1.400G Optical Transceivers Market Summary

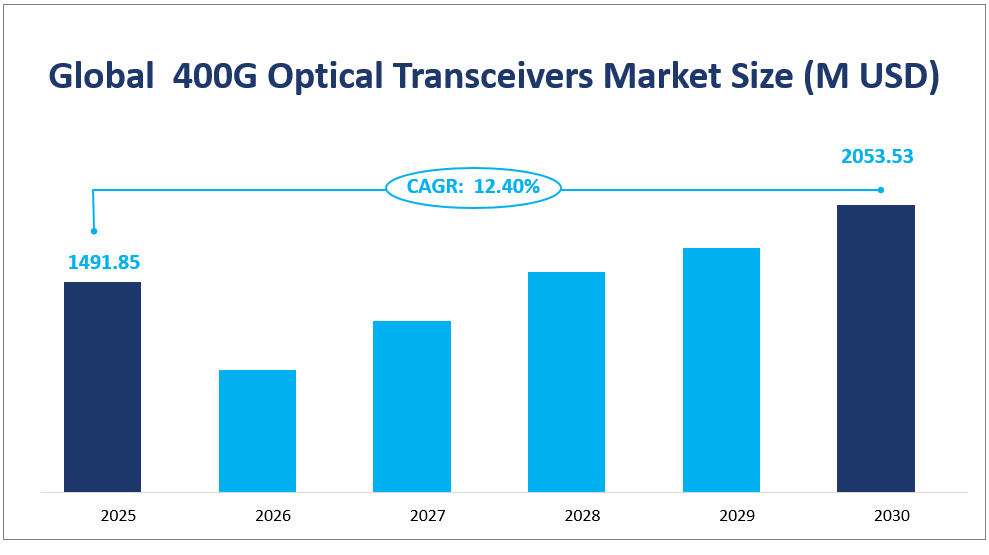

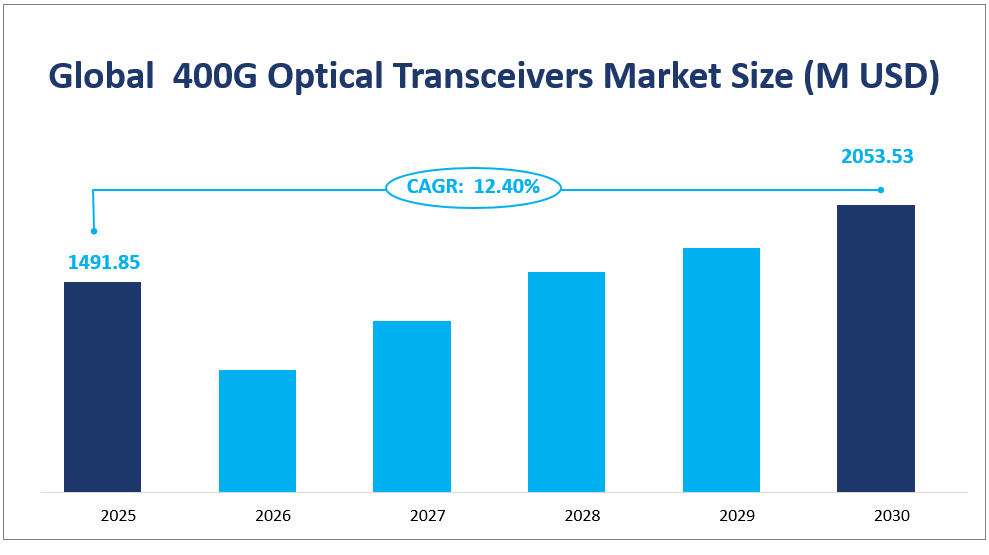

The 400G Optical Transceivers market is poised for substantial growth, reflecting the rapid evolution of data transmission technologies. By 2025, the global market value is projected to reach approximately $1491.85 million, showcasing a Compound Annual Growth Rate (CAGR) of around 12.40% from 2025 to 2030. This significant growth is indicative of the market’s potential and the increasing reliance on high-speed data transmission solutions.

