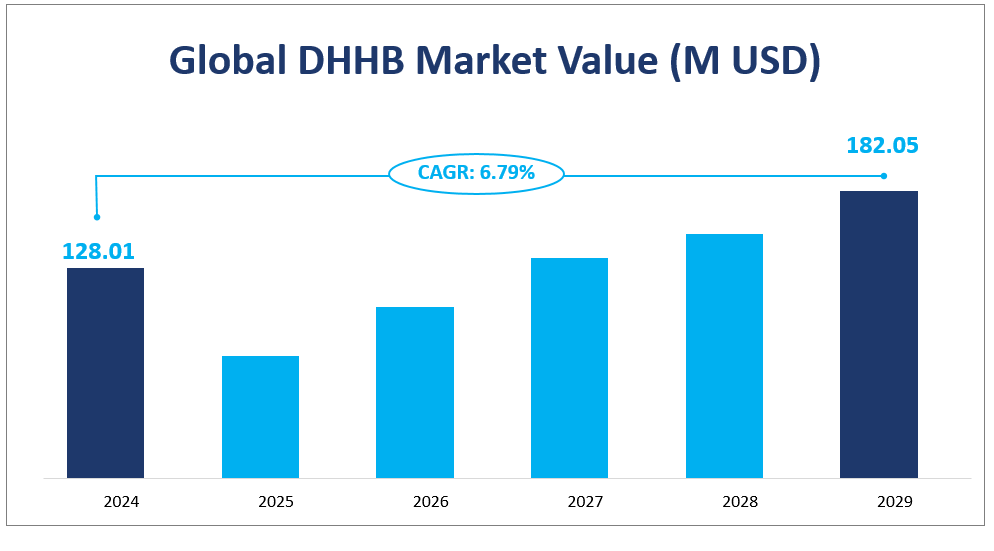

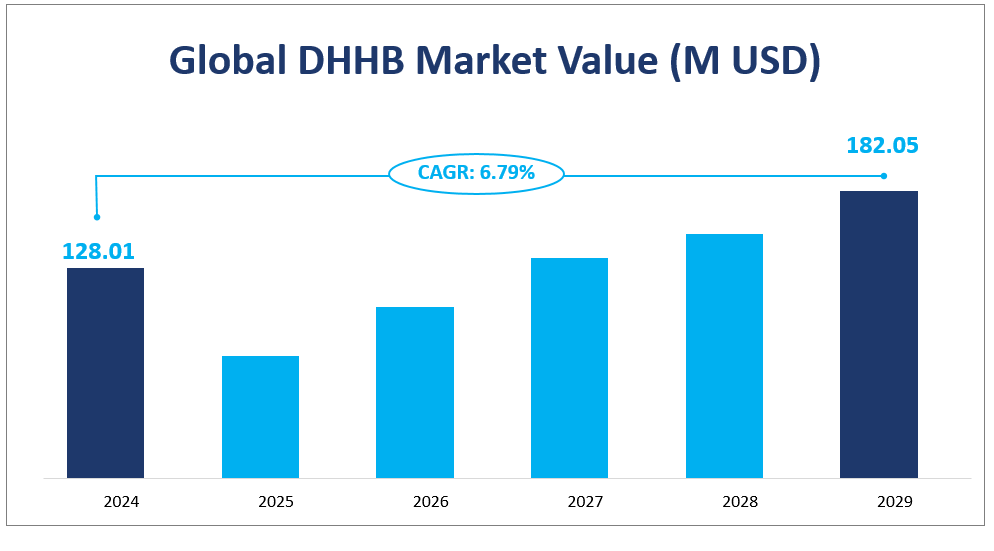

The global DHHB market size is $128.01 million in 2024 with a CAGR of 6.79% from 2024 to 2029. DHHB is an organic compound with slightly white powder or granules. DHHB can be added to cosmetic preparations to absorb UVA radiation, increase the sun protection factor (SPF), and reduce fabric pollution caused by cosmetic preparations. DHHB has good light stability and is oil-soluble and insoluble in water, making it suitable for use with many cosmetic and personal care products.

1. Global DHHB Market Overview

The global DHHB market size is $128.01 million in 2024 with a CAGR of 6.79% from 2024 to 2029.

