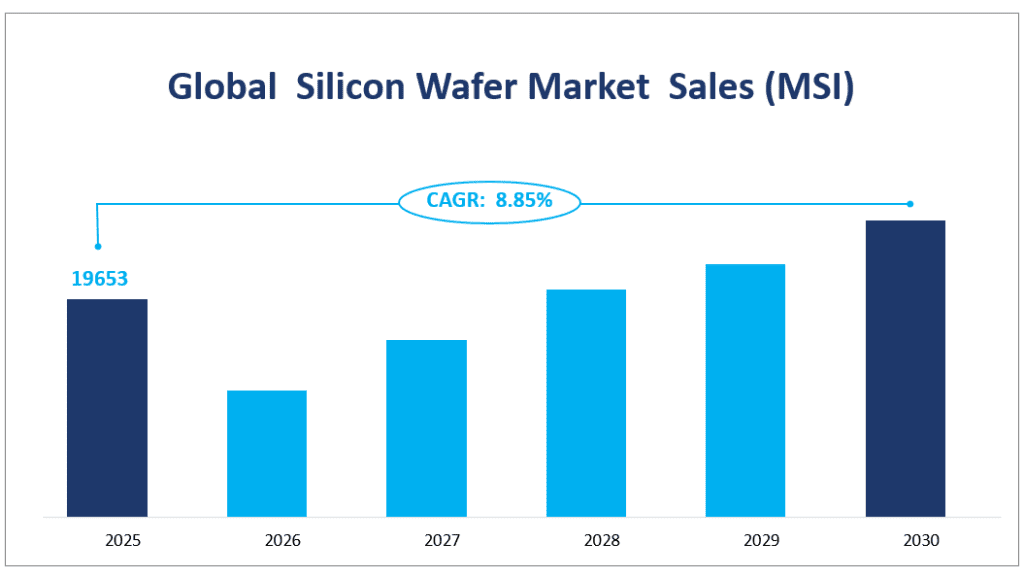

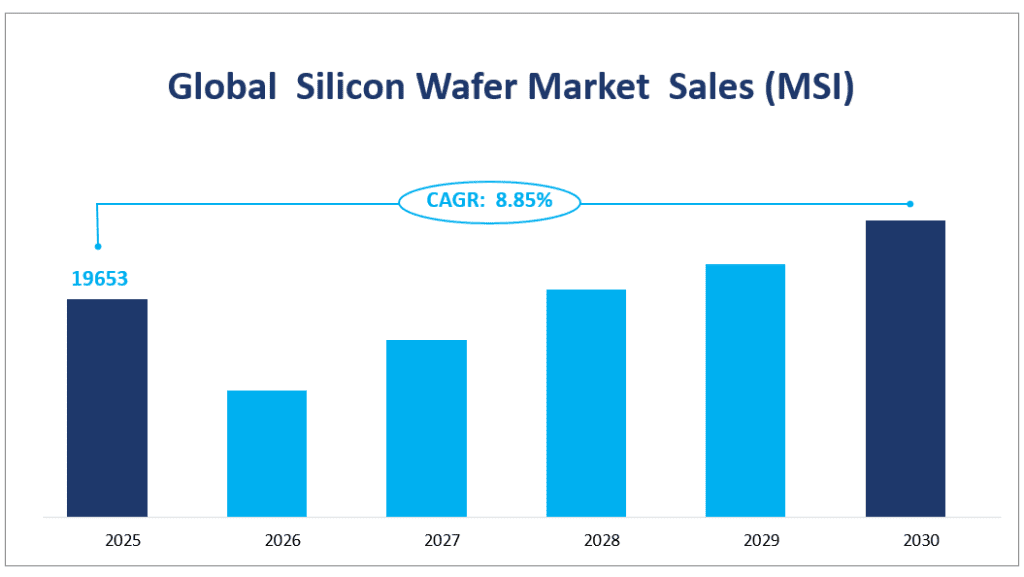

1. Global Silicon Wafer Market Sales (MSI) in 2025

The silicon wafer market is anticipated to reach substantial sales in 2025, with an estimated total sale of 19653 MSI, reflecting a CAGR of 8.85% from 2025 to 2030. This growth is attributed to the increasing demand for consumer electronics, automotive, defense, and aerospace applications, and the continuous technological advancements in the semiconductor industry. Silicon wafers, defined as the silicon substrates used in the fabrication of silicon semiconductor integrated circuits, are crucial for the production of a wide array of electronic devices. The growth in the silicon wafer market is also driven by the need for higher performance and more energy-efficient semiconductor devices, which in turn, propels the demand for advanced silicon wafers.