400G Optical Transceivers are advanced telecommunication components designed to facilitate data transfer rates of up to 400 gigabits per second (Gbps). These devices are pivotal in the modern digital infrastructure, serving a wide array of applications including high-speed data centers, cloud computing platforms, and next-generation networking technologies. The demand for these transceivers is driven by the burgeoning need for faster and more efficient data processing capabilities, which is essential for handling the ever-increasing volume of global internet traffic.

The growth is fueled by several factors, including technological advancements, the rising adoption of cloud services, the proliferation of data centers, and the need for higher bandwidth in various industries. The market is also influenced by the development of new applications and the continuous improvement in the performance of optical transceivers, which are becoming more energy-efficient and cost-effective.

Global 400G Optical Transceivers Market Size (M USD)

2. Driving Factors of 400G Optical Transceivers Market

Data Center Expansion: The rapid expansion of data centers globally is a key driver for the 400G Optical Transceivers market. As data centers require high-speed connectivity to handle massive amounts of data, the demand for 400G transceivers is expected to increase significantly.

Technological Innovations: Continuous advancements in optical communication technology are driving the market forward. Innovations such as silicon photonics and coherent detection are enabling higher data transfer rates and longer transmission distances, making 400G transceivers more viable for a wider range of applications.

Rising Bandwidth Demand: The exponential growth in internet traffic, driven by video streaming, social media, and the Internet of Things (IoT), is creating a need for higher bandwidth solutions. 400G Optical Transceivers offer the necessary bandwidth to meet these demands, positioning them as a critical component in the future of data transmission.

Advancements in 5G Technology: The rollout of 5G networks worldwide is another significant driver for the 400G Optical Transceivers market. 5G networks require high-speed backhaul connections, which 400G transceivers can provide, ensuring seamless and high-speed data transfer.

3. Limiting Factors of 400G Optical Transceivers Market

High Initial Costs: The high initial cost of deploying 400G Optical Transceivers can be a barrier for some organizations, especially smaller companies with limited budgets. The cost of the transceivers and the infrastructure required to support them can be prohibitive.

Technological Challenges: While advancements in technology are a driving factor, they also present challenges. The transition from older technologies to 400G requires significant R&D investments and technical expertise, which can be a barrier for new entrants and smaller players in the market.

Market Competition: The market is highly competitive, with several established players and new entrants vying for market share. This competition can lead to price wars, which may compress profit margins and limit the growth potential of some companies.

Dependency on the Global Economy: The market for 400G Optical Transceivers is influenced by the global economy. Economic downturns can lead to reduced spending on IT infrastructure, affecting the demand for high-speed data transmission solutions.

In conclusion, the 400G Optical Transceivers market is set to experience significant growth in the coming years, driven by the increasing demand for high-speed data transmission and the continuous advancements in optical communication technology. However, challenges such as high initial costs, technological barriers, and market competition may limit the growth to some extent. Despite these challenges, the market is expected to continue its upward trajectory, offering substantial opportunities for growth and innovation.

The global 400G Optical Transceivers market is diversifying, with different product types catering to various segments of the telecommunication industry. By 2025, the market is expected to showcase a significant shift towards higher-speed transceivers, with each product type playing a crucial role in shaping the industry’s future. This article delves into the definitions and projected market values of these product types, identifying the ones with the largest market share and the fastest growth rate.

4. 400G Optical Transceivers Market Segment

Product Types Analysis

QSFP-DD (Quad Small Form-factor Pluggable Double Density)

QSFP-DD transceivers are high-density, small form-factor devices designed for data centers and high-speed networking. They support multiple channels on a single module, making them ideal for space-constrained environments.

The market value of this type is projected to reach a market value of $895.68 million in 2025, QSFP-DD transceivers are expected to dominate the market due to their high-density design and backward compatibility, which simplifies the migration to 400G Ethernet.

OSFP (Octal Small Form-factor Pluggable)

OSFP transceivers are known for their octal compatibility, offering eight times the data rate of traditional SFP transceivers. They are designed for high-speed data transmission over longer distances.