DHHB is an organic compound with slightly white powder or granules. DHHB can be added to cosmetic preparations to absorb UVA radiation, increase the sun protection factor (SPF), and reduce fabric pollution caused by cosmetic preparations. DHHB has good light stability and is oil-soluble and insoluble in water, making it suitable for use with many cosmetic and personal care products. These properties make DHHB more widely used in cosmetics and personal care products. Europe accounts for a significant share of the DHHB market. The high concentration of DHHB market may have an impact on the market development.

Global DHHB Market Value (M USD)

2. Market Dynamics

The development of sunscreen cosmetics and the personal care industry

Sunscreens mainly refer to ultraviolet absorbers. When the molecules absorb ultraviolet light, the structure changes, and the excess energy is released by heat or other energy. It absorbs ultraviolet light over and over again to play a protective role. With the rapid development of the global cosmetics market, the market sales of related sunscreen cosmetics are also in the process of rapid growth. With the improvement of living standards, people’s requirements for the design of sunscreen cosmetics have evolved from UVB protection to UVA-based organic molecular protection. The concept of protection has also evolved from the protection of the face to the protection of other parts of the human body exposed to sunlight, and the market demand for sunscreen cosmetics will continue to rise. In recent years, consumers have paid more attention to skin damage such as whitening, freckle removal, and anti-wrinkle. With the increasing knowledge of skincare, makeup, and maintenance and the continuous enhancement of pre-prevention concepts, more consumers have begun to pay more attention to the daily use of sunscreen cosmetics. In addition to conventional sunscreens, other types of cosmetics have also begun to focus on sunscreen functions, and the application fields of sunscreens have become more extensive, including lipsticks, face creams, and eye creams. DHHB has good light stability. At the same time, DHHB is oil-soluble and insoluble in water, making it suitable for use in combination with many cosmetics and personal care products. With the further development of sunscreen cosmetics and personal care industries, the DHHB industry will also continue to develop.

Development of alternative products

At present, in addition to DHHB, there are other types of sunscreens on the market. AVB has the advantages of high absorption rate, non-toxicity, non-teratogenicity, and good stability to light and heat. It is especially suitable for light-colored transparent products and is widely used in sunscreen creams, creams, lotions, and other cosmetics. OCT can absorb both UVA and UVB at the same time. It is a class I sunscreen approved by the US FDA and has a higher usage rate in the US and Europe. OMC has a high absorption rate, no irritation to the skin, and good safety. It is also a therapeutic drug for photodermatitis. These organic compounds have similar characteristics as sunscreen agents and can be replaced with each other to a certain extent. The development of DHHB alternative products will limit the development of the DHHB industry to a certain extent.

