs, and improve user experiences, making it a preferred choice for many enterprises.

Products Offered

ServiceNow offers a comprehensive suite of products that cater to various aspects of enterprise management. Its Software Asset Management (SAM) solution is a key component of its IT Asset Management offerings.

This solution allows organizations to track and manage their software licenses, ensuring compliance with licensing agreements while optimizing software usage.

Additionally, ServiceNow provides IT Service Management (ITSM), IT Operations Management (ITOM), and IT Business Management (ITBM) solutions, which further enhance its capabilities in managing IT assets and services.

Sales Revenue in 2023

In 2023, ServiceNow reported a sales revenue of approximately 212.88 million USD from its Software Asset Management solutions.

This revenue reflects the company’s strong market position and the growing demand for its products as organizations increasingly recognize the importance of effective software management.

7.2 Broadcom

Company Introduction and Business Overview

Broadcom Inc., established in 1991 and headquartered in San Jose, California, is a global technology leader that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions.

The company serves various markets, including data center, networking, software, broadband, wireless, and storage. Broadcom’s extensive portfolio and commitment to innovation have made it a key player in the technology sector, with a focus on delivering high-performance solutions that meet the evolving needs of its customers.

Products Offered

Broadcom’s Software Asset Management offerings are primarily centered around its Symantec Asset Management Suite. This suite provides organizations with tools to improve visibility into their IT assets, enabling them to track software licenses and vendor contracts effectively.

The suite helps businesses optimize their software investments, eliminate unnecessary purchases, and avoid penalties for non-compliance.

In addition to SAM solutions, Broadcom offers a wide range of products in areas such as cybersecurity, networking, and broadband, further solidifying its position in the technology landscape.

Sales Revenue in 2023

In 2023, Broadcom’s Software Asset Management solutions generated approximately 164.74 million USD in sales revenue.

This figure highlights the company’s strong performance in the SAM market and its ability to leverage its extensive product portfolio to meet customer demands.

7.3 IBM

Company Introduction and Business Overview

IBM (International Business Machines Corporation), founded in 1911 and headquartered in Armonk, New York, is one of the world’s largest technology companies.

With a rich history of innovation, IBM specializes in computer hardware, middleware, and software, as well as offering hosting and consulting services.

The company has a strong focus on research and development, which has led to numerous technological advancements and a robust portfolio of products and services that cater to various industries.

Products Offered

IBM’s Software Asset Management solutions are primarily delivered through its IBM Z Software Asset Management platform. This platform enables organizations to identify and manage their software inventory, monitor usage, and ensure compliance with licensing agreements.

IBM Z Software Asset Management provides comprehensive asset discovery, monitoring, and reporting capabilities, allowing businesses to optimize their software assets effectively.

In addition to SAM, IBM offers a wide range of products and services, including cloud computing, AI, data analytics, and cybersecurity solutions.

Sales Revenue in 2023

In 2023, IBM’s Software Asset Management solutions generated approximately 150.97 million USD in sales revenue.

This revenue reflects IBM’s strong market presence and the continued demand for its innovative software management solutions as organizations seek to enhance their operational efficiency and compliance.

1 Market Overview

1.1 Product Overview and Scope of Software Asset Management

1.2 Classification of Software Asset Management by Type

1.2.1 Overview: Global Software Asset Management Market Size by Type: 2018 Versus 2022 Versus 2030

1.2.2 Global Software Asset Management Revenue Market Share by Type in 2022

1.2.3 On-premises

1.2.4 Cloud

1.3 Global Software Asset Management Market by Applications

1.3.1 Overview: Global Software Asset Management Market Size by Application: 2018 Versus 2022 Versus 2030

1.3.2 Banking, Financial Services, and Insurance

1.3.3 IT and Telecom

1.3.4 Manufacturing

1.3.5 Retail and Consumer Goods

1.3.6 Government

1.4 Global Software Asset Management Market Size & Forecast

1.5 Global Software Asset Management Market Size and Forecast by Region

1.5.1 Global Software Asset Management Market Size by Region: 2018 VS 2022 VS 2030

1.5.2 North America Software Asset Management Status and Prospect (2018-2030)

1.5.3 Europe Software Asset Management Status and Prospect (2018-2030)

1.5.4 Asia-Pacific Software Asset Management Status and Prospect (2018-2030)

1.5.5 South America Software Asset Management Status and Prospect (2018-2030)

1.5.6 Middle East and Africa Software Asset Management Status and Prospect (2018-2030)

1.6 Market Drivers, Restraints and Trends

1.6.1 Software Asset Management Market Drivers

1.6.2 Software Asset Management Market Restraints

1.6.3 Software Asset Management Trends Analysis

2 Company Profiles

2.1 Servicenow

2.1.1 Servicenow Details

2.1.2 Servicenow Major Business

2.1.3 Servicenow Software Asset Management Product and Solutions

2.1.4 Servicenow Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.1.5 Servicenow Recent Developments and Future Plans