With a projected market value of $299.06 million in 2025, OSFP transceivers are anticipated to hold a significant share, particularly in applications requiring longer reach and higher power efficiency.

Others:

This category includes other form factors and emerging technologies that do not fit into the QSFP-DD or OSFP categories but are still significant in the market. The market value is expected to reach $297.11 million in 2025, reflecting the niche but vital role of alternative technologies in specific applications.

Applications Analysis

The 400G Optical Transceivers market serves a wide range of applications, each with its unique requirements and market dynamics. By 2025, the market is expected to see significant growth across various applications, with some experiencing faster expansion than others. This article provides an analysis of the different applications, their definitions, and their projected market values, identifying the applications with the largest market share and the fastest growth rate.

Client-Side Transceivers

These are used for interconnection between metropolitan area networks and optical backbone networks, typically covering shorter distances and requiring standardized interfaces for network connection.

The market value is expected to reach $822.59 million in 2025, client-side transceivers dominate the market due to the vast number of data centers and the need for high-speed, short-distance data transfer.

Line-Side Transceivers

Designed for long-haul transmission, these transceivers use dense wavelength division multiplexing (DWDM) to achieve transmission distances of 80 kilometers or more, handling larger signal processing than client-side transceivers.

The market value is projected to reach $669.26 million in 2025, line-side transceivers are crucial for long-distance data transmission, supporting the backbone of global communication networks.

Client-side transceivers are anticipated to hold the largest market share in 2025, driven by the rapid expansion of data centers and the increasing demand for high-speed, efficient data transfer within metropolitan areas. Line-side transceivers, while having a smaller market share, are expected to exhibit a CAGR of 36.5% during the same period. This growth is attributed to the need for robust and reliable long-distance data transmission, which is essential for the global communication infrastructure.

The 400G Optical Transceivers market is a pivotal segment within the global telecommunications industry, experiencing significant growth due to the increasing demand for high-speed data transmission. By 2025, this market is expected to be shaped by regional dynamics, with each region contributing differently to the overall market value. This article analyzes the market value by major region, identifying the biggest regional market by revenue and the fastest-growing region.