3. Market Segment

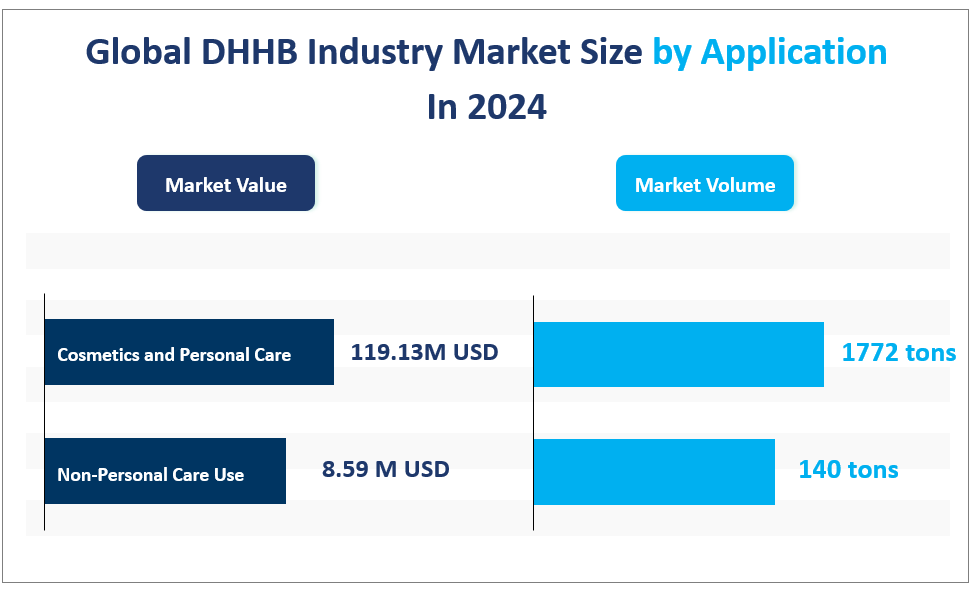

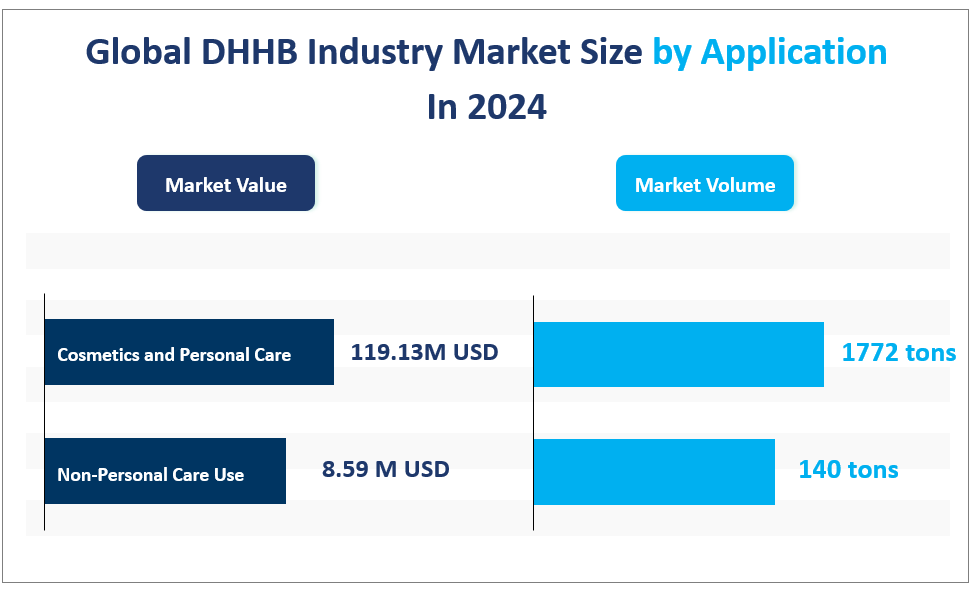

By application, the cosmetics and personal care segment occupies the biggest share.

The downstream application market is mainly concentrated in the cosmetics and personal care segment, and the reasons for the market growth include the increase in global consumer demand for sun protection and personal care products, as well as the preference for high-quality products.

DHHB is soluble in various organic solvents and various oils in cosmetics, but insoluble in water, which makes it easily added to cosmetics and personal care formulations. DHHB can be added to sunscreen formulations to absorb UVA radiation and increase the sun protection factor (SPF). It can also be used as a light stabilizer and light protection for cosmetics. DHHB has good solubility in ultraviolet UV-A (320-400nm) and can be used as a UV-A ultraviolet absorber in resin lens anti-ultraviolet glasses. DHHB can also be used as a UV-A ultraviolet absorber and anti-aging agent in advanced coatings, automotive coatings, and furniture paints. In some topical drug formulations, DHHB can also be used as a light stabilizer. The market value of Cosmetics and Personal Care is $119.13 million in 2024 with market sales of 1772 Tons.

DHHB is a light-stable UV-A absorber with a high absorption peak in the UV-A range (specifically at 354nm), and this light stability makes it an ideal sunscreen ingredient in cosmetics. DHHB has excellent compatibility with other sunscreens and beauty ingredients, which means it can be mixed with other ingredients without adverse reactions, which is crucial for cosmetic formulation design. DHHB can absorb UVA radiation, helping to improve a product’s Sun protection factor (SPF), which is a key performance indicator for sunscreen products. DHHB is oil-soluble and insoluble in water, which makes it easy to add to cosmetics and personal care formulations, especially those containing oil-based ingredients. DHHB can also reduce contamination of clothing by cosmetic preparations, which is an added benefit for consumers when using sunscreen products.

With the rapid development of the global cosmetics market, especially the rapid growth of the market sales of sunscreen cosmetics, DHHB as an effective UVA absorber, the market demand has also risen. Consumers are increasingly paying attention to skin damage such as whitening, freckle removal, anti-wrinkle, and the daily use of sunscreen cosmetics, which has driven the application of DHHB in cosmetics and personal care products.