The market is characterized by a high concentration rate, with the top three companies—Shin-Etsu Chemical Co., Ltd., SUMCO Corporation, and Global Wafers Co., Ltd.—holding significant market shares. These companies, along with other key players, are continuously investing in research and development to introduce new products and technologies, further driving market growth.

Global Silicon Wafer Market Sales (MSI)

2. Driving Factors of Silicon Wafer Market Growth

The silicon wafer market is influenced by several driving factors that are expected to contribute to its growth in the coming years. One of the primary drivers is the increasing demand for advanced semiconductor devices in consumer electronics, such as smartphones, tablets, and computers. The advent of 5G technology has further accelerated this demand, as 5G-enabled devices require more powerful and efficient semiconductor chips, thereby increasing the need for high-quality silicon wafers.

Another significant factor is the growth in the automotive sector, particularly with the rise of electric and autonomous vehicles. These vehicles rely heavily on semiconductors for various functions, including battery management, powertrain control, and advanced driver-assistance systems (ADAS). The electrification and intelligence of vehicles have led to a substantial increase in the silicon content required per vehicle, thereby driving the demand for silicon wafers.

3. Limiting Factors of Silicon Wafer Market Growth

Despite the promising growth prospects, the silicon wafer market faces certain challenges that could limit its expansion. One of the primary constraints is the high barrier to entry for new market participants. The production of silicon wafers is a capital-intensive process that requires significant technological expertise and substantial investments in research and development. This barrier is further heightened by the rapid pace of technological change in the semiconductor industry, which demands continuous innovation and upgrades to manufacturing processes.

Another limiting factor is the risk of trade friction between countries. The semiconductor industry is a global one, with supply chains that span across multiple countries. Trade restrictions or tariffs can disrupt these supply chains and affect the availability and cost of silicon wafers, impacting the market negatively.

4. Global Silicon Wafer Market by Segment

Product Types

150 mm (6-inch) Wafers: These are the smaller diameter wafers that are used for producing a variety of semiconductor devices, including mature process chips such as power management chips and display driver chips. The market is expected to sell approximately 904 MSI in 2025.

200 mm (8-inch) Wafers: These wafers are primarily used for producing CMOS image sensors, power discrete devices, MCU, and analog devices. They are also utilized for mature process chips. Sales are projected to reach 5103 MSI, indicating continued demand for this product type.

300 mm (12-inch) Wafers: The larger diameter wafers are predominantly used for manufacturing high computing power logic devices, DRAM memory, 3D NAND memory, and CMOS image sensors. With the highest sales volume, 300 mm wafers are expected to lead the market with 12966 MSI in 2025.

Others: This category includes wafers of sizes other than the standard 150 mm, 200 mm, and 300 mm, which may serve specialized niche applications.

The silicon wafer market is diverse, with each product type catering to specific segments of the semiconductor industry. In 2025, the 300 mm wafers are projected to have the biggest market share, primarily due to their use in high-performance applications. However, the 200 mm wafers are expected to have the fastest growth rate, highlighting the continued demand for the devices they produce. The market’s dynamics are influenced by technological advancements, changes in consumer preferences, and the ongoing development of new applications for semiconductor devices.

Applications of the Silicon Wafer Market

Consumer Electronics: This application sector includes the use of silicon wafers in the production of semiconductors for smartphones, computers, tablets, and other consumer devices. The segment is expected to lead with 13001 MSI, reflecting the sector’s massive demand for semiconductors.