Market Value and Share by Segment

| Market Value in 2025 | Market Share in 2025 | ||

| By Type | QSFP-DD | 895.68 M USD | 53.23% |

| OSFP | 299.06 M USD | 19.98% | |

| Others | 297.11 M USD | 19.79% | |

| By Application | Client-Side Transceivers | 822.59 M USD | 55.24% |

| Line-Side Transceivers | 669.26 M USD | 44.76% |

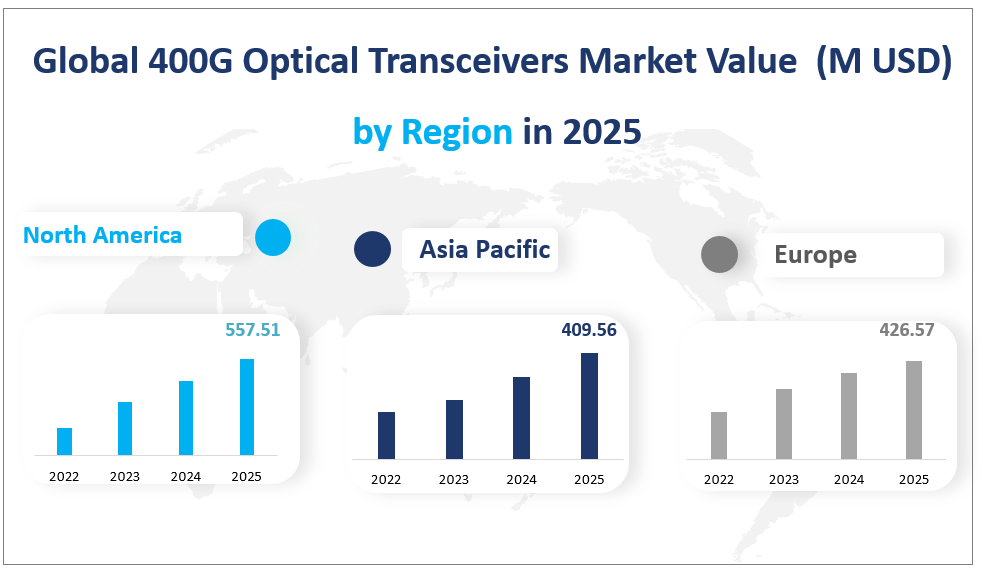

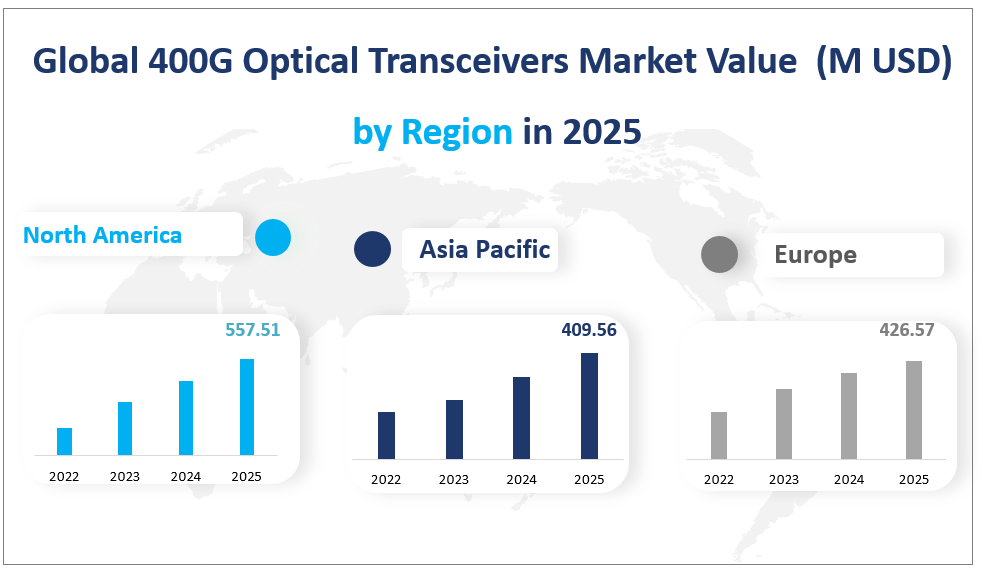

5.400G Optical Transceivers Market Value by Region

North America

With a projected market value of $557.51 million in 2025, North America is expected to be the largest regional market for 400G Optical Transceivers. This region’s dominance can be attributed to the presence of major data centers, technological advancements, and a strong focus on developing next-generation networking infrastructure.

Asia Pacific

The Asia Pacific region is projected to have a market value of $409.56 million in 2025. This region’s growth is driven by the rapid expansion of data centers, especially in countries like China and India, which are experiencing a surge in internet usage and cloud services.

Europe

Europe is expected to have a market value of $426.57 million in 2025. The region’s mature telecom market and ongoing investments in 5G technology contribute to the demand for 400G Optical Transceivers.

The North American region is identified as the biggest regional market by revenue in 2025, primarily due to the region’s early adoption of advanced technologies and the presence of major tech companies driving the demand for high-speed data transmission solutions.

The Asia Pacific region is projected to be the fastest-growing region. This growth is fueled by the rapid expansion of data centers, especially in China and India, and the increasing demand for high-speed connectivity in the region.

In conclusion, the 400G Optical Transceivers market is expected to see significant growth across all regions, with North America leading in terms of revenue and Asia Pacific showing the fastest growth rate. These regional dynamics are shaped by factors such as technological advancements, data center expansion, and the increasing need for high-speed data transmission capabilities.

Global 400G Optical Transceivers Market Value (M USD) by Region in 2025

6. Analysis of the Top Five Companies in the 400G Optical Transceivers Market

The 400G Optical Transceivers market is characterized by the presence of several key players who are driving innovation and growth in the industry.

Company Introduction and Business Overview: Arista Networks is a leading provider of cloud networking solutions, known for its software-driven, cognitive cloud networking for large-scale data centers and campus environments.