Global DHHB Industry Market Size by Application

4. Regional Market

Europe accounts for a considerable share of the DHHB market.

Europe, especially Western European countries, has a high level of economic development, and residents’ living standards and consumption power are strong, which provides a broad market space for high-end cosmetics and personal care products. With the rapid development of the global cosmetics market, especially the rapid growth of the market sales of sunscreen cosmetics, the demand for DHHB in the European market has also increased. Consumer requirements for sunscreen cosmetics have evolved from UVB protection to UVa-based organic molecular protection, and the demand for effective sunscreen ingredients such as DHHB is rising. European consumers pay more attention to freckle, anti-wrinkle, and other damage to the skin, with the continuous increase of skincare, makeup, and maintenance knowledge and the continuous enhancement of the concept of prevention, more and more consumers began to pay more attention to the daily use of sunscreen cosmetics. As one of the major players in the DHHB market, BASF’s presence in Europe has played a driving role in the development of the DHHB market. For Biotech companies of non-European origin, the UK, Switzerland, Ireland, and Germany are the preferred locations for European headquarters, as these countries have a good pharmaceutical ecosystem and network, as well as a strong infrastructure. This helps in the marketing and sales of products such as DHHB. The market value of Europe is $55.02 million in 2024 and the market consumption is 811 Tons in 2024.

DHHB has good light stability and a good oil-soluble UV filter, so DHHB is widely used in pharmaceuticals and cosmetics as a light stabilizer or light protection. The increase in consumption levels and the number of consumers in China and India will continue to contribute to the growth of the DHHB market. China and India are the most populous countries in the world, and their huge population base provides huge potential for the DHHB market. With the economic development of China and India, consumer preferences have also changed. With the further understanding of skin cancer, the awareness of sunscreen beauty has gradually increased, which has driven the demand for sunscreen in China and India, thereby promoting the development of the DHHB industry in the region. At the same time, the development of the pharmaceutical industry in China and India also has an impact on the DHHB industry. Take the Indian pharmaceutical market as an example. Indian generic drugs have maintained their competitiveness in the global generic drug market by their cost-effective advantages. This factor has led pharmaceutical companies around the world to choose India as their manufacturing destination. DHHB can be added to pharmaceutical formulations as a light stabilizer. The production of generic drugs will increase the demand for DHHB, thereby driving the DHHB market.

Regional Market Value and Consumption in 2024

| Market Value | Market Consumption | |

| Europe | 55.02 M USD | 811 Tons |

| China | 27.77 M USD | 423 Tons |

| Japan | 14.32 M USD | 211 Tons |

| Middle East and Africa | 5.58 M USD | 84 Tons |

| India | 4.32 M USD | 66 Tons |

| North America | 0.41 M USD | 6 Tons |

5. Market Competition

DHHB industry concentrate rate is high. The top three companies are BASF, MFCI, and SIMP Biotechnology with a revenue market share of 97.66% in 2024.

BASF: BASF is a chemical company. The Company operates in six segments, including chemicals, plastics, performance products, functional solutions, agricultural solutions, and oil and gas. BASF is one of the major players operating in the DHHB market, holding a share of 94.94% in 2024.

MFCI: MFCI is a high-tech enterprise integrating R&D, production, sales, and service of professional UV absorbers. MFCI R&D Center is a core platform. Implements UV absorber innovation per strategic plan. Does new product R&D, improves existing products, and provides tech support for sales and service.

SIMP Biotechnology: SIMP Biotechnology is committed to special products with functional active ingredients, raw materials, excipients, and new materials for medicines, cosmetics, food, daily necessities, special industry products, and functional ingredient formulations.