2.2 Broadcom

2.2.1 Broadcom Details

2.2.2 Broadcom Major Business

2.2.3 Broadcom Software Asset Management Product and Solutions

2.2.4 Broadcom Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.2.5 Broadcom Recent Developments and Future Plans

2.3 IBM

2.3.1 IBM Details

2.3.2 IBM Major Business

2.3.3 IBM Software Asset Management Product and Solutions

2.3.4 IBM Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.3.5 IBM Recent Developments and Future Plans

2.4 1E

2.4.1 1E Details

2.4.2 1E Major Business

2.4.3 1E Software Asset Management Product and Solutions

2.4.4 1E Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.4.5 1E Recent Developments and Future Plans

2.5 Microsoft

2.5.1 Microsoft Details

2.5.2 Microsoft Major Business

2.5.3 Microsoft Software Asset Management Product and Solutions

2.5.4 Microsoft Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.5.5 Microsoft Recent Developments and Future Plans

2.6 Flexera

2.6.1 Flexera Details

2.6.2 Flexera Major Business

2.6.3 Flexera Software Asset Management Product and Solutions

2.6.4 Flexera Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.6.5 Flexera Recent Developments and Future Plans

2.7 BMC Software

2.7.1 BMC Software Details

2.7.2 BMC Software Major Business

2.7.3 BMC Software Software Asset Management Product and Solutions

2.7.4 BMC Software Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.7.5 BMC Software Recent Developments and Future Plans

2.8 Micro Focus

2.8.1 Micro Focus Details

2.8.2 Micro Focus Major Business

2.8.3 Micro Focus Software Asset Management Product and Solutions

2.8.4 Micro Focus Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.8.5 Micro Focus Recent Developments and Future Plans

2.9 Open iT

2.9.1 Open iT Details

2.9.2 Open iT Major Business

2.9.3 Open iT Software Asset Management Product and Solutions

2.9.4 Open iT Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.10 USU

2.10.1 USU Details

2.10.2 USU Major Business

2.10.3 USU Software Asset Management Product and Solutions

2.10.4 USU Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.11 Matrix42

2.11.1 Matrix42 Details

2.11.2 Matrix42 Major Business

2.11.3 Matrix42 Software Asset Management Product and Solutions

2.11.4 Matrix42 Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.11.5 Matrix42 Recent Developments and Future Plans

2.12 Ivanti

2.12.1 Ivanti Details

2.12.2 Ivanti Major Business

2.12.3 Ivanti Software Asset Management Product and Solutions

2.12.4 Ivanti Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.12.5 Ivanti Recent Developments and Future Plans

2.13 Snow Software

2.13.1 Snow Software Details

2.13.2 Snow Software Major Business

2.13.3 Snow Software Software Asset Management Product and Solutions

2.13.4 Snow Software Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.13.5 Snow Software Recent Developments and Future Plans

2.14 Belarc

2.14.1 Belarc Details

2.14.2 Belarc Major Business

2.14.3 Belarc Software Asset Management Product and Solutions

2.14.4 Belarc Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.15 SymphonyAI

2.15.1 SymphonyAI Details

2.15.2 SymphonyAI Major Business

2.15.3 SymphonyAI Software Asset Management Product and Solutions

2.15.4 SymphonyAI Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.15.5 SymphonyAI Recent Developments and Future Plans

2.16 Zylo

2.16.1 Zylo Details

2.16.2 Zylo Major Business

2.16.3 Zylo Software Asset Management Product and Solutions

2.16.4 Zylo Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.16.5 Zylo Recent Developments and Future Plans

2.17 Productiv

2.17.1 Productiv Details

2.17.2 Productiv Major Business

2.17.3 Productiv Software Asset Management Product and Solutions

2.17.4 Productiv Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.18 Eracent

2.18.1 Eracent Details

2.18.2 Eracent Major Business

2.18.3 Eracent Software Asset Management Product and Solutions

2.18.4 Eracent Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.18.5 Eracent Recent Developments and Future Plans

2.19 ManageEngine

2.19.1 ManageEngine Details

2.19.2 ManageEngine Major Business

2.19.3 ManageEngine Software Asset Management Product and Solutions

2.19.4 ManageEngine Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.19.5 ManageEngine Recent Developments and Future Plans

2.20 License Dashboard

2.20.1 License Dashboard Details

2.20.2 License Dashboard Major Business

2.20.3 License Dashboard Software Asset Management Product and Solutions

2.20.4 License Dashboard Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.20.5 License Dashboard Recent Developments and Future Plans