Automotive: With the rise of electric and autonomous vehicles, the demand for silicon wafers in the automotive industry has grown significantly, particularly for powertrain control, battery management, and ADAS. Automotive is projected to have sales of 2439 MSI, indicating the growing importance of silicon wafers in the automotive industry.

Defense and Aerospace: Silicon wafers are used in advanced defense and aerospace systems, including communication systems, navigation, and control systems. Defense and Aerospace is anticipated to have 1581 MSI in sales, driven by the need for advanced systems in this sector.

Others: This category includes applications such as industrial control, medical devices, and IoT devices that utilize silicon wafers.

The applications of the silicon wafer market are diverse, with consumer electronics dominating the market share and the automotive sector leading in growth. In 2025, consumer electronics are expected to have the biggest market share, while the automotive application is projected to have the fastest growing rate. These trends reflect the evolving landscape of the semiconductor industry, where technological advancements and new applications are driving market growth.

Market Sales and Share by Segment

| Market Sales (MSI) in 2025 | Market Share (MSI) in 2025 | ||

| By Type | 150 mm | 904 | 4.60% |

| 200 mm | 5103 | 25.97% | |

| 300mm | 12966 | 65.98% | |

| By Application | Consumer Electronics | 13001 | 66.16% |

| Automotive | 2439 | 12.41% | |

| Defense and Aerospace | 1581 | 8.05% |

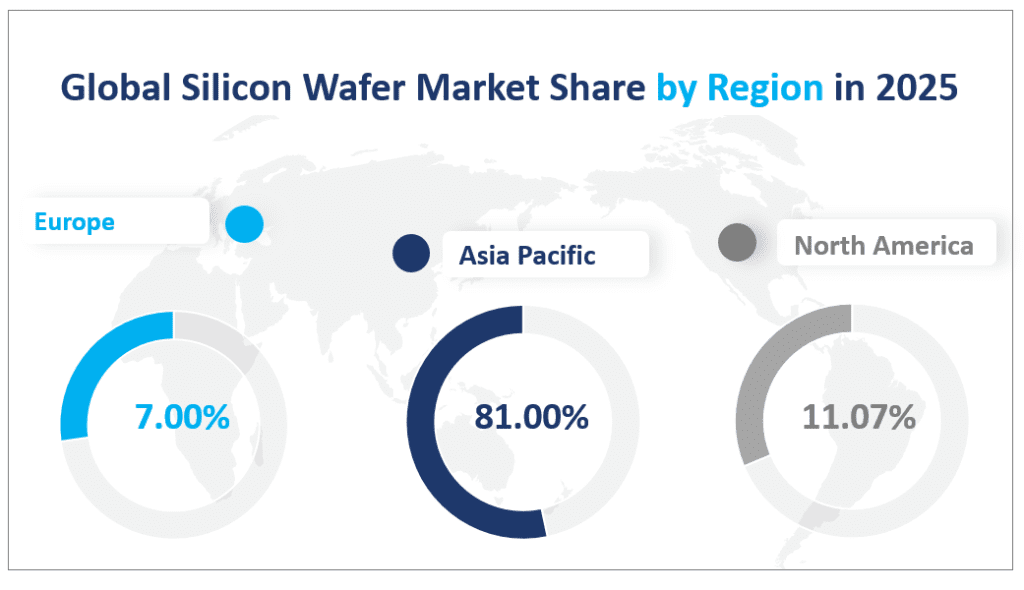

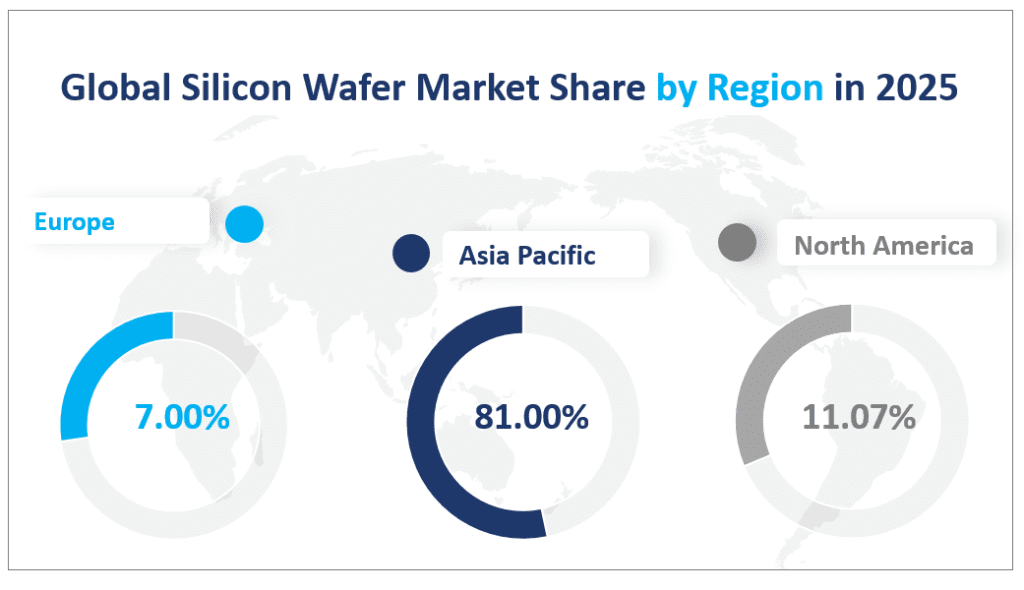

5. Global Silicon Wafer Market by Region

Asia-Pacific: With the most significant growth, Asia-Pacific is expected to lead with 15918 MSI, driven by the region’s booming electronics manufacturing industry and technological advancements. Asia-Pacific is expected to be the biggest regional market by revenue, primarily due to the region’s rapid industrialization and the high demand for semiconductors in countries like China, Japan, and South Korea. The region’s market is further boosted by the presence of major manufacturers and the growing demand for consumer electronics and automotive applications.

While Asia-Pacific is the largest market, the fastest-growing region is anticipated to be Asia-Pacific as well. This growth is attributed to the region’s economic development, investment in semiconductor fabrication, and the increasing demand for advanced electronics in consumer and industrial applications.