Major Players Introduction

| Major Players | Market Share in 2024 | Plants Distribution | Sales Region |

| BASF | 94.94% | Germany and China Taiwan | Worldwide |

| MFCI | 2.18% | China | Worldwide |

| SIMP Biotechnology | 0.54% | China | Mainly in Asia Pacific |

| Others | 2.34% |

1 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Introduction and Market Overview

1.1 Objectives of the Study

1.2 Introduction of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

1.3 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Scope and Market Size Estimation

1.3.1 Market Concentration Ratio and Market Maturity Analysis

1.3.2 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Value and Growth Rate from 2015-2025

1.4 Market Segmentation

1.4.1 Applications of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

1.4.2 Research Regions

1.5 Market Dynamics

1.5.1 Drivers

1.5.2 Limitations

1.5.3 Opportunities

1.6 Industry News and Policies by Regions

1.6.1 Industry News

1.6.2 Industry Policies

1.7 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Industry Development Trends under COVID-19 Outbreak

1.7.1 Global COVID-19 Status Overview

1.7.2 Influence of COVID-19 Outbreak on DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Industry Development

1.8 Global UVA Sunscreen Ingredients Production and Value by Types (2016-2021)

2 Industry Chain Analysis

2.1 Upstream Raw Material Suppliers of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Analysis

2.2 Major Players of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

2.2.1 Major Players Manufacturing Base of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) in 2019

2.3 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Manufacturing Cost Structure Analysis

2.3.1 Production Process Analysis

2.3.2 Manufacturing Cost Structure of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

2.3.3 Raw Material Cost of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

2.3.4 Labor Cost of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

2.4 Market Channel Analysis of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate)

2.5 Major Downstream Buyers of DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Analysis

3 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market, by Application

3.1 Downstream Market Overview

3.2 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption and Market Share by Application (2015-2020)

3.3 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption and Growth Rate by Application (2015-2020)

3.3.1 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption and Growth Rate of Cosmetics and Personal Care (2015-2020)

3.3.2 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption and Growth Rate of Non-Personal Care Use (Coating, Topical medications, etc.) (2015-2020)

4 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Production, Value (M USD) by Region (2015-2020)

4.1 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Sales Value and Market Share by Region (2015-2020)

4.2 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Production and Market Share by Region (2015-2020)

4.3 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Volume, Value, Price and Gross Margin (2015-2020)

4.4 North America DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.5 Europe DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.6 China DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.7 Japan DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.8 Middle East and Africa DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.9 India DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

4.10 South America DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption, Value, Price and Gross Margin (2015-2020)

5 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Production, Consumption, Export, Import by Regions (2015-2020)

5.1 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Consumption by Regions (2015-2020)

5.2 Europe DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Production, Consumption, Export, Import (2015-2020)

5.3 China DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Production, Consumption, Export, Import (2015-2020)

6 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis by Regions

6.1 North America DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.2 Europe DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.3 China DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.4 Japan DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.5 Middle East and Africa DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.6 India DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

6.7 South America DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Status and SWOT Analysis

7 Competitive Landscape

7.1 Competitive Profile

7.2 BASF

7.2.1 Company Profiles

7.2.2 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Product Introduction

7.2.3 BASF Production, Value, Price, Gross Margin 2015-2020

7.3 MFCI

7.3.1 Company Profiles

7.3.2 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Product Introduction

7.3.3 MFCI Production, Value, Price, Gross Margin 2015-2020

7.4 SIMP Biotechnology

7.4.1 Company Profiles

7.4.2 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Product Introduction

7.4.3 SIMP Biotechnology Production, Value, Price, Gross Margin 2015-2020

8 Global DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Analysis and Forecast by Application

8.1 Global Market Value (M USD) Forecast by Application (2020-2025)

8.2 Global Market Volume Forecast by Application (2020-2025)

8.3 Cosmetics and Personal Care Market Value and Volume Forecast (2020-2025)

8.4 Non-Personal Care Use (Coating, Topical medications, etc.) Market Value and Volume Forecast (2020-2025)

9 DHHB (Diethylamino hydroxybenzoyl hexyl benzoate) Market Analysis and Forecast by Region

9.1 North America Market Value and Consumption Forecast (2020-2025)

9.2 Europe Market Value and Consumption Forecast (2020-2025)

9.3 China Market Value and Consumption Forecast (2020-2025)

9.4 Japan Market Value and Consumption Forecast (2020-2025)

9.5 Middle East and Africa Market Value and Consumption Forecast (2020-2025)

9.6 India Market Value and Consumption Forecast (2020-2025)

9.7 South America Market Value and Consumption Forecast (2020-2025)

10 New Project Feasibility Analysis

10.1 Industry Barriers and New Entrants SWOT Analysis

10.2 Analysis and Suggestions on New Project Investment

11 Research Finding and Conclusion

12 Appendix

12.1 Methodology

12.2 Research Data Source