2.21 Xensam

2.21.1 Xensam Details

2.21.2 Xensam Major Business

2.21.3 Xensam Software Asset Management Product and Solutions

2.21.4 Xensam Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.22 InvGate

2.22.1 InvGate Details

2.22.2 InvGate Major Business

2.22.3 InvGate Software Asset Management Product and Solutions

2.22.4 InvGate Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

2.22.5 InvGate Recent Developments and Future Plans

2.23 Certero

2.23.1 Certero Details

2.23.2 Certero Major Business

2.23.3 Certero Software Asset Management Product and Solutions

2.23.4 Certero Software Asset Management Revenue, Gross Margin and Market Share (2018-2023)

3 Market Competition, by Players

3.1 Global Software Asset Management Revenue and Share by Players (2020-2023)

3.2 Market Concentration Rate

3.2.1 Top 3 Software Asset Management Players Market Share in 2022

3.2.2 Top 10 Software Asset Management Players Market Share in 2022

3.3 Software Asset Management Players Headquarters, Sales Regions

3.3.1 Software Asset Management Players Headquarters

3.3.2 Sales Regions of Software Asset Management Players

3.4 Software Asset Management Mergers & Acquisitions

4 Market Size Segment by Type

4.1 Global Software Asset Management Revenue and Market Share by Type (2018-2023)

4.2 Global Software Asset Management Market Forecast by Type (2023-2030)

5 Market Size Segment by Application

5.1 Global Software Asset Management Revenue Market Share by Applications (2018-2023)

5.2 Software Asset Management Market Forecast by Applications (2023-2030)

6 North America Software Asset Management Revenue by Countries, by Type, and by Application

6.1 North America Software Asset Management Revenue and Market Share by Type (2018-2030)

6.2 North America Software Asset Management Revenue Market Share by Applications (2018-2030)

6.3 North America Software Asset Management Revenue by Countries (2018-2030)

6.3.1 North America Software Asset Management Revenue by Countries (2018-2030)

6.3.2 United States Software Asset Management Revenue and Growth Rate (2018-2030)

6.3.3 Canada Software Asset Management Revenue and Growth Rate (2018-2030)

6.3.4 Mexico Software Asset Management Revenue and Growth Rate (2018-2030)

6.4 North America Software Asset Management Revenue by Major Players

7 Europe Software Asset Management Revenue by Countries, by Type, and by Application

7.1 Europe Software Asset Management Revenue and Market Share by Type (2018-2030)

7.2 Europe Software Asset Management Revenue Market Share by Applications (2018-2030)

7.3 Europe Software Asset Management Revenue by Countries (2018-2030)

7.3.1 Europe Software Asset Management Revenue by Countries (2018-2030)

7.3.2 Germany Software Asset Management Revenue and Growth Rate (2018-2030)

7.3.3 France Software Asset Management Revenue and Growth Rate (2018-2030)

7.3.4 United Kingdom Software Asset Management Revenue and Growth Rate (2018-2030)

7.3.5 Russia Software Asset Management Revenue and Growth Rate (2018-2030)

7.3.6 Italy Software Asset Management Revenue and Growth Rate (2018-2030)

7.3.7 Austria Software Asset Management Revenue and Growth Rate (2018-2030)

7.4 Europe Software Asset Management Revenue by Major Players

8 Asia-Pacific Software Asset Management Revenue by Countries, by Type, and by Application

8.1 Asia-Pacific Software Asset Management Revenue and Market Share by Type (2018-2030)

8.2 Asia-Pacific Software Asset Management Revenue Market Share by Applications (2018-2030)

8.3 Asia-Pacific Software Asset Management Revenue by Countries (2018-2030)

8.3.1 Asia-Pacific Software Asset Management Revenue by Countries (2018-2030)

8.3.2 China Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.3 Japan Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.4 South Korea Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.5 India Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.6 Southeast Asia Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.7 Australia Software Asset Management Revenue and Growth Rate (2018-2030)

8.3.8 New Zealand Software Asset Management Revenue and Growth Rate (2018-2030)

8.4 Asia-Pacific Software Asset Management Revenue by Major Players

9 South America Software Asset Management Revenue by Countries, by Type, and by Application

9.1 South America Software Asset Management Revenue and Market Share by Type (2018-2030)

9.2 South America Software Asset Management Revenue Market Share by Applications (2018-2030)

9.3 South America Software Asset Management Revenue by Countries (2018-2030)

9.3.1 South America Software Asset Management Revenue by Countries (2018-2030)

9.3.2 Brazil Software Asset Management Revenue and Growth Rate (2018-2030)

9.3.3 Argentina Software Asset Management Revenue and Growth Rate (2018-2030)

9.4 South America Software Asset Management Revenue by Major Players

10 Middle East & Africa Software Asset Management Revenue by Countries, by Type, and by Application

10.1 Middle East & Africa Software Asset Management Revenue and Market Share by Type (2018-2030)

10.2 Middle East & Africa Software Asset Management Revenue Market Share by Applications (2018-2030)

10.3 Middle East & Africa Software Asset Management Revenue by Countries (2018-2030)

10.3.1 Middle East & Africa Software Asset Management Revenue by Countries (2018-2030)

10.3.2 Turkey Software Asset Management Revenue and Growth Rate (2018-2030)

10.3.3 Saudi Arabia Software Asset Management Revenue and Growth Rate (2018-2030)

10.3.4 UAE Software Asset Management Revenue and Growth Rate (2018-2030)

10.4 Middle East & Africa Software Asset Management Revenue by Major Players

11 Appendix

11.1 Methodology

11.2 Research Data Source

11.2.1 Secondary Data

11.2.2 Primary Data

11.2.3 Market Size Estimation

11.2.4 Legal Disclaimer