North America: Projected to have sales of 2175 MSI, North America’s market is influenced by the demand from high-tech industries and a strong presence of semiconductor companies.

Europe: Anticipated to have 1375 MSI in sales, Europe’s market is characterized by a mature industrial base with a focus on advanced semiconductor technologies.

The global silicon wafer market is poised for growth, with Asia-Pacific leading the pack in both market size and growth rate. The region’s dominance is a result of its strong electronics industry and technological advancements. As the market continues to evolve, regions must navigate challenges and leverage opportunities to sustain growth and maintain competitiveness in the global semiconductor industry.

The growth in the silicon wafer market is influenced by several factors, including the expansion of the electronics industry, advancements in technology, and the regional economic climate. Asia-Pacific’s growth is particularly driven by the rapid industrialization of countries like China and the increasing demand for high-performance semiconductors in the region. Each region faces unique challenges and opportunities. For instance, North America and Europe are dealing with the pressure of maintaining their competitive edge in technology, while Asia-Pacific must manage the rapid growth and the need for sustainable practices in the industry.

Global Silicon Wafer Market Share by Region in 2025

6.TOP5 Players Analysis

Introduction and Overview: Shin-Etsu Chemical is a leading global manufacturer of silicon wafers, known for its high-quality products used in various semiconductor applications.

Products Offered: The company offers a range of silicon wafers, including 150 mm, 200 mm, and 300 mm products, serving memory, logic, and analog IC substrates, among others.

Introduction and Overview: SUMCO is a major manufacturer of electronic-grade silicon wafers, supplying to companies worldwide for integrated circuits and semiconductor devices.

Products Offered: SUMCO specializes in polished wafers with various doping options to meet specific customer requirements.

Introduction and Overview: Global Wafers is recognized as a significant supplier of professional wafer materials, with a complete production line for high-value-added products.