Products: Arista offers a range of 400G Optical Transceivers, including OSFP and QSFP-DD types, catering to various data center and networking needs.

Company Introduction and Business Overview: Finisar, now part of II-VI Incorporated, is a global leader in engineering materials and optoelectronic components, offering a wide range of specialized photonic and electronic materials and components.

Products: Finisar’s product line includes 400GBASE-SR8, 400GBASE-LR8, and 400GBASE-FR8 QSFP-DD Optical Transceivers.

Company Introduction and Business Overview: InnoLight Technology is committed to the development, manufacture, and customer technical support of 10G/25G/40G/100G/200G/400G series optical transceivers.

Products: InnoLight offers a range of high-speed optical transceivers, including 400G coherent QSFP-DD products.

Company Introduction and Business Overview: Ciena is a network strategy/technology company focusing on converged packet optical, software-defined networking (SDN), and cloud networking solutions.

Products: Ciena’s product lineup includes the WaveLogic 5 Nano 400ZR Transceiver, designed for direct connection with data center structures.

Company Introduction and Business Overview: NeoPhotonics is a leading developer and manufacturer of ultra-pure optical lasers and optoelectronic products for high-speed transmission in cloud and large-scale data centers.

Products: NeoPhotonics offers 400G Coherent Transceiver OSFP-DCO, featuring compliance with the 400ZR Implementation Agreement and support for DWDM links.