Products Offered: The company produces SOI wafers, polished wafers, and other niche products, catering to power devices and MEMS applications.

Introduction and Overview: Siltronic is an internationally positioned manufacturer, supplying high-quality silicon wafers to the global semiconductor industry.

Products Offered: Siltronic offers polished silicon wafers with diameters ranging from 125mm to 300mm, using various dopants during manufacturing.

Introduction and Overview: SK Siltron is a renowned manufacturer with a focus on becoming a global semiconductor material company, continuing South Korea’s reputation as a semiconductor superpower.

Products Offered: The company provides polished wafers used in memory semiconductors such as DRAM/NAND Flash Memory.

Major Players

| Company Name | Plants Distribution | Sales Regions |

| Shin-Etsu Chemical Co., Ltd. | Mainly in the USA, Europe, and Asia | Mainly in North America, Europe, Asia |

| SUMCO Corporation | Mainly in Japan | Mainly in North America, Europe, Asia |

| Global Wafers Co., Ltd. | Mainly in China, USA, Japan, Europe | Mainly in Asia, North America, and Europe |

| Siltronic AG | Mainly in Singapore, Europe, USA | Mainly in Asia, Europe, and North America |

| SK Siltron Co., Ltd. | Mainly in the USA, South Korea | Mainly in Europe, Asia, and North America |

| Soitec | Mainly in the USA, France, Asia | Mainly in the USA, Europe, and Asia |

| Wafer Works Corporation | Mainly in China, USA | Mainly in Asia, Europe, and North America |