Major Players

| Company Name | Plants Distribution | Sales Region |

| Arista | Mainly in the US | Worldwide |

| Finisar (II-VI Inc.) | Mainly in the US, Europe and Asia | Worldwide |

| Innolight Technology | Mainly in China | North America, Europe, Asia |

| Ciena | Mainly in the US | Worldwide |

| NeoPhotonics | Mainly in the USA, Japan, China | Worldwide |

| Smartoptics | Mainly in Europe | Worldwide |

| Cisco | Mainly in the US | Worldwide |

| FS.COM | Mainly in the US, Europe | Worldwide |

| Broadcom | Mainly in the US | Worldwide |

| NEC | Mainly in Japan | Worldwide |

| Hisense Broadband | Mainly in China | North America, Europe, Asia |

1 400G Optical Transceivers Introduction and Market Overview

1.1 Objectives of the Study

1.2 Overview of 400G Optical Transceivers

1.3 Scope of The Study

1.3.1 Key Market Segments

1.3.2 Players Covered

1.3.3 COVID-19’s impact on the 400G Optical Transceivers industry

1.4 Methodology of The Study

1.5 Research Data Source

2 Executive Summary

2.1 Market Overview

2.1.1 Global 400G Optical Transceivers Market Size, 2018 – 2020

2.1.2 Global 400G Optical Transceivers Market Size by Type, 2018 – 2020

2.1.3 Global 400G Optical Transceivers Market Size by Application, 2018 – 2020

2.1.4 Global 400G Optical Transceivers Market Size by Region, 2018 – 2025

2.2 Business Environment Analysis

2.2.1 Global COVID-19 Status and Economic Overview

2.2.2 Influence of COVID-19 Outbreak on 400G Optical Transceivers Industry Development

3 Industry Chain Analysis

3.1 Upstream Raw Material Suppliers of 400G Optical Transceivers Analysis

3.2 Major Players of 400G Optical Transceivers

3.3 400G Optical Transceivers Manufacturing Cost Structure Analysis

3.3.1 Production Process Analysis

3.3.2 Manufacturing Cost Structure of 400G Optical Transceivers

3.3.3 Labor Cost of 400G Optical Transceivers

3.4 Market Distributors of 400G Optical Transceivers

3.5 Major Downstream Buyers of 400G Optical Transceivers Analysis

3.6 The Impact of Covid-19 From the Perspective of Industry Chain

3.7 Regional Import and Export Controls Will Exist for a Long Time

4 Global 400G Optical Transceivers Market, by Type

4.1 Global 400G Optical Transceivers Value and Market Share by Type (2018-2020)

4.2 Global 400G Optical Transceivers Production and Market Share by Type (2018-2020)

4.3 Global 400G Optical Transceivers Value and Growth Rate by Type (2018-2020)

4.3.1 Global 400G Optical Transceivers Value and Growth Rate of QSFP-DD (2018-2020)

4.3.2 Global 400G Optical Transceivers Value and Growth Rate of OSFP (2018-2020)

4.4 Global 400G Optical Transceivers Price Analysis by Type (2018-2020)

5 400G Optical Transceivers Market, by Application

5.1 Downstream Market Overview (Volume Basis)

5.2 Global 400G Optical Transceivers Consumption and Market Share by Application (2018-2020)

5.3 Global 400G Optical Transceivers Consumption and Growth Rate by Application (2018-2020)

5.3.1 Global 400G Optical Transceivers Consumption and Growth Rate of Client-Side Transceivers (2018-2020)

5.3.2 Global 400G Optical Transceivers Consumption and Growth Rate of Line-Side Transceivers (2018-2020)

6 Global 400G Optical Transceivers Market Analysis by Regions

6.1 Global 400G Optical Transceivers Sales, Revenue and Market Share by Regions

6.1.1 Global 400G Optical Transceivers Sales by Regions (2018-2020)

6.1.2 Global 400G Optical Transceivers Revenue by Regions (2018-2020)

6.2 North America 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

6.3 Europe 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

6.4 Asia-Pacific 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

6.5 Middle East and Africa 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

6.6 South America 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

7 North America 400G Optical Transceivers Market Analysis by Countries

7.1 The Influence of COVID-19 on North America Market

7.2 North America 400G Optical Transceivers Sales, Revenue and Market Share by Countries

7.2.1 North America 400G Optical Transceivers Sales (Units) by Countries (2018-2020)

7.2.2 North America 400G Optical Transceivers Revenue by Countries (2018-2020)

7.3 United States 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

7.4 Canada 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

7.5 Mexico 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8 Europe 400G Optical Transceivers Market Analysis by Countries

8.1 The Influence of COVID-19 on Europe Market

8.2 Europe 400G Optical Transceivers Sales, Revenue and Market Share by Countries

8.2.1 Europe 400G Optical Transceivers Sales (Units) by Countries (2018-2020)

8.2.2 Europe 400G Optical Transceivers Revenue by Countries (2018-2020)

8.3 Germany 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8.4 UK 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8.5 France 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8.6 Italy 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8.7 Spain 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

8.8 Russia 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9 Asia Pacific 400G Optical Transceivers Market Analysis by Countries

9.1 The Influence of COVID-19 on Asia Pacific Market

9.2 Asia Pacific 400G Optical Transceivers Sales, Revenue and Market Share by Countries

9.2.1 Asia Pacific 400G Optical Transceivers Sales (Units) by Countries (2018-2020)

9.2.2 Asia Pacific 400G Optical Transceivers Revenue by Countries (2018-2020)

9.3 China 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9.4 Japan 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9.5 South Korea 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9.6 India 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9.7 Southeast Asia 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

9.8 Australia 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

10 Middle East and Africa 400G Optical Transceivers Market Analysis by Countries

10.1 The Influence of COVID-19 on Middle East and Africa Market

10.2 Middle East and Africa 400G Optical Transceivers Sales, Revenue and Market Share by Countries

10.2.1 Middle East and Africa 400G Optical Transceivers Sales (Units) by Countries (2018-2020)

10.2.2 Middle East and Africa 400G Optical Transceivers Revenue by Countries (2018-2020)

10.3 Saudi Arabia 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

10.4 UAE 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

10.5 Egypt 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

10.6 South Africa 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

11 South America 400G Optical Transceivers Market Analysis by Countries

11.1 The Influence of COVID-19 on Middle East and Africa Market

11.2 South America 400G Optical Transceivers Sales, Revenue and Market Share by Countries

11.2.1 South America 400G Optical Transceivers Sales (Units) by Countries (2018-2020)

11.2.2 South America 400G Optical Transceivers Revenue by Countries (2018-2020)

11.3 Brazil 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

11.4 Argentina 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

11.5 Columbia 400G Optical Transceivers Sales (Units) and Growth Rate (2018-2020)

12 Competitive Landscape

12.1 Competitive Landscape Changes Caused by COVID-19 Outbreak

12.2 Arista

12.2.1 Company Profiles

12.2.2 400G Optical Transceivers Product Introduction

12.2.3 Arista Production, Value, Price, Gross Margin 2018-2020

12.3 Finisar

12.3.1 Company Profiles

12.3.2 400G Optical Transceivers Product Introduction

12.3.3 Finisar Production, Value, Price, Gross Margin 2018-2020

12.4 Innolight Technology

12.4.1 Company Profiles

12.4.2 400G Optical Transceivers Product Introduction

12.4.3 Innolight Technology Production, Value, Price, Gross Margin 2018-2020

12.5 Ciena

12.5.1 Company Profiles

12.5.2 400G Optical Transceivers Product Introduction

12.5.3 Ciena Production, Value, Price, Gross Margin 2018-2020

12.6 NeoPhotonics

12.6.1 Company Profiles

12.6.2 400G Optical Transceivers Product Introduction

12.6.3 NeoPhotonics Production, Value, Price, Gross Margin 2018-2020

12.7 Smartoptics

12.7.1 Company Profiles

12.7.2 400G Optical Transceivers Product Introduction

12.7.3 Smartoptics Production, Value, Price, Gross Margin 2018-2020

12.8 Cisco

12.8.1 Company Profiles

12.8.2 400G Optical Transceivers Product Introduction

12.8.3 Cisco Production, Value, Price, Gross Margin 2018-2020

12.9 FS.COM

12.9.1 Company Profiles

12.9.2 400G Optical Transceivers Product Introduction

12.9.3 FS.COM Production, Value, Price, Gross Margin 2018-2020

12.10 Broadcom

12.10.1 Company Profiles

12.10.2 400G Optical Transceivers Product Introduction

12.10.3 Broadcom Production, Value, Price, Gross Margin 2018-2020

12.11 NEC

12.11.1 Company Profiles

12.11.2 400G Optical Transceivers Product Introduction

12.11.3 NEC Production, Value, Price, Gross Margin 2018-2020

12.12 Hisense Broadband

12.12.1 Company Profiles

12.12.2 400G Optical Transceivers Product Introduction

12.12.3 Hisense Broadband Production, Value, Price, Gross Margin 2018-2020

13 Industry Outlook

13.1 Market Driver Analysis

13.1.2 Market Restraints Analysis

13.1.3 Market Trends Analysis

13.2 Merger, Acquisition and New Investment

13.3 News of Product Release

14 Global 400G Optical Transceivers Market Forecast

14.1 Global 400G Optical Transceivers Market Value & Volume Forecast, by Type (2020-2025)

14.1.1 QSFP-DD Market Value and Volume Forecast (2020-2025)

14.1.2 OSFP Market Value and Volume Forecast (2020-2025)

14.2 Global 400G Optical Transceivers Market Value & Volume Forecast, by Application (2020-2025)

14.2.1 Client-Side Transceivers Market Value and Volume Forecast (2020-2025)

14.2.2 Line-Side Transceivers Market Value and Volume Forecast (2020-2025)

14.3 400G Optical Transceivers Market Analysis and Forecast by Region

14.3.1 North America Market Value and Consumption Forecast (2020-2025)

14.3.2 Europe Market Value and Consumption Forecast (2020-2025)

14.3.3 Asia Pacific Market Value and Consumption Forecast (2020-2025)

14.3.4 Middle East and Africa Market Value and Consumption Forecast (2020-2025)

14.3.5 South America Market Value and Consumption Forecast (2020-2025)

15 New Project Feasibility Analysis

15.1 Industry Barriers and New Entrants SWOT Analysis

15.1.1 Porter’s Five Forces Analysis

15.1.2 New Entrants SWOT Analysis

15.2 Analysis and Suggestions on New Project Investment