| Okmetic | Mainly in Asia and Finland | Mainly in the USA, Europe, and Asia |

1 Study Coverage

1.1 Silicon Wafer Product Introduction

1.2 Market Analysis by Type

1.2.1 Global Silicon Wafer Market Size Growth Rate by Type

1.3 Market by Application

1.3.1 Global Silicon Wafer Market Share by Application (2016-2027)

1.3.2 Consumer Electronics

1.3.3 Automotive

1.3.4 Defense and Aerospace

1.4 Study Objectives

1.5 Years Considered

1.6 Global Silicon Wafer Price Trends 2016-2027

2 Executive Summary

2.1 Global Silicon Wafer Market Size Estimates and Forecasts

2.1.1 Global Silicon Wafer Revenue 2016-2027

2.1.2 Global Silicon Wafer Sales 2016-2027

2.2 Silicon Wafer Market Size by Region: 2020 Versus 2027

2.3 Silicon Wafer Sales by Region (2016-2027)

2.3.1 Global Silicon Wafer Sales by Region: 2016-2021

2.3.2 Global Silicon Wafer Sales Forecast by Region (2022-2027)

2.3.3 Global Silicon Wafer Sales Market Share by Region (2016-2027)

2.4 Silicon Wafer Market Estimates and Projections by Region (2016-2027)

2.4.1 Global Silicon Wafer Revenue by Region: 2016-2021

2.4.2 Global Silicon Wafer Revenue Forecast by Region (2022-2027)

2.4.3 Global Silicon Wafer Revenue Market Share by Region (2016-2027)

3 Global Silicon Wafer by Manufacturers

3.1 Global Top Silicon Wafer Manufacturers by Sales

3.1.1 Global Silicon Wafer Sales by Manufacturer (2016-2021)

3.1.2 Global Silicon Wafer Sales Market Share by Manufacturer (2016-2021)

3.2 Global Top Silicon Wafer Players by Revenue

3.2.1 Global Silicon Wafer Revenue by Players (2016-2021)

3.2.2 Global Silicon Wafer Revenue Market Share by Players (2016-2021)

3.3 Global Silicon Wafer Price by Manufacturer (2016-2021)

3.4 Competitive Landscape

3.4.1 Key Silicon Wafer Manufacturers Covered: Ranking by Revenue

3.4.2 Global Silicon Wafer Market Concentration Ratio (CR5 and HHI) & (2016-2021)

3.4.3 Global Silicon Wafer Market Share by Company Type (Tier 1, Tier 2 and Tier 3)

3.5 Global Silicon Wafer Manufacturing Base Distribution, Product Type

3.5.1 Silicon Wafer Manufacturers Manufacturing Base Distribution, Headquarters

3.5.2 Establishment Date of Silicon Wafer Manufacturers

3.6 Manufacturers Mergers & Acquisitions, Expansion Plans

4 Company Profiles

4.1 Shin-Etsu Chemical Co., Ltd.

4.1.1 Shin-Etsu Chemical Co., Ltd. Corporation Information

4.1.2 Company Description and Business Overview

4.1.3 Silicon Wafer Products Offered

4.1.4 Shin-Etsu Chemical Co., Ltd. Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.1.5 Shin-Etsu Chemical Co., Ltd. Silicon Wafer Revenue by Product

4.1.6 Shin-Etsu Chemical Co., Ltd. Silicon Wafer Revenue by Application

4.1.7 Shin-Etsu Chemical Co., Ltd. Silicon Wafer Revenue by Geographic Area

4.1.8 Shin-Etsu Chemical Co., Ltd. Recent Development

4.2 SUMCO Corporation

4.2.1 SUMCO Corporation Corporation Information

4.2.2 Company Description and Business Overview

4.2.3 Silicon Wafer Products Offered

4.2.4 SUMCO Corporation Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.2.5 SUMCO Corporation Silicon Wafer Revenue by Product

4.2.6 SUMCO Corporation Silicon Wafer Revenue by Application

4.2.7 SUMCO Corporation Silicon Wafer Revenue by Geographic Area

4.2.8 SUMCO Corporation Recent Development

4.3 Global Wafers Co., Ltd.

4.3.1 Global Wafers Co., Ltd. Corporation Information

4.3.2 Company Description and Business Overview

4.3.3 Silicon Wafer Products Offered

4.3.4 Global Wafers Co., Ltd. Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.3.5 Global Wafers Co., Ltd. Silicon Wafer Revenue by Product

4.3.6 Global Wafers Co., Ltd. Silicon Wafer Revenue by Application

4.3.7 Global Wafers Co., Ltd. Silicon Wafer Revenue by Geographic Area

4.3.8 Global Wafers Co., Ltd. Recent Development

4.4 Siltronic AG

4.4.1 Siltronic AG Corporation Information

4.4.2 Company Description and Business Overview

4.4.3 Silicon Wafer Products Offered

4.4.4 Siltronic AG Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.4.5 Siltronic AG Silicon Wafer Revenue by Product

4.4.6 Siltronic AG Silicon Wafer Revenue by Application

4.4.7 Siltronic AG Silicon Wafer Revenue by Geographic Area

4.4.8 Siltronic AG Recent Development

4.5 SK Siltron Co., Ltd.

4.5.1 SK Siltron Co., Ltd. Corporation Information

4.5.2 Company Description and Business Overview

4.5.3 Silicon Wafer Products Offered

4.5.4 SK Siltron Co., Ltd. Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.5.5 SK Siltron Co., Ltd. Silicon Wafer Revenue by Product

4.5.6 SK Siltron Co., Ltd. Silicon Wafer Revenue by Application

4.5.7 SK Siltron Co., Ltd. Silicon Wafer Revenue by Geographic Area

4.5.8 SK Siltron Co., Ltd. Recent Development

4.6 Soitec

4.6.1 Soitec Corporation Information

4.6.2 Company Description and Business Overview

4.6.3 Silicon Wafer Products Offered

4.6.4 Soitec Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.6.5 Soitec Silicon Wafer Revenue by Product

4.6.6 Soitec Silicon Wafer Revenue by Application

4.6.7 Soitec Silicon Wafer Revenue by Geographic Area

4.6.8 Soitec Recent Development

4.7 Wafer Works Corporation

4.7.1 Wafer Works Corporation Corporation Information

4.7.2 Company Description and Business Overview

4.7.3 Silicon Wafer Products Offered

4.7.4 Wafer Works Corporation Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.7.5 Wafer Works Corporation Silicon Wafer Revenue by Product

4.7.6 Wafer Works Corporation Silicon Wafer Revenue by Application

4.7.7 Wafer Works Corporation Silicon Wafer Revenue by Geographic Area

4.7.8 Wafer Works Corporation Recent Development

4.8 Okmetic

4.8.1 Okmetic Corporation Information

4.8.2 Company Description and Business Overview

4.8.3 Silicon Wafer Products Offered

4.8.4 Okmetic Silicon Wafer Sales, Price, Revenue and Gross Margin (2016-2021)

4.8.5 Okmetic Silicon Wafer Revenue by Product

4.8.6 Okmetic Silicon Wafer Revenue by Application

4.8.7 Okmetic Silicon Wafer Revenue by Geographic Area

4.8.8 Okmetic Recent Development

5 Breakdown Data by Type

5.1 Global Silicon Wafer Sales by Type (2016-2027)

5.1.1 Global Silicon Wafer Sales by Type (2016-2021)

5.1.2 Global Silicon Wafer Sales Forecast by Type (2022-2027)

5.2 Global Silicon Wafer Revenue Forecast by Type (2016-2027)

5.2.1 Global Silicon Wafer Revenue by Type (2016-2021)

5.2.2 Global Silicon Wafer Forecast Revenue by Type (2022-2027)

5.3 Silicon Wafer Average Selling Price (ASP) by Type (2016-2027)

6 Breakdown Data by Application

6.1 Global Silicon Wafer Sales by Application (2016-2027)

6.1.1 Global Silicon Wafer Sales by Application (2016-2021)

6.1.2 Global Silicon Wafer Sales Forecast by Application (2022-2027)

6.2 Global Silicon Wafer Revenue Forecast by Application (2016-2027)

6.2.1 Global Silicon Wafer Revenue by Application (2016-2021)

6.2.2 Global Silicon Wafer Forecast Revenue by Application (2022-2027)

6.3 Silicon Wafer Average Selling Price (ASP) by Application (2016-2027)

7 North America

7.1 North America Silicon Wafer Market Size YoY Growth 2016-2027

7.2 North America Silicon Wafer Market Facts & Figures by Country

7.2.1 North America Silicon Wafer Sales by Country (2016-2027)

7.2.2 North America Silicon Wafer Revenue by Country (2016-2027)

7.3 North America Silicon Wafer Sales by Type

7.4 North America Silicon Wafer Sales by Application

8 Europe

8.1 Europe Silicon Wafer Market Size YoY Growth 2016-2027

8.2 Europe Silicon Wafer Market Facts & Figures by Country

8.2.1 Europe Silicon Wafer Sales by Country (2016-2027)

8.2.2 Europe Silicon Wafer Revenue by Country (2016-2027)

8.3 Europe Silicon Wafer Sales by Type

8.4 Europe Silicon Wafer Sales by Application

9 Asia-Pacific

9.1 Asia-Pacific Silicon Wafer Market Size YoY Growth 2016-2027

9.2 Asia-Pacific Silicon Wafer Market Facts & Figures by Country

9.2.1 Asia-Pacific Silicon Wafer Sales by Country (2016-2027)

9.2.2 Asia-Pacific Silicon Wafer Revenue by Country (2016-2027)

9.3 Asia-Pacific Silicon Wafer Sales by Type

9.4 Asia-Pacific Silicon Wafer Sales by Application

10 Supply Chain and Sales Channel Analysis

10.1 Silicon Wafer Supply Chain Analysis

10.2 Silicon Wafer Key Raw Materials and Upstream Suppliers

10.3 Silicon Wafer Clients Analysis

10.4 Silicon Wafer Sales Channel and Sales Model Analysis

11 Market Dynamics

11.1 Silicon Wafer Market Drivers

11.2 Silicon Wafer Market Opportunities

11.3 Silicon Wafer Market Challenges

11.4 Silicon Wafer Market Restraints

11.5 Porter’s Five Forces Analysis

12 Research Findings and Conclusion

13 Appendix

13.1 Methodology

13.2 Research Data Source

13.2.1 Secondary Data

13.2.2 Primary Data

13.2.3 Market Size Estimation